|

市場調查報告書

商品編碼

1643960

醫療保健的元宇宙市場:各零件,各技術類型,各用途,各終端用戶,各地區,與主要企業:2035年前的產業趨勢與全球預測Metaverse in Healthcare Market by Component, Type of Technology, Applications, End Users, Geographical Regions and Key Players: Industry Trends and Global Forecasts, Till 2035 |

||||||

全球醫療保健元宇宙市場規模預計將從目前的 146 億美元增長到 2035 年的 2,191 億美元,預測期內的複合年增長率為 31.1%。

元宇宙是融合擴增實境、虛擬實境、人工智慧、混合實境、區塊鏈技術、物聯網等先進技術而形成的虛擬生態系統。醫療保健元宇宙專注於增強患者參與度,為分散式資料存取和儲存以及向偏遠地區患者提供遠距醫療服務開闢了新途徑。此外,數位健康服務在即時診斷和治療方面的應用日益增多,凸顯了元宇宙相關應用在醫療保健領域的擴展。

虛擬和擴增實境工具的進步使外科醫生能夠在受控的虛擬環境中執行複雜的醫療程序,有助於減少錯誤並改善整體手術效果。此外,值得強調的是,近年來,這些尖端技術進步由於上述優勢引起了醫療專業人士和患者的極大關注。最值得注意的是,它可以使用利用資料合成、演化建模和模式識別的預測人工智慧(AI)模型來掃描大量資料。因此,元宇宙有可能透過提供更個人化和便利的醫療保健體驗來簡化醫療保健服務、降低治療成本並改善患者治療效果。

由於元宇宙在醫療保健領域的眾多好處,該領域的公司正廣泛致力於探索這些數位功能的潛力,以準確治療和診斷疾病,並為患者和護理人員提供支援。此外,隨著數位健康元宇宙生態系統的發展,全球範圍內將提供更多的培訓選擇,醫療保健元宇宙市場將在未來幾年大幅成長。

本報告提供全球醫療保健的元宇宙市場相關調查,提供市場概要,以及各零件,各技術類型,各用途,各終端用戶,各地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 背景

第2章 調查手法

第3章 市場動態

第4章 經濟以及其他的計劃特有的考慮事項

第5章 摘要整理

第6章 簡介

第7章 市場影響分析

- 市場促進因素

- 市場阻礙因素

- 市場機會

- 市場課題

第8章 全球醫療保健的元宇宙市場

第9章 醫療保健的元宇宙市場(各零件)

第10章 醫療保健的元宇宙市場(各技術類型)

第11章 醫療保健的元宇宙市場(各用途)

第12章 醫療保健的元宇宙市場(各終端用戶)

第13章 醫療保健的元宇宙市場(各地區)

第14章 醫療保健的元宇宙市場(主要加入企業)

第15章 市場形勢

第16章 企業競爭力分析

第17章 企業簡介:北美設立總公司主要元宇宙企業

第18章 歐洲和亞太地區設立總公司主要元宇宙企業

第19章 醫療保健的元宇宙市場:進行中的大趨勢

第20章 問題點的分析

第21章 醫療保健的元宇宙用途: 使用案例

第22章 案例研究:區塊鏈技術供應商的市場形勢

第23章 執行洞察

第24章 附錄I:表格形式資料

第25章 附錄II:企業及團體一覽

METAVERSE IN HEALTHCARE MARKET:

As per Roots Analysis, the global metaverse in healthcare market size is estimated to grow from USD 14.6 billion in the current year to USD 219.1 billion by 2035, at a CAGR of 31.1% during the forecast period, till 2035.

The opportunity for metaverse in healthcare market has been distributed across the following segments:

- Type of Technology

- Augmented Reality / Virtual Reality

- Artificial Intelligence

- Blockchain Technology

- Mixed Reality

- Other Technologies

- Applications

- Telehealth

- Medical Training and Education

- Drug Discovery and Personalized Medicine

- Diagnosis

- Other Applications

- End User

- MedTech Companies

- Healthcare Providers

- Biopharmaceutical, Biotechnology and Life Sciences Companies

- Payers

- Patients

- Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

- Key Players

METAVERSE IN HEALTHCARE MARKET: GROWTH AND TRENDS

Metaverse is a virtual ecosystem developed through the integration of advanced technologies, such as augmented reality, virtual reality, artificial intelligence, mixed reality, blockchain technology and IoT. With the growing focus on enhanced patient engagement, metaverse in healthcare has opened new avenues for accessing and storing decentralized data, along with offering telehealth services to patients based in remote locations. Moreover, the increasing adoption of digital health services for real time diagnosis and treatment accentuates the expansion of metaverse related applications in the healthcare sector.

