|

市場調查報告書

商品編碼

1462795

全球瓦斯表市場(智慧和標準):2024 年第 5 版Gas Meters Smart & Standard Ed 5 2024 |

||||||

價格

簡介目錄

全球瓦斯表市場預計到 2023 年將擴大到 8,080 萬台,價值 55 億美元,2028 年將達到 1.16 億台。

以下三個因素可以作為推動瓦斯表需求的因素。

- 智慧型瓦斯錶曾落後於智慧電錶,但現在正變得越來越受歡迎。 歐洲、亞太和中亞已確認大規模部署智慧瓦斯表。

- 超音波計量表長期以來一直用於批量計量和託管計量,但其進入住宅市場一直受到價格的阻礙。 這些問題現已解決,該公司準備向目前占主導地位的住宅隔膜表發起課題。 荷蘭、美國、加拿大、日本和英國已簽署大規模部署合同,也有可能在中國部署。 國際領先製造商已開發出G1.6-16超音波儀表,並獲得世界各地監管機構的認證。

- 儘管存在淨零目標、綠色活動人士的反對以及風能和太陽能的爆炸性增長,但化石燃料仍然是世界能源的支柱。 天然氣的排放量低於煤炭和石油,因此非常適合作為過渡燃料。 在一些最大的市場中,城市燃氣分銷正處於雄心勃勃的成長軌道上。

本報告分析了全球瓦斯表(智慧表、標準表)市場,並提供了整體銷售、銷售價值和平均銷售價格的趨勢預測(所有 42 個國家,2022-2028 年),詳細趨勢依儀表類型(隔膜式、旋轉式、渦輪式、孔板式、超音波式、科氏式、渦流式、MEMS)、主要公司簡介和全球市場佔有率(前23 名公司)、每個國家的市場概況(產品/公司簡介)相關市場(天然氣汽車(NGV)、汽車燃氣(autogas)、供氣基礎設施等、需求趨勢等)的全面概述。

目錄

第 1 章執行摘要

第二章瓦斯表市場狀況(2023年)

第三章全球瓦斯表需求(2019-2025)

第三章智慧瓦斯表需求

- 測量技術概述

- 用儀表測量

- 隔膜流量計

- 超音波計

- 智慧電錶

- 對智慧電錶的需求

第四章瓦斯表長期需求趨勢

第五章天然氣開採、運輸與分配

- 氣壓

- 採礦系統

- 傳輸系統

- 壓實站

- 線路封包

- 門站

- 分銷網絡

- 最後一哩:將天然氣運送到千家萬戶

第 6 章儀表類型:從 1843 年到未來

- 正氣壓表

- 隔膜流量計

- 旋轉流量計

- 預期米數

- 渦輪流量計

- 孔板流量計

- 超音波流量計

- 家用超音波測量儀

- 智慧型微電腦電錶

- 科氏流量計

- 渦流計

- MEMS(微機電系統)

- 智慧型/進階儀表

- 通訊模組

- 米尺寸(G)

