|

市場調查報告書

商品編碼

1398376

Mini LED背光顯示器趨勢,OLED技術的競爭的分析(2025年)2025 Mini LED Backlight Display Trend and OLED Technology Competition Analysis |

|||||||

信息圖形

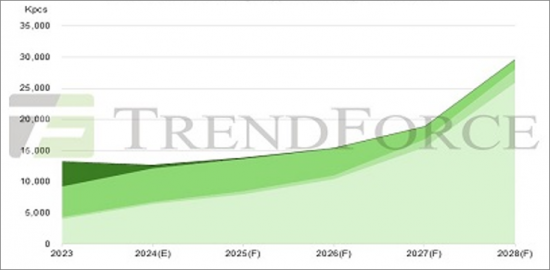

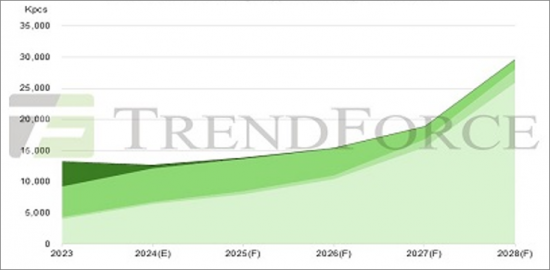

2024-2028年Mini LED背光應用出貨量預測

第一章產業趨勢:Mini LED與OLED零和博弈,大中小顯示器激烈競爭

搭載Mini LED背光源的液晶面板出貨量在各個細分領域都在增加,與OLED的對抗在所難免。在大、中、小面板的各種應用中,Mini LED背光的優勢正在被OLED犧牲,反之亦然,這是一場零和遊戲。有趣的是,這並不是科技發展史上常見的典型單向替代模式。相反,這兩種技術都有自己的優點和缺點,並且彼此之間存在著密切的競爭。

2024年Mini LED背光電視市場將呈現顯著成長,但品牌投資Mini LED背光技術的熱情卻較低,部分原因是OLED技術在IT市場的利多影響。 TrendForce預計,2024年各類應用的總出貨量將為1,270萬台,較2023年下降5%。

Mini LED 在電視、汽車和未來 MNT 市場上比 OLED 更具優勢。雖然Mini LED背光電視節省的成本顯著,但OLED技術在大型電視市場的實力有限。為了加強產品差異化、增加品牌競爭力,Mini LED背光技術是升級產品規格的合適解決方案。從長遠來看,這一趨勢也將對MNT市場產生正面影響,成為提高MNT滲透率的推動因素。在汽車市場,Mini LED背光在可靠性方面具有優勢,出貨量佔有率高於OLED。

不過,在筆記型電腦、平板電腦和VR領域,Mini LED的競爭力不如OLED。蘋果在其NB和平板電腦產品中採用OLED將改變整體市場格局,導致Mini LED背光技術在這兩個應用領域的滲透率持續下降。

第二章技術聚焦:Mini LED以降低成本為目標,OLED以效能提升為目標

2024年Mini LED背光最大的變化是解決方案逐漸成熟,從上游到下游各細分領域的廠商對於如何降低成本已經達成共識。全產業共識將加速產品標準化,鼓勵供應商規模化,進一步提高成本競爭力。由此,Mini LED背光發展的最大障礙可望被消除。

第三章電視市場:由於成功的市場區隔,全球Mini LED電視銷售將首次超過OLED電視。

2024年,Mini LED背光電視預計出貨量為642萬台。中國品牌製造商正在主導市場。隨著Mini LED背光供應鏈的完善以及企業逐步實施成本降低策略,全球出貨量將較2023年成長59%,呈現強勁成長。

OLED有77吋、83吋70至80吋顯示器等產品,但其在G8.5生產中的成本競爭力較低,並且在超大尺寸和靈活佈局方面無法趕上LCD。由於供應相對集中、面板價格不靈活、品牌策略不斷變化以及經濟切割尺寸集中在55英寸和65英寸,OLED將無法像LED背光電視那樣實現理想的市場細分。因此,就2024年總出貨量而言,Mini LED背光電視有望史上首次超越OLED電視。

