|

市場調查報告書

商品編碼

1690167

歐洲挖掘機和裝載機:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Excavator And Loaders - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

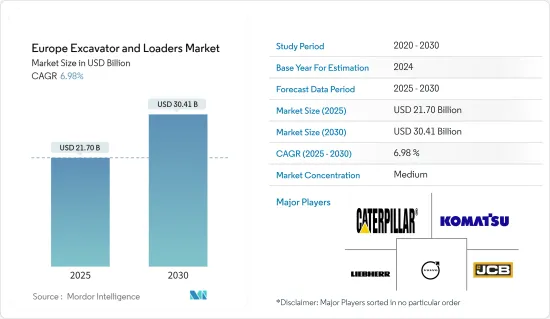

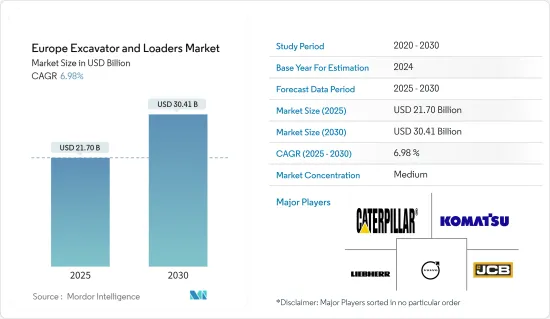

預計 2025 年歐洲挖土機和裝載機市場規模為 217 億美元,預計到 2030 年將達到 304.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.98%。

預計建設活動的增加將推動對挖土機和裝載機的需求。預計經濟獎勵策略和降低住宅成本等政府計劃將鼓勵人們購買住宅,從而推動預測期內的市場擴張。

隨著該地區多個政府部門加大對建築和採礦活動的投入,對具成本效益機械的需求以及低排放氣體的監管壓力,促使施工機械製造商選擇電動式和混合動力汽車,而不是傳統的液壓和機械汽車。

預測期內,歐洲國家的基礎建設和建築業發展可能會推動施工機械的銷售。例如

根據聯邦交通基礎設施計畫(FTIP)2030,聯邦政府宣佈2030年將投資1,476億美元用於德國道路基礎建設的發展。

此外,由於人事費用上升導致對先進施工機械的需求不斷增加,也可能繼續成為市場的主要驅動力,從而在預測期內推動對挖土機和裝載機的需求。

隨著歐洲商業建築和住宅數量的增加,定期維護以確保其成為安全的居住和工作場所的需求也隨之增加。因此,建築業主和承包商不僅要花費大量的資金來維護建築,而且還希望透過翻新舊的和未充分利用的房間來獲取利潤。這反過來又增加了對挖土機和裝載機的需求,促進了整體市場的成長。

市場的主要企業包括Caterpillar公司、凱斯紐荷蘭工業公司、利勃海爾集團、小鬆有限公司等。考慮到不斷成長的需求,領先的公司正在建立策略聯盟和產品推出以保持競爭優勢。

例如,SMT 宣布將於 2024 年 5 月向英國市場推出一款全新的 23 噸Volvo EC230 電動挖土機,該機型是沃爾沃建築設備公司在中型挖土機類別中的首款全電動車型,並且具有環境永續。

因此,預計上述因素將推動歐洲挖土機和輪式裝載機市場顯著成長。

歐洲挖土機和裝載機市場趨勢

挖土機市佔率最高

全部區域鑽井活動的增加可能會在未來幾年增加對鑽井工的需求。在歐洲,預測期內房地產領域投資的增加將為市場提供有吸引力的機會。

挖土機一般有兩種:輪式挖土機和履帶挖土機。大多數買家都購買低成本的履帶挖土機,而不是高成本的輪式挖土機,因為與輪式挖土機相比,前者在崎嶇或不平坦的地形上進行挖掘作業時具有更高的穩定性。

隨著政府對綠色汽車轉型的要求不斷提高,挖土機和裝載機製造商正在將傳統汽車轉變為電動和混合動力汽車以適應這項變化。大多數汽車製造商都推出了新款電動挖土機。例如

- 2023年11月,霍蘭德展示了該公司首台全電動迷你挖土機。 E15X 是該製造商的 15 款新型迷你挖土機型號之一,採用緊湊設計,使用環保的生物液壓油來延長維修間隔,並透過無鈷鋰電池進一步增強了其環保資質。

未來五年,由於歐盟國家對基礎設施計劃投入大量資金以及引進電動和氫動力挖土機,預計市場將實現強勁成長。幾家主要企業正在推出新型挖土機,預計這將在預測期內提振市場。例如,

