|

市場調查報告書

商品編碼

1690158

路線最佳化軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Route Optimization Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

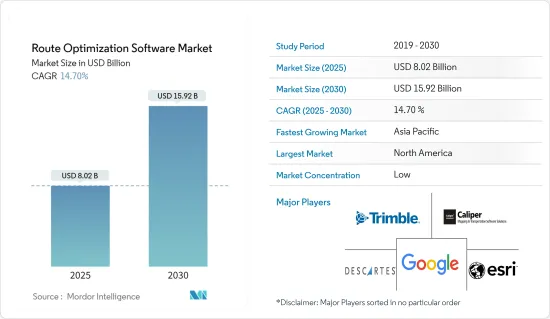

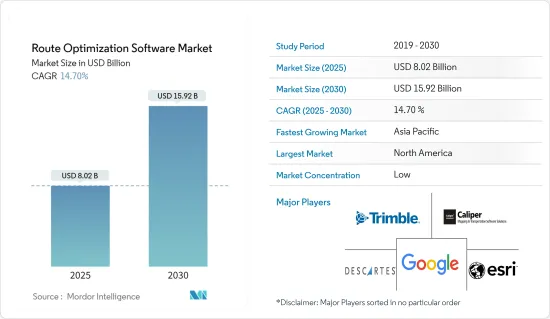

路線最佳化軟體市場規模預計在 2025 年為 80.2 億美元,預計到 2030 年將達到 159.2 億美元,預測期內(2025-2030 年)的複合年成長率為 14.7%。

路線最佳化軟體可以規劃、安排和計算最有效的車輛路線,節省您的時間和金錢。當您有多個停靠點、客戶會議和產品交付時,路線最佳化軟體會非常有用。該軟體透過使用場景測試和歷史資料來確定哪些路線最慢或最擁擠,從而避免交通堵塞。

研究中的市場數據代表來自不同終端用戶的收益,包括按需食品配送、零售和快速消費品、現場服務、叫車和計程車服務等。食品和飲料、零售和電子商務以及物流等多個行業正在轉變其業務流程,以提供配送服務,例如按需食品配送、零售和雜貨配送服務以及電子商務配送。預計這些發展將大大促進對路線最佳化軟體日益成長的需求。

隨著燃料價格飆升,運輸成本上昇在所難免,影響貨物需求,造成物流業收益與利潤下降。企業專注於透自訂的物流路線最佳化解決方案來最佳化和管理車隊路線,而物流公司則專注於透過減少時間和里程來維持運輸成本、維持客戶滿意度並增加利潤。

傳統物流系統需要增加硬體投資,這常常導致擴充性的限制。然而,雲端基礎的解決方案的出現使企業能夠降低成本,同時獲得無與倫比的靈活性。物流供應商可以擴大業務規模,以適應需求和業務成長的波動。大多數雲端解決方案採用訂閱模式,因此比購買硬體和軟體更實惠。硬體成本下降使企業能夠投資所需的伺服器、儲存設備和高效能網路設備。

路線最佳化軟體的準確性取決於底層資料的品質。因此,與資料相關的不準確性可能導致路線決策不理想、資源利用效率低下以及客戶對軟體的不滿。例如,如果路線最佳化軟體不能考慮非結構化資料模式,就會導致路線效率低下和運送不佳。

新冠肺炎疫情正在影響世界各地的生活和商業。隨著新冠肺炎疫情的持續,快遞公司面臨多重障礙。由於到府限購的限制,網路買菜增加。如圖所示,網路使用者數量顯著增加。超級市場配送需求的增加對電子商務、線上零售和雜貨公司按時送貨構成了重大障礙。受此影響,路線最佳化軟體產業在疫情期間和疫情後都蓬勃發展。

路線最佳化軟體市場趨勢

按需食品配送大幅成長

- 在後疫情時代,按需宅配已成為全球成長最快的產業之一。自疫情爆發以來,隨著新的按需送餐業務的出現,該行業經歷了成長。隨著客戶對快速送餐的期望越來越高,對路線最佳化軟體的需求也隨之增加,以幫助食品配送業者實現最高效率並確保及時送餐,同時最大限度地降低費用。

