|

市場調查報告書

商品編碼

1687714

印度聯合收割機:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Combine Harvester - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

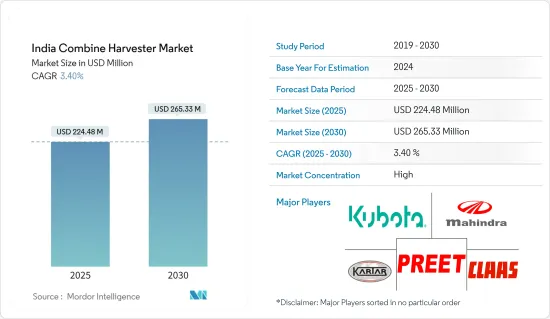

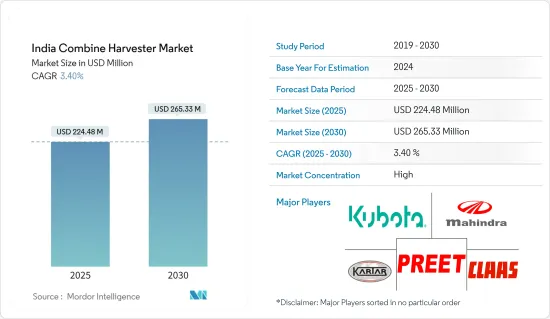

印度聯合收割機市場規模預計在 2025 年達到 2.2448 億美元,預計到 2030 年將達到 2.6533 億美元,預測期內(2025-2030 年)的複合年成長率為 3.4%。

主要亮點

- 根據印度農業研究理事會(ICAR)的數據,印度主糧、豆類、油籽、粗糧和經濟作物(不包括米和小麥)的收割和脫粒機械化程度接近32%。其中稻米、小麥收割脫粒機械化率已超過60%。這一趨勢凸顯了聯合收割機的日益普及,它簡化了收割和脫粒過程,從而有助於擴大市場。

- 此外,在研究期間,各種作物的種植面積增加。例如,根據糧農組織統計資料庫 (FAOSTAT) 的統計數據,到 2022 年,印度粗粒種植總面積預計將從 2019 年的 9,510 萬公頃增加到 9,960 萬公頃。對於聯合體來說,這似乎是一個非常大的可能性。

- 在整個研究期間,Preet 987、Mahindra Arjun 605、Kartar 4000、Dasmesh 9100 Self Joint Harvester、New Holland TC5.30、Kubota HARVESTING DC-68G-HK 等知名品牌在該國佔有重要地位。印度採用這些聯合收割機是由於農業產業嚴重的勞動力短缺。

- 印度政府對包括機械在內的各種農業投入提供補貼。 2022 年,根據首席部長提出的「薩瑪格拉鄉村發展計畫」(CMSGUY),阿薩姆邦政府旨在促進鄉村發展,向阿薩姆邦奇朗區的兩家農民生產公司(FPC)提供了聯合收割機,補貼率高達 90%。透過補貼使聯合收割機機械更容易獲得的努力有望增加聯合收割機機械的採用率並進一步促進市場成長。

印度聯合收割機市場的趨勢

農業勞動成本高

農業是大部分人口的主要生計來源。根據《2022-23年印度經濟調查》,農業部門僱用了印度近45.76%的勞動力。印度都市化趨勢的上升是人口擴張的結果。根據世界銀行的資料,2020年至2023年間,都市化從34.9%上升到36.4%。這導致農村家庭遷移到附近的城市,造成該國農業勞動力短缺。例如,根據世界銀行的資料,2020年至2022年間,農業就業勞動力從44.3%下降到42.9%。

同樣,農業勞動力的短缺也推高了工資,增加了農民的整體生產成本。根據印度政府統計,2022年全印度女性田間(農業)工人的日平均年薪為328.51印度盧比(4美元),與前一年同期比較成長8.32%。同樣,對於男性田間(農業)勞動力,據報導 2022 年全印度的日薪為 394.52 印度盧比(4.8 美元),與前一年同期比較成長 8.55%。這導致農場就業人數減少和聯合收割機的引進。

該國農業嚴重依賴體力勞動,農業工人數量的下降對收割等農業工作構成了重大挑戰。為了解決這個問題,使用先進的收割機械來有效、有效率地完成這些農業任務正變得越來越流行。

