|

市場調查報告書

商品編碼

1690170

汽車聲學工程服務:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Automotive Acoustic Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

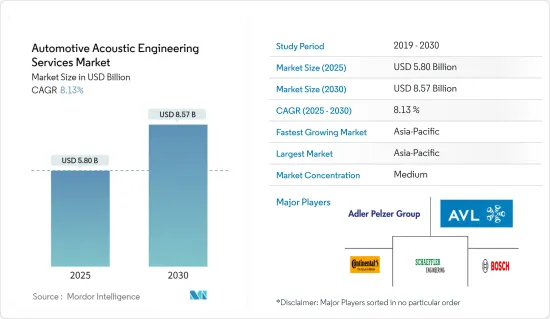

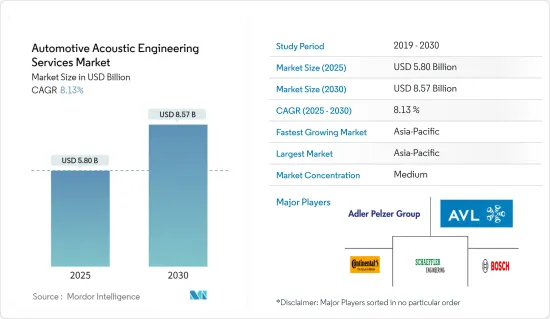

汽車聲學工程服務市場規模預計在 2025 年將達到 58 億美元,預計到 2030 年將達到 85.7 億美元,預測期內(2025-2030 年)的複合年成長率為 8.13%。

汽車聲學工程服務的重要性在於不斷追求提高駕駛體驗和車輛性能。近年來,由於電動和混合動力汽車汽車需求激增、噪音排放法規越來越嚴格以及汽車行業對舒適性和豪華性的日益關注,汽車聲學工程服務市場經歷了顯著成長。隨著汽車製造商努力滿足消費者的期望和監管要求,對專業聲學工程服務的需求日益增加。

有幾個促進因素推動了汽車聲學工程服務市場的成長。首先,人們越來越意識到噪音污染及其對人類健康和環境的不利影響,這導致世界各地制定了更嚴格的噪音排放法規。這一趨勢迫使汽車製造商投資先進的聲學工程解決方案以確保合規。此外,電動和混合動力汽車的日益普及也推動了對噪音、振動和聲振粗糙度 (NVH) 管理解決方案的需求,以提高駕駛舒適度。豪華車市場的成長和主動降噪系統等新技術的引入進一步推動了汽車聲學工程服務的需求。

主要挑戰之一是需要不斷進行技術創新以跟上不斷變化的監管環境和消費者偏好。隨著汽車技術的進步,聲學工程師必須跟上新材料、設計方法和測試技術,以確保最佳性能。同時,電動和混合動力汽車的普及也為聲學工程服務帶來了巨大的商機。這些車輛需要專門的 NVH 管理解決方案來解決馬達噪音和電池振動的獨特挑戰。自動駕駛汽車的日益普及可能會產生新的聲學工程要求以提升乘客體驗,包括車載音景設計。

隨著電動和混合動力汽車汽車越來越受歡迎,對專業聲學工程服務的需求可能會增加。此外,ADAS(高級駕駛輔助系統)和自動駕駛技術的整合可能會為聲學工程師創造新的機會,以最佳化車內音景並改善整體駕駛體驗。汽車產業的個人化趨勢可以帶來針對個別車型和客戶偏好量身定做的聲學解決方案。總體而言,在技術進步、監管壓力和不斷變化的消費者期望的推動下,汽車聲學工程服務的前景光明。

汽車聲學工程服務的市場趨勢

乘用車主導汽車聲學工程服務市場

由於乘用車的廣泛使用以及對舒適性、豪華性和降噪性的日益重視,汽車行業佔據了聲學工程服務市場的大部分佔有率。隨著汽車製造商努力滿足客戶期望和監管要求,對專業聲學工程解決方案的需求正在大幅成長。乘用車需要先進的噪音、振動和聲振粗糙度 (NVH) 管理解決方案來提供安靜、舒適和愉快的駕駛體驗。

