|

市場調查報告書

商品編碼

1687448

施工機械遠端資訊處理-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Construction Machinery Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

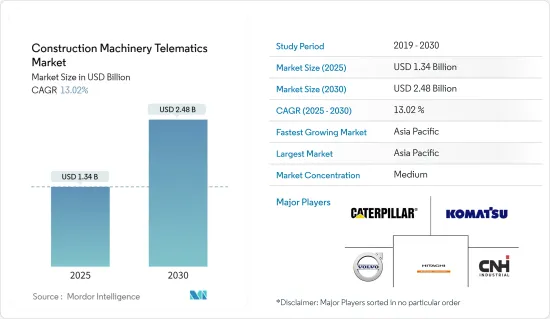

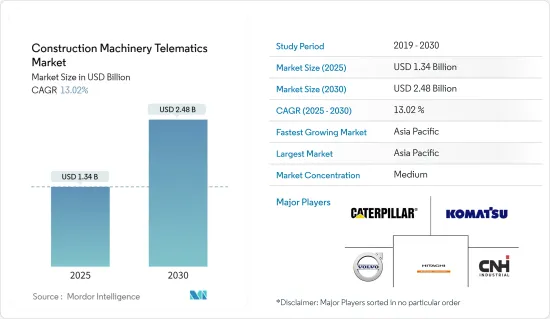

預計2025年施工機械遠端資訊處理市場規模為13.4億美元,2030年預計將達到24.8億美元,預測期內(2025-2030年)的複合年成長率為13.02%。

施工機械遠端資訊處理市場是施工機械產業內一個動態發展的領域。快速的都市化、工業化、政府對基礎設施建設的投資增加以及全部區域房地產和建設公司的擴張和成長活動等因素預計將推動市場需求。

消費者對設備效率日益成長的需求推動了施工機械遠端資訊處理市場的發展。行動技術在施工機械上的應用迅速增加,包括智慧型手機和高級駕駛輔助系統 (ADAS) 功能(如接近警報和防撞系統),也推動了遠端資訊處理在施工機械中的應用。然而,由於這些技術的複雜性和高價格,車隊營運商不願採用這些技術,對預測期內施工機械遠端資訊處理市場的成長產生不利影響。

推動市場成長的主要因素之一是建築業的不斷發展,尤其是在新興經濟體中,因為基礎設施、住宅和非住宅領域存在大量成長機會。隨著人口成長和都市化,建設公司的數量不斷增加,道路、高速公路、智慧城市、地鐵、橋樑和高速公路建設的投資也在增加。

建設活動和基礎設施建設的激增正在推動對重型設備的需求。預計未來幾年施工機械重型機械的增加將有助於機械遠端資訊處理市場的成長。

施工機械遠端資訊處理市場趨勢

挖掘機領域主導施工機械遠端資訊處理市場

近年來,挖掘機遠端資訊處理技術的採用取得了顯著成長,這主要歸功於技術進步和電動車型的市場推廣。雖然遠端資訊處理技術已在挖土機上應用了幾十年,但近年來車隊所有者和營運商對遠端資訊處理解決方案的需求激增。

例如,2023 年 3 月,凱斯建築設備推出了兩款電動迷你挖土機 CX15EV 和 CX25EV,標配 SiteWatch 遠端資訊處理系統。此次入職培訓提供了有關機器性能的寶貴見解,並促進了與當地 CASE 經銷商合作的無縫車隊管理。

然而,該行業面臨的一個主要挑戰是小型挖土機車隊營運商需要更多地採用遠端資訊處理技術。這是因為人們認為使用遠端資訊處理技術十分複雜,而且取得此類模型的成本也很高。目前,遠端資訊處理的主要用戶是大型挖土機車隊的營運商,他們利用這些資料來改善設備管理和整體業務效率。

