|

市場調查報告書

商品編碼

1687349

自主移動機器人 (AMR):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Autonomous Mobile Robot (AMR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

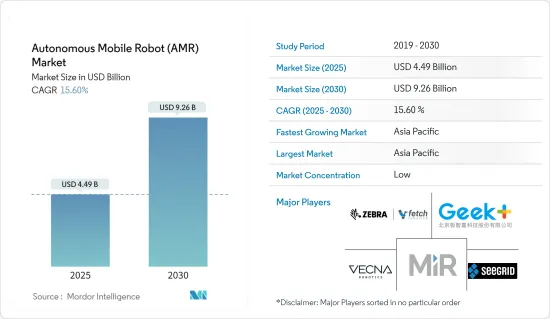

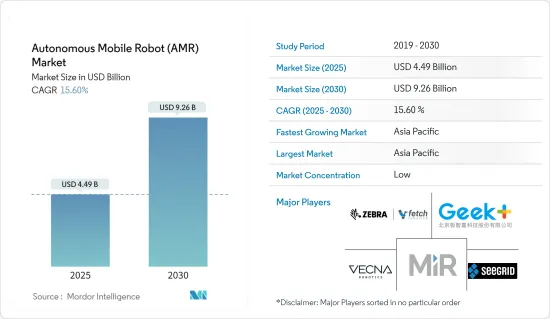

2025 年自主移動機器人市場規模預估為 44.9 億美元,預計到 2030 年將達到 92.6 億美元,預測期內(2025-2030 年)的複合年成長率為 15.6%。

主要亮點

- 市場的主要促進因素是製造業自動化程度的提高、電子商務產業的發展、產品的大規模個人化以及低成本勞動力的短缺。

- AMR 的核心優勢在於它能夠了解其運作環境,使其即使在有人類操作員的情況下也能越過障礙物並安全運行。與需要某種引導路徑(例如磁帶或2D碼)的自動導引車不同,AMR 可以使用來自攝影機、雷射掃描器和其他感測器的資料來了解其周圍環境並決定如何操縱。

- 機器人技術、自動駕駛技術和物聯網的進步為各行各業採用連結產業用自動駕駛汽車創造了理想的環境。隨著自動駕駛技術在消費性汽車和交通運輸領域的不斷應用,這些汽車有望改變產業格局。此類自動化工業車輛的興起預計將繼續推動市場成長。

- 除了與勞動力相關的挑戰之外,安全性也是使用 AMR 實現倉庫自動化的關鍵因素。例如,職業安全與健康管理局 (OSHA) 和美國勞工部表示,超過 11% 用於在倉庫中移動和運輸托盤的堆高機有事故隱患。也就是說,能夠處理托盤和散裝移動的 AMR 的開發有助於減少對某些任務的堆高機的依賴,這可能會大大改善倉庫安全。

- AMR 的初始成本可能很高,尤其是在暫時評估其成功時。 AGV 系統比僱用人力或使用手動堆高機等附加工具更昂貴。然而,從長遠來看,AMR 可帶來正面的投資收益(ROI),提高整體效率和生產力,進而帶來財務效益。

- 在後疫情時代背景下,針對B2C和B2B企業的機器人租賃選項-機器人即服務(RaaS)正變得越來越受歡迎。透過使用 RaaS,不需要引入機器人相關的初始成本。此項租賃服務使AMR能夠更容易被中小企業所接受。 RaaS 讓中小型企業可以利用 AMR 提供的靈活性和擴充性。否則,似乎只有能夠負擔安裝成本的大公司才能夠享受這些好處。

- 隨著疫情爆發後職場和求職者偏好的變化,勞動力自動化和 AMR 的採用將再次證明其價值。勞動力自動化和 AMR 的採用是公司渡過勞動力短缺危機、無憂無慮地繼續營運以及建立可以透過勞動力自動化使公司及其客戶現在和將來受益的商業實踐的最有效方法之一。