印度糧食種植面積的增加將推動自走式聯合收割機的需求

在印度,穀物在飲食中扮演著至關重要的角色,使該國成為這些主食的主要生產國和消費國。隨著糧食消費量的增加,擴大耕地面積的必要性也日益增加。這一趨勢也從穀類種植面積的不斷增加中可以看出。例如,根據糧農組織統計資料庫 (FAOSTAT) 的數據,穀物收穫面積將從 2019 年的 9,510 萬公頃增加到 2022 年的 9,960 萬公頃。考慮到聯合收割機,尤其是自走式聯合收割機主要用於穀物收割,種植面積的增加將直接刺激對此類設備的需求,從而推動市場成長。

自走式聯合收割機配備強勁的引擎,擅長在田間作業,確保高效收割並提高生產力。生產率的提高是該領域擴張的關鍵驅動力。自走式聯合收割機主要用於印度北部、西部和中部收割水稻、小麥和其他季節性作物。此外,大型農場主,特別是在旁遮普邦和哈里亞納邦等主要稻米和小麥種植區,對這些收割機的有利可圖的僱傭行為,導致其他農場對這些收割機的使用量激增。

為了適應種植作物面積不斷增加的需要,製造商正在推出專門用於種植作物的聯合收割機產品。其中一個例子是馬恆達 (Mahindra & Mahindra) 的 Swaraj 部門,該部門於 2021 年 10 月推出了自走式聯合收割機「Gen2 8100 EX」。此機型旨在提高水稻種植者的生產力和績效,並確保大面積區域的最佳糧食產量。

印度聯合收割機產業概況

印度聯合收割機市場已經鞏固。 Claas India、Preet Group、Kubota Corporation、Mahindra &Mahindra Ltd 和 Kartar Agro Industries Private Limited 是主要的市場參與者。公司在產品品質和促銷方面競爭,並專注於採取策略性措施來佔領主導市場佔有率。此外,為了擴大市場佔有率並加強我們的研發活動,我們正在與其他公司建立聯盟和收購關係,並大力投資新產品的開發。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 需要提高作物產量

- 增加政府支持

- 農業機械化需求

- 市場限制

- 聯合收割機高成本

- 所擁有土地小而分散

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 類型

- 自走式聯合收割機

- 卡車式聯合收割機

- 曳引機式聯合收割機

第6章競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- PREET Group

- John Deere India Pvt. Ltd

- CLAAS India

- Tractors and Farm Equipment(TAFE)Ltd

- Mahindra Tractors

- Kubota Agricultural Machinery India Pvt. Ltd

- Dasmesh Group

- Balkar Combines

- Kartar Agro Industries Pvt. Ltd

- Sonalika Group

第7章 市場機會與未來趨勢

The India Combine Harvester Market size is estimated at USD 224.48 million in 2025, and is expected to reach USD 265.33 million by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

Key Highlights

- Indian Council of Agricultural Research (ICAR), in India, harvesting and threshing operations for major cereals, pulses, oil seeds, millets, and cash crops (excluding rice and wheat) are nearly 32% mechanized. Notably, mechanization levels for harvesting and threshing in rice and wheat exceed 60%. This trend emphasizes the growing adoption of combine harvesters, which streamlines harvesting and threshing, bolstering market expansion.

- Additionally, the area under cultivation of various crops has been rising during the study period. For instance, according to the FAOSTAT Statistics, the total area for cultivating coarse cereals across India increased from 95.1 million hectares in 2019 to 99.6 million hectares in 2022. This seems like a great potential for combine harvesters.

- Throughout the study period, prominent brands such as Preet 987, Mahindra Arjun 605, Kartar 4000, Dasmesh 9100 Self Combine Harvester, New Holland TC5.30, and Kubota HARVESTING DC-68G-HK have established a significant presence in the country. The rising adoption of these combines in India can be largely attributed to a notable shortage of farm labor.

- The Indian government extends subsidies on various agricultural inputs, including machinery. In 2022, under the Chief Minister's Samagra Gramya Unnayan Yojana (CMSGUY) - a scheme by the Assam Government aimed at village development - two farmer-producer companies (FPCs) in Assam's Chirang District were granted combined harvester machinery at a remarkable 90% subsidized rate. Such initiatives, making combined harvester machinery more accessible through subsidies, are poised to amplify their adoption and further fuel market growth.

