|

市場調查報告書

商品編碼

1689762

包裝印刷:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Packaging Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

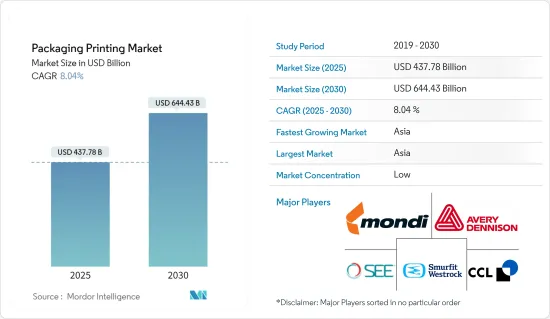

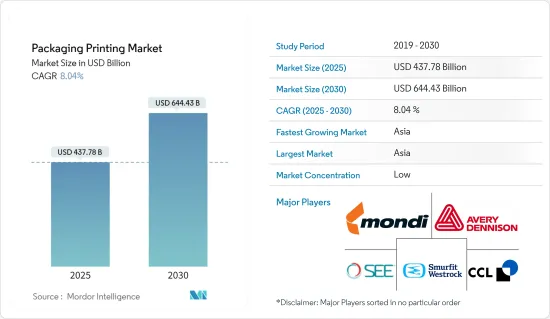

2025 年包裝印刷市場規模預估為 4,377.8 億美元,預計到 2030 年將達到 6,444.3 億美元,預測期內(2025-2030 年)的複合年成長率為 8.04%。

主要亮點

- 由於對技術先進的包裝和創新的包裝解決方案的需求,包裝印刷市場正在成長。品牌間激烈的競爭和消費者意識的增強推動了這種需求。食品、食品和飲料、化妝品行業等主要終端用戶領域對創造性包裝的需求日益成長,進一步推動了市場擴張。包裝印刷產業正在快速發展,新的印刷技術和材料不斷開發以滿足不斷變化的消費者偏好和永續性要求。

- 數位印刷技術越來越受歡迎,為品牌提供了靈活性和客製化選項。由於線上零售商希望改善客戶的拆包體驗,電子商務的成長為包裝印刷商創造了新的機會。隨著企業尋求在實體店和數位市場中使其產品脫穎而出,包裝印刷在品牌傳播和產品保護中發揮越來越重要的作用。

- 促銷和行銷印刷的需求不斷成長,推動了印表機技術的創新。為了有效回應當前趨勢,該公司正在開發新模式,專注於更快、更通用、更具成本效益的印刷解決方案,可以處理各種材料和格式。 2024 年 1 月,惠普公司宣布推出 HP Thermal InkjetTM 108mm 大量列印解決方案,利用 TIJ 4.0 印字頭技術的進步。這款新型印表機旨在透過提高列印品質、加快速度和提高耐用性來滿足包裝行業的需求。此印表機設計用於處理大批量列印,同時保持包裝和促銷材料所需的精確度和色彩準確度。這些技術進步表明該行業對不斷變化的市場需求的適應能力以及印刷品質在品牌表達和產品行銷中日益成長的重要性。

- 多年來,包裝產業的採用率持續成長。特別是在化妝品包裝領域,創新解決方案取得了長足的進步。數位印刷使美容品牌能夠創造客製化的 SKU 和限量版產品。品牌使用數位印刷來嘗試圖像和訊息,利用可以在數位印刷機上輕鬆調整的設計來瞄準不同的消費者群體。該方法已被證明在實施可變策略和進行市場測試方面是有效的。

- 數位印刷技術的快速進步正在改變標籤印刷市場並加速數位印刷標籤的採用。推動數位印刷標籤成長的關鍵因素是其靈活性、多功能性和高品質的圖形輸出。同時,柔版印刷方法的獨特之處在於它能夠在多種基材上進行印刷,包括金屬薄膜、塑膠、賽珞玢、紙張和瓦楞表面。

- 柔版印刷可望在標籤印刷領域大幅擴張。最近的技術進步,包括先進的柔版印刷機、連續印刷解決方案、改進的軟體整合和增強的耐用性,大大縮短了生產前置作業時間。例如,總部位於荷蘭的藥品標籤供應商Pharmalabel最近安裝了Ink Manager軟體和GSE ColorsatSwitch分配系統。這種整合提高了柔版印刷過程的效率和品管。