- 熱值

- 氫氣混合物

第七章歐洲瓦斯表市場

- 歐洲天然氣公司

- 俄羅斯入侵烏克蘭對歐洲天然氣供應的影響

- 智慧電錶

- 超音波計

- 儀表需求

- 奧地利

- 比利時

- 保加利亞

- 捷克共和國

- 丹麥

- 愛沙尼亞

- 芬蘭

- 法國

- 德國

- 希臘

- 匈牙利

- 愛爾蘭

- 義大利

- 拉脫維亞

- 立陶宛

- 荷蘭

- 波蘭

- 葡萄牙

- 羅馬尼亞

- 斯洛伐克

- 斯洛維尼亞

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 英國

第八章獨聯體國家瓦斯表市場

- 儀表需求

- 俄羅斯

- 烏克蘭

- 亞塞拜然

- 哈薩克

- 烏茲別克

第九章中東瓦斯表市場

- 伊朗

第十章非洲瓦斯表市場

- 北非

- 阿爾及利亞

- 埃及

- 撒哈拉以南非洲地區

第11章亞太地區瓦斯表市場

- 亞太地區電錶需求

- 中國

- 澳大利亞

- 印度

- 印尼

- 日本

- 韓國

- 紐西蘭

- 巴基斯坦

- 台灣

- 泰國

第十二章北美瓦斯表市場

- 美國

- 加拿大

- 墨西哥

第十三章南美洲瓦斯表市場

- 儀表需求

- 阿根廷

- 巴西

- 智利

- 哥倫比亞

第14章中美洲瓦斯表市場

第 15 章競爭分析、公司概況、市佔率

- Elster

- Itron

- Landis+Gyr

- Dresser

- Diehl

- Apator

- Panasonic

- Nicor Gas

- Sagemcom

- Sensus

- Dongfa Group

- Holley

- Qianwei Kromschroder

- Emerson

- DNV GL

第十六章 NGV(天然氣汽車)與汽車瓦斯表

- 填充過程

第十七章世界天然氣工業的起源

- 電力與天然氣

- 能源轉型中的天然氣

第十八章 瓦斯供應來源、種類及供應量

- 氣體類別

- 天然氣

- 人工氣體

- 焦爐瓦斯

- 液化石油氣 (LPG)

- 瓦斯

- 沼氣

- 高爐煤氣

- 天然氣水合物

- 煉廠氣

- 合成天然氣 (SNG)

- PG 汽油

- 天然氣運輸及儲存

- 管道煤氣

- 液化天然氣 (LNG)

- 液化石油氣 (LPG)

- 壓縮天然氣 (CNG)

- 分析法

- 安裝的瓦斯表數量

- 安裝基礎

- 對瓦斯表的需求

- 長期需求週期

- 法國年度長期需求趨勢:由於智慧瓦斯表的普及而重新測量後

- 短期需求

簡介目錄

The Gas Meter market rose to 80.8 million meters in 2023 with a value of $5.5 billion and is predicted to reach 116 million meters by 2028.

SAMPLE VIEW

The new edition of Gas Meters Smart & Standard Ed5 2024 has identified three significant factors driving demand.

- Smart gas metering is taking off, after lagging behind electricity smart metering. Large deployments of smart gas meters are identified in Europe, Asia Pacific and Central Asia.

- Ultrasonic meters have long been used for bulk and custody metering but their entry into the residential market has been hampered by price. Costs have now come down and they are poised to challenge the traditional dominance of residential diaphragm meters. Large deployments have been contracted in the Netherlands, in the USA and Canada, in Japan and potentially in the UK, with China simmering. The leading international manufacturers have developed G1.6-16 ultrasonic meters and regulators are accrediting them around the globe.

- Despite net zero targets, opposition from green activists and an explosion of wind power and solar PV, fossil fuels are still the mainstay of global energy. Natural gas is well positioned as a transitional fuel because of lower emissions than coal and oil. City gas distribution is on ambitious growth paths in some of the largest markets.

Market statistics and analysis

- Sales of gas meters for 42 countries, by meter type - basic residential, AMR/AMI, prepayment, communal, communications modules, C&I - units, value, and average selling price, from 2022 to 2028.

- New deployments of smart gas meters, together with suppliers.

- The status of residential ultrasonic metering in relevant markets, deployments and manufacturers.

- The gas metering landscape in 2023 - numbers of population, households, gas consumers, and demand in meters and $ value.

- The major meter technologies described with total market shares; diaphragm, rotary, turbine, orifice and ultrasonic, Coriolis, vortex and MEMS.

- The major customers for gas meters, the gas transmission and distribution utilities in each of the 42 countries profiled, together with their structure.

