|

市場調查報告書

商品編碼

1666663

軍用光電/紅外線 (EO/IR) 系統市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Military Electro-optics/Infrared (EO/IR) Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

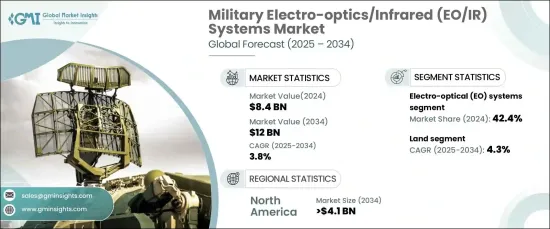

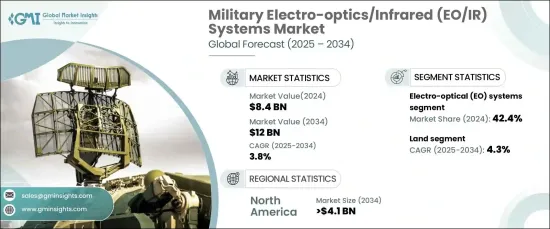

2024 年全球軍用光電/紅外線 (EO/IR) 系統市場價值為 84 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.8%。這一成長是由對先進監視系統(尤其是專注於情報、監視和偵察 (ISR) 的系統)的需求不斷成長所推動的成長所推動的系統)。現代武裝部隊嚴重依賴光電/紅外線技術來監視大片領土、識別新出現的威脅並收集關鍵情報。這些系統在保護軍事人員和確保作戰成功方面發揮著至關重要的作用。隨著即時威脅偵測需求的不斷升級,軍隊正在優先開發和整合先進的 EO/IR 解決方案,這對於增強態勢感知、戰略規劃和戰術決策至關重要。

EO/IR 系統使軍事人員能夠以無與倫比的精度追蹤目標並評估威脅,即使在夜間或惡劣天氣等惡劣條件下也是如此。它們提供即時成像和資料分析的能力對於現代軍事行動至關重要,可在複雜的戰鬥環境中提供技術優勢。隨著這些系統的不斷進步,包括人工智慧整合和改進的成像技術,EO/IR 解決方案正在不斷發展,以滿足陸地、空中和海軍平台的多樣化需求。這一趨勢反映了這些系統對於在迅速變化的作戰情況下保持作戰優勢的重要性日益增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 120億美元 |

| 複合年成長率 | 3.8% |

電光 (EO) 系統領域佔據主導地位,到 2024 年貢獻率為 42.4%。 EO 系統可以捕捉可見光和近紅外光,即使在低光源條件下也能提供清晰的影像,這對於各種軍事行動來說非常有用。 EO 技術的發展繼續專注於提高解析度、範圍和處理速度,未來的進步可能包括配備增強決策能力的更多自主系統。

陸地平台上的 EO/IR 系統市場預計將以最快的速度成長,預測期內的複合年成長率為 4.3%。這些系統安裝在坦克和裝甲運兵車等軍用車輛上,以增強地面監視和作戰效能。 EO/IR 技術使軍隊能夠探測遠距離和多樣化環境中的威脅,從而提高戰場意識和安全性。陸基 EO/IR 系統的持續發展強調更輕的設計、更好的耐用性和人工智慧驅動的分析,以確保更快、更準確的威脅偵測和回應。

預計北美將引領市場,到 2034 年市場規模將超過 41 億美元。重點是融入人工智慧、提高態勢感知能力以及開發用於聯合作戰的多平台系統。加強網路安全措施和升級現有平台也是確保軍隊做好應對新興威脅的準備的關鍵優先事項。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對情報、監視和偵察 (ISR) 的需求日益成長

- 對高階態勢感知的需求日益增加

- 先進技術開發

- 無人機(UAV)或無人駕駛飛機的使用日益增多

- 軍隊現代化

- 產業陷阱與挑戰

- EO/IR 系統與多種平台整合的複雜性

- 開發和生產成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按冷卻技術,2021 年至 2034 年

- 主要趨勢

- 冷卻

- 非製冷

第 6 章:市場估計與預測:按感測器技術,2021 年至 2034 年

- 主要趨勢

- 凝視感測器

- 掃描感應器

第 7 章:市場估計與預測:按影像技術,2021 年至 2034 年

- 主要趨勢

- 電光(EO)系統

- 紅外線(IR)系統

- 高光譜和多光譜系統

第 8 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 手持系統

- 光電/紅外線有效載荷

第 9 章:市場估計與預測:按平台,2021-2034 年

- 主要趨勢

- 土地

- 車載

- 戰鬥車輛

- 無人地面車輛(UGV)

- 士兵系統

- 空降

- 攻擊直升機

- 軍用機

- 戰鬥機

- 運輸飛機

- 特殊任務飛機

- 無人駕駛飛行器(UAV)

- 海軍

- 戰鬥艦

- 無人水面艦艇(USV)

第 10 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 情報、監視和偵察 (ISR)

- 定位

- 態勢感知

- 導航

- 其他

第 11 章:市場估計與預測:按銷售點,2021 年至 2034 年

- 主要趨勢

- OEM

- 售後市場

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 13 章:公司簡介

- Aselsan AS

- BAE Systems plc

- CONTROP Precision Technologies Ltd.

- Elbit Systems Ltd.

- Excelitas Technologies Corp.