自主移動機器人 (AMR) 市場趨勢

汽車產業預計將大幅成長

- AMR 使汽車製造商能夠加快物料流、縮短前置作業時間並提高生產效率。此外,預計在預測期內,汽車製造商將透過採用準時 (JIT) 製造技術來提高靈活性和產量。作為一種能夠快速回應生產模式和程序變化的物流解決方案,AMR 正變得越來越受歡迎。

- 機器人技術在汽車製造的應用預計將帶來產量的增加。例如,2023年,印度售出超過150萬輛電動車。其中大部分為電動摩托車,約有86萬輛。為了搶佔機器人市場的更大佔有率,寶馬和豐田等汽車製造商正在投資機器人和製造業,以利用他們已知的技術。 BMW和英偉達多年來一直合作開發用於工廠的移動機器人,主要作為最後一哩路的物料輸送解決方案。

- 此外,預計先進行動市場將越來越依賴各地區對自動化生產技術(包括工業 4.0 標準)的投資。

- 然而,隨著行業相關人員認知到應用這些解決方案的好處,預計未來幾年市場將大幅擴張。例如,汽車產業透過增加勞動力自動化可以消除非增值勞動時間,並為現代工人提供在安全的工作環境中增強複雜工作的任務。

亞太地區可望主導市場

- 亞太地區佔據市場主導地位,預計這種局面將在預測期內持續下去。亞太國家電子商務產業的發展正在推動自主移動機器人用於庫存管理。

- 中國是工業機器人的重要使用者。由於資源豐富、人事費用低廉且安全法規比北美或歐洲寬鬆,該國以擁有創新的生產設施而聞名。然而,在「中國製造2025」等政府宏偉計畫的推動下,中國有意提高其在機器人、人工智慧和雲端資料技術方面的研究能力。

- 日本的「新機器人戰略」旨在使日本成為世界頂級機器人製造國。機器人開發將主要集中在製造業、服務業、護理/醫療保健、基礎設施、災害應變、農業和建設業。

- 印度、中國和日本是機器人和自動化的重要市場。儘管遠遠落後於世界其他國家,印度正在提高其自動化水準。

- 此外,2023 年 3 月,日本 AMR(自主移動機器人)公司 LexxPluss 報告在 A 輪投資中籌集了 14.5 億日圓(約 1,100 萬美元)。 LexxPlus 計劃在未來兩年內將混合動力 AMR 產量提高到每年 1,500 輛。

自主移動機器人 (AMR) 市場概覽

- 預計未來幾年該產業仍將保持技術主導,頻繁的收購和策略聯盟是參與者擴大產業影響力的關鍵策略。例如,總部位於馬薩諸塞州切姆斯福德的 AutoGuide Mobile Robots 與丹麥工業自動化公司 Mobile Industrial Robots ApS (MiR) 合併,兩家自主移動機器人 (AMR) 供應商將於 2022 年 10 月合併為一個單位,此舉有望擴大產品系列並簡化客戶的自動化計劃。兩家公司已開始合作為 AMR 提供相同的車隊管理軟體。

- 我們的自主移動機器人和移動機械手服務創造了實現智慧工廠所需的靈活、自主的工業自動化。在這些工廠裡,物聯網、人工智慧和巨量資料等先進技術將融入機器人技術,實現資訊交換。這推動了自主移動機器人在工業 4.0 和製造業的應用。

- 如今,AMR 採用者正在加速採用,從少數機器人的先導計畫轉向「車隊規模」部署。例如,Zebra Technologies 的滾頂 AMR 在製造、倉儲和配送中心越來越受歡迎。這些機器人建立在 Fetch Robotics 的 Freight 100 平台上,經常以協作的方式一起工作。這是透過尖端感測器、人工智慧和車隊管理系統的改進來實現的。

- 自主移動機器人(AMR)可以輕鬆滿足工作需求。 AMR 與人類之間的協作顯著提高了工作準確性、生產力和效率。部署小型(數十個) AMR 車隊與人類一起工作也能提供基本水準的控制。

