|

市場調查報告書

商品編碼

1687831

量子級聯雷射(QCL):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Quantum Cascade Lasers (QCL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

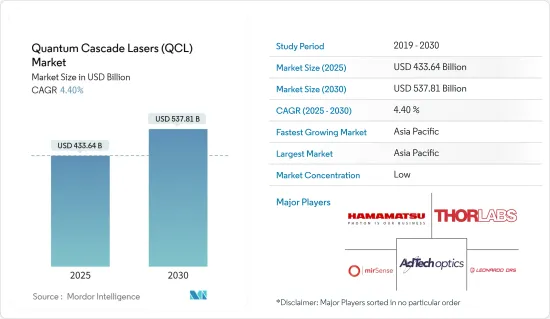

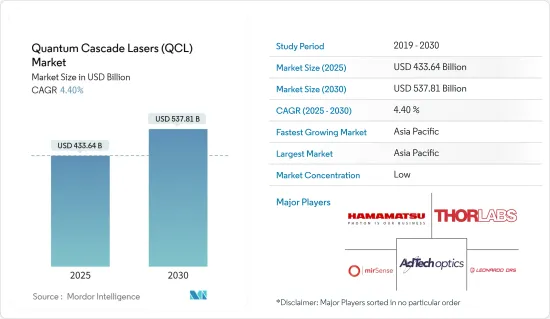

量子級聯雷射(QCL) 市場規模預計在 2025 年為 4,336.4 億美元,預計到 2030 年將達到 5,378.1 億美元,預測期內(2025-2030 年)的複合年成長率為 4.4%。

QCL 的主要優點之一是它們可以覆蓋很寬的波長範圍,從中紅外線到兆赫區域。這種多功能性可以精確控制雷射發射,使其適用於各種應用,例如氣體感測,分子光譜,甚至爆炸物和藥物檢測。調整 QCL 波長頻寬的能力為科學研究和實際應用開啟了新的可能性。

主要亮點

- 量子級聯雷射具有高功率,並能輸出強烈的聚焦光束。此特性使 QCL 適用於遠距遙感探測應用,例如 LIDAR(光檢測和測距)。此外,QCL 的高功率使得各種光譜技術能夠實現高效、準確的測量,確保科學研究和工業應用中的可靠結果。

- 量子級聯雷射(QCL)因其獨特的特性在精準醫療中有著廣泛的應用。 QCL 是一種緊湊型半導體雷射器,工作在電磁波頻譜的中紅外線和兆赫區域。它提供高解析度光譜、精確控制發射波長和高功率。由於全球醫院數量的增加以及醫療環境中新技術的採用,量子連鎖雷射 (QCL) 市場預計將在未來幾年大幅擴張。

- 量子級聯雷射(QCL)在軍事和國防應用的氣體感測和化學檢測方面具有廣泛的應用。 QCL 的獨特性質(例如其中紅外線發射範圍和高靈敏度)使其適合識別和量化各種氣體和化學物質。

- 根據斯德哥爾摩國際和平研究所報告,2022年北美地區軍費開支將達9,000多億美元,同年東亞地區軍費開支近4,000億美元,中歐和西歐地區軍費開支位居第三。預計這將推動市場成長。

- 量子級聯雷射(QCL) 的高初始相關成本取決於多種因素,包括特定的 QCL 設計、製造流程、波長範圍、輸出功率和所需的性能特性。同時,這種可變性使得很難提供 QCL 前期成本的精確數字。

- 由於其高頻能力,QCL 可用於開發先進的無線通訊系統,例如毫米波和兆赫通訊。這些系統將實現超高速、大容量的無線資料傳輸,並有可能為通訊網路開闢新的可能性。隨著5G普及率提升,5G智慧型手機滲透率也不斷提升,預計將推動受訪市場的擴大。

