|

市場調查報告書

商品編碼

1687776

印度環氧樹脂:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

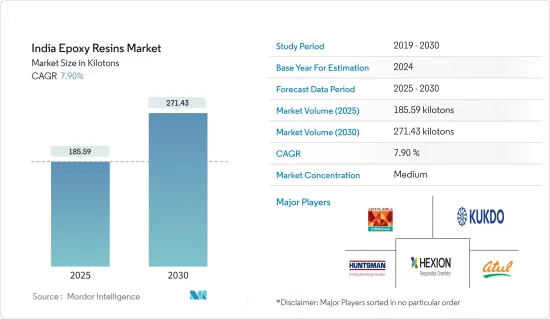

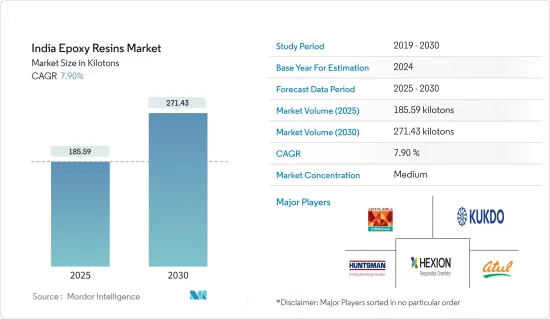

預計 2025 年印度環氧樹脂市場規模為 185.59 千噸,2030 年將達到 271.43 千噸,預測期間(2025-2030 年)的複合年成長率為 7.9%。

由於全國範圍內的封鎖、嚴格的社交距離規定以及供應鏈中斷,市場在 COVID-19 疫情期間受到了嚴重影響。這導致各種需要環氧樹脂的產品(如油漆、被覆劑、黏合劑和密封劑)的生產和製造暫時停止。然而,疫情過後政府對各製造業的支持正在加速市場成長。

主要亮點

- 市場的成長受到建築業的成長以及汽車產業對黏合劑和密封劑的需求不斷成長的推動。

- 另一方面,環氧樹脂的有害影響預計會阻礙市場成長。

- 預計在預測期內,可回收和可改性環氧樹脂的日益普及將為市場帶來機會。

印度環氧樹脂市場趨勢

DGBEA(雙酚F和ECH)需求不斷成長

- 雙酚A-環氧氯丙烷基環氧樹脂仍是最廣泛使用的環氧樹脂。環氧樹脂是由含活性氫基團的化合物與環氧氯丙烷反應,再經脫鹵化氫而製備而成。

- 基於雙酚 A 二縮水甘油醚(DGEBA) 的環氧樹脂最常用於黏合劑、被覆劑、層壓板和封裝的配方中。

- 目前全球約90%的環氧樹脂材料都是由雙酚A二縮水甘油醚(DGEBA)製成的。這種樹脂具有獨特的特性,例如優異的機械性能、耐化學性和形狀穩定性。

- 聚碳酸酯和環氧樹脂是 BPF 的主要衍生產品。這些環氧樹脂的製造方式與 DGEBA 相同。 DGEBF(雙酚F)環氧樹脂比DGEBA環氧樹脂具有更低的黏度和更好的機械和化學性能。

- 雙酚F環氧樹脂用途廣泛,包括塗料、土木工程、黏合劑、電絕緣材料及反應中間體。特別是液態樹脂黏度低,易於加工和成型,適用於多種應用。

油漆和被覆劑領域佔據市場主導地位

- 由於環氧樹脂在建築、汽車、能源和電子行業中的廣泛應用,油漆和塗料領域預計將成為印度環氧樹脂行業中成長最快的領域。

- 環氧樹脂在塗料應用中用作黏合劑,以增加地板和金屬應用塗料的耐久性。

- 印度是製造業和機械行業發展最快的國家之一,導致對油漆和被覆劑的需求增加。政府一直為在該國設立製造部門的公司提供各種便利,並推出各種政策來促進製造業的發展。例如,印度於2021年8月制定了一項計劃,以實現其製成品出口額1兆美元的目標。

- 印度塗料產業的營業額估計約為67.0833億美元。國內主要亞洲塗料公司在該國營運 10 家生產設施,而伯傑塗料公司則擁有 12 家生產設施。

- 根據OICA統計,2021年汽車產量約43,991,112輛,較2020年的33,811,819輛成長30%。

- 截至 2021 年 10 月,包括乘用車(不包括寶馬、賓士、塔塔汽車和沃爾沃汽車)、三輪車、二輪車和四輪車在內的汽車產量達到 2,214,745 輛。

- 據IBEF稱,印度政府預計到2023年汽車業將從國內外投資中獲得80億至100億美元的收入。

- 預計這些因素將推動油漆和塗料中環氧樹脂的需求,從而促進預測期內的市場成長。

印度環氧樹脂產業概況

印度環氧樹脂市場較為分散,市場上有多家公司。印度環氧樹脂市場的主要企業(不分先後順序)包括 Aditya Birla Chemicals、Atul Ltd.、KUKDO CHEMICAL、Hexion 和 Huntsman International LLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建設產業強勁成長

- 汽車產業對黏合劑和密封劑的需求不斷增加

- 限制因素

- 環氧樹脂的危險影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 原料

- DGBEA(雙酚A和ECH)

- DGBEF(雙酚F和ECH)

- 酚醛樹脂(甲醛和苯酚)

- 脂肪族(脂肪醇)

- 縮水甘油胺(芳香胺和ECH)

- 其他成分

- 應用

- 油漆和被覆劑

- 黏合劑和密封劑

- 複合材料

- 電氣和電子

- 其他用途

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介(概況、財務狀況、產品與服務、最新發展)

- 3M

- Aditya Birla Chemicals

- Atul Ltd

- BASF SE

- Daicel Corporation

- DuPont

- KUKDO CHEMICAL CO., LTD.