- 根據英國國家統計局的數據,截至 2023 年 1 月,約有 11.5% 的美國企業表示面臨勞動力短缺,低於 2022 年 9 月的 15.7%。勞動力短缺可能會推動英國和其他歐洲國家對 AMR 的需求。

- 如果沒有幾項進一步說服消費者的技術進步,自主移動機器人可能就不會獲得今天的普及。隨著 AMR 逐漸脫離概念驗證階段並被用於解決勞動力短缺和供應鏈中斷問題,越來越多的組織意識到了這項技術的潛力。公司也開始重新評估其 AMR 實施的範圍。

- 此外,自主移動機器人市場較為分散,主要企業包括Fetch Robotics(Zebra Technologies Corporation)、Mobile Industrial Robots(Mir)(Teradyne Inc.)、Geek+Technology、Vecna Robotics Inc.和Seegrid Corporation。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 例如,2023 年 11 月,OMRON宣布推出具有中等有效載荷能力(650 公斤和 900 公斤)的 MD-650 和 MD-900 自主移動機器人 (AMR)。這些新增功能擴展了OMRON的自主機器人產品線,可滿足各種零件和材料處理應用的需求,進而提高生產車間的效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情和其他宏觀經濟趨勢對市場的影響

第5章 市場動態

- 市場促進因素

- 終端用戶產業對自動化的需求日益增加

- 與科技進步相關的勞工挑戰

- 市場限制

- 通訊和連接問題

- 高資本要求

第6章 市場細分

- 按類型

- 無人地面車輛

- 人類生物

- 無人駕駛飛行器

- 無人船

- 按最終用戶產業

- 國防和安全

- 倉儲和物流

- 能源和電力

- 車

- 製造業

- 石油和天然氣

- 採礦和礦產

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Fetch Robotics(Zebra Technologies Corporation)

- Mobile Industrial Robots(Mir)(Teradyne Inc.)

- Geek+Technology Co. Ltd

- Vecna Robotics Inc.

- Seegrid Corporation

- Aethon Inc.(ST ENGINEERING HUB)

- Omron Corporation

- OTTO Motors

- Clearpath Robotics

- HiK Robot

- Softbank Robotics

- SMP Robotics

第 8 章供應商定位分析

第9章投資分析

第 10 章:市場的未來

簡介目錄

Product Code: 61495

The Autonomous Mobile Robot Market size is estimated at USD 4.49 billion in 2025, and is expected to reach USD 9.26 billion by 2030, at a CAGR of 15.6% during the forecast period (2025-2030).

Key Highlights

- The main drivers of the market are the increasing trend of automation in manufacturing, the development of the e-commerce industry, the mass personalization of goods, and the lack of low-cost labor.

- An essential advantage is an AMR's ability to understand its operating environment, enabling it to navigate through obstacles and operate safely in the presence of human operators. In contrast to an automated guided vehicle that requires some kind of guidance path, such as a magnetic tape or QR code, the AMR can use data from cameras, laser scanners, and other sensors to understand its environment and decide how it should be operated.

- The ideal environment for adopting connected industrial autonomous vehicles in different sectors is being created by increasing robotics, autonomous technology, and Internet of Things development. In addition to the continued adoption of autonomous technologies in consumer vehicles and transport, these vehicles are expected to alter the industrial environment. The market's growth is expected to continue due to this increase in autonomous industrial vehicles.

- Besides labor-related challenges, security is another critical factor in using AMRs for warehouse automation. For example, the Occupational Safety and Health Administration (OSHA) and the US Department of Labor stated that over 11% of forklifts used to carry and transport pallets in a warehouse may be at risk of accidents. Nevertheless, the development of AMRs capable of handling pallet and bulk movements is helping to decrease reliance on forklifts for specific activities; this will bring significant improvements in warehouse safety.

