|

市場調查報告書

商品編碼

1687470

RF GaN-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)RF GaN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

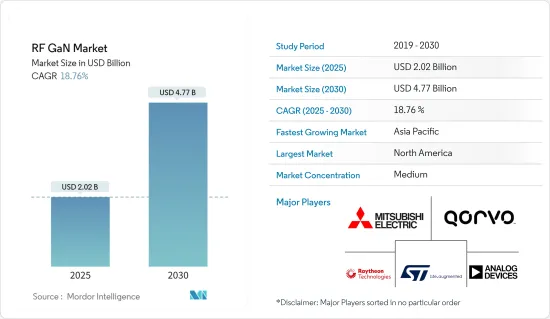

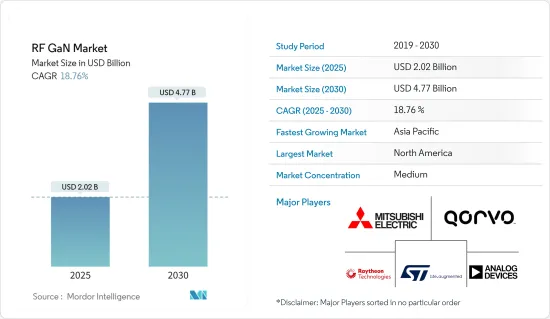

預計 2025 年 RF GaN 市場規模為 20.2 億美元,預計 2030 年將達到 47.7 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 18.76%。

隨著越來越多的行業採用物聯網 (IoT) 技術,在廣泛的即時連接設備和應用中使用 RF GaN 的優勢預計將推動市場的成長。隨著 GaN 技術的不斷發展,GaN 在更複雜的應用中能夠實現更高的頻率,例如相位陣列、雷達、有線電視 (CATV)、甚小孔徑終端 (VSAT) 和國防通訊的基地台收發器。

主要亮點

- RF GaN 在無線基礎設施中發揮著至關重要的作用,它可以提高效率並增加頻寬以支援不斷成長的資料傳輸。 RF GaN 市場將主要受到 5G 日益普及和無線通訊進步的推動。電訊營運商也可能受益於 GaN 功率電晶體的使用增加。

- 電動車對射頻 GaN 的採用日益增多也是推動該市場需求的主要因素之一。碳化矽元件用於電動公車、計程車、貨車和乘用車的車載電池充電器。此外,政府對電動車市場的支持立法不斷增加也刺激了射頻 GaN 市場的需求。

- 自動駕駛汽車和無人機發展所需的基礎設施也是推動RF GaN技術需求的因素之一。因此,預計在預測期內,自動駕駛汽車和無人機在各種應用(尤其是軍事和國防應用)中的採用和發展將進一步增加 RF GaN 設備的採用。

- GaN 固有的材料優勢也帶來了一些相關的製造挑戰,包括成本以及裝置加工和封裝的最佳化。為了擴大這些設備的採用,需要解決其他問題,包括電荷捕獲和電流崩塌。儘管基於 GaN 的射頻 (RF) 裝置已經有了顯著的改進(性能和產量比率),但仍有幾個障礙阻礙 GaN-on-SiC(碳化矽上氮化鎵)進入主流應用(即無線通訊基地台和 CATV)。

- 新冠疫情影響了供應鏈和電訊業。新冠疫情影響了供應鏈和通訊業,嚴重阻礙了通訊領域5G的推廣。預計消費者將在此次危機期間繼續使用行動電話,但大多數人可能無法進一步投資於仍處於起步階段的技術。

- 資料消費的迅猛成長推動了商業網路的成長,並鼓勵網路供應商採用 4G 和 5G 等下一代網路。根據思科可視化網路指數,預計到 2022 年全球行動資料流程量將以 46% 的複合年成長率成長,達到每月 77.5 Exabyte。

- 世界各地的組織都在創新產品並擴展業務。例如,2022 年 6 月,創新射頻和微波功率解決方案供應商 Integra 宣布已開始向美國和歐洲客戶出貨其突破性的 100V RF GaN 技術。該公司還宣布將擴大其 100V RF GaN產品系列,推出七款新產品,單一電晶體可提供高達 5kW 的功率水平,適用於航空電子、定向能、電子戰、雷達和科學市場。

