|

市場調查報告書

商品編碼

1690789

東南亞 POS 終端:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Southeast Asia POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

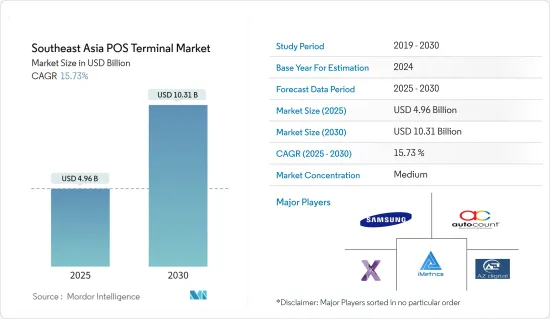

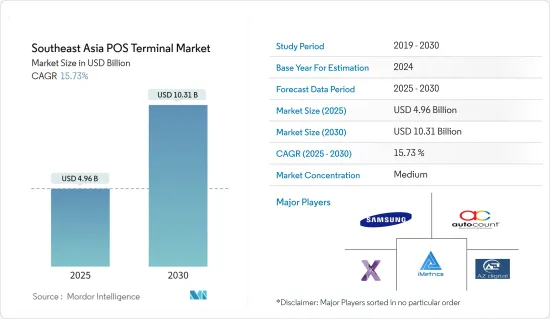

東南亞 POS 終端市場規模預計在 2025 年為 49.6 億美元,預計到 2030 年將達到 103.1 億美元,預測期內(2025-2030 年)的複合年成長率為 15.73%。

由於能夠提供積極的收益回報和提高可近性,POS 終端在過去幾年中得到了迅速普及。在過去的幾年中,POS 系統對小型、中型和大型企業變得越來越重要,促進了零售、酒店、運輸和銀行等行業企業核心的交易。

主要亮點

- POS 終端已經從交易導向的終端發展成為與公司 CRM 和其他金融解決方案整合的系統。因此,最終用戶可以更好地利用商業智慧來更好地管理收益來源和庫存。由於先進的POS系統的功能優勢,企業正在用POS系統取代傳統的收費軟體,從而確保了POS系統的成長。

- 近年來,東南亞金融犯罪案例不斷增加,促使政府監管機構呼籲提高付款交易的安全性。為了滿足消費者對數位交易安全性和可靠性的需求,對安全的付款程序的需求日益增加。這些監管機構對 POS 終端的採用產生了積極影響。由於全球行動趨勢日益成長,行動 POS 系統正迅速變得越來越流行。由於採用無現金交易技術,該地區的 POS 採用率正在上升。

- 預計電子商務和網路購物趨勢以及實體零售業務的興起將阻礙終端和麵對面商店的成長。由於各大電子商務平台提供貨到付款服務,行動 POS 終端機的採用呈指數級成長。

- 隨著客戶要求快捷、方便的付款,卡片詐騙變得越來越複雜。有跡象表明,駭客瞄準 POS 系統韌體來竊取信用和其他付款資料。 POS詐騙的主要原因是商家沒有利用點對點加密 (P2PE) 解決方案來保護他們的 POS資料。

東南亞POS終端市場趨勢

零售領域可望強勁成長

- 隨著消費者偏好的快速變化,東南亞市場也變得越來越活躍。當談到消費者喜歡的無縫零售體驗時,精通技術和非精通技術的消費者都希望獲得相同的體驗。

- 此外,POS 終端透過其提供的豐富庫存、銷售報告、財務管理和客戶分析功能幫助零售商克服客戶維繫挑戰。因此,POS 終端的發展取決於維持客戶忠誠度和加強該領域競爭的需求。

- 憑藉大幅折扣和其他服務,該地區的許多商店都吸引了顧客,但留住顧客已成為市場持續發展的關鍵問題。為了避免價格戰,同時平衡新技術的投資和收益,根據競爭環境重新考慮經營模式變得越來越重要。

- 此外,東南亞數位經濟正在迅速擴張。據谷歌和淡馬錫稱,受銷售點終端需求不斷成長的推動,排名前六的國家的線上消費支出預計未來一年將達到約 2500 億美元。

- 東協的主要企業——印尼、泰國、馬來西亞、新加坡、菲律賓和越南——正在整合其零售店,以佔領更大的市場佔有率。 POS 終端市場的本地參與者正在透過擴展其網路和建立夥伴關係關係來增加客戶,從而利用不斷成長的需求。

新加坡市場可望快速成長

- 新加坡一直處於付款創新的前沿。加速數位付款是政府智慧國家計畫的主要目標之一。在此方面,新加坡投入巨資建設無現金付款的長期基礎建設。據新加坡金融管理局稱,POS 終端已覆蓋全國多個行業,卡片付款交易量正在增加。

