|

市場調查報告書

商品編碼

1498833

ALD/high-k金屬前驅體(重要材料)的全球市場,2024-2025ALD / High K Metal Precursors Market Report 2024-2025 (Critical Materials Report) |

||||||

價格

簡介目錄

本報告涵蓋了半導體裝置製造中使用的前驅物的市場前景和供應鏈。它還包括有關主要供應商的資訊,材料供應鏈中的問題和趨勢,供應商市場佔有率的估計和預測以及材料細分市場的預測。

範例視圖

目錄

第1章 執行摘要

第2章 研究範圍、目的與方法

第3章 半導體產業:市場現況與展望

- 世界經濟與展望

- 半導體產業與全球經濟的聯繫

- 半導體銷售額成長

- 台灣外包廠商每月銷售趨勢

- 晶片銷售趨勢:以電子產品領域劃分

- 電子產品的前景

- 汽車產業的前景

- 智慧型手機前景

- 電腦展望

- 伺服器/IT 市場

- 半導體製造業的成長與擴張

- 在晶片擴張方面投入巨資

- 美國新廠

- 全球工廠擴編推動成長

- 資本投資趨勢

- 先進邏輯技術路線圖

- 工廠投資評估

- 政策/貿易趨勢及其影響

- 半導體材料概述

- 引進的晶圓數量:未來預測(~2028年)

- 材料市場預測(~2028年)

第4章 材料市場趨勢

- CVD/ALD 金屬/high-k/先進電介質前驅體的市場趨勢

- 前驅市場(2023年):與2024年的聯繫

- 前驅體市場前景

- 金屬和high-k前驅物的出貨量預測:依細分市場(未來 5年)

- 前驅供應能力、需求與投資

- 主要供應商金屬及high-k前驅體產能

- 金屬/high-k產量:依地區劃分

- 擴大 ALD/CVD 材料產能

- 投資公告:概述

- 前驅供需平衡:概述

- 價格趨勢

- 技術趨勢/技術推廣因素:概述

- 前驅體的整體技術概述:技術趨勢

- 客戶驅動的技術

- NAND 路線圖與挑戰:堆疊/分層 3D NAND 級別

- 3D NAND 製程需要進步

- 新材料和蝕刻化學物質可實現 3D NAND 微縮-PF3(G)和 MOO2CL2(S)

- 鉬:基於 Lam 研究的半導體金屬化新前沿

- 需要在 DRAM 製程方面取得進展

- DRAM 未來的技術問題

- Micron推出突破性 NVDRAM:雙層 32 GB 非揮發性鐵電記憶體,具有類似 DRAM 的效能

- 先進邏輯路線圖與挑戰:邏輯電晶體EST.Roadmap

- 高階邏輯(Foundry)節點 HVM 估算

- 需要改進 ADV 邏輯流程

- 高階邏輯:未來的技術挑戰

- 光刻技術進步的影響

- CFET 架構:CFET 擴展的優勢

- 無機 EUV 光阻:ALD 沉積

- 分子層沉積(MLD)

- 區域選擇性沉積(ASD)

- 特殊/新興金屬及其用途

- 特殊/新興HIGH-K及其應用

- 區域考慮因素:金屬/high-k

- 區域因素與驅動因素

- EHS 與貿易/物流問題:金屬、high-k、電介質

- ESH金屬

- ESH high-k

- ESH 回收

- 貿易/物流問題:金屬材料

- 貿易/物流問題:high-k材料

- 分析師對high-k市場趨勢的評估

- 分析師對金屬市場趨勢的評估

第5章 供給面市場情勢

- 前驅體材料的市佔率

- 最新季活動:MERCK

- 最新季活動:AIR LIQUIDE

- 最新季活動:ENTEGRIS

- ADEKA

- 併購(M&A)活動與合作夥伴關係

- 工廠關閉

- 新進入公司

- MSP 推出 TURBO II(TM)蒸發器:半導體製造的下一代效率

- 新型 ZR 前驅體晶圓級二氧化鋯薄膜

- 鉬薄膜的進展:新型液體前驅體促進氣相沉積

- Hanwha為記憶體應用提供鉬沉積 ALD 設備

- 供應商或零件/產品線面臨停產風險

- 分析師對領先供應商的評估

第6章 下游供應鏈:前驅物

- 下游(次級)供應鏈:供應商與市場概覽

- 下游供應鏈:供應商和市場概述-二級範例:NOURYON 和 GELEST

- 下游供應鏈:供應商和市場概況-化學品和氣體管理系統

- 下游供應鏈:供應商與市場概況-化學品配送櫃

- 下游供應鏈:供應商和市場概覽-閥門歧管盒(VMB)

