|

市場調查報告書

商品編碼

1624827

病毒載體製造,非病毒載體製造,基因治療製造的全球市場:各產業規模,各媒介類型,各應用領域,各治療領域,主要各地區:產業趨勢與2035年前的全球預測Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market by Scale of Operation, Type of Vector, Application Area, Therapeutic Area, and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035 |

||||||

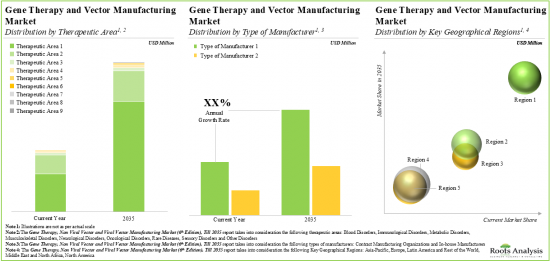

預計到 2035 年,全球病毒載體製造、非病毒載體製造和基因治療製造市場規模將以複合年增長率 11.44% 擴大,從目前的 7 億美元增長到 2035 年的 23 億美元。增長至美元。

在過去的幾十年裡,各種病毒和非病毒載體已經針對基因轉移目的進行了優化和標準化。值得注意的是,迄今為止,已有超過30種基於病毒載體的基因療法產品獲得了全球監管機構的批准。此外,僅在美國,就有超過 200 種基於病毒載體的基因療法正在針對多種適應症的臨床試驗中進行評估。這表明該領域的利害關係人正在進行廣泛的開發工作。同時,開發人員繼續面臨與製造病毒和非病毒載體相關的複雜性。為了克服這些課題,開發商更願意外包關鍵營運。目前,有超過270家工業和非工業公司從事病毒載體和質粒DNA的生產,以滿足細胞治療、基因治療和病毒載體疫苗日益增長的需求。

隨著藥物開發公司加強對這些創新療法的投資,病毒載體製造、非病毒載體製造和基因治療製造市場預計將進一步擴大。此外,隨著細胞和基因療法的加速批准以及基於病毒載體的基因療法相關臨床試驗的持續進行,對病毒和非病毒載體的需求不斷增加,為載體製造商提供了利潤豐厚的機會。

本報告提供全球病毒載體製造,非病毒載體製造,基因治療製造市場相關調查,提供市場概要,以及各產業規模,各媒介類型,各應用領域,各治療領域,各地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟以及其他的計劃特有的考慮事項

第4章 摘要整理

第5章 簡介

第6章 病毒載體及基因治療廠商(產業參與企業):市場形勢

第7章 媒介及基因治療廠商(非前世的業緣界參與企業):市場形勢

第8章 媒介及基因治療製造技術:市場形勢

第9章 企業競爭力分析

第10章 北美的媒介及基因治療廠商

第11章 歐洲的媒介及基因治療廠商

第12章 亞太地區的媒介及基因治療廠商

第13章 波特的五力分析

第14章 夥伴關係和合作

第15章 最近的擴張

第16章 策略性合作夥伴分析

第17章 新媒介

第18章 重要的洞察

第19章 原價分析

第20章 外包:GO/NO-GO組成架構

第21章 容量分析

第22章 需求分析

第23章 市場影響分析:促進因素,阻礙因素,機會,課題

第24章 全球媒介製造市場

第25章 媒介製造市場,各產業規模

第26章 媒介製造市場,各媒介類型

第27章 媒介製造市場,各應用領域

第28章 媒介製造市場,各治療領域

第29章 媒介製造市場,各廠商類型

第30章 媒介製造市場,各地區

第31章 調查分析

第32章 結論

第33章 執行洞察

- 章概要

- Batavia Biosciences

- Touchlight

- HALIX

- CEVEC Pharmaceuticals

- Clean Cells

- Massachusetts General Hospital

- CJ PARTNERS

- Polypus Transfection

- University of Nantes

- ACGT

- Delphi Genetics

- Amsterdam BioTherapeutics Unit

- VIVEBiotech

- GEG Tech

- Richter-Helm BioLogics

- Plasmid Factory

- Waisman Biomanufacturing

- EFS-West Biotherapy

- 獨立顧問

第34章 附錄1:表格形式的資料

第35章 附錄2:企業·團體一覽

VIRAL VECTOR MANUFACTURING, NON-VIRAL VECTOR MANUFACTURING AND GENE THERAPY MANUFACTURING MARKET: OVERVIEW

As per Roots Analysis, the global viral vector manufacturing, non-viral vector manufacturing and gene therapy manufacturing market is estimated to grow from USD 0.70 billion in the current year to USD 2.3 billion by 2035, at a CAGR of 11.44% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Scale of Operation

- Preclinical

- Clinical

- Commercial

Type of Vector

- Adeno Associated Virus Vectors

- Adenoviral Vectors

- Lentiviral Vectors

- Retroviral Vectors

- Other Vectors

Application Area

- Gene Therapies

- Cell Therapies

- Vaccines

Therapeutic Area

- Oncological Disorders

- Rare Diseases

- Neurological Disorders

- Sensory Disorders

- Metabolic Disorders

- Musculoskeletal Disorders

- Blood Disorders

- Immunological Disorders

- Other Disorders

Type of Manufacturer

- In-house

- Contract Manufacturing Organizations

End User

- Clinics

- Health Insurance Agencies

- Hospitals

- Other End Users

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America and Rest of the World

- Middle East and North Africa

VIRAL VECTOR MANUFACTURING, NON-VIRAL VECTOR MANUFACTURING AND GENE THERAPY MANUFACTURING MARKET: GROWTH AND TRENDS

Over the last few decades, various viral and non-viral vectors have been optimized and standardized for the purpose of gene delivery. It is worth mentioning that, till date, over 30 viral vector based gene therapy products have been approved by different regulatory agencies, globally. In addition, more than 200 viral vector based gene therapies targeting a wide range of disease indications are being evaluated in clinical trials in the US alone. This demonstrates the extensive development efforts being undertaken by stakeholders in this domain. On the contrary, developers continue to face production related complexities for viral and non-viral vectors. In order to overcome such challenges, developers prefer to outsource key operations. At present, over 270 industry and non-industry players are engaged in the production of viral vectors and plasmid DNA in order to meet the growing demand for cell therapies, gene therapies and viral vector vaccines.

As drug developers invest more in these innovative therapies, the market for viral vector manufacturing, non-viral vector manufacturing and gene therapy manufacturing is anticipated to expand further. In addition, the accelerated approval of cell and gene therapies and ongoing clinical trials related to viral vector based gene therapy, has led to a rise in the demand for viral and non viral vectors, offering lucrative opportunities to vector manufacturers.

VIRAL VECTOR MANUFACTURING, NON-VIRAL VECTOR MANUFACTURING AND GENE THERAPY MANUFACTURING MARKET: KEY INSIGHTS

The report delves into the current state of the viral vector, non-viral vector and gene therapy manufacturing market and identifies potential growth opportunities within the industry. Some key findings from the report include:

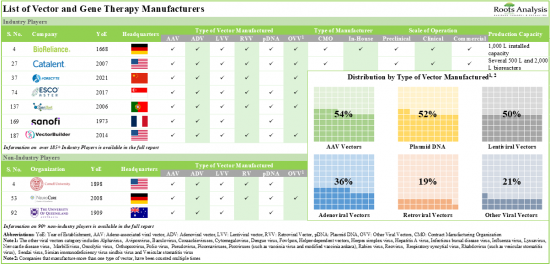

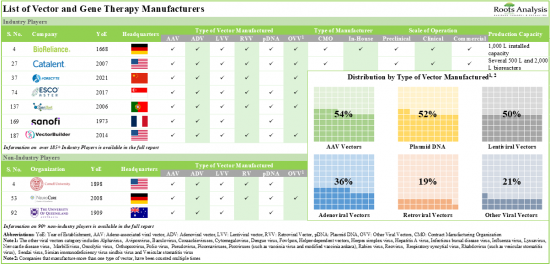

1. Presently, over 270 industry and non-industry players claim to have the necessary capabilities to manufacture different types of viral and non viral vectors, for in-house requirements and / or contract service engagements.

2. The current viral vector manufacturing market landscape features the presence of more than 85 players that offer contract manufacturing services; among these, ~55% players offer services at all scales of operation.

3. Nearly 55% of the industry players and 75% of the non-industry players are capable of manufacturing adeno-associated viral vectors; this is followed by players manufacturing lentiviral vectors and plasmid DNA.

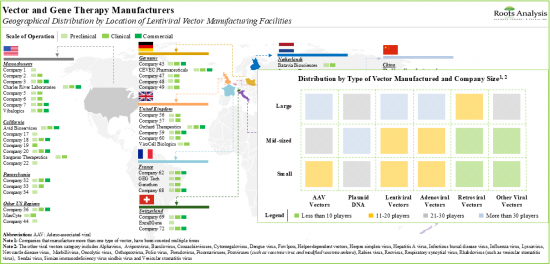

4. In order to cater to the evolving needs of clients / sponsors, stakeholders have established their presence in multiple regions across the world; currently, the US and EU are considered as the manufacturing hubs.

