|

市場調查報告書

商品編碼

1687307

油漆和塗料樹脂-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Resins in Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

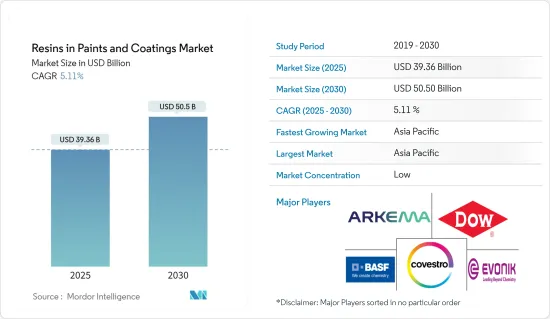

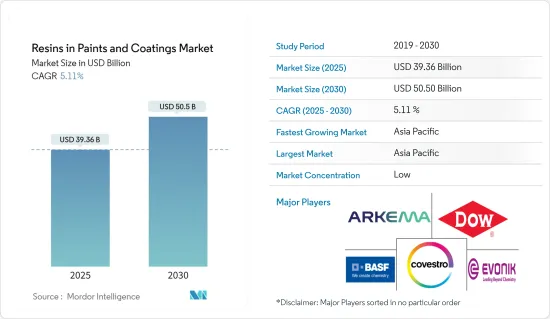

預計 2025 年油漆和塗料樹脂市場規模為 393.6 億美元,到 2030 年將達到 505 億美元,預測期內(2025-2030 年)的複合年成長率為 5.11%。

COVID-19 疫情對各個行業產生了短期和長期影響,從而影響了全球油漆和塗料樹脂市場。工業活動的限制、供應鏈中斷和勞動力短缺對所研究的市場產生了負面影響。然而,該領域自 2021 年以來已經復甦,並在 2022 年也呈現成長。

關鍵亮點

- 短期內,亞太地區建設活動的增加是推動市場發展的關鍵因素。

- 另一方面,由於其他使用樹脂的行業的競爭導致的需求波動可能會阻礙市場成長。

- 預計環保樹脂的出現將在預測期內為製造商提供大量機會。

- 預計亞太地區將主導市場,並在預測期內實現最高的複合年成長率。

油漆和耐腐蝕樹脂市場趨勢

在建築業的應用日益增多

- 許多國家對各種商業和住宅建築的新建和維修的強勁需求正在增加油漆和被覆劑的生產和消費,從而推動建築領域對樹脂的需求。

- 建築塗料中常用的樹脂有環氧樹脂、聚氨酯、乙烯基丙烯酸酯、苯乙烯丙烯酸、純丙烯酸等,佔據了建築塗料市場的很大佔有率。油漆和被覆劑廣泛應用於建築領域的外部和內部應用。

- 中產階級人口的增加和可支配收入的增加正在推動中檔住宅領域建築塗料的擴張。

- 2021年全球建築業產出強勁成長。根據牛津經濟研究院預測,到2030年,全球建築業產出預計將達到約15.2兆美元,成長42%。這刺激了所研究市場的需求。

- 由於人口成長、中產階級壯大和都市化,亞太地區的建築業持續健康成長。在亞太地區,中國是購物中心建設領先的國家之一。中國目前約有 4,000 家購物中心,預計到 2025 年還將有 7,000 家購物中心開幕。

- 美國正在進行幾項住宅裝修計劃。該國的移民人口正在成長,對住宅和裝修的需求也日益成長。此外,人們對永續性和高效建築的認知不斷增強,也推動了修復趨勢。一些政府融資計劃也在支持該國的住宅裝修。

- 預計到 2022 年底,美國住宅建設規模將達到 8,190 億美元,主要得益於獨棟住宅和住宅維修計劃(包括擴建、重建和大型更換)。

- 在歐洲,建築業正迅速復甦。預計到2022年底,疫情造成的損失將得以彌補。根據EUROCUNSTRUCT的分析,預計2021年該產業的成長率為3.8%。預計2022年和2023年建築業將分別成長3.0%和2.1%。

