|

市場調查報告書

商品編碼

1687306

氣相二氧化矽:市場佔有率分析、產業趨勢與成長預測(2025-2030)Fumed Silica - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

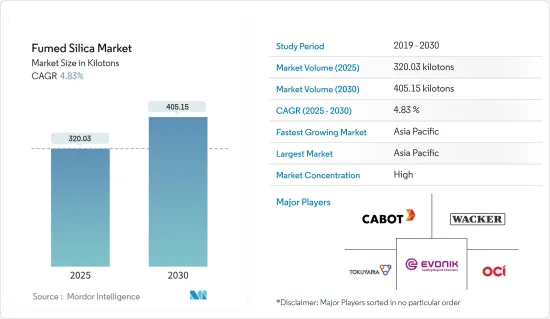

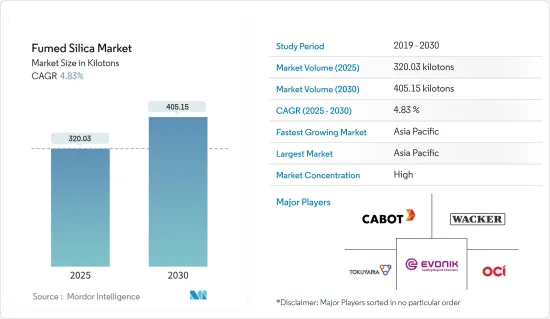

氣相二氧化矽市場規模預計在 2025 年為 320.03 千噸,預計到 2030 年將達到 405.15 千噸,預測期(2025-2030 年)的複合年成長率為 4.83%。

2020 年,市場受到新冠疫情的負面影響。由於疫情,建築業和汽車製造活動暫時停止。這減少了用於黏合劑、油漆、被覆劑、塑膠和複合材料等產品配方的添加劑的需求,對氣相二氧化矽的市場需求產生了負面影響。不過,去年隨著各行各業恢復生產,市場維持了成長軌跡。

關鍵亮點

- 短期內,牙膏、乳霜等個人護理產品對氣相二氧化矽的需求激增預計將推動市場成長。

- 預計生物來源二氧化矽和沈澱二氧化矽等氣相二氧化矽替代品的開發將阻礙市場發展。

- 氣相二氧化矽在各行業的新興應用預計將帶來機會。

- 亞太地區佔據全球市場主導地位,其中中國和印度等國家佔最大消費量。

氣相二氧化矽市場趨勢

黏合劑和密封劑應用佔據市場主導地位

- 氣相二氧化矽在黏合劑和密封劑中的主要用途是作為防流掛添加劑、流變控制添加劑和防沉降添加劑。氣相二氧化矽也可用作流變控制添加劑和密封劑增強劑。提高黏合劑和密封劑的儲存穩定性和加工效率。

- 黏合劑和密封劑行業中的氣相二氧化矽用於增加產品黏度、增強儲存期間的防沉降性能、調整應用期間的擠出性能以及賦予固化期間的防流掛性能。

- 在建築業,氣相二氧化矽黏合劑和密封劑用於結構嵌裝玻璃和耐候性,有助於提高建築物的能源效率。它還有助於提高現場生產力,減少材料浪費,延長建築物的使用壽命並降低生命週期成本。

- 根據英國土木工程師學會的數據,預計到 2025 年,中國、印度和美國將佔全球建築業成長的近 60%,推動氣相二氧化矽市場的成長。

- 美國是世界領先的建築市場之一。根據美國人口普查局的數據,2022 年建設業是美國第 12 大產業,約佔 GDP 總量的 4.3%。根據美國人口普查局的數據,2022年美國建築業的市場規模約為1.79兆美元。