- 軟質包裝已成為行業主要供應商關注的核心,為全球差異化、收益成長和提高利潤率提供了重大機會。例如,該領域的主要企業Amcor 約 70% 的收益來自軟包裝。這一高比例凸顯了軟包裝在新興市場和成熟西方經濟體的潛力。

- 人工智慧、RFID 技術和資料分析的進步正在推動包裝行業個人化服務的增強。這些技術使公司能夠收集和分析消費者資料,從而促進客製化包裝設計和體驗的創造。數位印刷的整合使得即使是大訂單也可以實現卓越的印刷客製化,使品牌能夠為每件商品生產具有獨特設計、可變資料或單獨訊息的包裝。這種個人化可以提高消費者參與度和品牌忠誠度。然而,實施這些先進封裝技術以及大規模生產客製化封裝的成本仍然是一個巨大的挑戰,因為需要在設備、軟體和熟練人力方面進行大量的投資。

包裝印刷市場趨勢

食品和飲料行業預計將佔據主要市場佔有率

- 近年來,由於全球食品和飲料消費量的增加,包裝產業發生了重大變化。這種演變與消費者偏好的變化、技術進步和對永續性的日益關注密切相關。消費者越來越尋求方便、環保的包裝解決方案,以維持食品品質並延長保存期限。同時,印刷技術的進步使得包裝材料上的設計更加精緻、引人注目。

- 在美國,食品和飲料的年度零售額正在大幅成長,這與全球趨勢一致。 2020 年銷售額將達 8,500 億美元,到 2023 年將增至 9,853 億美元。這一成長不僅反映了人口的成長,也反映了隨著包裝食品和簡便食品的興起而改變的飲食習慣。電子商務和食品宅配服務的擴張進一步增加了對創新包裝解決方案的需求。

- 食品和飲料行業的成長產生了對包裝多樣化印刷格式的需求,尤其是在行業內部。例如,數位印刷因其能夠小批量生產高品質、客製化包裝而變得流行。柔版印刷仍然是大規模生產的首選,而凹版印刷則適用於設計精良的高檔包裝。出於對環境問題的考慮,該行業也在探索更永續的印刷選擇,例如水性和紫外線固化油墨。

- 預計食品和飲料產品需求的增加將推動食品和飲料印刷市場的成長。隨著消費者對更多樣化和更具視覺吸引力的產品的需求,該領域的公司正在轉向創新的包裝和印刷解決方案,以區分他們的產品並增強其貨架吸引力。作為回應,食品和飲料印刷行業正在適應市場需求,並透過在包裝印刷中採用新技術和永續實踐來滿足這些不斷變化的需求。

- 食品和非食品產品種類的日益增加以及對食品和飲料產品的需求不斷成長,推動著包裝印刷品質的大幅提升。這一趨勢是由對標籤和包裝的需求所驅動,這些標籤和包裝需要能夠承受惡劣條件(包括冰凍溫度)並保持耐用。標籤的防水印刷已變得至關重要,特別是對於可能暴露在潮濕或冰中的產品,例如瓶裝飲料。

- 由於消費者對包裝產品的偏好不斷提高,食品包裝上的印刷需求也日益增加。這一趨勢是由飲食習慣的改變和生活方式的演變所驅動,可能會對市場產生重大影響。由於印刷包裝具有高阻隔性、延長保存期限和消費者安全性等特點,預計人均可支配收入的提高和人口的擴大將推動產品需求。在食品包裝材料上印刷既可以傳遞訊息,又可以達到行銷的目的。各種包裝材料都可以直接印刷,包括塑膠、紙張、紙板和軟木。

- 食品包裝產業正在不斷發展以滿足消費者對透明度和品質的需求。包裝上印刷的營養資訊正在提高人們的意識,而對天然、少加工食品的追求正在推動包裝設計的創新。食品包裝有多種用途:保護、方便、控制份量。永續包裝解決方案解決食品廢棄物和安全問題。

