|

市場調查報告書

商品編碼

1690849

雷射打標產業:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Laser Marking Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

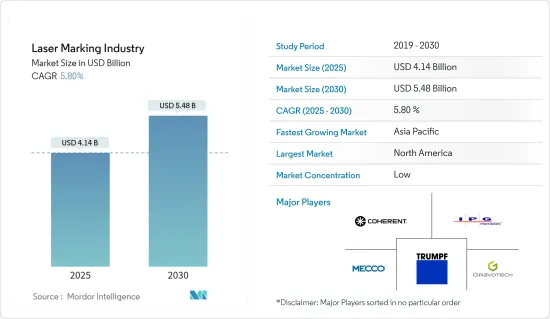

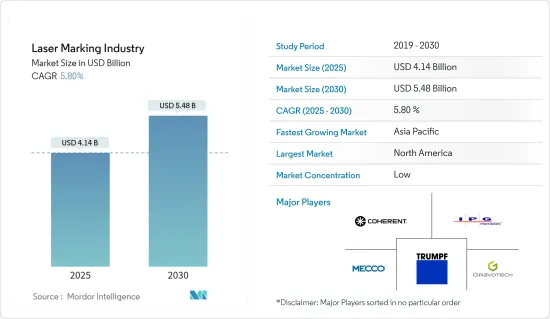

預計雷射打標產業規模將從 2025 年的 41.4 億美元成長到 2030 年的 54.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.8%。

雷射打標經常用於增強設備製造中的可追溯性、品管和製程改進。透過在生產線早期為每個零件分配一個標識,條碼閱讀器可以在生產的每個階段追蹤該零件。

主要亮點

- 傳統的雷射打標機和一體機通常局限於平面視野,只能透過在打標時旋轉或移動物體來調整傾斜或圓柱形表面。然而,隨著製造業的發展,包括更複雜的字元形狀,雷射打標機開始整合到編程機器人和先進的 5 軸機器中。

- 雷射打標是一種用途廣泛的技術,廣泛應用於各行各業。可以透過雷射蝕刻、雕刻或退火在多個表面上建立永久標記。這項卓越的技術可應用於醫療保健和製藥、汽車、電子、工具機和包裝領域。

- 市場受到各行業應用範圍擴大和研發投入增加的影響,從而提高了雷射打標設備的功能。在設備製造過程中,經常採用雷射打標來輔助可追溯性、品管和製程改進。持續的研究和創新對於開發對環境負責的雷射打標流程至關重要,以確保卓越的操作和生態完整性。這將為永續的市場成長鋪平道路。維持市場競爭力的關鍵是加大研發投入,創造創新產品。

- 高額的初始投資對於預算有限的小型企業和新興企業來說是一個挑戰。雷射打標機需要大量的初始投資,這會根據雷射位置、所需功率、打標區域大小和附加功能等因素而有所不同。因此,高昂的初始成本可能會阻礙市場擴張。

- 包括 COVID-19 在內的各種宏觀經濟因素對全球雷射打標市場產生了不利影響。世界各地實施的嚴格封鎖措施導致供應鏈中斷。美國、德國、英國和中國等主要製造業國家先前對設備和機械的需求很高,但受到疫情的嚴重影響,導致此類產品的市場陷入停滯。作為遏制病毒的努力的一部分,美國製造業蓬勃發展,因為公司允許非必要員工遠端工作。中國面臨經濟成長放緩,亞洲市場暫停發展,而中國政府在最近的五年計畫中瞄準的西方市場則因疫情復發而舉步維艱。

雷射打標產業趨勢

最大的終端用戶是工具機。

- 汽車零件的雷射打標是一種靈活、永久性的過程,有助於在生產期間和生產後追蹤和識別零件。以高精度和細節標記文字、徽標和其他圖像。在汽車領域,零件必須完全可追溯,不僅出於安全原因,而且出於技術原因。汽車製造商在其車輛上使用獨特的、防偽的、易於閱讀的資料矩陣代碼和字母數字標記。雷射打標機可用於將這些重要代碼永久刻在幾乎任何材料上,無論零件是由塑膠還是金屬製成的。

- 許多汽車零件由塑膠、輕金屬和鋼製成,並帶有標記以便於追溯和品管。這些標記必須耐用且能延長車輛或零件的使用壽命,即使暴露在高溫和油氣等液體中也是如此。因此,汽車零件的雷射打標可以在汽車製造中使用的大多數材料上提供持久的標記。

