|

市場調查報告書

商品編碼

1687310

住宅電池:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Residential Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

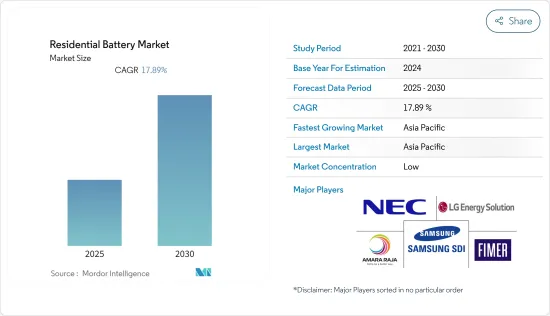

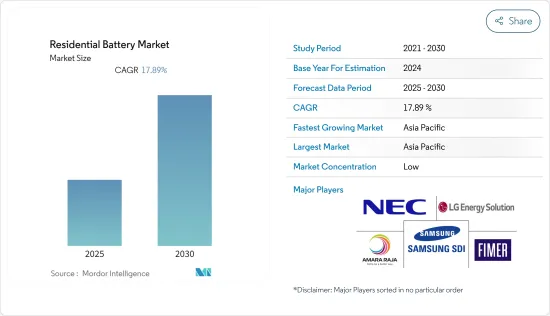

預計預測期內住宅電池市場將以 17.89% 的複合年成長率成長。

受訪市場在2020年受到新冠疫情的影響,但已恢復至疫情前的水準。

預計預測期內鋰離子電池價格下跌將推動市場成長。然而,預計鉛酸電池的環境缺陷將在預測期內阻礙市場成長。預計在預測期內,離網太陽能的日益普及將為全球住宅電池市場帶來有利的成長機會。

亞太地區在所研究的市場中佔據主導地位,預計在預測期內將以最高的複合年成長率成長。這一成長是由中國、印度和日本對住宅屋頂太陽能光電裝置的投資和採用不斷增加所推動的。

住宅電池市場趨勢

預計鋰離子電池領域將佔市場主導地位。

與鉛酸電池等其他技術相比,鋰離子 (Li-ion) 電池具有多種技術優勢。可充電鋰離子電池的平均額定循環次數為 5,000 次以上。

鋰離子電池不需要像鉛酸電池那樣進行大量維護或更換。鋰離子電池在整個放電週期中保持其電壓,使電氣元件更有效率、使用壽命更長。雖然鋰離子電池的初始成本較高,但考慮到其壽命和性能,其實際成本遠低於鉛酸電池。

電池在能源儲存系統中起著關鍵作用,佔總系統成本的很大一部分,尤其是在住宅能源儲存系統中使用時。全球再生能源來源的總設備容量正在大幅成長,住宅太陽能安裝量也在增加。

太陽能屋頂容量的增加可能會推動對電池能源儲存的需求增加。因此,預計住宅用新型能源儲存系統(ESS)的出現將在預測期內推動對鋰離子電池的需求。鋰離子電池因其重量輕、充電時間快、充電週期數多、價格低而非常適合此應用。

由於價格下降,鋰離子電池最近作為住宅太陽能發電和家用逆變器的儲能系統而變得流行。 2021年鋰離子電池價格為123美元/度數,較2013年的668美元/kWh下降了81.58%。迄今為止,住宅能源儲存計畫仍處於起步階段。不過,美國、德國等國家正尋求透過國家政策行動和監管措施為本土能源儲存市場創造機會。

例如,2022年10月,作為總統兩黨基礎設施法案的一部分,美國能源局(DOE)宣布了第一波計劃,以擴大目前從海外進口的電池、材料和零件的國內製造。總合將分配給 20 家公司,用於在 12 個州建造或擴大商業規模的設施,以提取、加工和展示新方法,例如利用回收材料、鋰、石墨和其他電池組件材料製造組件。 2021年11月,金霸王在美國推出了與新建或現有住宅太陽能發電系統相容的磷酸鋰鐵(LFP)電池。該電池的額定輸出功率為5kW,儲存容量為14kWh。電壓範圍為44.5-53.5V,最大充放電電流為74.0A,往返效率超過85.7%,性能保證超過6000次循環。