高頻氮化鎵市場趨勢

5G實施進展帶動通訊基礎設施領域需求強勁

- 通訊業作為全球數位化的關鍵驅動力和市場環境全面變化的產業,被視為數位轉型技術的主要用戶。通訊業對互通性和技術的投資正在推動全球經濟中資本和資訊流的模式轉移,為各產業全新經營模式的出現奠定了基礎。

- 5G技術可望改變各種寬頻服務的格局,並增強各種終端用戶的垂直連接。推動 GaN市場佔有率的主要因素是行動用戶、線上視訊內容串流、5G 基礎設施以及利用 5G 的各種物聯網應用的成長。 5G可望支援多種場景的多種業務及相關服務需求。

- 目前,5G行動用戶數估值為42萬,預計到2022年將達到4億人。隨著全球5G技術部署的顯著增加,預計對RF GaN技術的需求將會增加。

- 2022 年 5 月,義法半導體 (ST) 和通訊、工業、國防和資料中心產業半導體產品供應商 MACOM Technology Solutions Holdings (MACOM) 宣布生產矽基射頻 GaN 原型。憑藉著此次成功,ST 和 MACOM 很高興能繼續並擴大合作。 ST 和 MACOM 正在開發的 GaN-on-Si 技術預計在整合到標準半導體製程流程時將提供具有競爭力的性能和顯著的規模經濟。

- Qorvo 是 2G、3G 和 4G基地台製造商 RF 解決方案的主要供應商之一。 Qorvo 在市場上具有獨特的優勢,支援 6GHz 以下和 cmWave/mmWave 無線基礎架構的開發。為了實現 5G,Qorvo 正在投資並提供涵蓋相關 5G 頻段(包括 3.5、4.8、28 和 39 GHz)的產品解決方案來服務市場。

- 5G 基礎設施需要高密度、小型天線陣列,這給射頻 (RF) 系統的電源和溫度控管帶來了重大挑戰。 GaN 裝置憑藉其改進的寬頻性能、效率和功率密度,提供了能夠應對這些挑戰的更緊湊的解決方案的潛力。

預計亞太地區將出現顯著成長

- 亞太離散半導體市場以中國大陸、日本、台灣和韓國為主導,約佔全球離散半導體市場的65%。相較之下,越南、泰國、馬來西亞和新加坡等其他司法管轄區也為該地區的市場主導地位做出了貢獻。

- 根據印度電子和半導體協會的數據,印度半導體元件市場預計將實現 10.1% 的複合年成長率(2018-2025),到 2025 年達到 323.5 億美元。該國是全球研發中心的重要目的地。因此,印度政府正在進行的「印度製造」舉措預計將為半導體市場帶來大量投資。印度政府的此類舉措可能會推動射頻 GaN 市場的發展。

- 2022年2月,氮化鎵積體電路(IC)供應商納微半導體(Navitas Semiconductor)宣布參加中國國際金融股份有限公司(CICC)投資者會議。該公司專有的 GaN 功率 IC 將 GaN 功率與 GaN 驅動、控制和保護整合在單一 SMT 封裝中。這些市場參與企業將推動該地區的 GaN 市場的發展。

- 由於投資者對支持 5G 技術的基礎設施建設的興趣增加,預計全部區域對 RF GaN 的需求將會增加。例如,根據GSMA的預測,到2025年,亞太地區行動電話營運商預計將花費超過4,000億美元,其中3,310億美元將用於5G部署。

- 隨著中國經濟從製造業主導向創新主導轉型,中國射頻 GaN 公司的成長是更廣泛趨勢的一部分。中國市場對商業無線通訊應用的需求正在激增,中國企業已開始開發下一代通訊網路。