With the ongoing advancements in virtual reality and augmented reality tools, surgeons can perform complex medical procedures in controlled virtual environment, which helps in reducing the errors and improves the overall surgical outcomes. Further, it is important to highlight that, in recent years, these cutting-edge technological advancements have gathered significant attention from both healthcare professionals and patients due to their abovementioned advantages. Notably, large volumes of data can be scanned by using predictive artificial intelligence (AI) models with data integration, evolutionary modeling and pattern recognition. Therefore, metaverse has the potential to streamline healthcare delivery, reduce treatment costs, and improve patient outcomes by facilitating more personalized and accessible healthcare experiences.

Owing to the numerous benefits of metaverse in healthcare, the companies engaged in this domain are extensively focused on exploring the potential of these digital capabilities to precisely address and diagnose the diseases and support both patients and care givers. Moreover, with the development of digital health metaverse ecosystems that can broaden the training options worldwide, the metaverse in healthcare market is poised for substantial growth in the coming years.

METAVERSE IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of the metaverse in healthcare market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

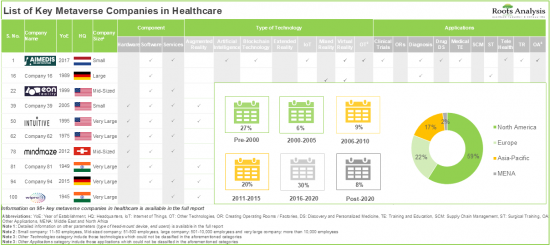

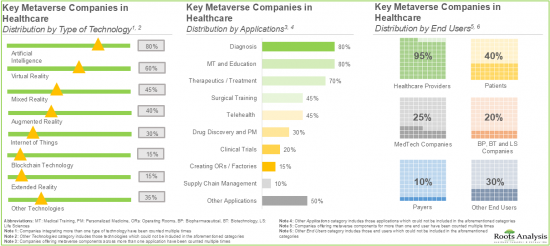

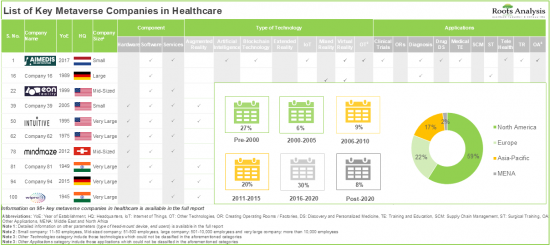

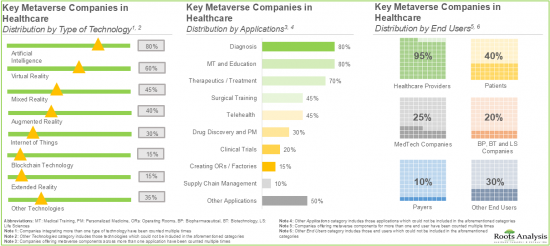

1.Majority of the key companies integrate artificial intelligence; of these, close to 45% companies offer components based on mixed reality, in order to support the healthcare providers for diagnosis, medical training and education.

2.Presently, more than 50 players claim to provide blockchain platform solutions across a wide range of drug development applications.

3.Driven by the increasing digital health services and need for extensive medical training, the metaverse in healthcare market is anticipated to witness a steady growth in the foreseen future.

4.Owing to the surplus usage of metaverse to improve medical outcomes and support patient experience, the market is anticipated to grow at an annualized rate of 31.1% in the coming decade.

METAVERSE IN HEALTHCARE MARKET: KEY SEGMENTS

Software is the Fastest Growing Segment of the Metaverse in Healthcare Market

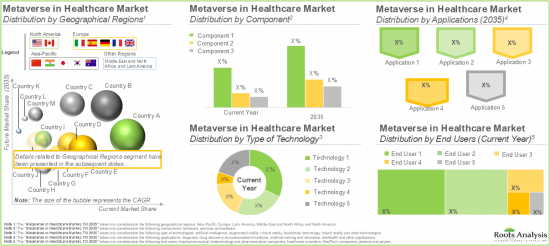

Based on the type of component, the global market for metaverse in healthcare is segmented into software, hardware and services. Currently, the software segment occupies the highest share of the overall market. It is worth mentioning that the services segment is expected to witness substantial market growth in the coming years.