市場上許多公司都在積極推廣整合先進遠端資訊處理解決方案的挖土機,以實現遠距離診斷、GPS 追蹤和綜合車隊管理等功能。例如,2023 年 5 月,Deveron 推出了兩款新型 6 噸 Stage V 小型挖土機 DX62R-7 和 DX63-7,標配 DeveronFleet Management TMS 3.0 蜂窩系統。該系統透過收集安裝在挖土機上的各種感測器的資料,為挖土機提供了強大的遠端資訊處理管理平台。

考慮到這些因素,預計未來幾年挖掘機遠端資訊處理的應用將繼續快速成長。

亞太地區預計將繼續佔據較大市場佔有率

該地區建築業的成長、大量重型機械的可用性、行動裝置消費群的增加等是推動研究市場發展的一些主要因素。

中國是亞太地區主要國家之一,受經濟成長推動,建設活動蓬勃發展。該國的成長率很高,但正在逐漸放緩(隨著人口老化以及經濟從投資到消費、從製造業到服務業、從外部需求到國內需求的再平衡)。

儘管房地產行業成長不穩定,但中國政府大力發展鐵路和公路基礎設施(以滿足工業和服務業的需求),帶動建築業強勁成長。由於公共和私人公司在建築業佔據主導地位,公共支出和私人支出的增加可能會推動該行業走向全球領導地位。最近的趨勢是中國出現了大型建設公司(來自歐盟),進一步刺激了該行業的發展。

2022-23會計年度,印度施工機械產業的成長率約為15%。施工機械製造業的成長與需求促進因素息息相關。主要需求屬性為道路建設、灌溉、城市發展和採礦。由於都市化、基礎設施建設以及建築和採礦業的成長等多種因素,印度工業對土木機械的需求正在增加。礦。印度政府透過國家基礎設施管道(NIP)和智慧城市計畫等措施注重基礎建設,進一步推動了對陸路運輸設備的需求。

儘管建築業的某些領域面臨短期挑戰,但印度的中長期成長前景仍沒有改變。由於基礎設施部門是印度經濟成長的重要支柱,預計印度建設產業在預測期內將穩定成長。該國政府正在採取各種措施,不受時間限制地發展優良的基礎設施。

日本政府也密切關注未來預計將實施的重大長期計劃(磁浮鐵路的長期和短期發展計畫)。例如,升級高速公路網路和建造通往東京羽田機場的新鐵路線將耗資 3 億日圓(200 萬美元),預計 2029 年通車。因此,這些積極的成長趨勢預計將推動日本建築市場的發展。

其他亞太地區包括馬來西亞、印尼、新加坡、越南、澳洲和韓國等東南亞國協。這些國家一直保持持續成長,導致住宅和商業建築的需求持續增加。

預計預測期內地方當局的此類積極舉措將會成長,從而支持預測期內施工機械遠端資訊處理市場的成長。

施工機械聯網產業概況

幾家主要企業主導市場,包括Caterpillar、日本小松公司、日立建築機械、現代施工機械和沃爾沃建築機械。為了滿足施工機械操作員日益成長的需求,許多施工機械製造商正致力於將尖端的遠端資訊處理解決方案融入其產品中。例如

2023 年 6 月,總部位於蘇塞克斯的 Southern Cranes 宣布與 Webfleet 合作夥伴 AES 船隊建立合作關係。該公司已開始在其 91 輛起重機、貨車和重型貨車中推廣整合式攝影機遠端資訊處理解決方案。

2023 年 5 月,特雷克斯越野起重機公司推出了配備 TerexT-Telematics 解決方案的越野起重機 TRT 65,可為起重機提供即時性能資料。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 建築和基礎設施活動的活性化推動了需求

- 互聯技術推動市場成長

- 市場挑戰

- 初始成本高

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 按機器類型

- 起重機

- 挖土機

- 伸縮式搬運

- 裝載機和後鏟

- 其他

- 按銷售管道

- OEM

- 售後市場

- 透過遠端資訊處理功能

- 追蹤

- 診斷

- 其他遠端資訊處理功能

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Komatsu Ltd

- Caterpillar Inc.