乘用車中的聲學工程服務對於提高駕駛舒適度和降低噪音水平至關重要。聲學工程師致力於乘用車設計的許多方面,包括隔音、隔音屏障系統和尖端材料,以最大限度地減少不必要的噪音和振動。結果是乘客享受到更舒適、更安靜的乘坐體驗,這是客戶滿意度和汽車銷售的關鍵因素。多家OEM)正在努力將此類產品推向市場。例如,3M 的「印度製造」解決方案於 2022 年 7 月推出,用於管理新型電動車和混合動力汽車的 NVH 水平。

豪華乘用車優先考慮聲學工程服務,以在競爭中脫穎而出並提供卓越的駕駛體驗。我們的聲學工程師致力於開發創新解決方案以最大限度地減少噪音和振動,包括主動降噪系統、先進的隔音材料和最佳化的引擎支架。例如,2023 年 10 月,英國公司 Warwick Acoustics 開發了一種汽車音響感測器,其製造過程中所需的稀土元素明顯減少。這項創新技術旨在最大限度地減少對環境的影響和對有限資源的依賴。

隨著汽車產業的發展和創新,乘用車聲學工程服務的未來前景光明。隨著人們對永續性和電動車的關注度日益提高,聲學工程師必須應對新的挑戰,例如管理馬達和電池系統產生的噪音。

此外,自動駕駛汽車的普及可能會帶來新的聲學工程要求,例如設計車內音景以增強乘客體驗。隨著汽車技術的進步和客戶偏好的演變,聲學工程服務對於乘用車開發仍然至關重要,可確保所有人都能享受舒適愉快的駕駛體驗。

亞太地區佔較大市場佔有率

由於經濟快速成長、汽車產量增加和消費群不斷擴大等因素,預計亞太地區將佔據汽車聲學工程服務市場的大部分佔有率。這個人口眾多、多元化的地區為專門從事聲學工程服務的汽車製造商和供應商提供了巨大的機會。此外,政府對車輛排放和噪音水平的嚴格規定也推動了亞太地區對先進聲學工程解決方案的需求。

該地區在汽車聲學工程服務市場佔據主導地位的主要原因之一是中國、印度和日本等國家的汽車工業的快速擴張。這些國家已成為本地和國際汽車製造商的主要生產中心,對聲學工程服務的需求不斷增加,以滿足區域和全球市場的需求。

中國是世界上最大的汽車市場之一。 2022年,全國乘用車銷量超過2,356萬輛,年銷量較2021年成長9.7%。隨著中國汽車產業的不斷擴張,對提供優質車載音響體驗的關注推動了對先進聲學工程服務的需求。中國汽車製造商正在投資研發,以保持在全球市場的競爭力並滿足國內消費者不斷變化的需求。

例如,2023年11月,中國吉利汽車旗下的動力傳動系統公司Aurobay押注混合動力技術,並在印度尋求合作夥伴。 Aurobay 旨在透過與當地汽車製造商合作並專注於開發未來先進的混合動力傳動系統解決方案來擴大其在印度市場的佔有率。

同樣,2022 年 12 月,Bose 和沃爾沃汽車宣佈建立新的聲音合作,以增強沃爾沃車主的車載音響體驗。此次合作將使 Bose 的尖端音響技術融入沃爾沃汽車,為乘客提供卓越的音質和身臨其境的聆聽體驗。

同樣,日本汽車製造商也在不斷突破聲學工程的極限,以開發具有更佳噪音、振動和聲振粗糙度 (NVH) 性能的汽車。隨著日本汽車製造商和供應商合作開發可提升整體駕駛體驗的尖端解決方案,對卓越音質的關注推動了日本聲學工程服務市場的成長。例如,旭化成微設備公司 (AKM) 於 2023 年 7 月推出了 AK7709VQ,這是一款專為下一代汽車聲學設計而設計的新型多核心數位訊號處理器 (DSP)。這款強大的 DSP 能夠進行大規模即時運算,為乘客提供身臨其境的聲音體驗。

