|

市場調查報告書

商品編碼

1690072

飛行時間 (TOF) 感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Time-of-Flight (TOF) Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

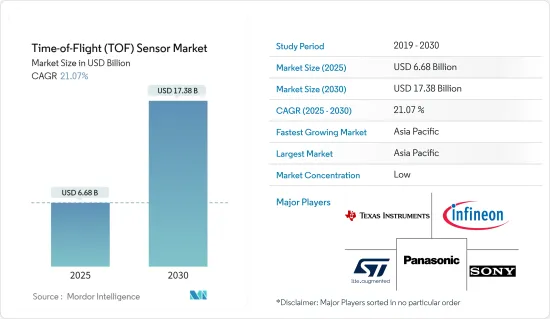

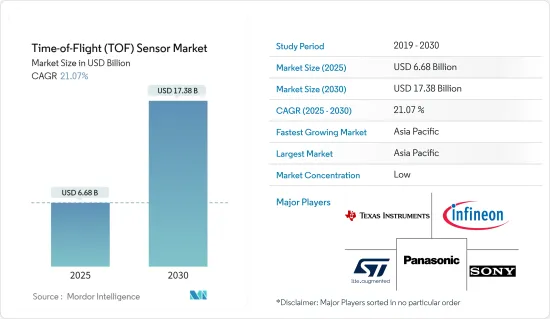

飛行時間 (TOF) 感測器市場規模預計在 2025 年為 66.8 億美元,預計到 2030 年將達到 173.8 億美元,預測期內(2025-2030 年)的複合年成長率為 21.07%。

主要亮點

- 市場對配備 3D 相機的智慧型手機的需求不斷成長,從而推動了市場的發展。智慧型手機最顯著和最受歡迎的功能之一是 ToF 相機。此外,值得注意的是,全球範圍內越來越多的人為他們的智慧型手機訂購行動網路。根據愛立信預測,2022年全球智慧型手機行動網路用戶數將達到約66億,到2028年將突破78億,其中智慧型手機行動網路用戶數最多的國家為中國、印度和美國。

- 推動這一市場擴張的關鍵因素是汽車行業對 ToF 感測器的需求不斷成長、智慧型手機中 3D 相機的使用不斷增加以及智慧型手機使用率的上升。隨著工業 4.0 和 3D 機器視覺系統的應用在各行業不斷擴展,ToF 感測器市場具有巨大的成長潛力。

- 根據愛迪生投資研究公司和OICA的數據,2016年至2025年間,西歐車載前置攝影機的銷售量將會增加。到2025年,西歐預計將售出約1,550萬套前置汽車攝影機系統,其中包括3D攝影機。

- 此外,在預期期內,3D 成像和掃描將主導 ToF 感測器市場。利用 3D 掃描技術可以將物件轉換成 3D 模型。收集物體的特定區域和尺寸,並且這些映射資料可用於深度感應設計。 3D掃描技術使用起來很方便,未來可能會越來越普及。飛行時間技術是一種主動式3D成像和掃描技術。另外兩種 3D 成像技術——結構光和立體視覺,比 ToF 速度更慢、可靠性更低、能耗更高。由於其易於使用,ToF 技術預計在 3D 成像和掃描應用方面的需求將會增加。

- TOF技術具有作用距離長、適用範圍廣、距離精度高的優點。但其也存在許多缺點。例如目前主流行動電話中的ToF感測器解析度相對較低(180*240、240*320、240*480等),這會導致近距離的精度和X/Y解析度相對較低。

- AR和VR領域攝影機的使用增加或將為後疫情時代的市場復甦開闢新的可能性。Sony Corporation推出了具有強大處理能力和記憶體的 IMX500。影像感測器執行機器學習(ML)來強力協助電腦視覺過程,而無需外部硬體。 3D ToF影像感測器很可能用於智慧型手機,為AR/VR應用提供對環境的3D感知。

飛行時間 (TOF) 感測器市場趨勢

最大的終端用戶是消費性電子產品

- 由於 TOF 感測器在智慧型手機、平板電腦、家用機器人、數位相機、智慧揚聲器、PC 投影機等領域的應用,對 TOF 感測器的需求正在增加。然而,與遊戲和娛樂產業相關的設備並不屬於這一領域。 ToF 相機感應器可測量距離和體積,並提供物件掃描、室內導航、避障、手勢姿態辨識、物件追蹤和響應式高度計。

- 在智慧型手機中,ToF 感測器用於多種用途,包括生物識別安全(臉部辨識、相機和運動追蹤等)。 ToF 感光元件讓智慧型手機相機變得更好。它用於行動裝置的模糊效果和自動對焦等攝影功能,使相機能夠捕捉移動物體、背景和身體部位。它還提供了一些引人注目的特效,尤其是在快速動作場景中。