因此,由於上述因素,預計鋰離子電池領域將在預測期內佔據市場主導地位。

亞太地區可望主導市場

亞太地區擁有多個發展中經濟體,擁有豐富的自然和人力資源。該地區佔了大部分收益,其中中國和印度是主要貢獻者。預計這些國家在預測期內將展現巨大的成長潛力。

在政府措施和監管支持的推動下,中國住宅電池市場預計將在預測期內成長。中國政府已經證明其有能力透過補貼和安裝目標來刺激國內太陽能相關設備需求的高速成長。

2020年1-9月,全國住宅屋頂光伏裝置容量741萬千瓦,2021年年增64.61%。 2021年9月,新增住宅屋頂光電裝置容量214千萬瓦。 2022年2月,Bslbatt在中國推出了用於離網太陽能能源儲存的模組化鋰離子電池。該電池的儲存容量為 5.1 至 30.7 kWh,可可靠運作長達 6,000 次充電循環。因此,預計住宅領域的此類新電池技術將在預測期內推動所研究市場的成長。

該地區另一個重要國家是印度,截至2021年12月,印度的裝置容量為393.83吉瓦,位居世界第五。但印度正面臨停電。印度政府旨在透過大幅增加包括屋頂太陽能在內的可再生能源發電能力,實現全天24小時供電,預計將增加對住宅電池的需求。

印度政府正在推動印度建立鋰離子電池製造廠,並於2022年開始生產,預計將降低鋰離子電池的成本。例如,中央電化學實驗室(CECRI)於2022年10月開始在印度清奈建造一座自主研發的鋰離子電池製造廠,日產能為1,000顆電池。該設施預計將於 2024 年在塔拉馬尼的印度科學與工業研究理事會 (CSIR) 馬德拉斯綜合大樓內竣工。

亞太地區是都市化最快的國家之一,預計家用電子電器產品、備用電源系統等各種應用對住宅電池的需求龐大。

住宅電池產業概況

住宅電池市場是細分的。市場的主要企業(不分先後順序)包括 FIMER SpA、Amara Raja Batteries Ltd、三星 SDI、NEC Corporation 和 LG Energy Solution Ltd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測(十億美元)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 按類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 按地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Duracell Inc.

- Energizer Holding Inc.

- BYD Co. Ltd

- FIMER SpA

- LG Energy Solution Ltd

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Siemens AG

- Luminous Power Technologies Pvt. Ltd

- Amara Raja Batteries Ltd

- Delta Electronics Ltd

- NEC Corporation

- Tesla Inc.

第7章 市場機會與未來趨勢

The Residential Battery Market is expected to register a CAGR of 17.89% during the forecast period.

Although the market studied was affected by COVID-19 in 2020, it recovered and reached pre-pandemic levels.

The declining prices of lithium-ion batteries are expected to drive the growth of the market studied during the forecast period. However, the environmental disadvantages of lead-acid batteries are expected to hamper the growth of the market studied during the forecast period. An increase in off-grid solar utilization is expected to create lucrative growth opportunities for the global residential battery market during the forecast period.

Asia-Pacific is dominating the market studied, and it is expected to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments and the adoption of residential rooftop solar installations in China, India, and Japan.

Residential Battery Market Trends

Lithium-ion Battery Segment Expected to Dominate the Market

Lithium-ion (Li-ion) batteries offer various technical advantages over other technologies, such as lead-acid batteries. Rechargeable Li-ion batteries, on average, offer cycles more than 5,000 times compared to lead-acid batteries that last around 400-500 times.

Li-ion batteries do not need as frequent maintenance and replacement as lead-acid batteries. Li-ion batteries maintain their voltage throughout the discharge cycle, allowing greater and longer-lasting efficiency of electrical components, whereas the voltage of lead-acid batteries drops consistently throughout the discharge cycle. Despite the higher upfront cost of Li-ion batteries, the true cost is much lesser than lead-acid batteries when considering lifespan and performance.

Batteries play a crucial part in energy storage systems and are responsible for a major portion of the total cost of the system, especially used in residential energy storage systems. The total installed capacity of renewable energy sources is increasing at a significant rate worldwide, and so is the installation of solar rooftops on residential buildings.

The increase in solar rooftop capacity is likely to foster an increase in the demand for battery energy storage. Therefore, the emergence of new energy storage systems (ESS) for residential applications is expected to boost the demand for lithium-ion batteries during the forecast period. Properties of lithium-ion batteries, such as less weight, low charging time, a higher number of charging cycles, and declining cost, make it preferable for this application.