- 下游供應鏈:供應商和市場概況-散裝規格氣體系統

- 下游供應鏈:供應商和市場概況-氣櫃

- 下游供應鏈:供應商和市場概況-成型氣體和摻雜劑氣體混合器

- 下游供應鏈:供應商和市場概覽:化學品-監測和分析系統

- 底層材質:CVD/ALD 前驅體的趨勢

- 底層材質:工業級與半導體級

- 半導體級底層材料供應商的國際網絡:Merck

- 半導體級底層材料供應商的國際網路:Air Liquide

- 半導體級下層材料供應商最新訊息

- 下游供應鏈中斷

- 下游供應鏈工廠最新訊息

- 下游供應鏈工廠的最新資訊:HAFNIA 和 REO(DUBBO PROJECT)

- 對半導體產業所使用的礦物的依賴

- 下游供應鏈的趨勢:鈷

- 下游供應鏈的趨勢:鋯/鉿

- 下游供應鏈的趨勢:鉿

- 下游供應鏈的趨勢:鎵

- 鋁

- 鈦

- 鎢

- 鉬

- 鈮鉭

- 稀土

- 下游供應鏈的趨勢:PGM

- 下游供應鏈的趨勢:鍺

- 下游供應鏈:分析師評估

第7章 供應商簡介

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- 20家以上其他公司

簡介目錄

This report covers the market landscape and supply-chain for Precursors used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 PRECURSORS BUSINESS - MARKET OVERVIEW

- 1.2 PRECURSORS MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT: METAL AND HIGH-K PRECURSORS

- 1.4 PRECURSOR TRENDS

- 1.5 PRECURSOR TECHNOLOGY TRENDS

- 1.6 COMPETITIVE LANDSCAPE METAL & HIGH-K PRECURSORS

- 1.7 PRECURSOR EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.8 ANALYST ASSESSMENT OF METAL AND HIGH-K PRECURSORS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 MATERIAL MARKET TRENDS

- 4.1 CVD, ALD METAL & HIGH-K AND ADVANCED DIELECTRIC PRECURSORS MARKET TRENDS

- 4.1.1 2023 PRECURSOR MARKET LEADING INTO 2024

- 4.1.2 PRECURSOR MARKET OUTLOOK

- 4.1.3 METAL AND HIGH-K PRECURSORS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.2 PRECURSORS SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.1 METAL & HIGH-K PRECURSOR PRODUCTION CAPACITY OF TOP SUPPLIERS

- 4.2.2 METAL & HIGH-K PRODUCTION BY REGION

- 4.2.3 ALD/CVD MATERIAL PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.5 PRECURSORS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.3 PRICING TRENDS

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 PRECURSOR GENERAL TECHNOLOGY OVERVIEW & TECHNOLOGY TRENDS

- 4.4.2 CUSTOMER DRIVEN TECHNOLOGIES

- 4.4.3 NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 4.4.4 3D NAND PROCESS ADVANCES REQUIRED

- 4.4.5 NEW MATERIALS AND ETCH CHEMISTRIES ENABLE 3D NAND SCALING - PF3(G) AND MOO2CL2(S)

- 4.4.6 MOLYBDENUM: THE NEW FRONTIER IN SEMICONDUCTOR METALLIZATION ACCORDING TO LAM RESEARCH

- 4.4.7 DRAM PROCESS ADVANCES REQUIRED

- 4.4.8 DRAM FUTURE TECHNOLOGY CHALLENGES

- 4.4.9 MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILE FERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 4.4.10 ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 4.4.11 ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 4.4.12 ADV LOGIC PROCESS ADVANCES REQUIRED

- 4.4.12.1 THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 4.4.13 ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 4.4.14 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 4.4.14.1 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 4.4.14.2 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 4.4.14.3 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 4.4.15 CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 4.4.15.1 CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 4.4.15.2 CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 4.4.16 INORGANIC EUV RESIST - ALD DEPOSITED

- 4.4.17 MOLECULAR LAYER DEPOSITION (MLD)

- 4.4.17.1 TREND IS MLD COMBINED WITH ALD

- 4.4.17.2 DIFFERENT TYPES OF MLD PRECURSORS AND MATERIALS

- 4.4.17.3 MLD APPLICATIONS

- 4.4.18 AREA SELECTIVE DEPOSITION (ASD)

