|

市場調查報告書

商品編碼

1687463

電動汽車電源逆變器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Electric Vehicle Power Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

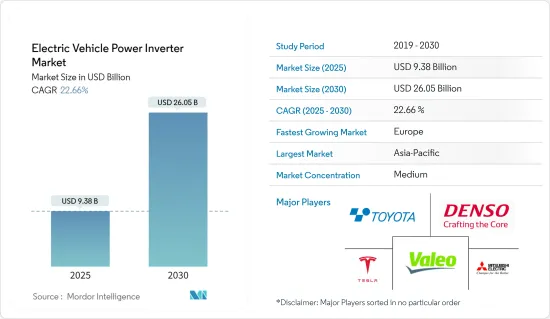

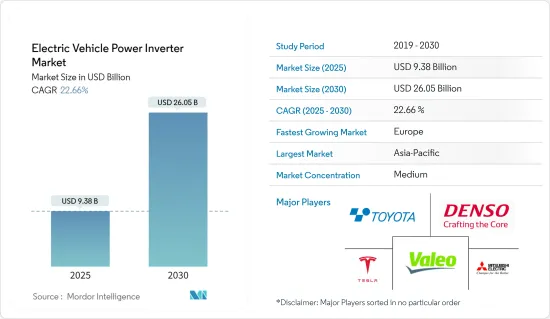

電動車電源逆變器市場規模預計在 2025 年為 93.8 億美元,預計到 2030 年將達到 260.5 億美元,預測期內(2025-2030 年)的複合年成長率為 22.66%。

世界各國政府都在電動車計劃上投入巨額資金。政府正在尋求為電動車電源逆變器製造商提供機會。政府也鼓勵汽車製造商和消費者生產和使用電動車。電動車需求的不斷成長也有望推動電動車所用零件(如電源逆變器)的銷售。

隨著全球排放法規愈發嚴格,汽車製造商正逐步從傳統引擎汽車轉向混合動力汽車汽車和電動車的生產。此外,世界各國政府已開始向電動車購買者提供減免道路稅、獎金和降低保險費等獎勵,以支持電動車銷售的成長。歐洲、北美和亞太地區(尤其是日本和中國)充電站安裝的增加進一步推動了電動車銷售的成長。

幾家製造商已經提高了電動車相關公告的標準,預測到 2025 年以後。超過 10 家主要OEM已經宣布了 2030 年及以後的電氣化目標。重要的是,一些OEM正計劃重新配置其產品線以只生產電動車。例如,通用汽車在第一季宣布,計劃到2025年將對電動和自動駕駛汽車的支出增加到200億美元。該公司的目標是到2023年終推出20款新電動車,並在預測期內在美國和中國每年銷售超過100萬輛電動車。

電動車電源逆變器市場趨勢

擴大電動車銷量

電動車已成為汽車產業不可或缺的一部分,並為實現能源效率以及減少污染物和其他溫室氣體的排放提供了一條途徑。人們對環境問題的認知不斷提高和政府的積極舉措是推動市場成長的主要因素。

2023 年,全球純電動車 (BEV) 和插電式混合動力汽車(PHEV) 銷量預計將成長 35%,達到 1,400 萬輛。其中,純電動車(BEV)1000萬輛,插電式混合動力車(PHEV)400萬輛。世界各地正在興起一股加速小型乘用電動車(EV)普及、逐步淘汰傳統內燃機汽車的運動。平均燃料價格的上漲反映出歐洲新電動車註冊比例高於其他地區。因此,由於燃料價格上漲而導致的電動車的大規模採用預計將擴大全球業務。

全球各國政府加大對充電基礎設施的投資可能會促進電動車的銷售。例如,

- 為了滿足日益成長的電動車需求,英國政府計劃在2030年將公共電動車充電站的數量擴大100倍以上,達到30萬個。

- 2023年2月,BP揭露了到2030年在美國投資10億美元建設電動車充電站的計劃,這標誌著BP向綜合能源公司轉型邁出了重要一步。

此外,隨著車輛性能的提高,電池相關的高成本使得逆變器和其他電力電子設備必須改進。

例如,客戶偏好向電動車的轉變是脫碳未來的明顯徵兆——同時,這對充電站來說也至關重要。然而,電動車的採用取決於許多屬性,包括消費者行為、基礎設施和特定的地理叢集。預計電動車銷量的成長將刺激對充電站的需求。市場主要企業牢牢掌握消費者情緒,並專注於透過在全國範圍內提供快速充電技術來滿足消費者情緒。

