|

市場調查報告書

商品編碼

1690940

非公路用車輪:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Off-Highway Wheels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

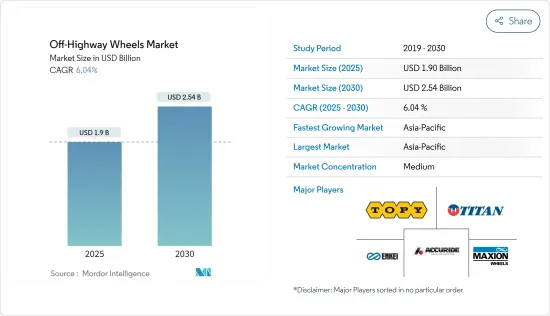

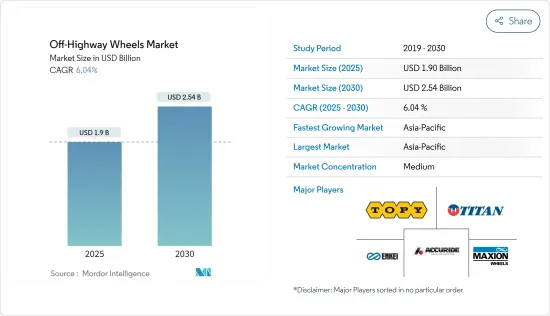

預計非公路用車輪市場規模在 2025 年將達到 19 億美元,到 2030 年將達到 25.4 億美元,預測期內(2025-2030 年)的複合年成長率為 6.04%。

非公路用車輪市場正在經歷強勁成長,這歸因於車輪技術的進步、基礎設施計劃投資的增加以及農業、建築和採礦業對耐用高效車輪的需求不斷成長等幾個關鍵因素。該報告分析了影響市場的關鍵促進因素和近期趨勢。

技術創新正在推動非公路車輪市場的發展。製造商專注於開發輕質、耐用的車輪,以提高性能和燃油效率。例如

主要亮點

- 馬可迅車輪公司將於 2022 年 11 月推出新一代輕量鋼製卡車車輪,每個車輪可減輕重量高達 3 公斤。這些進步不僅提高了燃油經濟性,而且還提高了負載容量,這對於非公路應用至關重要。

此外,全球基礎設施發展是非公路用車輪市場的主要促進因素。大型建築計劃,尤其是新興經濟體的大型建築項目,正在推動對配備先進車輪的堅固非公路用車輛的需求。世界各地的多個大型企劃正在對非公路用車輪市場產生重大影響。例如

主要亮點

- 中國的「一帶一路」計劃於 2013 年啟動,旨在透過在亞洲、歐洲和非洲進行大規模基礎設施建設來增強全球貿易路線,從而推動對建築和採礦設備的需求。印度的Bharatmala Pariyojana於2017年啟動,是一項全國性高速公路發展計劃,預計將於2025年分階段完成,這將推動對工程車輛和施工機械的需求。

- 同樣,沙烏地阿拉伯的 Neom City計劃於 2017 年宣布,預計將於 2030 年完工,這是一項雄心勃勃的智慧城市計劃,需要大量的施工機械。

「一帶一路」計劃、印度鐵路和 Neom City 等大型基礎設施計劃預計將推動非公路用車輪市場的大幅成長。

非公路輪圈市場趨勢

建築業可望主導市場

建築業是一個高度活躍的行業,整體經濟、預算和全球經濟狀況等眾多因素都會影響市場的成長。這些方面的波動將影響施工機械OEM的業務,進而影響非公路用車輪的需求。

由於全球計劃項目對土木機械的需求龐大,非公路用車輪的需求主要由該產業主導。中國的「一帶一路」計畫和印度的「印度支那計畫」等大型工程需要大量的施工機械,包括挖土機、裝載機、推土機和反鏟挖土機。這些計劃涉及大量的土方工程,需要耐用、高性能的車輪,以確保在複雜地形上的效率和可靠性。隨著各國繼續投資建設和升級基礎設施,對施工機械車輪的需求可能會保持強勁。

