|

市場調查報告書

商品編碼

1692145

電動車高壓 DC-DC 轉換器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Electric Vehicle High-Voltage DC-DC Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

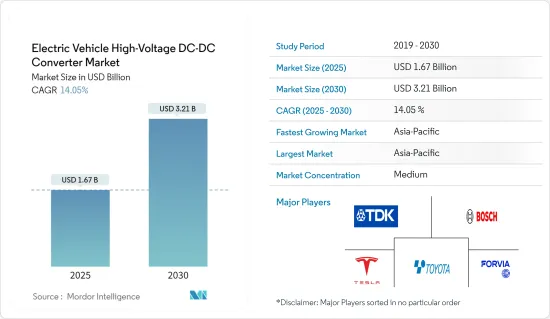

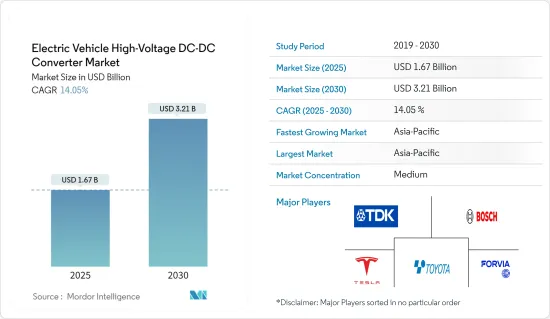

電動車高壓 DC-DC 轉換器的市場規模預計在 2025 年為 16.7 億美元,預計到 2030 年將達到 32.1 億美元,預測期內(2025-2030 年)的複合年成長率為 14.05%。

從長遠來看,電動車普及率的提高、嚴格的排放法規、政府促進電動車銷售的舉措、充電基礎設施的擴大以及電池技術和電動車零件的進步等因素都在促進市場的成長。例如,

根據國際能源總署(IEA)的數據,2024年第一季的電動車銷量將比2023年第一季成長約25%,其中中國佔電動車銷量的最大佔有率,為45%,其次是歐洲(25%)。

隨著全球電動車銷量的上升,高壓 DC-DC 轉換器技術的最新進展集中在提高效率、減小尺寸和重量以及提高可靠性。碳化矽 (SiC) 和氮化鎵 (GaN) 半導體等技術創新使更高效的轉換器能夠在更高的頻率下運行,同時減少被動元件的尺寸。

考慮到這種情況,各製造商都致力於改進電動車及其零件(例如轉換器)的技術。

2024年6月,三星馬達宣布推出專門針對電動車DC-DC轉換器等應用的高壓積層陶瓷電容(MLCC)「CL32B104KHU6PN#」。 CL32B104KHU6PN#具有體積小、耐高壓、穩定、容量高等特點,推動了MLCC在汽車上的應用。

雲端處理、物聯網(IoT)等技術引進電動車電池管理系統,再加上確保輸出電壓穩定的DC-DC轉換器,導致電動車中轉換器的使用增加。

在電動車高壓 DC-DC 轉換器市場中,亞太地區估計佔突出佔有率,因為印度和中國等國家在電動車銷售中佔有最大佔有率。由於電動車日益普及以及政府更加重視實現未來的排放目標,北美和歐洲也預計將出現強勁成長。

預計這些因素將在預測期內對市場成長產生正面影響。

電動車高壓 DC-DC 轉換器的市場趨勢

乘用車佔最大市場佔有率

從長遠來看,對提供更好的駕駛體驗、舒適性和安全性的汽車的需求不斷成長,可能會增加對省油引擎的需求。由於各國透過嚴格的法規、補貼、稅額扣抵和其他激勵措施鼓勵人們使用電動車,電動車銷量的成長進一步推動了乘用車的銷售量。

根據國際能源總署(IEA)的數據,2023年歐洲新電動車註冊量將達到近320萬輛,較2022年成長近20%,電池電動車將佔當年電動車保有量的70%。

世界各國政府也推出了各種計畫和政策,鼓勵人們購買電動車而不是傳統汽車。鼓勵購買電動車的舉措之一是加州的零排放車 (ZEV) 計劃,該計劃的目標是到 2025 年讓 150 萬輛電動車上路。其他提供各種激勵措施的國家包括印度、中國、英國、韓國、法國、德國、挪威和荷蘭。

