|

市場調查報告書

商品編碼

1687768

虹膜辨識:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Iris Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

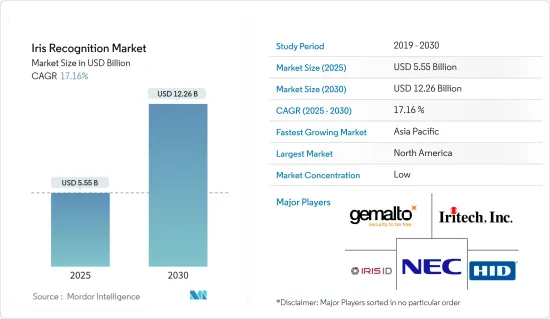

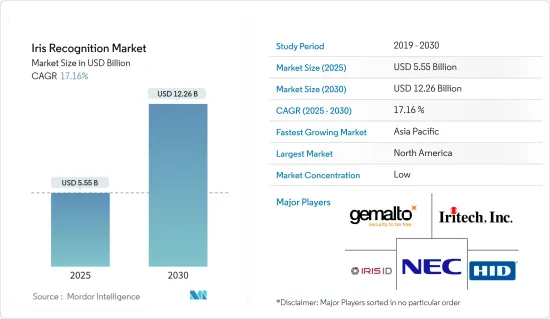

虹膜辨識市場規模在 2025 年預估為 55.5 億美元,預計到 2030 年將達到 122.6 億美元,預測期內(2025-2030 年)的複合年成長率為 17.16%。

虹膜辨識技術採用數學模式識別技術對虹膜的視訊影像進行識別,其複雜的隨機圖案具有穩定、唯一性,並且在一定距離內可見。獨特性、穩定性和安全性是推動虹膜辨識市場需求的關鍵因素。虹膜圖案穩定,並利用了虹膜中豐富的紋理和細節,包括冠狀突起、凹槽、雀斑和條紋。因此虹膜辨識更加安全。

主要亮點

- 智慧型手機配備虹膜掃描器、在政府計劃中使用日益增多、詐騙和安全問題發生率上升以及消費電子領域的需求不斷成長等因素正在推動市場的發展。

- 由於銷售管道增加、研發計劃增加、旅遊/移民行業的高需求以及企業招聘增加等機會,市場的未來前景光明。

- 政府機構還採用各種生物識別技術來最大限度地減少網路威脅並簡化系統存取。紐約市警察局是最早採用虹膜辨識的警察局之一。

- 此外,虹膜掃描還可與指紋和臉部辨識等其他生物辨識技術結合使用。例如,阿拉伯聯合大公國 (UAE) 的政府部門使用包括臉部認證和虹膜辨識在內的生物識別流程。

- 此外,各大銀行正在各種場景中使用虹膜辨識技術,包括使用生物識別技術對手機銀行應用程式進行身份驗證。例如,TSB 銀行已將虹膜辨識引入其手機銀行應用程式,成為歐洲第一家提供該技術的銀行。虹膜辨識讓TSB的行動應用程式只需一眼便可解鎖,為客戶提供快速、易用的體驗。

- 市場成長受到使用者對設備缺乏認知、高成本、虹膜辨識系統的脆弱性、侵犯隱私等因素的限制。

- 為了迅速、廣泛地遏制新冠肺炎疫情,一些政府和組織正在利用生物辨識系統進行病患篩檢和公共監測。生物辨識技術正在邊境管制、監視、醫療保健、生物技術、運輸業等領域迅速應用,以控制這種感染疾病。

虹膜辨識市場趨勢

醫療保健產業強勁成長

- 建立準確的患者身分識別這一長期問題一直困擾著醫療保健產業。醫療保健管理應用正在朝著生物辨識虹膜辨識技術發展。預計當前的技術發展和合理成本的多層身份驗證系統的開發將促進全球醫療保健系統中透過虹膜辨識技術擴大使用生物識別技術。

- 虹膜辨識技術具有高度準確性和易於使用的特點,可識別正確的保險狀態並防止詐欺和重複醫療記錄。患者也可以從接受正確的治療中受益。

- 此外,使用虹膜辨識技術可以幫助在醫療保健的各個領域實現有效的身份驗證和核准機制,包括患者登記、治療或追蹤到不同醫療部門的路徑、安排和安排檢查、重複治療、支持國家和私人健康保險卡、門診治療文件等。

- 用於患者識別的虹膜辨識等技術在醫療保健領域發展勢頭強勁,因為它們不僅能夠在患者進入醫療機構時準確識別患者,而且還效用在醫院內、居家醫療、急診室、其他移動環境或長期護理之前的其他位置等各個部門之間快速準確地識別患者的當前位置。

