|

市場調查報告書

商品編碼

1649581

通訊的最大的公司供應商 - 2024年第3季版:Huawei的復活與8季度樣子即使催促供應商的市場復甦,2024年第3季的成長率0.3%和低調轉變Telecom's Biggest Vendors - 3Q24 Edition: Huawei's Resurgence Fuels Vendor Market Recovery in 3Q24 after Eight-Quarter Slump, but Growth Remains Sluggish at 0.3% |

||||||

圖

報告的主要焦點

- 營收: 2024 年第三季通訊網路基礎設施供應商營收將達到 496 億美元,以年率計算將達到 2,057 億美元,分別年增 0.3% 及下降 5.6%。華為推動了市場的發展。除華為外,整體市場3Q24年比年率下降8.3%。華為經歷了多個季度的令人失望的表現,但在過去的四個季度中似乎已經出現轉機。

- 頂級供應商:前三名的電信網路基礎設施供應商通常是華為、愛立信和諾基亞。這些佔 2024 年第三季整個市場的年化率為 37.5%,僅 2024 年第三季就佔 33.6%。自2019年初以來,中國通訊服務與中興通訊一直在爭奪第四和第五的位置。

- 以年收入成長排名的領先供應商:截至 2024 年第三季度,按季度和年度計算,以年收入成長排名的前兩大供應商是 Tejas Networks 和 Broadcom。這分別歸功於 BSNL 在印度推出 4G(Tejas)以及於 2023 年 11 月收購 VMWare(Broadcom)。

- 支出展望根據我們最新的官方預測,電信資本支出(電信網路基礎設施市場的主要驅動力)預計將從 2023 年的 3140 億美元下降到 2024 年的略低於 3000 億美元。未來幾年資本支出可能保持低迷,到 2028 年將在 2,800 億美元左右徘徊。每個國家的市場前景各不相同。特別是,由於政府資助(BEAD 和 RDOF),美國市場資本投資前景短期內具有吸引力。

本報告對全球電信業進行了研究和分析,並提供了134家通訊網路基礎設施供應商的收入和市場佔有率數據。

拿起的企業

|

|

目錄

第1章 報告的亮點

第2章 摘要 - 結果的說明

第3章 通訊網路基礎設施市場 - 最新的結果

第4章 前 25 名供應商 - 可列印樣頁

第5章 表(圖表) - 單一供應商的概述

第6章 表(圖表) - 供應商5公司的比較

第7章 研究開發費:各供應商

第8章 原始數據 - 收益的估計:各企業

第9章 調查手法與前提條件

第10章 關於MTN Consulting

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-3Q24 period. Of these 134 vendors, 108 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

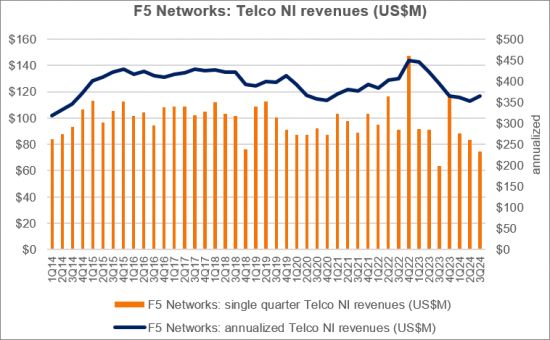

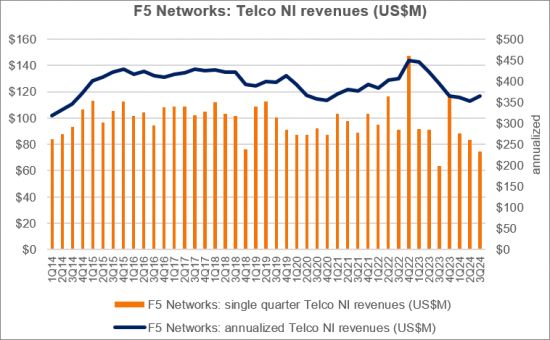

- Revenues: Telco NI vendor revenues were $49.6B in 3Q24 and $205.7B for the annualized 3Q24 period overall, up 0.3% and down 5.6% on a YoY basis, respectively. Huawei lifted the market: excluding Huawei, the total market declined by 8.3% in annualized 3Q24 on a YoY basis. After many disappointing quarters, Huawei appears to have turned a corner in the last four quarters.

- Top vendors: The top three Telco NI vendors remain the usual trio: Huawei, Ericsson, and Nokia. They account for 37.5% of the total market in annualized 3Q24, or 33.6% in 3Q24 alone. China Comservice and ZTE have been jostling for the 4th and 5th positions since early 2019.

- Key vendors by YoY revenue growth: The top two vendors, in terms of YoY revenue growth, are common to both single quarter and annualized 3Q24: Tejas Networks and Broadcom. Respectively, their jumps were due to BSNL's 4G rollout in India (Tejas), and acquisition of VMWare in Nov 2023 (Broadcom).

- Spending outlook: Per our latest official forecast, we expect telco capex - the main driver of the Telco NI market - to dip from $314B in 2023 to just below $300B in 2024. Capex will struggle to see any growth over the next few years, likely ending 2028 at ~$280B. The outlook for specific country markets varies. Notably, the spending outlook for the US market is appealing in the short-term due to government funding (BEAD and RDOF).

Companies Listed:

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

List of Figures (partial):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 3Q24 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 3Q24 ($B)

- Top 25 vendors based on Telco NI revenues in 3Q24 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 3Q24 TTM vs. 3Q23 TTM

- Telco NI annualized revenue changes, 3Q24 vs. 3Q23

- YoY growth in Telco NI revenues (3Q24)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 3Q24 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 3Q24 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (3Q22-3Q24)