|

市場調查報告書

商品編碼

1687876

法律產業的人工智慧軟體-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)AI Software In Legal Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

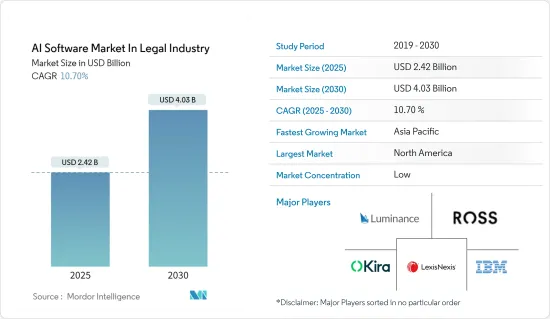

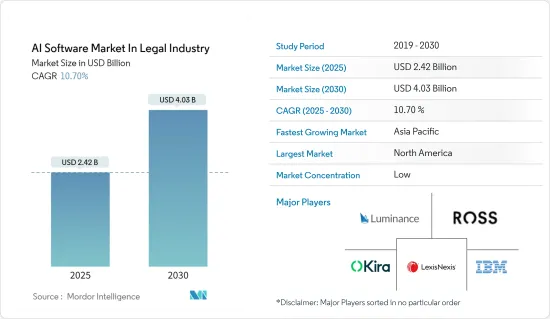

法律產業AI軟體市場預計將從2025年的24.2億美元成長到2030年的40.3億美元,預測期間(2025-2030年)的複合年成長率為10.7%。

人工智慧 (AI) 繼續處於利用新技術突破提高法律產業生產力和效率的前沿。此外,NLP、神經網路、晶片和處理能力的進步正在增強其在法律領域的應用價值。

關鍵亮點

- 法律產業已經開始頻繁採用人工智慧技術來有效地處理法律業務。例如,內部法律部門通常要花費 50% 的時間來審查契約,即使是像保密協議這樣簡單的契約,也會減慢業務並造成不必要的瓶頸。透過讓律師專注於每份合約的相關部分,人工智慧可以節省無數的時間。

- 由於電子取證、合約審查和管理、案例預測和合規等領域對自動化的需求不斷成長,市場正在不斷擴大。對於企業創造有形價值而言,自動化合約管理可以提高其團隊達成交易的能力,加強與客戶的聯繫,並對組織的許多其他部門產生積極影響。

- 不遵守 HIPAA、PCI DSS、GDPR 和其他金融法規等不斷擴展的標準將使您付出更大的代價。據 Globalscape 稱,金融業公司遵守資料保護 IT 規則的成本約為 547 萬美元,而當公司考慮到罰款、生產力和利潤損失時,違規的成本接近 1,500 萬美元。

- 預計在整個預測期內,人工智慧與法律的交叉領域將顯著成長。人工智慧 (AI) 還可用於各種任務,例如實質審查(審查合約、法律研究和進行實質審查的電子電子證據揭示能力)、預測技術(預測法庭上可能出現的結果)、法律分析(提供律師可以在當前訴訟中使用的過去案件和先例法的資料點)、文件自動化、智慧財產權以及各種其他任務。

- 由於法律研究的複雜性,這可能是一項耗時且繁瑣的任務。許多律師事務所需要縮短完成高效、準確的法律研究業務的周轉時間,這進一步凸顯了對人工智慧的需求。人工智慧軟體可以顯著提高生產力和準確性,幫助法官更快做出決策。例如,ROSS Intelligence 使用自動化技術快速審查合約。該程式突出顯示適當的文件。使用合適的軟體可以大大增強和簡化法律研究。

- 除了多個國家法律框架外,歐盟還將通過新的《人工智慧法案》對高風險人工智慧系統進行明確而全面的監管,該法案預計將於2022年最終確定。雖然已經提出了許多與人工智慧相關的立法提案,但美國尚未接受歐盟委員會提案的全面的人工智慧監管方法。

- 同時,新冠疫情的爆發也導致企業法律部門和律師事務所為其法律圖書館購買人工智慧/機器學習解決方案的數量增加。電子搜尋軟體和其他人工智慧平台在對抗 COVID-19 的鬥爭中發揮了重要作用。此類軟體有可能加快醫學研究人員對如何治療 COVID-19 的研究,並旨在幫助訴訟律師更快地了解案件的核心。