5. More than 90 innovative technological platforms, developed by nearly 65 players, are available for the discovery, development and delivery of cell therapies, gene therapies and vaccines.

6. In pursuit of gaining a competitive edge, industry stakeholders are actively upgrading their existing capabilities and adding new competencies to enhance their respective vector and gene therapy related portfolios.

7. A growing number of expansion projects undertaken by various players and a notable increase in partnership activity are indicative of the increasing interest in the vector-based cell and gene therapy domain.

8. In order to increase efficiency and optimize the manufacturing processes, several vector and gene therapy innovators are anticipated to forge strategic alliances with vector and gene therapy manufacturers.

9. Nearly 40% of the players claim to offer manufacturing services for emerging vectors; majority of these stakeholders have expertise to carry out manufacturing operations at both preclinical and clinical scale.

10. The pricing of vectors varies considerably and is influenced by parameters such as complex scalability, high cost of manufacturing, complex supply chain and high cost of storage / delivery.

11. Given the numerous benefits of cell and gene therapies, the demand for vector, cell and gene therapy manufacturing is anticipated to increase significantly in future.

12. Over 65% of the global installed gene therapy and vector manufacturing capacity is dedicated to viral vector manufacturing; ~55% of viral vector manufacturing capacity is installed in the facilities located in North America.

13. Driven by the expanding pipeline of cell and gene therapies, and increasing investments in the domain, the vector and gene therapy manufacturing market is poised to witness significant growth in the foreseeable future.

14. In 2035, nearly 40% of the vector and gene therapy manufacturing demand is expected to be generated from the Asia-Pacific region.

15. The overall opportunity associated with the vector manufacturing domain is anticipated to grow at the CAGR of 13%; it is likely to be well distributed across different scales of operation, types of vectors and application areas.

16. In the long term, the vector-based recombinant therapies for oncological disorders, with more than 60% of the market share, are likely to emerge as the key growth driver of the vector and gene therapy manufacturing market.

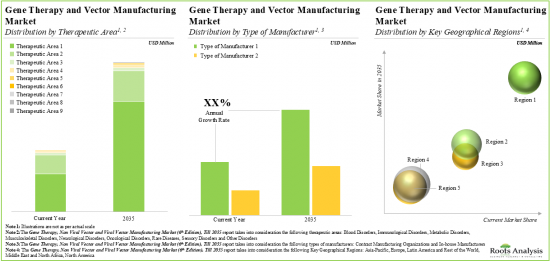

VIRAL VECTOR MANUFACTURING, NON-VIRAL VECTOR MANUFACTURING AND GENE THERAPY MANUFACTURING MARKET: KEY SEGMENTS

Currently, Clinical Scale Occupies the Largest Share of the Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market

Based on the scale of operation, the market is segmented into preclinical, clinical and commercial. At present, majority share is expected to be captured by clinical scale. It is worth highlighting that, over the years, viral vector manufacturing, non-viral vector manufacturing and gene therapy manufacturing market at commercial scale is likely to grow at a relatively higher CAGR during the forecast period.

Lentiviral Vectors Segment is Likely to Capture the Largest Share of the Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market During the Forecast Period

Based on the type of vector, the market is segmented into AAV vectors, adenoviral vectors, lentiviral vectors, retroviral vectors and other vectors. It is worth highlighting that lentiviral vectors are likely to drive the market in the forthcoming years. However, the viral vector manufacturing, non-viral vector manufacturing and gene therapy manufacturing market for adenoviral vectors is likely to grow at a relatively higher CAGR during the forecast period.

Cell Therapy Segment is Likely to Dominate the Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market During the Forecast Period

Based on the application area, the market is segmented into gene therapies, cell therapies and vaccines. It is worth highlighting that the cell therapy segment is expected to capture the highest share of the market in the coming decade. However, the viral vector manufacturing, non-viral vector manufacturing and gene therapy manufacturing market for vaccines is likely to grow at a relatively higher CAGR during the forecast period.

Oncological Disorders Segment Accounts for the Largest Share of the Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market

Based on the therapeutic area, the market is segmented into oncological disorders, rare diseases, neurological disorders, sensory disorders, metabolic disorders, musculoskeletal disorders, blood disorders, immunological disorders and other disorders. While oncological disorders account for a relatively higher market share, it is worth highlighting that the autoimmune disorders segment is expected to witness substantial market growth in the coming years.

At Present, Contract Manufacturing Organizations Occupies the Largest Share of the Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market

Based on the type of manufacturer, the market is segmented into in-house and contract manufacturing organizations. It is worth highlighting that the market is primarily driven by revenues generated by contract manufacturing organizations. This trend is unlikely to change in the near future.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America and the Rest of the World. Majority share is expected to be captured by manufacturers based in North America and Europe.

Example Players in the Viral Vector Manufacturing, Non-Viral Vector Manufacturing and Gene Therapy Manufacturing Market

- Advanced BioScience Laboratories

- AGC Biologics

- Aldevron

- Altruist Biotechnology

- BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

- BioReliance (a subsidiary of Merck KGaA)

- Biovian

- Celonic

- Catalent Biologics

- Cobra Biologics

- Centre for Process Innovation

- CEVEC Pharmaceuticals

- Charles River Laboratories

- CoJourney

- Esco Aster

- Jiangsu Puxin Biopharmaceutical

- Lonza

- Matica Biotechnology

- Nikon CeLL innovation

- NorthX Biologics

- Novartis

- Oxford BioMedica

- Resilience

- Sanofi

- Thermo Fisher Scientific

- VectorBuilder

- Wuxi AppTech

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Chief Executive Officer, Batavia Biosciences

- Chief Operating Officer, Touchlight

- Business Developer, HALIX

- Chief Executive Officer and Chief Scientific Officer, CEVEC Pharmaceuticals

- Former Business Development Manager and Xavier Leclerc, Head of Gene Therapy, Clean Cells

- Director, Massachusetts General Hospital

- Former Managing Director, CJ PARTNERS

- Director of Marketing and Technical Support, Polypus Transfection

- Former Scientific Director, University of Nantes

- Scientific Director, ACGT

- Former Executive and Scientific Director, Delphi Genetics

- Former Director, Amsterdam BioTherapeutics Unit

- Head of Communications, VIVEBiotech

- Chief Scientific Officer, GEG Tech

- Key Account Management, Richter-Helm BioLogics

- Head of Project Management and Tatjana Buchholz, Former Marketing Manager, Plasmid Factory

- Director of Business Development, Waisman Biomanufacturing

- ATMP Key Account Manager, EFS-West Biotherapy

VIRAL VECTOR MANUFACTURING, NON- VIRAL VECTOR MANUFACTURING AND GENE THERAPY MANUFACTURING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the viral vector manufacturing market, focusing on key market segments, including [A] scale of operation, [B] type of vector, [C] application area, [D] therapeutic area, [E] type of manufacturer and [F] key geographical regions.

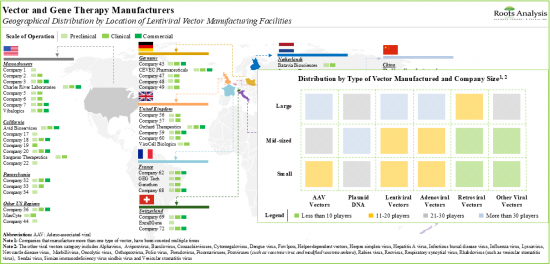

- Market Landscape (Viral Vector and Gene Therapy Manufacturers): A comprehensive evaluation of companies involved in manufacturing viral vectors and gene therapies, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of product manufactured, [E] location of manufacturing facility, [F] type of manufacturer, [G] scale of operation, [H] type of vector manufactured and [I] application area. In addition, the chapter also highlights information on the installed production capacity with stakeholders related to vector manufacturing.

- Market Landscape (Plasmid DNA and Gene Therapy Manufacturers): A comprehensive evaluation of companies involved in manufacturing plasmid DNA and gene therapies, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of product manufactured, [E] location of manufacturing facility, [F] type of manufacturer, [G] scale of operation, [H] type of vector manufactured and [I] application area.

- Market Landscape (Non-Industry Players): A comprehensive evaluation of non-industry players involved in manufacturing viral, non viral and other novel types of vectors and gene therapies, considering various parameters, such as [A] year of establishment, [B] location of vector manufacturing facility, [C] type of manufacturer, [D] scale of operation, [E] type of vector manufactured, and [F] application area.