- 4.4.18.1 AREA SELECTIVE DEPOSITION (ASD) - ADEKA PRESENT ASD HF-PRECURSOR

- 4.4.18.2 AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 4.4.20 SPECIALTY/EMERGING METAL AND APPLICATIONS

- 4.4.21 SPECIALTY/EMERGING HIGH-K AND APPLICATIONS

- 4.5 REGIONAL CONSIDERATIONS - METAL AND HIGH-K

- 4.5.1 REGIONAL ASPECTS AND DRIVERS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES - METALS, HIGH-K AND DIELECTRICS

- 4.6.1 ESH METALS

- 4.6.2 ESH HIGH-K

- 4.6.3 ESH RECYCLING

- 4.7 TRADE/LOGISTICS ISSUES - METAL MATERIALS

- 4.7.1 TRADE/LOGISTICS ISSUES - HIGH-K MATERIALS

- 4.8 ANALYST ASSESSMENT OF HIGH-K MARKET TRENDS

- 4.8.1 ANALYST ASSESSMENT OF METAL MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 PRECURSOR MATERIAL MARKET SHARE

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.1.1.1 MERCK

- 5.1.2 CURRENT QUARTER ACTIVITY - AIR LIQUIDE

- 5.1.2.1 AIR LIQUIDE

- 5.1.3 CURRENT QUARTER ACTIVITY -ENTEGRIS

- 5.1.3.1 ENTEGRIS

- 5.1.4 ADEKA

- 5.1.4.1 ADEKA

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.2 M&A ACTIVITY AND PARTNERSHIPS

- 5.3 PLANT CLOSURES

- 5.4 NEW ENTRANTS

- 5.4.1 MSP LAUNCHES TURBO II(TM) VAPORIZERS: NEXT-GEN EFFICIENCY FOR SEMICONDUCTOR FABRICATION

- 5.4.2 A NEW ZR PRECURSOR WAFER-SCALE ZIRCONIUM DIOXIDE FILMS

- 5.4.3 ADVANCES IN MOLYBDENUM THIN FILMS: NEW LIQUID PRECURSORS BOOST VAPOR PHASE DEPOSITION

- 5.4.4 HANWHA TO SUPPLY ALD EQUIPMENT FOR MOLYBDENUM DEPOSITION FOR MEMORY APPLICATIONS

- 5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 SUB-TIER SUPPLY-CHAIN, PRECURSORS

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - TIER 2 EXAMPLES NOURYON AND GELEST

- 6.1.2 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL & GAS MANAGEMENT SYSTEMS

- 6.1.3 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL DELIVERY CABINETS

- 6.1.4 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW VALVE MANIFOLD BOXES (VMB)

- 6.1.5 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - BULK SPEC GAS SYSTEMS

- 6.1.6 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - GAS CABINETS

- 6.1.7 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - FORMING GAS & DOPANT GAS BLENDERS

- 6.1.8 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW CHEMICAL - MONITORING AND ANALYTICAL SYSTEMS

- 6.2 SUB-TIER MATERIAL CVD & ALD PRECURSOR TRENDS

- 6.3 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR-GRADE

- 6.4 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK MERCK

- 6.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK AIR LIQUIDE

- 6.6 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.7 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS

