|

市場調查報告書

商品編碼

1526407

面板驅動IC供需分析(2024年)2024 Analysis of Supply and Demand for Panel Driver ICs |

||||||

調查概述

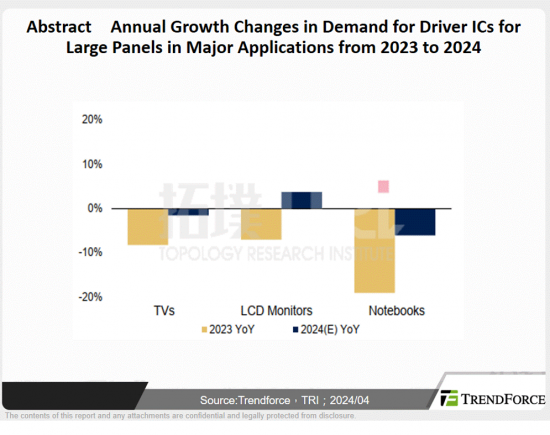

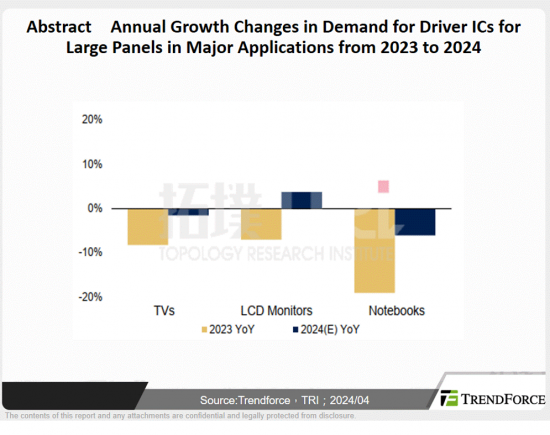

到2024年,大尺寸面板驅動IC的需求將逐漸增加,整體供應充足。然而,終端用戶需求的不確定性導致供應鏈庫存管理保守,增加對短期、緊急訂單的依賴,威脅供應鏈的長期健康。

2023年,行動TDDI晶片受惠於維修和二手市場的蓬勃發展,全年出貨量大幅超出最初預期。中國晶圓代工廠推出低成本生產設備將有助於在2023-2024年維持行動TDDI的強勁需求。然而,這一領域的競爭非常激烈,價格競爭也很激烈。

對於AMOLED驅動IC,隨著AMOLED智慧型手機面板滲透率的提高,新生產設備的引進提振需求。目前,市場並未面臨短期供應短缺的情況。隨著越來越多的供應商進入AMOLED DDI市場,價格不斷下降。維持 AMOLED DDI 生產的獲利能力仍然是 IC 製造商面臨的主要挑戰,尤其是在晶圓價格穩定的情況下。

目錄

第1章 大面板驅動IC:需求與供給

- (1)大型面板驅動IC的需求趨勢

- (2)大面板驅動IC供需分析

- (3)中美供應鏈多元化與中國面板製造商持續本土化策略

第2章 智慧型手機 TDDI:供給與需求

第3章 智慧型手機 AMOLED 驅動 IC:需求與供應

- (1)AMOLED驅動IC:需求與供應

- (2)RAM-less AMOLED驅動IC發展現狀

第4章 TRI 的觀點

- (1)大面板驅動IC的供需狀況

- (2)中美供應鏈持續分歧與中國面板製造商在地化策略

- (3)智慧型手機TDDI的需求與供應

- (4)AMOLED驅動IC:需求與供應

- (5)RAM-less AMOLED驅動IC開發

Report Summary:

Demand for large panel driver ICs is set to rise sequentially throughout 2024, with ample overall supply. However, uncertainty in end-user demand has led to conservative stocking practices in the supply chain, fostering a reliance on short-term, rush orders-a practice that threatens long-term supply chain health.

In 2023, mobile TDDI chips benefited significantly from active repair and second-hand markets, resulting in annual shipments far exceeding intial forecasts. The release of lower-cost capacities by Chinese wafer foundries has helped sustain robust demand for mobile TDDIs through 2023 to 2024. Nonetheless, intense comptition in this segment has escalated price wars.

For AMOLED driver ICs, the introduction of new production capacities has boosted demand as AMOLED smartphone panel penetration increases. Currently, the market faces no-short-term supply shortages. As more suppliers enter the AMOLED DDI market, prices continue to decline. Maintaining profitability in AMOLED DDI production remains a critical challenge for IC manufacturers, especially with stable wafer prices.

INFOGRAPHICS

Table of Contents

1. Large Panel Driver ICs: Supply and Demand

- (1) Changes in demand for large panel driver ICs

- (2) Supply and demand analysis for large panel driver ICs

- (3) Continued diversification of Sino-US supply chains and localization strategies of Chinese panel makers

2. TDDI for Smartphones: Supply and Demand

3. AMOLED Driver ICs for Smartphones: Supply and Demand

- (1) AMOLED driver ICs: Supply and demand

- (2) Development status of RAM-less AMOLED driver ICs

4. TRI's View

- (1) Large panel driver ICs: Supply and demand

- (2) Continued divergence of US and Chinese supply chains and localization strategy of Chinese panel makers

- (3) TDDI supply and demand for smartphones

- (4) AMOLED driver ICs: Supply and demand

- (5) Developing RAM-less AMOLED driver ICs