|

市場調查報告書

商品編碼

1687787

歐洲焊接設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Welding Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

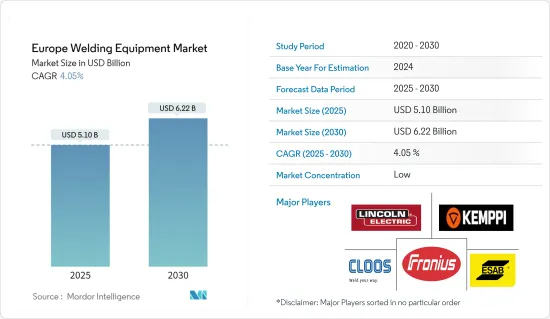

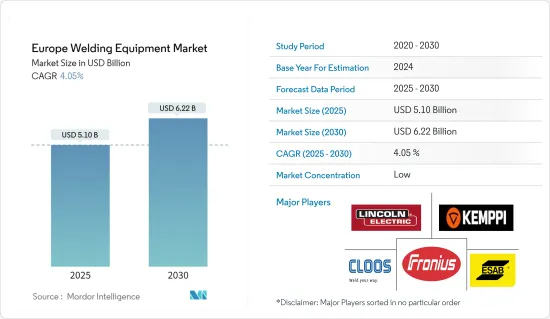

預計 2025 年歐洲焊接設備市場規模將達到 51 億美元,預計到 2030 年將達到 62.2 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 4.05%。

新冠疫情及其導致的停工導致全球所有與建築相關的業務陷入停滯。因此,教育、住宅和機場等各個建築領域的模組化建築計劃減少,嚴重影響了對預製建築的需求。此外,一些地區的供應鏈中斷,導致必要建築材料的交付延遲,影響了建設活動。

主要亮點

- 焊接是製造業中採用的重要工藝之一。後者的成長對前者有重大影響。作為主要製造業生產地區之一的歐洲,製造業正在經歷復甦。製造業是歐洲經濟的支柱。

- 正在進行的第四次工業革命(工業4.0)正在全球影響製造業,從已開發國家開始,逐漸蔓延至新興國家。感測器的廣泛使用、無線通訊和網路的擴展以及日益智慧的機器人和機器的引入有可能徹底改變歐洲的製造業。

- 這場數位工業革命可望提高生產的靈活性、大規模客製化、提高速度、提高品質和提高生產力。這種情況要求歐洲焊接業必須加強競爭力,並嚴格注重技術。

- 據業內人士稱,市場似乎已經成熟,大多數終端用戶焊接應用都採用電弧焊接和電阻焊接等傳統技術。此外,製造業對焊接機器人的需求日益增加。焊接機器人在汽車工業中應用最為廣泛,可以輕鬆地重新編程以適應靈活的生產過程。

歐洲焊接設備市場趨勢

洞察歐洲鋼鐵消費趨勢

歐洲鋼鐵業正在恢復更穩定的基礎,就業和生產水準趨於穩定或上升。據業內人士透露,歐洲大部分鋼材消費是透過焊接過程完成的,這顯示該地區的焊接活動呈現成長趨勢。這也為設備製造商進入不斷成長的市場提供了機會。

此外,鋼鐵消費量的增加預計將為該地區的焊工提供更多的就業機會。在歐洲,人們非常重視引入培訓模組,為焊接行業提供技術純熟勞工。

Weld 4.0 將對焊接專業人員所需的技能、能力和學習方法產生重大影響,引領他們進入數位時代。隨著大多數歐洲公司繼續邁入工業 4.0 的數位化時代,他們需要確保其專業人員的資格與數位焊接技能和能力保持同步,以跟上這些變化。

關注俄羅斯焊接產業

俄烏衝突對供應鏈有重大影響,導致貨物流通放緩、價格大幅上漲、產品短缺,造成兩國嚴重的糧食短缺。然而,俄羅斯石油和天然氣工業的成長正在擴大該國的焊接鋼管市場。這種成長,加上政府未來發展新工廠的計劃,對俄羅斯焊接設備市場來說是一個好兆頭。

石油和天然氣產業是俄羅斯經濟的主要貢獻者,佔國內生產毛額的16%、政府預算收入的52%和出口總額的70%。俄羅斯的石油和天然氣產業由俄羅斯天然氣工業股份公司、韃靼石油公司、盧克石油公司和俄羅斯石油公司等大公司大量投資。近年來,盧佈在全球市場上貶值,導致進入和設備成本下降。由於國內產量較低,俄羅斯從其他歐洲國家、中國和美國進口多種類型的焊接設備。