長期來看,Mini LED背光電視的定價仍將低於OLED電視,部分產品將與高階液晶顯示器價格重疊,進一步提高Mini LED產品的滲透率。

在本報告中,我們對Mini LED背光顯示產業進行了研究和分析,提供了出貨量和滲透率、技術發展趨勢以及電視、IT和汽車三大市場發展趨勢的預測。

目錄

第1章 Mini LED背光/OLED應用出貨量及滲透率預測

- 消費者電子產品Mini LED背光的出貨台數(2024年~2028年)

- Mini 對LED背光的消費者電子產品的普及(2024年~2028年)

- Mini LED背光/OLED TV的出貨台數(2024年~2028年)

- Mini LED背光/OLED TV的普及率(2024年~2028年)

- Mini LED背光/OLED MNT的出貨台數(2024年~2028年)

- Mini LED背光/OLED MNT的普及率(2024年~2028年)

- Mini LED背光/OLED NB的出貨台數(2024年~2028年)

- Mini LED背光/OLED NB的普及率(2024年~2028年)

- Mini LED背光/OLED平板電腦的出貨台數(2024年~2028年)

- Mini LED背光/OLED平板電腦的普及率(2024年~2028年)

- Mini LED背光VR的出貨台數與普及率(2024年~2028年)

- Mini LED背光TV種類與LED的需求(2024年~2028年)

- Mini LED背光MNT種類與LED的需求(2024年~2028年)

- Mini LED背光NB種類與LED的需求(2024年~2028年)

- Mini LED背光平板電腦種類與LED的需求(2024年~2028年)

- Mini LED背光VR種類與LED的需求(2024年~2028年)

- Mini LED背光用途所需的LED(COB)

- Mini LED背光用途所需的LED(POB)

- Mini LED背光用途的LED(COB)的收益

- Mini LED背光用途的LED(POB)的收益

- Mini LED背光用途的LED(COB/POB)的收益

第二章Mini LED背光技術發展趨勢

- COB技術的成本降低分析

- PCB成本降低分析

- LED晶片成本降低分析

- Mini LED背光驅動架構分析

- 驅動IC成本降低分析

- AM驅動IC市場分析

- 主流8頻道AM驅動IC對比

- 製程和材料的成本降低分析

- 8.x代OLED面板廠投資計劃

- 計劃將 Apple 的 OLED 技術整合到其產品中

- OLED技術路線圖

- 提高 OLED 效率 - 華星光電噴墨 VS UDC 乾式列印

- OLED 效率提升 - JDI eLEAP VS 維信諾 ViP。

第三章Mini LED背光/OLED電視市場

- Mini LED 背光/OLED 電視供貨狀況:依地區

- Mini LED 背光/OLED 電視價格差異:按地區劃分

- 超大型電視的需求 - 75 吋和 80 吋(2022-2024 年)

- 超大型電視的需求 - 98 吋和 100 吋(2023-2024 年)

- Mini LED 背光電視價格變動:依地區

- 中國Mini LED背光電視規格與價格變化

- 中國低價Mini LED背光電視規格及價格變化

- 低區電視背光源成本分析

- 中區電視背光成本分析

- 高區電視背光源成本分析

- 品牌:Mini LED背光型號概述(2023/2024)

- Mini LED 背光電視出貨量:依品牌劃分(2023-2024 年)

- Mini LED背光電視供應鏈分析

- 主流Mini LED背光電視售價對比

- OLED電視出貨量及滲透率(2023-2024年)

- 電視面板價格比較:55 吋 OLED 與 LCD Open Cell

第四章Mini LED背光/OLED IT市場

1.MNT市場

- Mini LED 背光/OLED MNT 供貨狀況:依地區

- 中國Mini LED背光MNT數量變化

- Mini LED 背光/OLED MNT 價格差異:依地區

- Mini LED 背光 MNT 價格變動:依地區

- 中國Mini LED背光MNT規格及價格變化

- 美國Mini LED背光MNT規格及價格變化

- 英國Mini LED背光MNT規格及價格變化

- 中國玻璃基Mini LED背光MNT規格及價格變化

- Mini LED 背光 MNT 出貨量:依品牌劃分(2023-2024 年)

- 主流OLED MNT售價比較(2024年)

- OLED MNT面板供應狀況(2023-2025)

- OLED MNT 佔有率:按品牌劃分(2023-2024 年)

2.NB市場

- Mini LED 背光/OLED NB 供貨數量:依地區

- Mini LED背光/OLED NB價格差異:按地區

- Mini LED 背光 NB 價格變動:依地區

- NB LTPS LCD面板出貨量(2023-2025)