- 隨著消費者對按需送餐需求的巨大變化,科技已成為送餐業務成功的關鍵。對於快餐連鎖店來說,網上訂餐已迅速成為其業務的主要部分。這導致對路線最佳化軟體的需求迅速成長,該軟體提供準確的預計到達時間 (ETA) 計算和通訊,以實現更快的交付並改善最終客戶體驗。

- 智慧型手機的廣泛使用和網際網路在全球的普及促進了網上訂餐。根據GSMA的《2023年行動經濟》報告,北美智慧型手機普及率將佔總行動連線的84%,預計到2030年將成長到90%。

- 隨著千禧世代的偏好從傳統外食轉向各種隨選送餐服務,送餐業者也開始專注於隨選送餐服務,為預測期內採用路線最佳化軟體創造了機會。

亞太地區預計將佔據主要市場佔有率

- 亞太地區正在經歷快速的都市化和人口成長,導致中國、印度和日本等主要國家的交通堵塞加劇。受此影響,DHL、FedEx 和 Bluedart 等物流公司已開始使用路線最佳化軟體來幫助公司高效地穿越都市區並減少運輸時間和燃料消耗,從而推動了該地區對路線最佳化軟體的需求。

- 食品配送、雜貨配送和叫車服務等隨選服務在亞洲迅速普及。許多按需配送公司已在亞洲開展業務,例如 Zepto、Blinkit 和 Zomato。這就是為什麼這些公司擴大採用路線來最佳化解決方案的原因。路線最佳化解決方案對於最佳化按需運送路線、提高效率和增加客戶滿意度至關重要。

- 此外,隨著全球化日益深入,亞太地區對高效率跨境物流解決方案的需求日益成長。路線最佳化解決方案可協助企業規劃和最佳化跨境路線,管理清關程序,並確保及時交付。

- 此外,由於電子商務活動的激增,該地區的運輸量也在增加。路線最佳化軟體可協助零售商和快速消費品公司管理將貨物分發到不同地點的複雜性,提高運送速度並降低成本。

- 因此,亞太地區對路線最佳化軟體的需求不斷成長,是由企業降低成本、提高效率和滿足不斷成長的客戶期望的需求所推動的。利用路線最佳化解決方案,企業可以發掘新機會,克服物流挑戰,並在充滿活力且快速發展的亞太市場中蓬勃發展。

路線最佳化軟體市場概覽

路線最佳化軟體市場比較分散,由全球和地區競爭者組成。市場對新參與企業的進入門檻很高,有幾家新參與企業正在推動市場:Trimble Inc.、Caliper Corporation、The Descartes Systems Group Inc.、ESRI Global Inc. 和 Google LLC(Alphabet Inc.)。

2024 年 2 月-笛卡爾系統集團宣布,Arctic Glacier 透過利用笛卡爾的戰略路線規劃解決方案最佳化從 100 多個設施和 1,000 多輛車輛向美國和加拿大的 75,000 個客戶地點的冰塊運送,提高了配送網路效率、車輛性能和客戶體驗。

2023 年 9 月 - Trimble 推出 Appian Daily Planner,這是一種雲端基礎的多商店、多車輛路線最佳化解決方案,可提高準時交貨率、資產利用率和客戶服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 宏觀趨勢如何影響市場

第5章 市場動態

- 市場促進因素

- 增加物流專用解決方案的使用

- 降低硬體和連接成本

- 市場限制

- 資料結構化和非結構化資料

第6章 市場細分

- 按最終用戶產業

- 按需送餐

- 零售和快速消費品

- 現場服務

- 叫車和計程車服務

- 其他最終用戶產業

- 按組織規模

- 中小型企業

- 大型企業

- 按部署形式

- 雲

- 本地

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Trimble Inc.

- Caliper Corporation

- The Descartes Systems Group Inc.