- Hensoldt AG

- Indra Sistemas, SA

- Israel Aerospace Industries

- L3Harris Technologies, Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Northrop Grumman

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Safran SA

- Teledyne FLIR LLC

- Textron Systems

- Thales Group

- Ultra Electronics Holdings plc

The Global Military Electro-Optics/Infrared (EO/IR) Systems Market was valued at USD 8.4 billion in 2024 and is anticipated to grow at a CAGR of 3.8% from 2025 to 2034. This growth is driven by increasing demand for advanced surveillance systems, particularly those focused on Intelligence, Surveillance, and Reconnaissance (ISR). Modern armed forces rely heavily on EO/IR technologies to monitor large territories, identify emerging threats, and gather critical intelligence. These systems play a vital role in safeguarding military personnel while ensuring operational success. As the need for real-time threat detection escalates, military forces are prioritizing the development and integration of advanced EO/IR solutions, which are crucial for enhancing situational awareness, strategic planning, and tactical decision-making.

EO/IR systems enable military personnel to track targets and assess threats with unparalleled precision, even in adverse conditions such as nighttime or bad weather. Their ability to offer real-time imaging and data analysis is integral to modern military operations, providing a technological edge in complex combat environments. With ongoing advancements in these systems, including artificial intelligence integration and improved imaging technologies, EO/IR solutions are evolving to meet the diverse needs of land, airborne, and naval platforms. This trend reflects the growing importance of these systems for maintaining operational superiority in rapidly changing combat situations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $12 Billion |

| CAGR | 3.8% |

The electro-optical (EO) systems segment holds a dominant market share, contributing 42.4% in 2024. These systems are critical for military applications, offering high-definition imaging capabilities for reconnaissance, target identification, and surveillance. EO systems capture both visible and near-infrared light to provide clear images even in low-light conditions, making them invaluable for various military operations. The development of EO technology continues to focus on improving resolution, range, and processing speeds, with future advancements likely to include more autonomous systems equipped with enhanced decision-making capabilities.

The market for EO/IR systems on land platforms is expected to grow at the fastest rate, with a CAGR of 4.3% during the forecast period. These systems are installed on military vehicles, such as tanks and armored personnel carriers, to enhance ground surveillance and operational effectiveness. EO/IR technology enables military forces to detect threats over long distances and in diverse environments, improving battlefield awareness and safety. The ongoing evolution of land-based EO/IR systems emphasizes lighter designs, better durability, and AI-driven analysis, ensuring faster and more accurate threat detection and response.

North America is predicted to lead the market, reaching over USD 4.1 billion by 2034. The region's strong demand for advanced defense and surveillance technologies is fueled by significant investments in military modernization programs, particularly in the United States. The focus is on incorporating artificial intelligence, improving situational awareness, and developing multi-platform systems for joint operations. Enhancing cybersecurity measures and upgrading existing platforms are also key priorities to ensure military readiness against emerging threats.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing need for Intelligence, Surveillance, and Reconnaissance (ISR)

- 3.6.1.2 Increasing demand for advanced situational awareness

- 3.6.1.3 Development of advanced technologies

- 3.6.1.4 Growing use of unmanned aerial vehicles (UAVs) or drones

- 3.6.1.5 Modernization of military forces

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complexity involved in integration of EO/IR System with wide range of platforms

- 3.6.2.2 High development and production costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Cooling Technology, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Cooled

- 5.3 Uncooled

Chapter 6 Market Estimates & Forecast, By Sensor Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Staring sensor

- 6.3 Scanning sensor

Chapter 7 Market Estimates & Forecast, By Imaging Technology, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Electro-optical (EO) systems

- 7.3 Infrared (IR) systems

- 7.4 Hyper-spectral and multi-spectral systems

Chapter 8 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Handheld system

- 8.3 EO/IR payload

Chapter 9 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Land

- 9.2.1 Vehicle-mounted

- 9.2.2 Combat vehicles

- 9.2.3 Unmanned Ground Vehicles (UGVs)

- 9.2.4 Soldier system

- 9.3 Airborne

- 9.3.1 Attack helicopters

- 9.3.2 Military aircrafts

- 9.3.3 Fighter aircraft

- 9.3.4 Transport aircraft

- 9.3.5 Special mission aircraft

- 9.3.6 Unmanned Aerial Vehicles (UAVs)

- 9.4 Naval

- 9.4.1 Combat ships

- 9.4.2 Unmanned Surface Vehicles (USVs)

Chapter 10 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 Intelligence, Surveillance, and Reconnaissance (ISR)

- 10.3 Targeting

- 10.4 Situational awareness

- 10.5 Navigation

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Point of Sale, 2021-2034 (USD Million)

- 11.1 Key trends

- 11.2 OEM

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Aselsan A.S.

- 13.2 BAE Systems plc

- 13.3 CONTROP Precision Technologies Ltd.

- 13.4 Elbit Systems Ltd.

- 13.5 Excelitas Technologies Corp.

- 13.6 Hensoldt AG

- 13.7 Indra Sistemas, S.A.

- 13.8 Israel Aerospace Industries

- 13.9 L3Harris Technologies, Inc.

- 13.10 Leonardo S.p.A.

- 13.11 Lockheed Martin Corporation

- 13.12 Northrop Grumman

- 13.13 Rafael Advanced Defense Systems Ltd.

- 13.14 Rheinmetall AG

- 13.15 Safran SA

- 13.16 Teledyne FLIR LLC

- 13.17 Textron Systems

- 13.18 Thales Group

- 13.19 Ultra Electronics Holdings plc