|

市場調查報告書

商品編碼

1597049

抗體探索的全球市場:各提供服務形式,抗體探索手法,各生成抗體類型,生成抗體的性質,各治療領域,各主要地區::2035年前的產業趨勢與全球預測Antibody Discovery Market by Type of Service Offered, Antibody Discovery Method, Type of Antibody Generated, Nature of Antibody Generated, Type of Therapeutic Areas and Key Geographies: Industry Trends and Global Forecasts, Till 2035 |

||||||

預計到 2035 年,全球抗體發現市場規模將從目前的 16 億美元增長到 63 億美元,到 2035 年的預測期間複合年增長率為 12%。

由於具有高特異性和良好的安全性等多種有益特性,抗體已成為一種有前景的選擇,特別是在癌症、自體免疫疾病和傳染病的治療方面。抗體是目前最大的一類生物製劑,迄今已批准了 79 種分子,還有 200 多種分子處於臨床前/探索階段。這表明利益相關者在該領域做出了廣泛的開發努力。

由於現代藥物開發的複雜性,許多公司更喜歡外包作為優化其研究工作的策略解決方案。這種預期轉變背後有許多原因,包括更短的時間、降低試驗失敗的財務風險以及更快的工作流程。目前,超過 160 家公司提供廣泛的抗體發現服務。

隨著藥物開發商投資和研究這些創新療法,抗體發現市場預計將在未來十年進一步成長。在對抗體療法的需求不斷增長以及對外包的偏好日益增加的推動下,抗體發現服務和平台的成長機會在預計的未來可能會以顯著的成長率擴大。

本報告提供全球抗體探索市場相關調查,提供市場概要,以及各提供服務形式,抗體探索手法,各生成抗體類型,生成抗體的性質,各治療領域,各地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟以及其他的計劃特有的考慮事項

第4章 摘要整理

第5章 簡介

第6章 抗體探索:流程與方法

第7章 抗體探索服務供應商:市場形勢

第8章 企業競爭力分析

第9章 企業簡介:抗體探索服務供應商

第10章 抗體探索技術:市場形勢

第11章 技術競爭力分析

第12章 企業簡介:抗體探索平台供應商

- 章概要

- Harbour BioMed

- ImmunoPrecise Antibodies

- Kymab

- Ligand Pharmaceuticals

- MorphoSys

第13章 夥伴關係和合作

第14章 資金籌措投資分析

第15章 對市場的影響分析:促進因素,阻礙因素,機會,課題

第16章 全球抗體探索服務市場

第17章 抗體探索服務市場,各提供服務形式

第18章 抗體探索服務市場,抗體探索手法

第19章 抗體探索服務市場,生成抗體的性質

第20章 抗體探索服務市場,各治療領域

第21章 抗體探索服務市場,各主要地區

第22章 全球抗體探索技術市場

第23章 抗體探索技術市場,各生成抗體類型

第24章 抗體探索技術市場,各主要地區

第25章 授權契約結構

第26章 SWOT分析:人源化抗體服務供應商

第27章 案例:暢銷貨的抗體醫藥品的藥物研發流程

- 章概要

- Humira(R)(Adalimumab)

- KEYTRUDA(R)(Pembrolizumab)

- Stelara(R)(Ustekinumab)

- Opdivo(R)(Nivolumab)

- daruzarekkusu(R)(Daratumumab)

第28章 抗體探索的未來的成長機會

第29章 結論

第30章 執行洞察

- 章概要

- Antibody Solutions

- Adimab

- ImmunoPrecise Antibodies

- Abveris, Acquired by Twist Biosciences

- Nidus BioSciences

- AvantGen

- Single Cell Technology

- Distributed Bio

- AbCellera

- AbGenics Life Sciences

- CDI Laboratories

- AP Biosciences

- YUMAB

- Antibody Solutions

- Ligand Pharmaceuticals

- LakePharma

第31章 附錄1:表格形式的資料

第32章 附錄2:企業及組織一覽

ANTIBODY DISCOVERY MARKET: OVERVIEW

As per Roots Analysis, the global antibody discovery market is estimated to grow from USD 1.6 billion in the current year to USD 6.3 billion by 2035, at a CAGR of 12% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Service Offered

- Antigen Designing

- Hit Generation

- Lead Selection

- Lead Optimization

- Lead Characterization

Antibody Discovery Method

- Hybridoma based

- Library based

- Single Cell based

- Transgenic Animal based

Type of Antibody Generated

- Monoclonal Antibodies

- Bispecific Antibodies

- Others

Nature of Antibody Generated

- Chimeric

- Human

- Humanized

- Murine

Type of Therapeutic Areas

- Cardiovascular Disorders

- Immunological Disorders

- Infectious Disorders

- Neurological Disorders

- Oncological Disorders

- Others

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

ANTIBODY DISCOVERY MARKET: GROWTH AND TRENDS

Owing to several beneficial features, such as high specificity, and a favorable safety profile, antibodies have emerged as a promising alternative, particularly for the treatment of cancer, autoimmune diseases, and infectious diseases. It is worth highlighting that, at present, antibodies represent the largest class of biologics, with 79 molecules approved till date and over 200 molecules in the preclinical / discovery stages. This demonstrates the extensive development efforts being undertaken by stakeholders in this domain.

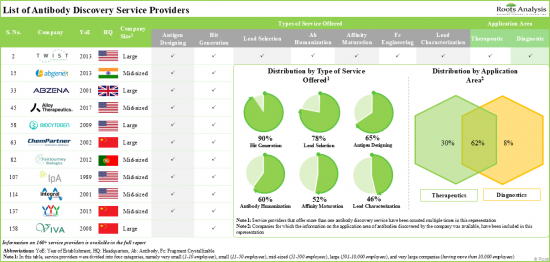

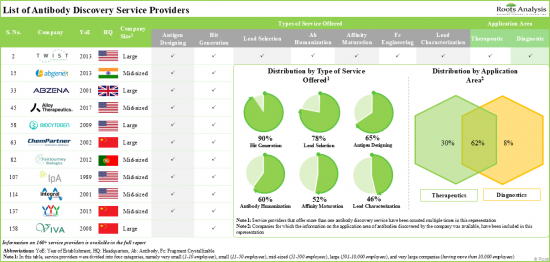

Given the complexities of modern drug development, several companies prefer to outsource as a strategic solution to optimize their research efforts. This expected shift can be attributed to various reasons, such as reduced timelines, lessened financial risks associated with failed trials and accelerated workflows. At present, over 160 players are offering a wide array of antibody discovery services.

As drug developers invest and investigate more in these innovative therapies, the market for antibody discovery is anticipated to expand further in the coming decade. Driven by the rising demand for antibody-based therapeutics and increasing preference for outsourcing, the opportunity for antibody discovery services and platforms is likely to increase at a significant growth rate in the foreseen future.

ANTIBODY DISCOVERY MARKET: KEY INSIGHTS

The report delves into the current state of the antibody discovery market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- 1. More than 160 players, present across the globe, claim to offer customized services to support antibody drug discovery operations; nearly 90% of these players offer the capability to provide hit generation services.

- 2. The market landscape is highly fragmented, featuring the presence of both new entrants and established players based across different geographical regions; close to 40% of such players are small companies.

- 3. In pursuit of building a competitive edge, service providers are actively upgrading their existing capabilities and adding new competencies in order to augment their respective portfolios and affiliated offerings.

- 4. Close to 300 antibody discovery technologies are currently available in the market, which can be utilized by antibody drug developers to conduct various types of antibody discovery operations.

- 5. Over 75% of the platform providers claim to offer technologies for the discovery of monoclonal antibodies; the majority of such players use mouse as their primary animal model to generate these antibodies.

- 6. Platform providers are focusing on the integration of advanced features into their respective platforms in order to augment their antibody discovery portfolios.

