|

市場調查報告書

商品編碼

1690701

液晶聚合物 (LCP) 薄膜和層壓板:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Liquid Crystal Polymer (LCP) Films And Laminates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

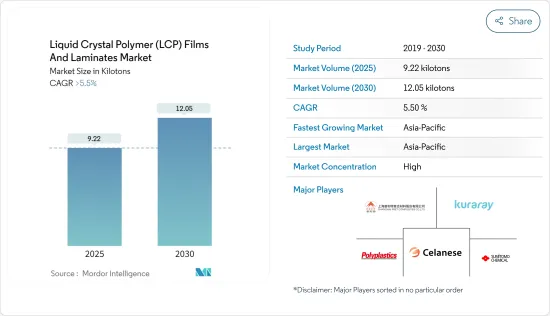

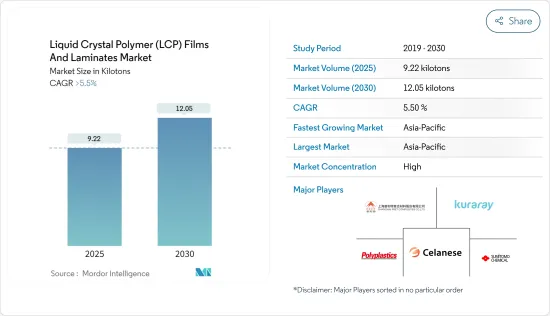

液晶聚合物 (LCP) 薄膜和層壓板的市場規模預計在 2025 年為 9.22 千噸,預計在 2030 年將達到 12.05 千噸,在預測期內(2025-2030 年)的複合年成長率將超過 5.5%。

COVID-19 疫情對液晶聚合物 (LCP) 薄膜和層壓板市場產生了負面影響。全國範圍的封鎖和嚴格的社交距離措施導致各種電子設備的製造活動停止,從而影響了液晶聚合物 (LCP) 薄膜和層壓板市場。

然而,由於電子、汽車和包裝應用對液晶聚合物 (LCP) 薄膜和層壓板的需求增加,市場已大幅復甦。

主要亮點

- 電氣和電子元件小型化的需求不斷增加,以及汽車零件輕量材料的開發預計將增加研究市場的需求。

- 液晶聚合物(LCP)薄膜和層壓板的高製造和加工成本預計會阻礙市場的成長。

- 預計東協和印度電子市場的潛在成長將在預測期內為市場提供成長機會。

- 亞太地區是最大的市場,由於中國、印度和東南亞國協的消費不斷增加,預計在預測期內將成為成長最快的市場。

液晶聚合物 (LCP) 薄膜和層壓板市場趨勢

電子應用領域佔據市場主導地位

- 液晶聚合物(LCP)和層壓板在整個電子產業中的應用越來越廣泛。 LCP薄膜具有優異的電氣性能和機械性能,包括低介電常數、高抗濕性、可控的熱膨脹係數、高頻特性和無鹵阻燃性。

- 遠距遠程辦公和在家工作的普及推動了對電子設備的需求。此外,數位化投資的活性化帶來了更複雜的資料利用和解決方案服務的擴展。預計這將增加電子產業對 LCP 薄膜和層壓板的需求。

- 全球電子產業取得了顯著的成長率。根據日本電子情報技術產業協會(JEITA)預測,2022年全球電子與IT產業產值將達3.43兆美元,2021年為3.36兆美元,較與前一年同期比較成長1%。預計到2023年將達到3.52兆美元,與前一年同期比較增3%。

- 亞太地區佔全球電子產品產量的70%以上。韓國、日本和中國等國家生產電氣元件並將其供應給世界各地的各個產業。此外,預計2025年印度將成為全球第五大家電和電子產業國。

- 預計到 2025 年,印度的電子系統設計和製造 (ESDM) 產業將創造超過 1,000 億美元的經濟價值。由於「印度製造」、「電子國家政策」和「電子淨零進口」等致力於發展國內製造業的政府政策,印度的電氣和電子設備產量預計將快速成長。預計電子產業的成長將推動當前的研究市場的發展。

- 在歐洲,德國的電子產業也取得了強勁的成長率。據ZVEI稱,德國電子和數位產業的銷售額預計將在2022年達到2,435億美元(2,245億歐元),而前一年為2,169億美元(2,000億歐元)。因此,電子產業的成長預計將推動該國對液晶聚合物(LCP)薄膜和層壓板的市場需求。