Due to their declining prices, lithium-ion batteries have recently gained popularity as battery storage systems for residential solar and home inverters. In 2021, the price of the lithium-ion battery was USD 123/kWh, which declined by 81.58% from USD 668/KWh in 2013. The residential energy storage policies to date are quite nascent. However, countries, like the United States and Germany, through state policy action and regulatory action, are creating opportunities in the local energy storage markets.

For instance, in October 2022, as part of the President's Bipartisan Infrastructure Law, the US Department of Energy (DOE) announced the first set of projects to expand domestic manufacturing of batteries, materials, and components imported from overseas. A total of USD 2.8 billion will be awarded to the 20 companies for building and expanding commercial-scale facilities in 12 states for extracting, processing, and demonstrating new approaches, such as manufacturing components from recycled materials, lithium, graphite, and other components battery materials. In November 2021, Duracell launched a lithium iron phosphate (LFP) battery compatible with new or existing residential PV systems in the United States. The battery has a power rating of 5 kW and a storage capacity of 14 kWh. It has a voltage range from 44.5 to 53.5 V and a maximum charge and discharges current of 74.0 A. The roundtrip efficiency is over 85.7%, with a guaranteed performance of over 6,000 cycles.

Therefore, owing to the above-mentioned factors, the lithium-ion battery segment is expected to dominate the market during the forecast period.

Asia-Pacific Expected to Dominate the Market

Asia-Pacific has multiple growing economies with substantial natural and human resources. The region holds the majority share in revenue, with China and India being the major contributors. These countries are anticipated to exhibit immense growth potential during the forecast period.

Due to the government's policy and regulatory support, the Chinese residential battery market is expected to grow during the forecast period. The Chinese government has already shown its ability to stimulate high growth in domestic demand for solar-related equipment through subsidies and installation targets.

In the first nine months of 2020, China's total residential rooftop solar capacity installed stood at 7.41 GW, which increased by 64.61% in 2021. The country added 2.14 GW of residential rooftop solar capacity in September 2021. In February 2022, Bslbatt unveiled a modular lithium-ion battery for off-grid solar energy storage in China. The battery has a storage capacity ranging from 5.1 to 30.7 kWh and can provide steady operation for up to 6,000 charge cycles. Thus, such new battery technologies in the residential sector are anticipated to increase the growth of the market studied during the forecast period.

Another important country in the region is India, which accounts for the world's fifth-largest power generation capacity, with an installed capacity of 393.83 GW, as of December 2021. However, India faces power outages. The Government of India aimed to supply electricity 24 hours a day by significantly adding to renewable energy generation capacity, including rooftop solar power, which is anticipated to increase the demand for residential batteries.

With the government of India pushing to install lithium-ion battery manufacturing plants in India and start production in 2022, the cost of lithium-ion batteries is expected to drop. For instance, in October 2022, the Central Electrochemical Research Institute (CECRI) started building an indigenously-developed lithium-ion battery manufacturing plant in Chennai, India, with the capacity to produce 1,000 batteries per day. The facility will be completed by 2024 at the Council of Scientific and Industrial Research (CSIR) Madras Complex at Taramani.

Asia-Pacific is home to the fastest urbanizing countries, which is anticipated to create a significant demand for residential batteries for various applications, including consumer electronics, backup power supply systems, etc.

Residential Battery Industry Overview

The residential battery market is fragmented. Some of the major companies in the market (in no particular order) include FIMER SpA, Amara Raja Batteries Ltd, Samsung SDI Co. Ltd, NEC Corporation, and LG Energy Solution Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Others Types

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Duracell Inc.

- 6.4.2 Energizer Holding Inc.

- 6.4.3 BYD Co. Ltd

- 6.4.4 FIMER SpA

- 6.4.5 LG Energy Solution Ltd

- 6.4.6 Panasonic Corporation

- 6.4.7 Samsung SDI Co. Ltd

- 6.4.8 Siemens AG

- 6.4.9 Luminous Power Technologies Pvt. Ltd

- 6.4.10 Amara Raja Batteries Ltd

- 6.4.11 Delta Electronics Ltd

- 6.4.12 NEC Corporation

- 6.4.13 Tesla Inc.