在俄羅斯,焊接設備進口佔有率正在大幅增加。俄羅斯生產焊接設備所需的機械和原料幾乎全部需要進口。因此,企業必須在實施國家主導的提高焊接設備生產能力的計畫的同時,加大對市場研發的投資。

2021年,進口全自動或半自動金屬電弧焊接(含等離子弧焊電弧焊接),價值125,024美元。進口了金屬電弧焊接(包括等離子電弧焊接,非全自動或半自動),價值 94,600 美元。

歐洲焊接設備產業概況

歐洲焊接設備市場似乎部分集中,因為歐洲是一些世界頂級焊接設備製造商的所在地,例如 Kemppi Oyy 和 Elektriska Svetsnings-Aktiebolaget (ESAB)。此外,專注於先進技術的本土公司也正在進入市場,增強市場競爭。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章 市場洞察

- 當前市場狀況

- 科技趨勢 – 機器人與自動化

- 鋼鐵業洞察

- 電子商務的角色 - 分析師觀點

- 全球工業雷射市場概況與雷射焊接機會

- 專注於破壞性焊接技術

第4章 市場動態

- 驅動程式

- 限制因素

- 機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/購買者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場區隔

- 按類型

- 焊接設備

- 焊接材料

- 按工藝

- 電弧焊接

- 氣焊

- 焊接和硬焊

- 其他製程(電阻焊接、鍛焊等)

- 按最終用戶

- 建築與基礎設施

- 石油和天然氣

- 能源和電力

- 汽車和造船

- 航太和國防

- 重工業

- 鐵路

- 其他最終用戶

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 芬蘭

- 荷蘭

- 比利時

- 其他歐洲國家

第6章 競爭格局

- 公司簡介

- Lincoln Electric Holdings Inc.

- Kemppi Oy

- Elektriska Svetsnings-Aktiebolaget(ESAB)

- Fronius International GmbH

- Carl Cloos Schweisstechnik GmbH

- AMADA WELD TECH

- EWM AG

- Hobart Welders

- Denyo Co. Ltd

- WW Grainger Inc

- Obara Corporation

- Polysoude SAS

- CEBORA SpA

- TRUMPF Group

- voestalpine AG*

第7章:市場的未來

第 8 章 附錄

- 洞察資本流動

- 主要國家經濟統計(製造業經濟貢獻)

- 焊接市場對外貿易統計資料(進口/出口,主要國家**按產品分類)

第9章 免責聲明

The Europe Welding Equipment Market size is estimated at USD 5.10 billion in 2025, and is expected to reach USD 6.22 billion by 2030, at a CAGR of 4.05% during the forecast period (2025-2030).

All construction-related operations worldwide had been halted due to the COVID-19 pandemic and consequent lockdowns. As a result, modular construction projects in various construction segments, such as educational, residential, airports, and others, had decreased, thus significantly impacting demand for prefabricated buildings. In several places, the supply chain had also been interrupted, thus causing a delay in the delivery of construction material required and affecting the construction activities.

Key Highlights

- Welding is one of the critical processes employed in the manufacturing sector. The growth of the latter one has a profound impact on the former one. Manufacturing is enjoying a resurgence in Europe, one of the regions with major manufacturing output. Manufacturing is the backbone of the European economy.

- The ongoing 4th Industrial Revolution (Industry 4.0) is impacting manufacturing at a global level, starting with developed countries, and progressively spreading to emerging countries. The ubiquitous use of sensors, along with the expansion of wireless communication and networks, and with the deployment of increasingly intelligent robots and machines, has the potential to transform the way manufacturing is done in Europe.

- Such a digital industrial revolution holds the promise of increased flexibility in production, mass customization, increased speed, better quality, and improved productivity. This scenario has created a need to strengthen the competitiveness of the European welding industry with an in-depth focus on technology.

- As per the industry sources, the market seems mature, and conventional techniques, such as arc welding and resistance welding, are the mostly employed for welding applications by a majority of the end users. Additionally, there is a growing demand for welding robots in the manufacturing industry. With their most extensive use found in the automotive industry, welding robots can easily be reprogrammed to accommodate flexible production processes.

Europe Welding Equipment Market Trends

Insights on Steel Consumption Trends in Europe

The European steel industry is getting back onto a more stable footing, with employment and production levels stable or rising. According to industry sources,the majority of the steel consumption in Europe happens through the welding process, which represents an increasing trend for welding activity in the region. Additionally, this is a good opportunity for equipment manufacturers to tap into the growing market.

