|

市場調查報告書

商品編碼

1687442

全氟烷氧基烷 (PFA):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Perfluoroalkoxy Alkane (PFA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

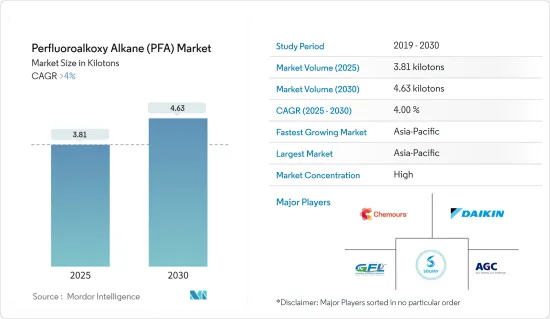

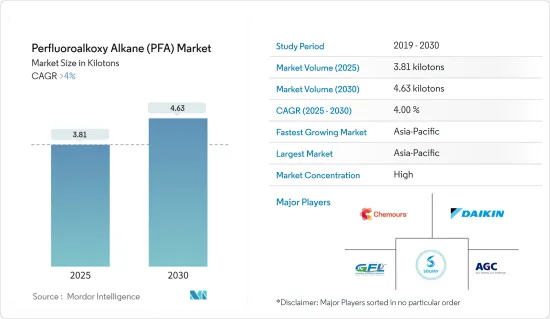

全氟烷氧基烷市場規模預計在 2025 年為 3.81 千噸,預計在 2030 年將達到 4.63 千噸,預測期內(2025-2030 年)的複合年成長率將超過 4%。

由於旅行限制導致供應鏈中斷,COVID-19 疫情對市場產生了負面影響。但此後市場已復甦。自那時起,石油和天然氣、化學加工和半導體行業的穩定成長推動了市場的發展。

主要亮點

- 關鍵流體輸送管應用對高純度和超純度 PFA 的需求不斷成長是推動市場成長的主要驅動力之一。此外,PFA 樹脂在半導體行業日益廣泛的使用也有望推動市場成長。

- 另一方面,PFA 的環境和健康風險可能會減緩市場成長。

- PFA 在鋰離子電池中的應用日益廣泛,也可能促進市場成長。

- 由於化學加工、石油和天然氣、電氣絕緣和半導體等行業的需求旺盛,亞太地區很可能在未來幾年引領 PFA 市場。

全氟烷氧基烷(PFA)市場趨勢

化學加工應用可望主導市場

- 全氟烷氧基烷(PFA)經常用於化學加工行業,因為它們可以承受高溫、機械衝擊和熱應力。

- PFA具有優良的耐化學性,滲透性低,透光性率高,耐紫外線和可見光,表面光滑,表面能低,耐候性優良,耐高溫和熱穩定性好,防水性和抗污性優良,純度高,電氣性能優良,不燃燒且發煙量少,因此用於防腐蝕襯裡和塗層。

- PFA 在化學加工工業中的應用包括密封件、O 形環、墊圈、編織填料、機械軸封、閥座、閥桿填料、襯裡閥門、配件、泵、視鏡、流量計、襯裡管、浸管、塔、管柱、伸縮接頭、波紋管、軟管管、油管、捲管、過濾器、襯裡、罐、管柱交換器、水霧器、電纜。

- 美國是世界主要化工產品生產國之一。 2022年該國化學品生產指數為95.5,與前一年同期比較去年同期成長2.24%。

- 根據經濟分析局預測,2022年美國化學產品產業增加價值約5,013.9億美元,與前一年同期比較成長12%。

- 隨著化學加工產業的興起,世界各地的一些大公司已經開始擴大業務或進入化學加工產業。例如,2022年12月,沙烏地阿美與法國石油公司道達爾能源合作,在沙烏地阿拉伯投資110億美元開發石化綜合體。

- 因此,化學加工應用很可能在未來幾年引領市場。

亞太地區可望主導市場

- 亞太地區已成為世界化學加工中心。中國、印度、日本等國家的化學工業正在快速成長。亞洲佔據全球化學品市場的最大佔有率。過去十年來,該地區一直佔據全球化學品市場的一半以上。

- 中國不僅是最大的化學品市場,也是成長最快的市場之一。根據VCI(德國化學工業協會)的數據,到2022年,中國將成為全球第三大化學品出口國,佔全球化學品出口以金額為準的9.3%。