- 在巴西,2021年第三季啟動的幾個多用戶住宅大樓建設計劃正在提振受調查市場的需求。其中一個計劃是容迪亞伊Reserva Alta Vista住宅區,計劃於2023年第三季完工,計劃預計耗資5,000萬美元。

- 由於這些因素,預計預測期內全球油漆和塗料樹脂市場將成長。

亞太地區佔市場主導地位

- 預計亞太地區將主導市場。以國內生產毛額計算,中國是該地區最大的經濟體。中國和印度是世界上成長最快的經濟體之一。

- 近年來,由於經濟快速成長、都市化加快以及基礎設施支出不斷增加,亞太地區的建築業一直穩步成長。外國公司在亞太地區的不斷成長也推動了建築業的成長,因為創造了對新辦公室、建築物和製造設施的需求。

- 預計2030年亞太地區建築業產值將達7.4兆美元,成長率超過50%。中國在亞太地區的建築業中佔據主導地位。此外,由於政府大規模支出,尤其是對基礎建設的投入,2021 年建設活動正在反彈。

- 由於其龐大的油漆和塗料製造基地,中國繼續在受調查的市場中佔據主導地位。中國佔全球塗料市場的四分之一以上。根據中國塗料工業協會統計,近年來該產業實現了7%的成長率。

- 中國政府已啟動一項大規模建設計畫,其中包括在未來十年內將2.5億人遷移到新的特大城市。這意味著樹脂可用於建築施工過程中各種用途的油漆和被覆劑中,從而改善其性能。

- 印度的建築業是該國第二大產業,對GDP的貢獻龐大。在經歷了疫情期間的成長急劇下滑之後,印度建築業在2021年出現反彈,這得益於公共和私人投資的快速成長。據越南統計和計劃執行部稱,2022 年第一季建築業在 GDP 中的比例達到 459.2 億美元,超過了 2021 年第四季 358.3 億美元的 GDP 佔比。

- 預計到 2022 年底,印度塗料產業產值將突破 80 億美元。過去二十年,印度塗料產業一直保持兩位數的穩定成長,是全球成長最快的塗料經濟體。全國有3000多家塗料生產企業,幾乎涵蓋了全球所有企業。建築塗料約佔整個市場的75%,而工業塗料佔25%。預計這些因素將在預測期內增加油漆和塗料市場對樹脂的需求。

- 受公共和私人基礎設施及商業計劃投資增加的推動,日本建築業預計將在未來五年內溫和擴張。根據內閣府預測,到2022年底,日本預計對外貿易對國內生產毛額的貢獻將達到2,779.1億美元,預計2023年和2024年該比例將進一步增加,分別達到2,195.1億美元及2,232.4億美元。

- 根據韓國建築協會(CAK)和韓國國際承包商協會(ICAK)統計,2021年累積建築訂單金額達1,362億美元,與前一年同期比較去年同期成長9.9%。其中公共部門訂單489億美元,與前一年同期比較增加10.8%。

- 受良好的政治環境和強勁的經濟成長推動,東南亞目前是世界上建築和建築計劃最具活力的地區之一。

- 因此,由於亞太地區建設活動的迅速擴張,預計預測期內對油漆和被覆劑的需求將大幅成長,這預計將對該地區用於生產油漆和被覆劑的樹脂消費產生積極影響。

油漆和塗料樹脂行業概況

全球油漆和塗料樹脂市場較為分散。市場的主要企業包括阿科瑪、BASF、陶氏、贏創工業股份公司和科思創。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區建設活動活性化

- 限制因素

- 由於與其他使用樹脂的行業的競爭導致需求波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 環氧樹脂

- 丙烯酸纖維

- 聚氨酯

- 聚酯纖維

- 聚丙烯

- 醇酸

- 其他

- 最終用戶產業

- 工業的

- 建築學

- 車

- 包裝

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率排名分析

- 主要企業策略

- 公司簡介

- Allnex GmbH

- Arkema

- BASF SE

- Covestro AG

- Dow

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Kangnam Chemical

- KANSAI HELIOS

- Mitsubishi Shoji Chemical Corporation

- Mitsui Chemicals Inc.

