|

市場調查報告書

商品編碼

1687700

5G 基礎設施 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)5G Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

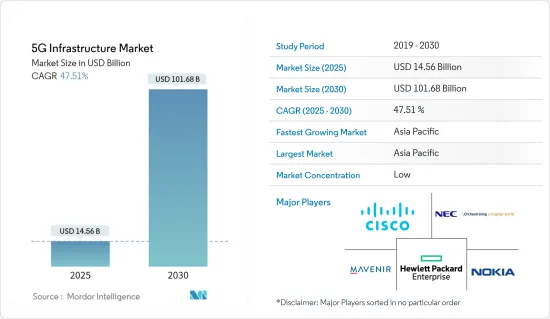

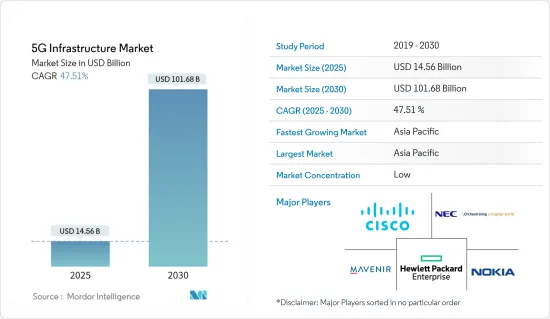

5G基礎設施市場規模預計在2025年為145.6億美元,預計到2030年將達到1016.8億美元,預測期內(2025-2030年)的複合年成長率為47.51%。

主要亮點

- 政府部署 5G 的舉措以及物聯網和智慧城市等新技術的進步推動了市場的發展,這些舉措促使市場參與者開發新服務和解決方案以佔領市場佔有率。

- 5G技術顯著降低了延遲,即接收和傳輸訊息之間的延遲。端到端延遲的減少改善了用戶體驗並為創新使用案例創造了新的機會。超可靠低延遲通訊 (URLLC) 也是一種趨勢,它是 5G 網路架構的一個分支,它將能夠高效地通訊資料傳輸,並支援工廠自動化、工業網際網路、智慧電網、自動駕駛和機器人手術等應用領域的一系列先進服務。因此,上述應用對更低延遲的需求正在顯著推動全球 5G 基礎設施市場的成長。

- 根據 GSMA Intelligence 2023 年行動經濟報告,5G 將以持續部署和採用為基礎,為未來的行動創新和服務奠定基礎。 5G普及率今年將達到17%,到2030年將達到54%(相當於53億個連線)。預計到2030年,該技術將為全球經濟增加約1兆美元,使各行各業受益。 5G 應用的顯著成長可能會推動研究市場的發展。

- 此外,在智慧城市領域,5G技術有可能顯著增強公共。利用快速、響應迅速的 5G 網路,智慧城市系統將能夠從多個來源收集和分析大量資料,包括視訊保全攝影機、智慧交通燈和其他物聯網設備。例如,拉斯維加斯正在測試三個先導計畫,政府已撥款 5 億美元,用於尋找 2025 年實現全城聯網的方法。政府智慧城市計劃的不斷增加正在影響對 5G 基礎設施的需求。

- 5G網路的推出需要大量的基礎設施投資,包括鋪設新的基地台、小型基地台和光纖電纜。與前幾代蜂巢式網路相比,5G基礎設施部署依賴於減少蜂窩規模和增加網路容量,從而實現密集的網路架構。這種密集化增加了基礎設施需求和整體資本支出,導致網路營運商和服務提供者的前期成本更高。預計這將對市場成長構成挑戰。

- 疫情期間,通訊業者已將 5G 連線擴展到多個國家。例如,菲律賓環球電信於2021年3月宣布,將加速在中東和亞洲其他國家部署5G漫遊。 Globe Telecom 計劃向新加坡 Singtel、CSL Hong Kong 和科威特 Ooredoo 的入境客戶開放 5G 連線。預計後疫情時代市場將進一步成長。

