|

市場調查報告書

商品編碼

1664196

光電系統的全球市場:2025-2035年Global Electro Optics Systems Market 2025-2035 |

||||||

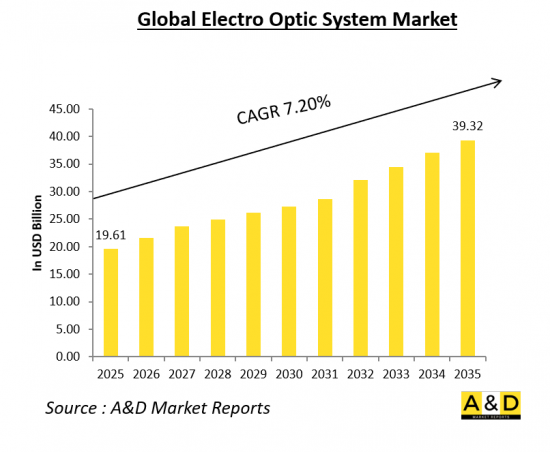

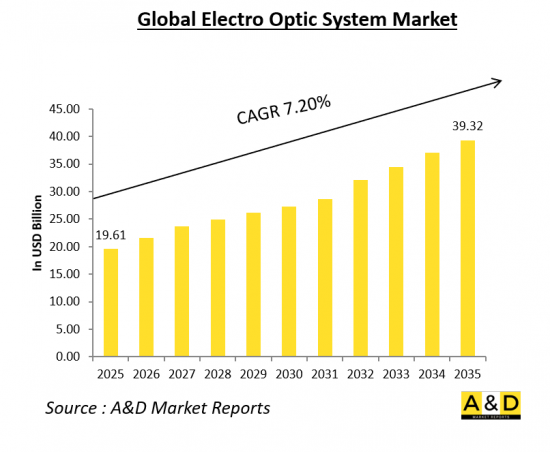

全球光電系統市場規模預計將從 2025 年的 196.1 億美元成長到 2035 年的 393.2 億美元,預測期內的複合年增長率為 7.20%。

這種成長是由對先進成像和感測技術日益增長的需求推動的,這些技術可用於提高態勢感知和威脅檢測能力,尤其是在航空航天和國防領域。無人機(UAV)在軍事監視和監控應用中的使用日益增多,進一步推動了市場的擴張。

電光系統市場:簡介

由於光學技術的進步及其在國防、航空航太、工業和商業應用領域的融入,電光系統市場近年來經歷了顯著成長。電光 (EO) 系統利用光和電子元件的相互作用來增強成像、瞄準、監視和通訊能力。這些系統對於現代戰爭、自動化系統、醫學成像和遙感至關重要,有助於提高態勢感知和準確性。隨著對即時數據處理、小型化和提高解析度的需求不斷增長,光電系統市場不斷發展,為各個領域提供創新的解決方案。

對國防現代化和邊境安全的日益關注,加上光電監視和瞄準系統的日益普及,正在推動市場擴張。光電系統用於無人駕駛飛行器(UAV)、海軍平台、裝甲車和手持設備的偵察、目標獲取和情報收集。人工智慧、機器學習 (ML) 和先進光學的整合正在進一步塑造市場,從而實現更複雜和高效的系統。隨著技術的不斷進步,預計光電系統市場在軍事和民用領域都將持續成長。

科技對光電系統市場的影響

技術的進步對光電系統市場產生了重大影響,促進了影像品質、偵測範圍和運作效率的提升。主要發展之一是將人工智慧和機器學習演算法整合到光電設備中,實現自動目標識別、即時數據分析和增強態勢感知。這些能力對於需要快速且準確決策的國防應用至關重要。

EO 市場的另一項變革性技術是使用高光譜和多光譜成像。這些成像系統提供詳細的光譜信息,可以精確識別和分類物體。廣泛應用於遙感、環境監測、軍事偵察等領域。感測器和光學元件的小型化對於使光電系統更輕、更適合部署在無人機、衛星和手持設備上也起著關鍵作用。