- 數位錢包的使用正在增加。行動電話使用率高導致其廣泛採用,目前佔交易量的 18%。到 2023 年,數位錢包預計將佔據 26% 左右的市場佔有率。 PayPal是最受認可的數位錢包品牌,市場佔有率為5%至10%。 Apple Pay、Samsung Pay、Visa Checkout 和 MasterPass 也是受歡迎的選擇。

- 此外,鑑於疫情刺激了電子商務的熱潮,數位錢包很可能在明年取代信用卡成為新加坡最受歡迎的線上付款方式。隨著消費者逐漸不再使用商店點終端的現金付款,數位錢包也提高了消費者在商店購物的忠誠度。根據Worldpay預測,明年它將佔據POS市場的20%。

- 隨著業務集中度提高以及客戶付款數位和付款的頻率增加,東南亞各國政府正在採取各種措施來推廣替代付款方式。

東南亞POS終端產業概況

東南亞POS終端市場呈現半固定格局,國內外參與者並存。市場參與者正在探索吸引和留住客戶的新策略。在軟體領域,基於訂閱的定價模式為客戶提供了靈活性,但也增加了市場競爭壓力。

2022 年 9 月,Shopify Inc. 推出了 POS Go,這是一款內建條碼掃描器、讀卡機和庫存追蹤器的手持工具。以前,商家可以下載適用於其桌上型電腦、筆記型電腦或行動應用程式的應用程式來使用 Shopify 的 POS 系統。 POS Go 具有便攜性,可在查核點、商店或路邊使用,無需連接到行動電話或電腦。隨著越來越多的顧客重新選擇在實體店而非線上購物,該公司推出了新工具。

2022年8月,三星電子與萬事達卡宣布將共同推出內建指紋感應器的付款卡。兩家公司的目標是提供更安全的付款服務,同時減少與付款終端的實體接觸。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 擴大 POS 投資可望推動市場成長

- 付款行業數位化的興起

- 市場限制

- 有關網路攻擊和資料外洩的安全性問題

第6章 市場細分

- 按組件

- 硬體

- 軟體和服務

- 按類型

- 固定POS終端

- 行動/可攜式POS 終端

- 按最終用戶產業

- 娛樂

- 飯店業

- 衛生保健

- 零售

- 其他最終用戶產業

- 按國家

- 新加坡

- 印尼

- 越南

- 馬來西亞

第7章 競爭格局

- 公司簡介

- Xilnex

- Auto Count Sdn Bhd

- iMetrics Pte. Ltd

- AZ Digital Pte. Ltd

- Samsung Electronics Co. Ltd

- NCR Corporation

- Toshiba Tec Corp.

- HP Development Company LP

- Bindo Labs Inc.

- Shopify Inc.

- Qashier Pte Ltd

- StoreHub Sdn Bhd

8. 馬來西亞 POS 軟體供應商名單

9. 馬來西亞主要供應商概況-比較分析

第 10 章:市場的未來

The Southeast Asia POS Terminal Market size is estimated at USD 4.96 billion in 2025, and is expected to reach USD 10.31 billion by 2030, at a CAGR of 15.73% during the forecast period (2025-2030).

As a result of its ability to deliver an improved return on investment and accessibility, POS terminals have been rapidly adopted over the last few years. Over the years, the importance of point-of-sale systems in small and large enterprises has increased, facilitating transactions from the central part of the enterprise in sectors such as retail, hospitality, transport, and banking.

Key Highlights

- POS terminals have evolved from transaction-oriented terminals to systems integrated with the company's CRM and other financial solutions. As a result, end users with business intelligence have better managed their revenue streams and inventory. Companies have replaced their traditional billing software with point-of-sale systems due to the functional benefits of advanced point-of-sale systems to ensure the growth of point-of-sale systems.

- Over the past few years, rising cases of financial crime in Southeast Asia have influenced government regulatory bodies to improve security for payment transactions. The need to use secure payment procedures is becoming increasingly essential to meet consumers' demands for safety and reliability with their digital transactions. These Regulatory Authorities have positively affected the adoption of POS terminals. Mobile POS systems have taken off as a result of rising mobility trends around the world. In the region, POS adoption rates have increased due to the introduction of cashless transaction technologies.

- The growth in terminals and face-to-face outlets is expected to be hampered by the growing e-commerce and online shopping trends and brick-and-mortar retail practices. With the possibility of cash on delivery offered by significant e-commerce platforms, a sudden surge in the adoption of mobile POS terminals was noticed.

