|

市場調查報告書

商品編碼

1479758

日本無線基礎設施市場:2024 年 4 月Japan Wireless Infrastructure Report, April 2024 |

||||||

價格

簡介目錄

本報告重點關注日本無線基礎設施市場,分析樂天移動的推出以及日本政府推動開放RAN的影響。它還提供 2023 年的詳細數據、2024 年的展望以及 5 年 RAN 預測。

目錄

概述

重點

2023 年:預計從 4G 過渡到 5G,但不足以維持市場成長

- 預計 5G 單元數量將是實際部署數量的 2.7 倍

- 由於單位銷售低於預期,銷售預測有所下降,但這被較高的平均售價部分抵消

- 投資5G仍沒有強烈動力

- 2023 年 Open RAN BTS 佔部署總數的 43%

- 儘管市場佔有率下降,Ericsson仍保持第一;Nokia、Fujitsu 、NEC的佔有率將在 2023 年擴大。

- Nokia繼續縮小與Ericsson的差距

- NEC重回第三位

- Samsung三年漲勢在2023年陷入停滯,但供應商仍領先Fujitsu

- 儘管Fujitsu 總部位於日本,但它正在發展強勁的國際業務。

- 2024年充其量也將持平,充滿5G

- 到 2028 年,開放虛擬 RAN 可能佔所有 5G RAN 單元的 95%

日本向世界展示了5G開放VRAN島的樣子

- 近兩年來,、Rakuten Symphony迅速擴張並開始征服世界

- 去年,、Rakuten Symphony的世界統治地位陷入停滯,一些知名高管離開了公司。

- 這一勢頭推動Fujitsu和 NEC 躋身 RU 供應商和 SI 冠軍之列,但情況將在 2023 年發生變化。

- KDDI、NTT DOCOMO、Softbank積極推動開放RAN議程

- Docomo、KDDI、Softbank和Rakuten Mobile合作成立 Otic 以加速開放 RAN 部署

2018年:日本決定改變寡占的手機市場並啟動Open RAN議程

- 受美國影響,日本政府迅速採取開放RAN計劃

- 給予Fujitsu和NEC激勵以鞏固其市場地位

- 美國要求 NTT 和 NEC 成為 Open RAN 政策聯盟創始成員

- 目前,美日在6G等多個領域合作

簡介目錄

This report focuses on Japan's wireless infrastructure market and analyzes the implications of the introduction of Rakuten Mobile and the Japanese government's open RAN push. The publication date is scheduled a few weeks after the 4 services providers (KDDI, NTT DOCOMO, Rakuten Mobile, and Softbank) provide their interim report so that we can gather many details about 2023 and provide 2024 outlook and a 5-year RAN forecast. This report includes base station (BTS) numbers and RAN vendor market shares and analysis.

TABLE OF CONTENTS

ABSTRACT

KEY TAKEAWAYS

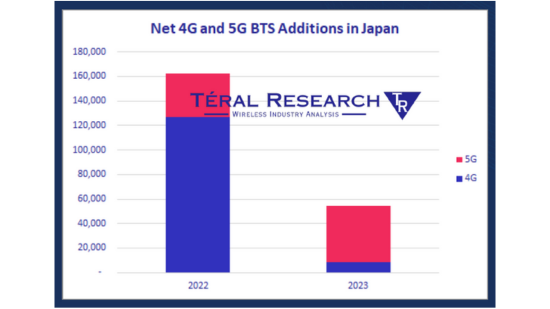

2023 SAW A SHIFT FROM 4G TO 5G, BUT IT WAS NOT ENOUGH TO KEEP THE MARKET IN GROWTH TERRITORY

- We expected 2.7x more 5G units than what was deployed

- Fewer units than anticipated sunk the sales forecast, a decline partially offset by the rise of ASP

- There is still no strong motivation to invest in 5G

- Open RAN BTS accounted for 43% of total units deployed in 2023

- While losing market share, Ericsson stay #1, Nokia, Fujitsu and NEC gained share in 2023

- Nokia continued to close the gap with Ericsson

- NEC is back to #3

- Samsung's 3-year long ascension stalled in 2023 but the vendor managed to stay ahead of Fujitsu