- 隨著《健康保險互通性與課責法案》(HIPPA)推出嚴格的新規定,以維護病患資訊的機密性和隱私性,生物辨識技術的引入也有望加強病患、醫生和護理人員的安全性。

北美佔據主要市場佔有率

- 該地區各行業的資料外洩事件顯著增加,導致大量企業轉向生物識別,為使用者提供額外的安全保障。

- 許多政府機構已經開始採用虹膜掃描設備,推動了該地區市場的成長。例如,聯邦調查局 (FBI) 依靠與地方、州、部落和聯邦機構的合作來開發關鍵項目,例如國家犯罪資訊中心 (NCIC) 和下一代身分識別 (NGI) 系統。這些系統引入虹膜辨識作為一種可行的身份驗證方法。

- 此外,IrisID 也與 Olive and Dove 公司合作,採用這種生物辨識技術實施虹膜辨識系統,並由其 Remo+ 品牌家庭視訊安全和物聯網解決方案提供支援。該合作夥伴關係將使該公司能夠推出新產品,補充和擴展虹膜辨識技術的門禁系統的功能。

- 據美國聯邦貿易委員會(FTC)稱,美國付款和銀行業相關的身份竊盜現像日益嚴重,推動了安全生物識別解決方案的採用。例如,根據美國聯邦調查局《2022年網路犯罪報告》,民眾向聯邦調查局報告的網路犯罪申訴數量為800,944起,比2021年下降了5%。同時,總潛在損失從2021年的69億美元增加到2022年的102億美元。網路犯罪受害者數量最多的州是加州、佛羅裡達州和德克薩斯州。該國金融機構正在考慮引入各種身份驗證軟體,虹膜辨識系統和軟體的相關性可能會變得更加突出。

虹膜辨識行業概況

虹膜辨識市場比較分散。生物辨識認證設備廣泛應用於政府、醫療保健機構、消費性電子、金融機構、零售店、商用車和企業。這使得許多公司進入市場,從而使該市場具有吸引力。市場的主要企業包括 Iritech Inc.、BioEnable Technologies Pvt。 Ltd.、Aware Inc.、Iris ID Inc.、HID Global 和 EyeLock LLC。

- 2023 年 11 月 - Innovatrics 的虹膜技術贏得 DHS 生物辨識競賽 Innovatrics 推出了一種基於虹膜生物辨識技術的新型活體偵測解決方案。該公司將 MagnifEye 系統描述為一種「半被動」活體檢測方法,可在基於自拍的身份驗證過程中提示最終用戶的眼睛位置。

- 2022年9月-海康威視推出MinMoe虹膜辨識終端,為門禁市場提供更高的安全性。海康威視MinMoe虹膜辨識終端可以在不到一秒的時間內檢驗獨特的虹膜特徵,辨識距離可達70cm。為確保出入認證的準確性和安全性,終端還配備了彩色影像處理和視訊防偽功能。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 詐欺活動頻率增加

- 提高多因素身份驗證的整合度

- 市場限制

- 資料隱私問題

第6章 市場細分

- 按組件

- 硬體

- 軟體

- 按最終用戶產業

- 消費性電子產品

- 衛生保健

- BFSI

- 軍事和國防

- 政府

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Iritech Inc.

- BioEnable Technologies Pvt. Ltd

- Aware Inc.

- Iris ID Inc.

- HID Global

- EyeLock LLC

- Princeton Identity Inc.

- Gemalto NV(Thales Group)

- NEC Corporation

- IrisGuard UK Ltd

- IDEMIA

第8章投資分析

第9章:市場的未來

The Iris Recognition Market size is estimated at USD 5.55 billion in 2025, and is expected to reach USD 12.26 billion by 2030, at a CAGR of 17.16% during the forecast period (2025-2030).

Iris recognition technology uses mathematical pattern-recognition techniques on video images of both irises, whose complex random patterns are stable, unique, and visible from certain distances. The uniqueness, stability, and security are the important factors driving the demand for the iris recognition market. The iris pattern is stable and uses the richness of textures and details present in the iris, like coronas, furrows, freckles, and stripes. Hence, they are more secure in nature.

Key Highlights

- Factors such as integrating iris scanners in smartphones, increased use in government projects, rising incidence of fraudulent activities and security concerns, and enhanced demand from the consumer electronics segment are driving the market.

- The future of the market is encouraging, owing to opportunities such as the increasing number of distribution channels, R&D initiatives, high demand from the travel/immigration industry, and increased adoption in enterprises.

- Government agencies are also adopting a range of biometric technologies to minimize cyber threats and streamline system access. The New York City (NYC) Police Department was among the first police departments to use iris recognition.

- Moreover, iris scanning is used in conjunction with other biometrics, such as fingerprints and face recognition. For instance, the UAE government departments use biometric verification processes that include facial recognition and iris recognition.

- Furthermore, major banks leverage biometrics technologies in a variety of scenarios, such as authenticating mobile banking apps using iris recognition technology. For instance, TSB bank introduced iris recognition to its mobile banking app, making it the first one in Europe to offer the technology. Iris recognition allows one to unlock their TSB mobile app with a simple glance, providing a fast and easy-to-use experience for its customers.

- The market growth is curtailed by restraining factors, such as the gap in the user's understanding of the device, high costs, the vulnerability of iris recognition systems, and intrusion of privacy.

