|

市場調查報告書

商品編碼

1690165

輪胎翻新:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Tire Retreading - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

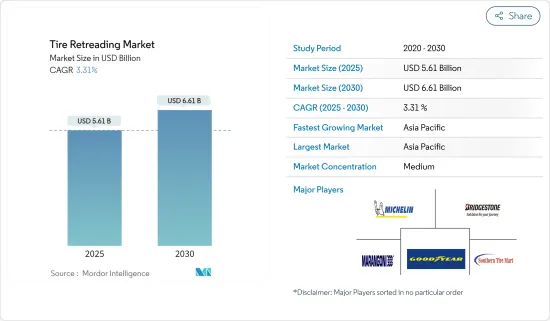

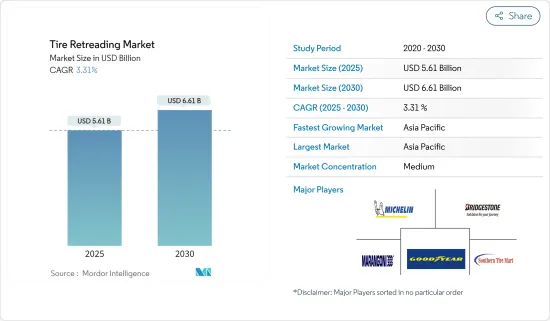

2025 年輪胎翻新市場規模預計為 56.1 億美元,預計到 2030 年將達到 66.1 億美元,預測期內(2025-2030 年)的複合年成長率為 3.31%。

2020年,由於為應對新冠疫情而實施的停工措施,全球汽車產業面臨重大挑戰。這些停工導致上半年包括輪胎翻新在內的製造活動暫停了數週,阻礙了市場成長。然而,到 2023 年,汽車產業強勁復甦,預示著未來幾年輪胎翻新市場將呈現良好的發展軌跡。

根據中期預測,輪胎翻新市場將因新輪胎價格上漲而加強,尤其是運動型多功能車市場。此次輪胎價格上漲,很大程度是由於天然橡膠成本上漲以及原油價格波動所致。此外,全球商用車持有的增加也有望刺激市場擴張。

輪胎製造商認知到輪胎翻新的需求日益成長,並正在深入研究這項技術。例如

主要亮點

- 2023年7月,Bridgestone宣布了加強輪胎材料回收的雄心勃勃的計畫。該公司專注於生產“可輕鬆重複使用的橡膠”,旨在將廢棄輪胎轉化為新輪胎。Bridgestone支持可再生資源並推廣諸如翻新(將新胎面安裝到磨損的輪胎上)和化學回收(將廢舊輪胎重新用作原料)等技術。

翻新輪胎環保且成本低於新輪胎,預計將推動輪胎翻新市場的發展。翻新輪胎不僅可以透過重新使用現有輪胎來節省垃圾掩埋場,還可以減少碳排放並節省數百萬加侖的石油(生產新輪胎的重要資源)。

輪胎翻新市場趨勢

商用車是輪胎翻新市場最大的細分市場

商用車領域由於輪胎使用率和損耗率率高而引領輪胎翻新市場。該領域的卡車、巴士和重型運輸車輛每天都要長途行駛,導致輪胎劣化很快。對於車隊營運商來說,翻新輪胎是一種經濟有效的替代方案,與購買新輪胎相比,可顯著降低營業成本。由於輪胎費用佔商業車隊維護成本的很大一部分,因此翻新是一種經濟可行的選擇,可延長輪胎壽命並確保一致的性能。

此外,輪胎翻新的環境效益對其在商用車領域的吸引力起著至關重要的作用。翻新輪胎所需的原料和消費量比生產新輪胎少得多,產生的碳足跡也更小。車隊營運商越來越意識到這種環境效益,並熱衷於採用永續的做法,加強其企業社會責任形象。此外,隨著許多地區的監管機構推行環保做法,翻新輪胎市場也逐漸成為商用車的首選。

技術的進步和翻新過程的可靠性進一步鞏固了商用車領域對翻新輪胎的採用。預固化和模具固化製程等現代技術可確保翻新輪胎達到新輪胎的性能和安全性。這種新發現的可靠性增強了優先考慮車輛安全和性能的車隊營運商的信心。高品質的翻新服務廣泛普及,強大的翻新設施網路進一步使商用車營運商能夠使用翻新輪胎,從而加強了該領域在輪胎翻新市場的領導地位。