- 同時,印度是世界第三大聚合物消費國、第四大農藥生產國和第六大化學品生產國。到 2025 年,化學品的需求預計將以每年 9% 的速度成長。據 IBEF 稱,到 2025 年,化學工業預計將為印度的 GDP 貢獻 3,000 億美元。

- 全氟烷氧基烷(PFA)用於半導體,因為它們在變化的負載下能夠持續很長時間。此外,其更好的電氣性能和抗應力開裂性能使其成為半導體行業的理想選擇。據印度電子和半導體協會稱,到 2025 年,該國的半導體元件業務價值將達到 323.5 億美元。政府正在進行的「印度製造」宣傳活動可能會吸引對該國半導體產業的投資。

- 日本佔全球半導體製造設備和材料銷售額的30%以上。 SEMICON Japan 2022 將於 2022 年 12 月在東京 Big Sight 舉行,屆時將匯集參與微電子製造供應鏈的國內外公司,深入了解最新的技術創新、發展和趨勢。在日本,半導體製造業的發展勢頭強勁,推動了對 PFA 的需求。

- PFA 的摩擦係數較低,且耐熱、耐化學腐蝕。因此,它們經常用於石油和天然氣工業的密封件、墊圈和滑動軸承。中國雖然是世界第二大油氣消費國,但產量卻只排第六。預計2023年該國原油產量將達2.08億噸,較2022年成長1.6%。

- 總體而言,預計亞太地區將在預測期內引領市場。

全氟烷氧基烷(PFA)產業概覽

全氟烷氧基烷(PFA)市場日益被主要企業壟斷,排名前五或六家的公司佔據了大部分市場佔有率。市場的主要企業包括科慕公司、DAIKIN INDUSTRIES、古吉拉特邦氟化學公司、索爾維、AGC 公司、3M 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- PFA 樹脂在半導體產業的應用不斷擴大

- 關鍵流體輸送管應用對高純度和超純 PFA 的需求不斷增加

- 限制因素

- 與 PFA 相關的環境和健康危害

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 供應概況

- 原料分析

第5章 市場區隔

- 產品類型

- 水性分散體

- 顆粒/粉末

- 應用

- 石油和天然氣

- 化學加工工業

- 光纖

- 半導體

- 烹調器具和烤盤塗料

- 電氣絕緣

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 越南

- 馬來西亞

- 印尼

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 俄羅斯

- 土耳其

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 埃及

- 卡達

- 奈及利亞

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- AGC Inc.

- Daikin Industries Ltd

- Gujarat Fluorochemicals

- Hubei Everflon Polymer Co. Ltd

- Li Chang Technology(Ganzhou)Co. Ltd

- RTP Company

- Solvay

- The Chemours Company

- Zeus Industrial Products Inc.

- Zibo Bainaisi Chemical Co. Ltd

第7章 市場機會與未來趨勢

- 擴大 PFA 在鋰離子電池的應用

The Perfluoroalkoxy Alkane Market size is estimated at 3.81 kilotons in 2025, and is expected to reach 4.63 kilotons by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market because of the travel restrictions causing supply chain disruptions. However, the market has since recovered. Since then, steady growth in the oil and gas, chemical processing, and semiconductor industries has driven the market.

Key Highlights

- The growing need for high- and ultra-high-purity PFA in critical fluid transport tubing applications is one of the main drivers of market growth. The growing use of PFA resin in the semiconductor industry is also expected to increase market growth.

- On the other hand, the environmental and health risks of PFA are likely to slow the growth of the market.

- The growing use of PFA in lithium-ion batteries may also boost the growth of the market.

- Due to high demand from industries like chemical processing, oil and gas, electrical insulation, and semiconductors, Asia-Pacific is likely to lead the PFA market over the next few years.

Perfluoroalkoxy Alkane (PFA) Market Trends

Chemical Processing Applications are Expected to Dominate the Market

- Perfluoroalkoxy alkane, or PFA, is used a lot in the chemical processing industry because it can withstand high temperatures, mechanical shock, and thermal stress.

- PFA is used for corrosion protection liners and coatings because it has good chemical resistance and low permeation, good light transparency, good resistance to UV and visible light, smooth surface, low surface energy, good resistance to weathering, high temperature and thermal stability, water repellent and anti-staining, high purity, excellent electric properties, and does not burn and makes little smoke.

