|

市場調查報告書

商品編碼

1692135

歐洲電動貨運自行車:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe E-cargo bike - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

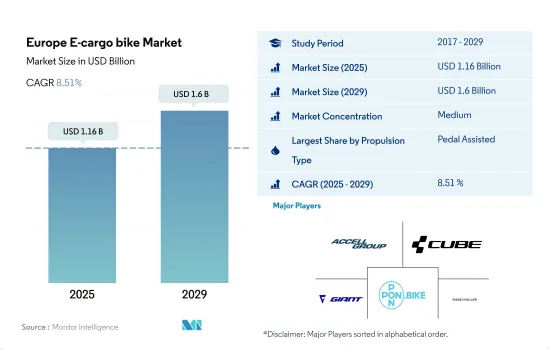

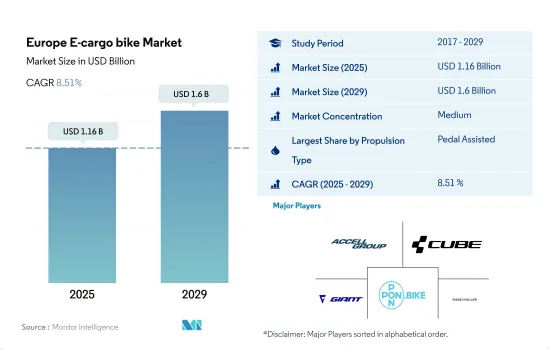

預計 2025 年歐洲電動貨運自行車市場規模為 11.6 億美元,預計到 2029 年將達到 16 億美元,預測期內(2025-2029 年)的複合年成長率為 8.51%。

- 近年來,歐洲電動貨運自行車市場一直穩定成長。隨著越來越多的城鎮投資基礎設施以促進永續的出行選擇,這一趨勢預計將持續下去。根據歐洲自行車聯合會(ECF)的報告,2019年歐洲電動自行車市場成長了23%。

- 在封鎖和貿易限制的情況下,網路購物的增加刺激了歐洲各城市對宅配服務的需求,活性化了貨運車輛的使用。電動貨運自行車更安全,不會排放溫室氣體。許多企業使用它們來代替貨車或其他運輸車輛,以滿足各種用途。例如,在荷蘭,DHL 60% 的城市送貨業務都使用貨運自行車。生活品質交通組織估計,電動貨運自行車可以取代高達 8% 的都市區貨車運輸里程。

- 隨著技術的進步,電動自行車製造商正致力於生產能夠連接騎乘者行動電話並提供速度和電池電量即時資訊的電動自行車。踏板輔助車型仍佔據電動貨運自行車銷量的大部分。然而,對油門輔助電動貨運自行車的需求日益成長,尤其是來自宅配業者和宅配公司等企業主的需求。油門輔助電動貨運自行車為傳統送貨車輛提供了一種便利、高效的替代方案,尤其是在交通和停車問題嚴重的都市區。

- 在過去十年中,由於需要供應的大型公司使用的送貨車輛增加以及網路購物的增加,歐洲白天交通堵塞問題日益嚴重。因此,由於交通堵塞問題,越來越多的餐廳和零售連鎖店將電動自行車和電動貨運自行車用於商務用,主要是因為它們可以提高平均速度。

- 一些在該國營運的領先電動自行車製造商正致力於開發創新的解決方案和有吸引力的車型以擴大客戶群。例如,2020 年,CityQ 開發了一款專為家庭和輕型貨物使用而設計的全天候電動自行車。德鐵信克挪威公司首次在卑爾根市中心推出用於拖車運送的 Armadillo 電動貨運自行車。未來,挪威計劃在大城市引入更多的犰狳。

- 稅收優惠和政府政策進一步推動了對電動貨運自行車的需求。 2021 年 2 月,德國聯邦環境、自然保護和核能安部 (BMU) 宣布計劃啟動一項財政援助計劃,為任何貨運自行車或拖車提供最高購買成本 25% 或最高 2,500 歐元的津貼。

歐洲電動貨運自行車市場的趨勢

德國尤其突出,普及率較高,顯示市場成熟,消費者接受度高。

- 近年來,歐洲對電動自行車的需求大幅增加。燃油價格上漲、尖峰時段交通堵塞和運動好處是推動英國、義大利、西班牙和德國等歐洲國家電動自行車普及率上升的一些因素。丹麥佔據電動自行車銷量的大部分,2019 年的普及率高於該地區的其他國家,例如盧森堡。電動自行車需求的不斷成長進一步加速了其在整個歐洲的普及率。

- 新冠疫情病例的增加對自行車業務產生了積極影響。為了保持社交距離,人們避免使用公共和租賃交通工具,因此他們改變了通勤方式,並購買了電動自行車,作為一種方便且實惠的選擇。這些因素導致2020年整個歐洲的電動自行車普及率加速。