此外,市場參與者正在推出折扣、具成本效益的政策和新產品的發布,這些可能會在未來幾年推動市場成長。例如

大陸輪胎的 Conti Bharosa 計劃為製造缺陷提供延長五年的保修,超過了印度輪胎製造商傳統上提供的兩到三年的保固。此外,Conti Bharosa 還為標準負載應用中使用的輪胎提供第二次輪胎壽命保修,以防止第一次翻新後的製造缺陷。

此外,輪胎翻新在中型車輛中蓬勃發展,增加了最後一哩配送服務和物流公司的採用。例如,UPS和FedEx等大型宅配公司已經在最後一哩的業務中使用翻新輪胎。固特異意識到中型卡車市場的不斷成長,並正在增加對輪胎翻新的投資,以作為戰略成本削減措施。

亞太地區仍為最大市場

中國是全球汽車大國,擁有全世界持有的乘用車。這項優勢不僅凸顯了中國在乘用車和商用車生產中的關鍵作用,也預示著輪胎翻新需求的激增。 2023年,中國乘用車和商用車產量將達3,016萬輛,年均成長率達12%。

日本總合899 萬輛註冊機動車,其中包括 123 萬輛商用車,也是輪胎翻新領域的重要參與者。日本大量的商用車和先進的技術力正在推動優質翻新輪胎製程的進步和廣泛應用。日本對永續性的承諾與輪胎翻新的環保效益完美契合,不僅節省了原料,也減少了廢棄物。此外,日本的嚴格規定確保翻新輪胎保持出色的安全和性能標準,使其成為商業營運商的可靠且經濟的選擇。

在印度,運輸和物流業嚴重依賴商用車,因此對輪胎翻新服務的需求強勁。考慮到印度的成本敏感型市場,翻新輪胎已成為一種戰略優勢,使車隊營運商能夠大幅降低營運成本。此外,印度基礎設施計劃激增和道路網路擴張導致商用車使用量增加,進一步推動輪胎翻新市場的成長。

此外,由於眾多的原料供應商和政府的支持政策,汽車輪胎市場正在蓬勃發展。由於農業車輛在日本、中國和韓國等國家佔據重要地位,該領域對汽車輪胎的需求依然強勁。

考慮到所有這些動態,再加上最近啟用的新輪胎翻新製造設施,輪胎翻新市場在未來幾年將呈現良好的發展軌跡。

輪胎翻新產業概況

普利司通公司、Southern Tire Mart、TreadWright 和固特異等主要企業主導著輪胎翻新市場。這些行業領袖推動永續解決方案和創新技術,為商業車隊和更廣泛的運輸業提供服務。例如

- 2023 年 12 月,Bridgestone在 2024 年國際消費電子展 (CES) 上參展,宣布其對永續性和效率的承諾。BridgestoneBandag翻新服務以及ENLITEN技術和先進的車隊管理解決方案等創新技術證明了輪胎壽命的永續延長。

- 2023年11月,米其林在法國里昂舉行的2023年Solutrans展會上亮相,展示了其環保輪胎系列。米其林 X-Multi HD Z 和 Agilis CrossClimate 等重點產品利用其在滾動阻力和再生材料方面的專業知識來減少對環境的影響。此外,米其林也將推出「米其林互聯行動」服務套件。

- 2023 年 9 月,米其林宣布幾乎所有卡車和巴士輪胎都可以翻新,達到了一個里程碑。為了紀念輪胎翻新一百週年,米其林自豪地表示,位於英國和德國的工廠已經翻新了約 3,000 萬條輪胎。這項成果不僅彰顯了米其林的能力,還意味著節省 150 萬噸原料並減少約 350 萬噸二氧化碳排放。此舉措的標誌性技術米其林 Remix 製程可確保更新的胎面與新輪胎材料和技術相容,從而秉持該品牌對安全性、牽引力和抓地力的承諾。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 環境效益推動成長

- 市場限制

- 橡膠產量下降,原料成本不穩定

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 車型

- 搭乘用車

- 輕型商用車

- 中大型貨車

- 公車

- 製造方法

- 光之美少女

- 黴菌治愈

- 輪胎類型

- 徑向

- 偏見

- 堅硬的

- 銷售管道

- OEM

- 獨立翻新商

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 墨西哥

- 阿拉伯聯合大公國

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Bridgestone Corporation

- Goodyear Tire and Rubber Company

- Marangoni SpA

- Michelin SCA

- Oliver Rubber Company

- Southern Tire Mart

- Parrish Tire Company

- Redburn Tire Company

- Southern Tire Mart

- TreadWright Tires

- Sumitomo Rubber Industries, Ltd.