先進紅外線 (IR) 感測器的興起提高了熱成像能力,能夠在低光源和惡劣天氣條件下增強監視和瞄準能力。高解析度夜視和長波紅外線 (LWIR) 技術的發展極大地提高了 EO 系統在軍事行動中的有效性。此外,光纖技術提高了數據傳輸速度並減少了訊號損失,進一步提高了光電系統在國防和商業應用中的性能。

此外,擴增實境 (AR) 和虛擬實境 (VR) 融入光電系統為訓練、模擬和醫學成像開闢了新的途徑。這些沉浸式技術正應用於飛行員訓練、戰場模擬和外科手術,擴大了傳統應用以外的市場範圍。隨著光學和光子學研究和開發的進步,光電系統有望變得更小、更有效率、更具成本效益,加速其廣泛應用。

本報告提供全球光電系統的市場調查,彙整世界及各地各國的主要趨勢,市場影響因素的分析,主要技術的招聘情形,主要的防衛計劃,市場情境·市場預測,主要企業的分析等資訊。

目錄

光電系統市場:報告定義

光電系統市場:市場區隔

各用途

各終端用戶

各地區

未來10年光電系統市場分析

本章詳細概述了十年來光電系統市場的成長、變化趨勢、技術採用概述和整體市場吸引力。

電光系統市場技術

本部分涵蓋預計會影響該市場的十大技術以及這些技術可能對整個市場產生的影響。

全球光電系統市場預測

該市場 10 年的市場預測詳細說明了上述各個部分。

各地區電光系統市場趨勢及預測

本部分涵蓋區域市場趨勢、推動因素、阻礙因素、挑戰、政治、經濟、社會和技術方面。它還詳細介紹了各地區的市場預測和情境分析。區域分析的最後一部分包括重點公司的分析、供應商格局和公司基準測試。目前的市場規模是根據正常業務情境估算的。

北美

促進因素,規定,課題

PEST分析

市場預測與情境分析

主要企業

供應商層級的形勢

企業基準

歐洲

中東

亞太地區

南美

電光系統市場國家分析

本章涵蓋主要的國防計劃,並包括最新的新聞和專利。本章也涵蓋了國家級 10 年市場預測和情境分析。

美國

防衛計劃

最新消息

專利

目前技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

電光系統市場機會矩陣

機會矩陣可幫助讀者了解高機會細分。

電光系統市場報告專家意見

以下是我們專家對該市場的可能分析意見。

總論

關於市場報告

The global Electro-Optic Systems market is estimated at USD 19.61 billion in 2025 and is expected to grow to USD 39.32 billion by 2035, registering a Compound Annual Growth Rate (CAGR) of 7.20% over the forecast period. This growth is driven by the increasing demand for advanced imaging and sensing technologies, particularly in the aerospace and defense sectors, to improve situational awareness and threat detection. The market expansion is further propelled by the growing use of unmanned aerial vehicles (UAVs) for military surveillance and monitoring applications.

Introduction to Electro-Optics System Market

The electro-optics system market has witnessed significant growth in recent years, driven by advancements in optical technologies and their integration into defense, aerospace, industrial, and commercial applications. Electro-optics (EO) systems leverage the interaction of light and electronic components to enhance imaging, targeting, surveillance, and communication capabilities. These systems are crucial in modern warfare, autonomous systems, medical imaging, and remote sensing, contributing to enhanced situational awareness and precision. With the increasing demand for real-time data processing, miniaturization, and improved resolution, the electro-optics system market continues to evolve, offering innovative solutions across various domains.

The growing emphasis on defense modernization and border security, coupled with the rising adoption of electro-optical surveillance and targeting systems, has accelerated market expansion. Electro-optics systems are used in unmanned aerial vehicles (UAVs), naval platforms, armored vehicles, and handheld devices for reconnaissance, target acquisition, and intelligence gathering. The convergence of artificial intelligence (AI), machine learning (ML), and advanced optics is further shaping the market, enabling more sophisticated and efficient systems. As technological advancements continue, the electro-optics system market is poised for sustained growth across both military and civilian sectors.