- 據愛立信稱,到 2026 年,全球智慧型手機用戶數量預計將達到 75.16 億部。這導致高階智慧型手機的普及度上升,智慧型手機製造商紛紛推出先進的功能,以在競爭中脫穎而出。這有助於TOF感測器市場的成長,預計在研究期間將繼續成長。同時,2022 年 8 月,三星宣布正在開發一款 3D ToF 感測器,可能會在 Galaxy S21 系列中首次亮相。這款智慧型手機上的感應器有望帶來更好的臉部辨識和深度感應功能。

- 幾家在新興市場營運的主要製造商正致力於開發新產品以滿足日益成長的需求。例如,2022 年 6 月,意法半導體 (STMicroelectronics NV) 發布了其最新的 FlightSense ToF 測距感測器,用於智慧型手機相機管理和虛擬/擴增實境。它採用創新的超表面鏡頭技術和節能架構,可減少電池消耗、擴大相機的自動對焦範圍並提高場景理解能力。

- 此外,智慧家庭概念的快速擴張正在推動已開發國家對家用和服務機器人的需求。服務機器人中的 ToF 感測器可偵測移動並確定物體和人的存在。該感測器還可在所有光照條件下工作,包括充足的陽光,提供不依賴目標顏色或光學清晰度的精確距離測量。此外,生活方式的改變、都市化進程的加快以及智慧消費產品的日益普及為預測期內市場的成長創造了有利的前景。

亞太地區可望佔據主要市場佔有率

- 中國是世界上最大的家用電子電器生產國和出口國,該領域擁有巨大的發展潛力。此外,該地區的電子製造業繼續穩步擴張。根據中國資訊通訊研究院調查,2022年1-2月,與前一年同期比較增12.7%,而全國工業業增加值年增7.5%。

- 中國消費性電子市場正快速擴張,主要電子企業的附加價值不斷提高,國內對電子設備的需求也不斷成長。透過實現臉部辨識、手勢控制和深度感應等功能,ToF 感測器大大提高了這些設備的可用性和功能性。隨著家用電子電器市場的成長,對 ToF 感測器的需求預計會增加。

- 日本擁有強勁的家電市場。 ToF 感應器用於虛擬實境 (VR) 耳機、遊戲機、智慧型手機和平板電腦。市場擴張可能是由消費者對這些產品及其與 ToF 感測器的整合的需求所推動的。

- 由於對增強型相機功能、AR/VR 應用、手勢姿態辨識、臉部解鎖、遊戲和 AI 功能的需求增加,印度對高階和旗艦智慧型手機的需求不斷成長,推動了 ToF 感測器市場的發展。隨著客戶越來越重視這些功能,智慧型手機製造商預計將增加對 ToF 感測器的使用。這有望擴大印度的 ToF 感測器市場規模。

- 本研究涵蓋的亞太地區的其他國家包括澳洲、東南亞國家等。這些國家也可能獲得相當大的市場佔有率。韓國、新加坡等國家對高階智慧型手機和其他消費性電子產品的需求不斷成長,促使許多公司在亞太地區建立生產基地。台灣等國家及地區原料充足、設備安裝及人事費用低廉,也有助於企業建立本地生產基地。

飛行時間 (TOF) 感測器產業概況

飛行時間(TOF)感測器市場高度分散。Sony Corporation和意法半導體公司等老牌公司的品牌形象對這個市場有顯著的影響。強大的品牌是卓越業績的代名詞,因此擁有長期良好業績記錄的公司有望佔據優勢。鑑於其市場滲透率和投資新技術的能力,競爭對手之間的競爭預計將持續下去。此外,競爭加劇導致供應商在市場上投入大量資金。

- 2023 年 6 月,德克薩斯宣布計劃在吉隆坡和馬六甲建立新的組裝和測試設施,擴大在馬來西亞的內部製造地。此次擴張將支持該公司在 2030 年將 90% 的組裝和測試業務轉移到內部的計劃,並使其對供應具有更大的控制權。

- 2023 年 1 月,Teledyne Technologies 旗下的 Teledyne e2v 推出了 Hydra3D+,這是一款新型飛行時間 (ToF) CMOS 影像感測器,解析度為 832 x 600 像素,專為靈活的 3D 偵測和測量而設計。獨特的片上多系統管理能力使得感測器能夠與許多主動系統並行工作,而不會產生干擾或不準確的資料。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 宏觀經濟趨勢如何影響市場

- 市場促進因素

- 各行各業擴大採用機器視覺系統

- 配備 3D 相機的智慧型手機的需求不斷增加

- 市場挑戰

- ToF 感測器的局限性

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 按類型

- 帶有相位檢測器的射頻調變光源

- 距離門成像器

- 直接飛行時間成像儀

- 按應用

- 擴增實境和虛擬實境

- LiDAR

- 機器視覺

- 3D 成像和掃描

- 機器人和無人機

- 按行業

- 消費性電子產品

- 車

- 娛樂和遊戲

- 產業

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Texas Instruments Incorporated

- STMicroelectronics NV

- Infineon Technologies AG

- Panasonic Corporation

- Sony Corporation

- Teledyne Technologies International Corp.