- 監管機構要求詳細的標籤,強調高品質印刷的重要性。例如,印度食品安全和標準局(FSSAI)要求提供有關食品袋的全面資訊。製造商優先採取嚴格控制措施來保護消費者,並遵守管理食品包裝各個方面(包括標籤)的綜合法規。對食品包裝的透明度、品質和安全性的關注反映了該行業對不斷變化的消費者偏好和監管要求的反應。

亞洲可望成為成長最快的市場

- 亞洲包裝印刷市場規模龐大,涵蓋多個行業的廣泛印刷技術和應用。中國、印度、日本和韓國等國家對包裝解決方案的需求很高。多個行業正在推動這一需求,包括食品和飲料、家電和其他行業。

- 在中國,電子商務的快速成長刺激了對創新包裝解決方案的需求,尤其是瓦楞紙箱和軟包裝。印度蓬勃發展的中產階級和不斷加快的都市化推動了包裝食品和個人保健產品的激增,從而促進了包裝印刷行業的發展。日本以其先進的包裝技術而聞名,在奢侈品和電子產品的高品質包裝印刷領域繼續保持領先地位。韓國蓬勃發展的電子產業正在推動對專業包裝印刷服務的需求。

- 該地區也正在向永續包裝解決方案轉變,許多公司採用環保材料和印刷過程。這一趨勢在新加坡和台灣尤為明顯,那裡的環境問題開始影響消費者的選擇和企業政策。

- 有幾個因素推動了這項需求。快速的都市化和不斷變化的消費者生活方式正在推動對包裝商品的需求。這些國家的中階人口不斷成長,推動了包裝產品的消費成長。此外,該地區電子商務的成長也加速了對創新和永續包裝解決方案的需求。

- 該地區的包裝印刷市場正與全球趨勢保持同步,尤其是永續和智慧包裝技術。主要舉措包括採用生物分解性材料、齊心協力減少塑膠使用量以及整合2D碼和無線射頻識別標籤以增強可追溯性並提高消費者意識。此外,企業正在投資先進的包裝技術來提高包裝品質和效率,並且也更加重視使用環保油墨和被覆劑。

- 在印度,包裝印刷對食品和飲料、製藥、化妝品、電子和汽車行業等多個領域都至關重要。包裝上數位資料印刷的應用正在迅速增加,尤其是在食品和飲料領域。這一趨勢主要由傳達基本細節的需求所驅動,例如最佳食用日期、成分和營養資訊。反映這一成長,印度包裝食品市值預計將從 2020 年的 4,377 萬美元飆升至 2026 年的 7,021 萬美元。包裝食品市場的強勁擴張刺激了對各種包裝印刷技術的需求增加。

- 不斷成長的消費者支出和對耐用品的需求正在推動亞洲包裝的進步。加工食品消費量的增加和新的包裝印刷技術進一步推動了市場的成長。製藥業和便捷包裝的需求也是主要貢獻者。亞洲對標準產品的需求不斷成長,推動了中小型工業的發展,增強了數位印刷包裝市場的發展。

- 包裝產業對研發的投入推動了全球市場的擴張和印表機的創新。 2024年2月,Canon針對亞太市場宣布推出三款全新IMAGE PROGRAF GP系列印表機(GP-526S/546S/566S),採用環保瓦楞紙箱包裝。 GP546S型號減少了89.5%的發泡聚苯乙烯包裝,最大限度地減少了廢棄物並促進了環境的永續性。

包裝印刷業概況

由於 Mondi PLC、Ahlstrom-Munksjo Oyj、Autajon CS、Huhtamaki Flexible Packaging(Huhtamaki Oyj)和 Avery Dennison Corporation 等主要企業的存在,包裝印刷市場的競爭格局較為分散。我們不斷創新產品的能力使我們比其他公司擁有競爭優勢。透過策略夥伴關係、研發和併購,這些公司在市場上佔據了更大的佔有率。