- NB OLED面板出貨量預測(2022-2027)

- OLED筆記型電腦出貨量預測(2022-2027)

3. 平板電腦市場

- Mini LED 背光/OLED 平板電腦供貨狀況:依地區

- Mini LED 背光/OLED 平板電腦價格差異:按地區劃分

4.其他地區的應用

- 印度Mini LED背光/OLED應用的可用數量

- 印度Mini LED背光/OLED應用的價格差異

- 巴西Mini LED背光/OLED應用的可用數量

- 巴西Mini LED背光/OLED應用的價格差異

第五章Mini LED車載顯示市場

- 智慧座艙的趨勢

- 車載顯示技術概述

- 汽車顯示面板出貨量及滲透率(2024-2028)

- 車用背光LED市場價值分析(2024-2028)

- Mini LED/HDR 汽車顯示器趨勢 - 面板尺寸(2022-2023 年)

- Mini LED/HDR 汽車顯示器趨勢 - 調光區(2022-2023 年)

- Mini LED/HDR 汽車顯示器 - 規格與供應鏈(2022 年)

- Mini LED/HDR 汽車顯示器 - 規格與供應鏈 (2023)

- COB/COG/POG 技術分析

- Mini LED/HDR 汽車顯示器時間表和規格(2022-2028 年)

- NIO ET7/ET5/ES7 車載顯示器 - 規格與成本分析

- 榮威 RX5 汽車顯示器 - 規格和成本分析

- 凱迪拉克 LYRIQ 汽車顯示器 – 規格與成本分析

- Minc Electra E5 汽車顯示器 - 規格與成本分析

- 林肯 Nautilus 汽車顯示器 - 規格與成本分析

- 凱迪拉克 Celestic 汽車顯示器 - 規格與成本分析

- LCD(邊緣式/直下式)與OLED汽車顯示器規格比較

- 汽車顯示器成本分析 - 邊緣/直下式(2024 年)

- 車用背光LED產品規格及價格分析(2024年)

- Mini LED車用顯示器-驅動IC規格分析

- Mini LED車用顯示器-Direct/Scan驅動IC優缺點分析

- OLED 汽車顯示器時間表和規格(2022-2024 年)

- 車上背光顯示器市場現況分析

- HUD 市場出貨量 - 產品與區域市場分析(2024-2028 年)

- HUD 產品規格分析(2024 年)

- AR-HUD技術分析

- HUD 產品價格分析(2023-2024 年)

- 全景平視顯示器(P-HUD)與透明顯示器

- AR-HUD OEM 供應鏈與產品規格分析

- HUD市場情勢分析

第6章 Mini LED背光產業的動態,Mini LED背光市場供應鏈

- LED晶片廠商:HC Semitek

- LED晶片廠商:Aucksun

- 驅動 IC廠商:HYASiC

- 驅動 IC廠商:X-Signal Integrated

- 設備企業:Kulicke & Soffa

- 設備供應商:HOSON

- LED構裝供應商:Everlight

- LED構裝供應商:Lextar

- LED構裝供應商:Jufei

- LED構裝供應商:APT Electronics

- LED構裝供應商:Hongli Display

- LED構裝供應商:Nationstar

- LED模組廠商:Core Photoelectric Technology

- LED構裝供應商:HGC

- LED構裝供應商:ESPACE

- LED構裝供應商:COREACH

- LED玻璃基材廠商:WG Tech

- 用途企業:BOE

- 用途企業:Tianma

- 用途企業:TCL

- 用途企業:Hisense

- 用途企業:小米

INFOGRAPHICS

2024-2028 Mini LED Backlight Applications Shipments Forecast

Chapter 1 Industry Trends: Mini LED and OLED in Zero-sum Game, with Fierce Competition between Large-, Mid-, and Small-size Displays

With expanded shipments of LCD panels engineered with Mini LED backlight for various segments, the confrontation with OLED is inevitable. In various application across large, medium, and small panels, it has become a zero-sum game: gains for Mini LED backlight come at the expense of OLED, and vice versa. Interestingly, this is not the typical one-way replacement mode usually seen in the history of technological development. Instead, both technologies have their own strengths and weaknesses, competing closely with each other.

Although the Mini LED backlight TV market makes a significant increase in 2024, the positive impact of OLED technology in the IT market has also suppressed the enthusiasm of brands in investing in Mini LED backlight technology. TrendForce estimates that the total shipment of each application will be 12.7Mpcs in 2024, a decrease of 5% compared to 2023.