由於投資增加,一些國家的基礎設施建設取得了顯著成長。建築、隧道、鐵路網、道路和橋樑的建設吸引了全國各地大量投資。預測期內,全國基礎設施建設的不斷擴大可能會增加對施工機械的需求。例如

- 2024年3月,印度政府為跨邦的112個國家高速公路計劃舉行了揭幕儀式,總價值約120.4億美元。這些計劃包括主要高速公路擴建和引入 GNSS 等無障礙收費新技術。

此外,公共和私營部門的基礎設施投資,如印尼的國家中期發展計畫(4,600億美元)、越南的社會經濟發展計畫(615億美元)和菲律賓的發展計畫「大建特建」(718億美元),預計將增加該地區對非公路用車的需求。

全球建築業的蓬勃發展可能會刺激未來幾年對施工機械的需求,進而增加對車輪的需求。

預計亞太地區將主導市場

由於推動建築、農業和工業領域成長的幾個關鍵因素,亞太地區 (APAC) 繼續引領非公路用輪圈市場。公路和鐵路基礎設施的顯著發展,加上對新計畫的大量投資,帶動全部區域建築業的顯著成長。因此,對非公路用車和車輪的需求正在增加。

亞太國家正在大力投資基礎設施,以支持其不斷成長的工業和服務業。例如,中國宣布了一項重大基礎設施計劃,投資預算約為 4.8 兆美元,旨在建造新計畫並加快現有建設進度。此項投資是中國加強公路、鐵路和城市發展等基礎設施網路的更廣泛戰略的一部分,推動了對堅固可靠的非公路用車輪的需求。

亞太地區,尤其是印度的農業部門也是非公路用車輪市場的主要推手。該產業對印度 GDP 的貢獻大幅增加,23 會計年度曳引機銷量已超過 90 萬輛。曳引機銷售的激增凸顯了對農業機械的需求不斷成長,這反過來可能推動對非公路用輪胎的需求。由於農業在許多亞太地區國家的經濟中發揮關鍵作用,非公路用車輪的需求預計將持續成長。

亞太地區建築業由私人企業和國有企業主導,對商業計劃、可再生能源和公共基礎設施的支出不斷增加。由於正在進行和計劃中的大型企劃,日本、中國和印度等國家的施工機械和挖掘機市場正在增強。

非公路車輪產業概況

Titan International Inc.、Moveero Limited、Yokohama、Accuride Corporation、Rimex、Steel Strips Wheels Ltd 和 Maxion Wheels 等主要企業主導非公路車輪市場。市場參與者正專注於多種成長策略,以獲得相對於其他參與者的競爭優勢。例如

- 2022 年 3 月,Titan International Inc. 宣布已達成最終協議,將其澳洲車輪業務出售給當地著名的非公路用車輛輪胎、車輪及相關服務供應商 OTR Tyres。這項策略舉措是泰坦公司簡化全球業務、專注於核心市場的努力的一部分。此次出售包括泰坦在澳洲的生產設施、庫存和客戶契約,使 OTR 輪胎能夠加強其市場影響力和服務水準。

- 2022 年 2 月,Titan International 與久保田曳引機公司 (KTC) 簽署了一項重要協議,為久保田的多功能和緊湊型曳引機型號供應新的 Trac Loader II 輪胎。該輪胎專為輕型建築、農業、商業和住宅應用而設計,具有卓越的性能和耐用性。 Trac Loader II 輪胎採用先進的胎面設計和材料,可提高牽引力、減少土壤壓實並提高曳引機在各種非公路環境中的整體效率。與久保田的夥伴關係彰顯了泰坦對非公路用車輪和輪胎技術創新的承諾,旨在滿足各種應用領域客戶不斷變化的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 依產品類型

- 合金車輪

- 鋼製輪圈

- 按應用

- 農業

- 建築業(土木機械)

- 物料輸送(移動式起重機和堆高機)

- 採礦(行動採礦設備)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Titan International Inc.