- Technology Landscape: An analysis of the technologies offered / developed by the companies engaged in this market, based on the [A] type of technology, [B] purpose of technology, [C] scale of operation, [D] type of vector, [E] application area. Additionally, it also highlights the most prominent players within this market, in terms of number of technologies.

- Company Competitiveness Analysis: A comprehensive competitive analysis of peptide contract manufacturers, examining factors such as [A] supplier strength, [B] manufacturing strength, [C] service strength and [D] company size.

- Company Profiles: In-depth profiles of key industry players based in North America, Europe and Asia-Pacific, focusing on [A] company overviews, [B] financial information (if available), [C] manufacturing facilities, [D] vector manufacturing technology, [E] an insightful recent development and [F] future outlook.

- Porter's Five Forces: A qualitative analysis that examines the five competitive forces in the non-viral and viral vector manufacturing market. This includes the threats posed by new entrants, the bargaining power of drug developers, the bargaining power of vector and gene therapy manufacturers, the threats from substitute technologies and the rivalry among existing competitors.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2019, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] scale of operation, [D] type of vector, [E] therapeutic area, [F] application area and [G] most active players (in terms of number of partnerships). This section also highlights the regional distribution of partnership activity in this market.

- Recent Expansions Analysis: An examination of the different expansion efforts made by various companies in viral vector and non viral vector manufacturing field to enhance their manufacturing capabilities, since 2019. This analysis considers various factors, including the [A] year of expansion, [B] type of expansion, [C] type of vector, [D] application area and [E] geographical location of the expansion.

- Strategic Partner Analysis: An analysis highlighting potential strategic partners segregated based on the likelihood of entering into collaboration with vector and gene therapy product developers. These players have been shortlisted based on several relevant parameters, such as [A] developer strength, [B] product strength, [C] type of vector, [D] therapeutic area and [E] pipeline strength.

- Emerging Trend 1: An elaborate discussion on the emerging trends of other viral / non viral gene delivery approaches that are currently being researched for the development of therapies involving genetic modification.

- Emerging Trend 2: An insightful analysis, highlighting the contemporary market trends in the plasmid DNA and viral vector manufacturing industry, through different representations, based on multiple relevant parameters.

- Cost Price Analysis: An analysis of the various factors that are expected to impact vector pricing, highlighting different models and approaches that product developers and manufacturers may use to determine the prices of their proprietary vectors.

- Outsourcing: Go / No-Go Framework: An insightful framework that emphasizes the key indicators and factors that need to be considered by developers to determine whether to manufacture their respective products in-house or outsource the manufacturing operation to contract service providers.

- Capacity Analysis: The report provides an estimation of global annual vector manufacturing capacity of industry players. The analysis takes into consideration the distribution of global capacity across [A] company size and [B] location of headquarters.

- Demand Analysis: Informed estimates of the annual demand for viral vectors and non viral vectors based on several relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- Survey Analysis: A survey analysis featuring inputs solicited from the survey conducted on over 400 stakeholders involved in the development of different types of gene therapy vectors. The participants, who were primarily Director / CXO level representatives of their respective companies, helped us develop a deeper understanding on the nature of their services and the associated commercial potential.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What is the current annual demand for viral and non-viral vectors?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Key Questions Answered

- 1.5. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating The Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Viral and Non-Viral Gene Transfer Techniques

- 5.3. Viral Vectors Used in Genetically Modified Therapies

- 5.4. Types of Viral Vectors

- 5.4.1. Adeno-associated Viral Vectors

- 5.4.1.1. Overview

- 5.4.1.2. Design and Manufacturing

- 5.4.1.3. Advantages

- 5.4.1.4. Limitations

- 5.4.2. Adenoviral Vectors

- 5.4.2.1. Overview

- 5.4.2.2. Design and Manufacturing

- 5.4.2.3. Advantages

- 5.4.2.4. Limitations

- 5.4.3. Lentiviral Vectors

- 5.4.3.1. Overview

- 5.4.3.2. Design and Manufacturing

- 5.4.3.3. Advantages

- 5.4.3.4. Limitations

- 5.4.4. Retroviral Vectors

- 5.4.4.1. Overview

- 5.4.4.2. Design and Manufacturing

- 5.4.4.3. Advantages

- 5.4.4.4. Limitations

- 5.4.5. Other Viral Vectors

- 5.4.5.1. Alphavirus

- 5.4.5.2. Foamy Virus

- 5.4.5.3. Herpes Simplex Virus

- 5.4.5.4. Sendai Virus

- 5.4.5.5. Simian Virus

- 5.4.5.6. Vaccinia Virus

- 5.4.5.7. Chimeric Viral Vectors

- 5.4.1. Adeno-associated Viral Vectors

- 5.5. Types of Non-Viral Vectors

- 5.5.1. Plasmid DNA

- 5.5.2. Liposomes, Lipoplexes and Polyplexes

- 5.5.3. Oligonucleotides

- 5.5.4. Other Non-Viral Vectors

- 5.6. Gene Delivery using Non-Viral Vectors

- 5.6.1. Biolistic Methods

- 5.6.2. Electroporation

- 5.6.3. Receptor Mediated Gene Delivery

- 5.6.4. Gene Activated Matrix (GAM)

- 5.7. Applications of Viral and Non-Viral Vectors

- 5.7.1. Cell and Gene Therapy

- 5.7.2. Vaccine

- 5.8. Current / Ongoing Trends in Vector Development / Manufacturing

- 5.8.1. Vector Engineering

- 5.8.2. Cargo Engineering

- 5.9. Vector Manufacturing

- 5.9.1. Types of Vector Manufacturers

- 5.9.2. Viral Vector Manufacturing Processes

- 5.9.2.1. Vector Production

- 5.9.2.2. Adherent and Suspension Cultures

- 5.9.2.3. Unit Process Versus Multiple Parallel Processes

- 5.9.2.4. Cell Culture Systems for Production of Viral Vectors

- 5.9.2.4.1. Small Scale / Laboratory Scale Cell Culture Systems

- 5.9.2.4.2. Large Scale Cell Culture Systems

- 5.9.2.4.2.1. Stirred Tank Reactor Systems

- 5.9.2.4.2.2. Fixed Bed Reactors / Packed Bed Reactors

- 5.9.2.4.2.3. Wave Bioreactor Systems

- 5.9.2.5. Serum-Containing versus Serum-Free Media

- 5.9.3. Bioprocessing of Viral Vectors

- 5.9.3.1. AAV Vector Production

- 5.9.3.2. Adenoviral Vector Production

- 5.9.3.3. Lentiviral Vector Production

- 5.9.3.4. Y -Retroviral Vector Production

- 5.9.4. Key Challenges Associated with Vector Manufacturing

- 5.10. Future Perspectives

6. VIRAL VECTOR AND GENE THERAPY MANUFACTURERS (INDUSTRY PLAYERS): MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Viral Vector and Gene Therapy Manufacturers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Type of Product Manufactured

- 6.2.5. Analysis by Location of Vector Manufacturing Facility

- 6.2.6. Analysis by Type of Manufacturer

- 6.2.7. Analysis by Scale of Operation

- 6.2.8. Analysis by Location of Headquarters and Scale of Operation

- 6.2.9. Analysis by Type of Viral Vector Manufactured

- 6.2.10. Analysis by Scale of Operation and Type of Viral Vector Manufactured

- 6.2.11. Analysis by Application Area

- 6.2.12. Information on Production Capacity

7. VECTOR AND GENE THERAPY MANUFACTURERS (NON-INDUSTRY PLAYERS): MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Vector and Gene Therapy Manufacturers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Location of Headquarters (Region)

- 7.2.3. Analysis by Location of Headquarters (Country)

- 7.2.4. Analysis by Type of Manufacturer

- 7.2.5. Analysis by Scale of Operation

- 7.2.6. Analysis by Type of Vector Manufactured

- 7.2.7. Analysis by Scale of Operation and Type of Vector Manufactured

- 7.2.8. Analysis by Application Area

8. VECTOR AND GENE THERAPY MANUFACTURING TECHNOLOGIES: MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Vector and Gene Therapy Manufacturing Technologies: Overall Market Landscape

- 8.2.1. Analysis by Type of Technology

- 8.2.2. Analysis by Purpose of Technology

- 8.2.3. Analysis by Scale of Operation

- 8.2.4. Analysis by Type of Vector

- 8.2.5. Analysis by Application Area

- 8.2.6. Most Active Players: Analysis by Number of Technologies

- 8.3. Concluding Remarks

9. COMPANY COMPETITIVENESS ANALYSIS

- 9.1. Chapter Overview

- 9.2. Methodology and Key Parameters

- 9.3. Vector and Gene Therapy In-House Manufacturers: Company Competitiveness Analysis

- 9.3.1. Players based in North America

- 9.3.2. Players based in Europe

- 9.3.3. Players based in Asia-Pacific and Rest of the World

- 9.4. Vector and Gene Therapy Contract Manufacturing Organizations: Company Competitiveness Analysis