法律人工智慧軟體市場趨勢

雲端運算有望佔據主導地位

- 事實證明,雲端基礎的業務管理軟體比內部部署系統具有許多優勢,包括一致的可用性、效率和簡單的可擴展性,所有這些都有助於律師提高其法律業務的生產力和盈利。

- 此外,AI 解決方案必須透過與律師事務所的 Microsoft Active Directory 建立的安全性使用者登入和權限同步來保護敏感資料。為了保持機密性,這些人工智慧系統通常安裝在律師事務所防火牆後面或私有雲端上。

- 在快速適應和靈活性方面,雲端解決方案比內部部署替代方案更具優勢。對於需要可擴展的實踐管理系統的小型律師事務所來說,雲端解決方案已成為理想的選擇。律師事務所可以將最相關的模組和功能整合到其現有的解決方案中。

- 此外,雲端解決方案允許同事、客戶和第三方使用集中式資訊系統進行安全通訊和文件共用。它減輕了單純依賴電子郵件所固有的危險。

- Casepoint 的技術涵蓋了法律發現的各個領域,並提供快速的企業級解決方案。透過評估單一平台,客戶可以管理和監控從法律保留到生產的整個發現過程,避免登入和登出不同的程序或手動移動資訊。

預計北美將佔據主要佔有率

- 人工智慧的使用正在增加。此外,該地區還有很多為法律行業提供人工智慧平台和工具的公司。範例包括 OpenText Corporation、IBM Corporation、Ross Intelligence Inc.、Veritone Inc. 和 Neota Logic Inc.

- 近年來,北美出現了一些最重要的法律科技新興企業投資。 Onit 是一家總部位於美國的法律和合約管理企業工作流程解決方案提供商,已獲得 2 億美元的策略投資。加拿大雲端法律管理新興企業Clio 已完成 2.5 億美元 D 輪資金籌措。這是加拿大對法律和科技公司最重要的投資之一。

- 全球法律產業最近發生了重大變化,北美律師事務所也緊隨其後。實質審查、合約分析、房地產分析、智慧財產權和爭議解決都受益於人工智慧能力。技術工具提高了企業的效率和競爭力。

- 企業培養箱和創新實驗室的存在將有助於該地區基於人工智慧的法律軟體的開發。為了促進法律科技的出現,現有的律師事務所、ALSP(如湯森路透)、四大會計師事務所和金融公司(如巴克萊銀行)已經合作或建立了培養箱。這些培養箱為創新公司提供指導、知識,在某些情況下,還提供在市場上取得成功所需的融資管道,同時也支援合法科技新興企業並提供擴大其發展的空間。

法律AI軟體產業概覽

法律人工智慧軟體市場尚未完全滲透,為現有企業和希望進入該領域的外部人士創造了巨大的潛力。然而,現有市場參與企業相對於新參與企業俱有壓倒性優勢。隨著未來前景強勁、投資增加和支持活動增加,預計當前市場參與企業之間的競爭將會升溫。

- 2023 年 5 月 - LexisNexis Group Inc. 宣布推出 Nexis Hub,這是一個支援和簡化任何研究工作流程的新工具。這項創新的解決方案專為滿足忙碌的專業人士的需求而開發,它與 Google Chrome 和 Microsoft Word 整合,幫助用戶簡化複雜且耗時的研究收集和報告撰寫流程。

- 2023 年 5 月 - Luminance Technologies Ltd 宣布該公司專家大規模語言模型 (LLM) 的最新尖端應用:由人工智慧驅動的「Ask Lumi」聊天機器人。 Ask Lumi 是第一個由這種法律級人工智慧驅動的聊天機器人。使用者可以在 Microsoft Word 中開啟一份契約,向 AI 詢問有關該合約的任何問題,並立即獲得答案。相較之下,Luminance 的法律預訓練變壓器 (LPT) 技術僅從經過法律檢驗的文件中學習。他們可以產生內容,並分析和理解內容,即使內容是由第三方創建或編輯的。生成型人工智慧和分析型人工智慧的強大組合確保了最高程度的法律嚴謹性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 法律行業對自動化的需求不斷增加,訴訟案件數量不斷增加

- 律師事務所擴大使用人工智慧來完成法律事務

- 市場限制

- 資料或合法資料的隱私問題

第6章市場區隔

- 按組件

- 解決方案

- 按服務

- 按部署

- 本地

- 雲

- 按應用

- 法律研究

- 審查和管理合約

- 電子帳單

- 電子取證

- 遵守

- 案例預測

- 其他

- 按最終用戶

- 律師事務所

- 公司法部門

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Luminance Technologies Ltd

- Ross Intelligence Inc.