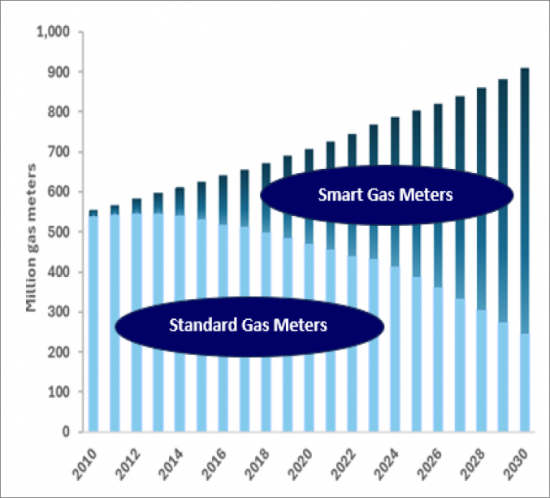

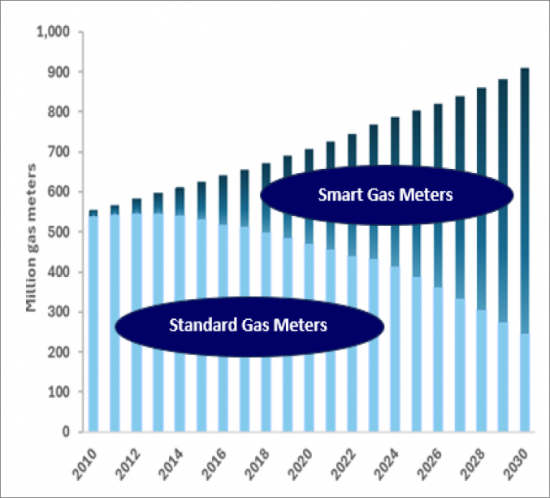

- The growth of housing units, gas and electricity customers charted for each profiled country, from 1950 to 2030.

- Global market shares with profiles of the top 23 meter manufacturers - Profiles of Elster, Itron, Landis+Gyr, Sensus, Dresser, Diehl, Apator, Panasonic, Nicor Gas, Sagemcom, Sensus, Dongfa Group, Holley, Qianwei Kromschroeder, Emerson.

- The smart meter rollouts are causing fundamental changes in the demand cycle for meters.

- The NGV and autogas segment is reviewed, a small but growing segment for gas meters, with numbers and metering technology.

- Gas supply infrastructure outlined, which meters required for each function.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1. Natural das in the transition to net zero

- 2. Smart gasmeters

- 3. Ultrasonic residential gas meters

- Long-term annual demand trend with continuation of basic diaphragm meters, France, 1900-2050.

- Turndown ratio and rangeability

- Split between residential and C&I meter sales

- Competitive landscape

- Market shares of gas meter manufacturers in value 2023.

- Meter types

- Gas sources, types and delivery

- The origins of the global gas industry

- Electricity versus Gas

2. THE GAS METERING LANDSCAPE IN 2023

3. WORLD DEMAND FOR GAS METERS FROM 2019 TO 2025

3. DEMAND FOR SMART GAS METERS

- Introduction to metering technology

- Meter measurement

- Diaphragm meters

- Ultrasonic meters

- Smart metering

- Smart meter demand

4. LONG-TERM DEMAND TREND FOR GAS METERS

- Demand

5. GAS GATHERING, TRANSMISSION, DISTRIBUTION

- Gas pressure

- The gathering system

- The transmission system

- Compressor stations

- Line pack

- Gate stations

- The distribution network

- The last mile, moving natural gas into the home

6. METER TYPES FROM 1843 TO THE FUTURE

- POSITIVE DISPLACEMENT GAS METERS

- Diaphragm meters

- Rotary meters

- INFERENTIAL METERS

- Turbine meters

- Orifice meters

- Ultrasonic flow meters

- Residential ultrasonic meters

- Intelligent Micom meters

- Coriolis meters

- Vortex meters

- MEMS (Micro-Electro-Mechanical System)