- 此外,雷射打標應用簡單快捷,使其成為大規模生產中經濟高效的解決方案,可簡化零件缺陷控制並減少出錯的機會。

- 雷射打標在汽車行業中具有許多優勢,例如耐用性、防偽、最高精度、速度和高對比度。汽車製造商發現雷射技術是零件標記的理想方法。雷射打標還能抵抗熱應力、酸、汽油、油和熱,從而永久保證每個組件品質的最大可追溯性。雷射打標由於其易於使用和速度快而具有經濟效益。

- 此外,中等收入階層的擴大和龐大的人口數量正在創造全球對汽車的需求,從而支持市場成長。據IBEF稱,印度汽車產業的目標是在2016年至2026年期間將汽車出口量增加五倍。 22會計年度印度的汽車出口數量為5,617,246輛。

- 許多汽車製造商正致力於擴大生產能力以滿足日益成長的需求,並支持市場成長。例如,2023年10月,現代汽車與公共投資基金(PIF)宣布簽署合資協議,在沙烏地阿拉伯建造高度自動化的汽車製造廠。

亞太地區:預計大幅成長

- 亞太地區有幾個新興經濟體的製造業成長強勁。中國、印度、韓國、台灣和越南等新興國家吸引了大量企業將其低技術和中等技術的生產設施從其他地區和國家遷移到這些新興國家,而這些國家的生產成本較低,使得這些地區成為全球製造地。

- 此外,這些國家的政府正在採取措施改善該地區的外國投資環境。例如,印度政府最近推出了舉措,旨在吸引企業進入印度並鼓勵對製造業的特定投資。中國政府也推出了進一步發展中國製造業的國家戰略規劃,名為「中國製造2025」。

- 此外,該地區的製造業支出大幅增加,預計未來將繼續以相應的速度成長。推動該地區對雷射打標解決方案需求的關鍵因素是生產支出的快速成長和新技術的採用。此外,該地區有多個已開發國家,其製造業為雷射打標市場提供了巨大的成長機會。

- 雷射打標技術因其成本效益、可靠性和產品獨特性而被廣泛的工業領域採用。一些公司,特別是醫療和國防領域的公司,已經實施了通訊協定,對各種產品進行永久標記,以便進行原產地追蹤、識別和記錄。此外,該技術在航空和汽車領域的應用也日益廣泛。汽車公司使用這項技術在不改變輪胎形狀的情況下在輪胎上列印序號。與傳統雕刻機相比,雷射打標因其高耐用性和識別許多不同飛機部件的能力而被認為是一種可行的選擇。

- 雷射打標設備在電子設備的應用十分廣泛。隨著電子設備和半導體產品製造數量的不斷增加,需要自動化標記和雕刻過程。零件上通常會刻有打標機雕刻的各種資訊。

雷射打標行業概況

雷射打標市場分散,主要參與者包括 Coherent Inc.、IPG Photonics Corporation、TRUMPF Group、Mecco Partners LLC 和 Gravotech Group。市場參與者正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 9 月 - Videojet Technologies Inc. 宣布將在 2023 年包裝博覽會上展示其在標記、編碼和印刷方面的工業 4.0 創新。該公司推出了新的 Videojet 3350 和 Videojet 3350 Smart Focus 雷射標記系統,旨在快速標記精確、複雜的代碼,適用於食品和飲料、化妝品、製藥和其他行業。這兩種系統在其他行業中都提供了幾乎無限的字體、程式碼和圖形選項。

- 2023 年 6 月 - Coherent 宣布推出 PowerLine PS 30,這是一款皮秒雷射打標機,用於醫療設備製造中的耐腐蝕黑色標記和精密微加工。 PowerLine PS 30 憑藉其高平均功率,可快速完成黑色標記和精細加工任務,同時保持極高的可靠性,顯著提高生產效率和擁有成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 宏觀趨勢如何影響市場

第5章 市場動態

- 市場促進因素

- 各種終端用戶產業的應用日益增多

- 增加研發投入,提升功能性

- 市場挑戰

- 實施成本高

第6章 市場細分

- 按設備

- 光纖雷射

- CO2雷射

- 固體雷射

- 其他設備

- 按產品

- 硬體

- 軟體

- 按最終用戶產業

- 衛生保健

- 車

- 電子產品

- 工具機

- 包裝

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Coherent Corporation

- IPG Photonics Corporation

- TRUMPF Group

- Mecco Partners LLC

- Gravotech Group

- Keyence Corporation

- Novanta Inc.

