|

市場調查報告書

商品編碼

1690141

低溫泵:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Cryogenic Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

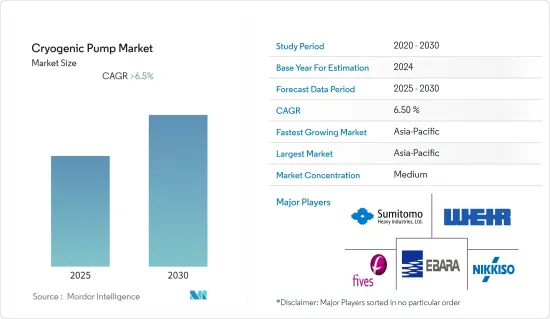

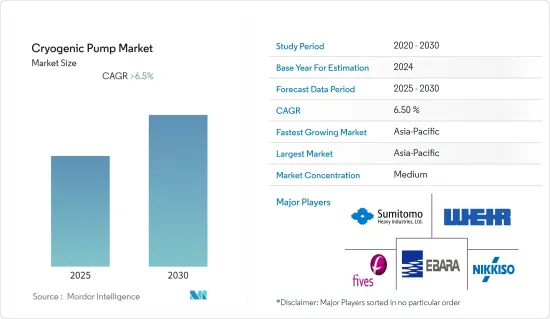

預計預測期內低溫幫浦市場複合年成長率將超過 6.5%。

由於正排量低溫泵在各種終端行業中的應用以及相對於動態泵的優勢,預計在預測期內,正排量低溫泵領域的需求將顯著成長。

由於低溫泵主要用於太陽能板的製造,對太陽能的日益關注和太陽能光伏製造基礎設施的發展可能會在未來幾年創造巨大的機會。

預計亞太地區將主導市場,大部分需求來自中國和印度等國家。

低溫泵市場趨勢

正排量低溫幫浦強勁成長

正排量幫浦 (PDP) 或往復式低溫幫浦旨在將馬達的機械能轉換為泵送流體的機械能。此幫浦的基本動作是將一定量的液體還原並置換到汽缸中。通常,正排量低溫幫浦由動力幫浦和直動幫浦組成。例如,動力幫浦使用帶有馬達或引擎的曲軸,而直動幫浦使用氣體或液體等動力流體。

由於雙相流體,這些泵浦通常取代離心式低溫泵浦使用。例如,這些泵浦設計用於運輸液體和固體顆粒的混合物。由於混合物中含有固體顆粒,離心式幫浦浦的葉輪可能會損壞,導致泵浦故障,因此 PDP 類型比動態類型具有優勢。

PDP 通常用於將低溫氣瓶和氣體填充到工業和醫用瓶中。此外,這些泵浦也用於其他幾種工業LNG和CO2應用。

2020 年 1 月,Ampco Pumps 推出了用於低溫處理應用的低溫泵技術。 ZP3 系列正排量型採用高度專業的內部密封設計,適用於低至 -70°F 或 -56 度C 的低溫處理。

因此,基於上述因素,正排量低溫泵將出現顯著成長,從而在預測期內推動低溫泵市場的需求。

亞太地區佔市場主導地位

亞太地區由於工業基礎設施的發展正在經歷強勁的經濟成長。中國、印度和其他亞洲國家等能源豐富的經濟體對液化天然氣(LNG)運輸和儲存的需求不斷成長,推動了亞太地區低溫泵市場的成長。

亞太地區對基礎設施領域的高投資和對可再生能源發電的日益關注預計將為全球低溫泵市場提供巨大的成長機會。

中國是電子及半導體產業需求龐大的主要國家之一。中國製造商高度注重加強材料、零件和設備領域的能力。

2020年,印度在蒙德拉運作第六個LNG接收站。該LNG接收站的產能為每天0.6億立方英尺,總合氣化產能為每天5.2億立方英尺。截至 2020 年,還有 4 個 LNG 進口終端正在建設中,預計將於 2023 年運作,將增加 25 億立方英尺/天的 LNG 進口能力。這些終端可能會增加該國對低溫泵的需求。

2021 年 1 月,法孚集團訂單,為中國一個新的空氣分離裝置 (ASU) 購買 13 台 Cryomec® 低溫離心式幫浦。此新建空分裝置的製氧能力將超過2000噸/日,將建於天津港保稅區港口經濟區。預計營運將於 2022年終。

因此,由於上述因素,預計亞太地區將在預測期內主導低溫泵市場。

低溫泵產業概況

低溫泵市場中等程度分散。市場的主要企業包括日機裝、住友重工業有限公司、法孚集團、荏原株式會社、威爾集團等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模與需求預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 動態泵浦

- 正排量泵

- 氣體

- 氮

- 氧

- 氬氣

- LNG

- 其他氣體

- 最終用戶

- 發電

- 化學

- 衛生保健

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Nikkiso Co. Ltd

- Sumitomo Heavy Industries Ltd

- Flowserve Corporation

- Ebara Corporation

- Weir Group PLC

- Fives Group

- Beijing Long March Tianmin Hi-Tech Co. Ltd

- KSB SE & Co. KGaA

- PHPK Technologies Inc.