- ESRI Global Inc.

- Google LLC(Alphabet Inc.)

- TrackoBit(InsightGeeks Solutions Pvt. Ltd)

- Microlise Group PLC

- Omnitracs LLC

- Ortec BV

- Paragon Software Systems PLC

- PTV Planung Transport Verkehr GMBH

- Route4me LLC

- Routific Solutions Inc.

- Verizon Connect Solutions Inc.

- WorkWave LLC

第8章投資分析

第9章:市場的未來

The Route Optimization Software Market size is estimated at USD 8.02 billion in 2025, and is expected to reach USD 15.92 billion by 2030, at a CAGR of 14.7% during the forecast period (2025-2030).

Route optimization software plans, schedules, and calculates the most efficient vehicle route, saving time and money. Route optimization software comes in handy when there are several stops, client meetings, and product delivery. This software avoids traffic congestion by utilizing scenario testing and historical data to determine which route is the slowest or busiest.

The study's market numbers indicate the revenue generated from various end users, such as on-demand food delivery, retail and FMCG, field services, ride-hailing and taxi services, and other end-user verticals. Several industries, such as food and beverages, retail and e-commerce, and logistics, are increasingly transforming their business processes to provide delivery services, including on-demand food delivery, retail and grocery delivery services, and e-commerce delivery. Such developments are expected to boost route optimization software's increasing demand significantly.

With fuel prices soaring, delivery costs are inevitably rising, impacting demand for goods and causing a drop in revenue and profit for the logistics industry. Businesses emphasize optimizing and managing their fleet routes with a custom logistics route optimization solution, and logistics companies focus on retaining their delivery costs, keeping customers satisfied, and making more profit through reductions in time and mileage.

Traditional logistics systems often require increased hardware investments, leading to scalability constraints. However, with the advent of cloud-based solutions, enterprises can now gain unparalleled flexibility at reduced costs. Logistics providers can scale their operations, accommodating demand fluctuations and business growth. Most cloud solutions operate on a subscription model, making it more affordable than purchasing hardware and software. With declining hardware costs, enterprises can invest in the required servers, storage devices, and networking equipment for high performance.

The accuracy of route optimization software depends on the quality of underlying data. Thus, inaccuracy related to data may lead to suboptimal route decisions, inefficient resource utilization, and customer dissatisfaction with the software. For example, if the route optimization software cannot account for unstructured data patterns, it may lead to inefficient routes, resulting in poor delivery.

The COVID-19 pandemic has had an influence on everyone's lives and businesses throughout the world. During the continuing COVID-19 outbreak, delivery companies confront several obstacles. Due to the lockdown limitations, there has been an increase in internet grocery buying. The growth in internet users has been significant, as indicated in the graph; this increased demand for supermarket delivery poses a significant barrier for e-commerce, online retail, and grocery firms to deliver supplies on time. As a result of these circumstances, the route optimization software sector flourished during the pandemic and the current post-pandemic period.

Route Optimization Software Market Trends

On-demand Food Delivery to Witness Significant Growth

- In the post-COVID era, on-demand food delivery has become one of the fastest-growing industries worldwide. The industry witnessed growth in the emergence of new on-demand food delivery businesses post-pandemic. Evolving customer expectations for fast delivery have necessitated the demand for route optimization software to help food delivery businesses achieve maximum efficiency and ensure timely delivery while minimizing expenses.

- With the dramatic shifts in consumer demand for on-demand food delivery, technologies are becoming critical for food delivery businesses to thrive. Online food ordering has quickly become a major part of the business for fast-food restaurant chains. Therefore, the demand for route optimization software is quickly gaining traction to deliver fast with accurate ETA calculation and communication to improve the end-customer experience.

- The high adoption of smartphones across the world and internet penetration prompted online food ordering. According to the Mobile Economy 2023 of GSMA, North America's smartphone adoption rate accounts for 84% of the total mobile connections, and it is expected to increase to 90% by 2030, along with regions like CIS and Asia-Pacific forecast to register larger growth.