- Kira Inc.

- IBM Corporation

- Lexisnexis Group Inc.(RELX Group Plc)

- Cs Disco Inc.

- Thomson Reuters Corporation

- Veritone Inc.

- Casetext Inc.

- Neota Logic Inc.

- Brainspace Corporation

- Smokeball Inc.

- Text IQ Inc.

- Opentext Corporation

第8章投資分析

第9章:市場的未來

The AI Software Market In Legal Industry is expected to grow from USD 2.42 billion in 2025 to USD 4.03 billion by 2030, at a CAGR of 10.7% during the forecast period (2025-2030).

Artificial intelligence (AI) has always been at the forefront of utilizing new technical breakthroughs for productivity and efficiency improvements in the legal industry. Also, due to the advancements and the increase in processing power in NLP, neural networks, and chips, the legal sector is observing improved value in its application.

Key Highlights

- The legal industry has started implementing AI technologies more frequently to handle legal operations effectively. For instance, an internal legal department often spends 50% of its time examining contracts, even those as simple as non-disclosure agreements, slows down operations and causes unnecessary bottlenecks. By enabling lawyers to concentrate their review on the pertinent sections of each contract, AI can save countless hours.

- The market is expanding due to the growing demand for automation in fields including eDiscovery, contract review and management, case prediction, and compliance. In order to help businesses generate tangible value, automation in contract management improves a team's capacity to close agreements, strengthens connections with clients, and positively impacts many other areas of the organization.

- It costs more money to not comply with growing standards like HIPAA, PCI DSS, GDPR, and other financial regulations. According to Globalscape, it costs firms in the financial sector roughly USD 5.47 million to comply with IT rules for data protection, and when a company takes into account fines, lost productivity, and profits, the cost of non-compliance is close to USD 15 million.

- The intersection of AI and law is anticipated to increase significantly throughout the forecast time period. Artificial intelligence (AI) can also be used for a variety of tasks, including due diligence (to review a contract, conduct legal research, or perform electronic discovery functions to do due diligence), prediction technology (to predict the likely outcome of cases being decided before a court of law), legal analytics (to provide data points from previous case laws and judgments and precedent law that lawyers can use in their present cases), automation of documentation, Intellectual property, a variety of other tasks, and several others.

- Due to the complexity involved in legal research, it can be time-consuming and tedious. The necessity for AI is further highlighted by the shorter deadlines that most law firms get to achieve efficient and precise legal research work. AI software can dramatically increase productivity and accuracy, helping judges make quick decisions. For instance, the ROSS Intelligence company uses automated technologies to examine contracts quickly. The program emphasizes pertinent documents. Legal research can be substantially enhanced and streamlined with the appropriate software.

- In addition to several domestic legislative frameworks, high-risk AI systems will be clearly and thoroughly regulated in the European Union with the new Artificial Intelligence Act, which is anticipated to be finalized in 2022. Although many AI-related legislation suggestions have been put out, the United States has not embraced the European Commission's suggested all-encompassing approach to AI regulation.

- On the other hand, a wide range of corporate legal departments and law firms bought AI/machine learning solutions for their law libraries due to the outbreak of COVID-19. In law libraries, technology has a significant role. eDiscovery software and other artificially intelligent platforms have benefited in the fight against COVID-19. Such software, which has the potential to speed up medical researchers' investigations into how to cure COVID-19, is created to assist litigation attorneys in getting to the heart of a case more rapidly.

Legal AI Software Market Trends

Cloud is Expected to Hold Significant Share

- Cloud-based practise management software has been proven to have numerous advantages over on-premise systems, including consistent availability, efficiency, and simple scalability, all of which assist attorneys boost the productivity and profitability of their law business.

- Furthermore, AI solutions must protect sensitive data by synchronising with the secure user logins and permissions established by the law firm's Microsoft Active Directory or maybe configured for something like their Box cloud storage. To preserve secrecy, these AI systems are typically installed on-premise behind a law firm's firewall or in a private cloud.

