|

市場調查報告書

商品編碼

1692146

寵物驅蟲劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pet Insect Repellants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

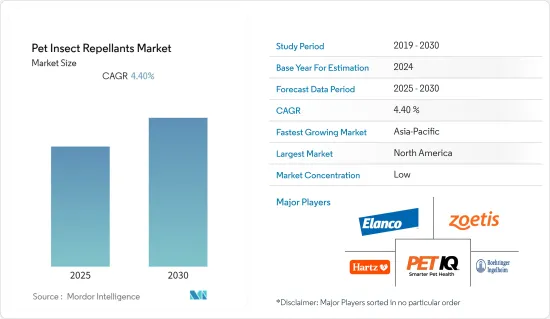

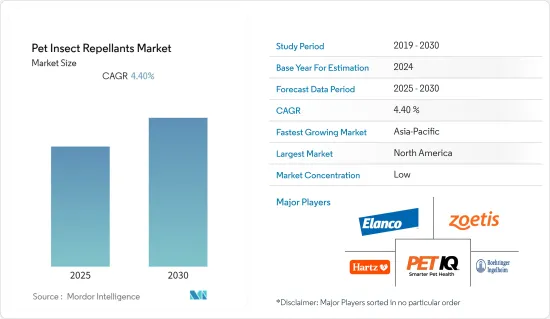

預測期內,寵物驅蟲劑市場預計複合年成長率為 4.4%。

從長遠來看,貧血、跛足、蜱麻痺以及蜱和跳蚤引起的搔癢等疾病的威脅日益嚴重,預計將在預測期內主要增加寵物驅蟲產品的需求。

跳蚤和蜱蟲是危害寵物最常見的害蟲。這些佔了 2021 年大部分佔有率,合計 63.8%。這意味著驅除跳蚤和蜱蟲的劑型佔了大部分市場佔有率,預計未來幾年這一趨勢將進一步成長。

各已開發國家和新興國家寵物飼主數量的增加、媒介傳播疾病的增加以及已開發國家寵物健康支出的增加是推動市場成長的因素,而嚴格的法規和化學品的毒性阻礙了市場的成長。

北美佔據市場主導地位。隨著北美地區寵物人性化的不斷提升,寵物驅蟲劑的需求也日益增加。人均動物保健支出的成長使寵物驅蟲劑產業受益匪淺。例如,根據美國寵物產品協會 (APPA) 的數據,美國狗飼主在過去 12 個月中平均為每隻狗花費 1,880 美元,包括寵物食品、零食、玩具、維生素、美容、獸醫檢查以及遛狗/狗舍服務。寵物飼主對寵物健康重要性的認知不斷提高,預計將在未來幾年推動市場成長。

寵物驅蟲劑的市場趨勢

對寵物健康的關注和支出增加

人均動物保健支出的成長使寵物驅蟲劑產業受益匪淺。例如,根據美國寵物產品協會 (APPA) 的數據,美國狗飼主在過去 12 個月中平均為每隻狗花費 1,880 美元,包括寵物食品、零食、玩具、維生素、美容、獸醫檢查以及遛狗/狗舍服務。同一時期,貓飼主平均每隻貓花費 902美國。獸醫費是飼養寵物的最大開支。

此外,在過去十年中,美國人在寵物上的支出增加了一倍以上。例如,2010年,用於寵物的總支出約為455.3億美元。在接下來的十年裡,這項支出飆升至每年1,036億美元。最大的年度增幅是從2017年到2018年,支出從695.1億美元躍升至905億美元,成長了30%。

同樣,根據安大略省獸醫協會 (OVMA) 的數據,在加拿大,照顧一隻小狗的平均每年費用為 3,242 加幣。據美國疾病管制與預防中心稱,2004年至2016年間,僅在美國就發現了七種透過受感染蜱蟲叮咬傳播的新型細菌菌株。這些病原體可以感染人類和狗,可能導致通用感染疾病。伴同性動物中各種疾病的發病率不斷上升,導致全國範圍內對診斷成像程序和預防疾病的補充劑的需求日益成長。