- 此外,2021 年 12 月,印度理工學院坎普爾分校的研究人員開發了一種高性能、行業標準的鋁氮化鎵 (AlGaN)高電子移動性電晶體(HEMT) 模型。該模型提供了一種簡單的設計方法,可用於製造高功率射頻電路。射頻電路包括用於無線傳輸的放大器和開關,可用於航太和國防應用。研究人員的持續技術創新有望推動該地區射頻 GaN 市場的成長。

高頻氮化鎵產業概況

由於雷神科技公司、意法半導體微電子公司等主要企業的存在,RF GaN 市場競爭非常激烈。持續的創新使他們比其他人擁有競爭優勢。透過研發、策略夥伴關係和併購,這些公司在市場上確立了強勢地位。

2022 年 6 月,Qorvo,一家致力於連接世界的創新 RF 解決方案的知名供應商,被美國國防部 (DoD) 選中,推動國內最先進 (SOTA) RF GaN 計劃的高級整合互連和藍圖,也稱為 STARRY NITE,作為國防部研究與工程副部長辦公室 (OUSD R&E) 微電子路線的一部分。該計劃旨在開發和完善國內開放的 SOTA RF GaN 代工廠,以與國防部先進封裝生態系統保持一致。

2022 年 5 月,義法半導體和工業、通訊、國防和資料中心產業半導體產品的主要供應商 MACOM Technology Solutions Holdings Inc. 宣布成功生產矽基射頻氮化鎵原型。憑藉這一成就,ST 和 MACOM 將繼續合作並加強彼此關係。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 5G實施進展帶動通訊基礎設施領域需求強勁

- 高性能、小外形規格等優勢特性

- 市場限制

- 成本和營運挑戰

第6章市場區隔

- 按應用

- 軍隊

- 通訊基礎設施(回程傳輸、RRH、大規模MIMO、小型基地台)

- 衛星通訊

- 有線寬頻

- 商用雷達和航空電子設備

- 射頻能量

- 依材料類型

- GaN-on-Si

- GaN-on-SiC

- 其他材料類型(GaN-on-GaN、GaN-on-Diamond)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

第7章競爭格局

- 公司簡介

- Aethercomm Inc.

- Analog Devices Inc.

- Wolfspeed Inc.(Cree Inc.)

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Microsemi Corporation(Microchip Technology Incorporated)

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- Qorvo Inc.

- STMicroelectronics NV

- Sumitomo Electric Device Innovations Inc.

- HRL Laboratories

- Raytheon Technologies

- Mercury Systems, Inc

第8章投資分析

第9章 市場機會與未來趨勢

The RF GaN Market size is estimated at USD 2.02 billion in 2025, and is expected to reach USD 4.77 billion by 2030, at a CAGR of 18.76% during the forecast period (2025-2030).

Due to the benefits of RF GaN usage across a wide range of real-time linked devices and applications, more industries are expected to use the Internet of Things (IoT) technology, which is expected to drive market growth. With the continuously evolving GaN technology, GaN enables higher frequencies in more complex applications, such as phased arrays, radar, and base transceiver stations for cable TV (CATV), very small aperture terminal (VSAT), and defense communications.

Key Highlights

- RF GaN plays a key role in wireless infrastructure, improving efficiency and expanding bandwidth to support ever-increasing data transmission speeds. The market for RF GaN is primarily driven by increasing 5G adoption and advances in wireless communications. Telecom operators could also benefit from increased use of GaN power transistors.

- The increasing adoption of RF GaN in electric automotive is also one of the major factors driving demand in this market. Silicon carbide devices are used in the onboard battery chargers of electric buses, taxis, lorries, and passenger cars. Further, increasing government laws favoring the electric vehicles market stimulates demand in the RF GaN market.

- The infrastructure needed to create autonomous vehicles and drones is another factor that increases demand for RF GaN technologies. Hence, growth in the adoption and development of autonomous vehicles and drones for various applications, especially military and defense, is expected to increase further the adoption of RF GaN devices over the forecast period.

- The inherent material advantages of GaN come with some associated manufacturing challenges that include the cost and optimization of device processing and packaging. Other issues include charge trapping and current collapse, which need to be resolved for increased adoption of these devices. Although significant improvements have been made in RF GaN-based devices (performance and yields), there are still some barriers preventing the gallium nitride on silicon carbide (GaN-on-SiC) from entering mainstream applications (i.e., in wireless telecom base-stations or CATV).

