|

市場調查報告書

商品編碼

1687451

UV LED-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)UV LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

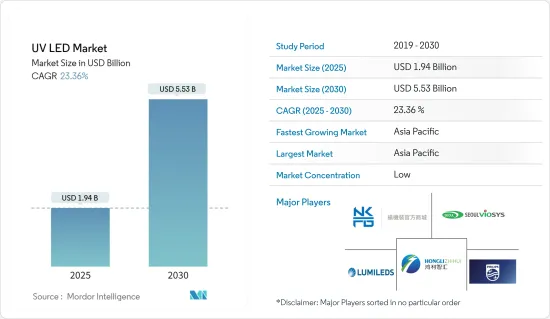

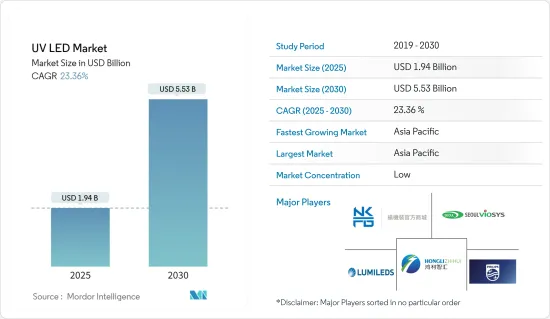

預計 2025 年 UV LED 市場規模為 19.4 億美元,到 2030 年將達到 55.3 億美元,預測期內(2025-2030 年)的複合年成長率為 23.36%。

在預計預測期內,各種應用對紫外線 LED 的需求不斷成長,以及供應商為進一步增強技術和創造新使用案例而做出的不斷努力,將支持所研究市場的成長。

近年來,在紫外線燈(汞、準分子、氙氣、汞合金等)已運作數十年的應用中,LED 的採用率顯著成長。 UV-LED 的流明密度、穩定性和運作的最新技術改進也使其成為替代傳統紫外線光源(如拱燈、熱陰極燈、冷陰極燈、汞弧燈和柵格燈)的有效解決方案。此外,由於紫外線 LED 不含有害汞、消費量更低、不會產生臭氧,因此更環保,這也促使其在各種應用中廣泛應用。

在光電子領域,UV LED 包括波長範圍約為 200nm 至 400nm 的產品,並具有多種封裝形式,包括表面黏著技術、通孔和 COB(板載晶片)。 UV LED 有許多獨特的應用。然而,這些 LED 的應用高度依賴其功率和波長。

在過去十年中,受消費者接受度不斷提高和技術創新的推動,LED 技術的普及度顯著提高。例如,根據歐盟委員會聯合研究中心和國際能源總署 (IEA) 的估計,LED 在照明產業的滲透率預計將從 2012 年的 1.8% 成長到 2030 年的 87.4%。這些趨勢有望推動人們對 LED 技術的認知和接受,為市場創造良好的前景。

然而,紫外線LED的高成本以及紫外線對用戶健康的不利影響是該市場成長的主要挑戰。此外,UV LED 的低效率和可靠性問題可能會對研究市場的成長構成挑戰。

由於 COVID-19 疫情爆發,全球市場對紫外線 LED 的需求顯著增加,這得益於其表面消毒和殺菌特性。預計大流行過後醫療保健產業將獲得重大推動,從而推動對先進的滅菌和消毒應用解決方案的需求。

UV LED市場趨勢

UV-C LED 將主導市場佔有率

- 全球對衛生的關注,尤其是醫療保健、酒店和公共空間產業,正在推動對基於 UV-C LED 的解決方案的需求。這些 LED 具有許多優點,包括消毒時間更快、化學品使用量減少以及不含有害產品。此外,UV-C LED 技術的進步使其更有效率、使用壽命更長且更經濟實惠。

- 目前製造商正在投入資源進行研發,以提高 UV-C LED 的效率,使其更加方便並適用於各種應用。因此,UV-C 領域預計將大幅擴張,為 UV LED 模組製造商、組件供應商和系統整合商提供寶貴的機會。人們對殺菌處理的重要性和 UV-C LED 的好處的認知不斷提高,預計將推動市場成長顯著。

- UV-C LED 模組適用於在空氣或水循環的系統中產生 UV-C 光。推動 UV-C LED 模組成長的關鍵因素包括環保 LED 的快速擴張和紫外線固化系統應用的不斷增加。由於UV-C LED在消毒方面的實用性,水淨化的快速普及是推動UV-C LED產業成長的關鍵因素。

- 此外,預計在預測期內,將 UV-C LED 技術融入消費性產品和家用電器將為擴大 UV-C LED 市場創造寶貴機會。此外,輸出功率和可靠性的提高,以及近期 UV-C LED 單價的下降,正在顯著推動市場成長。

亞太地區預計將經歷強勁成長

- UV LED 技術在紫外線固化製程的應用日益廣泛,推動著市場的成長。與傳統乾燥工藝相比,紫外線固化工藝更受歡迎。因為結果好得多,廢品率更低,整個過程使產品更易溶解、更耐刮。