- Keyence Corporation

- Sharp Corporation

- Omron Corporation

- Invensense Inc.(TDK Corporation)

第7章投資分析

第 8 章:市場的未來

The Time-of-Flight Sensor Market size is estimated at USD 6.68 billion in 2025, and is expected to reach USD 17.38 billion by 2030, at a CAGR of 21.07% during the forecast period (2025-2030).

Key Highlights

- The market under study is driven by the rising demand for smartphones equipped with 3D cameras. One of the smartphones' most notable and popular features is their toF cameras. Additionally, it is noted that more people worldwide are subscribing to mobile networks for smartphones. According to Ericsson, smartphone mobile network subscriptions worldwide reached approximately 6.6 billion in 2022 and are expected to surpass 7.8 billion by 2028. The nations with the most smartphone mobile network subscriptions are China, India, and the United States.

- This market's expansion is primarily fueled by rising automotive industry demand for ToF sensors, rising 3D camera use in smartphones, and rising smartphone usage. The market for ToF sensors contains a lot of room to develop because of the expanding use of Industry 4.0 and 3D machine vision systems across various industries.

- As per Edison Investment Research and OICA, forward-facing automotive camera unit sales will increase in Western Europe from 2016 to 2025. By 2025, some 15.5 million forward-facing automotive camera systems are expected to be sold in Western Europe, which also includes 3D cameras altogether.

- Additionally, 3D imaging and scanning will rule the market for ToF sensors throughout the expected timeframe. An object can be turned into a 3D model using 3D scanning technology. The specific area and dimensions of the object are collected, and this mapping data can be used for designing using depth sensing. Future years will see a rise in the adoption of 3D scanning technology because it is easy to use. Time-of-flight technology is an active type of 3D image and scanning technology. Structured light and stereo vision, the other two 3D imaging techniques, are slower, less trustworthy, and use more energy than ToF. ToF technology is anticipated to experience an increase in demand for 3D imaging and scanning applications because of its accessibility.

- TOF technology includes the benefits of long working distances, wide application range, and high distance accuracy. However, there are many disadvantages. For instance, the current mainstream ToF sensor on the mobile phone includes a relatively low resolution (180*240, 240*320, 240*480, etc.), so the accuracy and X/Y resolution in the close range may be relatively low.

- The rising use of cameras in AR and VR may open up new opportunities for the market in post-COVID-19 recovery. Sony Corporation introduced the IMX500, which includes both processing power and memory. This image sensor performs machine learning (ML) and aids in powering computer vision processes without using any external hardware. 3D ToF image sensors could be used in smartphones to provide 3D awareness of the environment for AR/VR applications.

Time-of-flight (TOF) Sensor Market Trends

Consumer Electronics to be the Largest End User

- The demand for Time-of-Flight sensors is increasing owing to their applications in smartphones, tablets, household robots, digital cameras, smart speakers, and PC projectors. However, devices concerning the gaming and entertainment industry are excluded from the segment. A ToF camera sensor measures the distance and volume and offers object scanning, indoor navigation, obstacle avoidance, gesture recognition, object tracking, and reactive altimeters.

- In smartphones, ToF sensors are used for various purposes, including biometric security (particularly facial recognition, cameras, movement tracking, and others. ToF sensors make the smartphone camera superior. It is used in mobile devices for photography features such as blurring effects and auto-focus and enables the camera to capture objects, background, and movement of human body parts. Moreover, it also provides an eye-catching special effect, particularly in fast-action scenes.

- According to Ericsson, worldwide smartphone subscription is expected to reach 7,516.0 million units by 2026. Thus, the increasing adoption of high-end smartphones led smartphone manufacturers to introduce advanced features to stay ahead of the competitors. It contributed to the TOF sensors market growth and is expected to do so over the study period. In line with this, in August 2022, Samsung announced it is working on its version of the 3D ToF sensor, which may debut with the Galaxy S21 series. The sensor in the smartphone will bring better face recognition and depth sensing capabilities.

- Several leading manufacturers operating in the market studied are focusing on developing new products to meet the growing demand. For instance, in June 2022, STMicroelectronics NV announced its newest FlightSense ToF ranging sensor for smartphone camera management and virtual/augmented reality. It features innovative metasurface lens technology and an energy-efficient architecture that reduces battery drain, extends the camera's autofocus range, and improves scene understanding.

