|

市場調查報告書

商品編碼

1687305

工業潤滑油:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Industrial Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

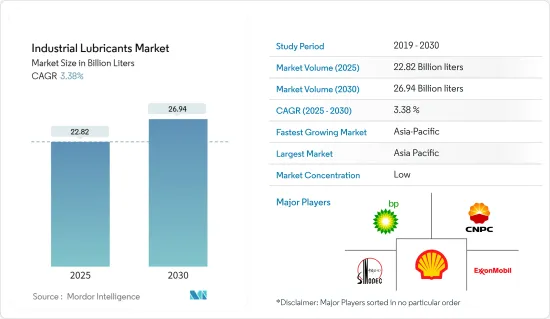

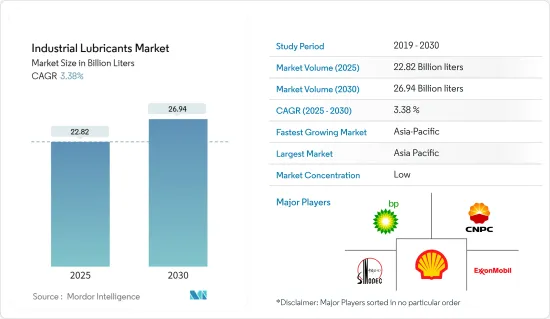

預計2025年工業潤滑油市場規模為228.2億公升,到2030年預計將達到269.4億公升,預測期內(2025-2030年)的複合年成長率為3.38%。

2020 年,市場受到了新冠疫情的負面影響。然而,這場疫情對大規模工業活動的自動化流程產生了正面影響。疫情導致的人手不足和不同個人防護設備的使用加速了各行各業對自動化的採用。此外,生產率的提高也帶來了機器運作和設備速度的提升。這使得設備的適當潤滑變得越來越重要和需求。

關鍵亮點

- 短期內,風力發電領域的需求成長預計將推動市場成長。

- 然而,潤滑劑對環境的不利影響可能會阻礙所研究市場的成長。

- 生物潤滑劑的興起和低黏度潤滑劑的發展可能為市場帶來成長機會。

- 亞太地區佔據全球市場主導地位,其中消費量最高的國家是中國、印度和印尼。

工業潤滑油市場趨勢

發電終端用戶產業主導市場

- 發電是全球經濟中最重要的終端用戶產業之一,如果沒有發電,幾乎所有的製造業務都可能陷入停頓。製造技術的進步正在推動各種新工廠的建設,從而增加終端用戶產業的電力需求。

- 渦輪機在能源領域的發電中發揮著至關重要的作用。 i.無論電力來源為何:風能、太陽能、水力發電或熱能,渦輪機都被廣泛用於發電。除渦輪機外,發電領域常用的其他主要部件包括泵浦、軸承、風扇、壓縮機、齒輪和液壓系統。風力發電機受到許多因素的影響,包括濕度、高壓、高負荷、振動和溫度。齒輪油和渦輪油廣泛用於該領域的潤滑目的。

- 潤滑油成本通常佔發電公司總營運支出的不到 5%。根據行業調查,約有58%的公司認為其潤滑油選擇可以節省5%或更多的成本。然而,不到十分之一(8%)的公司意識到潤滑可能會產生高達六倍的影響。

- 在水力發電中,潤滑劑用於空氣壓縮機、齒輪、渦輪機、循環油系統、液壓系統、軸承等。消耗的潤滑劑包括潤滑脂、通用潤滑劑、變速箱油、渦輪機油和油壓油。在核能發電廠中,潤滑油(渦輪機油)主要用於蒸氣渦輪,以提高其效率。

- 在燃煤發電廠中,潤滑劑用於空氣壓縮機、液壓裝置、渦輪機、移動設備、軸承和齒輪。煤炭挖土機系統也使用不同類型的潤滑劑,例如齒輪油、潤滑脂、變速箱油和液壓油。燃煤發電廠使用專為高溫和重載設計的潤滑劑。

- 此外,根據國際能源總署 (IEA) 的數據,到 2023 年,水力發電和風力發電等可再生能源發電將分別比 2022 年增加約 17.5 吉瓦 (GW) 和 107.8 吉瓦 (GW)。由於對可再生能源發電的投資不斷增加,預計這一成長趨勢將在預測期內持續下去。預計這將在未來大幅提升發電終端用戶產業對工業潤滑油的需求,並有助於他們維持市場主導地位。