- 9.4.1. Players based in North America

- 9.4.2. Players based in Europe

- 9.4.3. Players based in Asia-Pacific and Rest of the World

- 9.5. Vector and Gene Therapy In-house Manufacturers and Contract Manufacturing Organizations: Company Competitiveness Analysis

- 9.5.1. Players based in North America

- 9.5.2. Players based in Europe

- 9.5.3. Players based in Asia-Pacific and Rest of the World

10. VECTOR AND GENE THERAPY MANUFACTURERS IN NORTH AMERICA

- 10.1. Chapter Overview

- 10.2. Key Players

- 10.2.1. Advanced BioScience Laboratories

- 10.2.1.1. Company Overview

- 10.2.1.2. Vector Manufacturing Portfolio

- 10.2.1.3. Recent Developments and Future Outlook

- 10.2.2. Catalent Biologics

- 10.2.2.1. Company Overview

- 10.2.2.2. Financial Information

- 10.2.2.3. Vector Manufacturing Portfolio

- 10.2.2.4. Recent Developments and Future Outlook

- 10.2.3. Charles River Laboratories

- 10.2.3.1. Company Overview

- 10.2.3.2. Financial Information

- 10.2.3.3. Vector Manufacturing Portfolio

- 10.2.3.4. Recent Developments and Future Outlook

- 10.2.4. Thermo Fisher Scientific

- 10.2.4.1. Company Overview

- 10.2.4.2. Financial Information

- 10.2.4.3. Vector Manufacturing Portfolio

- 10.2.4.4. Recent Development and Future Outlook

- 10.2.5. VectorBuilder

- 10.2.5.1. Company Overview

- 10.2.5.2. Financial Information

- 10.2.5.3. Vector Manufacturing Portfolio

- 10.2.5.4. Recent Developments and Future Outlook

- 10.2.1. Advanced BioScience Laboratories

- 10.3. Other Key Players

- 10.3.1. AGC Biologics

- 10.3.1.1. Company Overview

- 10.3.1.2. Vector Manufacturing Portfolio

- 10.3.2. Aldevron

- 10.3.2.1. Company Overview

- 10.3.2.2. Vector Manufacturing Portfolio

- 10.3.3. Matica Biotechnology

- 10.3.3.1. Company Overview

- 10.3.3.2. Vector Manufacturing Portfolio

- 10.3.4. Resilience

- 10.3.4.1. Company Overview

- 10.3.4.2. Vector Manufacturing Portfolio

- 10.3.1. AGC Biologics

11. VECTOR AND GENE THERAPY MANUFACTURERS IN EUROPE

- 11.1. Chapter Overview

- 11.2. Key Players

- 11.2.1. Lonza

- 11.2.1.1. Company Overview

- 11.2.1.2. Financial Information

- 11.2.1.3. Vector Manufacturing Portfolio

- 11.2.1.4. Recent Developments and Future Outlook

- 11.2.2. Touchlight

- 11.2.2.1. Company Overview

- 11.2.2.2. Vector Manufacturing Portfolio

- 11.2.2.3. Recent Developments and Future Outlook

- 11.2.1. Lonza

- 11.3. Other Key Players

- 11.3.1. BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

- 11.3.1.1. Company Overview

- 11.3.1.2. Vector Manufacturing Portfolio

- 11.3.2. Biovian

- 11.3.2.1. Company Overview

- 11.3.2.2. Vector Manufacturing Portfolio

- 11.3.3. Celonic

- 11.3.3.1. Company Overview

- 11.3.3.2. Vector Manufacturing Portfolio

- 11.3.4. Centre for Process Innovation

- 11.3.4.1. Company Overview

- 11.3.4.2. Vector Manufacturing Portfolio

- 11.3.5. CEVEC Pharmaceuticals

- 11.3.5.1. Company Overview

- 11.3.5.2. Vector Manufacturing Portfolio

- 11.3.6. NorthX Biologics

- 11.3.6.1. Company Overview

- 11.3.6.2. Vector Manufacturing Portfolio

- 11.3.7. Novartis

- 11.3.7.1. Company Overview

- 11.3.7.2. Vector Manufacturing Portfolio

- 11.3.8. Oxford BioMedica

- 11.3.8.1. Company Overview

- 11.3.8.2. Vector Manufacturing Portfolio

- 11.3.9. Sanofi

- 11.3.9.1. Company Overview

- 11.3.9.2. Vector Manufacturing Portfolio

- 11.3.1. BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

12. VECTOR AND GENE THERAPY MANUFACTURERS IN ASIA-PACIFIC

- 12.1. Chapter Overview

- 12.2. Key Players

- 12.2.1. CoJourney

- 12.2.1.1. Company Overview

- 12.2.1.2. Vector Manufacturing Portfolio

- 12.2.1.3. Recent Developments and Future Outlook

- 12.2.2. Esco Aster

- 12.2.2.1. Company Overview

- 12.2.2.2. Vector Manufacturing Portfolio

- 12.2.2.3. Recent Developments and Future Outlook

- 12.2.3. Wuxi AppTec

- 12.2.3.1. Company Overview

- 12.2.3.2. Financial Information

- 12.2.3.3. Vector Manufacturing Portfolio

- 12.2.3.4. Recent Developments and Future Outlook

- 12.2.1. CoJourney

- 12.3. Other Key Players

- 12.3.1. Altruist Biotechnology

- 12.3.1.1. Company Overview

- 12.3.1.2. Vector Manufacturing Portfolio

- 12.3.2. Jiangsu Puxin Biopharmaceutical

- 12.3.2.1. Company Overview

- 12.3.2.2. Vector Manufacturing Portfolio

- 12.3.3. Nikon CeLL innovation

- 12.3.3.1. Company Overview

- 12.3.3.2. Vector Manufacturing Portfolio

- 12.3.1. Altruist Biotechnology

13. PORTER'S FIVE FORCES ANALYSIS

- 13.1 Chapter Overview

- 13.2. Methodology and Assumptions

- 13.3. Key Parameters

- 13.3.1. Threats of New Entrants

- 13.3.2. Bargaining Power of Suppliers

- 13.3.3. Bargaining Power of Buyers

- 13.3.4. Threats of Substitute Products

- 13.3.5. Rivalry Among Existing Competitors

- 13.4. Concluding Remarks

14. PARTNERSHIPS AND COLLABORATIONS

- 14.1. Chapter Overview

- 14.2. Partnership Models

- 14.3. Vector and Gene Therapy Manufacturing: Partnerships and Collaborations

- 14.3.1. Analysis by Year of Partnership

- 14.3.2. Analysis by Type of Partnership

- 14.3.3. Analysis by Scale of Operation

- 14.3.4. Analysis by Type of Vector Manufactured

- 14.3.5. Analysis by Therapeutic Area

- 14.3.6. Analysis by Application Area

- 14.3.7. Most Active Players: Analysis by Number of Partnerships

- 14.3.8. Analysis by Geography

- 14.3.8.1. Local and International Agreements

- 14.3.8.2. Intercontinental and Intracontinental Agreements

- 14.4. Other Collaborations

15. RECENT EXPANSIONS

- 15.1. Chapter Overview

- 15.2. Type of Expansions

- 15.3. Vector and Gene Therapy Manufacturing: Recent Expansions

- 15.3.1. Analysis by Year of Expansion

- 15.3.2. Analysis by Type of Expansion

- 15.3.3. Analysis by Year and Type of Expansion

- 15.3.4. Most Active Players: Analysis by Number of Expansions

- 15.3.5. Most Active Players: Analysis by Amount Invested

- 15.3.6. Analysis by Type of Manufacturing Facility

- 15.3.7. Analysis by Scale of Operation

- 15.3.8. Analysis by Type of Vector Manufactured

- 15.3.9. Analysis by Application Area

- 15.3.10. Analysis by Geography

- 15.3.10.1. Intercontinental and Intracontinental Expansions

- 15.3.10.2. Analysis by Location of Expansion

16. STRATEGIC PARTNER ANALYSIS

- 16.1. Chapter Overview

- 16.2. Methodology and Key Parameters

- 16.3. Strategic Partner Analysis: Viral Vector based Therapy Developers

- 16.3.1. Opportunity for AAV Vector based Therapy Developers

- 16.3.1.1. Most Likely Partners

- 16.3.1.2. Likely Partners

- 16.3.1.3. Less Likely Partners

- 16.3.1.4. Least Likely Partners

- 16.3.2. Opportunity for Adenoviral Vector based Therapy Developers

- 16.3.2.1. Most Likely Partners

- 16.3.2.2. Likely Partners

- 16.3.2.3. Less Likely Partners

- 16.3.2.4. Least Likely Partners

- 16.3.3. Opportunity for Lentiviral Vector based Therapy Developers

- 16.3.3.1. Most Likely Partners

- 16.3.3.2. Likely Partners

- 16.3.3.3. Less Likely Partners

- 16.3.3.4. Least Likely Partners

- 16.3.4. Opportunity for Retroviral Vector based Therapy Developers

- 16.3.4.1. Most Likely Partners

- 16.3.4.2. Likely Partners

- 16.3.4.3. Less Likely Partners

- 16.3.4.4. Least Likely Partners

- 16.3.5. Opportunity for Other Viral Vector based Therapy Developers

- 16.3.5.1. Most Likely Partners

- 16.3.5.2. Likely Partners

- 16.3.5.3. Less Likely Partners

- 16.3.5.4. Least Likely Partners

- 16.3.1. Opportunity for AAV Vector based Therapy Developers

- 16.4. Strategic Partner Analysis: Viral Vector based Purification Product Developers