Technology Impact in Electro-Optics Systems Market

Technological advancements have had a profound impact on the electro-optics systems market, driving improvements in imaging quality, detection range, and operational efficiency. One of the key developments is the integration of AI and ML algorithms in electro-optical devices, enabling automated target recognition, real-time data analysis, and enhanced situational awareness. These capabilities are critical for defense applications, where rapid and accurate decision-making is essential.

Another transformative technology in the EO market is the use of hyperspectral and multispectral imaging. These imaging systems provide detailed spectral information that enables precise identification and classification of objects. They are widely used in remote sensing, environmental monitoring, and military reconnaissance. The miniaturization of sensors and optics has also played a crucial role in making EO systems more lightweight and adaptable for deployment on UAVs, satellites, and portable devices.

The rise of advanced infrared (IR) sensors has improved thermal imaging capabilities, allowing for enhanced surveillance and targeting in low-light and adverse weather conditions. The development of high-resolution night vision and long-wave infrared (LWIR) technologies has significantly enhanced the effectiveness of EO systems in military operations. Additionally, fiber-optic technology has improved data transmission speeds and reduced signal losses, further enhancing the performance of EO systems in both defense and commercial applications.

The incorporation of augmented reality (AR) and virtual reality (VR) into electro-optical systems has also opened new avenues in training, simulation, and medical imaging. These immersive technologies are being used for pilot training, battlefield simulations, and surgical procedures, expanding the market's scope beyond traditional applications. As research and development in optics and photonics continue, EO systems are expected to become more compact, efficient, and cost-effective, driving their widespread adoption.

Key Drivers in Electro-Optics Systems Market

Several key factors are fueling the growth of the electro-optics system market. One of the primary drivers is the increasing demand for enhanced surveillance and reconnaissance capabilities in defense and security operations. Governments worldwide are investing heavily in electro-optical sensors and imaging systems to strengthen border security, counterterrorism efforts, and intelligence gathering. The rising geopolitical tensions and asymmetric warfare strategies have further amplified the need for advanced EO solutions.

The rapid expansion of autonomous systems and UAVs has also contributed to market growth. Electro-optics systems play a vital role in enabling autonomous navigation, obstacle detection, and target identification for drones and robotic platforms. The proliferation of UAVs in both military and commercial applications, including agriculture, disaster management, and infrastructure inspection, has increased the demand for high-performance EO sensors and imaging systems.

The growing adoption of EO systems in industrial and commercial sectors is another significant market driver. Industries such as healthcare, automotive, and aerospace are leveraging electro-optical technologies for applications such as medical diagnostics, driver assistance systems, and satellite-based Earth observation. In the automotive industry, night vision and LiDAR-based electro-optics systems are enhancing vehicle safety and enabling the development of autonomous driving solutions.

The advancements in semiconductor and photonic technologies have also contributed to the growth of the EO market by enabling cost-effective production of high-performance sensors and imaging systems. The increasing focus on energy-efficient and lightweight electro-optical devices is driving innovation and opening new opportunities for market expansion.

Regional Trends in Electro-Optics Systems Market

The electro-optics system market is witnessing significant growth across various regions, with North America, Europe, Asia-Pacific, and the Middle East being the key markets. Each region has distinct market dynamics influenced by defense budgets, technological advancements, and industrial applications.

North America, particularly the United States, is a dominant player in the EO market due to its strong defense industry, high investments in research and development, and presence of major defense contractors. The U.S. Department of Defense continues to invest in EO technologies for intelligence, surveillance, and reconnaissance (ISR) applications. Additionally, the growing adoption of EO systems in space exploration and commercial aviation is driving market growth in the region.

Europe is also a significant market for electro-optics systems, with countries such as the United Kingdom, France, and Germany leading in defense modernization and industrial applications. The European Union's initiatives for border security, counter-terrorism, and space-based EO systems have accelerated technological advancements. The integration of EO systems in law enforcement, maritime surveillance, and autonomous vehicle development is further boosting market demand in the region.