5G基礎設施市場趨勢

5G無線接取網路預計將佔據市場佔有率

- RAN 為無線設備提供無線存取網路資源。核心網路和用戶設備中的矽晶片實現了 RAN 功能。無線接取網路(RAN)包括基地台、天線、大型基地台和小型基地台。 5G 可以透過兩種方式部署:透過 5G 核心網路或將 5G RAN 連接到 4G 網路。

- 向 5G 的過渡是一個關鍵因素,因為它可以實現更高的頻寬和更低的延遲。雲端 RAN 和開放介面實現的 RAN 分解將使通訊業者受益於更廣泛的生態系統。

- 愛立信預計,2022年至2023年間,全球5G用戶數將從5.5億多成長至16.7億多。此外,根據 GSMA 的預測,到 2025 年,海灣合作理事會國家的 5G 普及率將略高於全球平均(15%)(客戶 5G 採用率為 16%)。此外,中東和北非地區的5G用戶數量預計將達到1.2962億。 5G用戶數量的大幅成長預計將推動市場發展。

- 因此,各大通訊業者都發布了有關 RAN 分解和開放解決方案的資訊請求 (RFI)。這使您可以靈活地為 RAN 的不同部分選擇最佳解決方案。例如,虛擬基頻單元 (BBU) 的邊緣伺服器可用於在邊緣雲端和 RAN 內執行應用程式以減少延遲。 5G NR與虛擬RAN架構的結合有望為低延遲和物聯網服務開闢新的可能性。

- 分析亞太地區已開發經濟體和新興經濟體之間不斷擴大的夥伴關係將如何提高市場成長率。例如,2022 年 12 月,三星電子宣布將提供一系列 5G 無線電,以支援 NTT Docomo 的開放無線存取網路 Open RAN 擴充計畫。除了 Docomo 目前支援的 3.4GHz 無線電之外,三星還將增加 3.7GHz、4.5GHz 和 28GHz 頻段的新無線電。這些無線電將支援 NTT DOCOMO 開放無線接取網路(O-RAN) 的擴展,並涵蓋 NTT DOCOMO 的所有持有雙工 (TDD) 頻段。隨著三星在日本擴大覆蓋範圍,能夠持有NTT Docomo 的頻譜將使其能夠建立多樣化的 5G 網路,並為全國各地的消費者和企業提供增強的服務。 NTT DoCoMo 的商業網路環境中也在進行這些新無線電與來自不同供應商的基頻的互通性測試。

亞太地區可望主導市場

- 亞太地區對 5G 基礎設施的投資正在不斷成長。中國是5G技術的最大投資國之一,超過美國,也是5G基礎設施供應商的關鍵市場。中國政府、通訊業者和設備供應商正在加強盡快推出5G,這推動了5G市場的投資增加。該國也是華為等一些最大的通訊5G 基礎設施供應商的所在地。但過去兩年,美國和中國之間的貿易戰削弱了部分電子產品的出口。

- 根據GSMA預測,到2025年,中國40%至50%的行動用戶可能會使用5G。中國將在網路融合、網路虛擬和網路切片方面獲得更多收益。政府也將獨立網路作為其早期 5G 部署的一部分,從頭開始建立 5G 網路,而不是將 4G 網路發展到 5G。這將促進該地區研究市場的成長。

- 建立5G是日本政府的首要任務。內務部是5G的主導機構。已有四家公司向內務部提交了5G網路發展計畫。四家公司的計畫均獲得批准,但需滿足某些條件,包括兼顧都市區需求、維持足夠光纖以提供 5G 服務,以及採取適當的核准安全措施(包括解決供應鏈風險)。

- 據韓國科學通訊通訊部稱,截至2023年3月,韓國5G用戶數約2,960萬。如此龐大的 5G用戶數量可能會推動所研究市場的需求,並使市場參與者能夠開發新的解決方案來滿足客戶的廣泛需求並佔領市場佔有率。