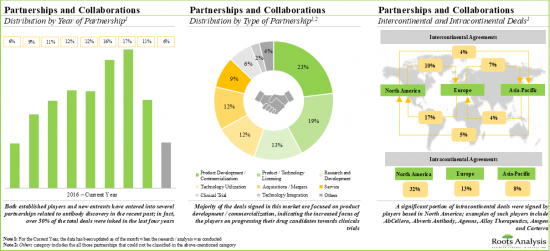

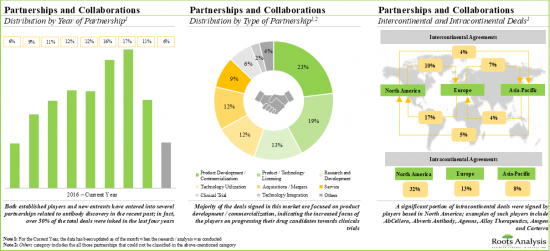

- 7. In recent years, the domain has witnessed a steady growth in partnership activity; majority of the initiatives have been product development / commercialization agreements, carried out by players based in North America.

- 8. Considering the lucrative opportunities associated with antibody discovery domain, investors have actively disbursed funds, primarily in the players based in North America.

- 9. In recent years, there has been a significant increase in the number of out-licensing deals and the upfront and conditional payments received by the antibody discovery technology developers.

- 10. The antibody discovery services market is likely to grow at a CAGR of ~12% over the next 11 years, primarily driven by the revenues generated from hit generation services offered by the players in this domain.

- 11. In the long term, the antibody discovery platforms developed for monoclonal antibodies are likely to emerge as the key growth drivers of the market; Asia Pacific is anticipated to be the fastest growing region.

ANTIBODY DISCOVERY MARKET: KEY SEGMENTS

Lead Selection Segment is the Fastest Growing Segment in the Antibody Discovery Services Market

Based on the type of service offered, the market is segmented into antigen designing, hit generation, lead selection, lead optimization, and lead characterization. It is worth highlighting that the majority of the current antibody discovery services market is captured by hit generation segment. This can be attributed to the fact that hit generation is a critical step that involves rigorous screening of a diverse pool of antibodies to extract leads with the highest affinity and specificity for a target. Therefore, the major proportion of the R&D expenditure for antibody discovery projects is spent on the hit generation step of antibody discovery.

Hybridoma Method is Likely to Dominate the Antibody Discovery Services Market During the Forecast Period

Based on the antibody discovery method, the market is segmented into hybridoma based method, library based method, single cell based method and transgenic animal based method. It is worth highlighting that the antibody discovery services market for single cell-based methods is likely to grow at a relatively higher CAGR, during the forecast period.

By Type of Antibody Generated, the Antibody Discovery Services Market is Currently Dominated by Monoclonal Antibodies

Based on the type of antibody generated, the market is segmented into monoclonal antibodies, bispecific antibodies and others. It is worth highlighting that bispecific antibody is likely to grow at a relatively higher CAGR as compared to monoclonal antibodies, during the forecast period.

Human Antibodies Segment is Likely to Dominate the Antibody Discovery Services Market During the Forecast Period

Based on the nature of the antibody generated, the market is segmented into chimeric antibodies, human antibodies, humanized antibodies and murine antibodies. It is worth highlighting that the human antibodies segment is likely to grow at a relatively higher CAGR, during the forecast period. This can be attributed to the several benefits of human antibodies, which include reduced immunogenicity and the increased serum half-life of the monoclonal antibodies in humans.

Oncological Disorders Segment Accounts for the Largest Share for the Antibody Discovery Services Market

Based on therapeutic area, the market is segmented into cardiovascular disorders, immunological disorders, infectious disorders, neurological disorders, oncological disorders and others. While oncological disorders account for a relatively higher market share, it is worth highlighting that the cardiovascular disorders segment is expected to witness substantial market growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. It is worth highlighting that over the years, the market in the Middle East and North Africa is expected to grow at a higher CAGR.

Example Players in the Antibody Discovery Market

- Ablexis

- Antibody Solutions

- ChemPartner

- Creative Biolabs

- GenScript

- Genmab

- Harbour BioMed

- ImmunoPrecise

- MabSilico

- Myrio Therapeutics

- Nona Biosciences

- Rockland Immunochemicals

- Synbio technologies

- WuXi Biologics

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and President, Antibody Solutions

- Chief Business Officer, Adimab

- Vice President of Commercial Services, ImmunoPrecise Antibodies

- Former Chief Executive Officer, Abveris

- Founder and Chief Technology Officer, Nidus BioSciences

- Former Chief Business Officer, AvantGen

- Chief Executive Officer and Chief Scientific Officer, Single Cell Technology

- Site Director, Distributed Bio

- Co-Founder and Director of Emerging Science and Technology, AbCellera

- Co-founder and Director, AbGenics Life Sciences

- President and Chief Operating Officer, CDI Laboratories

- Chief Executive Officer, AP Biosciences

- Chief Executive Officer and General Manager, YUMAB

- Business Development Manager, Antibody Solutions

- Senior Vice President, Ligand Pharmaceuticals

- Former Chief Scientific Officer, LakePharma

ANTIBODY DISCOVERY MARKET: RESEARCH COVERAGE

- The report features an in-depth analysis of the antibody discovery market, focusing on key market segments, including type of service offered, antibody discovery method, type of antibody generated, nature of antibody generated, type of therapeutic areas and key geographical regions.

- A comprehensive evaluation of over 160 service provides companies involved in antibody discovery services market, considering various parameters, such as year of establishment, company size, location of headquarters, type of service offered (antigen designing, hit generation, lead selection, and lead optimization and lead characterization), type of antibody discovery method (hybridoma based, library based, single cell based, transgenic animal based, and others), animal model used (rabbit, rat, mouse, llama, chicken, transgenic animal and others), type of antibody discovered (monoclonal antibody, bispecific antibody, single domain antibody, antibody drug conjugate, antibody fragment and others) and purpose of antibody discovery (therapeutic and diagnostic).

- A comprehensive competitive analysis of antibody discovery service providers, examining factors such as years of experience, number of platforms, number of antibody discovery services offered, types of antibody discovery methods adopted, type of antibody formats generated, type of application areas. This analysis also presents the antibody discovery capabilities in different regions, based on a number of relevant parameters, such as type of service offered for service providers, and number of technologies offered, number of antibody discovery methods and type of antibody discovered by the platform providers.

- In-depth profiles of key industry players that are actively engaged in providing antibody discovery services, focusing on company overviews, recent developments and an informed future outlook.

- Thorough analysis of over 290 antibody discovery platforms, type of antibody discovered (monoclonal antibody, bispecific antibody, single domain antibody, antibody drug conjugate, antibody fragment and others), type of antibody discovery method (hybridoma based, library-based, single cell-based, transgenic animal-based, and others) and animal model used (rabbit, rat, mouse, llama, chicken, transgenic animal and others). In addition, it includes analysis of 190+ antibody discovery platform providers based on their company details such as year of establishment, company size and location of headquarters.

- A comprehensive competitive analysis of antibody discovery technologies, examining factors such as supplier power and key specifications of the platforms, such as type of antibody discovered, compatibility of antibodies in human, number of deals signed for a particular platform (since 2015).

- In-depth profiles of key industry players that are actively offering antibody discovery platform / technology to other companies, focusing on company overviews, antibody discovery platforms / technology, recent developments and an informed future outlook.

- An analysis of partnerships established in this sector, since 2021, covering acquisitions, clinical trial agreements, mergers, multipurpose agreements, product / technology licensing agreements, product development and commercialization agreements, research and development agreements, service agreements, technology integration agreements, technology utilization agreements.

- A detailed evaluation of the investments made in antibody discovery market, encompassing seed financing, venture capital financing, debt financing, grants, capital raised from IPOs and subsequent offerings.

