|

市場調查報告書

商品編碼

1692036

越南潤滑油:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vietnam Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

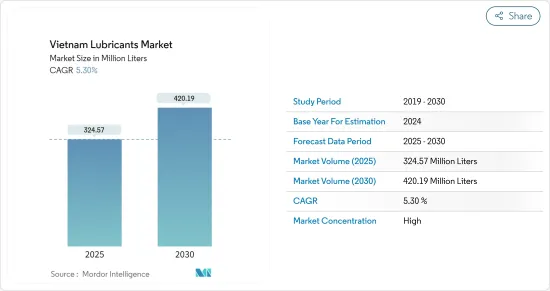

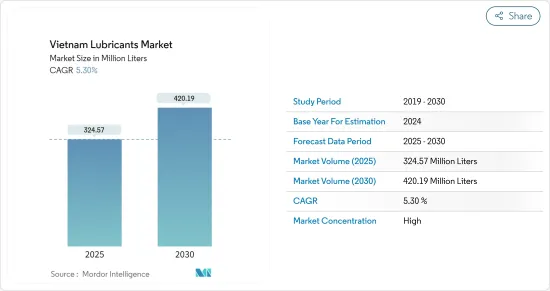

預計 2025 年越南潤滑油市場規模為 3.2457 億公升,預計 2030 年將達到 4.2019 億公升,預測期內(2025-2030 年)的複合年成長率為 5.3%。

主要亮點

- 按最終用途行業分類的最大細分市場——汽車:汽車是所有類別中最大的最終用途行業,因為與其他工業應用相比,汽車使用的潤滑劑更多。

- 按終端用戶產業分類的成長最快的終端用戶細分市場——發電:受天然氣爐和風力發電機發電使用量的增加所推動,發電預計將成為越南成長最快的終端用戶。

- 按產品類型分類的最大細分市場-機油:引擎機油是越南消費量最大的產品類型,因為潤滑內燃機需要大量且頻繁更換的引擎機油。

- 按產品類型分類的最快細分市場:液壓油:預計未來幾年建築、採礦、鋼鐵、海洋和航空領域的成長將支持越南的液壓油消費。

越南潤滑油市場趨勢

最大的終端使用者領域:汽車

- 2020年,汽車產業約佔越南潤滑油消費量的81%。 2015年至2019年間,汽車業潤滑油消費量成長了約41%。

- 2020 年,新冠疫情相關法規導致多個產業的維護要求減少。受到的影響最大的是汽車產業,其產量下降了 4.9%,其次是重型機械產業(4.4%),而該產業產量在年內也有所下降。

- 預計發電業在 2021 年至 2026 年期間的複合年成長率為 8.35%,成為繼汽車行業(4.48%)之後該市場成長第二快的終端用戶行業。預計未來幾年,該國發電能力的不斷提高(尤其是可再生能源)將推動潤滑油消費。

越南潤滑油產業概況

越南潤滑油市場比較集中,前五大公司佔65.03%的市佔率。該市場的主要企業是:BP Plc(Castrol)、MEKONG PETROCHEMICAL JSC、Petrolimex(PLX)、Royal Dutch Shell Plc 和 TotalEnergies(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第 2 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第3章 產業主要趨勢

- 汽車產業趨勢

- 製造業趨勢

- 發電產業趨勢

- 法律規範

- 價值鏈與通路分析

第 4 章 市場細分

- 按最終用戶

- 車

- 重型機械

- 冶金與金屬加工

- 發電

- 其他最終用戶產業

- 依產品類型

- 機油

- 潤滑脂

- 油壓

- 金屬加工油

- 變速箱和齒輪油

- 其他產品類型

第5章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 公司簡介

- AP SAIGON PETRO JSC

- BP Plc(Castrol)

- Chevron Corporation

- MEKONG PETROCHEMICAL JSC

- Motul

- NIKKO LUBRICANT VIETNAM

- Petrolimex(PLX)

- PVOIL

- Royal Dutch Shell Plc

- TotalEnergies

第6章 附錄

- 附錄 1. 參考文獻

- 附錄 2 圖表目錄

第7章:執行長的關鍵策略問題

簡介目錄

Product Code: 90315

The Vietnam Lubricants Market size is estimated at 324.57 million liters in 2025, and is expected to reach 420.19 million liters by 2030, at a CAGR of 5.3% during the forecast period (2025-2030).

Key Highlights

- Largest Segment by End-user Industry - Automotive : Due to the huge volume of lubricants used in motor vehicles compared to any other industrial application, automotive was the largest end user among all categories.

- Fastest Segment by End-user Industry - Power Generation : Due to the increasing use of natural gas reactors and wind turbines for energy generation, power generation is projected to be the fastest-growing end user in Vietnam.

- Largest Segment by Product Type - Engine Oils : Engine oil is the most consumed product type in Vietnam due to the high volumes of engine oil with high replacement frequencies required to lubricate IC engines.

- Fastest Segment by Product Type - Hydraulic Fluids : The expected growth in the construction, mining, steel, marine, and aviation sectors is expected to support the hydraulic fluid consumption in the coming years in Vietnam.

Vietnam Lubricants Market Trends

Largest Segment By End User : Automotive

- In 2020, the Vietnamese lubricant market was dominated by the automotive industry, which accounted for around 81% of the total lubricant consumption in the country. During 2015-2019, lubricant consumption in the automotive industry increased by around 41%.

- In 2020, COVID-19-related restrictions led to decreased maintenance requirements from several industries. The major impact was observed in the automotive industry, which recorded a dip of 4.9%, followed by heavy equipment (4.4%) during the year.

- Power generation is expected to be the fastest-growing end-user industry of the market studied, recording a CAGR of 8.35% during 2021-2026, followed by automotive (4.48%). The increasing power generation capacity (especially renewables) in the country is anticipated to drive lubricant consumption in the coming years.

Vietnam Lubricants Industry Overview

The Vietnam Lubricants Market is fairly consolidated, with the top five companies occupying 65.03%. The major players in this market are BP Plc (Castrol), MEKONG PETROCHEMICAL JSC, Petrolimex (PLX), Royal Dutch Shell Plc and TotalEnergies (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Manufacturing Industry Trends

- 3.3 Power Generation Industry Trends

- 3.4 Regulatory Framework

- 3.5 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By End User

- 4.1.1 Automotive

- 4.1.2 Heavy Equipment

- 4.1.3 Metallurgy & Metalworking

- 4.1.4 Power Generation

- 4.1.5 Other End-user Industries

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Metalworking Fluids

- 4.2.5 Transmission & Gear Oils

- 4.2.6 Other Product Types

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 AP SAIGON PETRO JSC

- 5.3.2 BP Plc (Castrol)

- 5.3.3 Chevron Corporation

- 5.3.4 MEKONG PETROCHEMICAL JSC

- 5.3.5 Motul

- 5.3.6 NIKKO LUBRICANT VIETNAM

- 5.3.7 Petrolimex (PLX)

- 5.3.8 PVOIL

- 5.3.9 Royal Dutch Shell Plc

- 5.3.10 TotalEnergies

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures

7 Key Strategic Questions for Lubricants CEOs

02-2729-4219

+886-2-2729-4219