|

市場調查報告書

商品編碼

1491039

Micro LED市場趨勢、技術與成本分析(2024年)2024 Micro LED Market Trend and Technology Cost Analysis |

|||||||

TrendForce 公佈Micro LED 晶片市場規模預估 2028 年達 5.8 億美元,聚焦頭戴式裝置 (HMD) 及車用應用

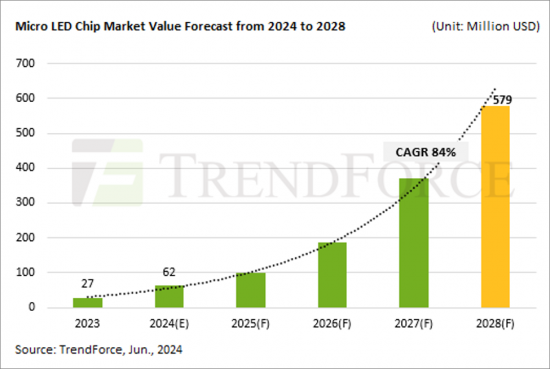

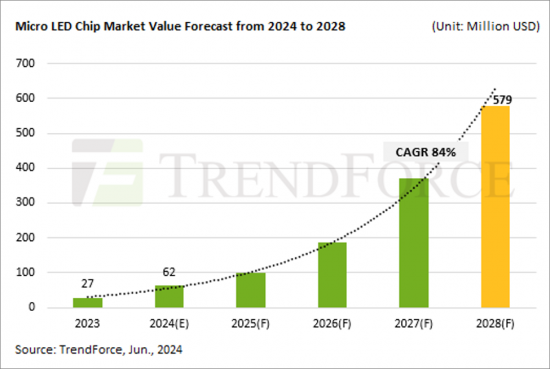

2024 年 6 月 3 日:透過小型化 LED 晶片來降低成本的努力正在取得進展。LGE□BOE□Vistar等公司持續投資大尺寸顯示器應用,友達則專注於開發智慧手錶產品。對頭戴式設備和新型車輛顯示應用的需求也在增加。根據TrendForce分析,2028年Micro LED晶片市場產值預計將達5.8億美元,2023年至2028年年複合成長率為84%。

Micro LED產業面臨的課題

無法降低成本和技術問題是蘋果停產Micro LED手錶的主要原因。因此,生產流程的持續最佳化對於Micro LED產業的發展至關重要。巨量轉移技術的發展預計將從單一技術轉向複合技術,例如將雷射轉移和印章轉移相結合,並具有無摩擦黏合能力的轉移解決方案的潛力。

檢查和修復製程對於提高 Micro LED 的產量和降低成本至關重要。目前的電氣測試方法正在改進,重點是精密探針卡和非接觸式測試。這些進步不僅引領了電氣檢測的發展,也為設備製造商帶來了龐大的商機。

Apple Watch 取消後,晶片供應商艾邁斯半導體歐司朗 (OSRAM) 正在考慮出售其位於馬來西亞的 8 吋工廠。如果買家是目前MicroLED供應鏈內的公司,則可能對該行業的技術發展和成本結構優化產生積極影響。考慮到技術路線和目標市場的變化,開發8吋SiC功率半導體的中國化合物半導體製造商也是潛在買家。這將使他們能夠擴展到國際市場,並為晶片製造商提供提高獲利能力的方法。

Micro LED 產業機會

與微型 OLED 等競爭技術相比,Micro LED(超小型 LED)具有明顯的優勢。在需要光引擎、高亮度、小體積的AR眼鏡中,Micro LED光引擎目前已經實現了小於0.2cc的尺寸。 Micro LED的亮度等級為35萬尼特,適合高亮度、全天候、全場景辨識。此外,人工智慧輔助工具的快速發展預計將在未來一到兩年內推動對採用 Micro LED 顯示器的 AR 眼鏡的需求。

在汽車領域,顯示器不需要極高的PPI,但需要更高的對比和可靠性。高亮度、高對比度、寬色域和快速響應的Micro-LED技術可以透過獨特的形狀、曲線、靈活性和回饋來整合到智慧座艙顯示解決方案中,從而增強駕駛體驗。這為 Micro LED 帶來了潛在的應用,包括 AR-HUD 和 P-HUDS 等車載場景,以及使用透明顯示器的車窗創新顯示技術。

在本報告中,我們分析了全球Micro LED的近期市場和技術趨勢,並概述了整體市場規模趨勢、各細分市場的技術發展進展、當前的技術問題以及重點企業的發展趨勢。正在調查個人資料和最新情況。

目錄

第一章Micro LED市場分析

- Micro LED市場規模分析(2024-2028):大型顯示器

- Micro LED市場規模比較(2024-2028):大型顯示器

- Micro LED 市場規模分析(2024-2028):穿戴式顯示器

- Micro LED市場規模比較(2024-2028):穿戴式顯示器

- Micro LED市場規模分析(2024-2028):頭戴式顯示器

- Micro LED市場規模比較(2024-2028):頭戴式顯示器

- Micro LED 市場規模分析(2024-2028 年):汽車顯示器

- Micro LED市場規模比較(2024-2028):車用顯示

- Micro LED 市場規模比較(2024-2028 年):行動裝置/IT 顯示器

- 市場規模分析(價值基礎,2024-2028 年)