- An insightful deal structure analysis, highlighting cash flows and net present values of licensor and licensee, taking into consideration multiple likely scenarios of upfront, milestone and royalty payments.

- A SWOT analysis of antibody humanization services focuses on identifying industry-specific trends, key market drivers and challenges faced by companies providing these services. This section also includes a comprehensive list of prominent players in the antibody humanization and affinity maturation market. Furthermore, it discusses the factors that are likely to impact the operations of firms involved in these services.

- Detailed profiles of the most successful therapeutic monoclonal antibody products (as per sales reported in 2022). It provides detailed profiles on top five drugs, namely Humira(R), Keytruda(R), Stelara(R), Opdivo(R) and Darzalex(R), including information on their historical sales, discovery process and methods.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What are the factors that are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Project Objectives

- 1.3. Scope of the Report

- 1.4. Inclusions and Exclusions

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Trends Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Structure of Antibodies

- 5.3. History of Antibody Development

- 5.4. Antibody Isotypes

- 5.5. Mechanism of Action of Antibodies

- 5.6. Classification of Antibodies

- 5.6.1. Monoclonal Antibodies

- 5.6.2. Polyclonal Antibodies

- 5.6.3. Bispecific Antibodies

- 5.7. Applications of Antibodies

- 5.8. Concluding Remarks

6. ANTIBODY DISCOVERY: PROCESS AND METHODS

- 6.1. Chapter Overview

- 6.2. Antibody Discovery Process

- 6.2.1. Target Selection and Validation

- 6.2.2. Hit Generation

- 6.2.3. Lead Selection

- 6.2.4. Lead Optimization

- 6.2.4.1. Humanization

- 6.2.4.2. Affinity Maturation

- 6.2.4.3. Fc Engineering

- 6.2.5. Lead Characterization

- 6.2.6. Candidate Selection

- 6.3. Antibody Discovery Methods

- 6.3.1. Hybridoma Technology-based Method

- 6.3.2. In vitro Display Method

- 6.3.2.1. Phage Display

- 6.3.2.2. Yeast Display

- 6.3.2.3. Ribosomal Display

- 6.3.3. Transgenic Animal-based Method

- 6.3.4. Single B Cell-based Method

- 6.3.5. Advantages and Disadvantages of Existing Antibody Discovery Techniques

- 6.4. Evolution of Monoclonal Antibodies

- 6.4.1. Fully Human Monoclonal Antibodies

- 6.5. Concluding Remarks

7. ANTIBODY DISCOVERY SERVICE PROVIDERS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Antibody Discovery Service Providers: List of Industry Players

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Type of Service Offered

- 7.2.5. Analysis by Type of Antibody Discovered

- 7.2.6. Analysis by Type of Antibody Discovery Method

- 7.2.7. Analysis by Animal Model Used

- 7.2.8. Analysis by Type of Antibody Discovered and Type of Antibody Discovery Method

- 7.2.9. Analysis by Type of Antibody Discovery Services and Location of Headquarters

- 7.2.10. Analysis by Application Area

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Competitiveness Analysis: Companies Grouped based on Company Size

- 8.4.1. Very Small Companies Offering Antibody Discovery Services

- 8.4.2. Small Companies Offering Antibody Discovery Services

- 8.4.3. Mid-sized Companies Offering Antibody Discovery Services

- 8.4.4. Large Companies Offering Antibody Discovery Services

- 8.5. Antibody Discovery Service Providers: Regional Capability

- 8.5.1. Antibody Discovery Service Providers based in North America

- 8.5.2. Antibody Discovery Service Providers based in Europe

- 8.5.3. Antibody Discovery Service Providers based in Asia

9. COMPANY PROFILES: ANTIBODY DISCOVERY SERVICE PROVIDERS

- 9.1. Chapter Overview

- 9.2. Antibody Discovery Service Providers in North America

- 9.2.1. Abwiz Bio

- 9.2.1.1. Company Overview

- 9.2.1.2. Recent Developments and Future Outlook

- 9.2.2. Aragen Bioscience (Subsidiary of GVK BIO)

- 9.2.2.1. Company Overview

- 9.2.2.2. Recent Developments and Future Outlook

- 9.2.3. Creative Biolabs

- 9.2.3.1. Company Overview

- 9.2.3.2. Recent Developments and Future Outlook

- 9.2.4. Distributed Bio

- 9.2.4.1. Company Overview

- 9.2.4.2. Recent Developments and Future Outlook

- 9.2.5. ImmunoPrecise Antibodies

- 9.2.5.1. Company Overview

- 9.2.5.2. Financial Information

- 9.2.5.3. Recent Developments and Future Outlook

- 9.2.6. Integral Molecular

- 9.2.6.1. Company Overview

- 9.2.6.2. Recent Developments and Future Outlook

- 9.2.7. LakePharma

- 9.2.7.1. Company Overview

- 9.2.7.2. Recent Developments and Future Outlook

- 9.2.8. Syd Labs

- 9.2.8.1. Company Overview

- 9.2.8.2. Recent Developments and Future Outlook

- 9.2.1. Abwiz Bio

- 9.3. Antibody Discovery Service Providers in Europe

- 9.3.1. Abzena

- 9.3.1.1. Company Overview

- 9.3.1.2. Financial Information

- 9.3.1.3. Recent Developments and Future Outlook

- 9.3.2. BIOTEM

- 9.3.2.1. Company Overview

- 9.3.2.2. Recent Developments and Future Outlook

- 9.3.3. PX'Therapeutics (Subsidiary of Aguettant Pharmaceutical Group)

- 9.3.3.1. Company Overview

- 9.3.3.2. Recent Developments and Future Outlook

- 9.3.1. Abzena

- 9.4. Antibody Discovery Service Providers in Asia and Rest of the World

- 9.4.1. ChemPartner

- 9.4.1.1. Company Overview

- 9.4.1.2. Recent Developments and Future Outlook

- 9.4.2. HD Biosciences

- 9.4.2.1. Company Overview

- 9.4.2.2. Recent Developments and Future Outlook

- 9.4.3. Viva Biotech

- 9.4.3.1. Company Overview

- 9.4.3.2. Financial Information

- 9.4.3.3. Recent Developments and Future Outlook

- 9.4.4. WuXi Biologics

- 9.4.4.1. Company Overview

- 9.4.4.2. Financial Information

- 9.4.4.3. Recent Developments and Future Outlook

- 9.4.1. ChemPartner

10. ANTIBODY DISCOVERY TECHNOLOGIES: MARKET LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Antibody Discovery: List of Technologies and Platforms

- 10.2.1. Analysis by Type of Antibody Discovery Method

- 10.2.2. Analysis by Type of Antibody Discovered

- 10.2.3. Analysis by Animal Model Used

- 10.2.4. Analysis by Type of Antibody Discovery Method and Location of Headquarters

- 10.2.5. Analysis by Type of Antibody Discovery Method and Type of Antibody Discovered

- 10.3. Antibody Discovery Technologies: List of Industry Players

- 10.3.1. Analysis by Year of Establishment

- 10.3.2. Analysis by Company Size

- 10.3.3. Analysis by Location of Headquarters

- 10.3.4. Most Active Players: Analysis by Number of Platforms

11. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 11.1. Chapter Overview

- 11.2. Assumptions and Key Parameters

- 11.3. Methodology

- 11.4. Antibody Discovery Technologies: Competitiveness Analysis

- 11.4.1. Antibody Discovery Technologies Offered by Companies based in North America

- 11.4.2. Antibody Discovery Technologies Offered by Companies based in Europe

- 11.4.3. Antibody Discovery Technologies Offered by Companies based in Asia and Rest of the World