Augmented Reality / Virtual Reality is Likely to Hold the Largest Share of the Metaverse in Healthcare Market During the Forecast Period

Based on the type of technology, the global market for metaverse in healthcare is segmented into augmented reality / virtual reality, artificial intelligence, blockchain technology, mixed reality and other technologies. Currently, amongst all these types, the augmented reality / virtual reality segment occupies the highest share in the overall market. It is worth noting that the artificial intelligence market segment is likely to flourish during the forecast period. This can be attributed to the fact that over the last few years, the use of AI in the healthcare industry has redefined the overall process of drug development, by significantly reducing the drug development timelines.

Metaverse in Healthcare Market for Telehealth is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on applications, the global market for metaverse in healthcare is segmented across telehealth, medical training and education, drug discovery and personalized medicine, diagnosis, and other applications. Presently, the market is dominated by the revenues generated from the telehealth segment and this trend is unlikely to change in the future as well.

Currently, MedTech Companies Hold the Largest Share of the Metaverse in Healthcare Market

Based on the end users, the global market for metaverse in healthcare is segmented into MedTech companies, healthcare providers, biopharmaceutical, biotechnology and life sciences companies, payers, and patients. Currently, MedTech companies' segment is likely to hold the largest market share, and this trend is unlikely to change in the future as well.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa and Latin America. In the current scenario, North America is likely to capture the largest market share. This can be attributed to the high acceptance and adoption of metaverse technologies in the healthcare sector, especially in the US. However, the metaverse in the healthcare market in Asia-Pacific is expected to grow at a higher CAGR during the forecast period.

Example Players in the Metaverse in Healthcare Market

- AccuVein

- Aimedis

- Brainlab

- CMR Surgical

- Elevate Healthcare

- Eon Reality

- GE Healthcare

- ImmersiveTouch

- Innoplexus

- Intuitive Surgical

- Medtronic

- Microsoft

- MindMaze

- NVIDIA

- Oodles Technologies

- Philips

- Siemens Healthineers

- Wipro

- XRHealth

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders in this domain. The market report features detailed transcripts of interviews conducted with the following individuals:

- Head of Research and Development, Large Company

- Senior Business Development Executive, Mid-sized Company

- Senior Blockchain Consultant, Mid-sized Company

METAVERSE IN HEALTHCARE MARKET: RESEARCH COVERAGE

The report on Metaverse in Healthcare Market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of metaverse in healthcare market, focused on key market segments, including [A] component, [B] type of technology, [C] application, [D] end user, [E] geographical regions and [F] key players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of metaverse companies in healthcare, based on several relevant parameters, such as [A] component, [B] type of technology, [C] type of head-mounted device, [D] applications, and [E] end User.

- Metaverse Companies in Healthcare Developer Landscape: The report features a list of players engaged in the metaverse in healthcare domain, along with analyses based on [A] year of establishment, [B] company size, and [C] location of headquarters.

- Company Profiles: In-depth profiles of key industry players in the metaverse in healthcare domain, featuring information on [A] company overview, [B] financial information (if available), [C] metaverse in healthcare portfolio, [D] recent developments, [E] future outlook statements.

- Company Competitiveness Analysis: An insightful competitiveness analysis of the leading players in the metaverse in healthcare domain, based on various relevant parameters, such as [A] company strength, [B] portfolio strength, and [C] benchmarking analysis.

- Megatrends: An evaluation of ongoing megatrends in metaverse in healthcare industry, including [A] integration of cloud services, [B] personalized medicine, [C] sustainability, [D] demand for remote healthcare solutions, [E] adoption of 5G network system, [F] investments in immersive platforms, and [G] the evolving regulatory guidelines.

- Pain Points Analysis: A comprehensive assessment of various customer pain-points in the metaverse in healthcare domain, which are preventing the market to reach its full potential based on various relevant parameters, such as [A] financial, [B] process, [C] support, [D] productivity pain-points, and [E] various strategies to address these pain points.

- Use Case Study: A use case study presenting insights on various healthcare applications, such as [A] diagnostics, [B] drug discovery and development, [C] medical training and education, [D] surgical treatment, and [E] supply chain management and telehealth.