- 2024 年 7 月 - DS Smith 是全球著名的永續纖維包裝解決方案提供商,在其位於西班牙 Torrelavit 的工廠安裝了 Nozomi 14000 AQ單一途徑水性數位噴墨印表機,走在創新的前沿。 Nozomi 14000 AQ 印表機由 Electronics for Imaging 公司開發,能夠使用環保的水性油墨進行高解析度列印。這款先進的印表機可以將您的設計直接列印到瓦楞紙板上,消除了平版印刷層壓等傳統方法帶來的浪費。

- 2023 年 9 月,利樂與 Flow Beverage Corp. 建立了第一個自訂印刷夥伴關係。此舉是在利樂的客自訂印刷解決方案在超過 1 億個包裝上成功檢驗之後採取的。新的解決方案旨在透過為消費者提供靈活性和個人化選項來擴大商業和行銷機會。

- 2023 年 6 月,Constantia Flexibles 宣布完成對波蘭包裝公司 Drukpol Flexo 的收購。 Drukpol Flexo 是食品、家居、個人護理和醫藥 (HPP) 市場的包裝解決方案提供商,其印刷和轉換能力受到本地和國際客戶的一致好評。

- 2023 年 4 月 Sealed Air 與 Koenig & Bauer 簽署了一份不具約束力的意向書,以擴大他們在數位印刷機領域的策略夥伴關係。此次合作旨在透過利用先進的數位印刷技術、設備和服務來提高包裝設計能力。 SEE 和 Koenig & Bauer 的創新加速了數位印刷材料的交貨,並使品牌所有者能夠透過更有效的包裝吸引消費者。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業生態系統分析

第5章 市場動態

- 市場促進因素

- RFID 和數位印刷需求

- 數位印刷和永續包裝印刷的需求不斷增加

- 市場限制

- 高資本投入

- 包裝印刷法規

第6章 市場細分

- 依印刷技術

- 平張膠印

- 凹版印刷

- 柔版印刷

- 數位印刷

- 網版印刷

- 按油墨類型

- 溶劑型墨水

- UV 固化墨水

- 水性油墨

- 按包裝類型

- 標籤

- 塑膠

- 玻璃

- 金屬

- 紙和紙板

- 按應用

- 化妝品和家居護理

- 飲食

- 藥品

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 哥倫比亞

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 北美洲

第7章 競爭格局

- 公司簡介

- Mondi PLC

- Ahlstrom-Munksjo Oyj

- Autajon CS

- Huhtamaki Oyj

- Avery Dennison Corporation

- CCL Industries Inc.

- Clondalkin Group Holdings BV

- Constantia Flexibles Group GmbH

- Tetra Pak

- Smurfit WestRock

- DS Smith PLC

- Georgia-Pacific LLC

- International Paper Company

- Sealed Air Corporation

- Stora Enso Oyj

- Sonoco Products Company

- Mayr-Melnhof Karton AG

- Trustpack UAB

- Duncan Printing Group

第8章投資分析

第9章:市場的未來

The Packaging Printing Market size is estimated at USD 437.78 billion in 2025, and is expected to reach USD 644.43 billion by 2030, at a CAGR of 8.04% during the forecast period (2025-2030).

Key Highlights

- The Packaging Printing Market is experiencing growth driven by technological advancements and the demand for innovative packaging solutions. This demand is fueled by intense competition among brands and increased consumer awareness. The growing need for creative packaging in crucial end-user segments, including the food, beverage, and cosmetics industries, further supports the market expansion. The packaging printing industry is rapidly evolving, with new printing techniques and materials being developed to meet changing consumer preferences and sustainability requirements.

- Digital printing technologies are gaining prominence, providing enhanced flexibility and customization options for brands. The growth of e-commerce has created new opportunities for packaging printers, as online retailers aim to improve customers' unboxing experience. As companies seek to differentiate their products in physical stores and digital marketplaces, packaging printing plays an increasingly vital role in brand communication and product protection.

- The growing demand for promotional and marketing printing is driving innovation in printer technology. Companies are developing new models to address current trends efficiently, focusing on faster, more versatile, cost-effective printing solutions capable of handling diverse materials and formats. In January 2024, HP Inc. introduced its HP Thermal InkjetTM 108mm bulk printing solution, leveraging advancements in TIJ 4.0 printhead technology. This new printer model aims to meet the packaging industry's requirements by offering enhanced print quality, increased speed, and improved durability. It is designed for high-volume printing tasks and maintains precision and color accuracy, essential for packaging and promotional materials. These technological advancements demonstrate the industry's adaptation to evolving market demands and the increasing significance of print quality in brand representation and product marketing.