- Rethread(Pty)Ltd

- Pirelli & CSpA

- MRF Limited

- Vipal Rubber Corporation

第7章 市場機會與未來趨勢

The Tire Retreading Market size is estimated at USD 5.61 billion in 2025, and is expected to reach USD 6.61 billion by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

In 2020, the global automotive industry faced significant challenges due to lockdowns imposed in response to the COVID-19 pandemic. These lockdowns halted manufacturing activities, including tire retreading, for several weeks in the year's first half, stunting market growth. Yet, by 2023, the automotive sector rebounded robustly, signaling a promising trajectory for the tire retreading market in the coming years.

Medium-term projections suggest that the tire retreading market will be bolstered by rising prices of new tires, particularly for sports utility vehicles. This surge in tire prices is largely due to escalating natural rubber costs and volatile crude oil prices. Additionally, the growing global fleet of commercial vehicles is set to further fuel the market's expansion.

Recognizing the burgeoning demand for tire retreading, tire manufacturers are diving deep into this technology. For instance,

Key Highlights

- In July 2023, Bridgestone unveiled its ambitious plans to bolster tire material recycling. Their focus is on crafting "rubber that can be readily reused," aiming to transform waste tires into new ones. Bridgestone is championing renewable resources and is advancing technologies like retreading-where a new tread is applied to worn tires-and chemical recycling, which repurposes waste tires into raw materials.

The eco-friendly advantages and cost savings of retreaded tires over new ones are set to propel the tire retreading market. Retreading not only conserves landfill space by reusing existing tires but also curbs carbon dioxide emissions and conserves millions of gallons of oil-an essential resource in new tire production.

Tire Retreading Market Trends

Commercial Vehicles is the Largest Segment in the Tire Retreading Market

Due to the high utilization and wear rates of tires, the commercial vehicle segment leads the tire retreading market. Trucks, buses, and heavy-duty transporters in this segment cover extensive daily distances, resulting in rapid tire degradation. For fleet operators, retreading presents a cost-effective alternative, significantly curtailing operating costs compared to buying new tires. Given that tire expenses constitute a major portion of a commercial fleet's maintenance costs, retreading stands out as a financially savvy choice, extending tire life and ensuring consistent performance.

Additionally, the environmental advantages of tire retreading play a pivotal role in its appeal within the commercial vehicle sector. Retreading consumes far fewer raw materials and energy than producing new tires, leading to a reduced carbon footprint. Fleet operators, increasingly cognizant of these environmental benefits, are keen to adopt sustainable practices, bolstering their corporate social responsibility image. Furthermore, with many regions' regulatory bodies promoting eco-friendly practices, the retreading market has gained traction as the go-to option for commercial vehicles.

Technological advancements and the reliability of retreading processes have further cemented the adoption of retreaded tires in the commercial vehicle sector. Modern techniques, like pre-cure and mold-cure processes, ensure retreaded tires match the performance and safety of new ones. This newfound reliability has fostered trust among fleet operators, who prioritize vehicle safety and performance. The widespread availability of quality retreading services and a robust network of retreading facilities further facilitate access to retreaded tires for commercial vehicle operators, reinforcing the segment's leadership in the tire retreading market.

Additionally, market players are rolling out discounts, cost-effective policies, and new product launches, likely fueling market growth in the coming years. For instance,

Continental Tires' Conti Bharosa program extends warranty coverage against manufacturing defects for five years, surpassing the traditional two to three-year coverage offered by Indian tire manufacturers. Furthermore, Conti Bharosa provides warranty coverage for the second life of tires, safeguarding against manufacturing defects post-first retread for those used in standard load applications.

Moreover, tire retreading is witnessing rapid growth among medium-duty vehicles, with last-mile delivery services and logistics companies increasingly deploying them. For instance, major parcel-delivery giants like UPS and FedEx are already utilizing retreads for their last-mile operations. Goodyear has acknowledged the growth of the medium-duty trucking segment and is ramping up investments in retreads as a strategic cost-saving measure.