這些國家層面的發展確保了亞太地區未來的汽車聲學工程服務市場。隨著該地區的汽車製造商努力滿足對高品質、舒適性和永續汽車日益成長的需求,對先進的聲學工程解決方案的需求也將繼續成長。這一趨勢要求聲學工程師適應新技術、新材料和新設計方法,以保持行業領先地位並保持該地區在汽車聲學工程服務方面的領先市場佔有率。

汽車聲學工程服務業概況

汽車聲學工程服務市場高度集中,少數公司佔據相當大的市場佔有率。市場主要企業包括 AVL List GmbH、舍弗勒工程有限公司、西門子、Adler Pelzer、羅伯特·博世、Autoneum 和 Bertrandt AG。

許多市場參與者正致力於開發最新技術,並透過夥伴關係和產品創新提供最優質的產品。例如

- 2024 年 2 月,ANSYS 與舍弗勒合作,利用 ANSYS模擬軟體推進永續產品開發。這項合作關係將使舍弗勒能夠最佳化其零件和系統,以減少材料使用、能源消費量和整體環境影響,同時保持高性能和高品質。 Ansys 解決方案還可協助降低產品開發的碳排放,並為混合動力/電動動力傳動系統解決方案和工業應用制定設計策略。

- 2023 年 6 月,Harman Kardon 與大眾合作,為大眾的下一代電動車 ID.7 開發高級音響系統。此次合作旨在將 Harman Kardon 的音響工程專業知識與大眾對創新汽車設計的承諾相結合,提供卓越的車載音響體驗。

- 2023 年 1 月,Panasonic汽車宣布推出專為電動車設計的新型 EV 音響系統。此創新系統可望提升電動車車主的車用音響體驗,同時提高能源效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按工藝

- 設計

- 發展

- 設計

- 按軟體

- 校準

- 振動

- 其他

- 按應用

- 內部的

- 車身和結構

- 動力傳動系統

- 傳動系統

- 按車型

- 搭乘用車

- 商用車

- 依推進類型

- 內燃機

- 電動/插電式混合動力車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 中東和非洲

- 南美洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Siemens Digital Industries Software(Siemens AG)

- Robert Bosch GmbH

- Continental Engineering Services GmbH(Continental AG)

- Bertrandt AG

- Schaeffler Engineering GmbH

- Autoneum Holding Ltd

- IAC Acoustics(Catalyst Acoustics Group)

- AVL List GmbH

- EDAG Engineering Group AG

- FEV Group GmbH

- Spectris PLC

- Adler Pelzer Holding GmbH

第7章 市場機會與未來趨勢

The Automotive Acoustic Engineering Services Market size is estimated at USD 5.80 billion in 2025, and is expected to reach USD 8.57 billion by 2030, at a CAGR of 8.13% during the forecast period (2025-2030).

The significance of automotive acoustic engineering services lies in the continuous quest for enhanced driving experiences and vehicle performance. In recent years, the automotive acoustic engineering services market has witnessed substantial growth, driven by a surge in demand for electric and hybrid vehicles, stringent noise emission norms, and a focus on comfort and luxury in the automotive industry. As automakers strive to meet consumer expectations and regulatory requirements, the demand for specialized acoustic engineering services has risen.

Several driving factors contribute to the growth of the automotive acoustic engineering services market. Firstly, the increasing awareness about noise pollution and its adverse effects on human health and the environment led to stricter noise emission norms worldwide. This trend has forced automakers to invest in advanced acoustic engineering solutions to ensure compliance. Additionally, the rising popularity of electric and hybrid vehicles has led to a higher demand for noise, vibration, and harshness (NVH) management solutions to improve driving comfort. The growing luxury car market and the introduction of new technologies, such as active noise cancellation systems, have further fuelled the demand for automotive acoustic engineering services.