- 2023 年 1 月,沃爾沃建築設備在歐洲推出了中型 EC230 Electric。沃爾沃建築設備(Volvo CE)的中型電動挖土機目前正在向歐洲特定客戶銷售。

該公司正專注於開發具有增強性能特徵和環保功能的新型挖土機,以獲得市場吸引力。預計這將在預測期內吸引客戶。

油壓設備預計將佔據最大佔有率

在使用液壓動力的各個行業中,建築業是從使用液壓驅動類型中受益最多的主要應用領域之一。配備液壓系統的現代化機器使施工工作更安全、更快捷、更有效率。

推動市場成長的主要因素之一是建築業的發展,尤其是在新興國家,因為基礎設施、住宅和非住宅領域存在大量成長機會。

隨著液壓驅動器的不斷創新,它們被用於各種類型的施工機械中,從強大的挖土機到更緊湊的設備。

建設產業引入液壓技術可以更快地完成更多工作,從而提高生產效率。液壓科學對於現代建設業至關重要,它使設備能夠完善其運動範圍並以更高的精度保持。

歐洲建設活動的成長導致各種活動中油壓設備的應用增加,並且公司正在擴大其油壓設備供應以滿足需求。例如

- 2023 年 5 月,久保田推出了 8.5 噸液壓迷你挖土機,增強了其廣泛的創新施工機械陣容。

因此,隨著一些歐洲國家建築業的成長以及新型挖土機和裝載機的不斷發展,預計未來幾年潛在市場將大幅成長。

歐洲挖土機和裝載機產業概況

歐洲挖土機和裝載機市場由知名的全球和區域參與者鞏固和主導。公司正在採取新產品發布、合作和合併等策略來保持其在市場中的地位。例如

- 2024 年 6 月,日本小松公司在 INTERMAT 2024 上展示了一系列最新的電氣化和數位化解決方案,包括適用於未來高效、智慧和清潔的建築工地的 3 噸 PC33E-6 電動迷你挖土機。日本小松公司計劃於2025年在歐洲推出這些產品。

市場的主要企業包括Caterpillar、日本小松公司、利勃海爾集團、沃爾沃建築設備和迪爾公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 全部區域基礎建設取得進展

- 市場挑戰

- 施工機械租賃服務快速擴張

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按機器類型

- 挖土機

- 裝載機

- 按驅動類型

- 油壓

- 電動式的

- 混合

- 按國家

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Caterpillar Inc.

- CNH Industrial NV

- Kobelco Construction Machinery Co. Ltd.

- Deere & Company

- Liebherr-International Deutschland GmbH

- Hitachi Construction Machinery Co. Ltd.

- Komatsu Ltd

- Manitou BF, SA

- Doosan Infracore Co. Ltd.

- Yanmar Construction Equipment Co. Ltd.

- Volvo Construction Equipment

第7章 市場機會與未來趨勢

The Europe Excavator And Loaders Market size is estimated at USD 21.70 billion in 2025, and is expected to reach USD 30.41 billion by 2030, at a CAGR of 6.98% during the forecast period (2025-2030).

The increase in construction activity is expected to drive demand for excavators and loaders. Government programs such as stimulus packages and lower housing costs that encouraged people to buy new homes are expected to drive market expansion during the forecast period.

With the increased spending from several government authorities in the region on construction and mining activities, the demand for cost-effective machines, along with regulatory pressures for lower emissions, has been pressurizing construction equipment manufacturers to opt for electric and hybrid vehicles over traditional hydraulic and mechanical ones.

Infrastructural growth and development in construction across European countries are likely to enhance the sale of construction equipment during the forecast period. For instance,

Under the Federal Transport Infrastructure Plan (FTIP) 2030, the federal government announced an investment of USD 147.6 billion for the development of road infrastructure in Germany by 2030.

The rise in demand for advanced construction machinery due to an increase in labor cost is also likely to drive the demand for excavators and loaders during the forecast period, which is likely to remain a prominent driver for the market.

As the number of commercial and residential buildings in Europe increases, so does the need for routine maintenance to keep them safe places to live and work. As a result, building owners and contractors spend significant amounts of money on building maintenance as well as remodeling old and underutilized rooms to profit from them. As a result, demand for excavators and loaders is increasing, contributing to overall market growth.

Major players in the market are Caterpillar Inc., CNH Industrial NV, Liebherr Group, Komatsu Ltd, and Many others. Considering the growth in demand, major players are working on strategic partnerships and product launches to stay ahead of the competition.

For instance, In May 2024, SMT aanounced to launch the new 23-tonne Volvo EC230 Electric excavator to the UK market. The model is Volvo CE's first fully electric model in the mid-sized excavator category, which is sustainable to the environment.