- Cryostar SAS

第7章 市場機會與未來趨勢

The Cryogenic Pump Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The positive displacement cryogenic pumps segment is expected to witness significant demand during the forecast period, owing to its adoption in various end-use industries and its advantages when compared to dynamic pumps.

Growing focus on solar power generation and development of solar PV manufacturing infrastructure can create immense opportunities over the coming years because cryogenic pumps are majorly used in the manufacturing of solar panels.

Asia-Pacific is expected to dominate the market, with a majority of the demand coming from countries such as China and India.

Cryogenic Pump Market Trends

Positive Displacement Cryogenic Pump Segment to Witness Significant Growth

Positive displacement pump (PDP) or reciprocating cryogenic pumps are designed to convert motor mechanical energy into pumped fluid mechanical energy. The basic operation of this pump consists of restoring and displacing a fixed liquid volume cylindrically. Typically, a positive displacement cryogenic pump consists of a power pump and a direct-acting pump. For instance, a power pump utilizes a crankshaft with a motor or engine, while a direct-acting pump uses a drive fluid, such as a gas or liquid.

These pumps are typically used over centrifugal cryogenic pumps because of a two-phase fluid. For instance, these pumps are designed to transport a mixture of liquid and solid particles. Because of the solid particles in the mixture, the impeller of the centrifugal pump could be damaged, leading to the breakdown of these pumps, hence giving an edge to the PDP type over the dynamic one.

PDPs are mostly used for cryogenic cylinder filling and industrial and medical bottle filling with gaseous products. Moreover, these pumps are also used in several other industrial LNG and CO2 applications.

In January 2020, Ampco Pumps introduced cryo-pump technology for low-temperature processing applications. The ZP3 series positive displacement has been designed with highly specialized internal seals for processing at temperatures as low as -70°F or -56°C.

Therefore, based on the abovementioned factors, positive displacement cryogenic pumps are expected to witness significant growth, which, in turn, is expected to boost the demand for the cryogenic pump market during the forecast period.

Asia-Pacific to Dominate the Market

Asia-Pacific is witnessing huge economic growth due to the development of industrial infrastructure. The demand for shipping and storing liquified natural gas (LNG) is increasing in energy-famished economies, such as China, India, and other Asian countries, which is driving the growth of the cryogenic pump market in the Asia-Pacific region.

High investments in the infrastructure sector and an increase in focus on renewable-based electricity generation in the Asia-Pacific region is expected to provide substantial growth opportunities for the global cryogenic pumps market.

China is one of the major countries with significant demand in the electronics and semiconductor industry. Manufacturers in China are highly focused on strengthening their capabilities in the fields of materials, components, and equipment.

In 2020, India commissioned its sixth LNG Terminal in Mundra. The LNG terminal had a capacity of 0.6 bcf/d, bringing the total regasification capacity to 5.2 Bcf/d. As of 2020, four more LNG import terminals were under construction and expected to come online by 2023, adding 2.5 bcf/d of LNG import capacity. The terminals are likely to propel the demand for cryogenic pumps in the country.

In January 2021, Fives Group was awarded a contract for the supply of 13 Cryomec(R) cryogenic centrifugal pumps for a new Air Separation Unit (ASU) in China. The new ASU, with an oxygen production capacity of more than 2,000 ton per day, will be built in the Lingang Economic District, Tianjin Port Free Trade Zone. It is expected to become operational by the end of 2022.

Therefore, based on the abovementioned factors, the Asia-Pacific region is expected to dominate the cryogenic pump market over the forecast period.

Cryogenic Pump Industry Overview

The cryogenic pump market is moderately fragmented. The key players in the market include Nikkiso Co. Ltd, Sumitomo Heavy Industries Ltd, Fives Group, Ebara Corporation, and Weir Group PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dynamic Pump

- 5.1.2 Positive Displacement Pump

- 5.2 Gas

- 5.2.1 Nitrogen

- 5.2.2 Oxygen

- 5.2.3 Argon

- 5.2.4 LNG

- 5.2.5 Other Gases

- 5.3 End User

- 5.3.1 Power Generation

- 5.3.2 Chemicals

- 5.3.3 Healthcare

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nikkiso Co. Ltd

- 6.3.2 Sumitomo Heavy Industries Ltd

- 6.3.3 Flowserve Corporation

- 6.3.4 Ebara Corporation

- 6.3.5 Weir Group PLC

- 6.3.6 Fives Group

- 6.3.7 Beijing Long March Tianmin Hi-Tech Co. Ltd

- 6.3.8 KSB SE & Co. KGaA

- 6.3.9 PHPK Technologies Inc.

- 6.3.10 Cryostar SAS