- Smart/advanced meters

- Communication module

- Meter sizes - G

- Heating value

- Hydrogen blending

7. THE GAS METER MARKET IN EUROPE

- Establishment of gas in Europe

- The impact on the natural gas supply in Europe of the Russian war in Ukraine

- Smart meters

- Ultrasonic meters

- Meter demand

- AUSTRIA

- Smart meters

- Meter demand

- BELGIUM

- Smart meters

- Meter demand

- BULGARIA

- CZECH REPUBLIC

- DENMARK

- Smart meters

- Danish meter companies

- Ultrasonic meters

- Meter demand

- ESTONIA

- Smart meters

- Meter demand

- FINLAND

- Smart meters

- Meter demand

- FRANCE

- Smart meters

- Ultrasonic gas meters

- Meter demand

- GERMANY

- Smart meters

- Ultrasonic meters

- Meter demand

- GREECE

- Smart meters

- Meter demand

- HUNGARY

- Smart meters

- Meter demand

- IRELAND

- Smart meters

- Meter demand

- ITALY

- Smart meters

- Ultrasonic meters

- Meter demand

- LATVIA

- Smart meters

- Meter demand

- LITHUANIA

- Smart meters

- Meter demand

- NETHERLANDS

- Smart meters

- Ultrasonic gas meters

- Meter demand

- POLAND

- Smart meters

- Meter demand

- PORTUGAL

- Smart meters

- Meter demand

- ROMANIA

- Smart meters

- Meter demand

- SLOVAK REPUBLIC

- Smart meters

- SLOVENIA

- Smart meters

- SPAIN

- Smart meters

- Meter demand

- SWEDEN

- Smart meters

- Meter demand

- SWITZERLAND

- Smart meters

- Meter demand

- TURKEY

- Prepayment gas meters

- Smart meter progress

- Meter demand

- UNITED KINGDOM

- Certification

- Remanufacturing meters for the secondary or sub-metering market

- Smart meters

- Smart meter failures

- Pulse transmission of data for AMR

- Ultrasonic gas meters

8. THE GAS METER MARKET IN THE CIS

- Meter demand

- RUSSIA

- Smart meters

- Meter demand

- Meter manufacturers

- UKRAINE

- Meter production and manufacturers

- Smart meters

- Meter demand

- AZERBAIJAN

- Smart meters

- KAZAKHSTAN

- Smart meters

- UZBEKISTAN

- Smart meters

9. THE GAS METER MARKET IN THE MIDDLE EAST

- IRAN

- Meter demand

- Meter manufacturers

10. THE GAS METER MAKET IN AFRICA

- NORTH AFRICA

- Meter demand

- ALGERIA

- Meter demand

- Meter manufacturers

- EGYPT

- Meter demand

- Meter manufacturers

- SUB-SAHARAN AFRICA

11. THE GAS METER MARKET IN ASIA PACIFIC

- Meter demand Asia Pacific

- CHINA

- The development of distributed gas in China

- Manufactured gas

- LPG

- Natural gas

- City Gas players

- Smart meter progress

- Meter demand

- Meter manufacturers

- AUSTRALIA

- Smart meters

- Meter demand

- INDIA

- Historical development of City Gas Distribution

- Recent developments in the City Gas sector

- Smart meter progress

- Meter demand

- Gas meter companies

- INDONESIA

- Smart meters

- Meter demand

- JAPAN

- The intelligent Micom gas meter

- Ultrasonic intelligent gas meter

- Smart meters

- LPG meters

- Meter demand

- Meter manufacturers

- SOUTH KOREA

- Smart meters

- NEW ZEALAND

- Smart meter progress

- Meter demand

- PAKISTAN

- Meter demand

- Meter manufacturers

- TAIWAN

- Smart meters

- Meter demand

- Meter manufacturers

- THAILAND

12. THE GAS METER MARKET IN NORTH AMERICA

- UNITED STATES

- Gas industry structure

- Smart meters

- Ultrasonic meters

- Meter demand

- Meter manufacturers

- CANADA

- Smart meters

- Ultrasonic meters

- Meter demand

- MEXICO

- Meter demand

13. THE GAS METER MARKET IN SOUTH AMERICA

- Meter demand

- ARGENTINA