- 由於這些因素,預計預測期內電子應用領域將主導液晶聚合物 (LCP) 薄膜和層壓板市場。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導液晶聚合物 (LCP) 薄膜和層壓板市場。中國、日本和印度的電子和汽車產業對液晶聚合物 (LCP) 薄膜和層壓板的需求正在不斷成長。

- 在中國和日本等國家,電子產業正在呈現顯著的成長率,推動了矽膠塗料市場的發展。 2021年中國電子市場成長10%,2022年成長13%。 2023年的預期成長率為7%。

- 日本是世界上最大的電子公司的所在地,在各種電子設備和裝置的生產中佔有重要佔有率。根據日本電子情報技術產業協會(JEITA)預測,2022年日本電子產業總產值將達到約743億美元(11.1243兆日圓),較上年成長近8%。

- 此外,汽車和運輸業對液晶聚合物 (LCP) 薄膜和層壓板的需求正在增加。印度是該地區第二大汽車製造國。根據OICA預測,2022年汽車產量將達545萬輛,較2021年的439萬輛成長24%。因此,汽車產量的增加預計將推動當前的研究市場。

- 液晶聚合物(LCP)薄膜也用於包裝產業。 2022年3月,TCPL Packaging Ltd.將其軟包裝工廠的產能加倍,並開始商業化生產。該公司還在果阿工廠增加了一條新生產線,擴大了膠印生產能力。隨著這些產能擴張,市場相關人員也正準備滿足預期的需求成長。

- 由於這些因素,預計亞太地區將在預測期內主導液晶聚合物 (LCP) 薄膜和層壓板市場。

液晶聚合物 (LCP) 薄膜和層壓板產業概況

液晶聚合物(LCP)薄膜和層壓板市場本質上是部分整合的。市場的主要參與者包括(不分先後順序)塞拉尼斯株式會社、KURARAY、寶理塑膠、住友化學先進技術公司、上海 PERT 複合材料有限公司和 UENO FINE CHEMICALS INDUSTRY LTD。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 對小型化電氣和電子元件的需求不斷增加

- 汽車零件輕量化材料開發

- 其他促進因素

- 限制因素

- 製造加工成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- LCP薄膜

- LCP層壓板

- 應用

- 汽車和運輸

- 電子產品

- 醫療設備

- 其他應用(工業機械、包裝等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Celanese Corporation

- KGK Chemical Corporation

- KURARAY CO. LTD.

- Panasonic Industry Co., Ltd.

- Polyplastics Co. Ltd.

- Rogers Corporation

- RTP Company

- Sumitomo Chemical Advanced Technologies

- Syensqo

- Toray Industries Inc.

- UENO FINE CHEMICALS INDUSTRY LTD.

第7章 市場機會與未來趨勢

- 東協和印度電子市場的成長潛力

- 其他機會

The Liquid Crystal Polymer Films And Laminates Market size is estimated at 9.22 kilotons in 2025, and is expected to reach 12.05 kilotons by 2030, at a CAGR of greater than 5.5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the liquid crystal polymer (LCP) films & laminates market. The nationwide lockdowns and strict social distancing measures had resulted in a halt in the manufacturing activities of various electronics, thereby affecting the market for liquid crystal polymer (LCP) films & laminates.

However, the market has recovered significantly since then, owing to the rising demand for liquid crystal polymer (LCP) films & laminates in electronics, automotive, and packaging applications.

Key Highlights

- The increasing demand for miniaturization of electrical and electronic components and the development of lightweight materials for automobile components are expected to increase demand for the studied market.

- The high manufacturing and processing costs of liquid crystal polymer (LCP) films and laminates are expected to hinder the market's growth.

- The potential growth in the ASEAN and India electronics market is expected to create opportunities for the market during the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and ASEAN countries.

Liquid Crystal Polymer (LCP) Films & Laminates Market Trends

Electronics Application Segment to Dominate The Market

- Liquid crystal polymers (LCP) and laminates have widened their application scope across the electronics industry. LCP films offer excellent electrical and mechanical properties, such as a low dielectric constant, high moisture barriers, a controllable thermal coefficient of expansion, high-frequency properties, and non-halogen flame-retardant characteristics.