- UV LED 可用於塗料行業的固化目的,因為它們節能、熱量損失小、不含汞、製造佔地面積比傳統 UV 燈小得多,並且具有更好的光學設計。由於紫外線固化黏合劑比傳統黏合劑系統具有諸多優勢,該國包裝產業的紫外線固化黏合劑使用量大幅成長。

- 日本的汽車工業是世界上最大的汽車工業之一。日本自1960年代以來一直是世界汽車產量前三大國家之一。日本有豐田、鈴木、本田等主要汽車製造商。這些公司的服務中心遍佈日本各地。紫外線固化在汽車行業的日益廣泛應用預計將創造成長機會並擴大該國的市場。

- 韓國以其蓬勃發展的電子製造業而聞名。 UV LED 廣泛應用於電子製造過程,包括紫外線固化黏合劑、被覆劑和油墨。隨著電子產業的持續成長,製造業對 UV LED 的需求預計會增加。

- 其他亞太地區包括台灣、印度和新加坡。新加坡的公司正在開發新產品並改進現有產品,以滿足最終用戶的需求並增加市場佔有率。

UV LED 產業概覽

UV LED 市場高度分散,主要參與者包括 Lumileds Holding BV、Koninklijke Philips NV、NKFG Corporation、鴻利智匯集團和首爾偉傲世 (Seoul Viosys) 等。市場上的公司正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2024 年 3 月,日亞化學開始大量生產流行的 434 系列封裝的新型 UV-B(308nm)和 UV-A(330nm)LED。在保持 434 系列緊湊的 3.5mm x 3.5mm 尺寸的同時,新發布的 UV-B 和 UV-A LED 分別提供業界領先的 90mW 和 100mW(350mA 時)輸出,從而最大限度地提高光通量密度。

- 2023 年 11 月,Crystal IS 宣布安麗已在其家用水處理系統 eSpring 中採用該公司的 UVC LED 技術。 UV LED 和 eSpring e3 碳過濾器的獨特組合使新 eSpring水質淨化能夠有效殺死 99.9999% 的細菌、高達 99.99% 的病毒和高達 99.9% 的囊腫。 UV C LED 的使用也使得新款 eSpring水質淨化器成為更環保的產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠疫情及其他宏觀經濟因素的影響及後果

第5章市場動態

- 市場促進因素

- 環保UV LED配置

- 紫外線固化市場採用率不斷提高

- 適應性更強,總擁有成本更低

- 市場限制

- 製造複雜性和技術限制不斷增加

第6章市場區隔

- 依技術

- UV-A

- UV-B

- UV-C

- 按應用

- 光學感測器和儀器

- 仿冒品檢測

- 消毒

- 紫外線固化

- 醫學光療

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- Lumileds Holding BV

- Koninklijke Philips NV

- NKFG Corporation

- Hongli Zhihui Group

- Seoul Viosys Co. Ltd

- Nichia Corporation

- Semileds Corporation

- EPIGAP OSA Photonics GmbH

- CRYSTAL IS Inc.(Asahi Kasei Corporation)

- Luminus Inc.

- LITE-ON Technology Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The UV LED Market size is estimated at USD 1.94 billion in 2025, and is expected to reach USD 5.53 billion by 2030, at a CAGR of 23.36% during the forecast period (2025-2030).

The growing demand for UV LEDs across different applications and increasing efforts made by vendors to enhance the technology further, giving rise to new use cases, are anticipated to support the growth of the market studied during the forecast period.

In recent years, the adoption of LEDs has grown significantly in applications wherein UV lamps (mercury, excimer, xenon, amalgam, etc.) have operated for decades. Recent technological improvements in the flux density, stability, and operating hours of UV-LEDs have also made them an efficient solution for replacing traditional UV light sources such as arch lamps, hot and cold cathode lamps, mercury arc lamps, and grid lamps. Moreover, the fact that UV LEDs are more environmentally friendly, as they do not use harmful mercury, consume less energy, and do not produce ozone, also supports its adoption across various applications.

In optoelectronics, UV LEDs consist of approximately 200 nm to 400 nm products with various package styles, including surface mount, through-hole, and COB (chip-on-board). There are many unique applications for UV LEDs. However, the application cases of these LEDs are greatly dependent on the output power and wavelength.

In the last decade, the prominence of LED technology has grown significantly, driven by increasing consumer acceptance and technological innovations. For instance, according to estimates by the European Commission's Joint Research Center and the International Energy Agency (IEA), the penetration of LEDs in the lighting industry is estimated to grow to 87.4% by 2030, from just 1.8% in 2012. Such trends are anticipated to drive the awareness and acceptance of LED technology, creating a favorable outlook for the market studied.

However, factors such as the higher cost of UV LEDs and the negative impact of UV light on users' health are significant challenges for the market's growth. Furthermore, lower efficiency and issues related to the reliability of UV LEDs may challenge the growth of the market studied.

With the outbreak of COVID-19, the global UV LED market witnessed a significant growth in demand due to its effectiveness in disinfecting surfaces and germ-killing properties. The healthcare sector received a significant boost post-pandemic, which is anticipated to drive the demand for advanced solutions for sterilization and disinfection applications.