- Case Study: A detailed assessment of healthcare companies using blockchain technology for drug discovery and clinical trials, based on a number of relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of blockchain technology, and [E] drug development applications, [F] clinical trial management applications, and [G] end user.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

3. MARKET DYNAMICS

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Overview of Metaverse in Healthcare

- 6.2. Key Technologies Employed

- 6.3. Metaverse Applications in Healthcare

- 6.4. Challenges associated with Metaverse in Healthcare

- 6.5. Recent Advancements in Metaverse in Healthcare

7. MARKET IMPACT ANALYSIS

- 7.1. Market Drivers

- 7.2. Market Restraints

- 7.3. Market Opportunities

- 7.4. Market Challenges

8. GLOBAL METAVERSE IN HEALTHCARE MARKET

- 8.1. Key Assumptions and Methodology

- 8.2. Global Metaverse in Healthcare Market: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 8.2.1. Scenario Analysis

- 8.2.1.1. Conservative Scenario

- 8.2.1.2. Optimistic Scenario

- 8.2.1. Scenario Analysis

- 8.3. Key Market Segmentations

- 8.4. Roots Analysis Perspective on Market Growth

9. METAVERSE IN HEALTHCARE MARKET, BY COMPONENT

- 9.1. Key Assumptions and Methodology

- 9.2. Metaverse in Healthcare Market: Distribution by Component

- 9.2.1. Metaverse in Healthcare Market for Software: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 9.2.2. Metaverse in Healthcare Market for Hardware: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 9.2.3. Metaverse in Healthcare Market for Services: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

10. METAVERSE IN HEALTHCARE MARKET, BY TYPE OF TECHNOLOGY

- 10.1. Key Assumptions and Methodology

- 10.2. Metaverse in Healthcare Market: Distribution by Type of Technology

- 10.2.1. Metaverse in Healthcare Market for Augmented Reality / Virtual Reality: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 10.2.2. Metaverse in Healthcare Market for Artificial Intelligence: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 10.2.3. Metaverse in Healthcare Market for Blockchain Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 10.2.4. Metaverse in Healthcare Market for Mixed Reality: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 10.2.5. Metaverse in Healthcare Market for Other Technologies: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

11. METAVERSE IN HEALTHCARE MARKET, BY APPLICATION

- 11.1. Key Assumptions and Methodology

- 11.2. Metaverse in Healthcare Market: Distribution by Application

- 11.2.1. Metaverse in Healthcare Market for Telehealth: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 11.2.2. Metaverse in Healthcare Market for Medical Training and Education: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 11.2.3. Metaverse in Healthcare Market for Drug Discovery and Personalized Medicine: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 11.2.4. Metaverse in Healthcare Market for Diagnosis: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 11.2.5. Metaverse in Healthcare Market for Other Applications: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

12. METAVERSE IN HEALTHCARE MARKET, BY END USER

- 12.1. Key Assumptions and Methodology

- 12.2. Metaverse in Healthcare Market: Distribution by End User

- 12.2.1. Metaverse in Healthcare Market for MedTech Companies: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.2. Metaverse in Healthcare Market for Healthcare Providers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.3. Metaverse in Healthcare Market for Biopharmaceutical, Biotechnology and Life Sciences Companies: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.4. Metaverse in Healthcare Market for Payers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.5. Metaverse in Healthcare Market for Patients: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

13. METAVERSE IN HEALTHCARE MARKET, BY GEOGRAPHICAL REGIONS

- 13.1. Key Assumptions and Methodology

- 13.2. Metaverse in Healthcare Market: Distribution by Geographical Regions

- 13.2.1. Metaverse in Healthcare Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.1.1. Metaverse in Healthcare Market in the US: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.1.2. Metaverse in Healthcare Market in Canada: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2. Metaverse in Healthcare Market in Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2.1. Metaverse in Healthcare Market in the UK: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2.2. Metaverse in Healthcare Market in Germany: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2.3. Metaverse in Healthcare Market in France: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2.4. Metaverse in Healthcare Market in Spain: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2.5. Metaverse in Healthcare Market in Italy: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2.6. Metaverse in Healthcare Market in Rest of Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3. Metaverse in Healthcare Market in Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3.1. Metaverse in Healthcare Market in China: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3.2. Metaverse in Healthcare Market in Japan: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3.3. Metaverse in Healthcare Market in Australia: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3.4. Metaverse in Healthcare Market in India: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3.5. Metaverse in Healthcare Market in South Korea: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3.6. Metaverse in Healthcare Market in Rest of Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.4. Metaverse in Healthcare Market in Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.4.1. Metaverse in Healthcare Market in Saudi Arabia: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.4.2. Metaverse in Healthcare Market in UAE: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.4.3. Metaverse in Healthcare Market in Israel: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.4.4. Metaverse in Healthcare Market in Rest of Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.5. Metaverse in Healthcare Market in Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.5.1. Metaverse in Healthcare Market in Brazil: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.5.2. Metaverse in Healthcare Market in Mexico: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.5.3. Metaverse in Healthcare Market in Argentina: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.5.4. Metaverse in Healthcare Market in Rest of Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.1. Metaverse in Healthcare Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.3. Metaverse in Healthcare Market, by Geographical Regions: Market Dynamics Assessment