- 根據美國人口普查局的數據,2023年前九個月的建築支出為1.4635兆美元,較2022年同期的1.3989兆美元增加4.6%。

- 在歐洲,DIY 黏合劑市場的製造商正在轉向透明包裝,用氣相二氧化矽取代不透明增強添加劑和用於流變控制的增強材料,氣相二氧化矽的屈光與透明聚合物非常接近。

- 經過處理的氣相二氧化矽顯示出比塗層沉澱碳酸鈣(PCC)更高的黏合強度,而塗層沉澱碳酸鈣(PCC)通常用於 STP 和聚氨酯接著劑和密封劑中的流變控制。此外,氣相二氧化矽的比重比碳酸鈣低,因此對黏合劑重量的貢獻要小得多,這在關注黏合劑重量的應用中(例如輕型汽車)是一個優勢。

- 汽車產業是黏合劑和密封劑的主要消費者之一。應用包括熱交換器管密封、變速箱和油底殼蓋墊圈以及內部儀表板粘合。根據OICA預測,2022年全球汽車產量將達8,502萬輛,較上年的8,020萬輛成長6%。

- 因此,預計這些因素將在預測期內對氣相二氧化矽市場產生重大影響。

亞太地區佔市場主導地位

- 亞太地區佔比最大,其中中國、印度等國的需求量較大。

- 矽膠黏合劑的生產始於從矽膠中分離二氧化矽。二氧化矽以純淨形式存在於多種礦物中。矽膠黏合劑因其優異的彈性體性能、寬的溫度範圍、耐燃料影響以及低收縮率和剪切應力而被廣泛使用。

- 中國、印度和越南等亞太國家的建設活動正在強勁成長,預計這將在預測期內推動該地區氣相二氧化矽的消費。

- 中國和印度佔亞太地區黏合劑和密封劑市場總佔有率的50%以上。它也是亞太地區最大的油漆和被覆劑生產商。

- 2023 年 1 月,亞洲塗料公司核准投資 200 億印度盧比(2.4053 億美元),在印度中央邦建立一座年產 40 萬千公升的水性塗料新生產廠。該工廠預計將在三年內開始生產。

- 2022年7月,BASF歐洲公司透過其子公司BASF塗料(廣東)有限公司(BCG)擴大了位於中國南方廣東省江門市的塗料工廠的汽車修補漆生產能力。擴建計劃將使公司的生產能力提高至每年3萬噸。

- 印度製藥業是氣相二氧化矽的主要消費者,氣相二氧化矽用作高純度賦形劑和多功能添加劑。中國是全球最大的學名藥供應國,滿足了美國40%的非專利需求和英國25%的所有藥品需求。

- 氣相二氧化矽用於許多嚴格要求的黏合劑應用,包括建築、施工、汽車應用和包裝。預計黏合劑和密封劑領域的高需求將推動氣相二氧化矽市場的發展。

- 在建築業中,氣相二氧化矽用於黏合劑、密封劑、被覆劑和塑膠。中國建築業正在經歷強勁成長。根據中國國家統計局的數據,中國建築業產出預計將在 2022 年達到峰值,約 4.64 兆美元。與 2021 年的 4.36 兆美元相比,這一數字將成長 6%。

- 黏合劑、密封劑、油漆和被覆劑也用於汽車工業。亞太地區的汽車製造業是世界上最大的。 OICA 預計,2022 年亞太汽車產量將達到 5,002 萬輛,較 2021 年的 4,677 萬輛成長 7%。

- 預計上述因素將在預測期內推動亞太地區對氣相二氧化矽的需求。

氣相二氧化矽產業概況

氣相二氧化矽市場已整合到大約主要參與企業(無特定順序)包括 Evonik Industries AG、Cabot Corporation、Wacker Chemie AG、Tokuyama Corporation 和 OCI COMPANY Ltd.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區個人護理應用需求激增

- 油漆和塗料行業需求增加

- 其他促進因素

- 限制因素

- 沉澱二氧化矽作為替代品

- 生物氣相二氧化矽的開發

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 親水性氣相二氧化矽

- 疏水性氣相二氧化矽

- 應用

- 矽膠橡膠

- 塑膠複合材料(不飽和聚酯樹脂)

- 飲食

- 油漆(包括油墨)

- 黏合劑和密封劑

- 其他用途(藥品、個人護理、肥料)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMS Applied Material Solutions

- Cabot Corporation

- China-Henan Huamei Chemical Co. Ltd

- Dongyue Group Co. Ltd

- Evonik Industries AG

- Gelest Inc.

