|

市場調查報告書

商品編碼

1687386

保鮮膜:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Cling Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

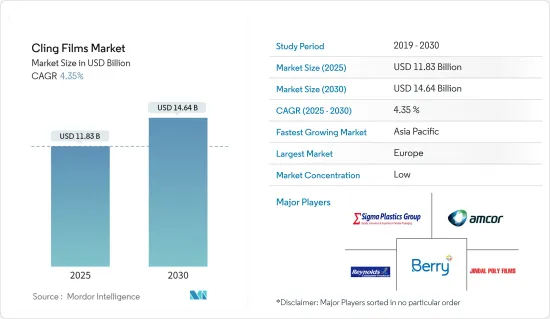

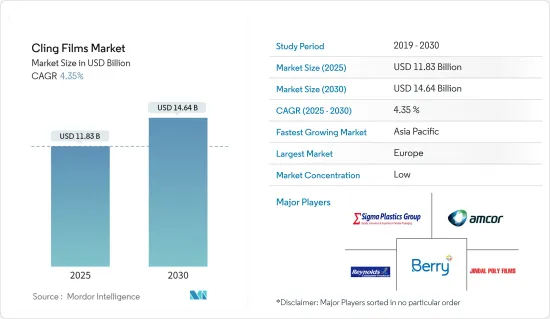

保鮮膜市場規模預計在 2025 年為 118.3 億美元,預計到 2030 年將達到 146.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.35%。

由於全球停工和嚴格的監管迫使多個行業關閉製造地,COVID-19 對 2020 年的市場產生了負面影響。不過,預計市場將達到疫情前的水平,並有望穩定成長。

預計在預測期內,對衛生食品包裝和包裝食品的偏好將推動需求成長。預計醫療保健行業的需求不斷成長也將推動市場成長。

然而,保鮮膜對極端天氣條件的抵抗力較差以及全球對保鮮膜使用監管的日益嚴格預計將抑制市場成長。

生物基清潔薄膜在永續食品包裝中的應用有望成為未來幾年市場成長的機會。

預計亞太地區將在預測期內實現最高成長率。

保鮮膜市場趨勢

食品領域佔市場主導地位

- 保鮮膜主要用於包裝食品,防止昆蟲和其他微生物的污染。此外,使用保鮮膜可以提高食物的保存效果,使其長時間保持新鮮,有效減少食物廢棄物。

- 以天然聚合物為基礎的清潔食品包裝膜是非生物分解的石油基合成聚合物的低成本替代品,具有積極的環境和經濟效益。

- 中國是最大的食品和飲料消費國之一,由於人口成長和對健康、美味包裝食品的需求增加,其食品加工行業持續擴張。該國受歡迎的食品包括烘焙產品、食品和飲料以及其他營養食品。

- 美國食品工業是世界上最大的食品工業之一。北美研究市場的需求主要由美國推動。此外,在美國,不斷成長的食品市場也正在推動當地市場的發展。

- 印度日益成長的知名度,加上其不斷擴張的經濟和不斷變化的生活方式,預計到2025年將主導全球包裝食品市場。印度目前是世界第二大食品生產國,這反映出所研究市場的巨大成長機會。

- 近年來,包裝食品和已調理食品越來越受歡迎,尤其是在都市區消費者中。由於大城市生活節奏快,消費者更喜歡已烹調食品作為日常飲食。收入、生活水準的快速提高和便利性是都市區包裝食品使用量增加的原因。

- 食品加工產業是世界上最大的產業之一,每年創造約7兆美元的產值。全球化意味著以前只能在當地買到的食物現在可以在世界各地買到。人們也越來越意識到全球食物的種類繁多。至2030年,全球食品加工市場預計將以每年7.6%的速度成長。

- 食品和飲料業是歐盟就業和附加價值最大的製造業部門。歐盟享有龐大的食品貿易順差,歐盟特色產品在國外受到高度重視。過去十年,歐盟食品和飲料出口額加倍,達到 900 多億歐元(約 950 億美元),順差約 300 億歐元(約 320 億美元)。

- 根據2022年12月發布的FoodDrink Europe報告,歐盟食品飲料業僱用了460萬人,營業額達1.1兆歐元(約1.2兆美元),增加價值2,300億歐元(約2,440億美元),是歐盟最大的加工產業之一。同時,歐盟是世界上最大的食品和飲料出口國,歐盟以外的出口額達1,560億歐元(約1,650億美元),貿易順差達730億歐元(約770億美元)。

- 因此,上述因素可能會在預測期內影響食品和飲料應用對氣相二氧化矽的需求。

亞太地區市場將強勁成長

由於保鮮膜在包括中國、印度和日本在內的新興經濟體的食品包裝、醫療保健和消費品領域的使用日益增加,亞太地區對保鮮膜的需求可能會出現高速成長。

中國是世界上最大的食品產業之一。由於人口成長和人均消費量增加,該國的食品市場正在擴大。根據中國國家統計局的數據,2021年中國食品企業利潤總額約為人民幣6,187億元(約959億美元),比前一年下降了6,210億元(約900億美元)。此外,食品製造業為整體利潤貢獻了近1,654億元人民幣(約256億美元)。