- 13.3.1. Penetration-Growth (P-G) Matrix

- 13.3.2. Market Movement Analysis

- 13.3.3. Data Triangulation and Validation

14. METAVERSE IN HEALTHCARE MARKET, BY KEY PLAYERS

15. MARKET LANDSCAPE

- 15.1. Chapter Overview

- 15.2. Key Metaverse Companies in Healthcare: Market Landscape

- 15.2.1. Analysis by Component

- 15.2.2. Analysis by Type of Technology

- 15.2.3. Analysis by Type of Head-mounted Device

- 15.2.4. Analysis by Applications

- 15.2.5. Analysis by End User

- 15.3. Metaverse Companies in Healthcare: Overall Market Landscape

- 15.3.1. Analysis by Year of Establishment

- 15.3.2. Analysis by Company Size

- 15.3.3. Analysis by Location of Headquarters

16. COMPANY COMPETITIVENESS ANALYSIS

- 16.1. Methodology and Key Parameters

- 16.2. Scoring Criteria

- 16.3. Key Metaverse Companies in Healthcare: Company Competitiveness Analysis

- 16.4. Key Metaverse Companies in Healthcare: Benchmarking Analysis

17. COMPANY PROFILES: KEY METAVERSE COMPANIES HEADQUARTERED IN NORTH AMERICA

- 17.1. Chapter Overview

- 17.2. Key Metaverse Companies Headquartered in North America

- 17.2.1. Intuitive Surgical

- 17.2.1.1. Company Overview

- 17.2.1.2. Metaverse in Healthcare Offerings Portfolio

- 17.2.1.3. Financial Details

- 17.2.1.4. Recent Developments and Future Outlook

- 17.2.2. GE HealthCare

- 17.2.3. Medtronic

- 17.2.4. Microsoft

- 17.2.5. NVIDIA

- 17.2.1. Intuitive Surgical

- 17.3. Other Key Metaverse Companies Headquartered in North America

- 17.3.1. AccuVein

- 17.3.2. CMR Surgical

- 17.3.3. Elevate Healthcare

- 17.3.4. EON Reality

- 17.3.5. Google Health

- 17.3.6. ImmersiveTouch

- 17.3.7. XRHealth

18. KEY METAVERSE COMPANIES HEADQUARTERED IN EUROPE AND ASIA-PACIFIC

- 18.1. Chapter Overview

- 18.2. Key Metaverse Companies Headquartered in Europe and Asia-Pacific

- 18.2.1. Philips

- 18.2.1.1. Company Overview

- 18.2.1.2. Metaverse in Healthcare Offerings Portfolio

- 18.2.1.3. Financial Details

- 18.2.1.4. Recent Developments and Future Outlook

- 18.2.2. Siemens Healthineers

- 18.2.3. Wipro

- 18.2.1. Philips

- 18.3. Other Key Metaverse Companies Headquartered in Europe and Asia-Pacific

- 18.3.1. Aimedis

- 18.3.2. Brainlab

- 18.3.3. Innoplexus

- 18.3.4. MindMaze

- 18.3.5. Oodles Technologies

19. METAVERSE IN HEALTHCARE MARKET: ONGOING MEGATRENDS

- 19.1. Chapter Overview

- 19.2. Key Megatrends

20. PAIN POINT ANALYSIS

- 20.1. Chapter Overview

- 20.2. Metaverse in Healthcare: Customer Pain Points

- 20.2.1. Financial Pain Points

- 20.2.2. Process Pain Points

- 20.2.3. Support Pain Points

- 20.2.4. Productivity Pain Points

- 20.3. Strategies to Address Pain Points

- 20.4. Concluding Remarks

21. METAVERSE APPLICATIONS IN HEALTHCARE: USE CASES

- 21.1. Chapter Overview

- 21.2. Key Metaverse Applications across Various Healthcare Segments

- 21.2.1. Diagnostics

- 21.2.2. Drug Discovery and Development

- 21.2.3. Medical Training and Education

- 21.2.4. Surgical Treatment

- 21.2.5. Supply Chain Management

- 21.2.6. Telehealth

- 21.3. Upcoming Trends in Metaverse in Healthcare Domain

- 21.4. Future Perspectives

22. CASE STUDY: BLOCKCHAIN TECHNOLOGY PROVIDERS MARKET LANDSCAPE

- 22.1. Chapter Overview

- 22.2. Blockchain Technology Providers: Market Landscape

- 22.2.1. Analysis by Year of Establishment

- 22.2.2. Analysis by Company Size

- 22.2.3. Analysis by Location of Headquarters

- 22.2.4. Analysis by Type of Blockchain Technology

- 22.2.5. Analysis by Drug Development Applications

- 22.2.6. Analysis by Clinical Trial Management Applications

- 22.2.7. Analysis by End User

- 22.2.8. Analysis by Type of Blockchain Technology and End User

- 22.2.9. Analysis by Type of Blockchain Technology and Drug Development Applications

23. EXECUTIVE INSIGHTS

24. APPENDIX I: TABULATED DATA

25. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Metaverse Applications in Healthcare

- Table 16.1 Key Metaverse Companies in Healthcare: Market Landscape

- Table 16.2 Metaverse Companies in Healthcare: Overall Market Landscape

- Table 18.1 Intuitive Surgical: Metaverse in Healthcare Offerings Portfolio

- Table 18.2 GE Healthcare: Metaverse in Healthcare Offerings Portfolio

- Table 18.3 Medtronic: Metaverse in Healthcare Offerings Portfolio

- Table 18.4 Microsoft: Metaverse in Healthcare Offerings Portfolio

- Table 18.5 NVIDIA: Metaverse in Healthcare Offerings Portfolio

- Table 19.1 Philips: Metaverse in Healthcare Offerings Portfolio

- Table 19.2 Siemens Healthineers: Metaverse in Offerings Healthcare Portfolio

- Table 19.3 Wipro: Metaverse in Healthcare Offerings Portfolio

- Table 24.1 Global Metaverse in Healthcare Market: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.2 Global Metaverse in Healthcare Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Table 24.3 Global Metaverse in Healthcare Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Table 24.4 Metaverse in Healthcare Market: Distribution by Component