這種變化雖然沒有導致內燃機汽車銷量的下降,但卻為電動車創造了一個充滿希望的市場,無論是現在還是未來。為了因應這一趨勢,一些汽車製造商增加了對電動車以及電源逆變器等相關零件的研發投入。另一方面,一些汽車製造商開始專注於推出新產品以搶佔市場佔有率,最終刺激了市場需求。

亞太地區引領電動車電源逆變器市場

近年來,受環保意識增強、政府舉措和電動車 (EV) 技術進步等因素的推動,亞太地區的電動車市場經歷了顯著成長。隨著人們對空氣品質的擔憂日益加劇以及對減少溫室氣體排放的承諾,該地區的國家正在實施支持性政策和獎勵,以鼓勵人們使用電動車。

- 2023年4月,包括印尼的ION Mobility和越南的VinFast在內的多家東南亞新興企業籌集了大量資金並推出了新的電動車車型。

中國作為亞太地區的主要企業,已成為最大的電動車市場。中國政府的強大支持,包括慷慨的補貼和獎勵以及全面的充電基礎設施建設,正在推動中國電動車的快速發展。此外,中國致力於成為電動車領域的全球領導者,這也刺激了電動車製造業的創新和投資。

- 2023年7月,中國電動車巨頭比亞迪超越特斯拉,成為2023年上半年全球第一大電動車銷售公司,凸顯中國企業在全球電動車市場實力日益增強。

日本、韓國等國家在亞太電動車市場也扮演著舉足輕重的角色。日本是許多知名汽車製造商的所在地,在技術進步和對永續交通的堅定承諾的推動下,電動車的普及率穩步成長。在韓國,政府的激勵措施和研發投資正在促進電動車市場的成長,重點是增強電池技術和擴大充電基礎設施。

- 日本政府於2023年3月修改了電動車補貼方案,對符合條件的電動車延長補貼期限並增加補貼,以進一步促進電動車的普及。

- 2023 年 2 月,LG Energy Solutions 和本田宣布成立合資企業,在美國建立電池生產工廠,以滿足北美對電動車日益成長的需求,並可能供應亞太市場。

印度憑藉其雄心勃勃的電氣化計劃,正逐漸成為亞太地區電動車領域的重要參與者。印度政府的舉措,例如加快採用和製造混合動力和電動車(FAME)計劃,旨在獎勵採用電動車並幫助發展充電基礎設施。再加上消費者意識的不斷增強,為電動車電源逆變器市場創造了有利的環境。

2023年5月,印度電動車市場出現銷售量激增,創下單年電動車銷量最高紀錄。

電動車電源逆變器產業概況

電動車電源逆變器市場由少數幾家公司主導,包括大陸集團、羅伯特·博世有限公司、Denso株式會社和三菱電機株式會社。公司正在透過開設新的生產工廠和建立合資企業來擴大業務,以獲得競爭優勢。例如

- 2024 年 6 月 NXP Semiconductors NV 和 ZF Friedrichshafen AG 合作開發了一種基於 SiC 的先進電動車牽引逆變器解決方案,該解決方案利用 NXP 的 GD316x HV 隔離閘極驅動器。這些解決方案旨在加速 800V 和 SiC 功率設備的採用,延長電動車續航里程,減少充電中斷並降低OEM成本。

- 2024 年 1 月:博格華納與陝西法士特汽車驅動集團合作,專注於中國電動商用車的高壓逆變器解決方案。

- 2023年11月:開發出採用鑽石晶片技術的電動車逆變器,其體積明顯小於特斯拉3號機組,並提供更有效率的電力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 電動車需求預計將增加

- 市場限制

- 基礎設施發展和營運挑戰

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 依推進類型

- 油電混合車

- 插電式混合動力汽車

- 純電動車

- 燃料電池電動車

- 按車型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Vitesco Technologies

- Robert Bosch GmbH

- DENSO Corporation

- Toyota Industries Corporation

- Hitachi Astemo Ltd

- Meidensha Corporation

- Aptiv PLC(Borgwarner Inc.)