- 16.5. Methodology and Key Parameters

- 16.5.1. Opportunity for AAV Vector based Purification Product Developers

- 16.5.1.1. Most Likely Partners

- 16.5.1.2. Likely Partners

- 16.5.2. Opportunity for Adenoviral Vector based Purification Product Developers

- 16.5.2.1. Most Likely Partners

- 16.5.2.2. Likely Partners

- 16.5.3. Opportunity for Lentiviral Vector based Purification Product Developers

- 16.5.3.1. Most Likely Partners

- 16.5.3.2. Likely Partners

- 16.5.4. Opportunity for Retroviral Vector based Purification Product Developers

- 16.5.4.1. Most Likely Partners

- 16.5.4.2. Likely Partners

- 16.5.5. Opportunity for Other Viral Vector based Purification Product Developers

- 16.5.5.1. Most Likely Partners

- 16.5.5.2. Likely Partners

- 16.5.1. Opportunity for AAV Vector based Purification Product Developers

17. EMERGING VECTORS

- 17.1. Chapter Overview

- 17.1.1. Alphavirus based Vectors

- 17.1.2. Anc80 based Vectors

- 17.1.3. Bifidobacterium longum based Vectors

- 17.1.4. Cytomegalovirus based Vectors

- 17.1.5. Listeria monocytogenes based Vectors

- 17.1.6. Minicircle DNA based Vectors

- 17.1.7. Myxoma Virus based Vectors

- 17.1.8. Self-Complementary Vectors

- 17.1.9. Sendai Virus based Vectors

- 17.1.10. Sleeping Beauty Transposons

- 17.1.11. Vaccinia Virus and Modified Vaccinia Ankara based Vectors

- 17.1.12. Chimeric Viral Vectors

18. KEY INSIGHTS

- 18.1. Chapter Overview

- 18.2. Vector and Gene Therapy Manufacturers: Key Insights

- 18.2.1. Analysis by Type of Manufacturer, Type of Vector Manufactured and Scale of Operation

- 18.2.2. Analysis by Type of Vector Manufactured and Company Size

- 18.2.3. Analysis by Type of Organization and Geography

- 18.2.3.1. Contract Manufacturing Organizations

- 18.2.3.2. In-House Manufacturers

- 18.2.3.3. In-House and Contract Manufacturing Organizations

- 18.2.4. Analysis by Type of Vector Manufactured and Location of Headquarters

- 18.2.4.1. AAV Vector Manufacturers

- 18.2.4.2. Adenoviral Vector Manufacturers

- 18.2.4.3. Lentiviral Vector Manufacturers

- 18.2.4.4. Retroviral Vector Manufacturers

- 18.2.4.5. Plasmid DNA Manufacturers

19. COST PRICE ANALYSIS

- 19.1. Chapter Overview

- 19.2. Factors Contributing to High Price of Viral Vector and Plasmid DNA based Therapies

- 19.3. Viral Vector and Plasmid DNA based Therapies: Pricing Models

- 19.3.1. Pricing Models Based on Expert Opinions

- 19.3.2. Pricing Models Based on Manufacturing Cost

- 19.3.2.1. Pricing Models Based on Technology Used

- 19.3.2.2. Pricing Models Based on Scale of Operation

- 19.3.2.3. Pricing Models Based on Type of Client

- 19.3.3. Prices of Different Types of Vectors

- 19.4. Concluding Remarks

20. OUTSOURCING: GO / NO-GO FRAMEWORK

- 20.1. Chapter Overview

- 20.2. Outsourcing: Go / No-Go Framework

- 20.3. Vector Manufacturing Outsourcing: Go / No-Go Framework

- 20.3.1. Key Parameters and Assumptions

- 20.3.2. Methodology

- 20.3.3. Results and Interpretations

- 20.3.3.1. Outsourcing: Go / No-Go Framework for Small Companies

- 20.3.3.2. Outsourcing: Go / No-Go Framework for Mid-Sized Companies

- 20.3.3.3. Outsourcing: Go / No-Go Framework for Large Companies

21. CAPACITY ANALYSIS

- 21.1. Chapter Overview

- 21.2. Methodology and Key Assumptions

- 21.3. Viral Vector and Plasmid DNA Manufacturing: Global Installed Capacity

- 21.4. Viral Vector Manufacturing: Global Installed Capacity

- 21.4.1. Analysis by Company Size

- 21.4.2. Analysis by Scale of Operation

- 21.4.3. Analysis by Location of Headquarters (Region)

- 21.4.4. Analysis by Location of Manufacturing Facility

- 21.5. Plasmid DNA Manufacturing: Global Installed Capacity

- 21.5.1. Analysis by Company Size

- 21.5.2. Analysis by Scale of Operation

- 21.5.3. Analysis by Location of Headquarters (Region)

- 21.5.4. Analysis by Location of Manufacturing Facility

- 21.6. Concluding Remarks

22. DEMAND ANALYSIS

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Global Demand for Viral Vectors and Plasmid DNA, till 2035

- 22.4. Global Clinical Demand for Viral Vectors and Plasmid DNA, till 2035

- 22.4.1. Analysis by Type of Vector

- 22.4.2. Analysis by Type of Therapy

- 22.4.3. Analysis by Therapeutic Area

- 22.4.4. Analysis by Geography

- 22.5. Global Commercial Demand for Viral Vectors and Plasmid DNA, till 2035

- 22.5.1. Analysis by Type of Vector

- 22.5.2. Analysis by Type of Therapy

- 22.5.3. Analysis by Therapeutic Area

- 22.5.4. Analysis by Geography

- 22.6. Demand and Supply Analysis

23. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 23.1. Chapter Overview

- 23.2. Market Drivers

- 23.3. Market Restraints

- 23.4. Market Opportunities

- 23.5. Market Challenges

- 23.6. Conclusion

24. GLOBAL VECTOR MANUFACTURING MARKET

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Global Vector Manufacturing Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 24.3.1. Scenario Analysis

- 24.3.1.1. Conservative Scenario

- 24.3.1.2. Optimistic Scenario

- 24.3.1. Scenario Analysis

- 24.4. Key Market Segmentations

25. VECTOR MANUFACTURING MARKET, BY SCALE OF OPERATION

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Vector Manufacturing Market: Distribution by Scale of Operation, 2018, 2023 and 2035

- 25.3.1. Preclinical Scale: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 25.3.2. Clinical Scale: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 25.3.3. Commercial Scale: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 25.4. Data Triangulation and Validation

26. VECTOR MANUFACTURING MARKET, BY TYPE OF VECTOR

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Vector Manufacturing Market: Distribution by Type of Vector, 2018, 2023 and 2035

- 26.3.1. AAV Vectors: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.2. Adenoviral Vectors: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.3. Lentiviral Vectors: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.4. Retroviral Vectors: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.5. Other Vectors: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.4. Data Triangulation and Validation

27. VECTOR MANUFACTURING MARKET, BY APPLICATION AREA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Vector Manufacturing Market: Distribution by Application Area, 2018, 2023 and 2035

- 27.3.1. Cell Therapy: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.2. Gene Therapy: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.3. Vaccines: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.4. Data Triangulation and Validation

28. VECTOR MANUFACTURING MARKET, BY THERAPEUTIC AREA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Vector Manufacturing Market: Distribution by Therapeutic Area, 2018, 2023 and 2035

- 28.3.1. Oncological Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.2. Rare Diseases: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.3. Immunological Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.4. Neurological Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.5. Sensory Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.6. Metabolic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.7. Blood Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.8. Musculoskeletal Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.9. Infectious Diseases: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.10. Ophthalmic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.11. Autoimmune Disorders: Forecasted Estimates (2026-2035)

- 28.3.12. Other Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.4. Data Triangulation and Validation

29. VECTOR MANUFACTURING MARKET, BY TYPE OF MANUFACTURER

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Vector Manufacturing Market: Distribution by Type of Manufacturer, 2018, 2023 and 2035