- Heraeus Holding

- Kemitura AS

- Kemipex

- OCI Company Ltd

- Tokuyama Corporation

- Wacker Chemie AG

第7章 市場機會與未來趨勢

- 氣相二氧化矽的新應用

- 永續生產氣相二氧化矽的新技術

The Fumed Silica Market size is estimated at 320.03 kilotons in 2025, and is expected to reach 405.15 kilotons by 2030, at a CAGR of 4.83% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic in 2020. Construction and automotive manufacturing activities were on a temporary halt due to the pandemic. This minimized the demand for additives used in the formulation of products such as adhesives, paints, coatings, plastics, and composites, negatively impacting the market demand for fumed silica. However, the market retained its growth trajectory last year due to all the industries resuming production processes.

Key Highlights

- Over the short term, the surging demand for fumed silica from products in the personal care segment, such as toothpaste, creams, and others, is expected to drive the market's growth.

- The development of biogenic fumed silica and precipitated silica as a substitute for fumed silica is anticipated to hinder the market's growth.

- The emerging applications of fumed silica in various industries are likely to act as an opportunity.

- The Asia-Pacific region dominated the global market, with the highest consumption coming from countries such as China and India.

Fumed Silica Market Trends

Adhesives and Sealants Application to Dominate the Market

- The primary uses of fumed silica in adhesives and sealants are as anti-sag additives, rheological control additives, and anti-settling additives. Fumed silica is also used as a rheological control additive and sealant reinforcing agent. It enhances the storage stability and processing efficiency of adhesives and sealants.

- Fumed silica in the adhesives and sealants industry is used to enhance the viscosity of the product, enhance anti-settling characteristics during storage, regulate the extrusion characteristics during application, and provide anti-sag characteristics during curing.

- In the construction industry, fumed silica adhesives and sealants are used in structural glazing and weatherproofing, contributing to the energy efficiency of buildings. They also help improve in-shop productivity, reduce material waste, extend building life, and reduce lifecycle costs.

- According to the Institution of Civil Engineers, China, India, and the United States are expected to account for almost 60% of all global growth in the construction sector by 2025, thus increasing the market growth of fumed silica in the industry.

- The United States was among the top construction markets globally. As per the United States Census Bureau, construction was the 12th largest industry in the country in 2022 and accounted for approximately 4.3% of its total GDP. As per the US Census Bureau, the market size of the US construction sector was around USD 1.79 trillion in 2022.

- According to the US Census Bureau, during the first nine months of 2023, construction spending amounted to USD 1,463.5 billion, 4.6% above the USD 1,398.9 billion for the same period in 2022.

- In Europe, manufacturers in the do-it-yourself (DIY) adhesives market have switched to clear packaging, where the opaque reinforcing aids additives used for rheology control and the reinforcements are replaced by fumed silica, which closely matches its refractive index with transparent polymers.

- Treated fumed silica provides significantly more adhesive strength than the coated precipitated calcium carbonates (PCC), usually used for rheology control of STP and polyurethane adhesives and sealants. Compounding the benefit of lower loading, fumed silica has a lower specific gravity than calcium carbonate and, thus, contributes far less to adhesive weight, which may be a benefit in applications where adhesive weight is a concern, e.g., automotive light-weighting.

- The automotive industry is one of the major consumers of adhesives and sealants. The applications include sealing heat exchanger tubes, gearbox and sump cover gasketing, bonding interior dashboards, and others. According to the OICA, global vehicle production reached 85.02 million units in 2022, with an increase of 6% from the previous year's production of 80.20 million units.

