|

市場調查報告書

商品編碼

1689768

丁腈橡膠 (NBR):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Nitrile Butadiene Rubber (NBR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

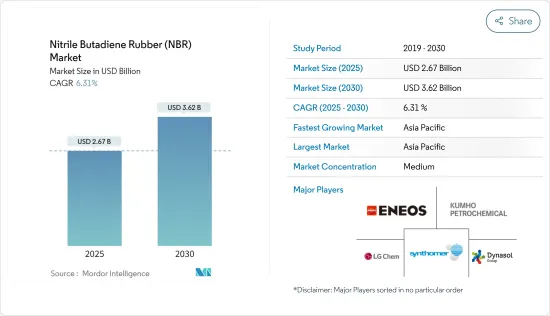

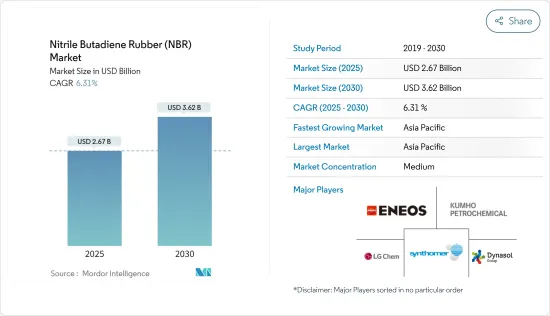

預計 2025 年丁腈橡膠 (NBR) 市場規模為 26.7 億美元,到 2030 年將達到 36.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.31%。

COVID-19 阻礙了丁腈橡膠市場的發展。疫情擾亂了全球供應鏈,影響了 NBR 製造商的原料供應、物流和製造業務。然而,疫情過後人們對衛生和安全的持續關注,導致對 NBR 手套和其他醫療相關應用的需求持續存在。

主要亮點

- 預計推動丁腈橡膠 (NBR) 市場發展的因素包括汽車工業以及新興市場的工業和基礎設施發展計劃對丁腈橡膠的需求增加。

- 然而,替代材料的可用性和原料價格的波動預計會阻礙丁腈橡膠市場的成長。

- 可再生能源領域以及醫療保健及醫療設備對丁腈橡膠的需求不斷增加,預計將在未來幾年為市場參與者提供各種機會。

- 亞太地區在全球丁腈橡膠市場佔據主導地位,其中消費量最高的國家是中國、印度和東南亞國協。

丁腈橡膠(NBR)市場趨勢

汽車和運輸業佔據市場主導地位

- NBR 廣泛用於製造汽車軟管和管材,例如燃油管、散熱器軟管、煞車軟管等。 NBR 對石油基流體、劣化和臭氧的耐受性使其非常適合這些要求苛刻的應用。

- NBR的高拉伸強度和耐磨性使其成為運輸業使用的正時帶、風扇帶和輸送機等汽車皮帶的理想材料。

- NBR 出色的耐用性和耐化學性使其成為工業車輛、重型卡車和施工機械中的密封件、墊圈和其他部件的熱門選擇。

- 根據國際汽車工業組織(OICA)發布的最新預測,2023年全球汽車產量將達到93,546,599輛,較2021年成長17%。

- 根據國際能源總署(IEA)發布的估計,美國電動車銷量將從2022年的100萬輛增加到2023年的160萬輛。

- 此外,根據國際能源總署發布的估計,歐洲電動車銷量將從2022年的270萬輛增加到2023年的340萬輛。

- 根據印度品牌股權基金會(IBEF)的估計,印度民航業在過去三年中已成為該國成長最快的產業之一。預計 2023 年印度航空運輸量將達到 3.2728 億架飛機,而 2022 年則為 1.8889 億架。

- 預測期內,丁腈橡膠 (NBR) 的需求預計會受到所有這些因素的影響。

亞太地區佔市場主導地位

- 亞太地區是中國、日本、韓國和印度等主要汽車製造地的所在地。這些國家的汽車工業蓬勃發展,推動了對 NBR 的需求,NBR 廣泛應用於密封件、墊圈、軟管、皮帶等各種汽車零件。