- Meter demand

- BRAZIL

- Meter demand

- CHILE

- Meter demand

- COLOMBIA

- Meter demand

14. THE GAS METER MARKET IN CENTRAL AMERICA

15. COMPETITIVE ANALYSIS, COMPANY PROFILES AND MARKET SHARES

- Elster

- Itron

- Landis+Gyr

- Dresser

- Diehl

- Apator

- Panasonic

- Nicor Gas

- Sagemcom

- Sensus

- Dongfa Group

- Holley

- Qianwei Kromschroder

- Emerson

- DNV GL

16. NGV and AUTOGAS METERING

- The filling process

17. THE ORIGINS OF THE GLOBAL GAS INDUSTRY

- Electricity versus Gas

- Natural gas in the energy transition

18. GAS SOURCES, TYPES AND DELIVERY

- GAS CATEGORIES

- Natural gas

- Manufactured gas

- Coke-oven gas

- 4. Liquefied petroleum gas (LPG)

- Coal gas

- Biogas

- Blast furnace gas

- Gas hydrates

- Refinery gas

- Syngas - SNG

- PG Autogas

- GAS DELIVERY AND STORAGE

- Piped gas

- Natural gas liquids, Liquefied Natural Gas (LNG)

- Liquefied petroleum gas (LPG)

- Compressed natural gas (CNG)

- METHODOLOGY

- Installed base of gas meters

- Installed base

- Demand for gas meters

- Long term demand cycle

- Long-term annual demand trend in France, reconfigured by the deployment of smart gas meters.

- Short term demand

Figures

- Figure 1: The global installed base of households with electricity and gas, 1900-2050

- Figure 2: Households with access to gas by region, 1900-2025.

- Figure 3: Long-term annual demand trend of basic diaphragm meters, France, 1900-2050.

- Figure 4: Long-term annual demand trend, reconfigured by the deployment of smart gas meters in a short rollout without periodic upgrading, France, 1900-2050.

- Figure 5: Gas gathering, transmission and distribution systems.

- Figure 6: The world's major gas transmission and distribution networks in km, 2018 and 2021.

- Figure 7: The European gas grid in 1965.

- Figure 8: The European gas grid in 2018.

- Figure 9: Natural gas pipeline flows into Europe from Russia since January 2022.

- Figure 10: Numbers of housing units, all gas and residential gas consumers, Europe,1900-2050.

- Figure 11: Numbers of metered users of gas, Europe, thousands, 2023

- Figure 12: Numbers of housing units, electricity and gas consumers, Austria, 1950-2030.

- Figure 13: Numbers of housing units, gas and electricity consumers, Belgium, 1950-2030.

- Figure 14: Numbers of housing units, gas and electricity consumers, Bulgaria, 1950-2050.

- Figure 15: Numbers of housing units, gas and electricity consumers, Czech Republic, 1950-2030.

- Figure 16: Numbers of housing units, gas and electricity consumers, Denmark, 1950-2020.

- Figure 17: Numbers of housing units, gas and electricity consumers, Estonia, 1900-2030.

- Figure 18: Numbers of housing units, gas and electricity consumers, Finland, 1900-2030.

- Figure 19: Household penetration of manufactured gas, natural gas and LPG in France, 1900-2030.

- Figure 20: Gazpar smart gas meter.

- Figure 21: Household penetration of manufactured gas, natural gas and LPG in Germany, 1900-2030.

- Figure 22: Numbers of housing units, gas and electricity consumers, Greece, 1950-2030.

- Figure 23: Numbers of housing units, gas and electricity consumers, Hungary, 1950-2030.

- Figure 24: Numbers of housing units, gas and electricity consumers, Ireland, 1950-2030.

- Figure 25: Household penetration of manufactured gas, natural gas and LPG in Italy, 1900-2030.

- Figure 26: Numbers of housing units, gas and electricity consumers, Latvia, 1950-2030.