India Combine Harvester Market Trends

High Cost of Farm Labor

Agriculture is a major source of livelihood for a large group of the population. As per the Indian Economic Survey 2022 -23, the agriculture sector employs nearly 45.76% of the Indian workforce. The rise in urbanization trends observed in the country is a result of the expanding population. According to the World Bank data, the degree of urbanization increased from 34.9% to 36.4% from 2020 to 2023. This resulted in the migration of rural households to the nearby cities, leading to the scarcity of farm labor in the country. For instance, the workforce employed in agriculture dropped from 44.3% to 42.9% from 2020 to 2022, as per the World Bank data.

Likewise, the scarcity of farm labor also increased wage rates, which increased the overall production costs of the farmers. As per the Government of India statistics, the annual average daily wage rate for female field (Agriculture) labor, at all India levels, has reported at ₹ 328.51 (USD 4.0) in 2022, registering an increase of 8.32% over the previous year. Likewise, in the case of male field (agriculture) labor, the daily wage rate at all India levels was reported at ₹ 394.52 (USD 4.8) in 2022, registering an increase of 8.55 percent over the previous year. This resulted in a restrain in employing them in farms, favoring the adoption of combine harvesters by the farmers in the country.

The agricultural industry of the country heavily relies on manual labor, and the decreasing workforce in agriculture has led to major challenges in performing farming operations such as harvesting. As a solution to this problem, the usage of advanced harvesting machinery has become increasingly popular for performing these agricultural operations effectively and efficiently.

Rising Grain Cultivation in India Fuels Demand for Self-Propelled Combine Harvesters

In India, cereals play a pivotal role in the culinary landscape, positioning the nation as a leading producer and consumer of these staples. As the consumption of cereal crops rises, so does the need for expanded cultivation. This trend is evident, with harvested areas for cereals and grains on the upswing. For instance, according to FAOSTAT, the area harvested under cereals increased from 95.1 million hectares in 2019 to 99.6 million hectares in 2022. Given that combines, especially self-propelled ones, are predominantly utilized for cereals, this uptick in cultivation directly boosts the demand for such equipment, propelling the market growth.

Equipped with a robust engine, self-propelled combine harvesters excel in the fields, ensuring efficient harvesting and heightened productivity. This boost in productivity is a key driver for the segment's expansion. Predominantly, these harvesters find their application in Northern, Western, and Central India, catering mainly to rice, wheat, and other seasonal crops. Moreover, the lucrative custom hiring of these harvesters by large farmers, especially in major rice-wheat regions like Punjab and Haryana, has led to a surge in adoption among other farmers.

In response to the expanding areas dedicated to grain crops, manufacturers are rolling out specialized combine harvester products tailored for these crops. A case in point is Swaraj Division, a Mahindra and Mahindra Ltd subsidiary, which unveiled its Gen2 8100 EX self-propelled combine harvester in October 2021. This model aims to enhance productivity and performance for paddy farmers, ensuring optimal grain yield across extensive acreage.

India Combine Harvester Industry Overview

The Indian combined harvester market is consolidated. Claas India, Preet Group, Kubota Corporation, Mahindra & Mahindra Ltd, and Kartar Agro Industries Private Limited are the major market players. Companies compete based on product quality and promotion and focus on strategic initiatives to account for prominent market shares. They are also heavily investing in developing new products while collaborating with and acquiring other companies, which may increase their market shares while strengthening their R&D activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need to Enhance Crop Production

- 4.2.2 Increase In Government Support

- 4.2.3 Demand for Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 High Cost of Combine Harvesters

- 4.3.2 Small and Fragmented Land Holdings

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Self-propelled Combine Harvester

- 5.1.2 Track Combine Harvester

- 5.1.3 Tractor-powered Combine Harvester

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 PREET Group

- 6.3.2 John Deere India Pvt. Ltd

- 6.3.3 CLAAS India

- 6.3.4 Tractors and Farm Equipment (TAFE) Ltd

- 6.3.5 Mahindra Tractors

- 6.3.6 Kubota Agricultural Machinery India Pvt. Ltd

- 6.3.7 Dasmesh Group

- 6.3.8 Balkar Combines

- 6.3.9 Kartar Agro Industries Pvt. Ltd

- 6.3.10 Sonalika Group