One of the primary challenges is the need for continuous innovation to meet the evolving regulatory landscape and consumer preferences. As automotive technologies advance, acoustic engineers must adapt to new materials, design methodologies, and testing techniques to ensure optimal performance. On the other hand, the growing adoption of electric and hybrid vehicles presents a significant opportunity for acoustic engineering services, as these vehicles require specialized NVH management solutions to address unique challenges such as electric motor noise and battery vibrations. The increasing adoption of autonomous vehicles may lead to new acoustic engineering requirements, such as designing interior soundscapes, to enhance the passenger experience.

As electric and hybrid vehicles continue to gain popularity, the demand for specialized acoustic engineering services will likely increase. Additionally, the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies may create new opportunities for acoustic engineers to optimize interior soundscapes and enhance the overall driving experience. The growing trend of personalization in the automotive industry may lead to tailored acoustic solutions for individual vehicle models and customer preferences. Overall, the future of automotive acoustic engineering services seems bright, driven by technological advancements, regulatory pressures, and evolving consumer expectations.

Automotive Acoustic Engineering Services Market Trends

Passenger Cars are Dominating the Automotive Acoustic Engineering Services Market

In the automotive industry, passenger cars dominate the market for acoustic engineering services due to their widespread use and the increasing emphasis on comfort, luxury, and noise reduction. As automakers strive to meet customer expectations and regulatory requirements, the demand for specialized acoustic engineering solutions has grown significantly. Passenger cars require advanced noise, vibration, and harshness (NVH) management solutions to provide a quiet, comfortable, and enjoyable driving experience.

The role of acoustic engineering services in passenger cars is crucial, as they enhance driving comfort and reduce noise levels. Acoustic engineers work on various aspects of passenger car design, such as sound insulation, noise barrier systems, and advanced materials to minimize unwanted noise and vibrations. This results in a more comfortable and quieter ride for passengers, which is a critical factor in customer satisfaction and vehicle sales. Several OEMs are working to deliver such products into the market. For instance, in July 2022, 3M's Make-in-India solution was introduced for managing NVH levels in new EVs and hybrid vehicles.

Luxury passenger cars prioritize acoustic engineering services to differentiate themselves from competitors and offer an exceptional driving experience. Acoustic engineers focus on developing innovative solutions to minimize noise and vibrations, such as active noise cancellation systems, advanced sound insulation materials, and optimized engine mounts. For instance, Warwick Acoustics, a UK-based company, developed car audio transducers in October 2023 that significantly reduced the need for rare-earth elements in their production. This innovative technology aims to minimize environmental impact and dependency on finite resources.

As the automotive industry evolves and innovates, the future of acoustic engineering services in passenger cars appears promising. With the growing focus on sustainability and electric vehicles, acoustic engineers must adapt to new challenges, such as managing noise generated by electric motors and battery systems.

Additionally, the increasing adoption of autonomous vehicles may lead to new acoustic engineering requirements, such as designing interior soundscapes to enhance the passenger experience. As automotive technologies advance and customer preferences evolve, acoustic engineering services will remain crucial to passenger car development, ensuring a comfortable and enjoyable driving experience for all.

Asia-Pacific to Hold a Major Market Share

Asia-Pacific is expected to hold a major share in the automotive acoustic engineering services market due to several factors, including rapid economic growth, increasing automotive production, and a growing consumer base. With a large and diverse population, the region offers significant opportunities for automotive manufacturers and suppliers, including those specializing in acoustic engineering services. Additionally, stringent government regulations on vehicle emissions and noise levels drive the demand for advanced acoustic engineering solutions in Asia-Pacific.

One of the primary reasons for the region's dominance in the automotive acoustic engineering services market is the rapid expansion of the automotive industry in countries like China, India, and Japan. These countries have become major production hubs for domestic and international automakers, leading to increased demand for acoustic engineering services to meet local and global market requirements.

China is one of the world's largest automotive markets. More than 23.56 million passenger cars were sold in the country in 2022, and the country's yearly sales recorded an increase of 9.7% compared to 2021. As China's automotive industry continues to expand, there is a growing emphasis on offering premium in-car audio experiences, which drives the demand for advanced acoustic engineering services. Chinese automakers are investing in R&D to stay competitive in the global market and meet the evolving needs of domestic consumers.