- Some of the applications of PFA in the chemical processing industry include seals, o-rings, gaskets, braided packing, mechanical seals, valve seats, valve stem packing, lined valves, fittings, pumps, sight glasses, flow meters, lined pipes, dip pipes, columns, tanks, expansion joints, bellows, hoses, tubing, convoluted tubing, filters, de-misters, strainers, column packing, heat exchanger tubing, and lining and tracing heating cables.

- The United States is one of the world's leading producers of chemical products. In 2022, the chemical production index in the country was 95.5, indicating a 2.24% growth over the previous year.

- According to the Bureau of Economic Analysis, the value added by the chemical products industry in the United States in 2022 was around USD 501.39 billion, a 12% rise over the previous year.

- With the rising chemical processing sector, several big firms throughout the world have begun to develop their operations or enter the chemical processing industry. For example, in December 2022, Saudi Aramco cooperated with TotalEnergies, a French oil company, to develop a petrochemical complex in Saudi Arabia for an anticipated USD 11 billion investment.

- Thus, it is likely that chemical processing applications will lead the market during the next few years.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has grown to be the hub for chemical processing across the world. The chemical industry in countries such as China, India, and Japan has been growing rapidly. Asia holds the largest share of the global chemical market. Over the last decade, the region has continuously accounted for more than half of the global chemical market.

- China is not just the largest market for chemicals, but it is also one of the fastest expanding. According to the VCI (Association of the Chemical Industry e.V.), in 2022, China was the world's third-largest chemical exporting nation, with a share of 9.3% of global chemical exports based on value.

- India, on the other hand, is the third-largest consumer of polymers, the fourth-largest producer of agrochemicals, and the sixth-largest producer of chemicals in the world. The demand for chemicals is expected to expand by 9% per year by 2025. According to IBEF, the chemical industry is expected to contribute USD 300 billion to India's GDP by 2025.

- Perfluoroalkoxyalkane (PFA) is used in semiconductors because it lasts longer under changing loads. Also, its better electrical properties and resistance to cracking under stress make it a great choice for the semiconductor industry. According to the India Electronics and Semiconductor Association, the country's semiconductor component business will be valued at USD 32.35 billion by 2025. The government's ongoing "Make in India" campaign is likely to lead to investments in the country's semiconductor industry.

- Japan accounts for more than 30% of global semiconductor manufacturing equipment and material sales. SEMICON Japan 2022 brought together Japanese and international companies from across the microelectronics manufacturing supply chain in December 2022 at Tokyo Big Sight for insights into the latest technological innovations, developments, and trends. The growing efforts in the country to make more semiconductors are driving up the demand for PFA.

- PFA has a low coefficient of friction and is resistant to heat and chemicals. This makes it a popular choice for seals, gaskets, and slide bearings in the oil and gas industry. China is the world's second-largest consumer of oil and gas, yet it ranks just sixth in terms of production. The country's crude oil production rose to 208 million metric tons in 2023, marking a 1.6% increase compared to 2022.

- Thus, because of the above factors, it seems likely that Asia-Pacific will lead the market during the forecast period.

Perfluoroalkoxy Alkane (PFA) Industry Overview

The perfluoroalkoxy alkane (PFA) market is majorly consolidated in nature, with the top five or six players accounting for the majority of the share in the market. The major players in the market include The Chemours Company, Daikin Industries, Gujarat Fluorochemicals, Solvay, AGC Inc., and 3M, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application of PFA Resin in the Semiconductor Industry

- 4.1.2 Increasing Demand for High- and Ultra High-purity PFA in Critical Fluid Transport Tubing Applications

- 4.2 Restraints

- 4.2.1 Environmental and Health Hazards Associated With PFA

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Supply Overview

- 4.6 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Aqueous Dispersion

- 5.1.2 Pellets/Powder

- 5.2 Application

- 5.2.1 Oil and Gas

- 5.2.2 Chemical Processing Industry

- 5.2.3 Fiber Optics

- 5.2.4 Semiconductor

- 5.2.5 Cookware and Bakeware Coatings

- 5.2.6 Electrical Insulation

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Malaysia

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Russia

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Gujarat Fluorochemicals

- 6.4.5 Hubei Everflon Polymer Co. Ltd

- 6.4.6 Li Chang Technology (Ganzhou) Co. Ltd

- 6.4.7 RTP Company

- 6.4.8 Solvay

- 6.4.9 The Chemours Company

- 6.4.10 Zeus Industrial Products Inc.

- 6.4.11 Zibo Bainaisi Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Use of PFA In Lithium-ion Batteries