- 亞太地區其他可能的國家包括越南、泰國和印尼。市場持續發展、智慧城市建設舉措不斷湧現以及新技術的開拓預計將推動亞太其他地區研究市場的需求。

5G基礎設施產業概覽

研究市場中競爭公司之間的競爭態勢非常激烈,預計在預測期內將保持不變。所研究的市場包括幾家全球性公司,它們在相當競爭的市場空間中爭奪關注。主要供應商包括思科系統公司、惠普企業發展有限公司、Mavenir 系統公司、日本電氣公司、諾基亞公司、甲骨文公司和高通技術公司。因此,它是眾多最終用戶和地區的首選 5G 基礎設施提供者。由於許多公司都將這個市場視為全球擴張的有利機會,預計企業集中度在預測期內將實現高成長。

- 2023 年 2 月-諾基亞與IT基礎設施公司 Kindrill 的私人 5G夥伴關係延長三年。兩家公司在聯合聲明中宣布了此次延期,並表示將專注於為全球客戶開發和提供 LTE、5G 專網無線服務和工業 4.0 解決方案。

- 2023年2月-NEC和ADVA將合作為印尼最大的固定網路營運商Telkom Indonesia部署時間同步解決方案。將新服務(例如提供超低延遲應用)收益對於行動通訊業者在 5G 時代獲得發展動力至關重要。為了滿足使用印尼電信服務的行動通訊業者和合作夥伴的預期需求,該公司正在提高其傳輸網路的計時準確性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 隨著各種設備的參與,M2M/IoT 連接不斷增加

- 行動資料服務需求不斷成長

- 市場限制

- 網路架構模型部署及頻譜挑戰導致初期資本投入高

- 推動 5G 發展的關鍵使用案例

- 車

- 產業

- 消費性電子產品

- 衛生保健

- 能源和公共產業

- 公共基礎設施

- 更多使用案例

第6章市場區隔

- 按通訊基礎設施

- 5G無線存取網路

- 5G核心網路

- 交通網路

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章競爭格局

- 公司簡介

- Cisco Systems Inc.

- Hewlett Packard Enterprise Development LP

- Mavenir Systems Inc.

- NEC Corporation

- Nokia Corporation

- Oracle Corporation

- Qualcomm Technologies Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Samsung Electronics Co. Ltd

- Qucell Networks Co. Ltd

- Huawei Technologies Co. Ltd

- Airspan Networks Inc.

- CommScope Holding Company Inc.

第8章投資分析

第9章:市場的未來

The 5G Infrastructure Market size is estimated at USD 14.56 billion in 2025, and is expected to reach USD 101.68 billion by 2030, at a CAGR of 47.51% during the forecast period (2025-2030).

Key Highlights

- The market is driven by government initiatives towards the deployment of 5G and advancement in new technologies like iot, smart cities, and many more, pushing the market players to develop new services/solutions to capture the market share.

- 5G technology offers a significantly lower latency rate, the delay between receiving and sending information. This decrease in end-to-end latency improves user experiences and creates new opportunities for innovative use cases. Also, there is a trend of Ultra-Reliable Low Latency Communications (URLLC), a subdivision of 5G network architecture that enables efficient scheduling of data transfers and caters to various advanced services across applications such as factory automation, the industrial internet, smart grid, autonomous driving, and or robotic surgeries. Hence, demand for lower latency rates among applications above is significantly boosting the growth of the global 5G infrastructure market.

- According to GSMA Intelligence Mobile Economy Report 2023, 5G will underpin future mobile innovation and services, building on ongoing deployments and adoption. 5G adoption will reach 17% this year, reaching 54% (equivalent to 5.3 billion connections) by 2030. The technology will add almost USD1 trillion to the global economy in 2030, spreading benefits across all industries. Such a huge rise in 5G adoption would drive the studied market.

- Further, in smart cities, 5G technology has the potential to enhance public security and safety significantly. Smart city systems can gather and analyze massive volumes of data from several sources, including video security cameras, intelligent traffic lights, and other iot devices, using the fast and responsive 5G network. For instance, Las Vegas is testing three pilot projects, with the government allocating USD 500 million to find ways to connect the entire city by 2025. The increase in the number of smart city projects undertaken by governments influences the demand for 5G infrastructure.