- Therefore, such factors are expected to impact the fumed silica market significantly over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the market with the largest share and high demand from countries such as China and India.

- The manufacture of silicone adhesives begins by isolating silica from silicon. Silica can be found in its pure form in some minerals. Silicone adhesives are widely used due to their excellent elastomeric properties, extended temperature range, resistance to the effects of fuels, and low shrinkage and shear stress.

- Countries in the Asia-Pacific region, such as China, India, and Vietnam, have been registering strong growth in construction activities, which is expected to drive the consumption of fumed silica in the region over the forecast period.

- China and India contribute to more than 50% of the total share of the Asia-Pacific region in the adhesives and sealants market. They are also the largest producer of paints and coatings in the Asia-Pacific region.

- In January 2023, Asian Paints approved an investment of INR 2,000 crore (USD 240.53 million) for a new waterborne paint manufacturing plant with 400,000 kiloliters per annum capacity in Madhya Pradesh, India. The facility's manufacturing is expected to be commissioned in three years.

- In July 2022, BASF SE, through its subsidiary BASF Coatings (Guangdong) Co. Ltd (BCG), expanded its manufacturing capabilities for automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province, South China. The company increased its production capacity to 30,000 ton annually through this expansion project.

- The pharmaceutical industry in India is a major consumer of fumed silica, used as a high-purity excipient and multi-functional additive. The country is the largest provider of generic drugs globally, fulfilling 40% of the generic demand in the United States and 25% of all medicine demand in the United Kingdom.

- Fumed silica is used in many demanding adhesive applications, from building, construction, and automotive applications to packaging. High demand from the adhesives and sealants sector is expected to drive the fumed silica market.

- In the construction industry, fumed silica is used in adhesives, sealants, coatings, and plastics. China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, the construction output value in China achieved its peak at around USD 4.64 trillion in 2022. It rose by 6% compared to USD 4.36 trillion in 2021.

- Adhesives, sealants, paints, and coatings are also finding application in the automotive industry. The Asia-Pacific automotive manufacturing industry is the largest in the world. According to the OICA, automotive production in Asia-Pacific stood at 50.02 million units in 2022, up 7% from 46.77 million units in 2021.

- The factors above are expected to increase the demand for fumed silica in the Asia-Pacific region over the forecast period.

Fumed Silica Industry Overview

The fumed silica market is mostly consolidated. The major players (not in any particular order) include Evonik Industries AG, Cabot Corporation, Wacker Chemie AG, Tokuyama Corporation, and OCI COMPANY Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from Personal Care Applications in the Asia-Pacific Region

- 4.1.2 Increasing Demand from the Paints and Coatings Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Precipitated Silica as a Substitute

- 4.2.2 Development of Biogenic Fumed Silica

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Hydrophilic Fumed Silica

- 5.1.2 Hydrophobic Fumed Silica

- 5.2 Application

- 5.2.1 Silicone Rubber

- 5.2.2 Plastics and Composites (Unsaturated Polyester Resin)

- 5.2.3 Food and Beverages

- 5.2.4 Paints and Coatings (Including Inks)

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other Applications (Pharmaceutical, Personal Care, and Chemicals and Fertilizers)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMS Applied Material Solutions

- 6.4.2 Cabot Corporation

- 6.4.3 China-Henan Huamei Chemical Co. Ltd

- 6.4.4 Dongyue Group Co. Ltd

- 6.4.5 Evonik Industries AG

- 6.4.6 Gelest Inc.

- 6.4.7 Heraeus Holding

- 6.4.8 Kemitura AS

- 6.4.9 Kemipex

- 6.4.10 OCI Company Ltd

- 6.4.11 Tokuyama Corporation

- 6.4.12 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Fumed Silica

- 7.2 New Technology for Sustainable Production of Fumed Silica