In the TV, automotive, and future MNT markets, Mini LED holds more advantages over OLED. The cost reduction effect of Mini LED backlight TV is significant, while OLED technology shows limited strength in the large-sized TV market. To enhance product differentiation and increase brand competitiveness, Mini LED backlight technology is the preferred solution for upgrading product specifications. In the long term, this trend will also have a positive impact on the MNT market, driving an increase in its penetration rate. In the automotive market, Mini LED backlight have won the reliability advantage, resulting in a higher share of shipments than OLED.

However, in the NB , Tablet, and VR sectors, Mini LED is not as competitive as OLED.Apple's embrace of OLED for NB and Tablet products will change the entire market landscape, leading to a continuous reduction in the penetration rate of Mini LED backlight technology in these two application areas.

Chapter 2 Technical Focus: Mini LED Strives for Cost Down, while OLED Aims at Better Performance

The biggest change in Mini LED backlight in 2024 is that the solutions are gradually becoming more mature, and manufacturers throughout the upstream and downstream segments have reached a consensus on ways to reduce costs. This chapter explores the cost reduction strategies that the industry is focusing on, including various strategies related to PCB, LED chips, driver IC, and process materials. The industry-wide consensus helps accelerate the standardization of products, which encourages suppliers to boldly scale up and further enhance cost competitiveness. As a result, the biggest obstacle to the development of Mini LED backlight is expected to be removed. According to TrendForce's analysis, cost reduction strategies for Mini LED that have achieved high consensus are as follows:

1. PCB Cost Down Analysis

- The form of PCB has transitioned from FR4 to single-sided aluminum substrates, comb boards, and light bars, which are applied to products with high, medium, and low dimming zone count, respectively.

- The harpoon board design enhances PCB material utilization, reducing the cost by more than 30%.

- Reduced material usage, increased single-board utilization, and decreased precision requirements have lowered PCB manufacturing costs but introduced reliability challenges.

- The key opportunity for cost reduction lies in whether the size of individual light boards can be standardized.

2. LED Chip Cost Down Analysis

- Increasing the pitch or optimizing the light emission angle through optical design to reduce the number of LEDs can achieve cost reduction.

- Using high-voltage chips(18V/24V/36V) not only reduces the number of LED per zone but also offers higher luminous efficiency, lower driving current, and simpler routing overall.

3. Driver IC Cost Down Analysis

- Among the two driving modes, Passive Matrix (PM) and Active Matrix (AM), the AM scheme is widely adopted due to its simple wiring and the ability to drive each zone separately.

- The AM driver IC is paired with a single-layer aluminum substrate and high-voltage LED chips to reduce the number of LED series connections, maximize driving efficiency, and lower PCB wiring complexity.

- As the number of dimming zones increases, more driver IC are needed.

- The material costs of using an AM driver IC are significantly reduced by over 70% compared to a PM driver IC, and increasing the number of channels further expands the cost reduction advantage.

4. Process and Materials Cost Down Analysis

- Currently, mainstream COB products are engineered with dispensing technology, which reduces material and manufacturing process costs while improving light uniformity.

- some manufacturers have replaced QD diffusion films with QD diffusion plates, reducing the cost by 20% in a single-channel process. However, high-temperature reliability challenges may still be encountered.

This chapter also discusses how, under the significant cost reduction pressure from Mini LED players, OLED manufacturers are advancing their technology to make their solutions increasingly refined, thereby defending against the threat posed by Mini LED.

Chapter 3 TV Market: Successful Market Segmentation Allows Mini LED TVs to Surpass OLED TVs in Global Sales for the First Time

From this chapter to Chapter 5, we will analyze the development trends of Mini LED backlight in the three major markets: TV, IT, and automotive.

In 2024, the estimated shipment of Mini LED backlight TV is 6,420K units. Chinese brand manufacturers have gained dominance in the market. With the improvement of the Mini LED backlight supply chain and the gradual implementation of cost reduction strategies by various companies, there has been significant growth, with global shipments increasing by 59% compared to 2023.

Although OLED has products such as 77-inch and 83-inch displays for the 70-80 inch range, its cost competitiveness in G8.5 production is poor, leading to OLED's inability to keep up with LCD in flexible layouts for extra-large sizes.Given the relatively concentrated supply, inflexible panel prices, changes in branding strategy, and the concentration of economic cutting size at 55 and 65 inches, OLED cannot achieve desirable market segmentation like Mini LED backlight TV through a diversified coverage strategy. Therefore, for the first time in history, Mini LED backlight TV will surpass OLED TV in total shipments for 2024.