- Micro LED 市佔率變化分析:依應用分類(2024 年)

- 晶圓市場需求分析(2024-2028)

第二章Micro LED技術發展

- Micro LED傳質技術的發展

- Micro LED TFT背板技術發展

- 質傳技術的發展

- 雷射轉移

- 接觸式轉帳與非接觸式轉賬

- 質傳技術:複雜的物理機制

- 質傳技術:複雜的轉移過程

- 巨量轉移技術:LGE 的 MDSAT 轉移技術

- 質傳技術:影響LED運動速度的因素分析

- 質傳技術:影響質傳效率的因素分析

- 質傳技術發展概述

- Micro LED檢測技術的發展

- Micro LED 檢測方法概述

- Micro LED 電氣檢測解決方案

- 高精度探針卡接觸電氣測試:NanoEx

- 非接觸式電氣測試:Top Engineering

第三章Micro LED大顯示市場分析

- Micro/Mini LED(COG方式)視訊牆規格及進展(2024年)

- Micro/Mini LED(COG方式)視訊牆規格及進展(2024年)

- Micro LED顯示器製造分析

- 6吋Micro LED(COC方式)價格趨勢(2021-2028)

- Micro LED晶片良率及品牌目標

- Micro LED晶片良率及品牌目標

- Samsung/AUO的LTPS驅動:框架分析

- 在拼接顯示器中路由 DDI 連接

- 側邊走線技術

- COG(側邊佈線)技術問題分析/公司側路線圖

- TGV(玻璃通孔)技術分析

- TGV解決方案提供者:康寧

第四章Micro LED穿戴顯示器市場分析

- Apple Micro LED 手錶規格與成本分析

- Micro LED手錶的製造分析

- Apple Micro LED Watch 的製造問題分析

- Apple取消 Micro LED 項目

- Apple Watch 計畫取消對產業的影響

- ams OSRAM馬來西亞8吋工廠:狀況分析

- AUO:圓形Micro LED顯示面板方案

- Touch Taiwan Micro LED

- Tag Heuer Micro LED 手錶規格與成本分析

第五章車用Micro LED顯示市場分析

- 汽車顯示器面臨的課題:太陽能電池的負載

- HUD 產品規格分析(2024 年)

- HUD 產品價格分析(2023-2024 年)

- AR-HUD技術分析

- AR-HUD的技術障礙

- 全景平視顯示器(P-HUD)與透明顯示器

- Micro LED 汽車顯示器概述:亮度

- 車用Micro LED透明顯示器成本分析(2024年)

- 汽車顯示器面臨的課題:安全與環保

第六章Micro LED企業最新動向

- Micro LED產業:資本投資、併購、聯盟、合資

- Micro LED企業產能分析(2024年)

- Micro LED 設備概述(2024 年)

- JBD

- Raysolve

- Innovision

- Sitan

- Saphlux

- Mojo Vision

- Ennostar

- PlayNitride

- Innolux

- Micro LED主要產品(2024年)

- Micro LED主要產品(2024年):大陸集團

- Micro LED主要產品(2024):聯想

Micro LED Chip Market Value Expected to Reach $580 Million by 2028, Focusing on Head-Mounted Devices and Automotive Applications, Says TrendForce

Jun. 3, 2024 ---- Efforts to reduce the cost of Micro LED chips through size miniaturization are ongoing. Companies like LGE, BOE, and Vistar continue to invest in large display applications, while AUO has been focusing on developing smartwatch products. There is also growing demand for new display applications in head-mounted devices and for automotive uses. TrendForce's "2024 Micro LED Market Trend and Cost Analysis Report" reveals that the market value of Micro LED chips is projected to reach $580 million by 2028, with a CAGR of 84% from 2023 to 2028.

Challenges in the Micro LED industry

The inability to reduce costs and technical challenges are major factors behind the cancellation of Apple's Micro LED watch. Therefore, continuous optimization of production processes remains critical for the development of the Micro LED industry. The evolution of mass transfer technology is expected to shift from single to composite technique, such as combining laser transfer with stamp transfer and potentially achieving a transfer solution with bonding capability with no stiction.

Inspection and repair processes are critical for improving yield rates and reducing Micro LED costs. Current electrical testing methods are being upgraded, focusing on high-precision probe cards and contactless testing. These advancements are not only leading the development of electrical testing but also present significant business opportunities for equipment manufacturers.

The cancellation of the Apple Watch has prompted chip supplier ams OSRAM to consider selling its 8-inch plant in Malaysia. If the buyer is a company within the current Micro LED supply chain, this could positively impact the industry's technical development and cost structure optimization. Considering the shift in technology routes and target markets, Chinese compound semiconductor manufacturers developing 8-inch SiC power semiconductors are also potential buyers. This would allow them to expand into international markets, providing chip manufacturers with a means to increase profitability.