- The packaging industry has been experiencing consistent year-on-year growth in adoption. The cosmetics packaging sector, in particular, has made significant advancements in innovative solutions. Digital printing has enabled beauty brands to create customized SKUs and exclusive limited-edition products. Brands are using digital printing to experiment with imagery and messaging, targeting various consumer segments with easily adjustable designs on digital presses. This method has proven effective for implementing variable strategies and conducting market tests.

- The swift advancement of digital print technology has transformed the label printing market and accelerated the adoption of digital print labels. Key factors propelling the growth of digital print labels include their flexibility, versatility, and high-quality graphic output. Concurrently, the flexographic method distinguishes itself through its ability to print on a wide array of materials, such as metallic films, plastics, cellophane, paper, and corrugated surfaces.

- Flexographic printing is set for significant expansion in the label printing sector. Recent technological advancements, including sophisticated flexographic printers, continuous printing solutions, improved software integrations, and enhanced durability, have markedly reduced production lead times. For instance, Pharmalabel, a Netherlands-based pharmaceutical label supplier, recently implemented a GSE ColorsatSwitch dispensing system with ink manager software. This integration has boosted both efficiency and quality control in its flexographic printing processes.

- Flexible packaging has become a central focus for major vendors in the industry, offering significant opportunities for differentiation, revenue growth, and profit enhancement globally. For example, Amcor, a leading company in the sector, derives approximately 70% of its revenue from flexible packaging. This high percentage highlights the potential of flexible packaging in both emerging markets and established Western economies.

- Artificial intelligence, RFID technology, and data analytics advancements have enhanced personalized offerings in the packaging industry. These technologies enable companies to gather and analyze consumer data, facilitating the creation of tailored packaging designs and experiences. Digital printing integration allows for superior print customization in large-volume orders, enabling brands to produce packaging with unique designs, variable data, or individualized messages for each item. This personalization can increase consumer engagement and brand loyalty. However, the cost factor remains a significant challenge, as implementing these advanced technologies and producing customized packaging at scale requires substantial investment in equipment, software, and skilled personnel.

Packaging Printing Market Trends

Food and Beverage Sector is Expected to Hold Significant Market Share

- The packaging industry has undergone substantial changes in recent years, driven by the global increase in food and beverage consumption. This evolution is closely tied to shifting consumer preferences, technological progress, and growing sustainability concerns. Consumers increasingly demand convenient, eco-friendly packaging solutions that preserve food quality and extend shelf life. Simultaneously, advancements in printing technologies have enabled more sophisticated and eye-catching designs on packaging materials.

- In the United States, annual retail food and drink sales have risen significantly, mirroring global trends. Sales reached USD 850 billion in 2020 and increased to USD 985.30 billion in 2023. This growth reflects not only population increases but also changes in eating habits, with a rise in packaged and convenience foods. The expansion of e-commerce and food delivery services has further fueled the demand for innovative packaging solutions.

- This growth in the food and beverage sector has created a demand for diverse printing formats in packaging, particularly within the industry. Digital printing, for instance, has gained popularity due to its ability to produce high-quality, customized packaging in smaller quantities. Flexographic printing remains a staple for large-scale production, while gravure printing is favored for premium packaging with intricate designs. The industry also explores sustainable printing options, such as water-based and UV-curable inks to align with environmental concerns.

- The increasing demand for food and beverage products is expected to drive growth in the food and beverage printing market. As consumers seek more diverse and visually appealing products, companies in this sector are increasingly utilizing innovative packaging and printing solutions to differentiate their offerings and enhance shelf appeal. In response, the printing industry within the food and beverage sector is adapting to meet these evolving needs by incorporating new technologies and sustainable practices in packaging printing, aligning with market demands.