- Furthermore, the rapidly growing smart home concept increased the demand for household/service robots in developed countries. ToF sensors in service robots detect motion to determine the presence of objects and people. The sensor can also work in any lighting conditions, including full sunlight, and provides accurate range measurements independent of the target's color and optical transparency. Moreover, the changing lifestyle, growing urbanization, and increasing penetration of smart consumer products created a favorable scenario for the studied market growth during the forecast period.

Asia-Pacific is Expected to Hold Significant Market Share

- China is the world's largest producer and exporter of consumer electronics, providing the sector with numerous potential for expansion. Additionally, the region's electronics manufacturing sector continued expanding steadily. According to research by the China Academy of Information and Communications Technology, major electronics manufacturers' added value increased 12.7% year over year between January and February 2022, as opposed to the country's total industrial sector's 7.5% rise.

- The consumer electronics market in China is expanding rapidly, reflected in the leading electronics companies' rising added value and rising demand for electronics in the nation. By enabling capabilities like facial recognition, gesture control, and depth sensing, ToF sensors significantly improve the usability and functionality of these gadgets. The need for ToF sensors is projected to rise as the consumer electronics market grows.

- Japan includes a robust consumer electronics market. ToF sensors are used in virtual reality (VR) headsets, gaming consoles, smartphones, and tablets. Market expansion was likely encouraged by consumer demand for these products and their integration with ToF sensors.

- In India, the ToF sensors market is fueled by the rising demand for premium and flagship smartphones and the rising demand for enhanced camera features, AR/VR apps, gesture recognition, face unlock, gaming, and AI capabilities. As customers place greater value on these functionalities, manufacturers of smartphones are anticipated to use ToF sensors more frequently. It will increase the size of the ToF sensors market in India.

- The other countries considered in the Asia Pacific region in this study are Australia, and all Southeast Asian Countries, among others. These countries also include a high potential for gaining a considerable market share. Growing demand for high-end smartphones and other consumer electronics products from countries such as the Republic of Korea and Singapore encourages many companies to set up production establishments in the Asia-Pacific region. The abundant availability of raw materials in countries such as Taiwan, the low establishment of facilities, and labor costs also helped the companies launch their regional production centers.

Time-of-flight (TOF) Sensor Industry Overview

The Time-of-Flight (TOF) Sensor Market is highly fragmented. The brand identity associated with established companies, like Sony Corporation and STMicroelectronics NV, includes a major influence in this market. Strong brands are synonymous with good performance, so long-standing players are expected for an upper hand. Considering their market penetration and the ability to invest in new technologies, the competitive rivalry is expected to continue to be high. Moreover, vendors are investing significantly in the market due to increasing competition.

- June 2023: Texas Instruments Inc. announced plans to expand its internal manufacturing footprint in Malaysia with two new assembly and test factories in Kuala Lumpur and Melaka. Through this expansion, the company aims to support its plan to bring 90% of its internal assembly and test operations by 2030 and include greater supply control.

- January 2023: Hydra3D+, a new Time-of-Flight (ToF) CMOS image sensor with 832 x 600 pixel resolution designed for flexible 3D detection and measurement, is released by Teledyne e2v, a division of Teledyne Technologies. Due to an inventive on-chip multi-system management function, the sensor can operate alongside numerous active systems without interference, resulting in inaccurate data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of Macroeconomics Trend on the Market

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of Machine Vision Systems Across Various Industries

- 4.3.2 Increasing Demand for Smartphones Enabled with 3D Cameras

- 4.4 Market Challenges

- 4.4.1 Limitations of ToF Sensors

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 RF-modulated Light Sources with Phase Detectors

- 5.1.2 Range-Gated Imagers

- 5.1.3 Direct Time-of-Flight Imagers

- 5.2 By Application

- 5.2.1 Augmented Reality and Virtual Reality

- 5.2.2 LiDAR

- 5.2.3 Machine Vision

- 5.2.4 3D Imaging and Scanning

- 5.2.5 Robotics and Drones

- 5.3 By End-user Vertical

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Entertainment and Gaming

- 5.3.4 Industrial

- 5.3.5 Healthcare

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Texas Instruments Incorporated

- 6.1.2 STMicroelectronics NV

- 6.1.3 Infineon Technologies AG

- 6.1.4 Panasonic Corporation

- 6.1.5 Sony Corporation

- 6.1.6 Teledyne Technologies International Corp.

- 6.1.7 Keyence Corporation

- 6.1.8 Sharp Corporation

- 6.1.9 Omron Corporation

- 6.1.10 Invensense Inc. (TDK Corporation)

![飛行時間感測器市場(類型:直接[dToF]和間接[iToF]) - 2023-2031年全球行業分析、規模、佔有率、成長、趨勢和預測](/sample/img/cover/42/1285830.png)