|

市場調查報告書

商品編碼

1687731

相機模組-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

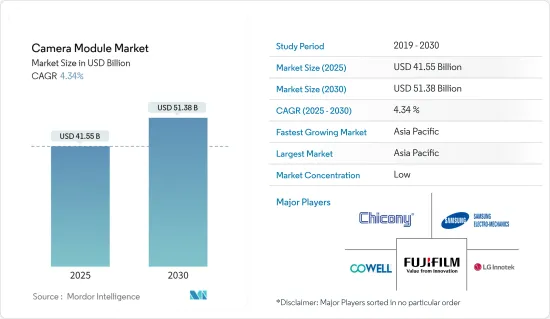

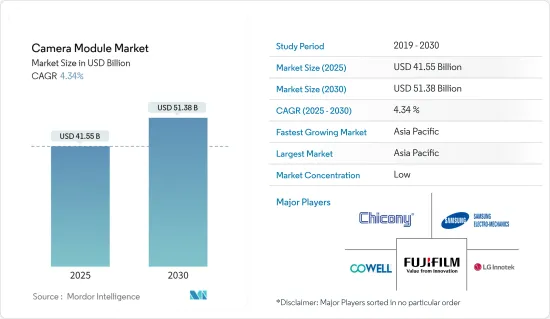

預計 2025 年相機模組市場規模為 415.5 億美元,到 2030 年將達到 513.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.34%。就出貨量而言,預計將從 2025 年的 80.8 億台成長到 2030 年的 109.2 億台,預測期間(2025-2030 年)的複合年成長率為 6.20%。

相機模組市場:全面分析

關鍵亮點

- ADAS(高級駕駛輔助系統)激增:相機模組市場正在經歷顯著成長,這主要是由於汽車對 ADAS(高級駕駛輔助系統)的需求不斷增加。前置攝影機系統在 ADAS 中發揮關鍵作用,為車道維持輔助、自動緊急煞車和主動車距控制巡航系統等安全功能提供先進的感測能力。對 ADAS 的日益依賴正在推動工業公司大力投資研發 (R&D) 和合作夥伴關係。例如,賽靈思公司和 Motovis 合作將賽靈思汽車 Zynq系統晶片平台與 Motovis 的卷積類神經網路IP 整合,以實現透過前置攝影機系統進行車輛感知和控制。

- 舜宇光學科技與 Valens Semiconductor 合作,將 MIPI A-PHY 相容晶片組整合到下一代 ADAS相機模組中。

- 麥格納國際推出了環景顯示攝影和電控系統,讓3D環景顯示技術更容易被消費者所接受。

- Foresight Autonomous Holdings 與日本一級供應商簽署了聯合概念驗證協議,以提高 ADAS 效能。

- 保全攝影機的普及率不斷提高:住宅和商業場所中保全攝影機的使用日益增多也是推動相機模組市場發展的主要因素。這種需求是在犯罪和恐怖主義威脅不斷增加以及基於物聯網的安全系統的採用的背景下產生的。例如,美國安裝的監視器數量從 2018 年的 7,000 萬個躍升至 2021 年的 8,500 萬個,增幅達 21%。同樣,預計到 2024 年,英國的安全系統服務收入將從 2019 年的 13.519 億美元增至 15.9884 億美元。

- 在韓國,公共CCTV安裝數量增加了200%,到2021年達到1,458,465台。

- 作為智慧城市計畫的一部分,古爾岡城市發展局計劃在 200 個地點安裝 1,000 個監視器。

- 為因應不斷上升的暴力犯罪率,蒙特婁警方安裝了九個額外的監視器。

- 技術進步推動創新相機模組市場正在經歷快速的技術進步,尤其是在行動攝影領域。隨著歐菲光等廠商推出超薄潛望鏡鏡頭模組,潛望鏡模組已成為旗艦智慧型手機的標準配備。此外,晶圓級玻璃 (WLG) + 塑膠鏡頭也越來越受歡迎,例如小米的 Redmi K40 遊戲版就採用了混合 WLG相機鏡頭。