- Along with millennials shifting their inclinations from conventional eat-out to various on-demand food delivery services, food delivery businesses are focusing on on-demand food delivery services, thus creating an opportunity to adopt route optimization software over the forecast period.

Asia-Pacific is Expected to Hold Significant Market Share

- The Asia-Pacific region is experiencing significant urbanization and population growth, leading to increased congestion and city traffic congestion in major countries such as China, India, and Japan. Due to this, logistic companies such as DHL, FedEx, Bluedart, and others have started using route optimization software that helps businesses navigate urban areas efficiently, reducing delivery times and fuel consumption, which is driving the demand for route optimization software in the region.

- The popularity of on-demand services, including food delivery, grocery delivery, and ride-hailing, is growing rapidly in Asia. Many companies such as Zepto, Blinkit, Zomato, and others that offer on-demand delivery have started in Asia. Hence, these companies are increasingly adopting route optimization solutions. Route optimization solutions are crucial in optimizing routes for on-demand deliveries, improving efficiency, and enhancing customer satisfaction.

- In addition, with increasing globalization, there is a growing demand for efficient cross-border logistics solutions in the Asia-Pacific region. Route optimization solutions assist businesses in planning and optimizing cross-border routes, managing customs procedures, and ensuring timely deliveries.

- Additionally, the surge in e-commerce activities in the region has led to a higher volume of deliveries. Route optimization software helps retailers and FMCG companies manage the complexities of delivering goods to diverse locations, improving delivery speed and reducing costs.

- Therefore, the rising demand for route optimization software in the Asia-Pacific region is driven by the need for businesses to reduce costs, improve efficiency, and meet customers' growing expectations. By utilizing route optimization solutions, businesses can unlock new opportunities, overcome logistical challenges, and position themselves for success in the dynamic and rapidly evolving Asia-Pacific market.

Route Optimization Software Market Overview

The route optimization software market is fragmented and comprises global and regional players in the competitive market space. Although the market poses high barriers to entry for the new players, several new entrants have gained traction: Trimble Inc., Caliper Corporation, The Descartes Systems Group Inc., ESRI Global Inc., Google LLC (Alphabet Inc.)

February 2024 - Descartes Systems Group announced that Arctic Glacier improved its distribution network efficiency, fleet performance, and customer experience by using Descartes' strategic route planning solution to optimize ice distribution from over 100 facilities and 1,000 vehicles to 75,000 customer locations across the United States and Canada.

September 2023 - Trimble introduced Appian Daily Planner, a cloud-based solution for multi-stop, multi-vehicle route optimization that improves on-time deliveries, asset utilization, and customer service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impacts of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Logistics-Specific Solutions

- 5.1.2 Declining Hardware and Connectivity Costs

- 5.2 Market Restraints

- 5.2.1 Handling Structured and Unstructured Data

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 On-Demand Food Delivery

- 6.1.2 Retail and FMCG

- 6.1.3 Field Services

- 6.1.4 Ride Hailing and Taxi Services

- 6.1.5 Other End-user Verticals

- 6.2 By Size of the Organization

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprises

- 6.3 By Deployment Mode

- 6.3.1 Cloud

- 6.3.2 On-Premise

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trimble Inc.

- 7.1.2 Caliper Corporation

- 7.1.3 The Descartes Systems Group Inc.

- 7.1.4 ESRI Global Inc.

- 7.1.5 Google LLC (Alphabet Inc.)

- 7.1.6 TrackoBit (InsightGeeks Solutions Pvt. Ltd)

- 7.1.7 Microlise Group PLC

- 7.1.8 Omnitracs LLC

- 7.1.9 Ortec BV

- 7.1.10 Paragon Software Systems PLC

- 7.1.11 PTV Planung Transport Verkehr GMBH

- 7.1.12 Route4me LLC

- 7.1.13 Routific Solutions Inc.

- 7.1.14 Verizon Connect Solutions Inc.

- 7.1.15 WorkWave LLC