For instance, in November 2023, China's Geely-owned powertrain company, Aurobay, bet on hybrid technology and sought a partner in India. Aurobay aims to strengthen its presence in the Indian market by collaborating with local automakers and focusing on developing advanced hybrid powertrain solutions for the future.

Similarly, in December 2022, Bose and Volvo Cars announced a new collaboration in sound, aiming to enhance the in-car audio experience for Volvo vehicle owners. This partnership will integrate Bose's cutting-edge audio technology into Volvo's vehicles, providing superior sound quality and an immersive listening experience for passengers.

Similarly, Japanese automakers are consistently pushing the boundaries of acoustic engineering to create vehicles with improved noise, vibration, and harshness (NVH) performance. This focus on acoustic excellence drives the growth of Japan's acoustic engineering services market, as local OEMs and suppliers collaborate to develop cutting-edge solutions that enhance the overall driving experience. For instance, in July 2023, Asahi Kasei Microdevices (AKM) launched the AK7709VQ, a new multicore digital signal processor (DSP) conceived for next-generation in-vehicle sound design. This powerful DSP enables the real-time large-scale computational processing required to provide an immersive sound experience for passengers.

Such country-level developments secure the future automotive acoustic engineering services market in Asia-Pacific. As automotive manufacturers in the region strive to meet the growing demand for high-quality, comfortable, and sustainable vehicles, the need for advanced acoustic engineering solutions will continue to grow. This trend will require acoustic engineers to adapt to new technologies, materials, and design methodologies, ensuring that they remain at the forefront of the industry and maintain the region's major market share in automotive acoustic engineering services.

Automotive Acoustic Engineering Services Industry Overview

The automotive acoustic engineering services market is significantly concentrated, with a few players accounting for a major market share. Some prominent companies in the market are AVL List GmbH, Schaeffler Engineering GmbH, Siemens, Adler Pelzer, Robert Bosch, Autoneum, and Bertrandt AG.

Several market players focus on developing the latest technologies and delivering the best quality products through partnerships and product innovations. For instance,

- In February 2024, Ansys and Schaeffler partnered to drive sustainable product development using Ansys' simulation software. This collaboration will help Schaeffler optimize its components and systems, reducing material usage, energy consumption, and overall environmental impact while maintaining high performance and quality. The Ansys solutions will also help decarbonize product development and shape design strategies for hybrid/electric powertrain solutions and industrial applications.

- In June 2023, Harman Kardon and Volkswagen joined forces to develop a premium sound system for Volkswagen's upcoming ID.7 electric vehicle. The collaboration aims to create an exceptional in-car audio experience, combining Harman Kardon's expertise in sound engineering with Volkswagen's commitment to innovative vehicle design.

- In January 2023, Panasonic Automotive unveiled a new EV audio system designed specifically for electric vehicles, offering high-quality sound with low power consumption. This innovative system is expected to enhance the in-vehicle audio experience for EV owners while contributing to energy efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Designing

- 5.1.2 Development

- 5.1.3 Testing

- 5.2 By Software

- 5.2.1 Calibration

- 5.2.2 Vibration

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Interior

- 5.3.2 Body and Structure

- 5.3.3 Powertrain

- 5.3.4 Drivetrain

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicle

- 5.5 By Propulsion Type

- 5.5.1 Internal Combustion Engine

- 5.5.2 Electric and Plug-in Hybrid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.5 Middle East and Africa

- 5.6.6 South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Siemens Digital Industries Software (Siemens AG)

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental Engineering Services GmbH (Continental AG)

- 6.2.4 Bertrandt AG

- 6.2.5 Schaeffler Engineering GmbH

- 6.2.6 Autoneum Holding Ltd

- 6.2.7 IAC Acoustics (Catalyst Acoustics Group)

- 6.2.8 AVL List GmbH

- 6.2.9 EDAG Engineering Group AG

- 6.2.10 FEV Group GmbH

- 6.2.11 Spectris PLC

- 6.2.12 Adler Pelzer Holding GmbH