- Oppo 推出了一款連續光學變焦鏡頭,其影像品質比傳統遠攝感測器更好。

- 蘋果公司已獲得潛望鏡相機系統的專利,該系統使用棱鏡、鏡頭陣列和影像感測器。

- Vision Components 推出了一種用於醫療技術應用的新型 MIPI相機模組,具有高解析度和快速影格速率。

- 市場機會與未來成長:由於智慧型手機、汽車和醫療設備等應用的進步,微型相機模組市場可望大幅成長。據愛立信稱,全球智慧型手機市場正在擴大,預計全球智慧型手機用戶數量將從 2021 年的 6.259 兆成長到 2027 年的 7.69 兆。汽車領域也正在見證後置相機和 ADAS 前置相機的普及率不斷提高,創造了巨大的機會。

- 對 360 度視角、車艙監控和電子後視鏡應用的需求正在推動每輛車的平均攝影機數量增加。

- OmniVision 和 Valens Semiconductor 合作開發了適用於汽車應用的符合 MIPI A-PHY 標準的攝影機解決方案。

- 醫療產業也從中受益,OmniVision 推出了用於內視鏡檢查的最小的醫療級 CMOS 影像感測器。

相機模組市場趨勢

影像感測器部分佔據主導地位

- 細分市場概述:影像感測器細分市場佔據相機模組市場的大部分,佔2021年市場總收入的50.16%。作為最大的組件細分市場,影像感測器在各行業的相機模組中發揮著至關重要的作用。

- 市場規模與成長:到 2027 年,影像感測器部分預計將達到 300.8 億美元,2022 年至 2027 年的年複合成長率(CAGR)為 6.71%。這一成長反映了影像感測器在相機模組生態系統中持續的重要性。

- 技術進步:對更高解析度和更佳低照度性能的需求正在推動影像感測器的技術進步。佳能開發的單光子Avalanche二極體 (SPAD) 感測器就是一個例子,能夠在低照度條件下實現高品質的捕捉。

- 競爭格局:索尼集團等主要企業之間的激烈競爭推動著科技不斷創新。索尼透過策略夥伴關係以及為智慧型手機、汽車和新興技術開發先進感測器,繼續保持市場領先地位。

- 工業應用:影像感測器的採用範圍正在超越傳統的相機應用,特別是在汽車領域,ADAS 和自動駕駛汽車需要高品質的感測器。 OmniVision 和 Valens Semiconductor 合作開發汽車級攝影機解決方案,彰顯汽車領域日益成長的重要性。

亞太地區是相機模組市場成長的中心

- 區域優勢:亞太地區是相機模組市場規模最大、成長最快的地區,預計到 2027 年將達到 389.4 億美元,複合年成長率為 10.77%。

市場促進因素

- 製造地:該地區的電子和半導體製造能力(主要在中國、韓國和台灣)正在推動相機模組的生產。

- 智慧型手機的普及:印度和中國等人口大國智慧型手機的快速普及推動了對相機模組的需求,據報道,到 2021 年,中國的行動網路用戶將超過 10 億。

- 汽車領域的成長:日本、韓國和中國等汽車市場的成長正在加速對ADAS和相機模組的需求。

- 政府舉措:「印度製造」計畫等支持措施正在吸引對相機模組製造的投資。

- 工業發展:主要企業正在該地區大力投資。為了滿足印度的製造目標,三星已將其工廠從中國遷至印度,而 OPPO 則建立了一座每三秒鐘就能生產一部智慧型手機的工廠。

- 技術創新:歐菲光集團等亞太公司處於技術創新的前沿,並正在建立研究機構以在全球市場上保持競爭力。

相機模組市場概覽

相機模組市場高度整合,LG Innotek、舜宇光學、歐菲光等全球領先公司在 2021 年佔據了 75% 的市場佔有率。 Luxvisions、Chicony 和 Mcnex 等較小的參與企業總合佔據剩餘市場佔有率的 34.6%。