- The COVID-19 pandemic impacted supply lines and the telecoms industry. It considerably hindered the penetration of 5G in the telecommunications sector. In this critical situation, consumers are expected to continue using mobile phones, but most of them may not be able to invest more in a technology that is still in a nascent stage.

- Rapidly increasing data consumption has resulted in the growth of commercial networks and is encouraging network providers to adopt next-generation networks, such as 4G and 5G. According to the Cisco Visual Networking Index, global mobile data traffic is expected to register a CAGR of 46%, reaching 77.5 exabytes per month by 2022.

- Organizations across the world are innovating new products and expanding their business. For instance, in June 2022, Integra, a provider of innovative RF and microwave power solutions, announced that it had begun shipping its breakthrough 100V RF GaN technology to customers in the United States and Europe. The company also announced the expansion of its 100V RF GaN product portfolio with the launch of seven new products for the avionics, directed energy, electronic warfare, radar, and scientific market segments, delivering power levels of up to 5kW in a single transistor.

Radiofrequency Gallium Nitride Market Trends

Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- As a primary driver of global digitization and an industry undergoing comprehensive changes in the market environment, the telecommunications industry is regarded as a major user of digital transformation technologies. The telecommunications industry's investment in interoperability and technology has facilitated a paradigm shift in the flow of capital and information throughout the global economy, providing the building blocks for the emergence of entirely new business models across the industry.

- The 5G technology is expected to revolutionize the domain of various broadband services and empower connectivity across different end-user verticals. The major factors boosting the market share of GaN are increasing mobile subscriptions, streaming of online video content, 5G infrastructure, and various IoT applications using 5G. 5G is anticipated to support different services and associated service requirements across multiple scenarios.

- Currently, the number of 5G mobile subscriptions is valued at 0.42 million, and it is expected to reach 400 million subscriptions by 2022. With the substantial growth in the rollouts of 5G technology globally, the demand for RF GaN technology is expected to increase.

- In May 2022, STMicroelectronics (ST) and MACOM Technology Solutions Holdings (MACOM), a supplier of semiconductor products for the telecommunications, industrial, defense, and data center industries, announced the production of RF GaN on silicon (RF Gan-on-Si) prototypes. With this success, ST and MACOM will continue to work together and expand their relationship. GaN-on-Si technology under development by ST and MACOM is anticipated to offer competitive performance and significant economies of scale enabled by integration into standard semiconductor process flows.

- Qorvo is one of the suppliers of RF solutions to the 2G, 3G, and 4G base station manufacturers. It is uniquely positioned in the market to support the development of sub-6 GHz and cmWave/mmWave wireless infrastructure. Qorvo has been investing in product solutions covering relevant 5G bands, such as 3.5, 4.8 and 28, and 39GHz, to service the market, mainly to enable 5G.

- The need for dense, small-scale antenna arrays in 5G infrastructure results in key challenges with power and thermal management in radio frequency (RF) systems. With their improved wideband performance, efficiency, and power density, GaN devices offer the potential for more compact solutions that can address these challenges.

Asia-Pacific is Expected to Experience Significant Growth

- The Asia-Pacific region's discrete semiconductor industry is driven by China, Japan, Taiwan, and South Korea, constituting around 65% of the global discrete semiconductor market. In contrast, others, like Vietnam, Thailand, Malaysia, and Singapore, contribute to the region's dominance in the market.

- According to the Electronics and Semiconductors Association of India,the Indian market for semiconductor components would register a 10.1% CAGR (2018-2025) to reach USD 32.35 billion by 2025. The country is a vital destination for global research and development centers. Therefore, the ongoing 'Make in India' initiative by the Government of India is expected to result in significant investment in the semiconductor market. Such initiatives by the government of India will leverage the RF GaN market.

- In February 2022, Navitas Semiconductor, a provider of GaN integrated circuits (ICs), announced its participation in the China International Capital Corporation Limited (CICC) Investor Conference. The company's proprietary GaN power IC integrates GaN power and GaN drive, control, and protection in a single SMT package. Such participation will leverage the GaN market in the region.