- 29.3.1. In-house Manufacturers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 29.3.2. Contract Manufacturing Organizations: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 29.4. Data Triangulation and Validation

30. VECTOR MANUFACTURING MARKET, BY GEOGRAPHY

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Vector Manufacturing Market: Distribution by Geography, 2018, 2023 and 2035

- 30.3.1. North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.3.2. Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.3.3. Asia-Pacific: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.3.4. Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.3.5. Latin America and Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.4. Data Triangulation and Validation

31. SURVEY ANALYSIS

- 31.1. Chapter Overview

- 31.2. Analysis by Seniority Level of Respondents

- 31.3. Analysis by Type of Manufacturer

- 31.4. Analysis by Scale of Operation

- 31.5. Analysis by Type of Vector Manufactured

32. CONCLUDING REMARKS

33. EXECUTIVE INSIGHTS

- 33.1. Chapter Overview

- 33.2. Batavia Biosciences

- 33.2.1. Company Snapshot

- 33.2.2. Interview Transcript: Chief Executive Officer

- 33.3. Touchlight

- 33.3.1. Company Snapshot

- 33.3.2. Interview Transcript: Chief Operating Officer

- 33.4. HALIX

- 33.4.1. Company Snapshot

- 33.4.2. Interview Transcript: Business Developer

- 33.5. CEVEC Pharmaceuticals

- 33.5.1. Company Snapshot

- 33.5.2. Interview Transcript: Chief Executive Officer and Chief Scientific Officer

- 33.6. Clean Cells

- 33.6.1. Company Snapshot

- 33.6.2. Interview Transcript: Co-Founder / President, Former Business Development Manager and Head of Gene Therapy

- 33.7. Massachusetts General Hospital

- 33.7.1. Organization Snapshot

- 33.7.2. Interview Transcript: Director

- 33.8. CJ PARTNERS

- 33.8.1. Company Snapshot

- 33.8.2. Interview Transcript: Former Managing Director

- 33.9. Polypus Transfection

- 33.9.1. Company Snapshot

- 33.9.2. Interview Transcript: Director of Marketing and Technical Support

- 33.10. University of Nantes

- 33.10.1. Organization Snapshot

- 33.10.2. Interview Transcript: Former Scientific Director

- 33.11. ACGT

- 33.11.1. Company Snapshot

- 33.11.2. Interview Transcript: Scientific Director

- 33.12. Delphi Genetics

- 33.12.1. Company Snapshot

- 33.12.2. Interview Transcript: Former Executive and Scientific Director

- 33.13. Amsterdam BioTherapeutics Unit

- 33.13.1. Organization Snapshot

- 33.13.2. Interview Transcript: Former Director

- 33.14. VIVEBiotech

- 33.14.1. Company Snapshot

- 33.14.2. Interview Transcript: Head of Communications

- 33.15. GEG Tech

- 33.15.1. Company Snapshot

- 33.15.2. Interview Transcript: Chief Scientific Officer

- 33.16. Richter-Helm BioLogics

- 33.16.1. Company Snapshot

- 33.16.2. Interview Transcript: Key Account Management

- 33.17. Plasmid Factory

- 33.17.1. Company Snapshot

- 33.17.2. Interview Transcript: Head of Project Management and Former Marketing Manager

- 33.18. Waisman Biomanufacturing

- 33.18.1. Company Snapshot

- 33.18.2. Interview Transcript: Director of Business Development

- 33.19. EFS-West Biotherapy

- 33.19.1. Company Snapshot

- 33.19.2. Interview Transcript: ATMP Key Account Manager

- 33.20. Independent Consultant

- 33.20.1. Interview Transcript

34. APPENDIX 1: TABULATED DATA

35. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 5.1 Key Features of Viral Vectors

- Table 5.2 Key Features of Small-scale Cell Culture Systems

- Table 6.1 Viral Vector and Gene Therapy Manufacturers: List of Industry Players

- Table 6.2 Viral Vector and Gene Therapy Manufacturers (Industry Players): Information on Location of Vector Manufacturing Facility, Scale of Operation and Type of Manufacturer

- Table 6.3 Viral Vector and Gene Therapy Manufacturers (Industry Players): Information on Type of Viral Vector Manufactured

- Table 6.4 Viral Vector and Gene Therapy Manufacturers (Industry Players): Information on Application Area

- Table 6.5 Viral Vector and Gene Therapy Manufacturers (Industry Players): Information on Production Capacity

- Table 7.1 Vector and Gene Therapy Manufacturers: List of Non-Industry Players

- Table 7.2 Vector and Gene Therapy Manufacturers (Non-Industry Players): Information on Scale of Operation

- Table 7.3 Vector and Gene Therapy Manufacturers (Non-Industry Players): Information on Type of Vector Manufactured

- Table 7.4 Vector and Gene Therapy Manufacturers (Non-Industry Players): Information on Application Area

- Table 8.1 Vector and Gene Therapy Manufacturing Technologies: List of Technology Platforms

- Table 10.1 Viral Vectors and Plasmid DNA Production: List of Companies Profiled

- Table 10.2 Viral Vectors and Plasmid DNA Production: List of Companies Profiled

- Table 10.3 Advanced BioScience Laboratories: Company Snapshot

- Table 10.4 Advanced BioScience Laboratories: Vector Manufacturing Portfolio

- Table 10.5 Advanced BioScience Laboratories: Recent Developments and Future Outlook

- Table 10.6 Catalent Biologics: Company Snapshot

- Table 10.7 Catalent Biologics: Vector Manufacturing Portfolio

- Table 10.8 Catalent Biologics: Recent Developments and Future Outlook

- Table 10.9 Charles River Laboratories: Company Snapshot

- Table 10.10 Charles River Laboratories: Vector Manufacturing Portfolio

- Table 10.11 Charles River Laboratories: Recent Developments and Future Outlook

- Table 10.12 Thermo Fisher Scientific: Company Snapshot

- Table 10.13 Thermo Fisher Scientific: Vector Manufacturing Portfolio

- Table 10.14 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 10.15 VectorBuilder: Company Snapshot

- Table 10.16 VectorBuilder: Vector Manufacturing Portfolio

- Table 10.17 VectorBuilder: Recent Developments and Future Outlook

- Table 10.18 AGC Biologics: Company Snapshot

- Table 10.19 AGC Biologics: Vector Manufacturing Portfolio

- Table 10.20 Aldevron: Company Snapshot

- Table 10.21 Aldevron: Vector Manufacturing Portfolio

- Table 10.22 Matica Biotechnology: Company Snapshot

- Table 10.23 Matica Biotechnology: Vector Manufacturing Portfolio

- Table 10.24 Resilience: Company Snapshot

- Table 10.25 Resilience: Vector Manufacturing Portfolio

- Table 11.1 Viral Vectors and Plasmid DNA Production: List of Companies Profiled

- Table 11.2 Lonza: Company Snapshot

- Table 11.3 Lonza: Vector Manufacturing Portfolio

- Table 11.4 Lonza: Recent Developments and Future Outlook

- Table 11.5 BioNTech Innovative Manufacturing Service: Company Snapshot

- Table 11.6 BioNTech Innovative Manufacturing Service: Vector Manufacturing Portfolio

- Table 11.7 Biovian: Company Snapshot

- Table 11.8 Biovian: Vector Manufacturing Portfolio

- Table 11.9 Celonic: Company Snapshot

- Table 11.10 Celonic: Vector Manufacturing Portfolio

- Table 11.11 Centre for Process Innovation: Company Snapshot

- Table 11.12 Centre for Process Innovation: Vector Manufacturing Portfolio

- Table 11.13 CEVEC Pharmaceuticals: Company Snapshot

- Table 11.14 CEVEC Pharmaceuticals: Vector Manufacturing Portfolio

- Table 11.15 NorthX Biologics: Company Snapshot

- Table 11.16 NorthX Biologics: Vector Manufacturing Portfolio

- Table 11.17 Novartis: Company Snapshot

- Table 11.18 Novartis: Vector Manufacturing Portfolio

- Table 11.19 Oxford BioMedica: Company Snapshot

- Table 11.20 Oxford BioMedica: Vector Manufacturing Portfolio

- Table 11.21 Sanofi: Company Snapshot

- Table 11.22 Sanofi: Vector Manufacturing Portfolio

- Table 11.23 Touchlight: Company Snapshot

- Table 11.24 Touchlight: Vector Manufacturing Portfolio

- Table 12.1 Viral Vectors and Plasmid DNA Production: List of Companies Profiled

- Table 12.2 Viral Vectors and Plasmid DNA Production: List of Companies Profiled