創新與垂直整合:市場領導非常重視研發和垂直整合。例如,LG Innotek每年將銷售額的5%以上投入研發,並計畫投資10.7億美元提升產能。舜宇光學透過收購富士天津並建立自己的精密光學公司,加強了垂直整合。

未來成功策略:為了保持競爭力,公司必須投資於技術進步、策略夥伴關係和市場多樣化。舜宇光學科技已與Valens Semiconductor合作開發支援ADAS的相機模組。此外,隨著公司專注於汽車和物聯網等新興領域,他們需要最佳化製造流程以滿足對小型化、高性能相機模組日益成長的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 工業影響評估

- 價格趨勢分析

- 超輕巧相機模組的動態

- 不同應用的相機模組尺寸的演變

- 各廠商提供的解析度和產品映射

- 解析度與成本分析

第5章市場動態

- 市場促進因素

- 汽車ADAS(高級駕駛輔助系統)市場驅動力不斷增加

- 家庭和商業場所保全攝影機的使用增加

- 市場限制

- 複雜的製造和供應鏈挑戰

- 科技發展趨勢

- 透過組件實現技術進步

- 每款最終產品的平均相機數量-智慧型手機與微型汽車

汽車和行動電話相機的演變

第6章市場區隔

- 按組件

- 影像感測器

- 鏡片

- 相機模組組裝

- VCM供應商(AF和OIS)

- 按應用

- 移動的

- 家用電子電器(不包括手機)

- 車

- 醫療保健

- 安全功能

- 工業的

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

7.供應商市場佔有率分析

- 相機模組供應商市場佔有率

- 影像感測器(CIS)供應商排名

- 鏡頭組供應商排名

第8章競爭格局

- 公司簡介

- Chicony Electronics Co. Ltd

- Cowell E Holdings Inc.

- Fujifilm Corporation

- LG Innotek Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Primax Electronics Ltd

- LuxVisions Innovation Limited(Lite-On Technology Corporation)

- Sharp Corporation

- Sony Group Corporation

- STMicroelectronics NV

- Sunny Optical Technology(Group)Company Limited

- AMS OSRM AG

- On Semiconductor(Semiconductor Components Industries LLC)

- OFILM Group Co. Ltd

- OmniVision Technologies Inc.

第9章投資分析

第10章市場機會與未來成長

The Camera Module Market size is estimated at USD 41.55 billion in 2025, and is expected to reach USD 51.38 billion by 2030, at a CAGR of 4.34% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 8.08 billion units in 2025 to 10.92 billion units by 2030, at a CAGR of 6.20% during the forecast period (2025-2030).

Camera Module Market: A Comprehensive Analysis

Key Highlights

- Surge in Advanced Driver Assistance Systems: The camera module market is experiencing significant growth, primarily due to the rising demand for Advanced Driver Assistance Systems (ADAS) in vehicles. Forward camera systems play a crucial role in ADAS by providing advanced sensing capabilities for safety features like lane-keeping assistance, automatic emergency braking, and adaptive cruise control. The increasing reliance on ADAS is prompting industry players to invest heavily in research and development (R&D) and collaborations. For example, Xilinx Inc. and Motovis collaborated to integrate the Xilinx Automotive Zynq system-on-chip platform with Motovis' convolutional neural network IP for vehicle perception and control through forward camera systems.

- Sunny Optical Technology and Valens Semiconductor partnered to incorporate MIPI A-PHY-compliant chipsets into next-generation camera modules for ADAS applications.

- Magna International launched surround-view cameras and electronic control units, making 3D surround-view technology more accessible to consumers.

- Foresight Autonomous Holdings signed a joint proof of concept with a Japanese Tier One supplier to enhance ADAS performance.