- The growing variety of food and non-food products and increased demand for food and beverages has led to a significant trend in quality printing for packaging. This trend is driven by the need for labels and packaging that can withstand extreme conditions, such as freezing temperatures, and maintain durability. Water-resistant printing for labels has become essential, particularly for products like bottled beverages that may be exposed to moisture or ice.

- The demand for printing in food packaging is increasing due to rising consumer preferences for packaged products. This trend is driven by changing eating habits and evolving lifestyles, which may significantly impact the market. The growth in per capita disposable income and expanding population are expected to boost product demand, owing to the high barrier properties, extended shelf life, and consumer safety offered by printed packaging. Printing on food packaging materials serves both informational and marketing purposes. Various packaging materials, including plastics, paper, cardboard, and cork, can be directly printed.

- The food packaging industry is evolving to meet consumer demands for transparency and quality. Nutritional information printed on packaging enhances awareness, while the trend toward natural, minimally processed foods drives innovation in packaging design. Food packaging serves multiple purposes, including protection, convenience, and portion control. Sustainable packaging solutions address food waste and safety concerns.

- Regulatory bodies mandate detailed labeling, emphasizing the importance of high-quality printing. For instance, the Food Safety and Standards Authority of India (FSSAI) requires comprehensive information on food pouches. Manufacturers prioritize strict controls to protect consumers, adhering to comprehensive legislation governing all aspects of food packaging, including labels. This focus on transparency, quality, and safety in food packaging reflects the industry's response to changing consumer preferences and regulatory requirements.

Asia is Expected to be the Fastest-growing Market

- The packaging printing market in Asia is substantial, incorporating various printing technologies and applications across multiple industries. Countries like China, India, Japan, and South Korea have experienced significant demand for packaging solutions. Multiple sectors drive this demand, including food and beverages, consumer electronics, and other industries.

- In China, the rapid growth of e-commerce has fueled the need for innovative packaging solutions, particularly in corrugated boxes and flexible packaging. India's burgeoning middle class and increasing urbanization have led to a surge in packaged food and personal care products, boosting the packaging printing sector. Japan, known for its advanced technology, continues to lead in high-quality packaging printing for premium products and electronics. South Korea's robust electronics industry drives demand for specialized packaging printing services.

- The region has also shifted toward sustainable packaging solutions, with many companies adopting eco-friendly materials and printing processes. This trend is particularly evident in Singapore and Taiwan, where environmental concerns increasingly influence consumer choices and corporate policies.

- Multiple factors drive this demand. Rapid urbanization and evolving consumer lifestyles have increased the need for packaged goods. The expanding middle-class population in these countries has contributed to higher consumption of packaged products. Furthermore, the growth of e-commerce in the region has accelerated the demand for innovative and sustainable packaging solutions.

- The packaging printing market in the region is aligning with global trends, notably in sustainable and intelligent packaging technologies. Key initiatives include adopting biodegradable materials, a concerted effort to reduce plastic usage, and integrating QR codes and RFID tags to enhance traceability and boost consumer engagement. Additionally, companies are investing in advanced printing techniques to improve packaging quality and efficiency, and there is a growing focus on using eco-friendly inks and coatings.

- Packaging printing is pivotal in India across multiple sectors, including food and beverage, pharmaceuticals, cosmetics, electronics, and the automobile industry. Notably, the food and beverage sector has seen a surge in adopting digital data printing on packages. This trend is primarily driven by the need to communicate essential details like shelf-life, ingredients, and nutritional information. Reflecting this growth, the market value of packaged food in India jumped from USD 43.77 million in 2020 and is projected to reach USD 70.21 million by 2026. Such robust expansion in the packed food market is fueling rising demand for varied printing techniques in packaging.

- Rising consumer spending and demand for durable goods drive packaging advancements in Asia. They increased processed food consumption and emerging packaging printing technologies further fuel market growth. The pharmaceutical sector and demand for convenient packaging also contribute significantly. The rise in demand for standard products in Asia boosts small and medium-scale industries, enhancing the digital printing packaging market.

- Investments in packaging industry R&D drive global market expansion and printer innovation. In February 2024, Canon introduced three new images PROGRAF GP Series printers (GP-526S/546S/566S) for the Asia-Pacific market, packaged in eco-friendly cardboard boxes. The GP546S model reduced polystyrene foam packaging by 89.5%, minimizing waste and promoting environmental sustainability.