- In order to contain the quick and widespread COVID-19, several governments and organizations are exploiting biometric systems to serve patient screening and public safety monitoring. There is a rapid increase of biometrics to be introduced to control this infectious disease, namely border control, surveillance, healthcare, biotechnologies, and the transportation industry.

Iris Recognition Market Trends

Healthcare Sector to Experience Significant Growth

- The healthcare industry is plagued with the persistent problem of establishing accurate patient identification. Healthcare management applications are turning toward biometric iris recognition technology. The evolution of current technologies and the development of multi-layered authentication systems at reasonable costs are projected to contribute to the global increase in the use of biometric technology in healthcare systems via iris recognition.

- With its high accuracy and ease of use, iris recognition technology offers an option to identify proper insurance status, preventing fraudulence and duplicate medical records. The patients may benefit as well by getting the correct treatments.

- Furthermore, the use of iris recognition technology helps implement effective authentication and authorization mechanisms in various areas of healthcare, which include tracking the patient registration, treatment, or passageways to different departments, checkup arrangement and scheduling, repetitive treatment, supporting national or private health insurance cards, and ambulant treatment document, among others.

- Technologies, such as iris recognition in patient identification, are gaining momentum in healthcare settings not only for their ability to identify a patient upon entry into a healthcare facility accurately but also for their utility to quickly and accurately identify patients' current location in the hospital among the various departments, such as home health, the ER, and other mobile environments, or in any other location prior to administering long term care.

- Due to new stringent regulations established by the Health Insurance Portability and Accountability Act (HIPPA) to preserve the confidentiality and privacy of patient information, the implementation of biometrics is also predicted to enhance security for patients, doctors, and nurses.

North America to have Significant Market Share

- The substantial increase in data breaches in the region across various industries is proliferating organizations to adopt biometrics, providing users another layer of security to secure themselves.

- Many government bodies have started implementing iris-scanning devices, which are fueling the market's growth in the region. For instance, the Federal Bureau of Investigation (FBI) relies on its partnerships with local, state, tribal, and federal agencies to collaboratively for the development of vital programs such as the National Crime Information Center (NCIC) and the Next Generation Identification (NGI) systems. These systems implement iris recognition as a viable means of identification.

- Also, working with Olive and Dove Company, Iris ID is embracing this biometric technology with the implementation of an iris recognition system that will be supported by home video security and IoT solutions under the brand Remo+. This partnership enables the company to introduce new products that complement and expand the capabilities of access control systems with iris recognition technology.

- According to the Federal Trade Commission, identity thefts related to the payment and banking sector are prominent in the United States, which, in turn, would boost the adoption of secured biometrics solutions. For instance, according to the FBI's Internet Crime Report 2022, the public reported 800,944 cyber-crime complaints to the FBI, a 5% decrease from 2021. The potential total loss, on the other hand, increased to USD 10.2 billion in 2022, up from USD 6.9 billion in 2021. The states with the highest number of cybercrime victims were California, Florida, and Texas. With financial institutes operating in the country, considering the implementation of various identity verification software, iris recognition systems and software are poised to become increasingly relevant.

Iris Recognition Industry Overview

The iris recognition market is fragmented. Biometric authentication devices are being extensively adopted across governments, healthcare institutions, consumer electronics, financial institutions, retail and commercial vehicles, and enterprises. This makes the market attractive, with many companies entering the market. Some of the key players in the market are Iritech Inc., BioEnable Technologies Pvt. Ltd, Aware Inc., Iris ID Inc., HID Global, and EyeLock LLC.

- November 2023 - Iris Technology from Innovatrics Wins DHS Biometric Rally Innovatrics has introduced a new liveness detection solution based on iris biometrics. The MagnifEye system is described by the company as a "semi-passive" method of liveness detection that prompts an end user to position their eye during a selfie-based identity verification session.

- September 2022 - Hikvision has introduced the MinMoe Iris Recognition Terminal, which offers higher security in the access control market. Hikvision's MinMoe Iris Recognition Terminal can verify unique iris characters in less than a second and has a recognition distance of up to 70cm. To ensure the accuracy and safety of access authentication, the terminal also includes colour imaging and video anti-counterfeiting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Frequency of Fraudulent Activities

- 5.1.2 Growing Integration of Multi Factor Authentication

- 5.2 Market Restraints

- 5.2.1 Data Pricacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Healthcare

- 6.2.3 BFSI

- 6.2.4 Military and Defense

- 6.2.5 Government

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Iritech Inc.

- 7.1.2 BioEnable Technologies Pvt. Ltd

- 7.1.3 Aware Inc.

- 7.1.4 Iris ID Inc.

- 7.1.5 HID Global

- 7.1.6 EyeLock LLC

- 7.1.7 Princeton Identity Inc.

- 7.1.8 Gemalto NV (Thales Group)

- 7.1.9 NEC Corporation

- 7.1.10 IrisGuard UK Ltd

- 7.1.11 IDEMIA