- Rising Security Camera Adoption: The growing use of security cameras in both residential and commercial settings is another major factor driving the camera module market. This demand is fueled by the increasing threat of crime and terrorism, coupled with the adoption of IoT-based security systems. For example, the number of installed surveillance cameras in the U.S. surged by 21%, from 70 million in 2018 to 85 million in 2021. Similarly, security system services in the U.K. are projected to generate USD 1,598.84 million in revenue by 2024, up from USD 1,351.9 million in 2019.

- South Korea saw a 200% increase in public CCTV installations, reaching 1,458,465 cameras in 2021.

- Gurugram Metropolitan Development Authority plans to install 1,000 surveillance cameras across 200 locations as part of its smart city initiative.

- Montreal police installed nine additional security cameras in response to rising violent crime rates.

- Technological Advancements Driving Innovation: The camera module market is experiencing rapid technological advancements, especially in mobile photography. Periscope modules have become standard features in flagship smartphones, with manufacturers like O-Film unveiling ultra-thin periscope lens modules. Additionally, Wafer Level Glass (WLG) + Plastic lenses are gaining traction, as seen in Xiaomi's Redmi K40 Gaming Edition, which incorporates a hybrid WLG camera lens.

- Oppo launched a continuous optical zoom lens offering superior image quality over conventional telephoto sensors.

- Apple was granted a patent for a periscope camera system using prisms, a lens array, and an image sensor.

- Vision Components introduced new MIPI camera modules for medical technology applications, featuring high image resolutions and fast frame rates.

- Market Opportunities and Future Growth: The compact camera module market is on the verge of substantial growth, driven by advancements across applications like smartphones, automotive, and healthcare. The global smartphone market is expanding, with worldwide smartphone subscriptions expected to grow from 6,259 billion in 2021 to 7,690 billion by 2027, according to Ericsson. The automotive sector also presents significant opportunities, particularly with the rising adoption of rear cameras and ADAS forward cameras.

- The average number of cameras per car is increasing, driven by the demand for 360-degree views, cabin monitoring, and e-mirror applications.

- OmniVision and Valens Semiconductor collaborated to develop a MIPI A-PHY-compliant camera solution for automotive applications.

- The healthcare industry is also benefiting, with OmniVision launching its smallest medical CMOS image sensor for endoscopy procedures.

Camera Module Market Trends

Image Sensor Segment Dominating the Component Landscape

- Segment Overview: The image sensor segment commands a significant portion of the camera module market, contributing to 50.16% of the total market revenue in 2021. As the largest component segment, image sensors play a vital role in camera modules across various industries.

- Market Size and Growth: By 2027, the image sensor segment is projected to reach USD 30.08 billion, with a compound annual growth rate (CAGR) of 6.71% from 2022 to 2027. This growth reflects the continued importance of image sensors in the camera module ecosystem.

- Technological Advancements: The demand for higher resolution and better low-light performance is driving technological evolution in image sensors. Canon's development of a single-photon avalanche diode (SPAD) sensor exemplifies this, allowing high-quality image capture in low-light conditions.

- Competitive Landscape: Intense competition among key players like Sony Group Corporation drives continuous innovation. Sony remains a market leader through strategic partnerships and the development of advanced sensors for smartphones, automotive, and emerging technologies.

- Industry Applications: The adoption of image sensors is expanding beyond traditional camera uses, particularly in the automotive sector, where ADAS and autonomous vehicles require high-quality sensors. OmniVision and Valens Semiconductor collaborated to develop automotive-grade camera solutions, illustrating the automotive sector's growing significance.

Asia-Pacific The Epicenter of Camera Module Market Growth

- Regional Dominance: The Asia-Pacific region is the fastest-growing and largest segment of the camera module market, expected to reach USD 38.94 billion by 2027 with a CAGR of 10.77%.

Market Drivers:

- Manufacturing Hub: The region's electronics and semiconductor manufacturing capabilities, particularly in China, South Korea, and Taiwan, drive camera module production.