量子級聯雷射(QCL) 市場趨勢

工業終端用戶產業佔據較大的市場佔有率

- QCL 因其高功率和亮度、寬波長範圍、長期穩定性、快速脈衝產生、緊湊性、固體以及增強的氣體感測靈敏度和選擇性而廣泛應用於工業應用。 QCL 非常適合工業環境監測。 QCL 優異的靈敏度、準確性和選擇性使其可用於檢測和分析微量氣體和污染物。基於 QCL 的感測器和系統在提高效率、合規性和環境永續性方面具有潛力,包括氣體檢測、工業製程控制、排放氣體監測和空氣品質監測。

- QCL 監測工業區的空氣品質。基於 QCL 的感測器可以檢測和計數各種空氣污染物,包括粒狀物、臭氧、二氧化氮、一氧化碳和揮發性有機化合物。這些感測器提供恆定的即時資料,可用於研究空氣品質、識別污染源和實施有針對性的緩解措施。

- 隨著工業 4.0 的到來,工業物聯網 (IIoT) 概念越來越受到工業和製程自動化領域的關注。此外,工業環境監測需求的大幅成長正在推動全球提取量子連鎖雷射市場的發展。工業4.0在各領域的進步帶動了製程自動化技術的採用大幅成長,尤其是在中國、印度、澳洲和韓國等新興國家。

- 全球多個地區製造業的蓬勃發展正在推動市場的成長。例如,由於技術進步、基礎設施發展、技術純熟勞工以及政府政策和舉措,中國製造業經歷了顯著成長。根據中國國家統計局的數據,2023年中國工業生產比2022年成長約4.6%。

- 預計各行業自動化程度的提高將推動量子連鎖雷射在工廠環境中的應用。例如,IFR預測,到2024年,全球工廠中運作的工業機器人數量將增加到518,000台。安裝數量最多的地區是澳洲/亞洲,光是 2020 年就安裝了約 266,000 台。 2024年,預計亞洲/澳洲工業機器人安裝基數將達37萬台。此外,根據IFR的預測,未來幾年工業機器人出貨量預計將大幅成長,超過2022年全球整體出貨量約45.3萬台的高峰。

亞太地區可望實現顯著成長

- 中國的醫療保健和醫療行業正在經歷顯著成長,並且越來越注重先進的診斷和治療。 QCL 用於醫療應用,例如呼吸分析、非侵入性血糖監測以及用於疾病檢測和監測的分子光譜。隨著醫療保健領域的擴大,這些領域對 QCL 的需求預計會增加。

- 在中國,由於飲食和生活方式的改變、快速的都市化和工業化,心臟病、中風、冠狀動脈疾病和心臟衰竭等心血管疾病的負擔正在增加。

- 2023年5月,研究人員利用中國2025家醫院的資料發現,空氣污染會增加心律不整的風險。該研究納入了 190,115 名急性出現症狀性心律不整的患者,包括心房顫動、心房撲動、心跳過快和室上性心動過速(導致心率過快的心臟病)。一項在中國 322 個城市進行的大規模研究表明,接觸空氣污染與心律不整風險增加有關。

- 隨著日本迅速邁向“社會 5.0”,我們介紹了這個全新超智慧社會中人類發展的四個主要階段的第5章。透過物聯網技術,萬物互聯,各項技術融為一體,大大改善了生活品質。

- 此外,該策略的重點針對領域是製造業(7,780 萬美元)、基礎設施(6.432 億美元)、醫療保健(5,500 萬美元)和農業(6,620 萬美元)。製造業的這種擴張將進一步促進研究市場的成長。

- 對 QCL 的需求可能會透過對該領域的投資推動日本 ICT 產業的發展。例如,全球領先的通訊投資控股公司之一Softbank Corporation近日宣布,計劃於2023年在北海道建設一個大型資料中心,新資料中心預計容量為4000萬至6000萬平方英尺(2.66億至4億美元),將成為日本資料的資料中心之一。

- 韓國政府宣布將加強與半導體產業研發和資本投資相關的稅收獎勵措施。此舉旨在鼓勵該行業的企業到2026年投資至少340兆韓元。

- 此外,政府計劃在2022年前建立半導體工程師培訓中心,並在未來10年內培訓超過15萬名專家。這些舉措旨在幫助韓國企業在2030年將其在全球非記憶體晶片市場的佔有率從3%提高到10%。這些舉措預計將推動產業成長,並在自動化和控制系統中對QCL產生巨大需求。