Asia-Pacific Continues to be the Largest Market

China stands tall as a global automotive giant, boasting the world's largest fleet of passenger cars. This dominance not only underscores China's pivotal role in the production of both passenger and commercial vehicles but also signals a burgeoning demand for tire retreading. In 2023, China's production of passenger and commercial vehicles hit a notable 30.16 million units, marking a robust annual growth of 12%.

Japan, registering a total of 8.99 million vehicles, including 1.23 million commercial ones, is another key player in the tire retreading arena. The nation's significant commercial vehicle volume, paired with its technological prowess, bolsters the advancement and uptake of premium retreading processes. Japan's commitment to sustainability dovetails seamlessly with the eco-friendly advantages of tire retreading, which not only conserves raw materials but also curtails waste. Moreover, Japan's rigorous regulations guarantee that retreaded tires uphold superior safety and performance standards, rendering them a trustworthy and economical choice for commercial operators.

In India, the transportation and logistics sectors' heavy reliance on commercial vehicles fuels a robust demand for tire retreading services. Given India's cost-sensitive market, retreading emerges as a strategic advantage, allowing fleet operators to significantly curtail operational costs. Moreover, as infrastructure projects burgeon and road networks expand in India, the uptick in commercial vehicle usage further amplifies the tire retreading market's growth.

Additionally, the automobile tire market thrives, buoyed by a myriad of raw material suppliers and supportive government policies. Given the prominence of agricultural vehicles in nations like Japan, China, and South Korea, the demand for automotive tires in this sector is poised to remain strong.

Considering all these dynamics, coupled with the recent inauguration of new tire retreading manufacturing facilities, the tire retreading market is set for a promising trajectory in the coming years.

Tire Retreading Industry Overview

Bridgestone Corporation, Southern Tire Mart, TreadWright, Goodyear, and other key players dominate the tire retreading market. These industry leaders are pushing forward with sustainable solutions and innovative technologies, catering to commercial fleets and the broader transport sector. For instance,

- In December 2023, Bridgestone, set to participate in CES 2024, unveiled its commitment to sustainability and efficiency. Among the highlights will be Bridgestone Bandag's retreading service, a testament to extending tire life sustainably, alongside innovations like ENLITEN Technology and advanced fleet management solutions.

- In November 2023, Michelin took center stage at Solutrans 2023 in Lyon, France, showcasing its eco-conscious tire lineup. Featured products, including the Michelin X Multi HD Z and Agilis CrossClimate, emphasize reduced environmental footprints, leveraging expertise in rolling resistance and recycled materials. Additionally, Michelin rolled out its "Michelin Connected Mobility" suite of services.

- In September 2023, Michelin marked a milestone, announcing the retreadability of nearly all its truck and bus tires. Celebrating a century of retreading, Michelin proudly noted the renewal of around 30 million tires at its UK and German plants. This achievement not only underscores Michelin's prowess but also translates to a savings of 1.5 million tons in raw materials and a reduction of nearly 3.5 million tons in CO2 emissions. The MICHELIN Remix process, a hallmark of this initiative, ensures that the renewed tread matches the materials and technologies of new tires, upholding the brand's commitment to safety, traction, and grip.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Environmental Benefits Driving Growth

- 4.2 Market Restraints

- 4.2.1 Decreasing Rubber Production And Volatile Raw Material Cost

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD)

- 5.1 Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Light commercial vehicle

- 5.1.3 Medium and Heavy duty Truck

- 5.1.4 Bus

- 5.2 Production Method

- 5.2.1 Pre-cure

- 5.2.2 Mold Cure

- 5.3 Tire Type

- 5.3.1 Radial

- 5.3.2 Bias

- 5.3.3 Solid

- 5.4 Sales Channel

- 5.4.1 OEM

- 5.4.2 Independent Retreaders

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United State

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Bridgestone Corporation

- 6.2.2 Goodyear Tire and Rubber Company

- 6.2.3 Marangoni SpA

- 6.2.4 Michelin SCA

- 6.2.5 Oliver Rubber Company

- 6.2.6 Southern Tire Mart

- 6.2.7 Parrish Tire Company

- 6.2.8 Redburn Tire Company

- 6.2.9 Southern Tire Mart

- 6.2.10 TreadWright Tires

- 6.2.11 Sumitomo Rubber Industries, Ltd.

- 6.2.12 Rethread (Pty) Ltd

- 6.2.13 Pirelli & C. S.p.A.

- 6.2.14 MRF Limited

- 6.2.15 Vipal Rubber Corporation