Thus, the factors above are projected to induce significant growth in the European excavator and wheel loader market.

Europe Excavator and Loaders Market Trends

Excavator Holds the Highest Share

A rise in excavation activity across the region is likely to increase the demand for excavators in the coming years. In Europe, the rise in investment in the real estate segment still offers attractive opportunities for the market during the forecast period.

Excavators are typically available in two types: wheeled excavators and crawler excavators. Most of the buyers purchased a low-cost crawler excavator over high-cost wheeled excavators because the former equipment offered high stability during digging operations on rough or uneven terrains compared to wheeled excavators.

With the evolving demand by the government to move toward greener vehicles, excavators and loader manufacturers are turning their conventional vehicles to electric and hybrid to adopt the changes. Most automakers are introducing new electric excavator models. For instance,

- In November 2023, Holland displayed its first fully electric mini excavator. The E15X is one of the manufacturer's new range of fifteen mini excavator models that have been designed with compact dimensions and has environmental credentials are further enhanced by its use of eco-friendly biological hydraulic oil, which also extends service intervals, and by the use of cobalt-free lithium batteries.

Over the next five years, the market is anticipated to register robust growth due to big spending on infrastructure projects by the EU countries and the introduction of electric and hydrogen-powered excavators. Several key players are introducing new models of excavators, which, in turn, is anticipated to boost the market during the forecast period. For instance,

- In January 2023, Volvo CE launched mid-size EC230 Electric in Europe. The mid-size electric excavator by Volvo Construction Equipment (Volvo CE) is now available for select customers in Europe.

Companies focus on the development of new models of excavators with enhanced performance characteristics and eco-friendly features to gain momentum in the market studied. This is expected to attract customers during the forecast period.

Hydraulics is Expected to Hold the Highest Share

Among the various industries that use hydraulic power, the construction sector is one of the major application areas that is most benefited by using hydraulic drive type. Modern machinery equipped with hydraulic systems makes construction work safer, faster, and more efficient.

One of the major factors driving the growth of the market is the growing construction industry, especially in developing countries, owing to numerous growth opportunities in infrastructure, residential, and non-residential sectors.

With the ongoing innovations in the hydraulics drive type, it is being used in various types of construction equipment from powerful excavators to more compact equipment.

The introduction of hydraulics in the construction industry has let more jobs be completed quickly and improved productivity. The science of hydraulics allowed the equipment to complete the range of motion and be held with increased precision as it is an essential part of the current construction industry, and persisting technological advancements will make utilizing hydraulic equipment even more necessary in the future.

With the growth in construction activities in Europe leads to the increased adoption of hydraulic equipment for various activities and companies are expanding its hydraulic equipment offering to cater the demand. For instance,

- In May 2023, Kubota had enhanced its extensive range of innovative construction machinery with the launch of a new 8.5 tonne hydraulic mini-excavator, providing operators with advanced performance and superior operation.

Hence, the growing construction sector in some of the European countries and the development of new excavators and loaders is expected to witness considerable growth in the target market in the upcoming years.

Europe Excavator and Loaders Industry Overview

The European excavator and loaders market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance

- In June 2024, Komatsu showcased a variety of its latest electrification and digitalization solutions which include a 3-ton PC33E-6 electric mini-excavator for the productive, smart, and clean construction sites of the future. in INTERMAT 2024. Komatsu plans to launch them in Europe in 2025.

Some of the major players in the market include Caterpillar Inc., Komatsu Corp., Liebherr Group, Volvo Construction Equipment, and Deere & Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing infrastructural development Across the Region

- 4.2 Market Challenges

- 4.2.1 Rapid Expansion of Construction Equipment Rental Services

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 By Machinery Type

- 5.1.1 Excavator

- 5.1.2 Loader

- 5.2 By Drive Type

- 5.2.1 Hydraulic

- 5.2.2 Electric

- 5.2.3 Hybrid

- 5.3 By Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Caterpillar Inc.

- 6.2.2 CNH Industrial NV

- 6.2.3 Kobelco Construction Machinery Co. Ltd.

- 6.2.4 Deere & Company

- 6.2.5 Liebherr-International Deutschland GmbH

- 6.2.6 Hitachi Construction Machinery Co. Ltd.

- 6.2.7 Komatsu Ltd

- 6.2.8 Manitou BF, SA

- 6.2.9 Doosan Infracore Co. Ltd.

- 6.2.10 Yanmar Construction Equipment Co. Ltd.

- 6.2.11 Volvo Construction Equipment