印度品牌股權基金會進一步表示,到2025年,印度包裝食品產業規模預計將達到4,700億美元。根據 2022-23 年聯邦預算,鑑於食品和飲料行業的不斷擴張,食品和飲料行業已獲得 215,960 億印度盧比(278.2 億美元)的預算。

根據中國國家統計局的數據,2022年中國社會消費品零售總額將達到約44兆元人民幣(約6.5兆美元),高於2021年的44.1兆元(約6.8兆美元)。此外,中國都市區消費品零售額將達到38兆元(約5.6兆美元),鄉村消費品零售額將達5.9兆元(約8,770億美元)。

在全球製藥領域,印度是表現突出的擴張者。印度是世界主要學名藥供應國之一,佔全球供應量的20%。印度藥品出口到200多個國家,其中美國是主要市場。此外,印度學名藥滿足了美國40%和英國30%的學名藥需求。日本的製藥公司由約10,500家公司組成。

此外,根據中華人民共和國財政部的數據,2022年醫療保健公共支出總額將達到約2.25兆元人民幣(約3,300億美元),比2021年成長約17%。

因此,基於上述原因,預計亞太地區將在預測期內主導研究市場。

保鮮膜產業概況

保鮮膜市場比較分散。市場的主要企業(不分先後順序)包括 Berry Global Inc.、Amcor plc、Sigma Plastics Group、Reynolds Consumer Products 和 Jindal Poly Films Limited。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 食品業的成長和食品包裝需求的增加

- 醫療保健產業需求增加

- 限制因素

- 對極端天氣條件的抵抗力較低

- 全球範圍內關於使用法規的不斷增加

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 材料類型

- 聚乙烯

- 雙軸延伸聚丙烯

- 聚氯乙烯

- 聚偏氯乙烯

- 其他材料類型

- 形狀

- 鑄造保鮮膜

- 布羅克林電影

- 最終用戶產業

- 食物

- 衛生保健

- 消費品

- 工業的

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- ADEX SRL

- Alliance Plastics

- All American Poly

- Amcor plc

- Anchor Packaging LLC

- Berry Global Inc.

- Deriblok SpA

- Hipac SPA

- Inteplast Group

- Intertape Polymer Group

- Jindal Poly Films Limited

- Malpack

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Novamont SPA

- Paragon Films

- Reynolds Consumer Products

- Sigma Plastics Group

- Technovaa Plastic Industries Pvt. Ltd.

第7章 市場機會與未來趨勢

- 生物基保鮮膜的新應用

The Cling Films Market size is estimated at USD 11.83 billion in 2025, and is expected to reach USD 14.64 billion by 2030, at a CAGR of 4.35% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020 due to the global lockdowns and strict rules that forced several sectors to close their manufacturing hubs. However, the market was estimated to reach pre-pandemic levels and was expected to grow steadily.

The preference for hygienic food packaging and packaged food will boost demand during the forecast period. The increasing demand from healthcare sector is also expected to drive the market growth.

However, low resistance to extreme weather conditions and rising global regulations on cling film usage are anticipated to restrain the market growth.

The application of bio-based cling films for sustainable food packaging is expected to act as an opportunity for market growth in the future.

The Asia-Pacific region is anticipated to witness the highest growth rate during the forecast period.

Cling Films Market Trends

Food Segment to Dominate the Market

- Cling films are primarily used in the packaging of food products to prevent contamination by insects or other microbial contamination. Additionally, using cling films helps improve the shelf life of the food and keeps it fresh for longer durations, thus effectively reducing food waste.

- Natural polymer-based cling films for food packaging can replace non-biodegradable petroleum-based synthetic polymers at a low cost, producing a positive, environmental, and economic effect.

- China is one of the largest consumers of food and beverages, with the food processing industry continuing to expand, given the growing population and rising demand for healthy and tasty packaged foods. Some of the popular food products in the country include bakery products, beverages, and other nutritious food items, among others.

- The food industry in the United States is one of the largest in the world. The demand for the studied market in North America mainly comes from the United States. Furthermore, in the United States, the growing food market is boosting the market in the country.

- With its growing popularity, India is set to dominate the global packaged food market by 2025 due to the expansion of the country's economy and changes in people's lifestyles. India currently operates as the world's second-largest food producer, thus reflecting significant growth opportunities for the market studied.

- In recent years, packaged and ready-to-eat foods have become increasingly popular, especially among urban consumers. Due to the fast pace of life in big cities, consumers prefer cooked meals in their regular diet. Rapidly rising incomes, living standards, and convenience are the reasons for the increased use of packaged foods in urban areas.

- One of the largest global industries, the food processing sector, produces approximately USD 7 trillion annually. Due to globalization, foods previously available locally are now accessible worldwide. People are also becoming more aware of the wide range of foods that are available on a worldwide scale. By 2030, a 7.6% annual growth rate in the global food processing market is expected.