- While keeping a foot in its home turf, Fujitsu enjoys a robust international business

- 2024 IS LOOKING FLAT AT BEST AND 5G LOADED

- The MIC's roadmad leads to a peak followed by a huge drop

- The Japanese government's initial 5G plan was published in April 2019

- Outdoor 5G deployments will remain above 70% throughout the forecast period

- OPEN VIRTUAL RAN HAS THE POTENTIAL TO ACCOUNT FOR 95% OF TOTAL 5G RAN UNITS BY 2028

- The open vRAN ramp up is expected in 2025

- The 4 service providers pointed out that the availability of the RAN intelligent controller (RIC) is fundamental for the success of open vRAN moving forward

- Japan's open RAN-based 5G BTS configuration simplifies the counting process, it is site counting

- Japan's 5G looks like 1 site = 1 CU (including the DU)

JAPAN IS SHOWING THE WORLD WHAT A 5G OPEN VRAN ISLAND LOOKS LIKE...

- OVER THE PAST 2 YEARS, RAKUTEN SYMPHONY QUICKLY EXPANDED AND STARTED TO CONQUER THE WORLD...

- The telecom world welcomes symworld, the nf app marketplace

- It was already obvious from the beginiing with its initiatives in the U.S. and Germany that Rakuten Mobile had bigger ambitions than solely acting as Japan's 4th mobile operator.

- Qualcomm came to the 5G open ran massive mimo rescue

- AT&T turned to Rakuten Symphony for network planning help

- Cisco brought its mobile, switching & routing, and automation portfolio to Rakuten Symphony

- Rakuten Symphony added robin.io to its quiver

- Rakuten Symphony selected nokia's cloud native software as first symworld partner

- Perhaps the icing on the cake? Ajit Pai joined the party

- Lastly, Rakuten Symphony went to africa with MTN

- BUT LAST YEAR, RAKUTEN SYMPHONY'S CONQUEST OF THE WORLD HAS STALLED, HIGH-PROFILE EXECUTIVES DEPARTED

- At MWC24, the signature of a letter of intent and a memorandum of understanding was the latest sale news we heard

- THIS MOMENTUM MADE FUJITSU AND NEC TOP RU SUPPLIERS AND SI CHAMPIONS BUT THINGS CHANGED IN 2023

- Since the start of Rakuten Mobile's network buildout in 2H19, Japan's domestic champions Fujitsu and NEC have been busy both at home and in international markets

- KDDI, NTT DOCOMO, AND SOFTBANK ARE ACTIVELY PUSHING THE OPEN RAN AGENDA

- In February 2022, KDDI successfully turned on the world's first 5G SA open vRAN site

- In March 2022, NTT docomo adopted the Rakuten Symphony playbook

- docomo's Shared Open Lab leverages its OREC initiatives

- At MWC23, docomo rebranded its OREC project OREX

- At MWC24, docomo and NEC launched OREX SAI

- At MWC24, SoftBank, NEC and VMware announced that they have jointly verified RAN virtualization by converging telco cloud with an O-RAN architecture

- AND LASTLY, DOCOMO, KDDI, SOFTBANK AND RAKUTEN MOBILE FORMED OTIC TO COMBINE EFFORTS AND ACCELERATE OPEN RAN ADOPTION

2018 WAS THE YEAR JAPAN DECIDED TO SHAKE UP ITS OLIGOPOLISTIC MOBILE MARKET, WHICH KICKED OFF THE OPEN RAN AGENDA

- INFLUENCED BY THE U.S., THE JAPANESE GOVERNMENT QUICKLY ADOPTED THE OPEN RAN AGENDA...

- ...AND GIVING INCENTIVES TO FUJITSU AND NEC TO STRENGTHEN THEIR MARKET POSITION

- THE U.S. ALSO ASKED NTT AND NEC TO BE FOUNDING MEMBERS OF THE OPEN RAN POLICY COALITION

- AND NOW THE U.S. AND JAPAN ARE COLLABORATING ON MULTIPLE FRONTS, INCLUDING 6G

02-2729-4219

+886-2-2729-4219