12. COMPANY PROFILES: ANTIBODY DISCOVERY PLATFORM PROVIDERS

- 12.1. Chapter Overview

- 12.2. Harbour BioMed

- 12.2.1. Company Overview

- 12.2.2. Antibody Discovery Platforms Portfolio

- 12.2.3. Recent Developments and Future Outlook

- 12.3. ImmunoPrecise Antibodies

- 12.3.1. Company Overview

- 12.3.2. Financial Information

- 12.3.3. Antibody Discovery Platforms Portfolio

- 12.3.4. Recent Developments and Future Outlook

- 12.4. Kymab

- 12.4.1. Company Overview

- 12.4.2. Antibody Discovery Platforms Portfolio

- 12.4.3. Recent Developments and Future Outlook

- 12.5. Ligand Pharmaceuticals

- 12.5.1. Company Overview

- 12.5.2. Financial Information

- 12.5.3. Antibody Discovery Platforms Portfolio

- 12.5.4. Recent Developments and Future Outlook

- 12.6. MorphoSys

- 12.6.1. Company Overview

- 12.6.2. Financial Information

- 12.6.3. Antibody Discovery Platforms Portfolio

- 12.6.4. Recent Developments and Future Outlook

13. PARTNERSHIPS AND COLLABORATIONS

- 13.1. Chapter Overview

- 13.2. Partnership Models

- 13.3. List of Partnerships and Collaborations

- 13.3.1. Analysis by Year of Partnership

- 13.3.2. Analysis by Type of Partnership

- 13.3.3. Analysis by Year of Partnership and Type of Partner

- 13.3.4. Analysis by Type of Antibody

- 13.3.5. Most Active Players: Analysis by Number of Partnerships

- 13.3.6. Most Popular Technologies: Analysis by Number of Partnerships

- 13.3.7. Analysis by Geography

- 13.3.8. Intracontinental and Intercontinental Agreements

14. FUNDING AND INVESTMENT ANALYSIS

- 14.1. Chapter Overview

- 14.2. Types of Funding

- 14.3. Antibody Discovery Service and Platform Providers: Funding and Investment

- 14.3.1. Analysis by Year of Funding

- 14.3.2. Analysis by Type of Funding

- 14.3.3. Analysis of Amount Invested by Year of Funding

- 14.3.4. Analysis by Year-wise Number of Funding Instances and Funding Amount

- 14.3.5. Most Active Players: Analysis by Number of Funding Instances

- 14.3.6. Most Active Players: Analysis by Amount Invested

- 14.3.7. Leading Investors: Analysis by Number of Funding Instances

- 14.3.8. Analysis by Year-wise Number of Funding Instances and Type of Player

- 14.3.9. Analysis by Year-wise Amount Invested and Type of Player

- 14.3.10. Analysis of Number of Funding Instances by Year of Establishment and Type of Player

- 14.3.11. Analysis by Geography

- 14.4. Concluding Remarks

15. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 15.1. Chapter Overview

- 15.2. Market Drivers

- 15.3. Market Restraints

- 15.4. Market Opportunities

- 15.5. Market Challenges

- 15.6. Conclusion

16. GLOBAL ANTIBODY DISCOVERY SERVICES MARKET

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Global Antibody Discovery Services Market, Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 16.3.1. Scenario Analysis

- 16.4. Key Market Segmentations

- 16.5. Dynamic Dashboard

17. ANTIBODY DISCOVERY SERVICES MARKET, BY TYPE OF SERVICE OFFERED

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Antigen Designing: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 17.4. Hit Generation: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 17.5. Lead Selection: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 17.6. Lead Optimization: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 17.7. Lead Characterization: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 17.8. Data Triangulation and Validation

18. ANTIBODY DISCOVERY SERVICES MARKET, BY TYPE OF ANTIBODY DISCOVERY METHOD

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Phage Display: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 18.4. Yeast Display: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 18.5. Hybridoma Method: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 18.6. Transgenic Animal based Method: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 18.7. Single Cell based Method: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 18.8. Other Antibody Discovery Methods: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 18.9. Data Triangulation and Validation

19. ANTIBODY DISCOVERY SERVICES MARKET, BY NATURE OF ANTIBODY DISCOVERED

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Humanized: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 19.4. Human: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 19.5. Chimeric: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 19.6. Murine: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 19.7. Data Triangulation and Validation

20. ANTIBODY DISCOVERY SERVICES MARKET, BY TYPE OF THERAPEUTIC AREAS

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Oncological Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 20.4. Immunological Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 20.5. Infectious Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 20.6. Neurological Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 20.7. Cardiovascular Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 20.8. Other Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 20.9. Data Triangulation and Validation

21. ANTIBODY DISCOVERY SERVICES MARKET, BY KEY GEOGRAPHIES

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. North America: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 21.4. Europe: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 21.5. Asia: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 21.6. Latin America: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 21.7. Middle East and North Africa: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 21.8. Rest of the World: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 21.9. Data Triangulation and Validation

22. GLOBAL ANTIBODY DISCOVERY TECHNOLOGIES MARKET

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Global Antibody Discovery Technologies Market, Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 22.3.1. Scenario Analysis

- 22.4. Key Market Segmentations

- 22.5. Dynamic Dashboard

23. ANTIBODY DISCOVERY TECHNOLOGIES MARKET, BY TYPE OF ANTIBODY DISCOVERED

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Monoclonal Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 23.4. Bispecific Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 23.5. Other Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 23.6. Data Triangulation and Validation

24. ANTIBODY DISCOVERY TECHNOLOGIES MARKET, BY KEY GEOGRAPHIES

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. North America: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 24.4. Europe: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 24.5. Asia: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- 24.6. Data Triangulation and Validation

25. LICENSING DEAL STRUCTURE

- 25.1. Chapter Overview

- 25.2. Key Parameters

- 25.3. Assumptions and Methodology

- 25.3.1. Overall Cash Flow for Licensee Companies

- 25.3.1.1. Investments Made by a Licensee

- 25.3.1.2. Revenues Earned by a Licensee

- 25.3.2. Overall Cash Flow for Licensor Companies

- 25.3.2.1. Investments Made by a Licensor

- 25.3.2.2. Revenues Earned by a Licensor

- 25.3.1. Overall Cash Flow for Licensee Companies

- 25.4. Key Analytical Outputs

- 25.4.1. Scenario 1: Variation of Upfront and Milestone Payments

- 25.4.2. Scenario 2: Variation of Upfront Payments and Sales-based Royalties

- 25.4.3. Scenario 3: Variation of Milestone Payments and Sales-based Royalties

26. SWOT ANALYSIS: ANTIBODY HUMANIZATION SERVICE PROVIDERS

- 26.1. Chapter Overview

- 26.2. Antibody Humanization and Affinity Maturation Service and Platform Providers: List of Players

- 26.3. Antibody Humanization Service Providers: SWOT Analysis

- 26.3.1. Strengths

- 26.3.2. Weaknesses

- 26.3.3. Opportunities

- 26.3.4. Threats

27. CASE IN POINT: DRUG DISCOVERY PROCESSES OF TOP SELLING ANTIBODIES

- 27.1. Chapter Overview

- 27.2. Humira(R) (Adalimumab)

- 27.2.1. Drug Overview

- 27.2.2. Discovery Process and Method

- 27.2.3. Historical Sales

- 27.3. Keytruda(R) (Pembrolizumab)

- 27.3.1. Drug Overview

- 27.3.2. Discovery Process and Method

- 27.3.3. Historical Sales

- 27.4. Stelara(R) (Ustekinumab)

- 27.4.1. Drug Overview

- 27.4.2. Discovery Process and Method

- 27.4.3. Historical Sales

- 27.5. Opdivo(R) (Nivolumab)

- 27.5.1. Drug Overview

- 27.5.2. Discovery Process and Method

- 27.5.3. Historical Sales

- 27.6. Darzalex(R) (Daratumumab)