From a long-term perspective, the pricing of Mini LED backlight TVs is expected to remain lower than that of OLED TVs, with some products even overlapping in pricing with high-end LCD, further increasing the penetration rate of Mini LED products.

Chapter 4 IT Market: As OLED Solidifies Its High-End Status, Mini LED is Likely to Become a "Wall Breaker"

Shipment of Mini LED backlight MNT in 2024 is estimated to be 347K units, which is only a 48% growth rate compared to 2023, lower than initially expected. This is mainly because of the positive response to OLED technology in the high-end market, leading brands to invest more actively in OLED product lines, resulting in Samsung's market share shrinking to 46%. However, Chinese brands continue to enter the mid-to-low-end market, but due their limited recognition and promotion efforts, benefits are limited.

Chinese brands such as Taidu and Titan Army continue to advance the specifications of

OLED MNT are currently in high demand and are almost a standard configuration product for all brands targeting the high-end market.In 2024, the supply capacity of OLED MNT will double compared to 2023. SDC's QD OLED, accounting for 75%, remains mainstream, while LGD's WOLED supply scale is also gradually increasing.Due to the strong demand, the supply of OLED MNT panels is expected to climb to 2.4 million pieces in 2025, with CSOT also joining the supply ranks.With the increasing availability of OLED MNT panels, the willingness of brands to adopt Mini LED backlight will also be correspondingly weakened.Brands almost universally allocate their high-end MNT resources to the promotion of OLED, causing a significant crowding-out effect on similarly positioned Mini LED backlight products.

In the long run, we still have faith in the development of Mini LED applications in the IT sector. As the shipments of Mini LED backlight TV increase, the cost reduction benefits are expected to extend to MNT applications, once again demonstrating the strategic advantage of diversified coverage for Mini LED products. Mini LED could overcome the current situation where high-end MNT products are primarily confined to the gaming market.

The rest of this chapter includes analyses of the price differences between Mini LED backlight and OLED products in the NB market, as well as shipment analysis. In addition to analyzing product specifications in the major markets, namely the US, Europe, and China, this report also offers insights into India and Brazil by analyzing the models available and the local price trends of new Mini LED backlight and OLED displays.

Chapter 5 Automotive Market: Smart Cockpit Transitions from Concept to Mass Production, Allowing Mini LED to Benefit from Increased Display Number and Size

With the trend towards digitalization in smart cockpit, automotive displays have become a crucial interface for connecting vehicles and driver interaction. Automotive displays include instrument clusters, central displays, rear view mirrors, HUD, rear-seat entertainment applications, and more. With an increasing number of vehicles incorporating a variety of automotive display products, larger sizes, wider aspect ratios, more displays, and freer placement methods are becoming the development direction for in-car displays. Additionally, the continuous improvement of performance parameters such as High Dynamic Range (HDR), Local Dimming, Wide Color Gamut, etc., coupled with the increasing demand for automotive displays, indicates a sustained rapid growth trend in the automotive display market.According to TrendForce analysis, the shipment of automotive display panels is expected to reach 257 million units in 2028. Mini LED displays will reap the benefits, with a penetration rate of 5.9%, surpassing OLED's 4.1%.

Chapter 6 Industry Dynamics: From a Competitive Landscape of Numerous Businesses to Major Manufacturers, Elite Mini LED Players Have Emerged

As Mini LED backlight products gradually enter the mass production stage, there have been significant changes in the list of highly active manufacturers. Different players have bet on various technologies and product solutions. By 2024, mainstream technologies and solutions become clear throughout the market. Manufacturers who have made the right bets are now enjoying the winners' dividends and returns, while those who missed out are gearing up for another round of intense investments.

This chapter outlines the main supply chain for the Mini LED backlight market, focusing on the dynamics of leading manufacturers in chips, driver IC, transfer equipment, packaging and modules, and applications regarding their products, technologies, revenues, and supply chain activities in the Mini LED sector.

Compared to the conventional backlight, Mini LED backlight represents a major technological innovation, bringing significant changes to the industry landscape. Conventional backlight supply chain companies have strong first-mover advantages and incumbent benefits. However, new players are also fully benefiting from these changes, breaking the previous monopoly and rising to prominence. By 2024, powerful players have begun to take center stage in the industry arena.