- 根據國際汽車工業組織(OICA)發布的資料,到2023年,中國汽車產量將達到30,160,966輛,高於2022年的27,020,615輛。

- 中國、印度和東南亞等國家的快速都市化和基礎設施發展計劃正在增加對施工機械、重型車輛和運輸系統的需求。 NBR 廣泛用於製造這些行業的零件,促進了市場的成長。

- 根據印度品牌股權基金會(IBEF)發布的估計,印度在基礎建設方面的投資已使其成為價值26兆美元的經濟體。印度政府已推出國家基礎設施管道(NIP)計劃,以促進基礎設施產業的發展。

- 亞太地區,特別是中國、日本和韓國,擁有幾家主要的 NBR 製造商和生產設施。該成熟的製造地確保了 NBR 的可靠供應,以滿足該地區日益成長的需求。

- 所有這些因素,再加上亞太地區其他新興經濟體的消費不斷成長,正在推動該地區的市場成長。

丁腈橡膠(NBR)產業概況

丁腈橡膠(NBR)市場部分整合。主要參與者包括錦湖石油化學、Synthomer PLC、LG Chem、ENEOS Materials Corporation 和 Dynasol Group。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 不斷擴張的汽車產業

- 工業和基礎設施發展計劃

- 限制因素

- 替代材料的可用性

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 應用

- 黏合劑和密封劑

- 皮帶和電纜

- 手套

- 軟管

- 墊圈和 O 型環

- 其他用途(消費品)

- 最終用戶產業

- 汽車與運輸

- 建築和施工

- 工業

- 醫療

- 其他終端用戶產業(石油和天然氣、航太)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 越南

- 印尼

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 埃及

- 卡達

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Apcotex

- ARLANXEO

- China Petrochemical Corporation(Sinopec)

- Dynasol Group

- ENEOS Materials Corporation

- KUMHO PETROCHEMICAL

- Lanxess

- LG Chem

- SIBUR

- Synthomer PLC

- Synthos

- TSRC

- Versalis SpA

- ZEON CORPORATION

第7章 市場機會與未來趨勢

- 可再生能源領域的需求不斷成長

- 醫療保健和醫療設備需求增加

The Nitrile Butadiene Rubber Market size is estimated at USD 2.67 billion in 2025, and is expected to reach USD 3.62 billion by 2030, at a CAGR of 6.31% during the forecast period (2025-2030).

COVID-19 hampered the nitrile butadiene rubber market. The pandemic disrupted the global supply chains, impacting the availability of raw materials, logistics, and manufacturing operations for NBR producers. However, the continued focus on hygiene and safety post-pandemic led to sustained demand for NBR gloves and other medical-related applications.

Key Highlights

- The increasing demand for nitrile butadiene rubber from the expanding automotive industry and from the industrial and infrastructure development projects are factors that are expected to drive the nitrile butadiene rubber market.

- However, the availability of substitute materials and fluctuating raw material prices are expected to hinder the growth of nitrile butadiene rubber market.

- The increasing demand for nitrile butadiene rubber from renewable energy sector and healthcare and medical devices are expected to provide various opportunities to the market players in the upcoming peroiod.

- The Asia-Pacific region dominates the nitrile butadiene rubber market globally, with the largest consumption from countries such as China, India, and ASEAN Countries.

Nitrile Butadiene Rubber (NBR) Market Trends

Automotive and Transportation Sector Dominates the Market

- NBR is extensively used in the manufacturing of hoses and tubing for automotive applications, including fuel lines, radiator hoses, and brake hoses. Its resistance to petroleum-based fluids, aging, and ozone makes it suitable for these demanding applications.