- 27.6.1. Drug Overview

- 27.6.2. Discovery Process and Method

- 27.6.3. Historical Sales

28. FUTURE GROWTH OPPORTUNITIES IN ANTIBODY DISCOVERY

- 28.1. Chapter Overview

- 28.2. Anticipated Shift from Monoclonal Antibodies to Other Novel Antibody Formats

- 28.3. Technological Advancements to Overhaul Conventional Antibody Discovery Processes

- 28.4. Transition to CADD-based Approaches to Help Achieve Better Operational Efficiencies

- 28.5. Rising Demand for Antibody-based Treatment Options for Non-Oncological Indications

- 28.6. Future Growth Opportunities in the Asia and Rest of the World

- 28.7. Expected Increase in Number of Collaborations and Licensing Activity

- 28.8. Concluding Remarks

29. CONCLUSION

30. EXECUTIVE INSIGHTS

- 30.1. Chapter Overview

- 30.2. Antibody Solutions

- 30.2.1. Company Snapshot

- 30.2.2. John S Kenney, Founder and President (Q3 2023)

- 30.3. Adimab

- 30.3.1. Company Snapshot

- 30.3.2. Guy Van Meter, Chief Business Officer (Q3 2023)

- 30.4. ImmunoPrecise Antibodies

- 30.4.1. Company Snapshot

- 30.4.2. Kari Graber, Vice President of Commercial Services (Q3 2023)

- 30.5. Anonymous

- 30.5.1. Anonymous, Chief Business Officer (Q3 2023)

- 30.6. Abveris, Acquired by Twist Biosciences

- 30.6.1. Company Snapshot

- 30.6.2. Tracey Mullen, Former Chief Executive Officer (Q2 2020)

- 30.7. Nidus BioSciences

- 30.7.1. Company Snapshot

- 30.7.2. Lisa Delouise, Founder and Chief Technology Officer (Q1 2020)

- 30.8. AvantGen

- 30.8.1. Company Snapshot

- 30.8.2. Mark Kubik, Former Chief Business Officer (Q1 2020)

- 30.9. Single Cell Technology

- 30.9.1. Company Snapshot

- 30.9.2. Chun-Nan Chen, Chief Executive Officer and Chief Scientific Officer (Q2 2018)

- 30.10. Distributed Bio

- 30.10.1. Company Snapshot

- 30.10.2. Giles Day, Co-Founder and Former Chief Executive Officer (Q2 2018)

- 30.11. AbCellera

- 30.11.1. Company Snapshot

- 30.11.2. Kevin Heyries, Co-Founder and Former Lead of Business Development Strategy (Q2 2018)

- 30.12. AbGenics Life Sciences

- 30.12.1. Company Snapshot

- 30.12.2. Sanjiban K Banerjee, Co-founder and Director (Q2 2018)

- 30.13. CDI Laboratories

- 30.13.1. Company Snapshot

- 30.13.2. Ignacio Pino, Co-founder and Chief Executive Officer (Q2 2017)

- 30.14. AP Biosciences

- 30.14.1. Company Snapshot

- 30.14.2. Jeng Her, Chief Executive Officer (Q2 2017)

- 30.15. YUMAB

- 30.15.1. Company Snapshot

- 30.15.2. Thomas Schirrmann, Chief Executive Officer and General Manager (Q2 2017)

- 30.16. Antibody Solutions

- 30.16.1. Company Snapshot

- 30.16.2. Debra Valsamis, Business Development Associate (Q2 2017)

- 30.17. Ligand Pharmaceuticals

- 30.17.1. Company Snapshot

- 30.17.2. Christel Iffland, Senior Vice President (Q2 2017)

- 30.18. LakePharma

- 30.18.1. Company Snapshot

- 30.18.2. Aaron Sato, Former Chief Scientific Officer (Q2 2017)

31. APPENDIX 1: TABULATED DATA

32. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATION

List of Tables

- Table 5.1 Antibody Isotypes: Key Features

- Table 5.2 Mechanism of Action of Therapeutic Antibodies Against Different Target Classes

- Table 5.3 Differences Between Polyclonal and Monoclonal Antibodies

- Table 7.1 Antibody Discovery Service Providers: Information on Year of Establishment, Company Size, Location of Headquarters

- Table 7.2 Antibody Discovery Service Providers: Information on Type of Services Offered

- Table 7.3 Antibody Discovery Service Providers: Information on Type of Antibody Discovered

- Table 7.4 Antibody Discovery Service Providers: Information on Type of Antibody Discovery Method

- Table 7.5 Antibody Discovery Service Providers: Information on Animal Model Used

- Table 7.6 Antibody Discovery Service Providers: Information on Application Area

- Table 8.1 Regional Capability Analysis: Antibody Discovery Service Providers Based in North America

- Table 8.2 Regional Capability Analysis: Antibody Discovery Service Providers Based in Europe

- Table 8.3 Regional Capability Analysis: Antibody Discovery Service Providers Based in Asia

- Table 9.1 List of Companies Profiled

- Table 9.2 Abwiz Bio: Company Snapshot

- Table 9.3 Abwiz Bio: Recent Developments and Future Outlook

- Table 9.4 Aragen Bioscience: Company Snapshot

- Table 9.5 Aragen Bioscience: Recent Developments and Future Outlook

- Table 9.6 Creative Biolabs: Company Snapshot

- Table 9.7 Creative Biolabs: Recent Developments and Future Outlook

- Table 9.8 Distributed Bio: Company Snapshot

- Table 9.9 Distributed Bio: Recent Developments and Future Outlook

- Table 9.10 ImmunoPrecise Antibodies: Company Snapshot

- Table 9.11 ImmunoPrecise Antibodies: Recent Developments and Future Outlook

- Table 9.12 Integral Molecular: Company Snapshot

- Table 9.13 Integral Molecular: Recent Developments and Future Outlook

- Table 9.14 LakePharma: Company Snapshot

- Table 9.15 LakePharma: Recent Developments and Future Outlook

- Table 9.16 Abzena: Company Snapshot

- Table 9.17 Abzena: Recent Developments and Future Outlook

- Table 9.18 BIOTEM: Company Snapshot

- Table 9.19 BIOTEM: Recent Developments and Future Outlook

- Table 9.20 PX'Therapeutics: Company Snapshot

- Table 9.21 PX'Therapeutics: Recent Developments and Future Outlook

- Table 9.22 ChemPartner: Company Snapshot

- Table 9.23 ChemPartner: Recent Developments and Future Outlook

- Table 9.24 Viva Biotech: Company Snapshot

- Table 9.25 Viva Biotech: Recent Developments and Future Outlook

- Table 9.26 WuXi Biologics: Company Snapshot

- Table 9.27 WuXi Biologics: Recent Developments and Future Outlook

- Table 10.1 Antibody Discovery Technologies: Information on Type of Antibody Discovered

- Table 10.2 Antibody Discovery Service Technologies: Information on Type of Antibody Discovery Method

- Table 10.3 Antibody Discovery Service Technologies: Information on Animal Model Used

- Table 10.4 Antibody Discovery Service Technologies: Information on Location of Headquarters of Developer

- Table 10.5 Antibody Discovery Platform Providers: Information on Year of Establishment, Company Size, Location of Headquarters