- Table 24.5 Metaverse in Healthcare Market for Software: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.6 Metaverse in Healthcare Market for Hardware: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.7 Metaverse in Healthcare Market for Services: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.8 Metaverse in Healthcare Market: Distribution by Type of Technology

- Table 24.9 Metaverse in Healthcare Market for Augmented Reality / Virtual Reality: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.10 Metaverse in Healthcare Market for Artificial Intelligence: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.11 Metaverse in Healthcare Market for Blockchain Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.12 Metaverse in Healthcare Market for Mixed Reality: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.13 Metaverse in Healthcare Market for Other Technologies: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.14 Metaverse in Healthcare Market: Distribution by Applications

- Table 24.15 Metaverse in Healthcare Market for Telehealth: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.16 Metaverse in Healthcare Market for Medical Training and Education: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.17 Metaverse in Healthcare Market for Drug Discovery and Personalized Medicine: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.18 Metaverse in Healthcare Market for Diagnosis: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.19 Metaverse in Healthcare Market for Other Applications: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.20 Metaverse in Healthcare Market: Distribution by End User

- Table 24.21 Metaverse in Healthcare Market for MedTech Companies: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.22 Metaverse in Healthcare Market for Healthcare Providers: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.23 Metaverse in Healthcare Market for Biopharmaceutical, Biotechnology and Life Science Companies: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.24 Metaverse in Healthcare Market for Payers: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.25 Metaverse in Healthcare Market for Patients: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.26 Metaverse in Healthcare Market: Distribution by Geographical Regions

- Table 24.27 Metaverse in Healthcare Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.28 Metaverse in Healthcare Market in the US: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.29 Metaverse in Healthcare Market in Canada: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.30 Metaverse in Healthcare Market in Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 24.31 Metaverse in Healthcare Market in Germany: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.32 Metaverse in Healthcare Market in the UK: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.33 Metaverse in Healthcare Market in France: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.34 Metaverse in Healthcare Market in Spain: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.35 Metaverse in Healthcare Market in Italy: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.36 Metaverse in Healthcare Market in Rest of Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.37 Metaverse in Healthcare Market in Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.38 Metaverse in Healthcare Market in China: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.39 Metaverse in Healthcare Market in Japan: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.40 Metaverse in Healthcare Market in South Korea: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.41 Metaverse in Healthcare Market in India: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.42 Metaverse in Healthcare Market in Australia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.43 Metaverse in Healthcare Market in Rest of Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.44 Metaverse in Healthcare Market in Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.45 Metaverse in Healthcare Market in Saudi Arabia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.46 Metaverse in Healthcare Market in UAE: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.47 Metaverse in Healthcare Market in Iran: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.48 Metaverse in Healthcare Market in Egypt: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.49 Metaverse in Healthcare Market in Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.50 Metaverse in Healthcare Market in Brazil: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.51 Metaverse in Healthcare Market in Argentina: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.52 Metaverse in Healthcare Market in Mexico: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 24.53 Penetration-Growth (P-G) Matrix