量子級聯雷射(QCL) 市場概覽

量子級聯雷射市場特點是格局多樣化,包括全球性公司以及中小型企業。該市場的主要參與企業包括 Hamamatsu Photonics K.K.、Thorlabs Inc.、Adtech Optics Inc.、Mirsense SAS 和 Leonardo Drs Inc. 這些公司正在採取建立夥伴關係和進行收購等策略來加強其產品線並確保持續的競爭優勢。

- 2024 年 1 月-Thorlabs 和 IRsweep 簽訂許可和技術轉移協議 (TTA),將公司的中紅外線光譜感測平台擴展到新的應用領域。 Thorlabs 將利用 Irsweep 的取得專利的QCL DFM-Comb 光譜儀創建一個高性能感測平台,將傳統寬頻頻譜的功能與可調諧雷射頻譜的靈活性結合在單一儀器中。這項新工具使Thorlabs能夠為各種應用提供強大的解決方案,包括氣體檢測、環境監測和化學分析。

- 2023 年 10 月 Block Engineering 推出其下一代緊湊型量子級聯雷射。新型 QCL 聲稱可將雷射功率提高六倍,將熱穩定性和時間穩定性提高幾個數量級,並具有獨特的脈衝設計能力,可實現最少的電子設備。該公司的 sQCL 是一種緊湊型雷射模組,可在 5.4-12.8 微米範圍內調節 2-3 微米的波長範圍。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 醫療實務對精準度的要求越來越高

- 軍事和國防部門對氣體和化學檢測應用的需求不斷增加

- 市場挑戰

- 前期投資成本高

第6章 市場細分

- 按類型

- 法布里-珀羅雷射器

- 分佈回饋雷射器

- 可調諧外共振器雷射

- 按行動

- 普通波

- 脈搏波

- 按最終用戶產業

- 產業

- 醫療

- 軍事和國防

- 通訊

- 飲食

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 韓國

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 供應商定位分析

- 公司簡介

- Hamamatsu Photonics KK

- Thorlabs Inc.

- Adtech Optics Inc.

- Mirsense SAS

- Leonardo Drs Inc.

- Nanoplus Nanosystems and Technologies GmbH

- Inphenix Inc.

- Alpes Lasers SA

- Sacher Lasertechnik Gmbh

- Block Engineering Inc.

第8章投資分析

第9章:市場的未來

The Quantum Cascade Lasers Market size is estimated at USD 433.64 billion in 2025, and is expected to reach USD 537.81 billion by 2030, at a CAGR of 4.4% during the forecast period (2025-2030).

One of the significant advantages of QCLs is their ability to cover a wide range of wavelengths, from the mid-infrared to the terahertz region. This versatility allows precise control over the laser emission, making them suitable for various applications like gas sensing, molecular spectroscopy, and even detecting explosives and drugs. The ability to tune the wavelength range of QCLs opens new possibilities for scientific research and practical applications.

Key Highlights

- Quantum cascade lasers exhibit high output power, enabling them to deliver intense and focused beams. This characteristic makes QCLs well-suited for long-range remote sensing applications, such as LIDAR (Light Detection and Ranging), where the laser beam needs to travel significant distances. In addition, the high output power of QCLs allows for efficient and accurate measurements in various spectroscopic techniques, ensuring reliable results in scientific research and industrial applications.

- Quantum Cascade Lasers (QCLs) have various applications in precision medical activities due to their unique properties. QCLs are compact, semiconductor-based lasers operating in the mid-infrared and terahertz regions of the electromagnetic spectrum. They offer high-resolution spectroscopy, precise control of emission wavelengths, and high-power output. The Quantum Cascade Lasers (QCLs) laser market is expected to expand significantly over the coming years due to the rise in hospitals and the adoption of new technologies in medical settings worldwide.

- Quantum Cascade Lasers (QCLs) have extensive applications in gas sensing and chemical detection in the military and defense sectors. The unique properties of QCLs, such as their mid-infrared emission range and high sensitivity, make them well-suited for identifying and quantifying various gases and chemicals.