- The deployment of 5G networks requires significant infrastructure investments, including installing new base stations, small cells, and fiber optic cables. Compared to previous generations of cellular networks, 5G infrastructure deployment involves a denser network architecture due to its reliance on smaller cell sizes and increased network capacity. This densification increases the infrastructure requirements and overall capital expenditure, leading to high initial costs for network operators and service providers. This is expected to challenge the market's growth.

- Telecom operators expanded the offering of their 5G connection for several countries during the pandemic. For instance, in March 2021, Philippines-based Globe Telecom announced that it would accelerate its 5G Roaming rollout to other countries in the Middle East and Asia. Globe is set to open its 5G connection to visiting customers of Singtel of Singapore, CSL Hong Kong, and Ooredoo of Kuwait. In the post-pandemic era, the market is expected to grow further.

5G Infrastructure Market Trends

5G Radio Access Networks Expected to Hold Major Market Share

- RAN provides radio access network resources across wireless devices. Silicon chips in the core network, as well as the user equipment, enable the functionality of the RAN. A radio access network (RAN) encompasses base stations, antennas, macro cells, and small cells. 5G can be deployed in two ways, through a 5G core network or connecting a 5G RAN to a 4G network.

- The migration to 5G has become a critical factor, as it will enable higher bandwidths, and lower latencies, to name a few. RAN disaggregation enabled by cloud RANs and open interfaces allows carriers to benefit from a wider ecosystem.

- According to Ericsson, 5G subscriptions are expected to increase globally between 2022 and 2023, rising from over 0.55 billion to over 1.67 billion. Further, according to GSMA, the usage of 5G in GCC states will be slightly higher (16% customer 5G adoption) than the global average (15%) by 2025, mainly driven by governments and mobile operators with the support of mobile technology partners. Moreover, the number of 5G subscriptions is expected to reach 129.62 million in the Middle East and North African regions. Such a huge rise in 5G subscriptions would drive the market.

- Therefore, major leading carriers request information (RFIs) for RAN disaggregation and open solutions. This is because they can have the flexibility to choose the best solutions for the different parts of the RAN. For instance, edge servers for virtualized baseband units (BBUs) can also be used to run applications within the edge cloud and RAN to reduce latency. The amalgamation of 5G NR with a virtualized RAN architecture is expected to open up new opportunities for low latency and IoT services.

- The growing partnerships in developed and developing economies in Asia-Pacific are analyzed to bolster the market's growth rate. For instance, in December 2022, in support of the NTT DOCOMO Open Radio Access Network Open RAN expansion plans, SAMSUNG Electronics announced it would provide a range of 5G radios. In addition to its current 3.4GHz radio support in DoCoMo, Samsung is adding new radios with a 3.7Ghz, 4.5Ghz, and 28Ghz frequency range. The radios support NTT DoCoMo's open Radio Access Network (O-RAN) expansion and cover all of the Time Division Duplex (TDD) spectrum bands held by the operator. As Samsung expands its coverage in Japan, the ability of NTT DOCOMO to take advantage of its spectrum holdings will allow it to build a diverse 5G network and offer enhanced services for consumers and enterprises throughout Japan. In the commercial network environment of NTT DOCOMO, they have also carried out interoperability tests on these new radios with basebands from various suppliers.

Asia Pacific Expected to Dominate the Market

- The Asia-Pacific region is witnessing growing investment in 5G infrastructure. China is one of the largest investors in 5G technology, even leaving behind the United States; hence, one of the significant markets for 5G infrastructure vendors too. The growing effort by the Chinese government, telecom operators, and vendors to deploy 5G as quickly as possible is bringing more investment into the market studied. The country also has some of the largest telecom 5G infrastructure providers, like Huawei. However, the US-China trade war has weakened the exports of some electronic segments in the last two years.