- Table 12.1 List of Companies Profiled

- Table 12.2 Ablexis: Company Snapshot

- Table 12.3 Ablexis: Antibody Discovery Platform Portfolio

- Table 12.4 Ablexis: Recent Developments and Future Outlook

- Table 12.5 Creative Biolabs: Company Snapshot

- Table 12.6 Creative Biolabs: Antibody Discovery Platform Portfolio

- Table 12.7 Creative Biolabs: Recent Developments and Future Outlook

- Table 12.8 Genmab: Company Snapshot

- Table 12.9 Genmab: Antibody Discovery Platform Portfolio

- Table 12.10 Genmab: Recent Developments and Future Outlook

- Table 12.11 Harbour BioMed: Company Snapshot

- Table 12.12 Harbour BioMed: Antibody Discovery Platform Portfolio

- Table 12.13 Harbour BioMed: Recent Developments and Future Outlook

- Table 12.14 Immunome: Company Snapshot

- Table 12.15 Immunome: Antibody Discovery Platform Portfolio

- Table 12.16 Immunome: Recent Developments and Future Outlook

- Table 12.17 Isogenica: Company Snapshot

- Table 12.18 Isogenica: Antibody Discovery Platform Portfolio

- Table 12.19 Isogenica: Recent Developments and Future Outlook

- Table 12.20 Kymab: Company Snapshot

- Table 12.21 Kymab: Antibody Discovery Platform Portfolio

- Table 12.22 Kymab: Recent Developments and Future Outlook

- Table 12.23 Ligand Pharmaceuticals: Company Snapshot

- Table 12.24 Ligand Pharmaceuticals: Antibody Discovery Platform Portfolio

- Table 12.25 Ligand Pharmaceuticals: Recent Developments and Future Outlook

- Table 12.26 MorphoSys: Company Snapshot

- Table 12.27 MorphoSys: Antibody Discovery Platform Portfolio

- Table 12.28 MorphoSys: Recent Developments and Future Outlook

- Table 13.1 Antibody Discovery Service and Platform Providers: List of Partnerships and Collaboration, 2015-2023

- Table 14.1 Antibody Discovery Service and Platform Providers: List of Funding Instances, 2016-2023

- Table 24.1 Developmental / Regulatory Milestones

- Table 24.2 Antibody Discovery Platforms: Average Upfront and Average Milestone Payments (USD Million)

- Table 25.1 Approved Monoclonal Antibodies: Information on Affinity

- Table 25.2 Antibody Humanization: List of Service Providers

- Table 26.1 List of Top Ten Selling Therapeutic Antibodies, 2022

- Table 29.1 Antibody Solutions: Company Snapshot

- Table 29.2 Adimab: Company Snapshot

- Table 29.3 ImmunoPrecise Antibodies: Company Snapshot

- Table 29.4 Abveris Antibody: Company Snapshot

- Table 29.5 Nidus BioSciences: Company Snapshot

- Table 29.6 AvantGen: Company Snapshot

- Table 29.7 Single Cell Technology: Company Snapshot

- Table 29.8 Distributed Bio: Company Snapshot

- Table 29.9 AbCellera: Company Snapshot

- Table 29.10 AbGenics Life Sciences: Company Snapshot

- Table 29.11 CDI Laboratories: Company Snapshot

- Table 29.12 AP Biosciences: Company Snapshot

- Table 29.13 YUMAB: Company Snapshot

- Table 29.14 Antibody Solutions: Company Snapshot

- Table 29.15 Ligand Pharmaceuticals: Company Snapshot

- Table 29.16. LakePharma: Company Snapshot

- Table 30.1 Antibody Discovery Service Providers: Distribution by Year of Establishment

- Table 30.2 Antibody Discovery Service Providers: Distribution by Company Size

- Table 30.3 Antibody Discovery Service Providers: Distribution by Location of Headquarters

- Table 30.4 Antibody Discovery Service Providers: Distribution by Type of Service Offered

- Table 30.5 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovered

- Table 30.6 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Method

- Table 30.7 Antibody Discovery Service Providers: Distribution by Animal Model Used

- Table 30.8 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovered and Type of Antibody Discovery Method

- Table 30.9 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Services and Location of Headquarters

- Table 30.10 Antibody Discovery Service Providers: Analysis by Application Area

- Table 30.11 ImmunoPrecise Antibodies: Annual Revenues, 2016 Onwards (USD Million)

- Table 30.12 Abzena: Annual Revenues, 2016 Onwards (GBP Million)

- Table 30.13 Fusion Antibodies: Annual Revenues, 2017 Onwards (EUR Million)

- Table 30.14 Viva Biotech: Annual Revenues, 2016 Onwards (RMB Million)

- Table 30.15 WuXi Biologics: Annual Revenues, 2016 Onwards (RMB Billion)

- Table 30.16 Antibody Discovery Technologies: Distribution by Type of Antibody Discovered

- Table 30.17 Antibody Discovery Technologies: Distribution by Type of Antibody Discovery Method

- Table 30.18 Antibody Discovery Technologies: Distribution by Animal Model Used

- Table 30.19 Antibody Discovery Technologies: Distribution by Type of Antibody Discovery Method and Location of Headquarters

- Table 30.20 Antibody Discovery Technologies: Distribution by Discovery Method and Type of Antibody Discovered

- Table 30.21 Antibody Discovery Technology Providers: Distribution by Year of Establishment

- Table 30.22 Antibody Discovery Technology Providers: Distribution by Company Size

- Table 30.23 Antibody Discovery Technology Providers: Distribution by Location of Headquarters

- Table 30.24 Most Active Players: Distribution by Number of Technologies

- Table 30.25 Partnerships and Collaborations: Cumulative Trend by Year, Since 2015

- Table 30.26 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 30.27 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2021

- Table 30.28 Partnerships and Collaborations: Distribution by Type of Antibody

- Table 30.29 Most Active Players: Distribution by Number of Partnerships

- Table 30.30 Most Popular Technologies: Distribution by Number of Partnerships

- Table 30.31 Partnerships and Collaborations: Distribution by Geography

- Table 30.32 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 30.33 Funding and Investment Analysis: Cumulative Year-wise Trend, Since 2016

- Table 30.34 Funding and Investment Analysis: Distribution by Type of Funding

- Table 30.35 Funding and Investment Analysis: Distribution of Amount Invested by Year of Funding, Since 2016 (USD Million)

- Table 30.36 Funding and Investment Analysis: Distribution by Year-wise Number of Funding Instances and Funding Amount, Since 2016 (USD Million)

- Table 30.37 Most Active Players: Distribution by Number of Funding Instances

- Table 30.38 Most Active Players: Distribution by Amount Invested (USD Million)

- Table 30.39 Leading Investors: Distribution by Number of Funding Instances

- Table 30.40 Funding and Investment Analysis: Distribution by Year-wise Number of Funding Instances and Type of Player

- Table 30.41 Funding and Investment Analysis: Distribution by Year-wise Amount Invested and Type of Player

- Table 30.42 Funding and Investment Analysis: Distribution of Number of Funding Instances by Year of Establishment and Type of Player

- Table 30.43 Funding and Investment Analysis: Distribution by Geography

- Table 30.44 Global Antibody Discovery Services Market, Historical Trends, Since 2017 (USD Million)

- Table 30.45 Global Antibody Discovery Services Market, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Million)

- Table 30.46 Antibody Discovery Services Market for Antigen Designing, Historical Trends Since 2017 (USD Million)

- Table 30.47 Antibody Discovery Services Market for Antigen Designing, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.48 Antibody Discovery Services Market for Hit Generation, Historical Trends, Since 2017 (USD Million)

- Table 30.49 Antibody Discovery Services Market for Hit Generation, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.50 Antibody Discovery Services Market for Lead Selection, Historical Trends, Since 2017 (USD Million)

- Table 30.51 Antibody Discovery Services Market for Lead Selection, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.52 Antibody Discovery Services Market for Lead Optimization, Historical Trends, Since 2017 (USD Million)

- Table 30.53 Antibody Discovery Services Market for Lead Optimization, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.54 Antibody Discovery Services Market for Lead Characterization, Historical Trends, Since 2017 (USD Million)

- Table 30.55 Antibody Discovery Services Market for Lead Characterization, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.56 Antibody Discovery Services Market for Phage Display, Historical Trends, Since 2017 (USD Million)

