|

市場調查報告書

商品編碼

1690134

浮體式液化天然氣發電廠:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Floating LNG Power Plant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

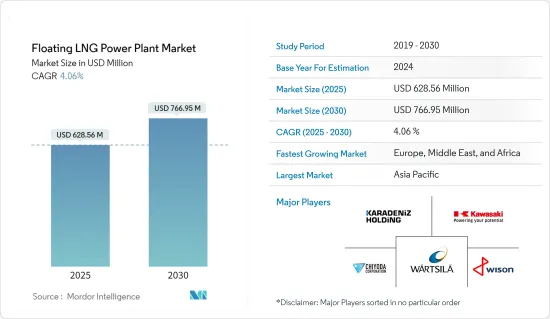

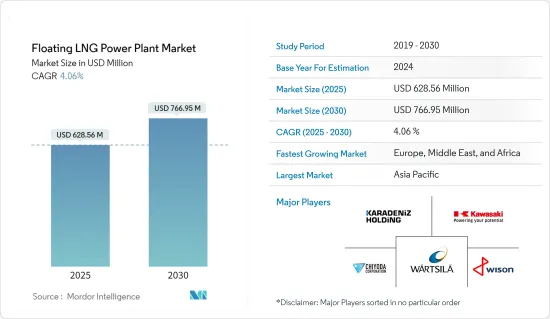

浮體式液化天然氣發電廠的市場規模預計在 2025 年為 6.2856 億美元,預計到 2030 年將達到 7.6695 億美元,預測期間(2025-2030 年)的複合年成長率為 4.06%。

從長遠來看,人口成長導致的電力需求增加以及新興國家缺乏適當的電力基礎設施等因素預計將推動浮體式液化天然氣發電廠市場的發展。

另一方面,波動且多變的液化天然氣價格預計將抑制浮體式液化天然氣發電廠市場的發展。

然而,由於全球排放法規,預計未來液化天然氣的採用將會增加。 LNG是一種相對清潔的燃料,符合廢氣排放法規。國際海事組織關於降低船用燃料含硫量的規定將於 2020 年生效,預計將導致液化天然氣作為船用燃料的使用增加。西非近海的石油和天然氣活動也在增加,這可能會為FLNG發電廠市場帶來機會。

亞太地區最近佔據了相當大的市場佔有率,預計在預測期內將成為最大且成長最快的市場。

浮體式液化天然氣發電廠的市場趨勢

預計動力駁船市場將佔據主導地位

- 發電駁船是一種安裝在平坦浮體結構上的發電設施。與機動船不同,駁船沒有自行推進系統來從一個地方移動到另一個地方,這降低了駁船的生產成本。

- 機動駁船沒有自行推進的運輸系統,需要由其他小船或船艦運送。駁船推進引擎節省下來的空間將用於增加船上的可用空間。

- 由於發電資本支出低、基礎設施可用性低的國家擴大安裝浮體式液化天然氣發電廠,預計未來幾年電力駁船市場將大幅成長。

- 此外,根據《2023 年世界能源統計數據》,天然氣發電量將達到 2022 年的 6,631.39 TWh,高於 2010 年的約 4,883.80 TWh 和 2015 年的 5,635.95 TWh。

- 電力駁船具有多種優勢,促使其在FLNG發電領域中得到應用。這些駁船用於散裝運輸,運輸成本低,且尺寸多樣。這些駁船能夠在低潮海洋中行駛,產生能量並漂浮,從而能夠成功運輸任何類型的貨物。

- 駁船是為特定水域設計的,並且其使用壽命只能在該水域中航行。如果駁船要在其他水域使用,則必須酌情由拖船拖曳或協助。

- 2022 年 6 月,Xcelerate Energy 宣布將為浮體式發電廠提供電力駁船,這些發電廠將在歐洲國家發電並增強電網。該公司還與埃克森美孚公司合作,在阿爾巴尼亞發羅拉港開發液化天然氣發電計劃。

