|

市場調查報告書

商品編碼

1618862

汽車網路安全的全球市場:軟體定義車輛的保護The Global Market for Automotive Cybersecurity: Safeguarding the Software-Defined Vehicle |

||||||

汽車產業正在經歷前所未有的向軟體定義汽車 (SDV) 概念的轉變,這從根本上改變了汽車網路安全要求。

本報告涵蓋汽車網路安全市場,包括遠端資訊處理和 V2X(車對萬物)通訊、車載支付、車輛充電、資訊娛樂系統功能、開源架構和其他行業軟體的舉措和進展。產生影響的技術和趨勢。作為 VDC 與研究目標技術市場持續合作的一部分,本報告還介紹了 VDC 的 "工程師之聲" 調查的最終用戶調查結果。最後,本報告重點介紹了數十家正在塑造市場的主要汽車網路安全供應商。

信息圖形

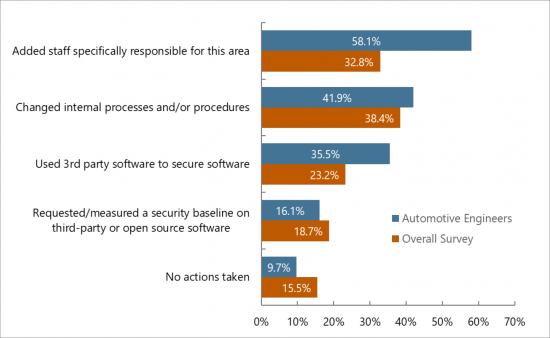

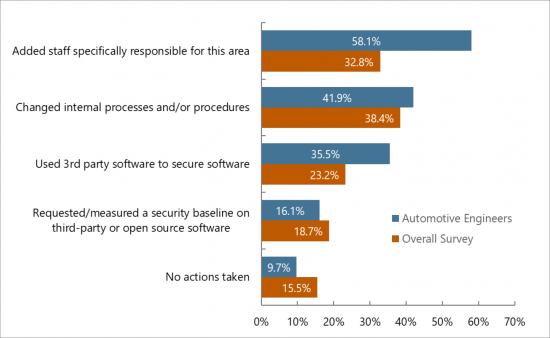

表 9:回應組織針對安全要求採取的行動

(受訪者百分比,允許多個答案)

對應的問題:

- 軟體和連線的大規模採用對汽車網路安全有何影響?

- 哪些領域成長最快:安全軟體、SaaS 和專業服務?

- 汽車網路安全監管的未來以及透過了解監管的未來可以獲得什麼?

- 到 2028 年,哪個地區將推動汽車網路安全市場的成長?

- 物聯網工程師和汽車工程師如何解決網路安全問題?

- 哪些公司正在塑造汽車網路安全市場以及如何塑造?

在本報告被刊登的組織:

|

|

目錄

本報告的內容

被拿起的問題

應該讀本報告人

在本報告被刊登的組織

摘要整理

- 主要調查結果

簡介

- 軟體定義車輛暴露漏洞

- 網路安全在向 SDV 的過渡中將扮演什麼角色?