- Table 30.57 Antibody Discovery Services Market for Phage Display, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.58 Antibody Discovery Services Market for Yeast Display, Historical Trends, Since 2017 (USD Million)

- Table 30.59 Antibody Discovery Services Market for Yeast Display, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.60 Antibody Discovery Services Market for Hybridoma Method, Historical Trends, Since 2017 (USD Million)

- Table 30.61 Antibody Discovery Services Market for Hybridoma Method, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.62 Antibody Discovery Services Market for Transgenic Animal based Method, Historical Trends, Since 2017 (USD Million)

- Table 30.63 Antibody Discovery Services Market for Transgenic Animal based Method, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.64 Antibody Discovery Services Market for Single Cell based Method, Historical Trends, Since 2017 (USD Million)

- Table 30.65 Antibody Discovery Services Market for Single Cell based Method, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.66 Antibody Discovery Services Market for Other Antibody Discovery Method, Historical Trends, Since 2017 (USD Million)

- Table 30.67 Antibody Discovery Services Market for Other Antibody Discovery Method, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.68 Antibody Discovery Services Market for Humanized Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.69 Antibody Discovery Services Market for Humanized Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.70 Antibody Discovery Services Market for Human Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.71 Antibody Discovery Services Market for Human Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.72 Antibody Discovery Services Market for Chimeric Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.73 Antibody Discovery Services Market for Chimeric Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.74 Antibody Discovery Services Market for Murine Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.75 Antibody Discovery Services Market for Murine Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.76 Antibody Discovery Services Market for Oncological Disorders, Historical Trends, Since 2017 (USD Million)

- Table 30.77 Antibody Discovery Services Market for Oncological Disorders, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.78 Antibody Discovery Services Market for Immunological Disorders, Historical Trends, Since 2017 (USD Million)

- Table 30.79 Antibody Discovery Services Market for Immunological Disorders, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.80 Antibody Discovery Services Market for Infectious Disorders, Historical Trends, Since 2017 (USD Million)

- Table 30.81 Antibody Discovery Services Market for Infectious Disorders, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.82 Antibody Discovery Services Market for Neurological Disorders, Historical Trends, Since 2017 (USD Million)

- Table 30.83 Antibody Discovery Services Market for Neurological Disorders, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.84 Antibody Discovery Services Market for Cardiovascular Disorders, Historical Trends, Since 2017 (USD Million)

- Table 30.85 Antibody Discovery Services Market for Cardiovascular Disorders, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.86 Antibody Discovery Services Market for Other Disorders, Historical Trends, Since 2017 (USD Million)

- Table 30.87 Antibody Discovery Services Market for Other Disorders, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.88 Antibody Discovery Services Market in North America, Historical Trends, Since 2017 (USD Million)

- Table 30.89 Antibody Discovery Services Market in North America, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.90 Antibody Discovery Services Market in Europe, Historical Trends, Since 2017 (USD Million)

- Table 30.91 Antibody Discovery Services Market in Europe, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.92 Antibody Discovery Services Market in Asia, Historical Trends, Since 2017 (USD Million)

- Table 30.93 Antibody Discovery Services Market in Asia, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.94 Antibody Discovery Services Market in Latin America, Historical Trends, Since 2017 (USD Million)

- Table 30.95 Antibody Discovery Services Market in Latin America, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.96 Antibody Discovery Services Market in Middle East and North Africa, Historical Trends, Since 2017 (USD Million)

- Table 30.97 Antibody Discovery Services Market in Middle East and North Africa, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.98 Antibody Discovery Services Market in Rest of the World, Historical Trends, Since 2017 (USD Million)

- Table 30.99 Antibody Discovery Services Market in Rest of the World, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.100 Global Antibody Discovery Technologies Market, Historical Trends (Since 2017)

- Table 30.101 Global Antibody Discovery Technologies Market, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.102 Antibody Discovery Technologies Market for Monoclonal Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.103 Antibody Discovery Technologies Market for Monoclonal Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.104 Antibody Discovery Technologies Market for Bispecific Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.105 Antibody Discovery Technologies Market for Bispecific Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.106 Antibody Discovery Technologies Market for Other Antibodies, Historical Trends, Since 2017 (USD Million)

- Table 30.107 Antibody Discovery Technologies Market for Other Antibodies, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.108 Antibody Discovery Technologies Market in North America, Historical Trends, Since 2017 (USD Million)

- Table 30.109 Antibody Discovery Technologies Market in North America, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.110 Antibody Discovery Technologies Market in Europe, Historical Trends, Since 2017 (USD Million)

- Table 30.111 Antibody Discovery Technologies Market in Europe, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.112 Antibody Discovery Technologies Market in Asia, Historical Trends, Since 2017 (USD Million)

- Table 30.113 Antibody Discovery Technologies Market in Asia, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 30.114 Humira(R): Annual Sales, Since 2016 (USD Billion)

- Table 30.115 Keytruda(R): Annual Sales, Since 2016 (USD Billion)

- Table 30.116 Stelara(R): Annual Sales, Since 2016 (USD Billion)

- Table 30.117 Opdivo(R): Annual Sales, Since 2016 (USD Billion)

- Table 30.118 Darzalex(R): Annual Sales, Since 2016 (CHF Million)

List of Figures

- Figure 2.1 Research Methodology: Research Assumptions

- Figure 2.2 Research Methodology: Project Methodology

- Figure 2.3 Research Methodology: Forecast Methodology

- Figure 2.4 Research Methodology: Robust Quality Control

- Figure 2.5 Research Methodology: Key Market Segmentations

- Figure 4.1 Executive Summary: Market Landscape of Antibody Discovery Service Providers

- Figure 4.2 Executive Summary: Market Landscape of Antibody Discovery Platform Providers

- Figure 4.3 Executive Summary: Partnerships and Collaborations

- Figure 4.4 Executive Summary: Funding and Investment Analysis

- Figure 4.5 Executive Summary: Market Sizing and Opportunity Analysis for Antibody Discovery Services

- Figure 4.6 Executive Summary: Market Sizing and Opportunity Analysis for Antibody Discovery Platforms

- Figure 5.1 Basic Structure of an Antibody

- Figure 5.2 Historical Timeline of Antibody Development

- Figure 5.3 Mechanism of Action of Antibodies

- Figure 5.4 Applications of Antibodies

- Figure 6.1 Overview of the Antibody Discovery Process

- Figure 6.2 Antibody Discovery Process: Hybridoma Method

- Figure 6.3 Antibody Discovery Process: Phage Display Method

- Figure 6.4 Antibody Generation Using Transgenic Animals

- Figure 6.5 Approved Monoclonal Antibodies: Development Trend Analysis

- Figure 6.6 Approval Timeline of Fully Human Monoclonal Antibodies

- Figure 6.7 Discovery Methods of Fully Human Monoclonal Antibodies

- Figure 7.1 Antibody Discovery Service Providers: Distribution by Year of Establishment

- Figure 7.2 Antibody Discovery Service Providers: Distribution by Company Size

- Figure 7.3 Antibody Discovery Service Providers: Distribution by Location of Headquarters

- Figure 7.4 Antibody Discovery Service Providers: Distribution by Type of Service Offered

- Figure 7.5 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovered

- Figure 7.6 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Method

- Figure 7.7 Antibody Discovery Service Providers: Distribution by Animal Model Used

- Figure 7.8 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovered and Type of Antibody Discovery Method

- Figure 7.9 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Services and Location of Headquarters

- Figure 7.10 Antibody Discovery Service Providers: Analysis by Application Area

- Figure 8.1 Competitiveness Analysis: Very Small Companies Offering Antibody Discovery Services

- Figure 8.2 Competitiveness Analysis: Small Companies Offering Antibody Discovery Services

- Figure 8.3 Competitiveness Analysis: Mid-sized Companies Offering Antibody Discovery Services

- Figure 8.4 Competitiveness Analysis: Large Companies Offering Antibody Discovery Services