- The food and beverage industry is the EU's largest manufacturing sector in terms of employment and value-added. The EU boasts a sizeable trade surplus in the food trade, and EU specialties are highly valued abroad. Over the past decade, EU food and beverage exports have doubled to reach more than EUR 90 billion (~USD 95 billion), contributing to a surplus of around EUR 30 billion (~USD 32 billion).

- According to the FoodDrink Europe report published in December 2022, the EU food and beverage industry employs 4.6 million people, has a turnover of EUR 1.1 trillion (~USD 1.2 trillion), and a value-added of EUR 230 billion (~USD 244 billion), making it one of the largest processing industries in the EU. At the same time, the European Union is the world's largest exporter of food and beverage, with exports outside the European Union of EUR 156 billion (~USD 165 billion) and a trade surplus of EUR 73 billion (~USD 77 billion).

- Thus, the abovementioned factors are likely to influence the demand for fumed silica in food and beverage applications during the forecast period.

Asia-Pacific Region to Witness High Market Growth

Asia-Pacific is likely to witness the high growth demand for cling films, owing to their increasing usage in the food packaging, healthcare, and consumer goods sector of emerging economies, including China, India, and Japan.

One of the world's largest food industries is found in China. The country's food market is expanding mostly due to the expanding population and average per capita consumption. The total profit of the Chinese food business was approximately CNY 618.7 billion (~USD 95.9 billion) in 2021, down from CNY 621 billion (~USD 90 billion) the year before, according to the National Bureau of Statistics of China. Also, food manufacturing contributed almost CNY 165.4 billion (~USD 25.6 billion) to the overall profits.

The India Brand Equity Foundation further stated that by 2025, India's processed food sector is anticipated to reach USD 470 billion. According to the Union Budget for FY 2022-23, the Department of Food and Public Distribution has received a budget of INR 215,960 crore (USD 27.82 billion) considering the expanding food and beverage sector.

According to the National Bureau of Statistics of China, the total retail sales of China's consumer goods industry in 2022 amounted to around CNY 44 trillion (~USD 6.5 trillion) from CNY 44.1 trillion (~USD 6.8 trillion) in 2021. Furthermore, Retail sales in China's cities totaled CNY 38 trillion (~USD 5.6 trillion), while sales in rural China totaled CNY 5.9 trillion (~USD 877 billion) in 2022.

In the global pharmaceuticals sector, India is a prominent and expanding player. India is one of the world's major suppliers of generic medicines, accounting for 20% of the global supply by volume. Indian drugs are exported to more than 200 countries, with the United States being the key market. Furthermore, India's generic drugs satisfy 40% of the generic drug demand of the United States and 30% of the United Kingdom. The domestic drug manufacturers consist of a chain of around 10,500 companies.

Furthermore, according to the Ministry of Finance of the People's Republic of China, total public expenditure on health care and hygiene increased by about 17% in 2022 compared to 2021, amounting to about CNY 2.25 trillion (~USD 0.33 trillion).

Hence, for the above reasons, the Asia-Pacific region is anticipated to dominate the market studied during the forecast period.

Cling Films Industry Overview

The Cling Films Market is fragmented in nature. Some of the major players in the market (not in any particular order) include Berry Global Inc., Amcor plc, Sigma Plastics Group, Reynolds Consumer Products, and Jindal Poly Films Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Food Industry and Increasing Demand For Food Packaging

- 4.1.2 Increase in Demand from the Healthcare Sector

- 4.2 Restraints

- 4.2.1 Low Resistance to Extreme Weather Conditions

- 4.2.2 Rising Global Regulations on its Usage

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyethylene

- 5.1.2 Biaxially Oriented Polypropylene

- 5.1.3 Polyvinyl Chloride

- 5.1.4 Polyvinylidene Chloride

- 5.1.5 Other Material Types

- 5.2 Form

- 5.2.1 Cast Cling Film

- 5.2.2 Blow Cling Film

- 5.3 End-user Industry

- 5.3.1 Food

- 5.3.2 Healthcare

- 5.3.3 Consumer Goods

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ADEX SRL

- 6.4.3 Alliance Plastics

- 6.4.4 All American Poly

- 6.4.5 Amcor plc

- 6.4.6 Anchor Packaging LLC

- 6.4.7 Berry Global Inc.

- 6.4.8 Deriblok SpA

- 6.4.9 Hipac SPA

- 6.4.10 Inteplast Group

- 6.4.11 Intertape Polymer Group

- 6.4.12 Jindal Poly Films Limited

- 6.4.13 Malpack

- 6.4.14 Mitsubishi Chemical Corporation

- 6.4.15 Nan Ya Plastics Corporation

- 6.4.16 Novamont SPA

- 6.4.17 Paragon Films

- 6.4.18 Reynolds Consumer Products

- 6.4.19 Sigma Plastics Group

- 6.4.20 Technovaa Plastic Industries Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications Of Bio-based Cling Films