Furthermore, higher steel consumption is anticipated to provide more job opportunities for welders in the region. Europe is focusing heavily on implementing training modules to provide skilled workers for the welding industry.

Weld 4.0 will have a profound impact on the skills and competencies required of welding professionals, as well as learning methodologies, bringing them into the Digital Age. As most companies in Europe continue powering ahead to get into the Digital Age of Industry 4.0, they need to ensure that their professionals' qualifications are updated with digital welding skills and competencies to keep up with these changes.

Spotlight on the Russian Welding Industry

The conflict between Russia and Ukraine is significantly affecting the supply chain, slowing down the movement of commodities, leading to sharp price hikes and product shortages, and causing severe food shortages across the two countries. However, growth in the Russian oil and gas industry has allowed the welded pipes market to expand in the country. This growth, coupled with the government's plans to develop new plants in the future, has created a positive wave in the welding equipment market in Russia.

In Russia, the oil and gas industry is the major contributor to the economy, and it accounts for 16% of the GDP, 52% of government budget revenues, and 70% of total exports. The Russian oil and gas industry witnessed heavy investments from major companies, like Gazprom, Tatneft, Lukoil, and Rosneft. In recent years, the value of RUB declined in the global market, resulting in low costs for entry and equipment. Russia imports several types of welding equipment from other European countries, China, and the United States, as its domestic production is low.

In Russia, the import share of welding equipment is increasing significantly. In Russia, almost all the machinery and raw materials required for the production of welding equipment have to be imported. Thus, it is essential for companies to invest in R&D of the market studied, along with implementation of state-initiated programs for the enhancing the production capacities of welding equipment.

In 2021, Fully or partly automatic machines for arc welding of metals, including plasma arc welding worth USD 125,024 were imported. Machines for arc welding of metals, including plasma arc welding, neither fully nor partly automatic worth USD 94,600 were imported.

Europe Welding Equipment Industry Overview

Since Europe is home to some of the top global welding equipment manufacturers like Kemppi Oyy, Elektriska Svetsnings-Aktiebolaget (ESAB), etc., the European welding equipment market seems to be partially concentrated. Additionally, some regional players are also entering into the market with prime focus on advanced technologies, which creates a healthy competition in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 MARKET INSIGHTS

- 3.1 Current Market Scenario

- 3.2 Technological Trends - Robotics and Automation

- 3.3 Insights on the Steel Industry

- 3.4 Role of E-Commerce - Analyst View

- 3.5 Brief on the Global Industrial Laser Market and Opportunity for Laser Welding

- 3.6 Spotlight on Disruptive Welding Techniques

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.2 Restraints

- 4.3 Opportunities

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers/Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Welding Equipment

- 5.1.2 Welding Consumables

- 5.2 By Process

- 5.2.1 Arc Welding

- 5.2.2 Gas Welding

- 5.2.3 Soldering and Brazing

- 5.2.4 Other Processes (Resistance Welding, Forge Welding, etc.)

- 5.3 By End-user

- 5.3.1 Construction and Infrastructure

- 5.3.2 Oil and Gas

- 5.3.3 Energy and Power

- 5.3.4 Automotive and Shipbuilding

- 5.3.5 Aerospace and Defense

- 5.3.6 Heavy Engineering

- 5.3.7 Railways

- 5.3.8 Other End Users

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Russia

- 5.4.6 Finland

- 5.4.7 Netherlands

- 5.4.8 Belgium

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Overview

- 6.2 Company Profiles

- 6.2.1 Lincoln Electric Holdings Inc.

- 6.2.2 Kemppi Oy

- 6.2.3 Elektriska Svetsnings-Aktiebolaget (ESAB)

- 6.2.4 Fronius International GmbH

- 6.2.5 Carl Cloos Schweisstechnik GmbH

- 6.2.6 AMADA WELD TECH

- 6.2.7 EWM AG

- 6.2.8 Hobart Welders

- 6.2.9 Denyo Co. Ltd

- 6.2.10 W. W. Grainger Inc

- 6.2.11 Obara Corporation

- 6.2.12 Polysoude SAS

- 6.2.13 CEBORA S.p.A

- 6.2.14 TRUMPF Group

- 6.2.15 voestalpine AG*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Insights on Capital Flows

- 8.2 Economic Statistics of Key Countries - (Manufacturing Sector Contribution to Economy)

- 8.3 External Trade Statistics of the Welding Market (Export and Import, by Product-key Countries**)