- NBR's high tensile strength and resistance to abrasion make it an ideal material for automotive belts, such as timing belts, fan belts, and conveyor belts used in the transportation industry.

- The exceptional durability and chemical resistance of NBR makes it a preferred choice for seals, gaskets, and other components in industrial vehicles, heavy-duty trucks, and construction equipment.

- According to the latest estimates published by the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, global production of motor vehicles stood at 93,546,599 units, a 17% increase from that in 2021.

- According to the estimate released by the International Energy Agency (IEA), the sales of electric vehicles increased from 1.0 million units in 2022 to 1.6 million units in 2023 in the United States.

- In addition, the sales of electric vehicles also increased from 2.7 million in 2022 to 3.4 million units in 2023 in Europe, according to the estimate released by the IEA.

- According to an estimate published by the Indian Brand Equity Foundation (IBEF), the civil aviation industry in India has emerged as one of the fastest-growing industries in the country in the last three years. The air traffic movement in India stood at 327.28 million in Financial Year 2023 compared to 188.89 million in 2022.

- The demand for nitrile butadiene rubber (NBR) is anticipated to be affected by all of these factors over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is home to major automotive manufacturing hubs, including China, Japan, South Korea, and India. The thriving automotive industry in these countries drives the demand for NBR, which is extensively used in various automotive components, including seals, gaskets, hoses, and belts.

- According to the data released by the International Organization of Motor Vehicle Manufacturers (OICA), in China, 30,160,966 units of vehicles were produced in 2023, which increased from 27,020615 units in 2022.

- Rapid urbanization and infrastructure development projects in countries like China, India, and Southeast Asian nations have led to an increase in the need for construction equipment, heavy-duty vehicles, and transportation systems. NBR is widely used in the manufacturing of components for these industries, contributing to its market growth.

- According to the estimate released by the Indian Brand Equity Foundation (IBEF), the investment in infrastructure development in India has helped India become an economy of USD 26 trillion. The government of India has launched the National Infrastructure Pipeline (NIP) to augment the growth of the infrastructure sector.

- Several major NBR manufacturers and production facilities are located in the Asia-Pacific region, particularly in countries like China, Japan, and South Korea. This established manufacturing base ensures a reliable supply of NBR to meet the region's growing demand.

- All such factors, coupled with the increasing consumption from other emerging economies of the Asia-Pacific region, are driving the market's growth in the region.

Nitrile Butadiene Rubber (NBR) Industry Overview

The nitrile butadiene rubber market is partially consolidated. Some of the major players include KUMHO PETROCHEMICAL, Synthomer PLC, LG Chem, ENEOS Materials Corporation, and Dynasol Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expanding Automotive Industry

- 4.1.2 Industrial and Infrastructure Development Projects

- 4.2 Restraints

- 4.2.1 Availability of Substitute Materials

- 4.2.2 Fluctuating Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Adhesives and Sealants

- 5.1.2 Belts and Cables

- 5.1.3 Gloves

- 5.1.4 Hoses

- 5.1.5 Gaskets and O-Rings

- 5.1.6 Other Applications (Consumer Goods)

- 5.2 End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Building and Construction

- 5.2.3 Industrial

- 5.2.4 Medical

- 5.2.5 Other End-user Industries (Oil and Gas, Aerospace)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Apcotex

- 6.4.2 ARLANXEO

- 6.4.3 China Petrochemical Corporation (Sinopec)

- 6.4.4 Dynasol Group

- 6.4.5 ENEOS Materials Corporation

- 6.4.6 KUMHO PETROCHEMICAL

- 6.4.7 Lanxess

- 6.4.8 LG Chem

- 6.4.9 SIBUR

- 6.4.10 Synthomer PLC

- 6.4.11 Synthos

- 6.4.12 TSRC

- 6.4.13 Versalis S.p.A.

- 6.4.14 ZEON CORPORATION

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Renewable Energy Sector

- 7.2 Increasing Demand from Healthcare and Medical Devices