- 因此,預計所有這些因素和趨勢將推動發電終端用戶產業對潤滑油的需求。

亞太地區佔市場主導地位

- 事實證明,亞太地區是工業潤滑油消費的主要市場。這是由於中國、印度和印尼等國家的消費量不斷增加。

- 目前,中國是潤滑油、脂的最大消費國。各行各業的大規模製造活動以及工業和汽車行業的快速成長,幫助該國躋身世界領先的潤滑油消費國和生產國。

- 此外,根據 Safeguard Global 的數據,中國、日本、韓國、印度和印尼則名列 2023 年製造業產出最高的十大國家。

- 中國也將重點建設新型基礎設施,在不久的將來,建築業將佔固定資產的絕大部分。由於支出增加和政府對基礎設施成長的關注,建設活動的成長預計將持續下去。

- 根據國際汽車工業組織(OICA)的數據,中國、日本、印度和韓國則名列世界五大汽車製造國。因此,與世界其他地區相比,亞太地區作為工業潤滑油需求量較大的地區,其汽車工業的規模也扮演關鍵角色。

- 此外,根據Invest India的數據,到2026年,印度汽車零件產業預計將成長到2,000億美元,2022-23年售後市場銷售額將達到106億美元(上年度100億美元)。印度和亞太新興經濟體的這些成長趨勢預計將顯著推動該地區工業潤滑油市場的成長。

- 印度是該地區第二大潤滑油消費國,也是繼美國和中國之後的世界第三大潤滑油消費國。該國約佔全球潤滑油市場需求的7%。儘管工業潤滑油市場較為分散,但印度潤滑脂市場卻高度集中,前五大企業佔據了超過 75% 的市場佔有率。

- 政府的優惠措施,例如將 FAME-II 計劃延長至 2024 年、加強對二輪車的獎勵、針對汽車和汽車零部件行業推出生產連結獎勵(PLI) 計劃(價值 2600 億印度盧比)、針對先進化學電池的 PLI(價值 1800 億印度盧比),都可能通過先進技術為該行業提供重大的採用力。

- 印尼憑藉其龐大的人口、較高的都市化以及快速崛起的中產階級,近年來已成為一個極具潛力的潤滑油市場。近年來,採礦、紡織和基礎設施等產業一直在推動工業潤滑油的消費。

- FocusEconomics 預計,2022 年印尼製造業成長率將達到 4.9%,高於去年的 3.4%。此外,根據印尼統計局 (BPS) 的數據,由於需求和產量增加,食品和飲料行業預計到 2022 年以年度為基礎成長 4.9%,達到 5,210 萬美元。

- 預計印尼將進行整體投資,吸引外國直接投資以增加出口,進而改善經濟表現。此外,台灣在食品自動化機械科技及餐飲服務領域已相當發達,國家也開始與台灣合作發展食品飲料產業。

- 因此,所有上述因素都有可能對未來的研究市場產生重大影響。

工業潤滑油產業概況

工業潤滑油市場本質上是細分的。市場的主要企業(不分先後順序)包括荷蘭皇家殼牌公司、埃克森美孚公司、中國石油化學集團公司、中國石油天然氣集團公司和英國石油公司(嘉實多)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 風力發電領域需求增加

- 其他促進因素

- 限制因素

- 潤滑劑對環境的負面影響

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 機油

- 傳動液和液壓油

- 金屬加工油

- 通用工業用油

- 齒輪油

- 潤滑脂

- 加工油

- 其他

- 最終用戶產業

- 發電

- 重型機械

- 飲食

- 冶金與金屬加工

- 化學製造

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 菲律賓

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 土耳其

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 伊朗

- 伊拉克

- 阿拉伯聯合大公國

- 科威特

- 其他中東地區

- 非洲

- 埃及

- 南非

- 奈及利亞

- 阿爾及利亞

- 摩洛哥

- 其他非洲國家

- 亞太地區

第6章 競爭格局

- 合併、收購、合資、合作和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMSOIL INC.

- Bharat Petroleum Corporation Limited

- Blaser Swisslube AG

- BP plc

- Carl Bechem GmbH

- Chevron Corporation

- China National Petroleum Corporation(PetroChina)

- China Petroleum & Chemical Corporation(SINOPEC Group)

- Eni SpA

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd.