- Table 24.54 Market Movement Analysis

- Table 24.55 Key Metaverse Companies in Healthcare: Distribution by Component

- Table 24.56 Key Metaverse Companies in Healthcare: Distribution by Type of Technology

- Table 24.57 Key Metaverse Companies in Healthcare: Distribution by Type of Head-mounted Device

- Table 24.58 Key Metaverse Companies in Healthcare: Distribution by Applications

- Table 24.59 Key Metaverse Companies in Healthcare: Distribution by End User

- Table 24.60 Key Metaverse Companies in Healthcare: Distribution by Year of Establishment

- Table 24.61 Key Metaverse Companies in Healthcare: Distribution by Company Size

- Table 24.62 Key Metaverse Companies in Healthcare: Distribution by Location of Headquarters

- Table 24.63 Intuitive Surgical: Financial Information (USD Billion)

- Table 24.64 GE Healthcare: Financial Information (USD Billion)

- Table 24.65 Medtronic: Financial Information (USD Billion)

- Table 24.66 Microsoft: Financial Information (USD Million)

- Table 24.67 NVIDIA: Financial Information (USD Billion)

- Table 24.68 Philips: Financial Information (USD Million)

- Table 24.69 Siemens Healthineers: Financial Information (YEN Billion)

- Table 24.70 Wipro: Financial Information (USD Million)

- Table 24.71 Blockchain Technology Providers: Distribution by Year of Establishment

- Table 24.72 Blockchain Technology Providers: Distribution by Company Size

- Table 24.73 Blockchain Technology Providers: Distribution by Location of Headquarters

- Table 24.74 Blockchain Technology Providers: Distribution by Type of Blockchain Technology

- Table 24.75 Blockchain Technology Providers: Distribution by Drug Development Applications

- Table 24.76 Blockchain Technology Providers: Distribution by Clinical Trial Management Applications

- Table 24.77 Blockchain Technology Providers: Distribution by End User

- Table 24.78 Blockchain Technology Providers: Distribution by Type of Blockchain Technology and End User

- Table 24.79 Blockchain Technology Providers: Distribution by Type of Blockchain Technology and Drug Development Applications

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 5.1 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 5.2 Executive Summary: Metaverse in Healthcare Market Landscape

- Figure 6.1 Challenges Associated with Metaverse in Healthcare

- Figure 7.1 Market Drivers

- Figure 7.2. Market Restraints

- Figure 7.3. Market Opportunities

- Figure 7.4. Market Challenges

- Figure 8.1 Global Metaverse in Healthcare Market: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 8.2 Global Metaverse in Healthcare Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Figure 8.3 Global Metaverse in Healthcare Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Figure 9.1 Metaverse in Healthcare Market: Distribution by Component

- Figure 9.2 Metaverse in Healthcare Market for Software: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 9.3 Metaverse in Healthcare Market for Hardware: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 9.4 Metaverse in Healthcare Market for Services: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 10.1 Metaverse in Healthcare Market: Distribution by Type of Technology

- Figure 10.2 Metaverse in Healthcare Market for Augmented Reality / Virtual Reality: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 10.3 Metaverse in Healthcare Market for Artificial Intelligence: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 10.4 Metaverse in Healthcare Market for Blockchain Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 10.5 Metaverse in Healthcare Market for Mixed Reality: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 10.6 Metaverse in Healthcare Market for Other Technologies: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 11.1 Metaverse in Healthcare Market: Distribution by Applications

- Figure 11.2 Metaverse in Healthcare Market for Telehealth: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 11.3 Metaverse in Healthcare Market for Medical Training and Education: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 11.4 Metaverse in Healthcare Market for Drug Discovery and Personalized Medicine: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 11.5 Metaverse in Healthcare Market for Diagnosis: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 11.6 Metaverse in Healthcare Market for Other Applications: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 12.1 Metaverse in Healthcare Market: Distribution by End User

