|

市場調查報告書

商品編碼

1687317

隔熱塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Thermal Insulation Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

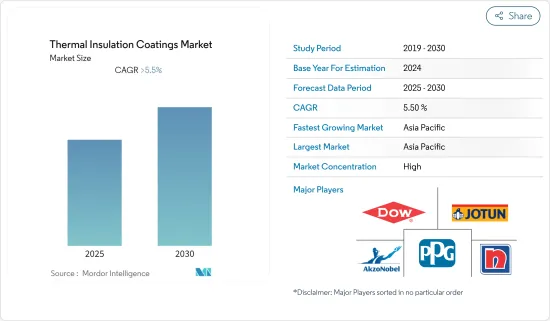

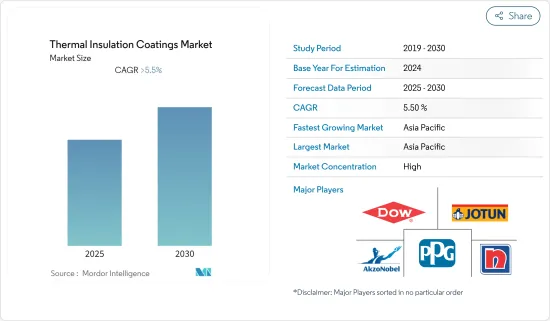

預測期內,隔熱塗料市場預計將以超過 5.5% 的複合年成長率成長。

新冠肺炎疫情為市場帶來了負面影響。不過,目前估計市場已達到疫情前的水準。

主要亮點

- 推動市場發展的首要因素是新煉油廠的建設和建設產業的需求不斷成長。

- 預計海洋產業需求的不斷成長將為市場提供機會。

- 亞太地區佔全球市場主導地位,其中中國和印度等國家消費量最高。

隔熱塗料市場趨勢

工業/製造業佔市場主導地位

- 工業部門包括石油和天然氣、石化、化學品和煉油廠等終端用戶產業。這些終端用戶產業在臨界溫度下運行,因此節約熱能起著關鍵作用。

- 石油和天然氣產業需要混凝土儲存槽、管道和支撐結構來在世界各地儲存和分配石油和天然氣。熱障塗層因其耐高溫的能力而被廣泛應用於石油和天然氣基礎設施。

- 此外,化學和石化工廠、儲存槽、管道和鍋爐都在極高的溫度下運作。因此,熱障塗層作為高效運作的合適隔熱材料被廣泛應用於這些行業。

- 全球各地規劃了多個陸上和海上計劃,預計這將在預測期內刺激石油和天然氣行業對隔熱塗層的需求。

- 因此,由於上述因素,工業/製造業預計將佔據市場主導地位。

中國主宰亞太地區

- 中國建築業的快速發展得到了全世界的認可。對低成本住宅和商業住宅的需求是其近年來成長的原因。

- 目前,中國生產了亞太地區一半以上的塗料,擁有10,000多家塗料生產企業,本土企業佔了國內塗料市場佔有率。

- 就在中國政府尋求實現經濟再平衡、更加以服務業為基礎的同時,它也在籌劃一項大規模的建設計畫,其中包括在未來十年內將 2.5 億人遷移到新的特大城市。

- 然而,恆大債務危機可能對中國建設產業負面影響。

- 此外,中國擁有世界上最大的航太工業之一。中國政府正在大力投資航太領域以促進國內生產,並計劃建造新機場。

- 因此,隨著各行業的快速成長,預計預測期內中國隔熱塗料市場將快速擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 興建新煉油廠

- 建設產業需求不斷成長

- 限制因素

- 高資本要求

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 釔安定氧化鋯(YSZ)

- 其他樹脂

- 最終用戶產業

- 建築和施工

- 工業/製造業

- 車

- 海洋

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AkzoNobel NV

- Caparol

- Carboline

- Dow

- Jotun

- Mascoat

- Nippon Paint Holdings Co. Ltd

- PPG Industries Inc.

- Sharpshell Industrial Solutions

- SIKA AG

- Synavax

- The Sherwin-Williams Company

第7章 市場機會與未來趨勢

- 海洋產業需求不斷成長

簡介目錄

Product Code: 61248

The Thermal Insulation Coatings Market is expected to register a CAGR of greater than 5.5% during the forecast period.

The COVID-19 pandemic had negatively impacted the market. However, the market has now been estimated to have reached pre-pandemic levels.

Key Highlights

- Major factors driving the market studied are the construction of new refineries and increasing demand in the construction industry.

- Increasing demand from the marine industry is expected to act like an opportunity for the market.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries such as China and India.

Thermal Insulation Coatings Market Trends

Industrial/Manufacturing Segment to Dominate the Market

- The industrial segment includes end-user industries such as oil and gas, petrochemicals, chemicals, and refineries. These end-user industries operate in critical temperatures, so conservation of heat energy plays a crucial role.

- The oil and gas industry needs concrete storage tanks, pipelines, and supporting structures to store and distribute oil and gas globally. In oil and gas infrastructure, thermal insulation coating is widely used due to its high-temperature resistance.

- Additionally, chemical and petrochemical plants, storage tanks, pipelines, and boilers, run under critically high temperatures. Therefore, thermal insulation coatings are widely helpful in providing proper insulation for efficient operation in such industries.

- There are several onshore and offshore projects planned across the world, which is expected to add to the demand for thermal insulation coatings requirement in the oil and gas industry over the forecast period.

- Hence based on the aforementioned factors, the Industrial/manufacturing segment is expected to dominate the market.

China to Dominate the Asia-Pacific Region

- China is globally recognized for its rapid architectural expansion. The demand for low-cost housing and commercial housing is the reason for its growth in recent years.

- China is currently producing more than half of the Asia-Pacific coatings and is home to more than 10,000 paint companies, among which local producers occupy more than half of the domestic paint market share.

- The Chinese government has planned massive construction plans, including making provision for the movement of 250 million people to its new megacities in the next ten years, despite efforts to rebalance its economy to a more service-oriented base.

- However, the Evergrande debt crisis may impact the construction industry of China negatively.

- Furthermore, China represents one of the biggest aerospace industries globally. The Chinese government is making huge investments in the aerospace sector to increase its domestic manufacturing and is planning to build new airports, which are expected to drive the thermal insulation coatings market over the forecast period.

- Hence, with the rapid growth in various industries, the market for thermal insulation coatings in China is expected to rapidly increase over the forecast period.

Thermal Insulation Coatings Industry Overview

The thermal insulation coatings market is a partially consolidated market. The major companies (in no particular order) include AkzoNobel NV, Dow, Jotun, Nippon Paint Holdings Co. Ltd, and PPG Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Construction of New Refineries

- 4.1.2 Increasing Demand in the Construction Industry

- 4.2 Restraints

- 4.2.1 High Capital Requirement

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Yttria-Stabilized Zirconia (YSZ)

- 5.1.5 Other Resins

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Industrial/Manufacturing

- 5.2.3 Automotive

- 5.2.4 Marine

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel NV

- 6.4.2 Caparol

- 6.4.3 Carboline

- 6.4.4 Dow

- 6.4.5 Jotun

- 6.4.6 Mascoat

- 6.4.7 Nippon Paint Holdings Co. Ltd

- 6.4.8 PPG Industries Inc.

- 6.4.9 Sharpshell Industrial Solutions

- 6.4.10 SIKA AG

- 6.4.11 Synavax

- 6.4.12 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from the Marine Industry

02-2729-4219

+886-2-2729-4219