In this report, we have added the analyses of niche businesses benefiting from Mini LED backlight, such as Aucksun, HYASiC, X-Signal Integrated, APT Electronics, Core Photoelectric Technology, HGC, COREACH, and ESPACE. We have also added an analysis focusing on the current development of WG Tech, a company with a comprehensive presence in LED glass substrates manufacturing.

Table of Contents

Chapter I. Mini LED Backlight/OLED Application Shipment and Penetration Rates Forecast

- 2024-2028 Mini LED Backlight Shipment for Consumer Electronics Applications

- 2024-2028 Mini LED Backlight Penetration for Consumer Electronics Applications

- 2024-2028 Mini LED Backlight/OLED TV Shipment

- 2024-2028 Mini LED Backlight/OLED TV Penetration Rate

- 2024-2028 Mini LED Backlight/OLED MNT Shipment

- 2024-2028 Mini LED Backlight /OLED MNT Penetration Rate

- 2024-2028 Mini LED Backlight/OLED NB Shipment

- 2024-2028 Mini LED Backlight /OLED NB Penetration Rate

- 2024-2028 Mini LED Backlight/OLED Tablet Shipment

- 2024-2028 Mini LED Backlight /OLED Tablet Penetration Rate

- 2024-2028 Mini LED Backlight VR Shipment and Penetration Rate

- 2024-2028 Mini LED Backlight TV Types and LED Demand

- 2024-2028 Mini LED Backlight MNT Types and LED Demand

- 2024-2028 Mini LED Backlight NB Types and LED Demand

- 2024-2028 Mini LED Backlight Tablet Types and LED Demand

- 2024-2028 Mini LED Backlight VR Types and LED Demand

- LED (COB) Demanded for Mini LED Backlight Applications

- LED (POB) Demanded for Mini LED Backlight Applications

- LED (COB) Revenue for Mini LED Backlight Applications

- LED (POB) Revenue for Mini LED Backlight Applications

- LED (COB/POB) Revenue for Mini LED Backlight Applications

Chapter II. Mini LED Backlight Technology Development Trend

- COB Technology Cost Down Analysis

- PCB Cost Down Analysis

- LED Chip Cost Down Analysis

- Mini LED Backlight Driving Architecture Analysis

- Driver IC Cost Down Analysis

- AM Driver IC Market Analysis

- Mainstream 8-Channel AM Driver IC Comparison

- Process and Materials Cost Down Analysis

- 8.x Generation OLED Panel Factory Investment Plan

- Apple's Plan for Integrating OLED Technology into Its Products

- OLED Technology Roadmap

- OLED Efficacy Improvement - CSOT Ink-jet VS. UDC Dry Printed

- OLED Efficacy Improvement - JDI eLEAP VS. Visionox ViP

Chapter III. Mini LED Backlight/OLED TV Market

- Quantity of Available Mini LED Backlight/OLED TV in Different Regions

- Mini LED Backlight/OLED TV Price Differences in Different Regions

- 2022-2024(E) Demand for Super-Large Sized TV - 75" and 80"

- 2023-2024(E) Demand for Ultra-Large Sizes TV - 98" and 100"