- Mitsubishi Electric Corporation

- Marelli Corporation

- Valeo Group

- Lear Corporation

- Infineon Technologies AG

- Eaton Corporation

第7章 市場機會與未來趨勢

- 雙向充電整合

The Electric Vehicle Power Inverter Market size is estimated at USD 9.38 billion in 2025, and is expected to reach USD 26.05 billion by 2030, at a CAGR of 22.66% during the forecast period (2025-2030).

Governments in various countries are spending heavily on electric mobility projects. They are trying to provide opportunities for electric vehicle power inverter manufacturers. The governments are also encouraging automobile manufacturers and customers to produce and adopt electric vehicles. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters.

With growing stringent emission standards globally, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. In addition, governments initiated incentives, such as a cut down in vehicle tax, bonus payments, and premiums, for buyers of electric vehicles in the respective countries to support electric vehicle sales growth. The increasing charging station facilities in the regions, especially in Europe, North America, and Asia-Pacific, particularly in Japan and China, further supported the growing electric vehicle sales.

Several manufacturers raised the bar to go beyond the announcements related to electric vehicles with an outlook beyond 2025. More than ten of the largest OEMs declared electrification targets for 2030 and beyond. Significantly, some OEMs plan to reconfigure their product lines to produce only electric vehicles. For instance, in the first trimester, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company launched 20 new electric models by the end of 2023 and aimed to sell more than 1 million electric cars a year in the United States and China over the forecast period.

EV Power Inverter Market Trends

Growing Sales of Electric Vehicles

Electric vehicles have become an integral part of the automotive industry, and they represent a pathway toward achieving energy efficiency, along with reduced emissions of pollutants and other greenhouse gases. The increasing environmental concerns, coupled with favorable government initiatives, are some of the major factors driving the market's growth.

In 2023, global sales of battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) surged by 35%, reaching 14 million units. Among these, 10 million were pure electric BEVs, while 4 million were PHEVs. The movement to accelerate the adoption of light-duty passenger electric cars (EVs) and phase out traditional vehicles with internal combustion engines is gaining traction around the world. The increase in average fuel prices reflects the fact that Europe holds a higher share of new electric car registrations than other parts of the world. Hence, mass adoption of electric vehicles, owing to rising fuel prices, is expected to increase business globally.

Rising government investment in the development of charging infrastructure worldwide is likely to promote the sale of electric vehicles. For instance,

- The UK government aims to expand the quantity of public electric vehicle charging stations by over a hundredfold, reaching 300,000 by 2030, to match the rising demand for electric vehicles.

- In February 2023, BP revealed intentions to inject USD 1 billion by 2030 into electric vehicle (EV) charge points across the United States. It marked a significant stride in the company's evolution toward becoming an integrated energy company.

Moreover, the high cost associated with batteries necessitated the improvement of inverters and other power electronics, along with improving the performance of vehicles.

For instance, shifting customer preference toward electric vehicles is an evident sign of future decarbonization and is simultaneously decisive for charging stations. However, the penetration of EVs is subjected to various attributes, including consumer behavior, infrastructure, and certain regional clusters. The increase in electric vehicle sales is anticipated to proportionally fuel the demand for charging stations. Prominent players in the market have pinpointed consumer sentiment and thus are focusing on catering to it by offering fast-charging technologies across the country.

Though the change did not result in a slump in IC engine vehicle sales, it created a promising market for electric vehicles in the present and future. The above trend propelled some of the automakers to increase their expenditure on R&D in electric vehicles and associated components, like power inverters. While others, on the other hand, started focusing on launching new products to capture the market share, eventually pushing the demand in the market.