- The initial cost of AMR can be high, mainly if the outcome is assessed on an interim basis. The AGV system is more expensive than hiring personnel or using additional tools such as manual forklifts. In the long run, however, AMR can lead to a positive return on investment (ROI) and increase overall efficiency and productivity, which results in economic benefits.

- In the post-pandemic situation, the popularity of robots-as-a-service (RaaS), a robotic rental option for B2C and B2B companies, has increased. RaaS eliminates the upfront costs associated with installing robots, which need significant expertise and computer capacity. This rental service gives small- and medium-sized businesses more access to AMRs. RaaS allows smaller organizations to take advantage of the flexibility and scalability that AMRs offer. Otherwise, only larger organizations that could afford the installation fees would be able to make use of these advantages.

- Labor automation and the adoption of AMRs again demonstrate their value as the workplace and job seekers' aspirations change after the pandemic. Automating labor or adopting AMRs is one of the most effective ways for businesses to get past labor scarcity difficulties, carry on without concern, and establish business practices that may benefit them and their clients now and in the future through labor automation.

Autonomous Mobile Robot (AMR) Market Trends

Automotive Industry Expected to Register Significant Growth

- AMRs allow automotive manufacturers to speed up the flow of materials, shorten lead times, and achieve more efficient production. In addition, during the forecast period, automotive manufacturers are expected to place a high priority on flexibility versus volume with the adoption of (JIT) manufacturing techniques. AMRs are becoming increasingly popular as a logistic solution that can react quickly to production patterns and procedure changes.

- The use of robotics in vehicle manufacturing is anticipated to proliferate production. For instance, in 2023, more than 1.5 million electric vehicles were sold in India. Most of these were electric two-wheelers, accounting for around 860 thousand units. To increase their share in the robotics market, auto manufacturers such as BMW and Toyota invest in robotics and manufacturing to leverage what they already know. BMW and Nvidia have been working together for many years on developing mobile robots to be used internally in their factories, mainly as an automated material handling solution at the final mile.

- In addition, the market for advanced mobility vehicles is projected to become increasingly dependent on investment in automated production techniques, including Industry 4.0 standards throughout the regions.

- Nevertheless, the market is expected to increase significantly over the next few years as industry players realize the benefits of applying these solutions. For example, a vehicle industry that adds automated management to its workforce can reduce unvalued work hours and provide modern workers with complex job-enhancing tasks in a safe working environment.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominates the market, which is expected to continue during the forecast period. The development of the e-commerce industry in Asia-Pacific countries is encouraging the use of autonomous mobile robots for inventory management.

- China has been a significant user of industrial robots. Given its abundant, low labor costs and generally weaker safety regulations than North America or Europe, it has been noted as having innovative production facilities. Nevertheless, the country intends to improve its research capacity for robots, AI, and cloud data technologies due to various government ambitions such as "Made in China 2025".

- Under the Japanese "New Robot Strategy," the country aims to make Japan the world's top robot manufacturer. Robots' development will primarily focus on the manufacturing, services, nursing and healthcare, infrastructure, disaster response, agriculture, and construction industries.

- India, China, and Japan are still essential markets for robots and automation. Despite severely lagging behind the rest of the world, India is increasing its level of automation.

- Furthermore, in March 2023, LexxPluss, a Japanese AMR (autonomous mobile robot) company, reported raising JPY 1.45 billion (about USD 11 million) in a Series A investment. Over the following two years, LexxPluss intends to increase the production rate of its hybrid AMR to 1,500 units annually.

Autonomous Mobile Robot (AMR) Market Overview

- The industry is anticipated to remain innovation-led for the next few years, with frequent acquisitions and strategic alliances embraced as the key strategies by the players to increase their industry presence. For instance, two autonomous mobile robots (AMR) vendors merged into a single unit in October 2022, claiming that the combination of Chelmsford, Massachusetts-based AutoGuide Mobile Robots and the Danish industrial automation firm Mobile Industrial Robots ApS (MiR) were expected to expand their product portfolios and simplify customer automation projects. The two businesses had already collaborated to provide their AMRs with the same fleet management software.