- ROCOL

- ENEOS Corporation

- Kluber Lubrication

- LUKOIL

- PT Pertamina(Persero)

- Petrobras

- Petronas Lubricants International

- Phillips 66 Company

- Repsol

- Shell PLC

- Tide Water Oil Co. (India) Ltd.

- TotalEnergies

- Valvoline

第7章 市場機會與未來趨勢

- 人們對生物潤滑劑的興趣日益濃厚

- 低黏度潤滑劑的開發

The Industrial Lubricants Market size is estimated at 22.82 billion liters in 2025, and is expected to reach 26.94 billion liters by 2030, at a CAGR of 3.38% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. However, the pandemic positively affected the automation process in industrial activities on a large scale. The limited availability of manpower due to the pandemic and the use of various personal protective equipment has accelerated the adoption of automation throughout industries. Moreover, the increase in productivity also increased the run time of the machinery and the speed of the equipment. It increased the importance of adequate lubrication for the equipment, thus enhancing the demand.

Key Highlights

- Over the short term, increasing demand from the wind energy sector is expected to drive the market's growth.

- However, the detrimental effects of lubricants on the environment are likely to hinder the growth of the market studied.

- Nevertheless, the growing prominence of bio-lubricants and the development of low-viscosity lubricants are likely to act as opportunities for the growth of the market studied.

- Asia-Pacific dominates the market across the world, with the most substantial consumption from countries like China, India, and Indonesia.

Industrial Lubricants Market Trends

Power Generation End-user Industry Dominated the Market

- Power generation is one of the most important end-user industries of the global economy, without which almost all manufacturing operations may cease. Advancements in manufacturing technologies are resulting in the building of various new plants, increasing the demand for electricity across end-user industries.

- Turbines play a key role in the energy sector for generating electricity. Irrespective of the source of electricity, i.e., wind, solar, hydro, thermal, and others, turbines are widely used for power generation. In general, other than turbines, the major components used in the power generation sector include pumps, bearings, fans, compressors, gears, and hydraulic systems. Wind turbines are subjected to many factors, such as humidity, high pressure, high loads, vibrations, and temperature. Gear and turbine oils are widely used in this sector for lubrication purposes.

- In general, the cost of lubricants accounts for less than 5% of a power generation company's total operational expenditure. According to an industry survey, about 58% of the companies recognized that lubricant selection could help reduce costs by 5% or more. Still, fewer than 1 in 10 (8%) companies realized that the impact of lubrication could be up to six times more.

- In hydroelectric power generation, lubricants are used for air compressors, gears, turbines, circulating oil systems, hydraulics, and bearings, among other purposes. The lubricants consumed include greases, general lubricating oils, transmission oils, turbine oils, and hydraulic oils, among others. In nuclear power plants, lubricants (turbine oils) are used mainly for steam turbines for better efficiency.

- In coal-fired power plants, lubricants are used for air compressors, hydraulics, turbines, mobile equipment, bearings, and gears. Coal excavator systems also consume different types of lubricants, including gear oils, greases, transmission oils, and hydraulic oils. Coal-fired power plants consume high-temperature and heavy-duty lubricants.

- Moreover, according to the International Energy Agency, in 2023, the volume of renewable electricity generated globally through hydropower and wind increased by about 17.5 gigawatts (GW) and 107.8 gigawatts (GW), respectively, over 2022. Such growth trends are expected to continue during the forecast period because of the growing investment in renewable energy generation. It will substantially boost the demand for industrial lubricants from the power generation end-user industry in the future and help it maintain its market dominance.

- Hence, all such factors and trends are expected to drive the demand for lubricants in the power generation end-user industry.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific was found to be the major market for the consumption of industrial lubricants. It is owing to increasing consumption from countries such as China, India, and Indonesia.

- China is the largest consumer of lubricants and greases in the current scenario. The vast manufacturing activities pertaining to different sectors and the rapid growth in the industrial and automotive sectors pushed the country to stand among the major lubricant consumers and producers in the global landscape.

- Moreover, according to Safeguard Global, China, Japan, South Korea, India, and Indonesia were among the top 10 countries with the highest manufacturing output in 2023.