Asia-Pacific is leading the Electric Vehicle Power Inverter Market

The Asia-Pacific electric vehicle market has witnessed substantial growth in recent years, driven by a combination of environmental awareness, government initiatives, and advancements in electric vehicle (EV) technology. With a rising concern for air quality and a commitment to reducing greenhouse gas emissions, countries in the region have implemented supportive policies and incentives to promote the adoption of electric vehicles.

- In April 2023, several startups in Southeast Asia, like Indonesia's ION Mobility and Vietnam's VinFast, raised significant funding and launched new electric vehicle models, indicating a growing interest in regional EV production.

China, as a major player in the Asia-Pacific region, has emerged as the largest market for electric vehicles. The Chinese government's robust support, including generous subsidies, incentives, and the establishment of a comprehensive charging infrastructure, has propelled the rapid growth of electric vehicles in the country. Additionally, China's push toward becoming a global leader in electric mobility has spurred innovation and investment in electric vehicle manufacturing.

- In July 2023, Chinese EV giant BYD overtook Tesla as the world's leading electric vehicle seller in the first half of 2023, highlighting the growing strength of Chinese players in the global EV market.

Countries like Japan and South Korea have also played pivotal roles in the Asia-Pacific electric vehicle market. Japan, home to renowned automakers, has seen a steady increase in electric vehicle adoption, driven by technological advancements and a strong commitment to sustainable transportation. In South Korea, government incentives and investments in research and development have contributed to the growth of the electric vehicle market, with a focus on enhancing battery technology and expanding charging infrastructure.

- In March 2023, the Japanese government revised its EV subsidy program, extending it and increasing benefits for eligible electric vehicles to further promote EV adoption.

- In February 2023, LG Energy Solution and Honda announced a joint venture to establish a battery cell production plant in the United States, catering to the growing demand for EVs in North America and potentially supplying the Asia-Pacific market as well.

India, with its ambitious plans for electrification, is gradually becoming a significant player in the Asia-Pacific electric vehicle landscape. The Indian government's initiatives, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, aim to incentivize electric vehicle adoption and support the development of charging infrastructure. This, coupled with increasing consumer awareness, is fostering a positive environment for the electric vehicle power inverter market.

In May 2023, the Indian EV market experienced a surge in sales, registering the highest number of electric vehicles sold in a single year, driven by rising fuel prices and increasing awareness of environmental benefits.

EV Power Inverter Industry Overview

A few players, such as Continental AG, Robert Bosch GmbH, DENSO Corporation, and Mitsubishi Electric Corporation, dominate the electric vehicle power inverter market. Companies are expanding their business by opening new production plants and making joint ventures so that they can gain an edge over their competitors. For instance,

- June 2024: NXP Semiconductors NV and ZF Friedrichshafen AG collaborated on advanced SiC-based traction inverter solutions for EVs, utilizing NXP's GD316x HV isolated gate drivers. These solutions aim to expedite the adoption of 800-V and SiC power devices, enhancing EV range, reducing charging stops, and lowering costs for OEMs.

- January 2024: BorgWarner, in partnership with Shaanxi Fast Auto Drive Group, is focusing on high-voltage inverter solutions for electric commercial vehicles in China.

- November 2023: Diamond Foundry Inc. developed an electric car inverter using diamond wafer technology, which was significantly smaller than Tesla 3's unit and delivered more efficient power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Electric Vehicles Is Expected to Increase the Demand

- 4.2 Market Restraints

- 4.2.1 Infrastructure Challenges May Possess Operational Challenges

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Propulsion Type

- 5.1.1 Hybrid Electric Vehicles

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Battery Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Vitesco Technologies

- 6.2.2 Robert Bosch GmbH

- 6.2.3 DENSO Corporation

- 6.2.4 Toyota Industries Corporation

- 6.2.5 Hitachi Astemo Ltd

- 6.2.6 Meidensha Corporation

- 6.2.7 Aptiv PLC (Borgwarner Inc.)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.9 Marelli Corporation

- 6.2.10 Valeo Group

- 6.2.11 Lear Corporation

- 6.2.12 Infineon Technologies AG

- 6.2.13 Eaton Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Bidirectional Charging