- According to a report by SIPRI, military expenditures in North America reached more than USD 900 billion in 2022. East Asia spent almost USD 400 billion that year, with Central and Western Europe spending the third highest. This is expected to propel market growth.

- The high up-front associated costs of Quantum Cascade Lasers (QCLs) can vary depending on various factors, including the specific QCL design, manufacturing processes, wavelength range, power output, and desired performance characteristics. At the same time, it is challenging to provide an exact figure for the up-front costs of QCLs due to the variability.

- With their high-frequency capabilities, QCLs can be employed in the development of advanced wireless communication systems, such as millimeter-wave and terahertz communication. These systems have the potential to provide ultra-fast, high-capacity wireless data transfer, opening up new possibilities for telecommunications networks. With the rising penetration of 5G, the penetration of 5G smartphones is also growing, which is estimated to rev the expansion of the studied market.

Quantum Cascade Lasers (QCL) Market Trends

Industrial End-User Industry to Hold Significant Market Share

- QCLs are broadly used in industrial applications due to their high power and brightness, broad wavelength coverage, long-term stability, rapid pulse generation, compactness, solid-state nature, and increased sensitivity and selectivity for gas sensing. QCLs are suitable for industrial environmental monitoring. They help detect and analyze trace gases and pollutants due to their great sensitivity, preciseness, and selectivity. Possibilities exist in areas where QCL-based sensors and systems can improve efficiency, compliance, and environmental sustainability, such as gas sensing, industrial process control, emissions monitoring, and air quality monitoring.

- QCLs monitor air quality in industrial zones. QCL-based sensors can detect and calculate a variety of air pollutants, including particulate case, ozone, nitrogen dioxide, carbon monoxide, and volatile organic compounds. These sensors give constant, real-time data that can be used to examine air quality, identify pollution sources, and perform targeted mitigation actions.

- The emergence of Industry 4.0 has garnered widespread interest among industrialists and process automation industries in the industrial Internet of Things (IIoT) concept. Additionally, a notable rise in demand for industrial environmental monitoring has led to a global boost in the extractive quantum cascade lasers market. The ongoing trend of Industry 4.0 in different sectors has resulted in a considerable surge in the adoption of process automation technologies, especially in emerging economies like China, India, Australia, and South Korea.

- The growing manufacturing sector in several regions globally is likely to aid the market's growth. For instance, China experienced significant growth in its manufacturing sector due to technological advancements, infrastructure development, skilled labor, government policies, and initiatives. According to the National Bureau of Statistics of China, China's industrial production increased by about 4.6% in 2023 compared to 2022.

- The increase in automation in various industries is anticipated to augment the adoption of quantum cascade lasers in factory settings. For instance, according to the IFR forecasts, the global adoption is expected to increase to around 518,000 industrial robots operational across factories all around the globe by 2024. Australia/Asia was the region with the most installed units; an estimated 266,000 units were fitted in 2020 alone. It is estimated that by 2024, industrial robot installations in Asia/Australia will reach 370,000 units. Also, according to IFR, industrial robot shipments are projected to rise significantly in the coming years, surpassing the peak in 2022 when around 453,000 industrial robots were shipped globally.

Asia Pacific Expected to Witness Significant Growth

- China's healthcare and medical sectors are experiencing significant growth, with an increasing focus on advanced diagnostics and treatment. QCLs are used in medical applications such as breath analysis, non-invasive glucose monitoring, and molecular spectroscopy for disease detection and monitoring. The demand for QCLs in these areas is expected to rise as the healthcare sector expands.

- China has been facing an increasing burden of cardiovascular diseases, including heart attack, stroke, coronary artery disease, heart failure, and other conditions, due to dietary & lifestyle changes, rapid urbanization, and industrialization.

- In May 2023, using data from 2,025 hospitals in China, researchers found that air pollution raises the risk of irregular heartbeat. The study included 190,115 patients with acute onset of symptomatic arrhythmia, including atrial fibrillation, atrial flutter, premature beat, and supraventricular tachycardia (a heart condition that causes abnormally fast heart rate). Exposure to air pollution was determined to be linked to an increased risk of irregular heartbeat in an extensive study of 322 Chinese cities.