- Table 12.3 CoJourney: Company Snapshot

- Table 12.4 CoJourney: Vector Manufacturing Portfolio

- Table 12.5 CoJourney: Recent Developments and Future Outlook

- Table 12.6 Esco Aster: Company Snapshot

- Table 12.7 Esco Aster: Vector Manufacturing Portfolio

- Table 12.8 Wuxi AppTec: Company Snapshot

- Table 12.9 Wuxi AppTec: Vector Manufacturing Portfolio

- Table 12.10 Wuxi AppTec: Recent Developments and Future Outlook

- Table 12.11 Altruist Biotechnology: Company Snapshot

- Table 12.12 Altruist Biotechnology: Vector Manufacturing Portfolio

- Table 12.13 Jiangsu Puxin Biopharmaceutical: Company Snapshot

- Table 12.14 Jiangsu Puxin Biopharmaceutical: Vector Manufacturing Portfolio

- Table 12.15 Nikon CeLL innovation: Company Snapshot

- Table 12.16 Nikon CeLL innovation: Vector Manufacturing Portfolio

- Table 14.1 Vector and Gene Therapy Manufacturing: List of Partnerships

- Table 14.2 Partnerships and Collaborations: Information on Type of Vector Manufactured, Therapeutic Area and Application Area, since 2019

- Table 14.3 Partnerships and Collaborations: Information on Type of Agreement (Country and Region), since 2019

- Table 14.4 Vector and Gene Therapy Manufacturing: List of Other Collaborations

- Table 15.1 Vector and Gene Therapy Manufacturing: List of Recent Expansions

- Table 15.2 Vector and Gene Therapy Manufacturing: Information on Type of Manufacturing Facility

- Table 15.3 Vector and Gene Therapy Manufacturing: Information on Scale of Operation, Type of Vector Manufactured and Application Area

- Table 16.1 AAV Vector-based Therapy Developers: Most Likely Partners

- Table 16.2 AAV Vector-based Therapy Developers: Likely Partners

- Table 16.3 AAV Vector-based Therapy Developers: Less Likely Partners

- Table 16.4 AAV Vector-based Therapy Developers: Least Likely Partners

- Table 16.5 Adenoviral Vector-based Therapy Developers: Most Likely Partners

- Table 16.6 Adenoviral Vector-based Therapy Developers: Likely Partners

- Table 16.7 Adenoviral Vector-based Therapy Developers: Less Likely Partners

- Table 16.8 Adenoviral Vector-based Therapy Developers: Least Likely Partners

- Table 16.9 Lentiviral Vector-based Therapy Developers: Most Likely Partners

- Table 16.10 Lentiviral Vector-based Therapy Developers: Likely Partners

- Table 16.11 Lentiviral Vector-based Therapy Developers: Less Likely Partners

- Table 16.12 Lentiviral Vector-based Therapy Developers: Least Likely Partners

- Table 16.13 Retroviral Vector-based Therapy Developers: Most Likely Partners

- Table 16.14 Retroviral Vector-based Therapy Developers: Likely Partners

- Table 16.15 Retroviral Vector-based Therapy Developers: Less Likely Partners

- Table 16.16 Other Viral Vector-based Therapy Developers: Most Likely Partners

- Table 16.17 Other Viral Vector-based Therapy Developers: Likely Partners

- Table 16.18 Other Viral Vector-based Therapy Developers: Less Likely Partners

- Table 16.19 Other Viral Vector-based Therapy Developers: Least Likely Partners

- Table 16.20 AAV Vector Purification Product Developers: Most Likely Partners

- Table 16.21 AAV Vector Purification Product Developers: Likely Partners

- Table 16.22 Adenoviral Vector Purification Product Developers: Most Likely Partners

- Table 16.23 Adenoviral Vector Purification Product Developers: Likely Partners

- Table 16.24 Lentiviral Vector Purification Product Developers: Most Likely Partners

- Table 16.25 Lentiviral Vector Purification Product Developers: Likely Partners

- Table 16.26 Retroviral Vector Purification Product Developers: Most Likely Partners

- Table 16.27 Retroviral Vector Purification Product Developers: Likely Partners

- Table 16.28 Other Viral Vector Purification Product Developers: Most Likely Partners

- Table 16.29 Other Viral Vector Purification Product Developers: Likely Partners

- Table 19.1 Viral Vector and Plasmid DNA Cost Price Analysis: Expert Opinions / Primary Research

- Table 19.2 Viral Vector and Plasmid DNA: Prices of Vectors

- Table 21.1 Viral Vector Manufacturers: Information on Manufacturing Capacity (in Liters) (Sample Dataset)

- Table 21.2 Plasmid DNA Manufacturers: Information on Manufacturing Capacity (in Liters) (Sample Dataset)

- Table 21.3 Global Installed Viral Vector Manufacturing Capacity (in Liters): Sample Data Set

- Table 21.4 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Sample Data Set

- Table 21.5 Global Installed Viral Vector Manufacturing Capacity (in Liters): Distribution by Company Size

- Table 21.6 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Company Size

- Table 22.1. Global Annual Demand for Vectors, till 2035 (1020 vg)

- Table 22.2 Global Vectors Manufacturing Annual Demand and Supply, till 2035 (1020 vg)

- Table 24.1 Viral Vector and Plasmid DNA: Active Clinical Studies (Vector-based Cell and Gene Therapies)

- Table 24.2 Viral Vector and Plasmid DNA: Distribution by Patients Enrolled in the Active Clinical Studies (Vector-Based Cell and Gene Therapies)

- Table 24.3 Viral Vector and Plasmid DNA: Number of Active Clinical Trials (Vector-Based Cell and Gene Therapies), till 2035

- Table 24.4 Viral Vector and Plasmid DNA: Number of Patients Enrolled in Active Clinical Trials (Vector-Based Cell and Gene Therapies), till 2035

- Table 24.5 Viral Vector and Plasmid DNA: Approved / Late-Stage Cell and Gene Therapies

- Table 31.1 Survey Responses: List of Respondents

- Table 31.2 Survey Responses: Information on Seniority Level of Respondents

- Table 31.3 Survey Responses: Information on Type of Manufacturer (In-house Production versus Contract Services)

- Table 31.4 Survey Responses: Information on Scale of Operation

- Table 31.5 Survey Responses: Information on Type of Vector

- Table 33.1 Batavia Biosciences: Company Snapshot

- Table 33.2 Batavia Biosciences: Vector Manufacturing Portfolio

- Table 33.3 Touchlight: Company Snapshot

- Table 33.4 HALIX: Company Snapshot

- Table 33.5 CEVEC Pharmaceuticals: Key Highlights

- Table 33.6 Clean Cells: Key Highlights

- Table 33.7 Massachusetts General Hospital: Key Highlights

- Table 33.8 CJ PARTNERS Key Highlights

- Table 33.9 Polyplus Transfection: Key Highlights

- Table 33.10 University of Nantes: Key Highlights

- Table 33.11 ACGT: Key Highlights

- Table 33.12 Delphi Genetics: Key Highlights

- Table 33.13 Amsterdam BioTherapeutics Unit: Key Highlights

- Table 33.14 VIVEBiotech: Company Snapshot

- Table 33.15 GEG Tech: Key Highlights

- Table 33.16 Richter-Helm BioLogics: Company Snapshot

- Table 33.17 PlasmidFactory: Key Highlights

- Table 33.18 Waisman Biomanufacturing: Key Highlights

- Table 33.19 EFS-West Biotherapy: Key Highlights

- Table 34.1 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Year of Establishment

- Table 34.2 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Company Size

- Table 34.3 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Location of Headquarters (Region)

- Table 34.4 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Location of Headquarters (Country)

- Table 34.5 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Type of Product Manufactured

- Table 34.6 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Location of Vector Manufacturing Facility (Region)

- Table 34.7 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Location of Vector Manufacturing Facility (Country)

- Table 34.8 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Type of Manufacturer

- Table 34.9 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Scale of Operation

- Table 34.10 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Location of Headquarters and Scale of Operation

- Table 34.11 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Type of Vector Manufactured

- Table 34.12 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Scale of Operation and Type of Vector Manufactured

- Table 34.13 Viral Vector and Gene Therapy Manufacturers (Industry Players): Distribution by Application Area

- Table 34.14 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Year of Establishment

- Table 34.15 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Location of Headquarters (Region)

- Table 34.16 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Location of Headquarters (Country)

- Table 34.17 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Type of Manufacturer

- Table 34.18 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Scale of Operation

- Table 34.19 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Type of Vector Manufactured

- Table 34.20 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Scale of Operation and Type of Vector Manufactured

- Table 34.21 Vector and Gene Therapy Manufacturers (Non-Industry Players): Distribution by Application Area

- Table 34.22 Vector and Gene Therapy Manufacturing Technologies: Distribution by Type of Technology

- Table 34.23 Vector and Gene Therapy Manufacturing Technologies: Distribution by Purpose of Technology

- Table 34.24 Vector and Gene Therapy Manufacturing Technologies: Distribution by Scale of Operation