- Figure 27: Numbers of housing units, gas and electricity consumers, Lithuania, 1950-2030.

- Figure 28: Numbers of housing units, gas and electricity consumers, Netherlands, 1950-2030.

- Figure 29: Numbers of housing units, gas and electricity consumers, Poland, 1950-2030.

- Figure 30: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Poland, 2019-2025.

- Figure 31: Numbers of housing units, gas and electricity consumers, Portugal, 1950-2030.

- Figure 32: Numbers of housing units, gas and electricity consumers, Romania, 1950-2030.

- Figure 33: Numbers of housing units, gas and electricity consumers, Slovak Republic 1950-2030.

- Figure 34: Numbers of housing units, gas and electricity consumers, Slovenia, 1950-2030.

- Figure 35: Numbers of housing units, gas and electricity consumers, Spain, 1950-2030.

- Figure 36: Numbers of housing units, gas and electricity consumers, Sweden, 1950-2030.

- Figure 37: Numbers of housing units, gas and electricity consumers, Switzerland, 1950-2030.

- Figure 38: Numbers of housing units, gas and electricity consumers, Turkey, 1950-2030.

- Figure 39: Household penetration of manufactured gas, natural gas and LPG in the UK, 1900-2030.

- Figure 40: The impact of Covid 19 on the smart meter rollout in the UK for domestic smart meters.

- Figure 41: Numbers of housing units, all gas and residential consumers, CIS, 1950-2030.

- Figure 42: Household penetration of manufactured gas, natural gas and LPG in Russia, 1900-2030.

- Figure 43: Numbers of housing units, gas and electricity consumers, Russia, 1950-2030.

- Figure 44: Numbers of housing units, electricity and gas consumers, Azerbaijan, 1950-2030.

- Figure 45: Numbers of housing units, electricity and gas consumers, Kazakhstan, 1950-2030.

- Figure 46: Numbers of housing units, all gas and residential consumers, Middle East, 1950-2030.

- Figure 47: Numbers of housing units, electricity and gas consumers, North Africa, 1950-2030.

- Figure 48: Numbers of housing units, electricity and gas consumers, Algeria, 1950-2030.

- Figure 49: Numbers of housing units, electricity and gas consumers, Egypt, 1950-2030.

- Figure 50: Numbers of housing units, electricity and gas consumers, Sub-Saharan Africa, 1950-2030.

- Figure 51: Numbers of housing units, electricity and gas consumers, Asia-Pacific not inc. China, 1950-2030.

- Figure 52: Length of pipeline networks for Manufactured Gas, LPG and Natural Gas in China, 1978-2015.

- Figure 53: Numbers of households, PNGand manufactured gas and cylinder LPG, China, 2000-2030.

- Figure 54: Numbers of housing units, electricity and gas consumers, Australia, 1950-2030.

- Figure 55: City Gas Distribution rounds of bidding, 2008-2921.

- Figure 56: Numbers of housing units, electricity and gas consumers, India, 1950-2030.

- Figure 57: Numbers of housing units, electricity and gas consumers, Indonesia, 1950-2030.

- Figure 58: Household penetration of manufactured gas, natural gas and LPG in Japan, 1900-2030.

- Figure 59: Micom, conventional diaphragm intelligent gas meter.

- Figure 60 : Ultrasonic gas meter.

- Figure 61: Numbers of housing units, all gas and residential consumers, South Korea, 2000-2030.

- Figure 62: Numbers of housing units, electricity and gas consumers, New Zealand, 1950-2030.

- Figure 63: Numbers of housing units, electricity and gas consumers, Pakistan, 1950-2030.

- Figure 64: Numbers of housing units, electricity and gas consumers, Taiwan, 1950-2030.

- Figure 65: Household penetration of manufactured gas, natural gas and LPG in the USA, 1900-2030.

- Figure 66: Numbers of housing units, electricity and gas consumers, Canada, 1950-2030.