- The spread of telework and stay-at-home demand drove up the demand for electronic equipment. Solution services grew as more investments in digitalization promoted more sophisticated data use. Thus, the demand for LCP films and laminates used in the electronics segment is expected to increase.

- The global electronics industry registered a significant growth rate. According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was valued at USD 3.43 trillion in 2022, registering a growth rate of 1% year on year, compared to USD 3.36 trillion in 2021. Moreover, the industry is expected to reach USD 3.52 trillion, with a growth rate of 3% year on year, by 2023.

- Asia-Pacific accounts for more than 70% of global electronics production. Countries like South Korea, Japan, and China manufacture electrical components and supply them to various industries globally. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- India's electronics system design and manufacturing (ESDM) sector is expected to generate over USD 100 billion in economic value by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, and Net Zero Imports in Electronics, which offer a commitment to growth in domestic manufacturing. The growing electronics industry is expected to drive the current studied market.

- Similarly, in Europe, the German electronics industry registered a significant growth rate. According to the ZVEI, Germany's electro and digital industry turnover accounted for USD 243.5 billion (EUR 224.5 billion) in 2022 as compared to the USD 216.9 billion ( EUR 200 billion) turnover registered in the previous year. Thus, the growth in the electronics industry is expected to drive the market demand for Liquid Crystal Polymer (LCP) Films and laminates in the country.

- Owing to all these factors, the electronics application segment is expected to dominate the market for liquid crystal polymer (LCP) films & laminates during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for liquid crystal polymer (LCP) films & laminates during the forecast period. The rising demand for liquid crystal polymer (LCP) films & laminates is rising from the electronics and automotive industries in China, Japan, and India.

- In countries like China and Japan, the electronics industry has registered a significant growth rate, thereby driving the market for silicone coatings. The Chinese electronics market increased by 13% in 2022 compared to 2021, when the market saw a 10% rise. The estimated growth rate for 2023 is 7%.

- Japan is home to the world's largest electronics companies and enjoys a significant share in the production of various electronic equipment and devices. According to the Japan Electronics and Information Technology Industries Association (JEITA), in 2022, the total production value of the electronics industry in Japan amounted to around USD 74.3 billion (JPY 11,124.3 billion), showcasing a rise of nearly 8% from the previous year.

- Furthermore, the demand for liquid crystal polymer (LCP) films & laminates is increasing in the automotive and transportation industries. India has become the second-largest automotive vehicle manufacturer in the region. According to OICA, the total production volume of automotive vehicles reached 5.45 million units in 2022, indicating a growth of 24% as compared to 4.39 million units registered in 2021. Thus, the increasing production volume of automotive vehicles is anticipated to drive the current studied market.

- Liquid crystal polymer (LCP) films also find applications in the packaging industry. In March 2022, TCPL Packaging Ltd. doubled its flexible packaging plant capacity, which has now gone into commercial production. The company also expanded offset capacity by adding a new production line at the Goa plant. With these capacity expansions, market players are also poised to manage the expected higher demand.

- Due to all such factors, the Asia-Pacific region is expected to dominate the market for liquid crystal polymer (LCP) films and laminates during the forecast period.

Liquid Crystal Polymer (LCP) Films and Laminates Industry Overview

The liquid crystal polymer (LCP) films and laminates market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Celanese Corporation, KURARAY CO. LTD., Polyplastics Co. Ltd., Sumitomo Chemical Advanced Technologies, Shanghai PERT Composites Co. Ltd, and UENO FINE CHEMICALS INDUSTRY LTD, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Miniaturization of Electrical and Electronic Components

- 4.1.2 Development of Lightweight Materials for Automobile Components

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Manufacturing and Processing Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 LCP Films

- 5.1.2 LCP Laminates

- 5.2 Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Electronics

- 5.2.3 Medical Devices

- 5.2.4 Other Applications (Industrial Machinery, Packaging, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 KGK Chemical Corporation

- 6.4.3 KURARAY CO. LTD.

- 6.4.4 Panasonic Industry Co., Ltd.

- 6.4.5 Polyplastics Co. Ltd.

- 6.4.6 Rogers Corporation

- 6.4.7 RTP Company

- 6.4.8 Sumitomo Chemical Advanced Technologies

- 6.4.9 Syensqo

- 6.4.10 Toray Industries Inc.

- 6.4.11 UENO FINE CHEMICALS INDUSTRY LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Potential in Growth in ASEAN and India Electronics Market

- 7.2 Other Opportunities