- Table 34.25 Vector and Gene Therapy Manufacturing Technologies: Distribution by Type of Vector

- Table 34.26 Vector and Gene Therapy Manufacturing Technologies: Distribution by Application Area

- Table 34.27 Most Active Players: Distribution by Number of Technologies

- Table 34.28 Catalent Biologics: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 34.29 Charles River Laboratories: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 34.30 Thermo Fisher Scientific: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 34.31 Lonza: Annual Revenues, FY 2018 Onwards (CHF Billion)

- Table 34.32 Wuxi AppTec: Annual Revenues, FY 2018 Onwards (RMB Billion)

- Table 34.33 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2019

- Table 34.34 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 34.35 Partnerships and Collaborations: Distribution by Scale of Operation

- Table 34.36 Partnerships and Collaborations: Distribution by Type of Vector Manufactured

- Table 34.37 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 34.38 Partnerships and Collaborations: Distribution by Application Area

- Table 34.39 Most Active Players: Distribution by Number of Partnerships

- Table 34.40 Partnerships and Collaborations: Local and International Agreements

- Table 34.41 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 34.42 Recent Expansions: Cumulative Year-wise Trend, since 2015

- Table 34.43 Recent Expansions: Distribution by Type of Expansion

- Table 34.44 Recent Expansions: Distribution by Year and Type of Expansion

- Table 34.45 Most Active Players: Distribution by Number of Expansions

- Table 34.46 Most Active Players: Distribution by Amount Invested

- Table 34.47 Recent Expansions: Distribution by Type of Manufacturing Facility

- Table 34.48 Recent Expansions: Distribution by Scale of Operation

- Table 34.49 Recent Expansions: Distribution by Type of Vector Manufactured

- Table 34.50 Recent Expansions: Distribution by Application Area

- Table 34.51 Recent Expansions: Intercontinental and Intracontinental Expansions

- Table 34.52 Recent Expansions: Distribution by Location of Expansion

- Table 34.53 Vector and Gene Therapy Manufacturers: Distribution by Type of Manufacturer, Type of Vector Manufactured and Scale of Operation

- Table 34.54 Vector and Gene Therapy Manufacturers: Distribution by Type of Vector Manufactured and Company Size

- Table 34.55 Vector and Gene Therapy Contract Manufacturing Organizations: Distribution by Geography

- Table 34.56 Vector and Gene Therapy In-House Manufacturers: Distribution by Geography

- Table 34.57 Vector and Gene Therapy In-House and Contract Manufacturing Organizations: Distribution by Geography

- Table 34.58 AAV Vector Manufacturers: Distribution by Location of Manufacturing Facility

- Table 34.59 Adenoviral Vector Manufacturers: Distribution by Location of Headquarters and Scale of Operation

- Table 34.60 Lentiviral Vector Manufacturers: Distribution by Location of Headquarters and Scale of Operation

- Table 34.61 Retroviral Vector Manufacturers: Distribution by Location of Headquarters and Scale of Operation

- Table 34.62 Plasmid DNA Manufacturers: Distribution by Location of Headquarters and Scale of Operation

- Table 34.63 Global Installed Viral Vectors Manufacturing Capacity (in Liters): Distribution by Company Size (Sample Data Set)

- Table 34.64 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Company Size (Sample Data Set)

- Table 34.65 Global Installed Viral Vector and Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Type of Vector Manufactured

- Table 34.66 Global Installed Viral Vector Manufacturing Capacity (in Liters): Distribution by Company Size

- Table 34.67 Global Installed Viral Vector Manufacturing Capacity: Distribution by Range of Installed Capacity (in Liters)

- Table 34.68 Global Installed Viral Vector Manufacturing Capacity (in Liters): Distribution by Scale of Operation

- Table 34.69 Global Installed Viral Vector Manufacturing Capacity (in Liters): Distribution by Location of Headquarters (Region)

- Table 34.70 Global Installed Viral Vector Manufacturing Capacity (in Liters): Distribution by Location of Manufacturing Facility

- Table 34.71 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Company Size

- Table 34.72 Global Installed Plasmid DNA Manufacturing Capacity: Distribution by Range of Installed Capacity (in Liters)

- Table 34.73 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Scale of Operation

- Table 34.74 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Location of Headquarters (Region)

- Table 34.75 Global Installed Plasmid DNA Manufacturing Capacity (in Liters): Distribution by Location of Manufacturing Facility

- Table 34.76 Global Demand for Viral Vector and Plasmid DNA (Thousand Patients), till 2035

- Table 34.77 Clinical Demand for Viral Vector and Plasmid DNA (Thousand Patients), till 2035

- Table 34.78 Global Clinical Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Type of Vector

- Table 34.79 Global Clinical Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Type of Therapy

- Table 34.80 Global Clinical Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Therapeutic Area

- Table 34.81 Global Clinical Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Geography

- Table 34.82 Global Commercial Demand for Viral Vector and Plasmid DNA (Thousand Patients), till 2035

- Table 34.83 Global Commercial Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Type of Vector

- Table 34.84 Global Commercial Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Type of Therapy

- Table 34.85 Global Commercial Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Therapeutic Area

- Table 34.86 Global Commercial Demand for Viral Vector and Plasmid DNA (Thousand Patients): Distribution by Geography

- Table 34.87 Global Vector Manufacturing Market, Historical Trends (since 2018) (USD Million)

- Table 34.88 Global Vector Manufacturing Market, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.89 Vector Manufacturing Market for Preclinical Scale, Historical Trends (since 2018) (USD Million)

- Table 34.90 Vector Manufacturing Market for Preclinical Scale, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.91 Vector Manufacturing Market for Clinical Scale, Historical Trends (since 2018) (USD Million)

- Table 34.92 Vector Manufacturing Market for Clinical Scale, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.93 Vector Manufacturing Market for Commercial Scale, Historical Trends (since 2018) (USD Million)

- Table 34.94 Vector Manufacturing Market for Commercial Scale, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.95 Vector Manufacturing Market for AAV Vectors, Historical Trends (since 2018) (USD Million)

- Table 34.96 Vector Manufacturing Market for AAV Vectors, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.97 Vector Manufacturing Market for Adenoviral Vectors, Historical Trends (since 2018) (USD Million)

- Table 34.98 Vector Manufacturing Market for Adenoviral Vectors, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.99 Vector Manufacturing Market for Lentiviral Vectors, Historical Trends (since 2018) (USD Million)

- Table 34.100 Vector Manufacturing Market for Lentiviral Vectors, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.101 Vector Manufacturing Market for Retroviral Vectors, Historical Trends (since 2018) (USD Million)

- Table 34.102 Vector Manufacturing Market for Retroviral Vectors, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.103 Vector Manufacturing Market for Other Vectors, Historical Trends (since 2018) (USD Million)

- Table 34.104 Vector Manufacturing Market for Other Vectors, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.105 Vector Manufacturing Market for Cell Therapy, Historical Trends (since 2018) (USD Million)

- Table 34.106 Vector Manufacturing Market for Cell Therapy, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.107 Vector Manufacturing Market for Gene Therapy, Historical Trends (since 2018) (USD Million)

- Table 34.108 Vector Manufacturing Market for Gene Therapy, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.109 Vector Manufacturing Market for Vaccines, Historical Trends (since 2018) (USD Million)

- Table 34.110 Vector Manufacturing Market for Vaccines, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.111 Vector Manufacturing Market for Oncological Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.112 Vector Manufacturing Market for Oncological Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.113 Vector Manufacturing Market for Rare Diseases, Historical Trends (since 2018) (USD Million)

- Table 34.114 Vector Manufacturing Market for Rare Diseases, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.115 Vector Manufacturing Market for Immunological Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.116 Vector Manufacturing Market for Immunological Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.117 Vector Manufacturing Market for Neurological Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.118 Vector Manufacturing Market for Neurological Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.119 Vector Manufacturing Market for Sensory Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.120 Vector Manufacturing Market for Sensory Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.121 Vector Manufacturing Market for Metabolic Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.122 Vector Manufacturing Market for Metabolic Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.123 Vector Manufacturing Market for Blood Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.124 Vector Manufacturing Market for Blood Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.125 Vector Manufacturing Market for Musculoskeletal Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.126 Vector Manufacturing Market for Musculoskeletal Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.127 Vector Manufacturing Market for Infectious Diseases, Historical Trends (since 2018) (USD Million)

- Table 34.128 Vector Manufacturing Market for Infectious Diseases, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.129 Vector Manufacturing Market for Ophthalmic Disorders, Historical Trends (since 2018) (USD Million)

- Table 34.130 Vector Manufacturing Market for Ophthalmic Disorders, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 34.131 Vector Manufacturing Market for Autoimmune Disorders, Forecasted Estimates (2026-2035), Conservative, Base and Optimistic Scenarios (USD Million)