UV LED Market Trends

UV-C LED to Hold Major Market Share

- The global focus on hygiene, especially in healthcare, hospitality, and public spaces industries, has increased the demand for UV-C LED-based solutions. These LEDs provide numerous benefits, such as shorter disinfection times, decreased chemical usage, and the absence of harmful byproducts. Moreover, advancements in UV-C LED technology have resulted in improved efficiency, longer lifespan, and greater affordability.

- Manufacturers are currently dedicating resources to research and development to improve the efficiency of UV-C LEDs, making them more convenient and applicable for various uses. Consequently, the UV-C sector is anticipated to experience considerable expansion, presenting valuable opportunities for UV LED module manufacturers, component providers, and system integrators. The growing understanding of the significance of disinfection and the benefits of UV-C LEDs is projected to drive a substantial increase in market growth.

- UV-C LED modules can help generate UV-C light in systems where air and water circulate. Some critical factors advancing the growth of UV-C LED modules include the rapid expansion of the use of environment-safe LEDs and the increase in the application of UV curing systems. Since UV-C LED is practical for disinfection, a surge in the adoption of water purification is a significant factor driving the growth of the UV-C LED industry.

- Furthermore, it is expected that the integration of UV-C LED technology into consumer products and household appliances will create a valuable opportunity to expand the UV-C LED market during the forecast period. Moreover, advancements in output power and reliability and the recent decrease in unit cost prices for UV-C LEDs are significantly driving the market's growth.

Asia-Pacific Expected to Witness Significant Growth

- The increasing use of UV LED technology in the UV curing process is driving the market's growth. The UV curing process is preferred over traditional drying, as the results are much better, rejection rates are low, and the entire process enhances the solvency and scratch resistance of the product.

- UV LED is helpful in curing purposes in the coating industries, as it is more energy-efficient, loses very little heat, contains no mercury, can be manufactured with a much smaller footprint, and has a far better optical design than traditional UV lamps. The use of UV-curable adhesives in the packaging industry is growing tremendously in the country, owing to their advantages over conventional adhesive systems.

- The Japanese automotive industry is one of the most prominent and largest industries in the world. Japan is one of the top three countries with the highest number of cars manufactured since the 1960s. The country is home to some of the major automotive players, such as Toyota, Suzuki, and Honda. These companies have an extensive presence in the country, along with their service centers. The growing application of UV curing in the automotive industry is expected to offer opportunities in the country and augment the market's growth.

- South Korea is known for its thriving electronics manufacturing industry. UV LEDs are used extensively in electronics manufacturing processes such as UV curing adhesives, coatings, and inks. As the electronics industry continues to grow, the demand for UV LEDs in manufacturing is expected to increase.

- The Rest of Asia-Pacific includes Taiwan, India, and Singapore. The companies in Singapore are developing new products or incorporating features in the existing products to meet the demand of the end users and increase their market shares.

UV LED Industry Overview

The UV LED market is highly fragmented with the presence of major players like Lumileds Holding BV, Koninklijke Philips NV, NKFG Corporation, Hongli Zhihui Group, and Seoul Viosys Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In March 2024, Nichia started mass production of the new UV-B (308 nm) and UV-A (330 nm) LEDs in its popular 434 series package. While maintaining the compact 3.5 mm x 3.5 mm size of the 434 series, the newly launched UV-B and UV-A LEDs deliver industry-leading outputs of 90 and 100 mW, respectively (at 350 mA), thus maximizing flux density.

- In November 2023, Crystal IS Inc. announced that Amway had chosen its UVC LED technology for its eSpring home water treatment system. With a unique combination of UV LEDs and eSpring e3 carbon filter, the new eSpring water purifier is 99.9999% effective at killing bacteria, viruses up to 99.99%, and cysts up to 99.9%. The use of UV C LEDs also makes the new eSpring water purifier a more environmentally friendly product, as the new device consumes 25% less energy during active use compared to the previous model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19, After Effects, and Other Macroeconomic Factors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Eco-friendly Composition of UV LED

- 5.1.2 Rising Adoption of the UV Curing Market

- 5.1.3 Increasing Adaptability Fueled by Low Total Cost of Ownership

- 5.2 Market Restraints

- 5.2.1 Increasing Manufacturing Complexity and Technical Limitations

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 UV-A

- 6.1.2 UV-B

- 6.1.3 UV-C

- 6.2 By Application

- 6.2.1 Optical Sensors and Instrumentation

- 6.2.2 Counterfeit Detection

- 6.2.3 Sterilization

- 6.2.4 UV Curing

- 6.2.5 Medical Light Therapy

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Chile

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lumileds Holding BV

- 7.1.2 Koninklijke Philips NV

- 7.1.3 NKFG Corporation

- 7.1.4 Hongli Zhihui Group

- 7.1.5 Seoul Viosys Co. Ltd

- 7.1.6 Nichia Corporation

- 7.1.7 Semileds Corporation

- 7.1.8 EPIGAP OSA Photonics GmbH

- 7.1.9 CRYSTAL IS Inc. (Asahi Kasei Corporation)

- 7.1.10 Luminus Inc.

- 7.1.11 LITE-ON Technology Corporation