同樣,2025年12月31日前在歐洲註冊的車輛將免徵10年的所有權稅,該豁免有效期至2030年12月31日。這些政策正在促進電動乘用車的銷售。

隨著電動乘用車銷量的不斷成長,生產電動車連接器的公司看到了電動車領域的成長機會,並專注於各種技術進步來開發新產品。

2024 年 5 月,伊頓推出了其低壓 48 伏特 DC-DC 轉換器的高功率版本。新推出的轉換器從 48 伏特系統獲取電力,並將其降至 12 伏特以運行配件或其他低功率系統。

除了這些因素之外,高可支配收入、不斷提高的品牌知名度和高購買力平滑度也促進了這一領域的成長。

亞太地區佔市場主導地位

亞太地區佔據電動車高壓 DC-DC 轉換器市場的大部分佔有率。由於中國等國家引領電動車銷售,預計市場在預測期內將顯著成長。

中日兩國致力於創新、技術和先進電動車的開發。此外,印尼等國家正在進行大規模電動車計劃。

中國是全球電動車產業的主要企業。政府正在鼓勵人們使用電動車。中國計劃在2040年實現全電動汽車出行。中國的電動乘用車市場也是全球最大的市場之一,近年來成長迅速。預計在預測期內還將進一步成長,這將對電動車高壓 DC-DC 轉換器市場產生積極影響。市場上的幾家主要企業正在與其他參與者合作開發電力電子元件。

預計汽車公司的大量投資將滿足日益成長的電動車需求,並有助於增加汽車銷售。OEM提供涵蓋各個領域的電動車,從 MG Comet EV 等掀背車到特斯拉 Model 3 等豪華轎車。

向電動車的轉變需要大量投資,汽車製造商正專注於升級製造地,這對於公司實現電氣化目標至關重要。

印度的電動車市場正處於成長階段。 TATA、Mahindra 和 MG 等印度汽車製造商正在致力於提供價格實惠的電動車。政府也支持電動車,以減少該國的溫室氣體排放。

2024年3月,印度政府核准了電動車政策。根據該政策,在該國設立製造工廠且投資額至少為 5 億美元的公司將獲得進口關稅優惠。

印度汽車製造商也在努力並投資研發,以在印度提供價格實惠的電動車。例如,現代汽車在 2021 年 2 月宣布將投資 1.2 億美元開發一款新型經濟型電動車。這些車輛將在當地生產,該公司正在與當地供應商洽談採購零件。現代汽車也可能探索與姊妹品牌起亞建立戰略合作夥伴關係,因為其計劃將電動車添加到其在印度的產品組合中。起亞正在為印度打造一款大眾市場、更實惠的電動車,該車型原計劃於 2024 年推出。

這些因素可能會增加對汽車 DC-DC 轉換器的需求,從而推動預測期內的市場成長。

電動汽車高壓 DC-DC 轉換器產業概覽

電動車高壓 DC-DC 轉換器市場由知名的全球和區域參與者鞏固和主導。為了維持市場地位,公司正在採取新產品發布、合作和合併等策略。

- 2024 年 6 月,TDK 宣布將在其 TDK-Lambda 品牌額定 300 W i7C 非隔離 DC-DC 轉換器系列中增加可調電流限制型號。新機型適用於在醫療、自動導引運輸車(AGV)和其他行業中從 12V、24V 和 48V 系統電壓產生更高功率的直流輸出。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 電動車日益普及

- 其他促進因素

- 市場限制

- 轉換器在運作時會產生噪音,這可能會對您的目標市場造成干擾。

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 車型

- 搭乘用車

- 商用車

- 推進類型

- 插電式混合動力汽車

- 純電動車

- 燃料電池電動車

- 冷卻方式

- 液體冷卻

- 空氣冷卻

- 輸入電壓

- 200 V-450 V

- 450 V-800 V

- 800 V-1000 V

- 輸出電壓

- 12 V-24 V

- 24 V-48 V

- 輸出功率

- 小於2kW

- 2千瓦或以上

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 挪威

- 波蘭

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Continental AG

- Robert Bosch GmbH

- Valeo Group

- ABB Ltd

- DENSO Corporation

- Hella GmbH & Co. KGaA

- Toyota Industries Corporation

- Infineon Technologies AG

- Texas Instruments

- STMicroelectronics

- TDK-Lambda Corporation

- Shinry Technologies

- Delta Electronics

- Vicor Corporation

- Hyundai Mobis Ltd

第7章 市場機會與未來趨勢

The Electric Vehicle High-Voltage DC-DC Converter Market size is estimated at USD 1.67 billion in 2025, and is expected to reach USD 3.21 billion by 2030, at a CAGR of 14.05% during the forecast period (2025-2030).