- The service of autonomous mobile robots and mobile manipulators creates flexible and autonomous industrial automation needed to create smart factories. In these factories, the exchange of information is made possible by integrating advanced technologies into robotics, such as the Internet of Things, artificial intelligence, or big data. This has pushed the adoption of autonomous mobile robots in Industry 4.0 and manufacturing.

- Today, AMR adopters have accelerated their adoption, moving from pilot projects with a few robots to "fleet-size" installations. For instance, roller-top AMRs from Zebra Technologies are gaining popularity in manufacturing, storage, and distribution centers. These robots, constructed on the Freight 100 platform from Fetch Robotics, are increasingly performing collaborative tasks. This has been made possible by cutting-edge sensors, artificial intelligence, and fleet management systems that are improving.

- Autonomous mobile robots, or AMRs, can readily meet the demand for work. Collaboration between AMRs and humans significantly boosts operational accuracy, productivity, and efficiency. A fundamental level of control is also added by deploying even a small fleet of AMRs working with humans-as few as a dozen.

- As of January 2023, roughly 11.5% of businesses in the United Kingdom stated that they were facing a workforce shortage, down from 15.7% in September 2022, according to the Office for National Statistics (UK). The demand for AMRs in the United Kingdom and other European nations may increase due to such labor shortages.

- Autonomous mobile robots would not have attained the level of popularity they have now without several technological advancements that further convinced consumers of their use. As AMRs move past the proof-of-concept stage and are utilized to manage labor shortages and supply chain disruptions, an increasing number of organizations are coming to understand the potential of these technologies. Businesses are also beginning to review the extent of their AMR deployments.

- Furthermore, the autonomous mobile robot market is fragmented, with significant players like Fetch Robotics (Zebra Technologies Corporation), Mobile Industrial Robots (Mir)(Teradyne Inc.), Geek+ Technology Co. Ltd, Vecna Robotics Inc., and Seegrid Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- For instance, in November 2023, OMRON announced the launch of the MD-650 and MD-900 medium-payload (650 kg and 900 kg) autonomous mobile robots (AMR). These additions expand OMRON's lineup of autonomous robots to meet the requirements of various part and material transport applications, providing greater efficiency at production sites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Automation across the End-user Industries

- 5.1.2 Labor-related Challenges Coupled with Advancements in Technology

- 5.2 Market Restraints

- 5.2.1 Communication and Connectivity Issues

- 5.2.2 High Capital Requirements

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Unmanned Ground Vehicles

- 6.1.2 Humanoids

- 6.1.3 Unmanned Aerial Vehicles

- 6.1.4 Unmanned Marine Vehicles

- 6.2 By End-user Industry

- 6.2.1 Defense and Security

- 6.2.2 Warehouse and Logistics

- 6.2.3 Energy and Power

- 6.2.4 Automotive

- 6.2.5 Manufacturing

- 6.2.6 Oil and Gas

- 6.2.7 Mining and Minerals

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.6 Middle East and Africa

- 6.3.6.1 Saudi Arabia

- 6.3.6.2 United Arab Emirates

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fetch Robotics (Zebra Technologies Corporation)

- 7.1.2 Mobile Industrial Robots (Mir) (Teradyne Inc.)

- 7.1.3 Geek+ Technology Co. Ltd

- 7.1.4 Vecna Robotics Inc.

- 7.1.5 Seegrid Corporation

- 7.1.6 Aethon Inc. (ST ENGINEERING HUB)

- 7.1.7 Omron Corporation

- 7.1.8 OTTO Motors

- 7.1.9 Clearpath Robotics

- 7.1.10 HiK Robot

- 7.1.11 Softbank Robotics

- 7.1.12 SMP Robotics

8 VENDOR POSITIONING ANALYSIS

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219