- Moveero Limited

- Accuride Corporation

- Rimex

- Steel Strips Wheels Ltd

- Maxion Wheels

- OTR Wheel Engineering

- Carrier Wheels Private Limited

- Bohnenkamp AG

- Citic Dicastal Co. Ltd

- Trident International

- Levypyora Oy

- JS Wheels

- Anyang Rarlong Machinery Co. Ltd

- STARCO

- Sun Tyre and Wheel Systems

- Baluchistan Wheels Limited

- Topy Industries Ltd

- SAF Holland Group

- Bhagwati Wheels

- Pronar Wheels

- Tej Wheels

- Camso Wheels

第7章 市場機會與未來趨勢

The Off-Highway Wheels Market size is estimated at USD 1.90 billion in 2025, and is expected to reach USD 2.54 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

The off-highway wheel market is experiencing robust growth driven by several key factors, including advancements in wheel technology, increased investment in infrastructure projects, and the growing demand for durable and efficient wheels in the agriculture, construction, and mining sectors. The report analyzes the primary drivers and recent developments influencing this market.

Technological innovations are significantly propelling the off-highway wheel market. Manufacturers are focusing on developing lightweight, durable wheels that offer enhanced performance and fuel efficiency. For example,

Key Highlights

- Maxion Wheels, in November 2022, launched a new generation of lightweight steel truck wheels, which provide weight savings of up to 3 kg per wheel. These advancements not only improve fuel efficiency but also allow for increased payload capacities, which is crucial for off-highway applications.

Furthermore, global infrastructure development is a major driver of the off-highway wheel market. Large-scale construction projects, particularly in developing economies, are increasing the demand for robust off-highway vehicles equipped with advanced wheels. Several mega projects around the world are significantly impacting the off-highway wheel market. For instance,

Key Highlights

- The Belt and Road Initiative (BRI) by China, launched in 2013, aims to enhance global trade routes through extensive infrastructure development across Asia, Europe, and Africa, driving demand for construction and mining equipment. India's Bharatmala Pariyojana, initiated in 2017, is a nationwide highway development project expected to be completed in phases by 2025, boosting the need for construction vehicles and equipment.

- Similarly, the Neom City Project in Saudi Arabia, announced in 2017 and expected to be completed by 2030, is an ambitious smart city initiative requiring vast quantities of construction machinery.

These large-scale infrastructure projects, such as the Belt and Road Initiative, Bharatmala Pariyojana, and Neom City, are set to drive substantial growth in the off-highway wheel market.

Off-Highway Wheels Market Trends

The Construction Segment is Expected to Dominate the Market Studied

The construction sector is highly dynamic, and numerous factors, such as the overall economy, budgets, and global economic scenario, are influencing the market's growth. Volatility in these aspects affects the businesses of construction equipment OEMs, which will, in turn, affect the demand for off-highway wheels.

The sector's demand for off-highway wheels is dominant due to the extensive need for earth-moving machinery in global infrastructure projects. Large-scale initiatives such as China's Belt and Road Initiative and India's Bharatmala Pariyojana necessitate a vast array of construction equipment, including excavators, loaders, bulldozers, and backhoes. These projects involve massive amounts of earth moving, which requires durable and high-performance wheels to ensure efficiency and reliability in challenging terrains. As countries continue to invest in building and upgrading their infrastructure, the demand for construction equipment wheels may remain robust.

Several countries are witnessing significant infrastructure growth owing to the increase in investments. The construction of buildings, tunnels, rail networks, roads, and bridges is attracting major investments across the country. Growing infrastructure development across the country is likely to increase the demand for construction equipment during the forecast period. For instance,

- In March 2024, the Indian government inaugurated and laid the foundation for 112 national highway projects across various states worth approximately USD 12.04 billion. These projects include major highway expansions and the introduction of new technologies like GNSS for barrier-free tolling.

In addition, the investments in infrastructure, both public and private, such as the Indonesian National Medium-term Development Plan (USD 460 billion), Vietnam Socio-Economic Development Plan (USD 61.5 billion), and the Philippine Development Plan "Build, Build, and Build" (USD 71.8 billion), are expected to increase the demand for off-highway vehicles in this region.

The increase in construction development across the globe is likely to enhance the demand for construction machinery, which, in turn, is likely to enhance the demand for wheels in the coming years.