Over the long term, factors such as the increasing shift toward electric vehicles, stringent emission regulations, government initiatives to promote sales of electric vehicles, expansions in charging infrastructure, and advancements in battery technology and EV components contribute to the market's growth. For instance,

According to the International Energy Agency, in Q1 2024, electric car sales grew by around 25% compared to Q1 2023, with China holding the largest share of 45% in terms of electric car sales, followed by Europe (25%).

With the rise in EV sales worldwide, recent advancements in high-voltage DC-DC converter technology have focused on increasing efficiency, reducing size and weight, and enhancing reliability. Innovations such as silicon carbide (SiC) and gallium nitride (GaN) semiconductors are leading to more efficient converters that operate at higher frequencies, thus reducing the size of passive components.

Considering the scenario, various manufacturers are focusing on upgrading their technologies for electric vehicles and their components, such as converters.

In June 2024, Samsung Electro-Mechanics introduced the CL32B104KHU6PN#, a high-voltage multi-layer ceramic capacitor (MLCC) tailored for EV applications, such as DC-DC converters. The features include miniaturization, high voltage, stability, and higher capacitance, which are driving the usage of MLCCs in vehicles.

The deployment of technologies like cloud computing and IoT (Internet of Things) in battery management systems of electric cars, coupled with a DC-DC converter to ensure a regulated output voltage, have increased the use of converters in electric vehicles.

Asia-Pacific is estimated to hold a prominent share in the electric vehicle high voltage DC-DC converter market, as countries like India and China hold the largest share in EV sales. North America and Europe are also expected to grow rapidly due to the increasing adoption of electric vehicles and the government's increasing focus on achieving emission goals in the future.

These factors are expected to positively impact the market's growth during the forecast period.

Electric Vehicle High-Voltage DC-DC Converter Market Trends

Passenger Cars Hold the Highest Share in the Market

Over the long term, the growing demand for automobiles that provide enhanced driving experiences, comfort, and safety may increase the demand for fuel-efficient engines. The increasing sales of electric vehicles have further boosted the sales of passenger cars as various countries promote their adoption through strict regulations, subsidies, tax credits, and other incentives.

According to the International Energy Agency, new electric car registrations in Europe reached nearly 3.2 million in 2023, increasing by almost 20% compared to 2022, with battery electric cars accounting for 70% of the electric car stock in the same year.

Governments worldwide have also launched various schemes and policies to encourage buyers to opt for electric vehicles over conventional ones. One such initiative that promotes the purchase of electric vehicles is the California Zero Emission Vehicle (ZEV) program, which aims to have 1.5 million electric vehicles on the road by 2025. Other countries offering various incentives include India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands.

Similarly, vehicles registered in Europe until December 31, 2025, are exempted from the ownership tax for 10 years, and this exemption is valid until December 31, 2030. Such policies are boosting the sales of electric passenger cars.

Owing to the growth of electric passenger car sales, companies manufacturing EV connectors are seeing a growing opportunity in the EV segment and are focusing on various technological advancements to develop new products.

In May 2024, Eaton launched the higher-power version of its low-voltage 48-volt DC-DC converter. The newly released converter takes power from a 48-volt system and steps it down to 12 volts to run accessories and other low-power systems.

Such factors, along with high disposable income, rising brand awareness, and high-power purchase parity, contribute to the segment's growth.

Asia-Pacific is Dominating the Market

Asia-Pacific holds the majority share in the electric vehicle high voltage DC-DC converter market. With countries like China leading the EV sales, the market is expected to grow significantly during the forecast period.