- In addition, China is focusing on new infrastructure, with construction being the majority type of fixed assets, in the near future. Such growth in construction activity is expected to be witnessed in the future, owing to increased expenditure and the government's focus on infrastructure growth.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), China, Japan, India, and South Korea were among the top 5 largest manufacturers of vehicles in the world. Therefore, the vast size of Asia-Pacific's automotive industry also plays a significant role in the region accounting for such high demand for industrial lubricants compared to other regions worldwide.

- Moreover, according to Invest India, the auto components industry in India is expected to grow to USD 200 billion by 2026, and the aftermarket turnover in FY 2022-23 of the industry stood at USD 10.6 billion as compared to USD 10 billion in the previous year. Such growth trends in India and developing economies of the Asia-Pacific are estimated to significantly boost the industrial lubricants market growth in the region.

- India is the second-largest lubricant consumer in the region and the third-largest in the world, after the United States and China. The country accounts for about 7% of the demand in the global lubricants market. While the industrial lubricants market is fragmented in nature, the Indian grease market is highly consolidated in nature, with the top five players accounting for more than 75% of the market share.

- Favorable government policies, such as the extension of the FAME-II scheme until 2024, the enhancement of incentives for two-wheelers, the launch of the production-linked incentive (PLI) scheme for the auto and auto component sector (worth INR 26,000 crore (~USD 3.20 billion)), and the PLI for advanced chemistry cell worth INR 18,000 crore (~USD 2.22 trillion), are likely to provide significant support to the sector due to the adoption of advanced technologies.

- Indonesia is among the potential lubricants markets in recent years on account of its huge population, high urbanization, and rapidly rising middle class. Sectors such as mining, textile, and infrastructure is driving the consumption of industrial lubricants in the recent past.

- According to FocusEconomics, in 2022, manufacturing growth in Indonesia was 4.9%, up from the 3.4% witnessed in the prior year. Moreover, according to Statistics Indonesia (BPS), the food and beverage industry increased by 4.9% on an annual basis in 2022 to USD 52.1 million as the demand and production increased.

- Indonesia is expected to invest and attract foreign direct investment across industries to boost its exports and, thus, its economic state. Additionally, the country started working with Taiwan to develop its food and beverage industry because Taiwan is quite developed in the field of automated food machine technology and catering services.

- Therefore, all the factors above are likely to significantly impact the market studied in the future.

Industrial Lubricants Industry Overview

The industrial lubricants market is fragmented in nature. Some of the key players in the market (not in any particular order) include Royal Dutch Shell PLC, Exxon Mobil Corporation, China Petroleum & Chemical Corporation, China National Petroleum Corporation, and BP PLC (Castrol), among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Wind Energy Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Detrimental Effects of Lubricants on the Environment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Hydraulic Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Heavy Equipment

- 5.2.3 Food and Beverage

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Chemical Manufacturing

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Philippines

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 Spain

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Iran

- 5.3.5.3 Iraq

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Kuwait

- 5.3.5.6 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 Egypt

- 5.3.6.2 South Africa

- 5.3.6.3 Nigeria

- 5.3.6.4 Algeria

- 5.3.6.5 Morocco

- 5.3.6.6 Rest of Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 Blaser Swisslube AG

- 6.4.4 BP p.l.c.

- 6.4.5 Carl Bechem GmbH

- 6.4.6 Chevron Corporation

- 6.4.7 China National Petroleum Corporation (PetroChina)

- 6.4.8 China Petroleum & Chemical Corporation (SINOPEC Group)

- 6.4.9 Eni SpA

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 FUCHS

- 6.4.12 Gazprom Neft PJSC

- 6.4.13 Gulf Oil International

- 6.4.14 Hindustan Petroleum Corporation Limited

- 6.4.15 Idemitsu Kosan Co. Ltd

- 6.4.16 Indian Oil Corporation Ltd.

- 6.4.17 ROCOL

- 6.4.18 ENEOS Corporation

- 6.4.19 Kluber Lubrication

- 6.4.20 LUKOIL

- 6.4.21 PT Pertamina(Persero)

- 6.4.22 Petrobras

- 6.4.23 Petronas Lubricants International

- 6.4.24 Phillips 66 Company

- 6.4.25 Repsol

- 6.4.26 Shell PLC

- 6.4.27 Tide Water Oil Co. (India) Ltd.

- 6.4.28 TotalEnergies

- 6.4.29 Valvoline

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence for Bio-Lubricants

- 7.2 Development of Low Viscosity Lubricants