Opportunities in the Micro LED industry

Micro LED still retains distinct advantages over competing technologies like Micro OLED. In AR glasses, which require light engines and high brightness and small volume, Micro LED light engines have now achieved sizes smaller than 0.2cc. With brightness levels advancing toward 350,000 nits, Micro LED is well-suited for high-brightness, all-weather, and all-scene recognition. The rapid development of AI-assisted tools is also expected to drive demand for AR glasses with Micro LED displays over the next 1 to 2 years.

In the automotive sector, displays do not require extremely high PPI but demand higher contrast and reliability. Micro LED technology, with its high brightness, contrast, wide color gamut, and fast response, can enhance the driving experience when integrated into smart cockpit display solutions with unique shapes, curves, flexibility, and feedback. This expands the potential applications of Micro LED in automotive scenarios-such as AR-HUDs and P-HUDS-as well as innovative display technologies for car windows using transparent displays.

Table of Contents

Chapter I. Micro LED Market Analysis

- 2024-2028 Micro LED Market Size Analysis: Large-sized Displays

- 2024-2028 Micro LED Market Size Comparison: Large-sized Displays

- 2024-2028 Micro LED Market Size Analysis: Wearable Displays

- 2024-2028 Micro LED Market Size Comparison: Wearable Displays

- 2024-2028 Micro LED Market Size Analysis: Head-mounted Displays

- 2024-2028 Micro LED Market Size Comparison: Head-mounted Displays

- 2024-2028 Micro LED Market Size Analysis: Automotive Displays

- 2024-2028 Micro LED Market Size Comparison: Automotive Displays

- 2024-2028 Micro LED Market Size Comparison: Mobile Devices/IT Displays

- 2024-2028 Market Value Analysis

- 2024 Micro LED Market Share Change Analysis by Applications

- 2024-2028 Wafer Market Demand Analysis

Chapter II. Micro LED Technology Development

- 2.1. Micro LED Mass Transfer Technology Development

- Micro LED TFT Backplane Technology Development

- Mass Transfer Technology Development

- Laser Transfer

- Contact Transfer Vs. Contactless Transfer

- Mass Transfer Technology: Combined Physical Mechanism

- Mass Transfer Technology: Combined Transfer Process

- Mass Transfer Technology: LGE's MDSAT Transfer Technology

- Mass Transfer Technology: Factors Affecting LED Transfer Rate Analysis

- Mass Transfer Technology: Factors Affecting Transfer Efficiency Analysis

- Mass Transfer Technology Development Summary

- 2.2. Micro LED Inspection Technology Development

- Micro LED Inspection Approaches Overview

- Micro LED Electrical Testing Solutions

- High Accuracy Probe Card Contact Electrical Testing-NanoEx

- Contactless Electrical Testing - Top Engineering

Chapter III. Micro LED Large-Sized Displays Market Analysis

- 2024 Micro/Mini LED COG Video Wall Specification and Progress

- 2024 Micro/Mini LED COG Video Wall Specification and Progress

- Micro LED Video Wall Manufacturing Analysis

- 2021-2028 6-inch Micro LED COC Price Trend

- Micro LED Chip Yield Rate and Brand Target

- Micro LED Chip Yield Rate and Brand Target

- Samsung/AUO LTPS Driver Framework Analysis

- Routing For DDI Connection in Spliced Displays

- Side Wiring Technology

- COG (Side Wiring) Technology Challenge Analysis / Player Roadmap

- TGV(Through Glass Via) Technology Analysis

- TGV Solution Provider: Corning

Chapter IV. Micro LED Wearable Display Market Analysis

- Apple Micro LED Watch Specification and Cost Analysis

- Micro LED Watch Manufacturing Analysis

- Apple Micro LED Watch Manufacturing Challenges Analysis

- Apple Cancelled Micro LED Project

- Impact From Apple's Cancellation of Watch Project on Industry

- ams OSRAM 8-inch Factory in Malaysia Situation Analysis

- AUO Circular Micro LED Display Panels Plan

- Touch Taiwan Micro LED

- Tag Heuer Micro LED Watch Specification and Cost Analysis

Chapter V. Micro LED Automotive Display Market Analysis

- Automotive Display Challenges: Solar Load

- 2024 HUD Product Specification Analysis

- 2023-2024 HUD Product Price Analysis

- AR-HUD Technology Analysis

- AR-HUD Technical Barriers

- Panoramic Head-up Display (P-HUD) vs. Transparent Display

- Micro LED Automotive Display Highlight: Brightness

- 2024 Micro LED Automotive Transparent Display Cost Analysis

- Automotive Displays Challenges: Safety and Environmental Protection

Chapter VI. Micro LED Player Dynamic Updates

- Micro LED Industry- Capital Investment, M&A, Alliance, and Joint Venture

- 2024 Micro LED Player Capacity Analysis

- 2024 Micro LED Equipment Highlights

- JBD

- Raysolve

- Innovision

- Sitan

- Saphlux

- Mojo Vision

- Ennostar

- PlayNitride

- Innolux

- 2024 Micro LED Key Products

- 2024 Micro LED Key Products- Continental

- 2024 Micro LED Key Products- Lenovo