- Epilog Corporation

- Videojet Technologies Inc

- Han's Laser Group

第8章投資分析

第9章:市場的未來

The Laser Marking Industry is expected to grow from USD 4.14 billion in 2025 to USD 5.48 billion by 2030, at a CAGR of 5.8% during the forecast period (2025-2030).

Laser marking is frequently utilized to enhance traceability, quality control, and process improvement in equipment manufacturing. By assigning an identification to each component at the beginning of the production line, barcode readers may track parts at every manufacturing stage.

Key Highlights

- Traditional laser markers and integrated machines have typically been restricted to a flat planar field of view, which may be adjusted for inclined planes or cylindrical surfaces by rotating and moving the object during marking. However, as manufacturing has evolved to include more complex-shaped characters, laser markers have been integrated into programmed robotics or advanced 5-axis machines.

- Laser marking is an incredibly versatile technology used across various industries. It can create permanent marks on multiple surfaces through laser etching, engraving, or annealing. This remarkable technology is applied in healthcare and pharmaceuticals, automotive, electronics, machine tools, and packaging sectors.

- The market is influenced by the expanding usage in different industries and the rise in investment in research and development, which results in improved functionality of laser markers. Laser marking is frequently employed to aid in traceability, quality control, and process enhancement during the manufacturing process of equipment. Continuing research and innovation will be crucial in developing laser marking processes that are environmentally responsible, guaranteeing both operational excellence and ecological integrity. This will pave the way for sustainable market growth. The key to remaining competitive in the market is increasing investment in research and development and creating innovative products.

- The high initial investment can challenge small businesses or startups operating on limited budgets. Laser marking machines can entail a notable upfront expense, which can differ based on factors such as laser placement, power needs, marking area size, and additional functionalities. Consequently, the elevated initial cost may impede the expansion of the market.

- Various macroeconomic factors, including COVID-19, adversely impacted the global laser marking market. The strict lockdown measures implemented worldwide caused disruptions in the supply chain. Leading manufacturing countries like the United States, Germany, the United Kingdom, and China, which previously showed significant demand for equipment and machinery, were heavily affected by the pandemic, leading to a suspension in the market for such products. The manufacturing sector in the United States thrived because companies allowed nonessential employees to work remotely as part of their virus containment measures. China faced a slowdown in growth, while Asian markets paused, and the Western market, which the government had targeted in their recent five-year plan, struggled with a resurgence of the pandemic.

Laser Marking Industry Trends

Machine Tools to be the Largest End User

- Laser marking automotive parts is a flexible and permanent process that helps track and identify parts during and even after manufacturing. It marks text, logos, or other images with great precision and detail. In the automobile sector, components need to be fully traceable, not only for safety reasons but also for technical reasons. Automobile manufacturers use unique, forgery-proof, and easy-to-read data matrix codes and alphanumeric inscriptions in the vehicles. The laser markers are used to immortalize these important codes on almost any material, regardless of whether the components are made from plastic or metal.

- Many auto parts and components are made from plastics, light metals, and steel and are marked for traceability and quality control. These markings must be durable and last the car's or part's life, even when exposed to high temperatures and fluids such as oil and gas. Thus, laser marking of automotive parts offers lasting marks over time on most materials used in car manufacturing.

- Moreover, laser markings can be applied easily and quickly, making them a cost-effective solution for mass production, making it easier to manage component malfunctions, and lowering the possibility of errors.

- Laser marking in the automotive industry offers numerous benefits, such as durability, protection against forgery, maximum precision, speed, and high contrast. Automobile manufacturers make laser technology the ideal method for labeling components. Since laser marking is also resistant to thermal stress and exposure to acids, gasoline, oils, and heat, maximum traceability is permanently guaranteed for each component in terms of quality. Laser marking is also economically beneficial thanks to its ease of use and high speed.