- 6.8 SUB-TIER SUPPLY-CHAIN PLANT UPDATES

- 6.9 SUB-TIER SUPPLY-CHAIN PLANT UPDATES - HAFNIA AND REO FROM THE DUBBO PROJECT

- 6.10 MINERAL USED IN THE SEMICONDUCTOR INDUSTRY DEPENDENCIES

- 6.11 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - COBALT

- 6.12 SUB-TIER SUPPLY-CHAIN PRICING TRENDS: ZIRCONIUM AND HAFNIUM

- 6.13 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - HAFNIUM

- 6.14 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - GALLIUM

- 6.15 ALUMINUM

- 6.16 TITANIUM

- 6.17 TUNGSTEN

- 6.18 MOLYBDENUM

- 6.19 NIOBIUM AND TANTALUM

- 6.20 RARE EARTHS

- 6.21 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - PGM

- 6.22 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - GERMANIUM

- 6.23 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- ...AND 20+ MORE

FIGURES

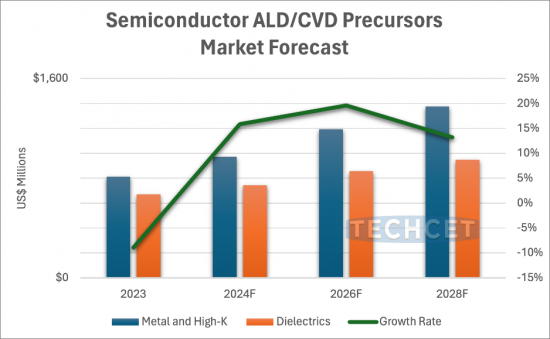

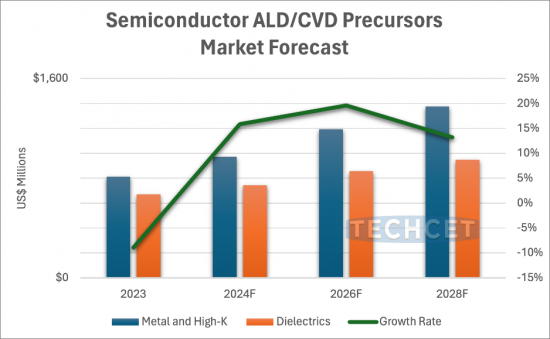

- FIGURE 1.1: METAL & HIGH-K PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 1.2: WW MARKET SHARE - METAL & HIGH-K PRECURSORS 2023 (U$ 811 M)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: METAL & HIGH-K PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 4.2: MEMORY SUPPLY/DEMAND SITUATION 2024

- FIGURE 4.3: WW MARKET SHARE - METAL & HIGH-K PRECURSORS 2023 (U$ 811 M)

- FIGURE 4.4: REGIONAL MARKET SHARES

- FIGURE 4.5: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 4.6: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 4.7: 3D NAND PROGRESSION

- FIGURE 4.8: ETCH DEPTH PERFORMANCE

- FIGURE 4.9: TOKYO ELECTRON'S NEW CRYOGENIC ETCH TOOL

- FIGURE 4.10: DRAM MESH BY MICRON

- FIGURE 4.11: IMEC CAPACITORLESS IGZO CELL FOR 3D STACKED DRAM

- FIGURE 4.12: TRANSITION FROM 2D TO 3D DRAM

- FIGURE 4.13: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 4.14: GATE STRUCTURE ROADMAP

- FIGURE 4.15: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 4.16: LOGIC TRANSISTOR PROGRESSION

- FIGURE 4.17: RIBBON FET

- FIGURE 4.18: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 4.19: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 4.20: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 4.21: DIRECTED SELF-ASSEMBLY

- FIGURE 4.22: DSA PATENT FILING BY COMPANY

- FIGURE 4.23: DSA PATEN FILING SINCE 2023

- FIGURE 4.24: WHAT IS PATTERN SHAPING?

- FIGURE 4.25: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 4.26: COMPLEMENTARY FET (CFET)

- FIGURE 4.27: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 4.28: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 4.29: MCFET NEW FEATURE: MIDDLE DIELECTRIC ISOLATION

- FIGURE 4.30: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 4.31: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 4.32: BSPDN ADVANTAGE: IR DROP REDUCTION

- FIGURE 4.33: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 4.34: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 4.35: PATENT FILING FOR MLD DEPOSITED EUV RESIST - SEARCH PERFORMED IN PATBASE

- FIGURE 4.36: MOLECULAR LAYER DEPOSITION VS ATOMIC LAYER DEPOSITION

- FIGURE 4.37: INCREASING TREND OF ALD/MLD PUBLICATIONS

- FIGURE 4.38: ADEKA ASD-HF PRECURSORS

- FIGURE 4.39: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 4.40: SPECIALTY/EMERGING METAL APPLICATIONS

- FIGURE 4.41: SPECIALTY/EMERGING HIGH-K APPLICATIONS - NVM DRAM (MICRON IEDM2023)

- FIGURE 4.42: 2023 METAL & HIGH-K REVENUE SHARE BY REGION

- FIGURE 4.43: EHS ISSUES - HIGH-K: MINING IN CHINA

- FIGURE 4.44: SK HYNIX'S RECYCLED AND RENEWABLE MATERIALS TARGETS

- FIGURE 5.1: 2023 PRECURSOR MATERIAL SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.2: MERCK ELECTRONICS REVENUE 2022-2023 (M EUR), LEFT - SEMICONDUCTOR SOLUTIONS ANNUAL REVENUE FORECAST (M EUR), RIGHT