- Reichhold LLC 2

- Uniform Synthetics

- Vil Resins

- Wanhua

第7章 市場機會與未來趨勢

- 環保樹脂的出現

The Resins in Paints and Coatings Market size is estimated at USD 39.36 billion in 2025, and is expected to reach USD 50.50 billion by 2030, at a CAGR of 5.11% during the forecast period (2025-2030).

The outbreak of COVID-19 brought several short-term and long-term consequences across various industries, which, in turn, affected the resins in paints and coatings market across the world. Restrictions on industrial activities, supply chain disruptions, and labor shortages negatively affected the market studied. However, the sector has been recovering since 2021 and witnessed growth in 2022 as well.

Key Highlights

- Over the short term, the major factor driving the market studied is the increasing construction activities in the Asia-Pacific region.

- On the other hand, fluctuation in demand due to competition from other industries using resin is likely to hinder the market's growth.

- The advent of eco-friendly resins is projected to offer numerous opportunities for manufacturers during the forecast period.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Paint & Coating Resins Market Trends

Increasing Usage in the Architecture Industry

- Increasing production and consumption of paints and coatings due to robust demand in new construction activities and refurbishments of various commercial and residential buildings in many nations are driving the demand for resins in the architecture sector.

- The commonly used resins for architectural coatings include epoxy, polyurethane, vinyl acrylate, styrene acrylics, pure acrylics, etc., and these account for a significant share of the architectural coatings market. Paints and coatings are extensively used in the architecture sector for both exterior and interior applications.

- The increasing middle-class population, coupled with their rising disposable income, has facilitated the expansion of architectural paints in the middle-class housing segment.

- The global construction output grew significantly in 2021. According to the Oxford Economics publication, the global construction output is estimated to reach around USD 15.20 trillion by 2030, registering a growth of 42%. This, in turn, is stimulating the demand for the market studied.

- The construction sector in the Asia-Pacifc is growing at a healthy rate, owing to the rising population, increase in middle-class income, and urbanization. In the Asia-Pacific, China is one of the leading countries in shopping-center construction. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- The United States has undertaken several home renovation projects. With the growing population of migrants in the country, the need for new houses and renovation has become increasingly important. In addition, the growing awareness about sustainability and high-efficiency structures has created a spur in the restoration trend. The availability of several loans by the government also supports home remodeling in the country.

- The value of new residential construction in the United States was expected to reach USD 819 billion by end of 2022, stemming from single-family housing and home improvement projects, including additions, alterations, and major replacements.

- In Europe, the recovery of the construction industry is quite rapid. The losses from the pandemic were expected to be recovered by end of 2022. EUROCUNSTRUCT's analysis suggests that the industry grew by 3.8% in 2021. The growth rates of the construction industry in 2022 and 2023 are expected to be 3.0% and 2.1%, respectively.

- In Brazil, several multi-family housing construction projects started in Q3 2021 has enhanced the demand for the market studied. One of these projects is the Jundiai ReservaAlta Vista Residential Complex, which is expected to be completed by Q3 2023. The estimated cost of the project is USD 50 million.

- Owing to all these factors, the market for resins in paints and coatings is likely to grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia -Pacific region is expected to dominate the market. In the region, China is the largest economy in terms of GDP. China and India are among the fastest emerging economies in the world.

- The construction sector of the Asia-Pacific region has been witnessing steady growth over the recent past, owing to the presence of fast-growing economies, rapid urbanization, and rising infrastructural spending. The increasing presence of foreign companies in the Asia-Pacific region has also created a demand for the construction of new offices, buildings, production houses, etc., thereby driving the growth of the construction sector.