- V2X連接

- 車內付款

- 車輛充電

- 應用程式和API

- AI所扮演的角色

- 開放原始碼和開放式架構

- 產品形勢

全球市場概要

- 汽車網路安全產品的分類

催促成長的法規

- WP.29規則155及的156

- ISO/SAE 21434

- 美國的法規

- 中國的GB 44495-2024及GB 44496-2024

- 印度的AISC AIS-189及AIS-190

地區分析

產業聯盟與標準化團體

- ASRG

- AUTO-ISAC

- COVESA

- digital.auto initiative

- Eclipse SDV

- eSync Alliance

- MIPI Alliance

- Uptane

業者情勢

- 業者簡介

- BlackBerry QNX

- Block Harbor

- Bosch/ETAS

- Continental/Elektrobit/PlaxidityX

- Green Hills Software

- Integrity Security Services

- Irdeto

- Karamba Security

- Kaspersky

- HARMAN

- Sonatus

- Thales

- VicOne

- Upstream

- Vector

終端用戶的洞察

- 產業適應安全要求

- 供應商格局支持創新

- 嵌入式安全軟體、硬體與 FOTA 實施

- 汽車科技的未來

關於作者

關於VDC Research

圖表清單*

Inside this Report

The automotive industry is undergoing an unprecedented shift toward the software-defined vehicle (SDV) concept that is fundamentally changing the requirements for automotive cybersecurity. This report includes an overview of technologies and trends that influence the automotive cybersecurity market, including telematics and vehicle-to- everything (V2X) communication, payment by car, vehicle charging, infotainment system capabilities, open source architectures, and other industry software initiatives and advancements. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey. Lastly, this report highlights dozens of key automotive cybersecurity vendors that are shaping the market.

INFOGRAPHICS

Exhibit 9: Actions Taken by Respondents Organization

in Response to Security Requirements

(Percentage of Respondents, Multiple Responses Permitted)

What Questions are Addressed?

- How has the mass introduction of software and connectivity affected automotive cybersecurity?

- Which segment is growing the fastest - Security software, Security-as-a-service or Professional services?

- What is the future of automotive cybersecurity regulations and what can be gained by understanding the future of regulations?

- Which geographic regions are driving growth in the automotive cybersecurity market through 2028?

- How are IoT engineers and automotive engineers responding to cybersecurity concerns?

- Which firms are shaping the automotive cybersecurity market and how are they doing it?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Software-Defined Vehicles Expose Vulnerabilities

- Where does Cybersecurity Fit in the Transition to the SDV?

- V2X Connectivity

- In-Car Payments

- Vehicle Charging

- Apps and APIs

- The Role of Artificial Intelligence

- Open Source and Open Architecture

- Product Landscape

Global Market Overview

- Automotive Cybersecurity Product Segmentation

- Product Segmentations within the Automotive Cybersecurity Market

Regulations Driving Growth

- WP.29 Regulations 155 and 156

- ISO/SAE 21434

- Regulations in the United States

- China GB 44495-2024 and GB 44496-2024

- India AISC AIS-189 and AIS-190

Regional Analysis

Industry Consortia and Standards Organizations

- ASRG

- AUTO-ISAC

- COVESA

- digital.auto initiative

- Eclipse SDV

- eSync Alliance

- MIPI Alliance

- Uptane

Vendor Landscape

- Vendor Profiles

- BlackBerry QNX

- Block Harbor

- Bosch / ETAS

- Continental / Elektrobit / PlaxidityX

- Green Hills Software

- Integrity Security Services

- Irdeto

- Karamba Security

- Kaspersky

- HARMAN

- Sonatus

- Thales

- VicOne

- Upstream

- Vector

End User Insights

- Industry Adaptation to Security Requirements

- Vendor Landscape Favors Innovation

- Diminishing Influence of Established Tech and System Integrators

- Implementation of Embedded Security Software, Hardware, and FOTA

- The Future of Automotive Technology

About the Authors

About VDC Research

List of Exhibits*

- Exhibit 1 Biggest Obstacle to the Development and Growth of the Connected/Software-Defined Vehicle Industry

- Exhibit 2: Current Concerns About AI-generated Software Code

- Exhibit 3: Sample Table of Vendors Offering Automotive Cybersecurity Solutions

- Exhibit 4: Global Revenue of Automotive Cybersecurity Software and Services

- Exhibit 5: Global Revenue for Automotive Cybersecurity Software and Services by Product Category

- Exhibit 6: Global Revenue for Automotive Cybersecurity and Software, 2023 to 2028, Share by Product Category

- Exhibit 7: Global Revenue for Automotive Cybersecurity Software and Services by Region

- Exhibit 8: Global Revenue of Automotive Cybersecurity Software & Services by Geographic

- Exhibit 9: Actions Taken by Respondents Organization in Response to Security Requirements

- Exhibit 10: Current Major Competition in the Software-defined Space

- Exhibit 11: Use of Embedded Security Software, Hardware, & Firmware-Over-the-Air Updating in Current Automotive Projects vs. Overall IoT Projects

- Exhibit 12: Technologies Automotive Respondent's Organization is Most Interested in and/or Building for Future Customers

*This report also includes access to 416 Exhibits from our 2024 Voice of the Engineer Survey.