北美引領市場

北美是寵物驅蟲劑的主要市場,2021 年約佔總市場佔有率的 43.5% 。美國的寵物數量在全球整體排名第一。根據 2021-2022 年 APPA 全國寵物主人調查,70% 的美國家庭擁有某種寵物,高於 2019-2020 年調查中的 67%。事實上,14% 的受訪者在疫情期間養了新寵物。此外,該國的寵物支出在過去一年中有所增加,35%的寵物主人增加了在寵物和寵物食品、保健產品和其他寵物護理用品(包括驅蟲劑)上的支出,這預計將推動該國市場的發展。

例如,美國已發生一系列昆蟲攻擊寵物的事件,包括2020年亞利桑那州一群蜜蜂襲擊並殺死三隻狗的事件,因此用於保護寵物和確保其健康的驅蟲劑的需求預計將增加。

此外,加拿大市場上還有許多聲稱可以防止昆蟲叮咬的產品。只有獲得政府核准的安全和有效的藥物才允許在該國使用。在加拿大,西尼羅河病毒和萊姆病是寵物健康的主要問題。藥用驅蟲劑在加拿大隨處可見。例如,總部位於亞伯達省卡加利的製造商 Xerion Dispensary 生產的同類療法配方 Mozi-Q 已將加拿大製造的驅蟲劑推向市場,為日常寵物疾病提供安全、自然的解決方案。因此,預計預測期內寵物擁有量的增加和寵物中昆蟲傳播疾病的流行將推動寵物驅蟲劑的需求。

寵物驅蟲劑產業概況

全球寵物驅蟲劑市場高度分散,參與者眾多。 Zoetis Inc.、Elanco Animal Health、Hartz Mountain Corporation、Boehringer Ingelheim、PetIQ LLC、Central Garden &Pet Company、Merck and Co. Inc. 和 Viebac Group 是市場的主要企業。這些市場主要企業正在擴大業務,透過增加產品系列和收購市場上的其他地區或全球參與者來維持其市場地位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 寵物類型

- 狗

- 貓

- 鳥類

- 其他動物

- 錯誤類型

- 打鉤

- 蒼蠅

- 蜜蜂

- 跳蚤

- 其他昆蟲

- 最終用戶/應用程式

- 寵物診所

- 寵物店

- 其他最終用戶/應用程式

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Merck And Co. Inc.

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- Vibrac

- The Hartz Mountain Corporation

- Tianjin Ringpu Bio-technology

- Zoetis Inc.

- Central Garden & Pet

第7章 市場機會與未來趨勢

第 8 章:COVID-19 對市場的影響

The Pet Insect Repellants Market is expected to register a CAGR of 4.4% during the forecast period.

In the long run, the rising threat of diseases such as anemia, lame disease, tick paralysis, and itching caused by ticks and fleas majorly is anticipated to increase the demand for pet insect repellent products during the forecast period.

Among all the insects, fleas and ticks are the major types of insects that cause damage to the pet. These account for the majority share of 63.8% together in 2021. This states that the repellents of fleas and ticks contribute to most of the share, and this is further anticipated to drive during the coming years.

An increase in the number of pet owners in various developed and developing countries, an increase in vector-borne diseases, and an increase in pet health expenditure in the developed countries are the factors that drive the market growth, while stringent regulations and toxicity in the chemicals hamper the growth of the market.

North America dominates the market. The increasing demand for the pet repellents market can be attributed to the enhanced pet humanization in North America. The pet insect repellents market is benefiting tremendously, owing to the increasing per capita animal healthcare expenditure. For instance, according to the American Pet Product Association (APPA), Dog owners in the United States spent an average of USD 1,880 per canine in the prior 12 months, which includes pet food, treats, toys, vitamins, grooming, visits to the vet, and dog-walking/kennel services. The rising awareness among pet owners about the importance of pet health, and this, in turn, will drive market growth in the coming years.