The Asia-Pacific region is experiencing rapid growth in the EO market, driven by increasing defense expenditures, territorial disputes, and advancements in commercial EO applications. Countries such as China, India, South Korea, and Japan are heavily investing in electro-optical technologies for military modernization, aerospace development, and smart city projects. The expanding commercial drone industry and satellite-based imaging applications are also contributing to the region's market growth.

The Middle East is another key market for EO systems, driven by defense procurement programs and the need for advanced surveillance solutions. Countries in the region are investing in electro-optical sensors for border security, oil and gas infrastructure monitoring, and counter-terrorism efforts. The growing partnerships between regional defense organizations and global EO technology providers are fostering market expansion.

As electro-optics systems continue to evolve with advancements in AI, photonics, and miniaturization, their applications will further expand across military, industrial, and commercial domains. The ongoing investments in research and development, coupled with increasing global security concerns, will sustain the growth of the electro-optics system market in the coming years.

Key Electro Optics System Programs

The Boeing Company, based in Albuquerque, New Mexico, has been awarded a $277,054,837 contract, incorporating cost and cost-plus-fixed-fee terms, for the advancement of Starfire Electro-Optics and Laser Lab technologies. This contract supports the Air Force Research Laboratory's Space Electro-Optics Division in its mission to enhance the nation's space superiority capabilities. The work will be conducted in Albuquerque, New Mexico, with an expected completion date of October 20, 2033. The contract was awarded as a sole-source acquisition, with $13,526,814 in fiscal year 2024 research, development, test, and evaluation funds obligated at the time of the award. The Air Force Research Laboratory at Kirtland Air Force Base, New Mexico, is overseeing the contracting activity.

cosine Remote Sensing and the Dutch Ministry of Defence (MoD) have signed a strategic contract to develop and demonstrate advanced electro-optical imaging systems in orbit. This agreement represents a major milestone for both parties, enabling cosine to advance its cutting-edge imaging technology and drive innovation in satellite-based Earth observation. The contract focuses on the development and in-orbit demonstration of electro-optical systems in low Earth orbit, supporting the evolution of high-performance imaging solutions for larger satellites. It is part of the PAMI program, a broader collaboration involving industry and government entities from both the Netherlands and the United States.

Table of Contents

Electro Optics Systems Market Report Definition

Electro Optics Systems Market Segmentation

By Application

By End User

By Region

Electro Optics Systems Market Analysis for next 10 Years

The 10-year electro Optics Systems market analysis would give a detailed overview of electro optics systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Electro Optics Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Electro Optics Systems Market Forecast

The 10-year electro optics systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Electro Optics Systems Market Trends & Forecast

The regional electro optics systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Electro Optics Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Electro Optics Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Electro Optics Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Electro Optics System Market Forecast, 2025-2035

- Figure 2: Global Electro Optics System Market Forecast, By Region, 2025-2035

- Figure 3: Global Electro Optics System Market Forecast, By Application, 2025-2035

- Figure 4: Global Electro Optics System Market Forecast, By End User, 2025-2035

- Figure 5: North America, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 6: Europe, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 8: APAC, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 9: South America, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 10: United States, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 11: United States, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 12: Canada, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 14: Italy, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 16: France, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 17: France, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 18: Germany, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 24: Spain, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 30: Australia, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 32: India, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 33: India, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 34: China, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 35: China, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 40: Japan, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Electro Optics System Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Electro Optics System Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Electro Optics System Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Electro Optics System Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Electro Optics System Market, By Application(Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Electro Optics System Market, By Application(CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Electro Optics System Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Electro Optics System Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Electro Optics System Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Electro Optics System Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Electro Optics System Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Electro Optics System Market, By Region, 2025-2035

- Figure 58: Scenario 1, Electro Optics System Market, By Application, 2025-2035

- Figure 59: Scenario 1, Electro Optics System Market, By End User, 2025-2035

- Figure 60: Scenario 2, Electro Optics System Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Electro Optics System Market, By Region, 2025-2035

- Figure 62: Scenario 2, Electro Optics System Market, By Application, 2025-2035

- Figure 63: Scenario 2, Electro Optics System Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Electro Optics System Market, 2025-2035