- Volvo Construction Equipment

- Joseph Cyril Bamford Excavators Ltd(JCB)

- Hitachi Construction Machinery Co. Ltd

- CNH Industrial NV

- Deere & Company

- Hyundai Construction Equipment

- Liebherr Group

- Doosan Infracore Ltd

- ACTIA Group

- Geotab

- Trimble Inc.

- Orbcomm

- Octo Telematics

第7章 市場機會與未來趨勢

- 車主對遠端資訊處理的偏好正在改變

The Construction Machinery Telematics Market size is estimated at USD 1.34 billion in 2025, and is expected to reach USD 2.48 billion by 2030, at a CAGR of 13.02% during the forecast period (2025-2030).

The construction machinery telematics market is a dynamic and evolving sector within the construction machinery industry. Factors such as rapid urbanization, industrialization, rising government investments in infrastructure development, and expansion and growth activities of the real estate and construction companies across the region are expected to enhance demand in the market.

The construction machinery telematics market is driven by consumers' growing demand for machinery efficiency. The surge in the usage of portable technology in construction machinery, such as smartphones and advanced driver assistance systems (ADAS) features, like proximity detection alerts and collision avoidance systems, has also pushed the adoption of telematics in construction machinery. However, complexity and high price features make fleet operators reluctant toward these technologies, negatively affecting the growth of the construction machinery telematics market during the forecast period.

One of the major factors driving the market's growth is the growing construction industry, especially in developing countries, owing to numerous growth opportunities in infrastructure, residential, and non-residential sectors. The rise in construction companies and increasing investments in the construction of roads, highways, smart cities, metros, bridges, and expressways due to the growing population and urbanization.

A surge in construction activities and infrastructure development, fueling demand for heavy machinery. The increasing heavy machinery for construction machinery is likely to contribute to the growth of the machinery telematics market over the coming years.

Construction Machinery Telematics Market Trends

The Excavators Segment Dominated the Construction Machinery Telematics Market

The adoption of telematics in excavators has experienced significant growth in recent years, primarily due to technological advancements and the introduction of electric models into the market. While telematics has been in use in excavators for decades, the demand from fleet owners and operators for telematics solutions has surged in recent times.

For instance, in March 2023, CASE Construction Equipment unveiled two electrified mini excavators, the CX15EV and CX25EV, both equipped with SiteWatch telematics as a standard feature. This inclusion provides invaluable insights into machine performance and facilitates seamless fleet management in collaboration with local CASE dealers.

However, a major challenge facing the industry is the need for more adoption of telematics technology among small-scale excavator fleet operators. This can be attributed to the perceived complexity of telematics usage and the cost associated with acquiring such models. Presently, the primary users of telematics are operators of large-scale excavator fleets who leverage this data to enhance equipment management and overall business efficiency.

Many companies in the market are actively promoting excavators integrated with advanced telematics solutions, enabling features like remote diagnostics, GPS tracking, and comprehensive fleet management. For instance, in May 2023, Develon introduced two new 6-tonne Stage V mini-excavators, the DX62R-7 and DX63-7, both featuring the DevelonFleet Management TMS 3.0 Cellular system as a standard component. This system offers a robust telematics management platform for excavators by collecting data from various sensors installed on the machines.

Considering these factors, the usage of telematics in excavators is expected to continue its rapid expansion in the coming years.

The Asia-Pacific Region is Expected to Continue to Account Highest Market Share

Some of the major factors that may aid in driving the market studied are the growing construction industry in the region, the availability of a large number of heavy equipment, and the rising consumer base of mobile devices.

China is also one of the major countries in the Asia-Pacific, with ample construction activities being supported by its growing economy. The country's growth rate is high but is gradually moving toward moderate (as the population ages and the economy rebalances from investment to consumption, from manufacturing to services, and from external to internal demand).