- Demand for RF GaN across the APAC region is expected to increase due to growing investor interest in developing infrastructure to support 5G technology. For instance, according to the GSMA, the Asia-Pacific mobile operator is expected to spend more than USD 400 billion by 2025, of which USD 331 billion will be expended on 5G deployments.

- The growth of RF GaN companies in China is part of a broader trend as the nation shifts from a manufacturing- to an innovation-driven economy. The Chinese market is witnessing an exploding demand for commercial wireless telecom applications, and Chinese companies are already developing next-gen telecom networks.

- Moreover, in December 2021, researchers from IIT Kanpur in India developed a high-performance, industry-standard model of aluminum GaN (AlGaN) high electron mobility transistor (HEMT). This model provides a simple design method that can be used to manufacture high-power RF circuits. RF circuits include amplifiers and switches used in wireless transmissions and are useful in aerospace and defense applications. Constant innovations by researchers will drive the market growth of RF GaN in the region.

Radiofrequency Gallium Nitride Industry Overview

The competitive rivalry among the players in the RF GaN market is high owing to the presence of some key players such as Raytheon Technologies, STM microelectronics, amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over other players. Through research and development, strategic partnerships, and mergers and acquisitions, these players have been able to gain a strong foothold in the market.

In June 2022, Qorvo, a prominent provider of innovative RF solutions that connect the world, was selected by the US Department of Defense (DoD) to proceed with the Advanced Integration Interconnection and Fabrication Growth for Domestic State-of-the-Art (SOTA) RF GaN program, also known as STARRY NITE, as part of the Office of Undersecretary of Defense Research & Engineering's (OUSD R&E) microelectronics roadmap. The program seeks to develop and mature domestic, open SOTA RF GaN foundries in alignment with the DoD's advanced packaging ecosystem.

In May 2022, STMicroelectronics and MACOM Technology Solutions Holdings Inc., a significant supplier of semiconductor products for the industrial, telecommunications, defense, and data center industries, announced the successful production of RF Gan on Silicon (RF Gan-on-Si) prototypes. With this achievement, ST and MACOM would continue to work together and enhance their relationship.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- 5.1.2 Favorable Attributes Such As High-performance and Small Form Factor to

- 5.2 Market Restraints

- 5.2.1 Cost & Operational Challenges

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Military

- 6.1.2 Telecom Infrastructure (Backhaul, RRH, Massive MIMO, Small Cells)

- 6.1.3 Satellite Communication

- 6.1.4 Wired Broadband

- 6.1.5 Commercial Radar and Avionics

- 6.1.6 RF Energy

- 6.2 By Material Type

- 6.2.1 GaN-on-Si

- 6.2.2 GaN-on-SiC

- 6.2.3 Other Material Types (GaN-on-GaN, GaN-on-Diamond)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aethercomm Inc.

- 7.1.2 Analog Devices Inc.

- 7.1.3 Wolfspeed Inc. (Cree Inc.)

- 7.1.4 Integra Technologies Inc.

- 7.1.5 MACOM Technology Solutions Holdings Inc.

- 7.1.6 Microsemi Corporation (Microchip Technology Incorporated)

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Qorvo Inc.

- 7.1.10 STMicroelectronics NV

- 7.1.11 Sumitomo Electric Device Innovations Inc.

- 7.1.12 HRL Laboratories

- 7.1.13 Raytheon Technologies

- 7.1.14 Mercury Systems, Inc

![RF GAN設備市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1341977.png)

![全球衛星通訊市場中的RF GAN設備:趨勢、機會和競爭分析 [2023-2028]](/sample/img/cover/42/1341978.png)

![全球軍事市場中的 RF GAN 設備:趨勢、機會和競爭分析 [2023-2028]](/sample/img/cover/42/1341976.png)

![全球通訊基礎設施市場中的 RF GAN 設備:趨勢、機會和競爭分析 [2023-2028]](/sample/img/cover/42/1341979.png)