- Huntsman International LLC

- MACRO POLYMERS Pvt Ltd

- NAN YA PLASTICS CORPORATION

- Olin Corporation

- Westlake Corporation(Hexion)

第7章 市場機會與未來趨勢

- 擴大可回收和可改性環氧樹脂的使用

The India Epoxy Resins Market size is estimated at 185.59 kilotons in 2025, and is expected to reach 271.43 kilotons by 2030, at a CAGR of 7.9% during the forecast period (2025-2030).

During the pandemic period due to COVID-19, the market was deeply impacted because of nationwide lockdown, stringent social distancing mandates, and supply chain disruptions. This led to a temporary halt in the production and manufacturing of different products such as paints and coatings, adhesives and sealants, etc., in which epoxy resins are required. However, the market's growth is picking pace because of the government's support to various manufacturing industries in the post-pandemic period.

Key Highlights

- The growing construction industry and increasing demand for adhesives and sealants from the automotive industry are the factors driving the market growth.

- On the flip side, the hazardous impact of epoxy resins is expected to hinder the growth of the market.

- The growing adoption of recyclable and reformable epoxy resin will act as a market oppurtunity in the forecast period.

Epoxy Resin in India Market Trends

Increasing Demand for DGBEA (Bisphenol F and ECH)

- Epoxy resins based on bisphenol A-epichlorohydrin are still the most widely used epoxies. Epoxy resins are prepared by reacting compounds containing an active hydrogen group with epichlorohydrin, followed by dehydrohalogenation.

- Epoxy resins based on the diglycidylether of bisphenol A (DGEBA) are most commonly used in formulations for adhesives, coatings, laminates, and encapsulants.

- Nowadays, roughly 90% of epoxy resin materials worldwide are made from diglycidyl ether of bisphenol A (DGEBA). This resin offers unique features such as outstanding mechanical properties, chemical resistance, and shape stability.

- Polycarbonates and epoxy resins are the primary products derived from BPF. These epoxy resins are produced using the same method as performed for DGEBA. The DGEBF (Bisphenol F) epoxy resins have lower viscosity and better mechanical and chemical properties than the DGEBA ones.

- Bisphenol F epoxy resins are used in broad applications, including coatings, civil engineering, adhesives, electrical insulating materials, and reactive intermediates. In particular, the liquid resins have low viscosity, so they excel in workability and moldability, which makes them suited to many applications.

Paints and Coatings Segment to Dominate the Market

- The paints and coatings segment is expected to grow the fastest in the Indian epoxy resin industry, owing to its widespread use in the building, automotive, energy, and electronic industries.

- Epoxy resins are used as binders for coating applications to enhance the durability of coating for floor and metal applications.

- India is one of the fastest-growing countries in manufacturing sectors and machinery growth, giving rise to the need for paints and coatings. The government is providing various benefits to the companies setting their manufacturing units in the country and framing various policies to boost the manufacturing sector. For instance, India outlined a plan in August 2021 to reach its goal of USD 1 trillion in manufactured goods exports.

- The Indian paint industry is estimated to have a turnover of around USD 6708.33 million. Asian Paints, the largest domestic player in the market, operates ten production facilities in the country, while Berger paints use 12 production facilities.

- According to the OICA, around 43,99,112 units of vehicles were produced in 2021, which increased by 30% in comparison to 33,81,819 units manufactured in 2020.

- Automotive production for passenger vehicles (except for BMW, Mercedes, Tata Motors & Volvo Auto), three-wheelers, two-wheelers, and quadricycles witnessed 2,214,745 units by October 2021.

- According to the IBEF, the government of India expects the automobile sector to generate USD 8-10 billion by 2023 through local and foreign investment.

- Such factors are expected to drive the demand for epoxy resins in paints and coatings, thus increasing the market's growth during the forecast period.

Epoxy Resin in India Industry Overview

The Indian epoxy resins market is partially fragmented, with the presence of various players in the market. A few major companies in India's epoxy resins market (not in a particular order) include Aditya Birla Chemicals, Atul Ltd., KUKDO CHEMICAL Co. Ltd, Hexion, and Huntsman International LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Growth in the Construction Industry

- 4.1.2 Increasing Demand of Adhesives and Sealants in Automotive Industry

- 4.2 Restraints

- 4.2.1 Hazardous Impact of Epoxy Resins

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenols)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Adhesives and sealants

- 5.2.3 Composites

- 5.2.4 Electrical and Electronics

- 5.2.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Atul Ltd

- 6.4.4 BASF SE

- 6.4.5 Daicel Corporation

- 6.4.6 DuPont

- 6.4.7 KUKDO CHEMICAL CO., LTD.

- 6.4.8 Huntsman International LLC

- 6.4.9 MACRO POLYMERS Pvt Ltd

- 6.4.10 NAN YA PLASTICS CORPORATION

- 6.4.11 Olin Corporation

- 6.4.12 Westlake Corporation (Hexion)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Recyclable And Reformable Epoxy Resins