Packaging Printing Industry Overview

The competitive rivalry in the packaging printing market is fragmented owing to the presence of some key players, such as Mondi PLC, Ahlstrom-Munksjo Oyj, Autajon CS, Huhtamaki Flexible Packaging (Huhtamaki Oyj), and Avery Dennison Corporation, among others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over others. Through strategic partnerships, R&D, and mergers and acquisitions, the players have achieved a more significant footprint in the market.

- July 2024: DS Smith, a prominent global provider of sustainable fiber-based packaging solutions, spearheads innovation by installing a Nozomi 14000 AQ single-pass, water-based digital inkjet printer at its Torrelavit facility in Spain. Developed by Electronics for Imaging, the Nozomi 14000 AQ printer offers high-resolution printing using eco-friendly water-based ink. This advanced printer applies designs directly onto corrugated cardboard, eliminating the waste typically associated with traditional methods like lithographic lamination.

- September 2023: Tetra Pak has launched its first Custom Printing partnership with Flow Beverage Corp. This initiative follows the successful validation of Tetra Pak's Custom Printing solution, which has been applied to over 100 million packages. The new offering aims to expand business and marketing opportunities by providing consumers with increased flexibility and personalization options.

- June 2023: Constantia Flexibles has announced the completion of its acquisition of Drukpol Flexo, an established packaging company in Poland. Drukpol Flexo, a packaging solutions provider for food and household, personal care, and pharmaceutical (HPP) markets, has built a reputation among local and international customers for its printing and converting capabilities.

- April 2023: Sealed Air and Koenig & Bauer AG have signed a non-binding letter of intent to broaden their strategic alliance in digital printing machines. This collaboration seeks to elevate packaging design capabilities by pioneering advanced digital printing technologies, equipment, and services. The innovations from SEE and Koenig & Bauer promise to expedite the delivery of digitally printed materials, allowing brand owners to engage consumers more effectively through enhanced packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for the Use of RFIDs and Digital Printing

- 5.1.2 Growing Demand for Digital and Sustainable Packaging Printing

- 5.2 Market Restraints

- 5.2.1 High Capital Investments

- 5.2.2 Packaging and Printing Regulations

6 MARKET SEGMENTATION

- 6.1 By Printing Technology

- 6.1.1 Offset Lithography

- 6.1.2 Rotogravure

- 6.1.3 Flexography

- 6.1.4 Digital Printing

- 6.1.5 Screen Printing

- 6.2 By Ink Type

- 6.2.1 Solvent-based Ink

- 6.2.2 UV-curable Ink

- 6.2.3 Aqueous Ink

- 6.3 By Packaging Type

- 6.3.1 Label

- 6.3.2 Plastic

- 6.3.3 Glass

- 6.3.4 Metal

- 6.3.5 Paper and Paperboard

- 6.4 By Application

- 6.4.1 Cosmetic and Homecare

- 6.4.2 Food and Beverage

- 6.4.3 Pharmaceutical

- 6.4.4 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Australia and New Zealand

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Columbia

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 South Africa

- 6.5.5.3 Saudi Arabia

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi PLC

- 7.1.2 Ahlstrom-Munksjo Oyj

- 7.1.3 Autajon CS

- 7.1.4 Huhtamaki Oyj

- 7.1.5 Avery Dennison Corporation

- 7.1.6 CCL Industries Inc.

- 7.1.7 Clondalkin Group Holdings BV

- 7.1.8 Constantia Flexibles Group GmbH

- 7.1.9 Tetra Pak

- 7.1.10 Smurfit WestRock

- 7.1.11 DS Smith PLC

- 7.1.12 Georgia-Pacific LLC

- 7.1.13 International Paper Company

- 7.1.14 Sealed Air Corporation

- 7.1.15 Stora Enso Oyj

- 7.1.16 Sonoco Products Company

- 7.1.17 Mayr-Melnhof Karton AG

- 7.1.18 Trustpack UAB

- 7.1.19 Duncan Printing Group