- 鑑於上述情況,預計預測期內浮體式液化天然氣發電廠市場將由電力駁船主導。

亞太地區可望主導市場

- 在亞太地區,能源供需缺口往往透過煤炭、水力、天然氣、核能和可再生能源技術來緩解。大多數經濟體已經基本實現了電力供應。另一方面,再生能源來源已基本消除了電力可靠性問題,表明該地區浮體式液化天然氣發電廠的市場不太可能發展。

- 然而,東南亞很少國家採用浮體式電站來保障其能源供應。據馬來西亞能源部門稱,預計2039年的電力需求將達到約24吉瓦。為了滿足日益成長的需求,各國政府正在採取措施擴大浮體式液化天然氣發電廠等能源系統的規模。

- 2023 年,馬來西亞國家石油公司與 Kejuruteraan Asastera (KAB) 簽署了一份契約,開發和試運行價值 5,220 萬美元的 52MW浮體式液化天然氣發電廠。該浮體式液化天然氣發電廠將位於沙巴。開發工作計劃於 2023 年第二季開始。此外,斯里蘭卡政府已同意於 2022 年與亞洲開發銀行合作對浮體式液化天然氣發電廠進行可行性研究。

- 此外,2022年,印尼預計將接受一艘以液化天然氣為動力的浮體式電力船,以協助滿足該國的發電需求。 BMPP Nusantara-1 有潛力滿足該國偏遠地區的電力需求,並將幫助企業和居民最大限度地減少對租用電力駁船的依賴。

- 鑑於上述情況,預計亞太地區將在預測期內主導浮體式液化天然氣發電廠市場。

浮體式液化天然氣發電廠產業概況

浮體式液化天然氣發電廠市場處於適度整合狀態。市場的主要企業(不分先後順序)包括惠生集團、川崎重工業有限公司、瓦錫蘭公司、千代田公司、Karadeniz Holding。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 增加液化天然氣作為能源來源的使用

- 限制因素

- 太陽能和風力發電的利用日益廣泛

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 組件類型

- 燃氣引擎或燃氣渦輪機

- 內燃機

- 蒸氣渦輪和發電機

- 船舶類型

- 動力船

- 動力駁船

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Kawasaki Heavy Industries Ltd.

- Wartsila Oyj Abp

- Siemens Energy AG

- Waller Marine Inc.

- Wison Group

- Chiyoda Corporation

- Karadeniz Holding

- Market Ranking/Share Analysis

第7章 市場機會與未來趨勢

- 混合發電機的使用為浮體式液化天然氣電力市場帶來巨大機會

The Floating LNG Power Plant Market size is estimated at USD 628.56 million in 2025, and is expected to reach USD 766.95 million by 2030, at a CAGR of 4.06% during the forecast period (2025-2030).

Over the long term, factors such as increasing demand for power due to increasing population and the lack of proper power infrastructures in developing countries are expected to drive the floating LNG power plant market.

On the other hand, high volatility and uneven LNG prices are expected to restrain the floating LNG power plant market.

Nevertheless, LNG adoption is expected to increase in the future owing to global emission norms. LNG, being a comparatively cleaner fuel, fulfills emission regulations. In 2020, IMO's reduced sulfur content in maritime fuel came into force, which is likely to result in the adoption of LNG as a bunker fuel. Offshore West Africa is also seeing increased oil and gas activity that, in turn, will present opportunities in the FLNG power plant market as well.

Asia-Pacific held a significant market share recently, and it is expected to be the largest and fastest market during the forecast period.

Floating LNG Power Plant Market Trends

Power Barge Segment Expected to Dominate the Market

- A power barge is a power plant facility installed on flat floating structures. Unlike power ships, a barge doesn't have a self-propelled system for moving from one location to the other, which cuts the cost of production for barges.