- Smartphone Penetration: Rapid smartphone adoption in populous countries like India and China is fueling demand for camera modules, with China reporting over 1 billion mobile internet users in 2021.

- Automotive Sector Growth: The growing automotive markets in countries like Japan, South Korea, and China are accelerating demand for ADAS and camera modules.

- Government Initiatives: Supportive policies like India's "Make in India" initiative are attracting investments in camera module manufacturing.

- Industry Developments: Key players are investing heavily in the region. Samsung shifted its factory from China to India, aligning with the country's manufacturing goals, while OPPO established a plant capable of producing one smartphone every three seconds.

- Technological Innovation: Asia-Pacific companies like OFILM Group Co. Ltd are at the forefront of innovation, establishing research institutes to maintain a competitive edge in the global market.

Camera Module Market Overview

The camera module market is highly consolidated, with leading global players such as LG Innotek, Sunny Optical, and O-Film commanding a 75% market share in 2021. Smaller players like Luxvisions, Chicony, and Mcnex collectively account for 34.6% of the remaining market share.

Innovation and Vertical Integration: Market leaders emphasize R&D and vertical integration. For instance, LG Innotek invests over 5% of its annual revenue in R&D and plans to increase production capacity with a USD 1.07 billion investment. Sunny Optical has bolstered its vertical integration by acquiring Fuji Tianjin and establishing its own precision optics company.

Strategies for Future Success: Companies must invest in technological advancements, strategic partnerships, and market diversification to remain competitive. Sunny Optical's partnership with Valens Semiconductor to develop ADAS-compliant camera modules exemplifies this. Moreover, companies should focus on emerging sectors like automotive and IoT, while optimizing manufacturing processes to meet growing demand for miniaturized, high-performance camera modules.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Price Trend Analysis

- 4.6 Ultra Small Camera Module Dynamics

- 4.6.1 Evolution of Camera Module Size Across Various Applications

- 4.6.2 Product Mapping with Resolutions Offered by Various Vendors

- 4.6.3 Resolution Vs. Cost Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Market Demand for Advanced Driver Assistance Systems in Vehicles

- 5.1.2 Increased Use of Security Cameras in Households and Commercial Establishments

- 5.2 Market Restraints

- 5.2.1 Complicated Manufacturing and Supply Chain Challenges

- 5.3 Technology Evolution Trends

- 5.3.1 Component-wise Technological Advancements

- 5.3.2 Average Number of Cameras Per End-product - Smartphones Vs. Light

Vehicles / Camera Evolution in a Mobile Phone

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Image Sensor

- 6.1.2 Lens

- 6.1.3 Camera Module Assembly

- 6.1.4 VCM Suppliers (AF & OIS)

- 6.2 By Application

- 6.2.1 Mobile

- 6.2.2 Consumer Electronics (Excl. Mobile)

- 6.2.3 Automotive

- 6.2.4 Healthcare

- 6.2.5 Security

- 6.2.6 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 VENDOR MARKET SHARE ANALYSIS

- 7.1 Camera Module Vendor Market Share

- 7.2 Image Sensor (CIS) Vendor Ranking

- 7.3 Lens Set Vendor Ranking

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Chicony Electronics Co. Ltd

- 8.1.2 Cowell E Holdings Inc.

- 8.1.3 Fujifilm Corporation

- 8.1.4 LG Innotek Co. Ltd

- 8.1.5 Samsung Electro-Mechanics Co. Ltd

- 8.1.6 Primax Electronics Ltd

- 8.1.7 LuxVisions Innovation Limited (Lite-On Technology Corporation)

- 8.1.8 Sharp Corporation

- 8.1.9 Sony Group Corporation

- 8.1.10 STMicroelectronics NV

- 8.1.11 Sunny Optical Technology (Group) Company Limited

- 8.1.12 AMS OSRM AG

- 8.1.13 On Semiconductor (Semiconductor Components Industries LLC)

- 8.1.14 OFILM Group Co. Ltd

- 8.1.15 OmniVision Technologies Inc.