- Mini LED Backlight TV Price Changes in Different Regions

- Mini LED Backlight TV Specifications and Price Changes in China

- Low-Priced Mini LED Backlight TV Specifications and Price Changes in China

- Low-Zones TV Backlight Cost Analysis

- Mid-Zones TV Backlight Cost Analysis

- High-Zones TV Backlight Cost Analysis

- Brands: 2023 and 2024 Mini LED Backlight Models Overview

- 2023-2024 Mini LED Backlight TV Shipments by Brand

- Mini LED Backlight TV Supply Chain Analysis

- Mainstream Mini LED Backlight TV Selling Price Comparison

- 2023-2024(E) OLED TV Shipment and Penetration Rate

- TV Panel Price Comparison: 55" OLED vs. LCD Open Cell

Chapter IV. Mini LED Backlight/OLED IT Market

4.1. MNT Market

- Quantity of Available Mini LED Backlight/OLED MNT in Different Regions

- Quantity Changes of Mini LED Backlight MNT in China

- Mini LED Backlight/OLED MNT Price Differences in Different Regions

- Mini LED Backlight MNT Price Changes in Different Regions

- Mini LED Backlight MNT Specifications and Price Changes in China

- Mini LED Backlight MNT Specifications and Price Changes in the US

- Mini LED Backlight MNT Specifications and Price Changes in the UK

- Glass-based Mini LED Backlight MNT Specifications and Price Changes in China

- 2023-2024 Mini LED Backlight MNT Shipments by Brand

- 1H24 Mainstream OLED MNT Selling Price Comparison

- 2023-2025(F) OLED MNT Panel Supply Status

- 2023-2024(E) OLED MNT Share by Brands

4.2. NB Market

- Quantity of Available Mini LED Backlight/OLED NB in Different Regions

- Mini LED Backlight/OLED NB Price Differences in Different Regions

- Mini LED Backlight NB Price Changes in Different Regions

- 2023-2025(F) NB LTPS LCD Panel Shipment

- 2022-2027(F) NB OLED Panel Shipment Forecast

- 2022-2027(F) OLED NB Set Shipment Forecast

4.3. Tablet Market

- Quantity of Available Mini LED Backlight/OLED Tablet in Different Regions

- Mini LED Backlight/OLED Tablet Price Differences in Different Regions

4.4. Applications in Other Regions

- Quantity of Available Mini LED Backlight/OLED Applications in India

- Mini LED Backlight/OLED Applications Price Differences in India

- Quantity of Available Mini LED Backlight/OLED Applications in Brazil

- Mini LED Backlight/OLED Applications Price Differences in Brazil

Chapter V. Mini LED Automotive Display Market

- Smart Cockpit Trend

- Automotive Display Technology Overview

- 2024-2028 Automotive Display Panel Shipment and Penetration Rate

- 2024-2028 Automotive Backlight LED Market Value Analysis

- 2022-2023 Mini LED / HDR Automotive Display Trend- Panel Size

- 2022-2023 Mini LED / HDR Automotive Display Trend- Dimming Zones

- 2022 Mini LED / HDR Automotive Display- Specification vs. Supply Chain

- 2023 Mini LED / HDR Automotive Display- Specification vs. Supply Chain

- COB / COG / POG Technology Analysis

- 2022-2028 Mini LED / HDR Automotive Display Schedule and Specification

- NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

- Roewe RX5 Automotive Display- Specification and Cost Analysis

- Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

- Buick Electra E5 Automotive Display- Specification and Cost Analysis

- Lincoln Nautilus Automotive Display- Specification and Cost Analysis

- Cadillac Celestiq Automotive Display- Specification and Cost Analysis

- LCD (Edge / Direct-Type) vs. OLED Automotive Display Specification

- 2024 Automotive Display Cost Analysis- Edge / Direct-Type

- 2024 Automotive Backlight LED Product Specification and Price Analysis

- Mini LED Automotive Display- Driver IC Specification Analysis

- Mini LED Automotive Display- Direct / Scan Driver IC Pros-Cons Analysis

- 2022-2024 OLED Automotive Display Schedule and Specification

- Automotive Backlight Display Market Landscape Analysis

- 2024-2028 HUD Market Shipment- Product vs. Regional Market Analysis

- 2024 HUD Product Specification Analysis

- AR-HUD Technology Analysis

- 2023-2024 HUD Product Price Analysis

- Panoramic Head-up Display (P-HUD) vs. Transparent Display

- AR-HUD OEM Supply Chain and Product Specification Analysis

- HUD Market Landscape Analysis

Chapter VI. Mini LED Backlight Industry DynamicsMini LED Backlight Market Supply Chain

- LED Chip Manufacturer: HC Semitek

- LED Chip Manufacturer: Aucksun

- Driver IC Manufacturer: HYASiC

- Driver IC Manufacturer: X-Signal Integrated

- Equipment Player: Kulicke & Soffa

- Equipment Provider: HOSON

- LED Package Provider: Everlight

- LED Package Provider: Lextar

- LED Package Provider: Jufei

- LED Package Provider: APT Electronics

- LED Package Provider: Hongli Display

- LED Package Provider: Nationstar

- LED Module Manufacturer: Core Photoelectric Technology

- LED Package Provider: HGC

- LED Package Provider: ESPACE

- LED Package Provider: COREACH

- LED Glass Substrate Manufacturer: WG Tech

- Application Player: BOE

- Application Player: Tianma

- Application Player: TCL

- Application Player: Hisense

- Application Player: Xiaomi