- Construction output in the Asia-Pacific is estimated to reach USD 7.4 trillion by 2030, registering a growth of over 50%. China dominates the construction industry in the Asia-Pacific region. Furthermore, major government spending, especially focused on infrastructure, has resulted in a rebounding of construction activity in 2021.

- China continues to dominate the demand for the market studied, powered by its huge production base for paints and coatings. China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has been registering a growth of 7% in recent years.

- The Chinese government rolled out massive construction plans, including making provisions for the movement of 250 million people to its new megacities over the next ten years. Thus, this may create a major scope for resins in paints and coatings used in various applications during building construction, enhancing the building properties.

- India's construction sector is the second-largest industry in the country, contributing a significant share to its GDP. After experiencing a drastic fall in growth during the pandemic, the Indian construction sector rebounded with a sharp growth in public and private investments in 2021. As per the Ministry of Statistics and Program Implementation, the construction sector contributed a GDP share amounting to USD 45.92 billion in Q1 2022, which was higher than the GDP share of USD 35.83 billion in Q4 2021.

- The Indian paint industry was expected to be valued at over USD 8 billion by the end of 2022. It is the fastest-growing paint economy globally, with a stable double-digit growth over the last two decades. The country has over 3,000 paint manufacturers, with nearly all global companies present here. Architectural paints constitute around 75% of the overall market, and a 25% share is taken by industrial paints. These factors are anticipated to increase the demand for the resins in paints and coatings market during the forecast period.

- The construction sector in the country is expected to expand at a moderate pace in the country over the next five years, owing to the increasing investments in public and private infrastructure and commercial projects. According to the forecasts given by Japan's Cabinet Office, Japan is expected to contribute USD 277.91 billion to its GDP by the end of 2022. The GDP shares in 2023 and 2024 are expected to enhance further, reaching USD 219.51 billion and USD 223.24 billion, respectively.

- According to the Construction Association of Korea (CAK) and International Contractors Association of Korea (ICAK), South Korea witnessed a hike of 9.9% in 2021 from the previous year in the cumulative construction order amount, reaching USD 136.2 billion. Out of the total amount, the construction orders received from the public sector stood at USD 48.9 billion, registering a 10.8% increase from the previous year's value of public sector orders.

- Southeast Asia is currently one of the most dynamic regions globally, with construction and building projects flourishing, owing to its healthy political environment and robust economic growth.

- Hence, from the rapidly growing construction activities in the Asia-Pacifc region, the demand for paints and coatings is projected to increase substantially during the forecast period, and this is anticipated to positively impact the consumption of resins used in the production of paints and coatings in the region.

Paint & Coating Resins Industry Overview

The global resins in paints and coatings market is fragmented in nature. Some of the major players in the market include Arkema, BASF SE, Dow, Evonik Industries AG, and Covestro.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activity in the Asia-Pacific

- 4.2 Restraints

- 4.2.1 Fluctuation in Demand due to Competition from Other Industries Using Resin

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Polyester

- 5.1.5 Polypropylene

- 5.1.6 Alkyd

- 5.1.7 Other Types

- 5.2 End-user Industry

- 5.2.1 Industrial

- 5.2.2 Architectural

- 5.2.3 Automotive

- 5.2.4 Packaging

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Allnex GmbH

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 Evonik Industries AG

- 6.4.7 Hexion

- 6.4.8 Huntsman International LLC

- 6.4.9 Kangnam Chemical

- 6.4.10 KANSAI HELIOS

- 6.4.11 Mitsubishi Shoji Chemical Corporation

- 6.4.12 Mitsui Chemicals Inc.

- 6.4.13 Reichhold LLC 2

- 6.4.14 Uniform Synthetics

- 6.4.15 Vil Resins

- 6.4.16 Wanhua

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advent of Environmentlly friendly Resins