Asia-Pacific is Anticipated to Dominate the Market

Asia-Pacific (APAC) continues to lead the off-highway wheel market due to several key factors driving growth in the construction, agricultural, and industrial sectors. The noteworthy development of road and rail infrastructure, coupled with significant investments in new projects, has resulted in substantial growth in the construction sector across the region. This has consequently increased the demand for off-highway vehicles and wheels.

APAC countries have been heavily investing in infrastructure to support their growing industrial and service sectors. For instance, China announced significant infrastructure plans involving an investment budget of approximately USD 4.8 trillion, aimed at new projects and speeding up existing construction efforts. This investment is part of China's broader strategy to enhance its infrastructure network, including roads, railways, and urban development, which drives the demand for robust and reliable off-highway wheels.

The agricultural sector in APAC, particularly in India, is another major driver of the off-highway wheel market. The sector's contribution to India's GDP increased significantly, with tractor sales reaching over 900 thousand units in FY 2023. This surge in tractor sales highlights the rising demand for agricultural machinery, which, in turn, may boost the need for off-highway wheels. With agriculture playing a crucial role in the economies of many APAC countries, the demand for off-highway wheels is expected to continue growing.

The construction sector in APAC is dominated by both private and state-owned enterprises, with increased spending on commercial projects, renewable energy, and public infrastructure. Countries like Japan, China, and India are seeing strengthening markets for construction machinery and excavators, driven by ongoing and planned mega-projects.

Off-Highway Wheels Industry Overview

Several key players, such as Titan International Inc., Moveero Limited, Yokohama, Accuride Corporation, Rimex, Steel Strips Wheels Ltd, and Maxion Wheels, dominate the off-highway wheels market. The players operating in the market are concentrating on several growth strategies to gain a competitive edge over other players. For instance,

- In March 2022, Titan International Inc. announced a definitive agreement to sell its Australian wheel business to OTR Tyres, a prominent local provider of tires, wheels, and related services for off-highway vehicles. This strategic move was part of Titan's efforts to streamline its global operations and focus on core markets. The sale included Titan's production facilities, inventory, and customer contracts in Australia, allowing OTR Tyres to enhance its market presence and service offerings.

- In February 2022, Titan International Inc. signed a significant agreement with Kubota Tractor Corporation (KTC) to supply its new Trac Loader II tires for Kubota's utility and compact tractor models. These tires are designed for light construction, agricultural, commercial, and residential applications, providing superior performance and durability. The Trac Loader II tires feature advanced tread designs and materials that improve traction, reduce soil compaction, and enhance the overall efficiency of tractors in various off-highway environments. This partnership with Kubota underscores Titan's commitment to innovation in off-highway wheels and tires, aiming to meet the evolving needs of customers in diverse applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Product Type

- 5.1.1 Alloy Wheels

- 5.1.2 Steel Wheels

- 5.2 By Application Type

- 5.2.1 Agriculture

- 5.2.2 Construction (Earth-moving Machinery)

- 5.2.3 Material Handling (Mobile Cranes and Forklift Trucks)

- 5.2.4 Mining (Mobile Mining Equipment)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Titan International Inc.

- 6.2.2 Moveero Limited

- 6.2.3 Accuride Corporation

- 6.2.4 Rimex

- 6.2.5 Steel Strips Wheels Ltd

- 6.2.6 Maxion Wheels

- 6.2.7 OTR Wheel Engineering

- 6.2.8 Carrier Wheels Private Limited

- 6.2.9 Bohnenkamp AG

- 6.2.10 Citic Dicastal Co. Ltd

- 6.2.11 Trident International

- 6.2.12 Levypyora Oy

- 6.2.13 JS Wheels

- 6.2.14 Anyang Rarlong Machinery Co. Ltd

- 6.2.15 STARCO

- 6.2.16 Sun Tyre and Wheel Systems

- 6.2.17 Baluchistan Wheels Limited

- 6.2.18 Topy Industries Ltd

- 6.2.19 SAF Holland Group

- 6.2.20 Bhagwati Wheels

- 6.2.21 Pronar Wheels

- 6.2.22 Tej Wheels

- 6.2.23 Camso Wheels