- Figure 67: Numbers of housing units, electricity and gas consumers, Mexico, 1950-2030.

- Figure 68: Numbers of housing units, electricity and gas consumers, Brazil, 1950-2030.

- Figure 69: Numbers of housing units, electricity and gas consumers, Chile, 1950-2030.

- Figure 70: Numbers of housing units, electricity and gas consumers, Columbia, 1950-2030.

- Figure 71: Numbers of housing units, all gas and residential consumers, Central America, 1900-2020.

- Figure 72: Market shares of gas meter manufacturers in value 2023.

- Figure 73: Timeline of global gas and electricity distribution.

Tables

- Table 1: Demographics, gas consumers and demand for gas meters in units and $ value, by region 2023.

- Table 2: Demographics, gas consumers and demand for gas meters in units and $ value, by country 2023.

- Table 3: Demand trend for gas meters, IGC and residential,in units, $ value, selected countries, 2022-2028.

- Table 4: Demand for gas meters in units, by region and country, 2018-2028..

- Table 5 Demand for gas meters in $ value, by region and country, 2018-28

- Table 6: Demand for smart gas meters in units by country, 2018 to 2028

- Table 7: Changes in the demand cycles for gas meter markets by country.

- Table 8: Typical turndown ratios of gas meter types.

- Table 9: G number for flow rates of gas metres

- Table 10: Basic population and gas statistics, Europe.

- Table 11: The status of smart gas metering in Europe, 2023.

- Table 12: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Europe, 2022-28.

- Table 13: Basic population and gas statistics, Austria.

- Table 14: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Austria, 2022-2028.

- Table 15: Basic population and gas statistics, Belgium.

- Table 16: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Belgium, 2022-2028.

- Table 17 : Basic population and gas statistics, Bulgaria.

- Table 18: Basic population and gas statistics, Czech Republic.

- Table 19: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Czech Republic, 2022-2028.

- Table 20: Basic population and gas statistics, Denmark.

- Table 21: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Denmark, 2022-2028.

- Table 22: Basic population and gas statistics, Estonia.

- Table 23: Basic population and gas statistics, Finland.

- Table 24: Basic population and gas statistics, France.

- Table 25: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, France, 2022-2028.

- Table 26: Basic population and gas statistics, Germany.

- Table 27: Gas meters in use in Germany by type.

- Table 28: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Germany, 2022-2028.

- Table 29: Basic population and gas statistics, Greece.

- Table 30: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Greece, 2022-2028.

- Table 31: Basic population and gas statistics, Hungary.

- Table 32: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Hungary, 2022-2028.

- Table 33: Basic population and gas statistics, Ireland.

- Table 34: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Ireland, 2022-2028.

- Table 35: Basic population and gas statistics, Italy.

- Table 36: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Italy, 2022-2028.

- Table 37: Basic population and gas statistics, Latvia

- Table 38: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Latvia, 2022-2028.

- Table 39: Basic population and gas statistics, Lithuania.

- Table 40: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Lithuania, 2022-2028.

- Table 41: Basic population and gas statistics, Netherlands.

- Table 42: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Netherlands, 2022-28.

- Table 43: Basic population and gas statistics, Poland.

- Table 44: Basic population and gas statistics, Portugal.

- Table 45: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Portugal, 2022-2028.

- Table 46: Basic population and gas statistics, Romania.

- Table 47: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Romania, 2022-2028.

- Table 48: Basic population and gas statistics, Slovak Republic.

- Table 49 : Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Slovak Republic, 2022-2028.

- Table 50: Basic population and gas statistics, Slovenia.

- Table 51: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Slovenia, 2022-2028.

- Table 52: Basic population and gas statistics, Spain.

- Table 53: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Spain, 2022-2028.

- Table 54: Basic population and gas statistics, Sweden.

- Table 55: Basic population and gas statistics, Switzerland.

- Table 56: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Switzerland, 2022-2028.

- Table 57: Basic population and gas statistic, Turkey.

- Table 58: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Turkey, 2022-2028.