- According to the GSMA, by 2025, 40-50% of China's mobile users may be using 5G. The country is gaining more in terms of network convergence, network virtualization, and network slicing. The government also started to include standalone as part of its initial 5G deployment, owing to building a 5G network from the ground rather than evolving a 4G network into a 5G. This would enable the growth of the studied market in the region.

- The establishment of 5G is a high priority for the Japanese government. The Ministry of Internal Affairs and Communications (MIC) is the lead agency on 5G. Four companies submitted plans to MIC for the development of 5G networks. All four plans were approved based on certain conditions, including focusing on the needs of both urban and rural areas; maintaining appropriate and sufficient optical fibers to provide 5G service; and taking adequate cybersecurity measures, including measures against supply chain risks.

- According to the Ministry of Science and ICT (South Korea), As of March 2023, South Korea had approximately 29.6 million 5G subscribers. Such a huge number of 5G subscribers would drive the demand for the studied market and enable the market players to develop new solutions to cater to a wide range of needs of customers and capture the market share.

- The countries that are considered in the rest of Asia-Pacific are Vietnam, Thailand, and Indonesia, among others. The developments happening in the market, the rise in the initiatives towards smart cities, and the development of new technologies are expected to drive the demand for the studied market in the rest of the Asia-Pacific region.

5G Infrastructure Industry Overview

The intensity of competitive rivalry in the market studied is high, and it is expected to remain the same over the forecast period. The market studied comprises several global players vying for attention in a fairly contested market space. Major vendors include Cisco Systems Inc., Hewlett Packard Enterprise Development LP, MavenirSystems Inc., NEC Corporation, Nokia Corporation, Oracle Corporation, Qualcomm Technologies Inc., and many more. And many more are highly preferred 5G infrastructure providers across various end users and regions. The firm concentration ratio is expected to record higher growth during the forecast period because several firms are looking at this market as a lucrative opportunity to expand globally.

- February 2023 - Nokia extended its private 5G partnership with IT infrastructure firm Kyndrylfor an additional three years. The two companies announced the extension in a joint statement, noting that the pair will focus on developing and delivering LTE, 5G private wireless services, and Industry 4.0 solutions to clients worldwide.

- February 2023 - NEC Corporation and ADVA will jointly deploy time synchronization solutions for Telkom Indonesia, Indonesia's largest fixed network operator, to help the operator prepare its transport network to deliver time-sensitive 5G services across the country. New service monetization, such as providing ultra-low latency applications, is critical for mobile operators to build momentum in the 5G era. To meet the anticipated demands of mobile operators and partners using Telkom Indonesia's services, the company is enhancing the timing accuracy of its transport network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Machine-to-Machine/IoT Connections Due to Involvement of Various Devices

- 5.1.2 Increase in Demand for Mobile Data Services

- 5.2 Market Restraints

- 5.2.1 High Initial Capital Expenditure due to Deployment of Network Architecture Model and Spectrum Challenges

- 5.3 Key Use-Cases Driving 5G

- 5.3.1 Automotive

- 5.3.2 Industrial

- 5.3.3 Consumer Electronics

- 5.3.4 Healthcare

- 5.3.5 Energy and Utilities

- 5.3.6 Public Infrastructure

- 5.3.7 Other Use Case

6 MARKET SEGMENTATION

- 6.1 By Communication Infrastructure

- 6.1.1 5G Radio Access Networks

- 6.1.2 5G Core Networks

- 6.1.3 Transport Networks

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Hewlett Packard Enterprise Development LP

- 7.1.3 Mavenir Systems Inc.

- 7.1.4 NEC Corporation

- 7.1.5 Nokia Corporation

- 7.1.6 Oracle Corporation

- 7.1.7 Qualcomm Technologies Inc.

- 7.1.8 Telefonaktiebolaget LM Ericsson

- 7.1.9 ZTE Corporation

- 7.1.10 Samsung Electronics Co. Ltd

- 7.1.11 Qucell Networks Co. Ltd

- 7.1.12 Huawei Technologies Co. Ltd

- 7.1.13 Airspan Networks Inc.

- 7.1.14 CommScope Holding Company Inc.