- Japan is rapidly moving toward "Society 5.0", thus introducing the fifth chapter to the four major stages of human development in this new ultra-smart society. All things are connected through IoT technology, and all technologies are getting integrated, dramatically improving the quality of life.

- Moreover, key sectors coming under this strategy are manufacturing (USD 77.8 million), infrastructure (USD 643.2 million), nursing and medical (USD 55 million), and agriculture (USD 66.2 million). Such expansion in the manufacturing industry further propels the studied market growth.

- The demand for QCLs is likely to propel the Japanese ICT sector owing to the country's investment in the ICT sector. For instance, SoftBank, one of the world's leading telecommunications investment holding companies, recently announced plans to build a large data center in the Japanese city of Hokkaido in 2023. The new data center, which is expected to have a capacity of 40 to 60 million square feet (USD 266 to 400 million), is expected to be one of the largest data centers in Japan.

- The government of South Korea has declared its intention to augment tax incentives associated with research and development and facility investment in the semiconductor industry. This move aims to encourage companies in the sector to invest a minimum of KRW 340 trillion by 2026.

- Furthermore, the government plans to establish a semiconductor engineer training center by 2022 to provide over 150,000 experts for the next decade. These measures are intended to assist South Korean companies in elevating their share in the global non-memory chip market from 3% to 10% by 2030. Such initiatives will drive the industry's growth and create significant demand for QCLs in automation and control systems.

Quantum Cascade Lasers (QCL) Market Overview

The quantum cascade laser market is characterized by its varied landscape, which includes global corporations and small and medium-sized businesses. Key participants in this market encompass Hamamatsu Photonics KK, Thorlabs Inc., Adtech Optics Inc., Mirsense SAS, and Leonardo Drs Inc. These companies are engaging in strategies like forming partnerships and pursuing acquisitions to bolster their product line and secure a lasting competitive edge.

- January 2024 - Thorlabs and IRsweep entered a Licensing and Technology Transfer Agreement (TTA) to extend the Mid-IR spectral sensing platform developed into new applications. Thorlabs will take advantage of Irsweep's patented QCL-based DFM-Comb spectroscopy instruments to create a high-performance sensing platform that combines the power of conventional broadband spectrum with the flexibility of tunable laser spectrum into a single device. This new tool will allow Thorlabs to provide a powerful solution for various applications, such as gas detection, environmental monitoring, and chemical analysis.

- October 2023 - Block Engineering released its next generation of compact quantum cascade lasers. The new QCLs claim to offer a six-fold increase in laser power, orders of magnitude better thermal and temporal stability, and minimal electronics with unique pulse design capabilities. The company's sQCL is a compact laser module that can be tuned across a 2-3 micron wavelength range within a more significant 5.4 to 12.8 micron span.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need For Precision in the Medical Activities

- 5.1.2 Increased Demand of Gas Sensing and Chemical Detection Applications in the Military and Defense

- 5.2 Market Challenges

- 5.2.1 High Up-front Associated Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fabry-Perot Lasers

- 6.1.2 Distributed Feedback Lasers

- 6.1.3 Tunable External Cavity Lasers

- 6.2 By Operation

- 6.2.1 Continuous Wave

- 6.2.2 Pulsed Wave

- 6.3 By End-user Industry

- 6.3.1 Industrial

- 6.3.2 Medical

- 6.3.3 Military and Defense

- 6.3.4 Telecommunication

- 6.3.5 Food and Beverage

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Hamamatsu Photonics KK

- 7.2.2 Thorlabs Inc.

- 7.2.3 Adtech Optics Inc.

- 7.2.4 Mirsense SAS

- 7.2.5 Leonardo Drs Inc.

- 7.2.6 Nanoplus Nanosystems and Technologies GmbH

- 7.2.7 Inphenix Inc.

- 7.2.8 Alpes Lasers SA

- 7.2.9 Sacher Lasertechnik Gmbh

- 7.2.10 Block Engineering Inc.