- 商業活動的恢復以及門鎖和貿易活動等限制的放寬促進了電動自行車的普及,活性化。預計在預測期內,消費者對電動自行車的興趣日益濃厚,將推動該地區電動自行車的普及。

英國和德國是該地區超當地語系化配送市場的主要貢獻者,兩個市場均呈現穩定的銷售成長。

- 電動自行車在歐洲越來越受歡迎。自2017年以來,過去五年裡,網購者的比例增加了80.25%,這也導致該地區的污染和交通堵塞加劇。因此,這些問題促使物流業者選擇更方便、更清潔的方式—i-bike送貨。 2019 年,荷蘭的電動自行車交付量最多,其次是丹麥和英國。 2019 年該地區使用電動自行車進行送貨的人數與 2018 年相比增加了 11.73%。

- 各小包裹和宅配業者擴大採用電動自行車作為最後一英里的物流選擇,以取代碳排放更高的大型車輛。 2020 年 9 月,聯邦快遞宣布正在倫敦和阿姆斯特丹測試電動貨運自行車用於小包裹運送。該公司還宣布,試點測試的初步結果非常積極,並計劃將服務擴展到該地區的其他城市。 2021年歐洲電動自行車交車量與2020年相比成長了24.99%。

- 由於電動自行車比替代燃料驅動的汽車具有成本優勢,且時間效率高、燃料效率高、環保且維護成本低,因此該地區各國的電動自行車市場正在不斷擴大。政府對電動自行車的補貼為銷售商提供了另一個優勢。因此,預計預測期內歐洲電動自行車的最後一哩本地配送將會增加。

歐洲電動貨運自行車產業概況

歐洲電動貨運自行車市場適度整合,前五大公司佔40.05%。市場的主要企業是:Accell Group、CUBE Bikes、Giant Manufacturing、Pon Holding BV 和 Riese & Muller(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 自行車銷量

- 人均國內生產毛額

- 通貨膨脹率

- 電動自行車普及率

- 每天出遊 5 至 15 公里的人口/通勤者百分比

- 自行車出租

- 電動自行車電池價格

- 電池化學價格表

- 超本地化配送

- 自行車道

- 電池充電容量

- 交通堵塞指數

- 法律規範

- 價值鏈與通路分析

第5章 市場區隔

- 推進類型

- 踏板輔助

- 高速電動自行車

- 油門輔助

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 原產地

- 奧地利

- 比利時

- 法國

- 德國

- 義大利

- 盧森堡

- 荷蘭

- 波蘭

- 西班牙

- 瑞士

- 英國

- 其他歐洲國家

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Accell Group

- Bakfiets.nl

- Bunch Bikes

- CUBE Bikes

- DOUZE Factory SAS

- Giant Manufacturing Co. Ltd.

- Pon Holding BV

- Rad Power Bikes

- Riese & Muller

- RYTLE GmbH

- Smart Urban Mobility BV

- The Cargo Bike Company

- YUBA BICYCLES LLC

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 90823

The Europe E-cargo bike Market size is estimated at 1.16 billion USD in 2025, and is expected to reach 1.6 billion USD by 2029, growing at a CAGR of 8.51% during the forecast period (2025-2029).

- The European market for e-cargo bikes has steadily grown in recent years. This trend is projected to continue as more towns invest in infrastructure to promote sustainable mobility options. The European Cyclists' Federation (ECF) reported that the European market for e-bikes rose by 23% in 2019.

- The demand for delivery services across European cities increased during the pandemic due to increased online shopping amid lockdowns and trade restrictions, thus boosting cargo vehicle use. E-cargo bikes are safer and do not emit greenhouse gas emissions. Many businesses use them for various applications instead of vans and other delivery vehicles. For instance, in the Netherlands, DHL makes 60% of inner-city deliveries by cargo bikes. Transport for Quality of Life estimated that e-cargo bikes could replace up to 8% of urban van trips by mileage.

- Due to increasing technological advancements, pedelec producers are focusing on producing pedelecs that can connect with riders' cell phones and provide real-time information on the speed and battery level. The majority of e-cargo bike sales are still accounted for by pedal-assisted models. However, there is a growing demand for throttle-assisted e-cargo bikes, particularly among business owners such as delivery companies and couriers. Throttle-assisted e-cargo bikes are a more convenient and efficient alternative to traditional delivery vehicles, especially in urban areas where traffic and parking may be a concern.

- Over the past decade, the problem of daytime traffic congestion has grown in Europe due to an increase in delivery vehicles used by large companies that require supplies and an increase in online shopping. Thus, due to the problem of congestion, restaurants and retail chains are turning toward e-bikes and e-cargo bikes for their operations, mainly due to their increased average speed.