China and Japan are inclined toward innovation, technology, and the development of advanced electric vehicles. Moreover, countries such as Indonesia are engaged in large electric mobility projects.

China is a key player in the electric vehicle industry worldwide. The country's government is encouraging people to adopt electric vehicles. China plans to switch to electric mobility entirely by 2040. The Chinese electric passenger cars market is also one of the largest worldwide, and it has been growing rapidly over the last few years. It is expected to grow further during the forecast period, which may positively impact the electric vehicle high voltage DC-DC converter market. Several key players in the market are partnering with other players to develop power electronics components.

Heavy investments made by automotive companies are expected to cater to the growing demand for electric vehicles and contribute to the high sales of vehicles. OEMs offer electric vehicles in different segments, ranging from hatchbacks like the MG Comet EV to high-end sedans like Tesla Model 3.

The transition to electric vehicles requires significant investments as carmakers focus on upgrading manufacturing sites, which is important in companies fulfilling electrification targets.

The Indian electric vehicle market is in its growing stage. Automobile manufacturers in India, such as TATA, Mahindra, and MG, are taking initiatives to provide affordable electric driving options. The government is also supporting electric mobility to reduce the exhaust emissions of greenhouse gases in the country.

In March 2024, the Indian government approved an EV policy under which import duty concessions will be given to companies setting up manufacturing units in the country with a minimum investment of USD 500 million, a strategic move to attract major global players like US-based Tesla.

Automobile manufacturers in India are also taking initiatives and investing in R&D practices to provide affordable electric cars in India. For instance, in February 2021, Hyundai announced an investment of USD 0.12 billion to develop new affordable EVs. The vehicles would be manufactured locally, and the company is in talks with local vendors to source the components. Hyundai may also seek a strategic partnership with its sister brand, Kia, as it plans to add EVs to its portfolio in India. The company is working on a mass-market, more affordable electric car for India, which was planned to be launched in 2024.

Due to such factors, the demand for DC-DC converters in vehicles is likely to increase, thus boosting the market's growth over the forecast period.

Electric Vehicle High-Voltage DC-DC Converter Industry Overview

The electric vehicle high voltage DC-DC converter market is consolidated and led by global and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- In June 2024, TDK announced the addition of adjustable current limit models to the TDK-Lambda brand 300W-rated i7C non-isolated DC-DC converter series. The new models are suitable for generating additional high-power DC outputs from 12 V, 24 V, and 48 V system voltages in medical, automated guided vehicles (AGV), and other industries.

Some of the major players in the market include Robert Bosch GmbH, TDK Corporation, Toyota Industries Corporation, and HELLA GmbH & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption of Electric Vehicles

- 4.1.2 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Converters Generate Noise During Operation, Which May Hinder the Target Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD Million)

- 5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Plug-in Hybrid Vehicles

- 5.2.2 Battery Electric Vehicles

- 5.2.3 Fuel Cell Electric Vehicles

- 5.3 Cooling Method

- 5.3.1 Liquid Cooled

- 5.3.2 Air Cooled

- 5.4 Input Voltage

- 5.4.1 200 V - 450 V

- 5.4.2 450 V - 800 V

- 5.4.3 800 V - 1000 V

- 5.5 Output Voltage

- 5.5.1 12 V - 24 V

- 5.5.2 24 V - 48 V

- 5.6 Output Power

- 5.6.1 Less Than 2 kW

- 5.6.2 2 kW and Above

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Norway

- 5.7.2.7 Poland

- 5.7.2.8 Russia

- 5.7.2.9 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Chile

- 5.7.4.4 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 South Africa

- 5.7.5.4 Other Countries

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Continental AG

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Valeo Group

- 6.2.4 ABB Ltd

- 6.2.5 DENSO Corporation

- 6.2.6 Hella GmbH & Co. KGaA

- 6.2.7 Toyota Industries Corporation

- 6.2.8 Infineon Technologies AG

- 6.2.9 Texas Instruments

- 6.2.10 STMicroelectronics

- 6.2.11 TDK-Lambda Corporation

- 6.2.12 Shinry Technologies

- 6.2.13 Delta Electronics

- 6.2.14 Vicor Corporation

- 6.2.15 Hyundai Mobis Ltd