- Figure 12.2 Metaverse in Healthcare Market for MedTech Companies: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 12.3 Metaverse in Healthcare Market for Healthcare Providers: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 12.4 Metaverse in Healthcare Market for Biopharmaceutical, Biotechnology and Life Science Companies: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 12.5 Metaverse in Healthcare Market for Payers: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 12.6 Metaverse in Healthcare Market for Patients: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.1 Metaverse in Healthcare Market: Distribution by Geographical Regions

- Figure 13.2 Metaverse in Healthcare Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.3 Metaverse in Healthcare Market in the US: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.4 Metaverse in Healthcare Market in Canada: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.5 Metaverse in Healthcare Market in Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.6 Metaverse in Healthcare Market in Germany: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.7 Metaverse in Healthcare Market in the UK: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.8 Metaverse in Healthcare Market in France: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.9 Metaverse in Healthcare Market in Spain: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.10 Metaverse in Healthcare Market in Italy: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.11 Metaverse in Healthcare Market in Rest of Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.12 Metaverse in Healthcare Market in Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.13 Metaverse in Healthcare Market in China: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.14 Metaverse in Healthcare Market in Japan: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.15 Metaverse in Healthcare Market in South Korea: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.16 Metaverse in Healthcare Market in India: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.17 Metaverse in Healthcare Market in Australia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.18 Metaverse in Healthcare Market in Rest of Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.19 Metaverse in Healthcare Market in Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.20 Metaverse in Healthcare Market in Saudi Arabia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.21 Metaverse in Healthcare Market in UAE: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.22 Metaverse in Healthcare Market in Iran: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.23 Metaverse in Healthcare Market in Egypt: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.24 Metaverse in Healthcare Market in Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.25 Metaverse in Healthcare Market in Brazil: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.26 Metaverse in Healthcare Market in Argentina: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.27 Metaverse in Healthcare Market in Mexico: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 13.28 Market Movement Analysis

- Figure 13.29 Penetration-Growth (P-G) Matrix

- Figure 15.1 Key Metaverse Companies in Healthcare: Distribution by Component

- Figure 15.2 Key Metaverse Companies in Healthcare: Distribution by Type of Technology

- Figure 15.3 Key Metaverse Companies in Healthcare: Distribution by Type of Head-mounted Device

- Figure 15.4 Key Metaverse Companies in Healthcare: Distribution by Applications

- Figure 15.5 Key Metaverse Companies in Healthcare: Distribution by End User

- Figure 15.6 Metaverse Companies in Healthcare: Distribution by Year of Establishment

- Figure 15.7 Metaverse Companies in Healthcare: Distribution by Company Size

- Figure 15.8 Metaverse Companies in Healthcare: Distribution by Location of Headquarters

- Figure 16.1 Key Metaverse Companies in Healthcare: Company Competitiveness

- Figure 16.2 Key Metaverse Companies in Healthcare: Benchmarking Analysis

- Figure 17.1 Intuitive Surgical: Financial Information (USD Billion)

- Figure 17.2 GE Healthcare: Financial Information (USD Billion)

- Figure 17.3 Medtronic: Financial Information (USD Billion)

- Figure 17.4 Microsoft: Financial Information (USD Million)

- Figure 17.5 NVIDIA: Financial Information (USD Billion)

- Figure 18.1 Philips: Financial Information (USD Million)

- Figure 18.2 Siemens Healthineers: Financial Information (EUR Billion)

- Figure 18.3 Wipro: Financial Information (USD Million)

- Figure 19.1 Key Megatrends

- Figure 21.1 Key Metaverse Applications across Various Healthcare Segments

- Figure 22.1 Blockchain Technology Providers: Distribution by Year of Establishment

- Figure 22.2 Blockchain Technology Providers: Distribution by Company Size

- Figure 22.3 Blockchain Technology Providers: Distribution by Location of Headquarters

- Figure 22.4 Blockchain Technology Providers: Distribution by Type of Blockchain Technology

- Figure 22.5 Blockchain Technology Providers: Distribution by Drug Development Applications

- Figure 22.6 Blockchain Technology Providers: Distribution by Clinical Trial Management Applications

- Figure 22.7 Blockchain Technology Providers: Distribution by End User

- Figure 22.8 Blockchain Technology Providers: Distribution by Type of Blockchain Technology and End User

- Figure 22.9 Blockchain Technology Providers: Distribution by Type of Blockchain Technology and Drug Development Applications