- Some key e-bike manufacturers operating in the country are focusing on developing innovative solutions and attractive models to widen their customer base. For instance, in 2020, CityQ developed a weather-protected e-bike, purpose-built for families and light cargo, with a built-in IT platform for managing the bike remotely. DB Schenker Norway premiered its Armadillo e-cargo bike for semi-trailer deliveries in the Bergen city center. More Armadillos are anticipated to be launched across the bigger Norwegian cities.

- Tax incentives and government policies further drive the demand for e-cargo bikes. In February 2021, the German Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety (BMU) announced its plans to start a funding program, providing grants of up to 25% of the purchase costs or a maximum of EUR 2,500 for cargo bikes or trailers.

Europe E-cargo bike Market Trends

Germany stands out with its notably high adoption rates, indicating a mature market and strong consumer acceptance

- Europe has witnessed a significant demand for e-bicycles over the past few years. Rising fuel prices, traffic jams during peak hours, and exercise benefits are some of the factors responsible for the increasing adoption rate of e-bikes in European countries, such as the United Kingdom, Italy, Spain, and Germany. Denmark accounted for the major share of e-bike sales and had a higher adoption rate in 2019 than other countries in the region, such as Luxembourg. The growing demand for e-bikes further accelerated their adoption rate across Europe.

- The growing number of COVID-19 cases affected the bicycle business positively. As people avoided public or rented transportation to maintain social distancing, they changed their commuting methods and invested in e-bikes as a convenient and price-friendly option. Such factors accelerated the adoption rate of e-bikes in 2020 across Europe.

- The resumption of business operations and the relaxation of restrictions, such as lockdowns and trade activities, boosted the adoption of e-bikes and increased the import and export activities in the region. The growing consumer interest in e-bikes is expected to increase their adoption in the region during the forecast period.

The UK and Germany are key contributors to the region's Hyper-Local Delivery market, both showing a steady increase in volume

- E-bikes are becoming highly popular across Europe. The share of online buyers increased by 80.25% in the last five years since 2017, which also increased pollution and traffic congestion in the region. Thus, due to these problems, logistic businesses are opting for a more convenient and cleaner option, i.e., an e-bike, for deliveries. The Netherlands accounted for the highest number of e-bike deliveries in 2019, followed by Denmark and the United Kingdom. The use of e-bikes for local deliveries in the region grew by 11.73% in 2019 over 2018.

- Various parcel and courier companies are making efforts to deploy e-bicycles as last-mile logistics options over large carbon-emission vehicles. In September 2020, FedEx announced that it was testing electric cargo bikes for parcel deliveries in London and Amsterdam. The company also announced that the initial results of the pilot testing were very good and planned to extend the services to other cities in the region. E-bicycle deliveries in Europe increased by 24.99% in 2021 over 2020.

- The e-bike market is developing in various countries across the region due to the cost advantages of these bikes over alternative fuel-powered vehicles, as well as time efficiency, fuel efficiency, eco-friendliness, and lower maintenance costs. Subsidies offered on e-bikes by the government also provide another advantage to vendors. Therefore, last-mile local deliveries made by e-bikes are projected to rise in Europe during the forecast period.

Europe E-cargo bike Industry Overview

The Europe E-cargo bike Market is moderately consolidated, with the top five companies occupying 40.05%. The major players in this market are Accell Group, CUBE Bikes, Giant Manufacturing Co. Ltd., Pon Holding B.V. and Riese & Muller (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Bicycle Sales

- 4.2 GDP Per Capita

- 4.3 Inflation Rate

- 4.4 Adoption Rate Of E-bikes

- 4.5 Percent Population/commuters With 5-15 Km Daily Travel Distance

- 4.6 Bicycle Rental

- 4.7 E-bike Battery Price

- 4.8 Price Chart Of Different Battery Chemistry

- 4.9 Hyper-local Delivery

- 4.10 Dedicated Bicycle Lanes

- 4.11 Battery Charging Capacity

- 4.12 Traffic Congestion Index

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Speed Pedelec

- 5.1.3 Throttle Assisted

- 5.2 Battery Type

- 5.2.1 Lead Acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Others

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 France

- 5.3.4 Germany

- 5.3.5 Italy

- 5.3.6 Luxembourg

- 5.3.7 Netherlands

- 5.3.8 Poland

- 5.3.9 Spain

- 5.3.10 Switzerland

- 5.3.11 UK

- 5.3.12 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Accell Group

- 6.4.2 Bakfiets.nl

- 6.4.3 Bunch Bikes

- 6.4.4 CUBE Bikes

- 6.4.5 DOUZE Factory SAS

- 6.4.6 Giant Manufacturing Co. Ltd.

- 6.4.7 Pon Holding B.V.

- 6.4.8 Rad Power Bikes

- 6.4.9 Riese & Muller

- 6.4.10 RYTLE GmbH

- 6.4.11 Smart Urban Mobility B.V

- 6.4.12 The Cargo Bike Company

- 6.4.13 YUBA BICYCLES LLC

7 KEY STRATEGIC QUESTIONS FOR E BIKES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219