Despite the volatile growth of the real estate sector, significant developments by the Chinese government in rail and road infrastructure (to meet demand from industries and services) are growing services) has led to significant growth in the construction sector. As public and private companies dominate the construction sector, increasing public and private spending will propel the sector to a global leadership position. In recent years, the emergence of large construction companies (from the European Union) in China has further fueled the development of this sector.

During the financial year 2022-23, the Indian construction equipment sector recorded a growth rate of about 15%. Growth in construction equipment manufacturing is tied to demand drivers. The key demand attributes are road construction, irrigation, urban development, and mining. The demand for earthmoving equipment in the Indian industry is increasing due to various factors such as urbanization, infrastructure development, and growth in the construction and mining sectors. Mine. Demand for land transport equipment is further fueled by the Indian government's focus on infrastructure development through initiatives such as the National Infrastructure Pipeline (NIP) and Mission Smart City.

Despite near-term challenges in certain construction sectors, the medium to long-term growth story in India remains intact. The construction industry in India is expected to grow steadily over the forecast period, as the infrastructure sector is a key pillar for the growth of the Indian economy. The government is taking various initiatives to ensure the time-bound creation of excellent infrastructure in the country.

The Japanese government is also constantly focusing on major long-term projects (the Maglev railway long-term and short-term development plans) that the country is expected to witness in the future. For instance, an upgrade of highway networks and a new rail link to Haneda Airport in Tokyo, with an investment of JPY 300 million (USD 2 million) and expected to open the line by 2029. Hence, such positive growth trends are anticipated to boost the Japanese construction market.

The Rest of Asia-Pacific includes ASEAN countries, such as Malaysia, Indonesia, Singapore, Vietnam, Australia, as well as South Korea. With the consistent growth in these countries, the demand for both residential and commercial buildings is continually increasing.

Such active initiatives by regional authorities are expected to grow over the forecast period and hence support the growth of the construction machinery telematics market over the forecast period.

Construction Machinery Telematics Industry Overview

Several key players dominate the market, including Caterpillar, Komatsu Ltd., Hitachi Construction Equipment Co. Ltd., Hyundai Construction Equipment Ltd, Volvo Construction Equipment, and others. To meet the growing demands of construction fleet operators, many construction machinery manufacturers are placing a strong emphasis on integrating cutting-edge telematics solutions into their product offerings. For instance:

In June 2023, Southern Cranes, based in Sussex, announced a partnership with Webfleetpartner AES fleet. They have initiated the deployment of an integrated camera telematics solution across their extensive fleet, which consists of 91 cranes, vans, and heavy haulage transport vehicles.

In May 2023, Terex Rough Terrain Cranes introduced the TRT 65, an off-road crane equipped with the TerexT-Telematics solution, providing real-time performance data for the crane.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Construction and Infrastructure Activities to Drive Demand

- 4.1.2 Connected Technology to Aid in the Growth of the Studied Market

- 4.2 Market Challenges

- 4.2.1 High Upfront Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Machinery Type

- 5.1.1 Crane

- 5.1.2 Excavator

- 5.1.3 Telescopic Handling

- 5.1.4 Loader and Backhoe

- 5.1.5 Other Machinery Types

- 5.2 By Sales Channel Type

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Telematic Feature

- 5.3.1 Tracking

- 5.3.2 Diagnostic

- 5.3.3 Other Telematics Features

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Komatsu Ltd

- 6.2.2 Caterpillar Inc.

- 6.2.3 Volvo Construction Equipment

- 6.2.4 Joseph Cyril Bamford Excavators Ltd (JCB)

- 6.2.5 Hitachi Construction Machinery Co. Ltd

- 6.2.6 CNH Industrial NV

- 6.2.7 Deere & Company

- 6.2.8 Hyundai Construction Equipment

- 6.2.9 Liebherr Group

- 6.2.10 Doosan Infracore Ltd

- 6.2.11 ACTIA Group

- 6.2.12 Geotab

- 6.2.13 Trimble Inc.

- 6.2.14 Orbcomm

- 6.2.15 Octo Telematics

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Fleet Owners Preferences Towards Telematics