Pet Insect Repellants Market Trends

Increased Focus and Expenditure on Pet Health

The pet insect repellents market is benefiting tremendously, owing to the increasing per capita animal healthcare expenditure. For instance, according to the American Pet Product Association (APPA), Dog owners in the United States spent an average of USD 1,880 per canine in the prior 12 months, which includes pet food, treats, toys, vitamins, grooming, visits to the vet, and dog-walking/kennel services. Cat owners, during the same time frame, spent an average of US 902 per feline. Among all, Vet bills are typically the costliest segment of the budget to own a pet, and lack of access can be prohibitive to pet ownership for many people.

Furthermore, in the past ten years, American pet spending has more than doubled. For instance, in 2010, the total money spent on pets was roughly USD 45.53 billion. Within the next decade, this spending has mushroomed to USD 103.6 billion annually. The biggest annual increase was between 2017 and 2018, when spending quickly jumped from USD 69.51 billion to USD 90.5 billion, a growth of 30%.

Similarly, in Canada, according to Ontario Veterinary Medical Association (OVMA), the annual cost of caring for a puppy was CAD 3,242. According to the Centers for Disease Control and Prevention, during the 13 years, from 2004 to 2016, seven new germs spreading through the bite of an infected tick were discovered in the United States alone. These germs can also infect people, alongside dogs, and cause zoonotic diseases. As the prevalence of various diseases in companion animals is increasing, the demand for diagnostic imaging procedures and supplements to prevent diseases is rising across the country.

North America Leads the Market

North America is the major market for pet insect repellants occupying about 43.5% share of the total market in 2021. The United States stands first in the overall pet population globally. According to the 2021-2022 APPA National Pet Owners Survey, 70% of US households own some pet, an increase from 67% in the 2019-2020 survey. In fact, 14% of total respondents obtained a new pet during the pandemic. Moreover, pet spending increased during the past year in the country, with 35% of pet owners spending more on their pet/pet supplies, including food, wellness-related products, and other pet care items, including insect repellants which are anticipated to drive the market in the country.

The insect attack incidences on pets in the country, for instance, in 2020, an aggressive swarm of bees fatally attacked three dogs in Arizona, will lead to an increase in demand for insect repellants to protect and ensure the well-being of the pets.

Further, in Canada, many products on the market claim to protect against insect bites. Only those that have been government-approved for their safety and effectiveness are allowed for use in the country. In Canada, the West Nile virus and Lyme disease are health concerns for pets. Medically formulated insect repellents are widespread in the country. For instance, Mozi-Q, a homeopathic formulation made by Xerion Dispensary, a manufacturing company based in Calgary, Alberta, has brought insect repellent made in Canada to the market that provides safe and natural solutions to everyday concerns in pets. Thus, increasing pet ownership and the spread of insect-transmitted diseases among pets are anticipated to drive the demand for pet insect repellants in t during the forecast period.

Pet Insect Repellants Industry Overview

The global pet insect repellent market is highly fragmented with alarge number of players. Zoetis Inc., Elanco Animal Health, the Hartz Mountain Corporation, Boehringer Ingelheim, PetIQ LLC, Central Garden & Pet Company, Merck and Co. Inc., and the Viebac Group are the key players in the market. These major players in the market are increasing their product portfolio and expanding their business to maintain their position in the market by acquiring the other regional or global players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Pet Type

- 5.1.1 Dogs

- 5.1.2 Cats

- 5.1.3 Birds

- 5.1.4 Other Animals

- 5.2 Insect Type

- 5.2.1 Ticks

- 5.2.2 Flies

- 5.2.3 Bees

- 5.2.4 Fleas

- 5.2.5 Other Insect Type

- 5.3 End User/Application

- 5.3.1 Pet Clinic

- 5.3.2 Pet Shops

- 5.3.3 Other End Users/Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Merck And Co. Inc.

- 6.3.2 Elanco Animal Health Incorporated

- 6.3.3 Boehringer Ingelheim International GmbH

- 6.3.4 Vibrac

- 6.3.5 The Hartz Mountain Corporation

- 6.3.6 Tianjin Ringpu Bio-technology

- 6.3.7 Zoetis Inc.

- 6.3.8 Central Garden & Pet