- FIGURE 5.3: AIR LIQUIDE ELECTRONICS REVENUE FORECAST (M EUR)

- FIGURE 5.4: THE MS (MATERIAL SOLUTIONS) DIVISION OF ENTEGRIS REVENUE FORECAST

- FIGURE 5.5: ADEKA REVENUE ELECTRONICS REVENUE FORECAST (100M JPY)

- FIGURE 5.6: NEW ZIRCONIUM PRECURSOR CLASS

- FIGURE 5.7: ADVANCES IN MOLYBDENUM THIN FILMS: NEW LIQUID PRECURSORS BOOST VAPOR PHASE DEPOSITION

- FIGURE 6.1: FORMING GAS BLENDER CONFIGURATION

- FIGURE 6.2: TOP COUNTRIES/REGIONS THAT SUPPLY VERSUM MATERIALS US LLC (PANJIVA APRIL 2024)

- FIGURE 6.3: TOP COUNTRIES/REGIONS THAT SUPPLY AIR LIQUIDE AMERICA CORP. (PANJEIVA APRIL 2024)

- FIGURE 6.4: TOP COUNTRIES/REGIONS THAT SUPPLY H.C. STARCK INC. (USA)

- FIGURE 6.5: PRICE TREND IN COBALT

- FIGURE 6.6: HAFNIUM 5-YEAR PRICING

- FIGURE 6.7: GALLIUM PRICE, 5 YEAR HISTORICAL

- FIGURE 6.8: RUTHENIUM AND PLATINUM, 5-YEAR HISTORICAL PRICING

- FIGURE 6.9: GERMANIUM PRICE, 5-YEAR HISTORICAL

TABLES

- TABLE 1.1: METAL AND HI-K PRECURSORS REVENUES AND GROWTH RATES

- TABLE 1.2: ESTIMATED METAL AND HIGH-K PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: PRECURSORS REVENUE AND GROWTH RATES

- TABLE 4.2: METAL AND HI-K PRECURSORS REVENUES AND GROWTH RATES

- TABLE 4.3: ESTIMATED METAL AND HIGH-K PRECURSOR MARKET HARE BY SUPPLIER 2023

- TABLE 4.4: METAL & HIGH-K PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- TABLE 4.5: OVERVIEW OF ANNOUNCED 2023/2024 MATERIAL SUPPLIER INVESTMENTS

- TABLE 4.6: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 4.7: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS

- TABLE 4.8: REGIONAL PRECURSOR MATERIAL MARKETS

- TABLE 4.9: REGIONAL PRECURSOR MATERIAL MARKETS, CONTINUED

- TABLE 5.1: MERCK QUARTER FINANCIALS

- TABLE 5.2: AIR LIQUIDE CURRENT QUARTER FINANCIALS

- TABLE 5.3: ENTEGRIS SUPPLIER CURRENT QUARTER FINANCIALS

- TABLE 6.1: CVD AND ALD PRECURSOR

- TABLE 6.2: ORIGIN OF MINERALS USED TO MAKE PRECURSORS

- TABLE 6.3: COBALT MINING AND PRODUCTION BY LOCATION

- TABLE 6.4: ZIRCONIUM AND HAFNIUM MINERAL PRODUCTION BY LOCATION

- TABLE 6.5: GALLIUM MINERAL PRODUCTION DESCRIPTION AND DEPENDENCIES

- TABLE 6.6: ALUMINUM MINERAL REFINING AND PRODUCTION BY LOCATION

- TABLE 6.7: TITANIUM ORE (ILMENITE AND RUTILE) PRODUCTION LOCATIONS

- TABLE 6.8: TUNGSTEN ORE PRODUCTION BY LOCATION

- TABLE 6.9: MOLYBDENUM PRODUCTION AND IMPORT AND EXPORTS

- TABLE 6.10: MOLYBDENUM PRODUCTION DESCRIPTIONS

- TABLE 6.11: NIOBIUM AND TANTALUM PRODUCTION BY LOCATION

- TABLE 6.12: RARE EARTHS PRODUCTION BY LOCATION, I.E. LANTHANUM

- TABLE 6.13: PGM PRODUCTION BY LOCATION

- TABLE 6.14: GERMANIUM APPLICATIONS BY PERCENTAGE VOLUME

02-2729-4219

+886-2-2729-4219