- Figure 8.5 Regional Capability: Benchmarking of Players based in North America

- Figure 8.6 Regional Capability: Benchmarking of Players based in Europe

- Figure 8.7 Regional Capability: Benchmarking of Players based in Asia

- Figure 9.1 ImmunoPrecise Antibodies: Annual Revenues, 2016 Onwards (USD Million)

- Figure 9.2 Abzena: Annual Revenues, 2016 Onwards (GBP Million)

- Figure 9.3 Fusion Antibodies: Annual Revenues, 2017 Onwards (EUR Million)

- Figure 9.4 Viva Biotech: Annual Revenues, 2016 Onwards (RMB Million)

- Figure 9.5 WuXi Biologics: Annual Revenues, 2016 Onwards (RMB Billion)

- Figure 10.1 Antibody Discovery Technologies: Distribution by Type of Antibody Discovered

- Figure 10.2 Antibody Discovery Technologies: Distribution by Type of Antibody Discovery Method

- Figure 10.3 Antibody Discovery Technologies: Distribution by Animal Model Used

- Figure 10.4 Antibody Discovery Technologies: Distribution by Type of Antibody Discovery Method and Location of Headquarters

- Figure 10.5 Antibody Discovery Technologies: Distribution by Discovery Method and Type of Antibody Discovered

- Figure 10.6 Antibody Discovery Technology Providers: Distribution by Year of Establishment

- Figure 10.7 Antibody Discovery Technology Providers: Distribution by Company Size

- Figure 10.8 Antibody Discovery Technology Providers: Distribution by Location of Headquarters

- Figure 10.9 Most Active Players: Distribution by Number of Technologies

- Figure 11.1 Competitiveness Analysis: Technologies Offered by Companies based in North America

- Figure 11.2 Competitiveness Analysis: Technologies Offered by Companies based in Europe

- Figure 11.3 Competitiveness Analysis: Technologies Offered by Companies based in Asia and Rest of the World

- Figure 13.1 Partnerships and Collaborations: Cumulative Trend by Year, Since 2015

- Figure 13.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 13.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2021

- Figure 13.4 Partnerships and Collaborations: Distribution by Type of Antibody

- Figure 13.5 Most Active Players: Distribution by Number of Partnerships

- Figure 13.6 Most Popular Technologies: Distribution by Number of Partnerships

- Figure 13.7 Partnerships and Collaborations: Distribution by Geography

- Figure 13.8 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Figure 14.1 Funding and Investment Analysis: Cumulative Year-wise Trend, Since 2016

- Figure 14.2 Funding and Investment Analysis: Distribution by Type of Funding

- Figure 14.3 Funding and Investment Analysis: Distribution of Amount Invested by Year of Funding, Since 2016 (USD Million)

- Figure 14.4 Funding and Investment Analysis: Distribution by Year-wise Number of Funding Instances and Funding Amount, Since 2016 (USD Million)

- Figure 14.5 Most Active Players: Distribution by Number of Funding Instances

- Figure 14.6 Most Active Players: Distribution by Amount Invested (USD Million)

- Figure 14.7 Leading Investors: Distribution by Number of Funding Instances

- Figure 14.8 Funding and Investment Analysis: Distribution by Year-wise Number of Funding Instances and Type of Player

- Figure 14.9 Funding and Investment Analysis: Distribution by Year-wise Amount Invested and Type of Player

- Figure 14.10 Funding and Investment Analysis: Distribution of Number of Funding Instances by Year of Establishment and Type of Player

- Figure 14.11 Funding and Investment Analysis: Distribution by Geography

- Figure 14.12 Funding and Investment Analysis: Concluding Remarks

- Figure 15.1 Market Drivers

- Figure 15.2 Market Restrainers

- Figure 15.3 Market Opportunities

- Figure 15.4 Market Challenges

- Figure 16.1 Global Antibody Discovery Services Market, Historical Trends (Since 2017) and Forecasted Estimates (till 2035) (USD Million)

- Figure 16.2 Global Antibody Discovery Services Market, till 2035, Optimistic Scenario (USD Million)

- Figure 16.3 Global Antibody Discovery Services Market, till 2035, Conservative Scenario (USD Million)

- Figure 17.1 Antibody Discovery Services Market for Antigen Designing: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 17.2 Antibody Discovery Services Market for Hit Generation: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 17.3 Antibody Discovery Services Market for Lead Selection: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 17.4 Antibody Discovery Services Market for Lead Optimization: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 17.5 Antibody Discovery Services Market for Lead Characterization: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 18.1 Antibody Discovery Services Market for Phage Display: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 18.2 Antibody Discovery Services Market for Yeast Display: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 18.3 Antibody Discovery Services Market for Hybridoma Method: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 18.4 Antibody Discovery Services Market for Transgenic Animal based Method: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 18.5 Antibody Discovery Services Market for Single Cell based Method: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 18.6 Antibody Discovery Services Market for Other Antibody Discovery Methods: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 19.1 Antibody Discovery Services Market for Humanized Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 19.2 Antibody Discovery Services Market for Human Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 19.3 Antibody Discovery Services Market for Chimeric Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 19.4 Antibody Discovery Services Market for Murine Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 20.1 Antibody Discovery Services Market for Oncological Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 20.2 Antibody Discovery Services Market for Immunological Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 20.3 Antibody Discovery Services Market for Infectious Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 20.4 Antibody Discovery Services Market for Neurological Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 20.5 Antibody Discovery Services Market for Cardiovascular Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 20.6 Antibody Discovery Services Market for Other Disorders: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 21.1 Antibody Discovery Services Market in North America: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 21.2 Antibody Discovery Services Market in Europe: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 21.3 Antibody Discovery Services Market in Asia: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 21.4 Antibody Discovery Services Market in Latin America: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 21.5 Antibody Discovery Services Market in Middle East and North Africa: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 21.6 Antibody Discovery Services Market in Rest of the World: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 22.1 Global Antibody Discovery Technologies Market, Historical Trends (Since 2017) and Forecasted Estimates (till 2035) (USD Million)

- Figure 22.2 Global Antibody Discovery Technologies Market, till 2035, Optimistic Scenario (USD Million)

- Figure 22.3 Global Antibody Discovery Technologies Market, till 2035, Conservative Scenario (USD Million)

- Figure 23.1 Antibody Discovery Technologies Market for Monoclonal Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 23.2 Antibody Discovery Technologies Market for Bispecific Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 23.3 Antibody Discovery Technologies Market for Other Antibodies: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 24.1 Antibody Discovery Technologies Market in North America: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 24.2 Antibody Discovery Technologies Market in Europe: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 24.3 Antibody Discovery Technologies Market in Asia: Historical Trends (Since 2017) and Forecasted Estimates (till 2035)

- Figure 25.1 Licensing Agreements: Distribution of Financial Components

- Figure 25.2 Technology Licensing Deal: Payment Structure

- Figure 26.1 Antibody Humanization Services and Platforms: SWOT Analysis

- Figure 26.2 Antibody Humanization Services and Platforms: Strengths

- Figure 26.3 Antibody Humanization Services and Platforms: Weaknesses

- Figure 26.4 Antibody Humanization Services and Platforms: Opportunities

- Figure 26.5 Antibody Humanization Services and Platforms: Threats

- Figure 27.1 Humira(R): Annual Sales, Since 2016 (USD Billion)

- Figure 27.2 Keytruda(R): Annual Sales, Since 2016 (USD Billion)

- Figure 27.3 Stelara(R): Annual Sales, Since 2016 (USD Billion)

- Figure 27.4 Opdivo(R): Annual Sales, Since 2016 (USD Billion)

- Figure 27.5 Darzalex(R): Annual Sales, Since 2016 (CHF Million)

- Figure 28.1 Future Opportunities Related to Upcoming Trends in Drug Discovery