- Moreover, the rising middle-class income and a huge population create global demand for automobiles, thus supporting market growth. According to IBEF, the Indian auto industry aims to increase car exports five times from 2016 to 2026. The total number of automobile exports from India in FY2022 was 5,617,246 units.

- Several automobile manufacturers focus on expanding their manufacturing capacity to meet the growing demand, thus supporting market growth. For instance, in October 2023, the Hyundai Motor Company and the Public Investment Fund (PIF) announced the signing of a joint venture agreement to construct a highly automated vehicle manufacturing plant in Saudi Arabia.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific includes several developing countries with strong growth in their manufacturing sectors. The developing countries in the region, such as China, India, South Korea, Taiwan, and Vietnam, attract several businesses from other areas or countries to relocate their low-skilled and medium-skilled production facilities to these developing countries, which are working at lower costs, the region has become a global manufacturing hub.

- Furthermore, development to improve the foreign investment situation in the region has been made by the governments of these countries. For instance, the Indian government has recently launched an initiative called 'Make in India' aimed at promoting enterprises to set up shop in India and encouraging their specific investments into manufacturing. In addition, the Chinese Government has introduced a National Strategic Plan for Further Development of the Chinese Manufacturing Sector called 'Made in China 2025'.

- Moreover, manufacturing spending in the region has increased significantly and is expected to continue rising at a reasonable growth rate over the years. The key factors stimulating demand for laser marking solutions in that region are this sharp increase in production expenditures and the adoption of new technologies. In addition, it is characterized by several advanced countries whose manufacturing sectors have given rise to a significant growth opportunity for laser marking markets.

- Given its cost-effectiveness, reliability, and product uniqueness, laser marking technology is generally adopted across a wide range of industrial sectors. Several companies, especially in the health and defense sectors, are implementing protocols for permanently marking a wide range of products to trace their provenance, evidence of identity, or documentation purposes. Moreover, the aviation and automotive sectors are increasingly adopting this technology. Automobile companies use this technology to print serial numbers on tires without changing shape. It is believed that laser marking has been a helpful option in comparison to traditional engravers due to its high durability and the ability to distinguish many different aircraft parts.

- The use of laser marking equipment in electronic devices is extensive. Many electronics and semiconductor products are manufactured, making it necessary to perform an automatic marking and engraving process. The components are usually marked with various information engraved on the marking machines.

Laser Marking Industry Overview

The laser marking market is fragmented, with the presence of major players like Coherent Inc., IPG Photonics Corporation, TRUMPF Group, Mecco Partners LLC, and Gravotech Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023 - Videojet Technologies Inc. announced that it would showcase Industry 4.0 innovations in marking, coding, and printing at Pack Expo 2023. The company introduced the new Videojet 3350 and Videojet 3350 Smart Focus laser marking systems, designed to mark precise, complex codes at high speed for the food, beverage, cosmetics, pharmaceutical, and other industries. Both systems offer virtually unlimited font, code, and graphics options in other industries.

- June 2023 - Coherent Corporation announced the launch of the PowerLine PS 30 picosecond laser marking machine for corrosion-resistant black marking and precision micromachining in medical device manufacturing. The PowerLine PS 30, with its high average power, quickly completes black marking and micro-machining tasks, significantly improving production productivity and cost of ownership while maintaining very high reliability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Applications in Various End-User Industries

- 5.1.2 Increased Investment in R&D leading to better Functionality

- 5.2 Market Challenges

- 5.2.1 High Cost of Deployment

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 Fiber Laser

- 6.1.2 CO2 Laser

- 6.1.3 Solid State Laser

- 6.1.4 Other Equipment

- 6.2 By Offering

- 6.2.1 Hardware

- 6.2.2 Software

- 6.3 By End-user Industry

- 6.3.1 Healthcare

- 6.3.2 Automotive

- 6.3.3 Electronics

- 6.3.4 Machine Tools

- 6.3.5 Packaging

- 6.3.6 Other End-User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coherent Corporation

- 7.1.2 IPG Photonics Corporation

- 7.1.3 TRUMPF Group

- 7.1.4 Mecco Partners LLC

- 7.1.5 Gravotech Group

- 7.1.6 Keyence Corporation

- 7.1.7 Novanta Inc.

- 7.1.8 Epilog Corporation

- 7.1.9 Videojet Technologies Inc

- 7.1.10 Han's Laser Group