- Due to growing customer demand for quick and easy payments, card fraud has become increasingly sophisticated. Hackers may be identified targeting the POS system's firmware to steal credit and other payment data. Point-of-sale fraud is largely caused by merchants' failure to leverage point-to-point encryption (P2PE) solutions to safeguard POS data.

Southeast Asia POS Terminal Market Trends

The Retail Segment is Expected to Grow Significantly

- With the rapid pace of changing consumer preferences, the Southeast Asian market is increasingly dynamic. Regarding the seamless experience they desire in their favored retailers, TechSavvy and Nontech Savvy customers also demand the same.

- In addition, retailers are assisted in overcoming the difficulty of retaining customers thanks to a wide range of inventory, sales reports, finance management, and customer analysis features offered by point-of-sale terminals. Therefore, the development of POS terminals is supported by a requirement to maintain customer loyalty and reinforce competition within this sector.

- With large discounts and other services, many outlets across regions attract customers, but their retention becomes an important problem for them to continue on the market. To avoid competition for prices while balancing investments in new technology and revenues, the competitive environment makes it all the more important that their business models are rethought.

- In addition, Southeast Asia is in for a rapid expansion of the Digital Economy. According to Google and Temasek, online consumer spending in the top six economies in the coming year is expected to reach approximately USD 250 billion, driving the market because of the growing demand for POS terminals.

- Top players in the ASEAN big six, Indonesia, Thailand, Malaysia, Singapore, Philippines, and Vietnam, are consolidating their retail outlets to take up a greater market share. Local players in the POS terminals market are taking advantage of rising demand by adopting partnerships to grow their networks and increase customer acquisition.

Singapore Anticipated to be the Fastest-growing Market

- Singapore has been at the forefront of payment innovation for some time. One critical goal of the government's vision for a smart nation is accelerating digital payments. In this connection, Singapore has significantly invested in building a long-term infrastructure for cashless payments. According to the Monetary Authority of Singapore, which suggests that POS terminals can be used in several industry sectors within this country, card payment transactions are growing at an increased rate.

- The use of digital wallets is on the rise. High use of mobile phones leads to uptake, which currently amounts to 18% of transactions. By 2023, digital wallets will have a market share of around 26%. PayPal is the most recognized brand for DigitalWallets, having a market share of between 5% and 10%. It is also popular to use Apple Pay, Samsung Pay, Visa Checkout, and Masterpass.

- In addition, given the e-commerce boom triggered by the epidemic, Digital Wallets will pass credit cards as Singapore's favorite online payment method next year. Digital wallets also capture more consumer loyalty to in-store purchases as consumers shift away from cash at point-of-sales terminals. They are projected to represent 20% of the POS market by next year, according to Worldpay, Inc.

- The increasing concentration of businesses and an increase in the frequency of Digital or Mobile Payments between customers are creating a variety of efforts by governments across Southeast Asia to promote alternative payment methods.

Southeast Asia POS Terminal Industry Overview

The Southeast Asian point-of-sale terminal market is semiconsolidated due to the presence of local and international players. Players in the market are developing new strategies to attract and retain customers. In software, the subscription-based pricing model provides customers flexibility while increasing competitive pressures on the market.

In September 2022, Shopify Inc. launched POS Go, a handheld tool with a built-in barcode scanner, card reader, and inventory tracker. Previously, merchants could download desktop, laptop, or mobile application applications to use Shopify's POS system. The POS Go is portable and does not require a mobile phone or computer connection at the checkpoint, shop floor, or curb. The company's new tool comes as more customers return to the habit of shopping in person rather than online.

In August 2022, Samsung Electronics and master card have announced that the collaboration will launch payment cards with built-in fingerprint sensors. Both companies aim to provide more secure payment services while reducing physical contact with payment terminal

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in POS is Expected to Boost the Market Growth

- 5.1.2 Increasing Digitalization in the Payment Industry

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to Cyber Attacks and Data Breaches

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By Type

- 6.2.1 Fixed Point-of-Sale Terminals

- 6.2.2 Mobile/Portable Point-of-Sale Terminals

- 6.3 By End-user Industries

- 6.3.1 Entertainment

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 Singapore

- 6.4.2 Indonesia

- 6.4.3 Vietnam

- 6.4.4 Malaysia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Xilnex

- 7.1.2 Auto Count Sdn Bhd

- 7.1.3 iMetrics Pte. Ltd

- 7.1.4 AZ Digital Pte. Ltd

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 NCR Corporation

- 7.1.7 Toshiba Tec Corp.

- 7.1.8 HP Development Company LP

- 7.1.9 Bindo Labs Inc.

- 7.1.10 Shopify Inc.

- 7.1.11 Qashier Pte Ltd

- 7.1.12 StoreHub Sdn Bhd