- Table 59: Basic population and gas statistics, United Kingdom.

- Table 60: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, United Kingdom, 2022-2028.

- Table 61: Basic population and gas statistics, CIS.

- Table 62: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, CIS, 2022-2028.

- Table 63: Basic population and gas statistics, Russia.

- Table 64: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Russia, 2022-2028.

- Table 65: Basic population and gas statistics, Ukraine.

- Table 66: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Ukraine, 2022-2028.

- Table 67: Basic population and gas statistics, Azerbaijan.

- Table 68: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Azerbaijan, 2022-2028.

- Table 69: Basic population and gas statistics, Kazakhstan.

- Table 70: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Kazakhstan, 2022-2028.

- Table 71: Basic population and gas statistics, Uzbekistan.

- Table 72: Numbers of housing units, electricity and gas consumers, Uzbekistan, 1950-2030.

- Table 73: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Uzbekistan, 2022-2028.

- Table 74: Basic population and gas statistics, Middle East.

- Table 75: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Middle East, 2022-2028

- Table 76: Basic population and gas statistics, Iran.

- Table 77: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Iran, 2022-2028.

- Table 78: Basic population and gas statistics, North Africa

- Table 79: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, North Africa, 2022-2028.

- Table 80: Basic population and gas statistics, Algeria.

- Table 81: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Algeria, 2022-2028.

- Table 82: Basic population and gas statistics, Egypt.

- Table 83: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Egypt, 2022-2028.

- Table 84: Basic population and gas statistics, sub-Saharan Africa.

- Table 85: Basic population and gas statistics, Asia Pacific not including China.

- Table 86: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Asia Pacific not including China, 2022-2028.

- Table 87: Basic population and gas statistics, China.

- Table 88: Five leading city gas distributors in China

- Table 89: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, China, 2022-2028.

- Table 90: Leading gas meter manufacturers in China

- Table 91: Basic population and gas statistics, Australia.

- Table 92: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Australia, 2022-2028.

- Table 93: Basic population and gas statistics, India.

- Table 94: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, India, 2022-2028.

- Table 95: Basic population and gas statistics, Indonesia.

- Table 96: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Indonesia, 2022-2028.

- Table 97: Basic population and gas statistics, Japan.

- Table 98: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Japan, 2022-2028.

- Table 99: Basic population and gas statistics, South Korea.

- Table 100: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Korea, 2022-2028.

- Table 101: Basic population and gas statistics, New Zealand.

- Table 102: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, New Zealand, 2022-2028.

- Table 103: Basic population and gas statistics, Pakistan.

- Table 104: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Pakistan, 2022-2028.

- Table 105: Basic population and gas statistics, Taiwan.

- Table 106: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Taiwan, 2022-2028.

- Table 107: Basic population and gas statistics, Thailand.

- Table 108: Basic population and gas statistics, United States.

- Table 109: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, United States, 2022-2028.

- Table 110: Basic population and gas statistics, Canada.

- Table 111: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Canada, 2022-2028.

- Table 112: Basic population and gas statistics, Mexico.

- Table 113: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Mexico, 2022-2028.

- Table 114: Basic population and gas statistics, South America.

- Table 115: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, selected countries in South America 2022-2028.

- Table 116: Basic population and gas statistics, Argentina.

- Table 117: Numbers of housing units, electricity and gas consumers, Argentina, 1950-2030.

- Table 118: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Argentina, 2022-2028.

- Table 119: Basic population and gas statistics, Brazil.

- Table 120: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Brazil, 2022-2028.

- Table 121: Basic population and gas statistics, Chile.

- Table 122: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Chile, 2022-2028.

- Table 123: Basic population and gas statistics, Colombia.

- Table 124: Annual demand trend for gas meters, IGC and residential, in units, $ value, with average selling price per meter, Columbia, 2022-2028.

- Table 125: Basic population and gas statistics, Central America (excluding Mexico) , 2013

02-2729-4219

+886-2-2729-4219