- As these power barges do not have any self-propelled moving systems, they are moved by other small boats or ships. The space saved from the propulsion engines in barges is used for more usable space in the vessel.

- The market for power barge is estimated to grow significantly in upcoming years due to the increasing installation of floating LNG-based power plants in countries with lower CAPEX for power generation or by countries having lower infrastructure availability.

- Moreover, as per the Statistical Review of World Energy 2023, the electricity generation from natural gas reached 6631.39 TWh in 2022 from around 4883.80 TWh in 2010 and 5635.95 TWh in 2015.

- Power barges have several advantages that fuel their adoption across the FLNG power generation segment. These are used to transport bulk with lower transportation costs, and they are available in different sizes. These barges can travel in low-tide water, and they can facilitate successful transportation of any sort of cargo while producing energy and floating.

- The barge is designed to carry out for a specific water body, and that barge can only run in that water body throughout its life. If that barge is used in some different water body, then it needs to be properly tugged or assisted by a tugboat.

- In June 2022, ExcelerateEnergy Inc. announced to supply power barge for floating power plants that will generate electricity and buoy the grid in the European nation. The company is also developing an LNG-to-Power project together with Exxon Mobil Corp. in the Albanian port of Vlora.

- Hence, owing to the above points, the power barge segment is expected to dominate the floating LNG power plant market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- In the Asia-Pacific region, the supply-demand energy gap is often mitigated by sources such as coal, hydro, natural gas, nuclear, and renewable energy technologies. A significant rate of electricity access has been achieved in most of the economies. On the other hand, renewable energy sources have eradicated power reliability issues to the maximum extent, which indicates low chances for the development of a floating LNG power plants market in the region.

- However, few countries in Southeast Asia have adopted floating power plants to secure energy supplies. According to Malaysia's energy authority, the electricity demand is expected to reach about 24 GW in 2039. To cater to the growing demand, the government has taken measures to scale up energy systems, such as floating LNG power plants, to fulfill the same.

- In 2023, Petronas contracted Kejuruteraan Asastera(KAB) to develop and commission a 52MW floating LNG power plant worth USD 52.2 million. The floating LNG power plant would be located at Sabah. The development work is expected to start in the second quarter of 2023. Also, the Sri Lankan government, in association with the Asian Development Bank, agreed to conduct a feasibility study in 2022 on a floating LNG power plant, which could help the country diversify its energy mix.

- Further, in 2022, Indonesia received a floating power barge designed to run on LNG, which is likely to bridge the power generation requirements in the country. BMPP Nusantara-1 holds the potential to fulfill the electricity demand of far-flung areas of the country, which would help businesses and residents minimize their dependence on rented power generation barges.

- Hence, owing to the above points, Asia-Pacific is expected to dominate the floating LNG power plant market during the forecast period.

Floating LNG Power Plant Industry Overview

The floating LNG power plant market is moderately consolidated. Some of the key players in the market (in no particular order) include Wison Group, Kawasaki Heavy Industries Ltd, Wartsila Oyj Abp, Chiyoda Corp, and Karadeniz Holding., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 An Increase in the Use of LNG as an Energy Source

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Solar and Wind Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component Type

- 5.1.1 Gas Engines or Gas Turbines

- 5.1.2 IC Engines

- 5.1.3 Steam Turbines & Generators

- 5.2 Vessel Type

- 5.2.1 Power Ship

- 5.2.2 Power Barge

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Nordic Countries

- 5.3.2.7 Turkey

- 5.3.2.8 Russia

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysis

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Kawasaki Heavy Industries Ltd.

- 6.3.2 Wartsila Oyj Abp

- 6.3.3 Siemens Energy AG

- 6.3.4 Waller Marine Inc.

- 6.3.5 Wison Group

- 6.3.6 Chiyoda Corporation

- 6.3.7 Karadeniz Holding

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage Of Hybrid Gensets Provides A Significant Opportunity for the Floating LNG Power Market