- When it comes to quick adaption and flexibility, cloud solutions outperform on-premise alternatives. Cloud solutions have emerged as the ideal option for small law firms in need of a practise management system that will scale with them. Law firms can integrate the modules or features that are most relevant to them into their existing solution.

- Furthermore, cloud solutions enable safe communication and file sharing among colleagues, clients, and third parties by utilising a centralised information system. It mitigates the inherent hazards of depending entirely on email.

- Casepoint's technology provides full-spectrum legal discovery with quick, enterprise-class solutions. through evaluate its single platform, their clients can manage and monitor the whole discovery process from legal hold through production, avoiding the need to log in and out of different programmes or manually move information.

North America is Expected to Hold a Major Share

- Rising usage of AI. Furthermore, there is a considerable presence in the region among firms that provide platforms and tools for artificial intelligence to the legal industry. Examples include OpenText Corporation, IBM Corporation, Ross Intelligence Inc., Veritone Inc., and Neota Logic Inc.

- In recent years, North America has seen some of the most important legal, technical startup investments. Onit, a US-based firm that provides corporate workflow solutions for legal and contract administration, has received a USD 200 million strategic investment. Clio, a cloud legal management startup located in Canada, has received a USD 250 million Series D fundraising round. This was one of the most significant investments in a legal and Canadian technology firms.

- The worldwide legal department has seen significant changes recently, and North American law firms are following suit. Due diligence, contract analysis, real estate analysis, intellectual property, and conflict resolution all benefit from artificial intelligence capabilities. Technology tools improve the company's efficiency and competitiveness.

- The availability of company incubators and innovation laboratories aids the region's development of AI-based legal software. To promote the emergence of legal technology, established law firms, ALSPs (such as Thomson Reuters), the Big Four, and financial corporations (such as Barclays) cooperated or founded their incubators. These incubators give access to the guidance, knowledge, and, in some cases, financing that innovative enterprises require to flourish in the market, as well as space to assist legal tech startups and scale-up growth.

Legal AI Software Industry Overview

The legal industry's AI software market has a low market penetration rate, creating tremendous potential for incumbent companies and outsiders looking to enter the sector. However, current market participants have a tremendous edge over any new entrants. Due to the outstanding prospects, rising investments, and supporting activities, competition among present market participants is expected to heat up.

- May 2023 - LexisNexis Group Inc has announced the launch of Nexis Hub, a new tool that supports and streamlines any research workflow to accelerate time to insight. The innovative new solution, created to meet the needs of busy professionals, integrates with Google Chrome and Microsoft Word to help users streamline the complicated and time-consuming process of collecting research and creating reports.

- May 2023 - Luminance Technologies Ltd has launched the latest cutting-edge application of its specialist legal large language model (LLM), the AI-powered 'Ask Lumi' chatbot. 'Ask Lumi' represents the first chatbot underpinned by this legal-grade AI. It allows users to open any contract in Microsoft Word, ask the AI questions about their agreement, and receive instant responses. In contrast, Luminance's Legal Pre-Trained Transformer (LPT) technology learns solely from legally verified documents. It is able to produce content and analyze and understand the content, even that created or edited by third parties. This powerful combination of both generative and analytical AI ensures the utmost legal rigor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Consumers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Automation And Increasing Number Of Litigations In The Legal Industry

- 5.1.2 Growth In The Utilization Of AI By Legal Companies To Complete Legal Cases

- 5.2 Market Restraints

- 5.2.1 Data Privacy Concerns Of The Confidential And Legal Data

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Legal Research

- 6.3.2 Contract Review and Management

- 6.3.3 E-billing

- 6.3.4 E-discovery

- 6.3.5 Compliance

- 6.3.6 Case Prediction

- 6.3.7 Other Applications

- 6.4 By End-User

- 6.4.1 Law Firms

- 6.4.2 Corporate Legal Departments

- 6.4.3 Other End-users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Luminance Technologies Ltd

- 7.1.2 Ross Intelligence Inc.

- 7.1.3 Kira Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Lexisnexis Group Inc. (RELX Group Plc)

- 7.1.6 Cs Disco Inc.

- 7.1.7 Thomson Reuters Corporation

- 7.1.8 Veritone Inc.

- 7.1.9 Casetext Inc.

- 7.1.10 Neota Logic Inc.

- 7.1.11 Brainspace Corporation

- 7.1.12 Smokeball Inc.

- 7.1.13 Text IQ Inc.

- 7.1.14 Opentext Corporation